Research on Risk Evaluation and Risk Response Strategies of

Chinese Internet Public Welfare Crowdfunding Based on Analytic

Hierarchy Process

Jinyao He

1

, Guiyang Wang

1,*

, Xiaoxue Han

2

and Xiangye Kong

3

1

School of Business, University of Western Australia, 6009, Perth, Australia

2

School of Finance, Nanjing Audit University, 211815, Nanjing, China

3

School of Information Technology, 224051, Yancheng, China

213080208@stu.nan.edu.cn, bertkong0304@163.com

Keywords: Analytic Hierarchy Process, Risks of Internet Public Welfare Crowdfunding, Risk Evaluation, Risk

Countermeasures.

Abstract: Internet-based public welfare crowdfunding is a new fundraising approach in China that blends Internet

finance with traditional public welfare crowdfunding. Its fast growth, however, it is accompanied by

enormous hidden risks. Consequently, it is essential to identify and prevent various crowdfunding process

related risks. By categorizing and summarizing the risks associated with Internet-based public welfare

crowdfunding in China, this study uses the Analytic Hierarchy Process to determine the overall ranking of

risks and recommends solutions.

1 INTRODUCTION

The notion of Internet finance has been popularized in

China with the development of "Internet +" and has

become a hot topic in entrepreneurship, investing, the

economy, and other industries. As an example of a

typical Internet finance model, Internet public welfare

crowdfunding has grown quickly in recent years. It is

an innovative financing model that blends Internet

finance and online charity. Internet's benefits can

facilitate the financing of several organizations and

individuals.

Currently, the Ministry of Civil Affairs of China

has designated 32 Internet-based fundraising

information portals for non-profit organizations.

Among these, the most well-known are Waterdrop,

Love chip, and Fun in funding, which provide the

public with an increasing number of direct avenues to

donate to charitable causes. In recent years, however,

concerns such as "gaining money" and "fraudulent

donations" have made Internet public welfare

crowdfunding a focal point of scholarly interest. Lin

and Li worried that Internet-based crowdfunding

platforms may become complicit in unlawful

*

Corresponding author

fundraising (Lin, 2016); Yuan feeled that China's

public welfare crowdfunding has raised social doubts

due to a lack of rules, protocols, and management

(Yuan, 2017). In Internet-based public welfare

crowdfunding, there is intentional exaggeration of

project propaganda, misappropriation of fundraising,

inconsistency of returns with promises, and a lack of

inspection of fundraiser access information and

stringent oversight in the project's final stages. These

issues raise the risk of financing, erode the trust of

Internet users, and have a negative effect on the long-

term growth of Internet public welfare crowdfunding.

Consequently, it is vital to examine the risk

identification and risk response strategies of Internet-

based crowdfunding for public welfare.

Using the AHP technique, this research

categorizes potential Internet public welfare

crowdfunding risks in China and creates a risk

hierarchy model for Internet public welfare

crowdfunding. Through the calculation, the overall

rating of each risk is determined, and several coping

solutions are offered based on the risk's significance,

in order to assist the future development of Internet-

based public welfare crowdfunding in China.

214

He, J., Wang, G., Han, X. and Kong, X.

Research on Risk Evaluation and Risk Response Strategies of Chinese Internet Public Welfare Crowdfunding Based on Analytic Hierarchy Process.

DOI: 10.5220/0012028300003620

In Proceedings of the 4th International Conference on Economic Management and Model Engineering (ICEMME 2022), pages 214-220

ISBN: 978-989-758-636-1

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

The remainder of the article is structured as

follows: the second part is devoted to the classification

of risks, the third part is devoted to the Analytic

Hierarchy Process, the fourth part is devoted to the

risk response plan, and the fifth part is devoted to the

conclusion and illumination.

