International Big Four, Customer Concentration and Audit Fees

Hongli Ma

a

Beijing Jiaotong University, China

Keywords: International Big Four, Customer Concentration, Audit Fees.

Abstract: With the development of economy, enterprises in the supply chain are competing more and more as a whole,

so the downstream of the supply chain and the customers of enterprises are becoming more and more

important for the development of enterprises. They are the main source of economic interests of enterprises

and have an important impact on the economic activities of enterprises, so they may have an impact on audit

expenses. This paper takes A-share listed companies as the research object, establishes an empirical regression

model, and studies how the customer concentration of enterprises in the supply chain affects the audit cost

from the perspective of the supply chain. In addition, when the audit unit of the enterprise is the Big Four, the

effect of customer concentration on reducing audit fees is not significant. In the non-big four enterprises, the

concentration of clients significantly reduces the audit fees.

1 INTRODUCTION

In recent years, with the development of economic

globalization and industrial diversification,

enterprises in the supply chain are no longer in the

traditional relationship of buying and selling, but as a

new type of partnership, the mutual influence is more

and more serious, the relationship is more and more

close, and the external competition is more and more

as a whole (Kotabe et al., 2003). Supply chain

relationship refers to the business relationship and

personal friendship created by supply chain member

enterprises in daily purchasing and sales activities (Li

and Liu, 2016), including upstream supplier

relationship and downstream customer relationship.

So in pursuit of the stability of supply chain,

enterprises will keep close contact with their

upstream and downstream enterprises From the

perspective of supply chain stability, business

activities of enterprises are completed through the

connection of supply chain, and the interruption and

transfer of key nodes in the supply chain will bring

huge losses to enterprises (Dhaliwal et al., 2016).As

a community of interests, neither customer nor

supplier can stand alone in the face of difficulties.

Different from market-oriented transactions in

western developed economies, in the Chinese market

with widespread overcapacity, enterprises tend to rely

a

https://orcid.org/0000-0002-7046-7111

more on downstream customers than upstream

suppliers (Shi and Qin, 2018), and advantageous

information brought by supply chain relationships

spills over to businesses through customer

relationships. The closer the relationship between the

customers and the enterprise the customer

concentration is higher, the more it helps enterprises

to establish long-term and stable customer

relationship with customers, the more it helps

enterprises to strengthen cooperation with customers

and maintain stable profits, also helps to promote the

company's management ability, management level

and the brand effect, resolve the company's financial

and non-financial business risk. Previous studies have

shown that customer concentration will have an

impact on the operating activities, cost structure and

profitability of enterprises, such as earnings quality,

bank credit, financing cost, investment behavior, etc.

As an important stakeholder, auditors' decisions are

also influenced by the concentration of clients, such

as audit quality and auditor selection. However, there

are relatively few researches on audit fees. Wang et

al. (2014) pointed out that the higher the client

concentration, the lower the audit fee. However, the

size and reputation of accounting firms will also

affect the impact of client concentration on audit fees.

This is because accounting firms with large scale and

high reputation do not lack clients, but the clients

24

Ma, H.

International Big Four, Customer Concentration and Audit Fees.

DOI: 10.5220/0012022900003620

In Proceedings of the 4th International Conference on Economic Management and Model Engineering (ICEMME 2022), pages 24-29

ISBN: 978-989-758-636-1

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

need them to improve the credibility of audit reports,

so these accounting firms tend to have a higher say in

audit bargaining. Therefore, this paper studies the

relationship between client concentration and audit

fees from the perspective of different scale and

reputation of accounting firms.

This paper uses Chinese A-share listed companies

from 2016 to 2021 as empirical samples to study the

relationship between client concentration and audit

fees based on different sizes and reputations of

accounting firms. The empirical results show that

customer service concentration has a significant

negative impact on audit costs. In addition, if the

accounting firm has a large scale and high reputation,

the negative correlation between client concentration

and audit fees is not significant, while if the

accounting firm has a small scale and low reputation,

the negative correlation between client concentration

and audit fees is more significant.