2 CLASSIFICATION OF RISKS

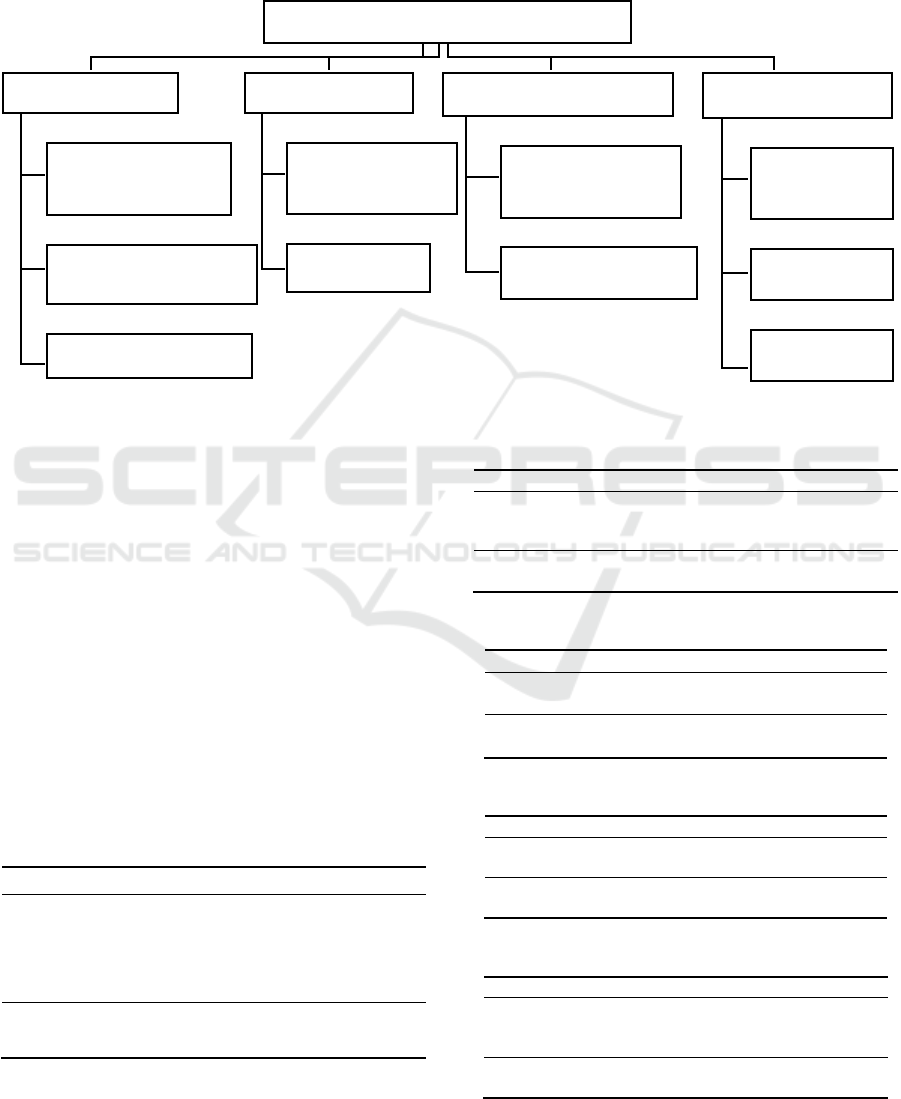

There are a variety of elements that influence the risk

of Internet-based crowdfunding for public welfare.

Before analyzing the origins and shifting tendencies

of Internet public welfare crowdfunding risks, it is

vital to scientifically categorize them. In this study,

Internet public welfare crowdfunding risk is

categorized into four B-layer risk factors: legal risk,

credit risk, audit risk, and platform security risk.

Further classified into 10 C-tier risk categories are the

B-tier risk factors.

2.1 Legal Risk (B1)

Li discovered that the majority of legal risks in over-

the-counter transactions were caused by the legal lag

resulting from financial innovation (Li, 1999). As a

new type of financing, the legal risks associated with

Internet public welfare crowdfunding can be separated

into three groups.

2.1.1 Industry Standard Risk (C1)

Industry standards are standards developed for

technical requirements that do not have national

standards but must be harmonized within a country's

industry.

The research of Dai (Dai, 2021) indicated

that industry standards have a normative and guiding

role for the entire industry and serve as a benchmark

for determining if the project process is compliant.

In 2017, the Ministry of Civil Affairs of China

promulgated two industry standards, "Basic Technical

Specifications for Internet Public Fundraising

Information Platforms for Charitable Organizations"

and "Basic Management Specifications for Internet

Public Fundraising Information Platforms for

Charitable Organizations", which provide a technical

level for the requirements for Internet fundraising

platforms but lacks the elaboration of the ethical

aspects of the industry. These immature industry

standards threaten the growth of Internet-based public

welfare crowdfunding.

2.1.2 Legal and Regulatory Risk (C2)

Presently, China's Internet crowdfunding financial

supervisory laws are extremely limited, particularly in

the part of crowdfunding for public welfare, and the

only known relevant legal basis is mainly the "Charity

Law of the People's Republic of China." The law

controls only nonprofit organizations and does not

mention internet crowdfunding platforms for public

welfare. Due to the lack of clarity surrounding the

legal status of Internet-based public welfare

crowdfunding platforms, academic and judicial circles

have not established an uniform criterion and criteria

for their legal status. Consequently, the absence of

laws and regulations in this sector is also among the

most significant risks.

2.1.3 Supervisory Body Risk (C3)

It is also challenging to identify the primary regulatory

authority for the industry in the absence of clear laws

and regulations. Currently, the platform, which has a

sizable fund of fund operation power, is in charge of

fundraising funds, allocating funds, and conducting

fundraising activities in the industry. Once a

crowdfunding initiative goes awry, it is challenging to

recover the losses of the donors' difficult investment

without the supervision of a clear regulatory body.

2.2 Credit Risk (B2)

Credit risk mainly refers to the problem of information

asymmetry presented by seekers and the platform's

inability to sufficiently review information in the

process of public welfare crowdfunding via the

Internet, collectively referred to as credit risk.

2.2.1 Information Asymmetry Risk (C4)

An efficient information bridge between the donor

and the seeker must be constructed for Internet public

welfare crowdfunding, although there are frequently

some issues with information asymmetry. The seekers

may be able to pay for the medical expenses

themselves, but they haven't told the platform or

haven't told it the truth, and it's hard for the platform

to confirm this. As a result, it will mislead the donors

and undermine faith in online public welfare

crowdfunding.

2.2.2 Censorship Risks (C5)

There are risks associated with platform censorship as

well. Due to the platform's inadequate information

review of online public welfare projects, many

Research on Risk Evaluation and Risk Response Strategies of Chinese Internet Public Welfare Crowdfunding Based on Analytic Hierarchy

Process

215

materials and even personal information needed for

fundraising have been altered and tampered, which

has caused to the dissemination of misleading

information. In addition, some crowdfunding projects

that are true but fall short of the fundraising standards

can be approved since the standards for information

review are not strict enough.

2.3 Audit Risk (B3)

Another major risk, which may be broken down into

internal control risk and auditor professional ability

risk, is the audit risk of an online platform for public

good crowdfunding.

2.3.1 Internal Control Risk (C6)

Although various risk control mechanisms are set up

in the operation process as a non-profit Internet public

welfare crowdfunding platform, there are some

objective risks in and of themselves. Many platforms

enhance their risk control mechanisms using AI

intelligence. Because the intelligent AI risk control

technology is not a mature technology that is

acknowledged as being used, some people continue to

use the gaps in it to conduct malicious fundraising,

even if this somewhat solves some malicious

fundraising behaviors.

2.3.2 Auditor Professional Competence Risk

(C7)

The specific processes and handling methods of

online public welfare crowdfunding in terms of fund

payment, fund management, and fund withdrawal are

unfamiliar to auditors in the electronic payment

environment, and they also lack the relevant

experience in handling Internet public welfare

crowdfunding audit risk control. As a result, there is a

dearth of relevant professional expertise in

recognizing and evaluating the audit risks associated

with Internet-based platforms for public welfare

crowdfunding.