The research significance of this paper may be as

follows: First, the study of audit fees, the study of

factors affecting audit fees is conducive to

strengthening the government's supervision of the

audit market, so as to standardize the competition of

the audit market. Secondly, this paper studies the

influence of customer concentration on audit costs,

and points out the direction for enterprises to reduce

audit costs. Enterprises could maintain close contact

with customers, so as to increase their right to speak

in bargaining, so as to reduce audit costs. Finally, the

paper supplements the literature on the impact of

client concentration on audit fees. The influence of

client concentration on audit fees is more significant

when the enterprise has a larger voice.

2 LITERATURE REVIEW AND

THEORETICAL ANALYSIS

Audit fee is the price agreed upon by the supply and

demand parties for audit services. It is a certain

amount of fees charged by the accounting firm to the

auditee after providing audit services, that is, the price

of audit services provided by certified public

accountants. Audit fee consists of three parts: audit

product cost, risk cost and normal profit of the firm

(Wu, 2003). Audit product cost refers to the cost of

executing necessary audit procedures and issuing

audit reports, which generally depends on enterprise

characteristics such as scale and business complexity,

corporate governance and internal control. And the

risk cost mainly refers to the litigation loss and the

potential cost of restoring reputation.

Customers are the most important economic

entities in market transactions. Through implicit or

explicit contractual arrangements, customers bring

core economic benefits to the company and are the

main source for the company to obtain sustainable

competitive advantages. High customer

concentration means a close relationship between the

company and customers. Long-term and stable

transactions between the company and customers in

the supply chain can promote information sharing

between the company and customers, so as to

improve the efficiency of inventory management and

the recovery rate of accounts receivable, which is

conducive to the improvement of the company's

performance (Feng et al., 2019). Large customers

help to stabilize the supply chain, enhance the

stability of the company's earnings, and the capital

market will also produce a positive response.

Customer relationship can affect business activities,

cost structure and profitability. The high degree of

integration between the buyer and the seller can

enhance the ability of the supplier to serve customers,

promote both parties to increase sales, reduce costs,

and improve the profitability of both parties. The

purchasing power of customers affects the price

strategy, operation and product design, marketing and

customer service activities, and then affects the cost

structure and profit of the enterprise. Previous studies

have also shown that client concentration can affect

audit quality (Hung, 2021; Zhao et al., 2021) and

audit pricing (Wang, 2020).

The customer characteristics of enterprises can

also affect the cost of audit products and risk costs,

and ultimately affect the audit fees If an enterprise has

a close relationship with its customers and a strong

performance correlation, the stronger the degree of

mutual influence between the two, the situation of

mutual prosperity and mutual loss will occur between

the two. Then the retailer with large customers will

have higher returns and earnings stability. (Gosman

et al., 2004). In short, companies with large customers

perform better, have lower own risk and audit risk; If

enterprises can realize supply chain integration with

customers (Kalwani and Narayandas, 1995), the

improvement of enterprise operation efficiency will

reduce the holding level of factors affecting audit

expenses such as cash, inventory and accounts

receivable (Patatoukas, 2012). At the same time,

since enterprises mainly trade with a few important

customers, The business complexity is reduced,

which may reduce the audit effort and thus the audit

cost. In summary, the hypothesis of this paper is as

follows:

International Big Four, Customer Concentration and Audit Fees

25

Hypothesis 1: The higher the customer

concentration, the lower the audit risk, the smaller the

audit workload, and the lower the audit fee.

There are big and small accounting firms, and

there are high and low reputation accounting firms. In

related studies, scholars often divide accounting firms

into the Big Four and non-Big Four accounting firms.

According to the study, DeAngelo (1981) proposed

that large firms have higher independence and higher

audit quality. The audit quality of Big Four firms is

higher than that of non-Big Four firms (Beatty,1989;

Palmrose,1988). Compared with non-Big Four

accounting firms, Big Four accounting firms have

higher audit fees (Li and Tang, 2020). Audit product

cost, risk cost and audit fee constitute the firm's

normal profit, and audit fee is the accounting firm and

the audited unit can compete with each other. In the

current market, the Big Four accounting firms have

larger scale and higher reputation. Compared with

non-Big Four accounting firms, they also have more

say in bargaining with audited companies. This is

because accounting firms with large scale and high

reputation, such as the Big Four international

accounting firms, do not lack clients, but the clients

need them to improve the credibility of audit reports,

so these accounting firms tend to have a higher say in

audit bargaining. However, due to the long

establishment time, large scale and high reputation of

the Big Four accounting firms, it is difficult for the

audited companies to play games with them, thus

reducing their normal profits and ultimately reducing

audit fees. Therefore, this paper puts forward the

following hypotheses:

Hypothesis 2a: The audit firm is a non-Big Four

accounting firm with a small scale and low reputation,

and the audited firm has a high degree of client

concentration, which can significantly reduce the

audit fee.

Hypothesis 2b: The audit firm is a Big Four

accounting firm with a large scale and high

reputation. Even if the auditee has a high

concentration of customers, it can not significantly

reduce its audit fee.

3 RESEARCH DESIGN

3.1 Sample Source

This paper selected A-share listed companies from

2016 to 2021 as the initial sample and conducted the

following screening: ① Financial and insurance

companies were excluded; (2) Eliminate ST or *ST

companies; ③ Remove companies with incomplete

data from the sample. You end up with 11,868

observations. In order to eliminate the influence of

extreme values, the continuous variables in the model

are shrunk at 1% and 99% quantile levels. All sample

data were collected from CSMAR Database. Data

screening and processing are mainly done by Excel

and stata15 software. In this paper, the first two codes

of 2012 China Securities Regulatory Commission

industry classification standard are adopted to divide

the industry.

3.2 Variable Definitions

3.2.1 Explained Variable: Audit Fee

According to the research of Wang Xiongyuan et al.

(Wang,2014), the natural logarithm of audit fees in

the financial statements of listed companies is used to

measure audit fees (infe).

3.2.2 Explanatory Variable: Customer

Concentration

According to the research of Zhang Min et al.

(Zhang,2012), the proportion of the annual sales of

the top five customers in the total annual sales in the

financial statements of listed companies is used to

measure the customer concentration degree (ab).

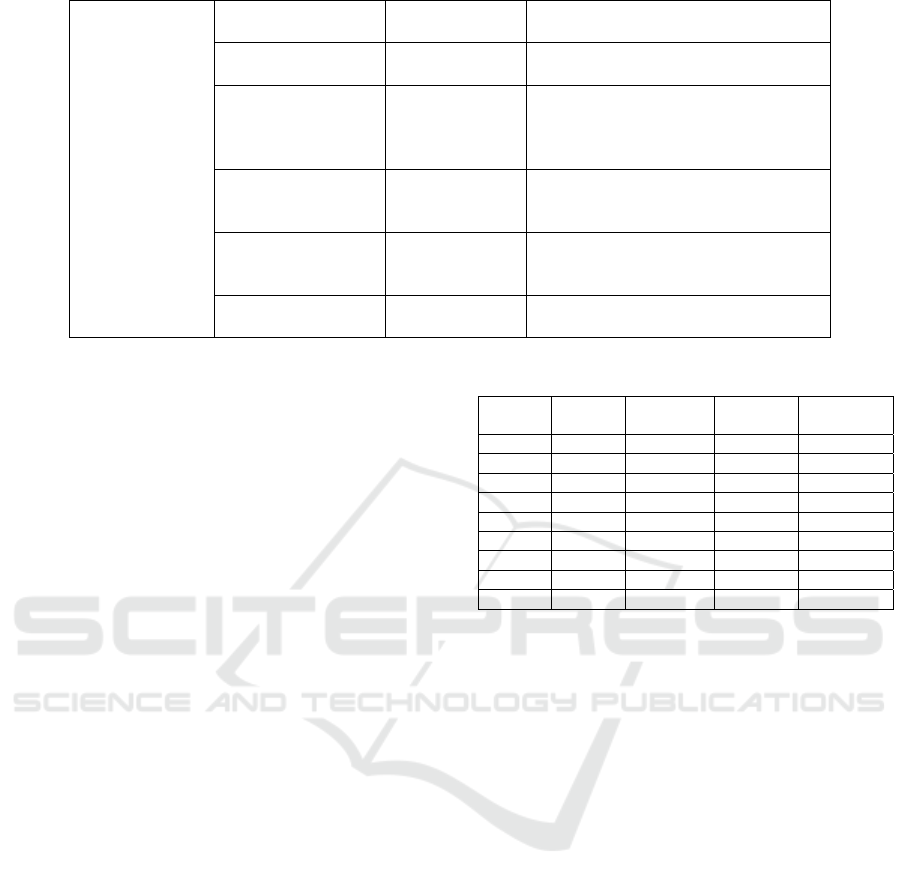

The variables are defined as follows:

Table 1: Variable definition table.

variable type

variable name variable symbol variable definition

explained

variable

audit fee infe

Natural logarithm of audit fee area

explaining

variable

Concentration of

customers

ab

The proportion of the annual sales of

the top five customers to the total

annual sales

control variable The enter

p

rise scale size Natural lo

g

of endin

g

total assets

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

26

Corporate financial

levera

g

e

lev

Total liabilities at year-end/total assets

at

y

ea

r

-en

d

Cash flow from

operating activities

cf

Cash flow from operating

activities/total assets

Type of Audit

Opinion

Q

If the audit opinion of the enterprise in

the last period is the standard

unqualified opinion, the value is 1;

otherwise, the value is 0

If the big four big4

If there are four accounting firms in

the current period, the value is 1;

otherwise, the value is 0

Discretionary

accruals

ada

Discretionary accrual earnings

management level calculated using the

modified Jones model

Return on assets roa

Average annual balance of net

p

rofit/total assets

3.3 Econometric Model

This paper mainly studies the relationship between

client concentration and audit fees. By referring to

factors affecting audit fees, this paper constructs a

panel model as shown in Equation (1) for empirical

analysis.

infe =β

0

+β

1

ab

i,t

+β

2

control

i,t

+μ

t

+μ

i

+ε (1)

Among them, infe

i,t

is the audit expense of the

enterprise in a certain year; ab

i,t

is the customer

concentration degree of an enterprise in a certain year.

control

i,t

is the control variable; μ

t

and μ

i

are year

fixed effects and individual fixed effects,

respectively. ε is the model disturbance term.

4 EMPIRICAL RESULT

4.1 Descriptive Statistics

Table 2 is the descriptive statistical results of each

variable, from which it can be seen that the minimum

value of enterprise audit fee (infe) is 11.513, and the

maximum value is 18.146. It indicates that there are

great differences in audit fees of sample companies,

and audit fees of different companies are different,

indicating that audit fee standards are different, and

enterprises may reduce their audit fees by some

means. The mean, minimum, maximum and standard

deviation of enterprise customer concentration (ab)

are 23.306, 0.01, 157.89 and 33.243, respectively,

indicating that the customer concentration of different

enterprises varies greatly. Some sample companies

maintain a close relationship with their customers, but

some sample companies do not. They don't even have

regular customers.

Table 2: Descriptive statistical results of main variables.