2.4 Platform Security Risk (B4)

Platform security risks include those associated with

information leakage, unauthorized fundraising, and

fund management on online platforms for public

good.

2.4.1 Management Risks of Funds Raised

(C8)

It is the platform's duty to hold onto the monies raised

for the fundraiser until the fundraising endeavor is

finished. After deducting the platform management

charge, the crowdfunding platform will distribute the

remaining funds to the project fundraiser if the project

is a success. In this process, all capital flow links were

implemented and controlled by the crowdfunding

platform, which raised the potential risk of fund

management, according to Xu et al. (Xu, 2016). This

is because there is no relevant department to supervise

and escrow the crowdfunding funds.

2.4.2 Illegal Fundraising Risk (C9)

Because Internet public welfare crowdfunding has

such strong public welfare qualities, some criminals

may use these characteristics to construct some illegal

third-party platforms that appear as public welfare

crowdfunding platforms with the intent of defrauding

a sizable amount of cash raised. Additionally, some

tiny platforms will loosen the criteria for help seekers'

reviews in order to gain larger platform management

fees. Ma (Ma, 2018) thought that illegal fund-raising

has severely weakened Internet public welfare

crowdfunding and undermined the people's trust in

online philanthropy.

2.4.3 Information Leakage Risk (C10)

Platforms on the internet for public good

crowdfunding are unbalanced in favor of one over the

other. Keeping profits while meeting the demands of

all social groups, including donors and those seeking

medical care, is extremely difficult for it. Because of

this, many platforms will include advertising in order

to collect advertising fees, increasing revenue and

decreasing losses. Users' personal information may be

compromised if the platform's scrutiny of advertising

is not stringent enough.

3 ANALYTIC HIERARCHY

PROCESS

Analytic Hierarchy Process, an international standard

analysis technique for complicated decision-making

situations, is used in this paper. It was a systematic,

hierarchical analytic method that integrates qualitative

and quantitative analysis, and it was first officially

suggested by the American operations researcher

Thomas L. Saaty (Saaty, 1988) in the middle of the

1970s.

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

216

3.1 Establishment of a Hierarchical

Model

According to Dong's research, risk identification was

used to construct the hierarchical structure. A

hierarchical structure diagram was ultimately

constructed by sorting and categorizing possible risk

variables, then placing them among several layers

(Dong, 2020). Based on the aforementioned risk

analysis, Figure 1 shows the model of risk hierarchy

for China's online public welfare crowdfunding.

Figure 1: Risk Hierarchy Model of Internet Public Welfare Crowdfunding in China.

3.2 Constructing the Pairwise

Comparison Matrix

By combining the expert scoring results, a paired

comparison matrix may be constructed in accordance

with the risk hierarchy model shown in Figure 1. Ten

expert scoring sheets in total were gathered. The

trustworthiness of scoring was verified by the experts'

affiliation with the TOP 10 Internet public welfare

crowdfunding platforms and their positions as product

operation directors and above. According to Li and

Zhang's research, the judgment matrix is built using

the 1–9 scale approach, and the weights of the

indicators at all levels are then determined (Li, 2006).

Tables 1 to 5 display the scoring results and weight

results for each judgment matrix.

Table 1: Judgment Matrix A-B.

A B1 B2 B3 B4 W

B1 1 3 4 2 0.4673

B2 1/3 1 2 1/2 0.1601

B3 1/4 1/2 1 1/3 0.0954

B4 1/2 2 3 1 0.2772

λmax CI RI CR

4.031 0.0103 0.89 0.0116

Table 2: Judgment Matrix B1-C.

B1 C1 C2 C3 W

C1 1 1/6 1/2 0.102

C2 6 1 5 0.7258

C3 2 1/5 1 0.1721

λmax CI RI CR

3.0291 0.01455 0.52 0.0279

Table 3: Judgment Matrix B2-C.

B2 C4 C5 W

C4 1 1/3 0.25

C5 3 1 0.75

λmax CI RI CR

2 0 0 0

Table 4: Judgment Matrix B3-C.

B3 C6 C7 W

C6 1 3 0.75

C7 1/3 1 0.25

λmax CI RI CR

2 0 0 0

Table 5: Judgment Matrix B4-C.

B4 C8 C9 C10 W

C8 1 5 4 0.6833

C9 1/5 1 1/2 0.1168

C10 1/4 2 1 0.1998

λmax CI RI CR

3.0246 0.0123 0.52 0.0237

Internet Public Welfare Crowdfunding Risks (A)

Legal Risk (B1)

Industry Standard Risk (C1)

Legal and Regulatory Risk (C2)

Supervisory Body Risk (C3)

Credit Risk (B2)

Information Asymmetry

Risk (C4)

Censorship Risks (C5)

Audit Risk (B3)

Internal Control Risk (C6)

Auditor Professional

Competence Risk (C7)

Platform Security Risk (B4)

Management Risks of

Funds Raised (C8)

Illegal Fundraising

Risk (C9)

Information Leakage

Risk (C10)

Research on Risk Evaluation and Risk Response Strategies of Chinese Internet Public Welfare Crowdfunding Based on Analytic Hierarchy

Process

217

3.3 Calculate the Single Sorting Weight

Vector and Do the Consistency Test

Enter each judgment matrix into the Matlab program

to determine its greatest eigenvalue and eigenvector,

then compute the weight vector for each index, and

finally run a consistency check on each judgment

matrix to guarantee the accuracy of the data. The

consistency test is qualified with the result CR≤0.1.

The calculation formulas of CR and CI are as follows,

and the value of RI is displayed in Table 6.

𝐶𝑅 = 𝐶𝐼/𝑅𝐼

1

𝐶𝐼 =

𝜆

−𝑛

𝑛−1

2

CR is the consistency ratio, CI is the consistency

index, λ

max

is the largest eigenroot, n is the order of the

matrix, and RI is a random one-time index.

Table 6: Random consistency index RI.

Order

(

nth

)

1 2 3 4 5 6 7 8 9 10 11 12

RI 0 0 0.58 0.89 1.12 1.24 1.32 1.41 1.45 1.49 1.52 1.54

3.4 Calculate the Total Sorting Weight

Vector and Do a Combined

Consistency Test

The weights of the first-level indicators and the

second-level indicators must be multiplied one by one

in order to determine the total weight. Next, go layer

by layer from the bottom to the top to determine the

weight of each indication. The results of the

hierarchy's overall ranking consistency test are shown

in Table 7, and the overall ranking results for each risk

factor hierarchy are shown in Table 8. The formula for

calculating the total weight consistency ratio CR

t

is as

follows.

𝐶𝑅

=

𝑏

𝐶𝐼

1

+𝑏

𝐶𝐼

+⋯+𝑏

𝐶𝐼

𝑏

𝑅𝐼

+𝑏

𝑅𝐼

+⋯+𝑏

𝑅𝐼

3

CI

m

is the consistency index of the m

th

matrix of

the second level, and b

m

is the weight of the index B

of the first level.

Table 7: Total Sort Consistency Test.

CI

i

0.0146 0 0 0.0123

RI

i

0.52 0 0 0.52

CR

i

0.0280 0 0 0.0237

CI 0.0102

RI 0.3871

CR 0.0263

Table 8: Overall ranking of risk factors in Internet public welfare crowdfunding.

B1 B2 B3 B4 Total Weight Ran

k

0.4673 0.1601 0.0954 0.2772

C1 0.1020 0.0477 7

C2 0.7258 0.3392 1

C3 0.1721 0.0804 4

C4 0.2500 0.0400 8

C5 0.7500 0.1200 3

C6 0.7500 0.0716 5

C7 0.2500 0.0239 10

C8 0.6833 0.1894 2

C9 0.1168 0.0324 9

C10 0.1998 0.0554 6

As can be seen from Table 8, the ranking of Legal

and Regulatory Risk (C2) and Supervisory Body Risk

(C3) is higher, indicating that Legal Risk (B1) is the

most important risk facing China's Internet public

welfare crowdfunding. Management Risks of Funds

Raised (C8) and Censorship Risks (C5) rank high and

are also very important and noteworthy risk factors.