variable mean standard

deviation

minimum maximum

infe 13.776 0.651 11.513 18.146

ab 33.243 23.306 0.01 157.89

ada 0.072 0.143 0 6.223

lev 0.409 0.206 0.008 3.919

size 22.247 1.348 17.786 28.624

roa 0.044 0.089 -1.872 0.969

Q 0.970 0.171 0 1

b

ig4 0.061 0.239 0 1

cf 0.051 0.075 -1.794 0.879

4.2 Multivariate Regression Analysis

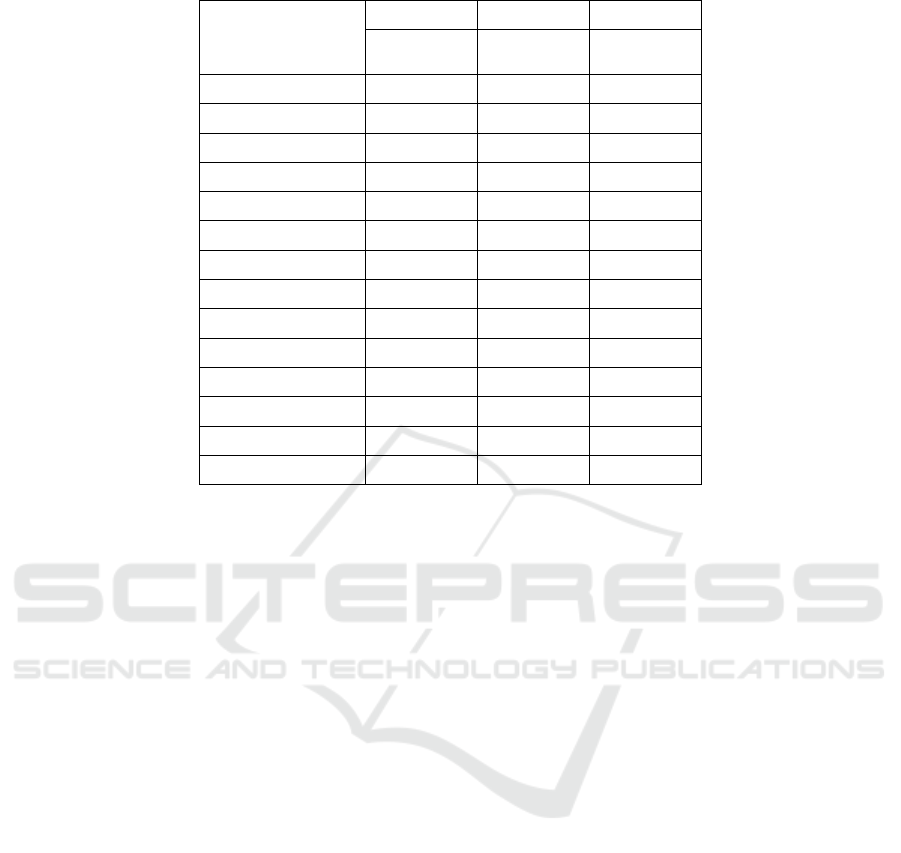

This paper first put all the sample data into the

regression model to test the hypothesis 1 of this paper,

and the specific regression results are shown in

column (1) in Table 3. Then, this paper divided the

samples into two groups according to whether the

enterprise's auditing unit is a Big Four accounting

firm, and put them into the regression model to test

the hypotheses 2a and 2b of this paper. Specific

regression results are shown in columns (2) and (3) in

Table 3. From the analysis of regression results, it can

be seen that: first, the P-value of F-test statistic in the

three regression models is all 0. This indicates that the

model is effective to a certain extent. Secondly, the

regression coefficient of customer concentration and

audit fees is negative, which verifies the negative

correlation between them. In addition, in the group

whose accounting firms are not the Big Four, the

negative correlation between client concentration and

audit expenses is still significant, while in the group

whose accounting firms are the big Four, the

relationship between client concentration and audit

expenses is not significant.

As can be seen from column (1) in Table 3, the

coefficient of customer concentration (ab) is -0.001,

indicating

that the customer concentration of

International Big Four, Customer Concentration and Audit Fees

27

Table 3: Regression results.

variable

infe infe infe

(1)All

the sam

p

les

(2)

b

i

g

4=1

(3)

b

i

g

4=0

ab -0.001*** 0.000 -0.001***

ada 0.029 0.125 0.026

lev 0.002 -0.358** 0.025

size 0.337*** 0.437*** 0.322***

roa -0.409*** -0.383* -0.393***

Q -0.114*** -0.007 -0.113***

big4 0.372*** 4.618*** 0.000***

cf 0.244*** -0.120 0.258***

_cons 6.414*** 0.000*** 6.731***

Vintage effect control control control

Individual effect control control control

N 11868 672 11196

P 0 0 0

R2 0.560 0.615 0.464

Note: *** indicates a significant correlation at the 0.01 level (bilateral).

enterprises negatively affects the audit expenses of

enterprises to some extent, which verifies hypothesis

1 in this paper. For enterprise, customer concentration

is high, means that companies with large customer,

and maintain good relationship with customers, to

some extent this ensures the stability of revenue

sources, and to ensure the stability, higher earnings

and earnings to reduce audit risk and audit work, by

reducing product cost and risk cost audit, And

ultimately lower audit fees.

From (2) column in the table 3 (3) as you can see,

in the enterprise audit units for the big four, enterprise

customer concentration and the relationship between

audit fees is not significant, but in the enterprise audit

units for the big four accounting firms, corporate

customers remain negative correlation relationship

between concentration and audit fees, and

significantly. This is because the big four accounting

firm after years of accumulation of experience, has a

high brand advantage and higher audit quality,

compared with the big four have higher competitive

advantage, so even if the customer of the enterprise

concentration is higher, the big four are often in a

favorable position when negotiating with the

enterprise, audit fees will not be lowered.