The ranking of risk factors can reflect the relative

importance of different risk factors; therefore,

corresponding coping strategies can be proposed

according to their importance.

4 RISK RESPONSE STRATEGIES

The following four risk prevention strategies are

proposed for the significance of various risk factors in

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

218

light of the results in the aforementioned table.

Among them, the first and second points are currently

strongly recommended strategies, while the third and

fourth points are optional techniques.

(i) Speed up the development of China's Internet

public welfare crowdfunding laws and regulations and

make clear who will be in charge of them. One idea is

to create a law on Internet public welfare

crowdfunding by incorporating current laws and

regulations including the Public Welfare Donation

Law, the Foundation Management Regulations, the

Social Organization Registration Management

Regulations, and the Charity Law. Both the notion of

Internet public welfare crowdfunding and the law's

intended application should be explicitly defined in

the law's text. At the same time, it should distinctly

define the regulations governing the creation of

crowdfunding platforms, the verification of platform

eligibility, and the project access review procedure.

Additionally, the decision made by the supervisory

authority is crucial. Since the specific supervisory

department for Internet public welfare crowdfunding

has not yet been established, the government should

do so as soon as possible in order to improve the

effectiveness of the department's oversight and the

speed with which the law is applied to the sector.

Aside from the development of industry associations,

the release, fundraising, and implementation of

Internet public welfare crowdfunding projects can be

effectively supervised to some extent by industry

associations as well as government supervision

departments. In addition to improving the protection

of donors' legal rights and interests, this will

significantly advance the healthy growth of public

benefit crowdfunding.

(ii) Putting up more restrictions for Internet public

welfare crowdfunding platforms and project sponsors.

The entrance of crowdfunding platforms and project

sponsors should be the first step in the risk prevention

of online public welfare crowdfunding. The stability

of the industry's future development is determined by

the access threshold level. According to Dai (Dai,

2021), platforms for crowdsourcing could be

regulated in the form of filing when they were in their

early stages of development, while platforms that

would more developed could be regulated in the form

of approval and are actively watched during their

following operations. Moreover, the welfare should

provide financial incentives to big Internet businesses

so they will enter the industry and contribute to the

public good by enabling the adoption of more cutting-

edge technologies and the resulting standardization of

the industry. Reviewing project sponsors' access

requirements is also essential to reducing hazards. The

access assessment of the project sponsors and

beneficiaries must be stringent and thorough, and if

necessary, they can cooperate with the civil affairs and

public security departments to thoroughly examine

their identification information, family information,

and bank information.

(iii) Give the internal control system your

complete attention while enhancing the auditors'

technical competence. The audit risk of China's online

public welfare crowdfunding platform, in Jiang's

opinion (Jiang, 2022), was significantly influenced by

the lack of adequate internal controls. Auditors should

speak with the grassroots staff of the Internet public

welfare crowdfunding platform prior to beginning the

audit procedure to gain a thorough understanding of

the platform's fundraising process and to check in

advance to see if there is any conflict of interest or a

relationship between fundraising behavior and

employee performance. In addition, auditors should

thoroughly examine the internal controls and

efficiency of Internet public welfare crowdfunding

platforms in order to minimize audit risks and

guarantee audit quality. To do this, they should assess

the whole internal control system of these platforms.

The professional competence of auditors is something

else that needs to be enhanced, and their lack of

competence is a significant factor contributing to audit

risk. The number of qualified auditors should

increase, and accounting firms should develop

compound auditors with expertise in both traditional

auditing and public-welfare crowdfunding.

(iv) Develop network security technologies, make

the platform's information more transparent, and set

up a third party fund custody system. The first thing

the platform needs to do to address the platform

security concerns of China's Internet public welfare

crowdfunding is to increase the transparency of

project information, which includes particular

information like financing strategies, amounts, and

fund management plans. Giving donors complete

transparency and enhancing the platform's legitimacy

would help them garner more support, which will help

the seekers raise money more swiftly. Furthermore,

crowdfunding platforms must establish a third-party

fund custody mechanism and segregate their own

accounts from fund funds in order to prevent being

associated with fund fraud or unlawful fundraising. Its

benefit is the realization of the separation of capital

flow and information flow, the prevention of the

platform's illegal operation, and at the same time the

reduction of the platform's management burden and

legal risks, allowing the platform to simply assume the

roles of an intermediary and carry out its own tasks. In

addition, platforms should be encouraged to recruit

Research on Risk Evaluation and Risk Response Strategies of Chinese Internet Public Welfare Crowdfunding Based on Analytic Hierarchy

Process

219

and develop cybersecurity technological expertise in

response to the risk of information leaking. In order to

maintain the smooth operation of the platform and the

security of investors' personal information and

finances, public welfare crowdfunding platforms

should actively study the most recent information in

the field of network security, increase investment in

money, people, and resources, and outfit a

professional network security team.

5 CONCLUSION

The risks associated with Internet public welfare

crowdfunding in China are divided into four distinct

categories and ten specific risk variables in this paper.

The following results were reached after using the

analytical hierarchy technique to investigate,

construct a hierarchical structure model, determine its

total risk ranking:

(i) The biggest risk that China's Internet public

welfare crowdfunding industry faces is legal risk,

therefore the nation needs to improve its proprietary

laws and regulations as soon as possible and clarify

the monitoring department. (ii) Management risks of

funds raised and censorship risk now have a stronger

impact on China's Internet public welfare

crowdfunding; these risks should be handled by

developing a third-party fund trust mechanism and

raising the entry threshold for platforms and project

initiators. (iii) Despite having a negligible impact,

audit risk must be taken into account. Platforms

should focus entirely on the internal control system to

minimize internal corruption, and accounting firms

should raise the professional standards of auditors and

improve compound talents that can successfully

combine audit knowledge with knowledge of public

welfare crowdfunding.

The expert scoring table that was created for this

paper's article still has the following flaws: the content

is too macroscopic, and the depth of the study is

hampered by the lack of content that accurately

reflects the impact of specific risks. The suggested risk

response method needs to be further investigated and

improved due to a lack of field research and real-world

experience. In next work and research, these

deficiencies must be continuously researched and

applied.

REFERENCES

Dai H. Risk Analysis and Prevention of Internet Public

Welfare Crowdfunding [J]. China Management

Informationization, 2021.

Dong W. Research on Real Estate Investment Risk

Evaluation and Risk Response Strategy Based on

Analytic Hierarchy process [J]. Journal of Anhui

University of Technology (Social Sciences), 2020,

37(4): 28-31.

Jiang J. Research on Audit Risk of Internet Public Welfare

Crowdfunding Platform [D]. Inner Mongolia

University of Finance and Economics, 2022.

Li R. International Financial Law [J]. Revised edition in

2005 10 month. Wuhan University Press, 1999.

Li X, Zhang B. The Application of Analytic Hierarchy

Process in Real Estate Investment System Risk

Evaluation[J]. Construction & Design for Project, 2006

(1): 64-65.

Lin Y, Li J. Research on P2P Online Lending Platform

Crime and Judicial Governance [J]. Hebei Law

Science, 2016, 34(10): 190-200.

Ma X. For online public welfare crowdfunding, supervision

cannot be "absent" [J]. People's Tribune, 2018, (34):

74-75.

Saaty T L. What is the analytic hierarchy process?

[M]//Mathematical models for decision support.

Springer, Berlin, Heidelberg, 1988: 109-121.

Xu J, Huo B, Wang R. Development Logic, Business

Efficiency and Risk Mechanism of Online

Crowdfunding [J]. Study and Practice, 2016 (9): 45-53.

Yuan Y. Research on the Development Status and Trend of

Public Welfare Crowdfunding in China [J]. Hebei

Academic Journal, 2017, 37(6): 154-158.

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

220