5 CONCLUSIONS

With the development of economy, enterprises in the

supply chain compete more and more as a whole, and

the relationship between suppliers and customers is

becoming closer and closer. Good customer

relationship can bring many advantages to

enterprises, such as reducing the degree of financing

constraints and improving the profitability of

enterprises. As a stakeholder of enterprises, the

decision of auditors will also be affected by the

concentration of enterprises' customers. This paper

makes an empirical analysis by combining customer

concentration with audit fees. The results show that

client concentration can significantly reduce audit

fees. In addition, the effect of client concentration on

the reduction of audit fees is different in whether the

audit unit of the enterprise is the Big Four accounting

firms. When the audit unit of the enterprise is the big

four accounting firms, the effect of client

concentration on the reduction of audit fees is not

significant. However, in non-big four auditing firms,

client concentration significantly reduces audit

fees(that is, the expenditure paid by the audited entity

to the auditing entity).

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

28

REFERENCES

Beatty R P(1989). Auditor Reputation and the Pricing of

Initial Public Offerings. J. The Accounting Review. 64

(04), 693-709.

DeAngelo L E(1981). Auditor Size and Audit Quality. J.

Journal of Accounting and Economics.3 (03), 183-199.

Dhaliwal, D., J. S. Judd, M. Serfling, and S. Shaikh(2016).

Customer Concentration Risk and the Cost of Equity

Capital. J. Journal of Accounting and Economics. 61

(1), 23-48.

Gosman M, Kelly T, Olsson P, et al.(2004).The

Profitability and Pricing of Major Customers. J. Review

of Accounting Studies. 19, 117-139.

Hong Jinming (2021). Auditor Characteristics, Client

concentration and Audit Quality. J. Journal of Hunan

University of Science and Technology (Social Science

Edition). 24 (04), 01-110.

Kalwani M U. and Narayandas N,(1995). Long-Term

Manufacturer-Supplier Relationships: Do They Pay Off

for Supplier Firms? J. Journal of Marketing. (59), 1-16.

Kotabe, M., X. Martin, and H. Domoto(2003). Gaining

from Vertical Partnerships: Knowledge Transfer,

Relationship Duratio, and Supplier Performance

Improvement in the U.S. and Japanese Automotive

Industries. J. Strategic Management Journal. 24.(4),

293-316.

Li Q, Y, Tang H,C(2020). Does Big4 have audit fee

differences? -- Preliminary evidence based on the

Chinese market. J. Contemporary Accounting

Review.3 (03), 37-70.

Li R,S, Liu H,X(2016). Supply chain relationship and

commercial credit financing: Competition or

cooperation. J. Contemporary Finance and Economics.

(4), 115-127.

Palmrose Z(1988). An Analysis of Auditor Litigation and

Audit Service Quality[J].The Accounting Review. 63

(01), 55-73.

Patatoukas P N(2012). Customer-Base Concentration:

Implications for Firm Performance and Capital

Markets. J. The Accounting Review.(187),363-392.

Shi J,Y, Qin J,C(2018). Financing constraints, customer

relationships and corporate cash holdings. J. Journal of

Systems Management. (5), 844-853.

Wang H,B, Xia X, Chen S,Z(2020). Customer

concentration, earnings management and audit pricing.

J. Finance and Accounting Monthly. (06), 95-102.

Wang X,Y, Wang P, Zhang J,P(2014). Customer

concentration and audit fees: Customer risk or supply

chain integration. J. Audit Research. (06), 72-82.

Wu L,N(2003). Analysis of the Impact of Earnings

Management on Audit Expenses: Evidence from the

First audit Expense Disclosure of Chinese Listed

Companies. J. Accounting Research. (12), 39-44.

Yin F, Wang B, Liu C, L(2019). The Influence of Customer

Concentration on Corporate Performance: An

Empirical analysis based on Social Network Theory. J.

Journal of Hohai University (Philosophy and Social

Sciences Edition). 21 (5), 51-57, 106-107.

Zhang M, Ma L,J, Zhang S(2012). Vendor-client

relationship and auditor selection. J. Accounting

Research. (12), 81-86+95.

Zhao Y, Gao J, Wang X, R, Qiao G,T(2021). Customer

concentration and audit quality. J. Friends of

Accounting. (21),107-115.

International Big Four, Customer Concentration and Audit Fees

29