Research of Inflation Processes in Ukraine in Crisis Conditions

Volodymyr M. Shinkarenko

1 a

, Alexey M. Hostryk

1 b

and Larysa V. Shynkarenko

2 c

1

Odessa National Economic University, 8 Preobrazenska Str., Odessa, 65000, Ukraine

2

International Humanitarian University, 33 Fontanskaya Rd., Odessa, 65000, Ukraine

Keywords:

Consumer Price Index, Multiple Regression Equation, Inflation Rate.

Abstract:

The purpose of the article is a research of the level of inflation in Ukraine based on the analysis of the dynamics

of the annual consumer price index. In connection with the crisis phenomena in the economy, which are

the consequences of the COVID-19 pandemic and Russian military aggression, the problem of restraining

excessive price growth becomes the most important condition for the implementation of the socio-economic

and monetary policy of the state. The impact of macroeconomic indicators such as gross domestic product,

the hryvnia exchange rate against the US dollar, and the average wage in Ukraine on the growth of consumer

prices is studied. With the use of application packages, it is substantiated that the dynamics of the consumer

price index is characterized by a random component and cannot be approximated by elementary functions that

depend only on time. With the help of MS Excel spreadsheets, a mathematical model of the dependence of

the consumer price index on the rates of growth and decline of the main macroeconomic indicators was built

in the form of a multiple regression equation and its adequacy was proven. Based on the constructed model,

it was concluded that the exchange rate of the national currency has the greatest influence on the consumer

price index. The results of the study can be used in forecasting the annual inflation rate for the next period.

Forecasting of the consumer price index for 2022 was made based on the constructed model.

1 INTRODUCTION

The coronavirus pandemic and the quarantine restric-

tions aimed at containing it have had a negative im-

pact on the global and domestic economy. The begin-

ning of 2022 shocked the whole world with the open

military aggression of the Russian regime, which led

to crisis phenomena in Ukraine and the world. At the

current stage, one of the most urgent problems is the

prevention of excessive price growth. In macroeco-

nomics, the situation in Ukraine is called stagflation.

Stagflation is characterized by rising prices during cri-

sis phenomena in the economy. The implementation

of measures to support a stable level of inflation be-

comes the most important condition for the imple-

mentation of the monetary policy of the state.

In the research, inflationary processes are stud-

ied on the basis of the annual consumer price index

(CPI) in Ukraine for the period from 2002 to 2021

according to the official website of the State Statis-

tics Service (SSSU, 2022). The consumer price in-

a

https://orcid.org/0000-0002-4388-3494

b

https://orcid.org/0000-0001-6143-6797

c

https://orcid.org/0000-0003-3819-9003

dex demonstrates the general level of inflation in the

economy and is an indicator of the population’s stan-

dard of living and social-economic development. The

CPI takes place in a center of the indicators of price

statistics system and is calculated in Ukraine, starting

from August 1991, as part of the program for devel-

oping a number of macroeconomic indicators based

on international standards. The CPI has become an

important economic indicator since its introduction.

The value of the CPI is difficult to overestimate, as it

directly or indirectly affects the standard of living of

the country’s population (State Statistics Service of

Ukraine, 2022). To curb excessive price growth, the

mathematical modeling of the level of inflation based

on a scientific analysis of the dynamics of the cost of

goods and services, the volume of GDP, the exchange

rate of the domestic currency, the level of wages and

other macroeconomic factors are needed.

156

Shinkarenko, V., Hostryk, A. and Shynkarenko, L.

Research of Inflation Processes in Ukraine in Crisis Conditions.

DOI: 10.5220/0011932200003432

In Proceedings of 10th International Conference on Monitoring, Modeling Management of Emergent Economy (M3E2 2022), pages 156-162

ISBN: 978-989-758-640-8; ISSN: 2975-9234

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

2 PROBLEM STATEMENT AND

SOLUTIONS

Considering the impact of inflation on socio-political

and economic life, various aspects of its research are

presented in the works of many domestic and foreign

scientists. The mutual influence of the growth of con-

sumer prices and inflationary expectations in Ukraine

was studied in the work of Khokhych (Khokhych,

2020). In the work of Gitis et al. (Gitis et al., 2020),

the problem of the impact of rising consumer prices

on the level of income of the population is raised. In

the article by Kuzheliev et al. (Kuzheliev et al., 2020),

the impact of inflation and other monetary policy in-

struments on key economic indicators in Ukraine dur-

ing periods of stability and crisis is considered.

Sarel (Sarel, 1996) analyzed the possibility of a

nonlinear impact of the CPI on economic growth,

when this indicator is critical – 108. Below this value,

the CPI does not affect growth, or may even have a

slightly positive effect.

In the works of Macovei and Scutaru (Macovei

and Scutaru, 2016; Macovei, 2020), the influence of

the consumer price index on the economic growth of

Romania was investigated on the basis of annual data

from 1991 to 2018 and it was proposed to use a non-

linear regression model. The results of the study show

a close relationship between the consumer price index

(CPI) and the gross domestic product (GDP).

The analysis of the use of the value unit index for

curbing inflation in Latin American countries was car-

ried out by Yereshko and Hafarov (Yereshko and Ha-

farov, 2020).

Shinkarenko et al. (Shinkarenko et al., 2021) ex-

amines the behavior of the consumer price index in

Ukraine for the period from January 2010 to Septem-

ber 2020 by month. The characteristics of the ini-

tial time series, the analysis of auto-correlation func-

tions made it possible to reveal the trend of their

development and the presence of annual seasonality.

To simulate the behavior of the consumer price in-

dex and forecast for the following months, 2 types

of models were used: the additive ARIMA*ARIMAS

model, better known as the Box-Jenkins model (Box

et al., 2015) and the exponential smoothing model

with Holt-Winters seasonality estimation (Gardner

Jr., 1985). As a result of using the STATISTICA pack-

age, the most adequate models reflecting the monthly

dynamics of the consumer price index in Ukraine

were built. However, the rapid deterioration of the

economic situation in Ukraine in connection with

open Russian military aggression does not allow the

application of these models.

3 MAIN RESULTS

Inflationary processes are studied on the basis of

the following macroeconomic indicators: the annual

consumer price index in Ukraine (CPI), the annual

gross domestic product (GDP) calculated in US dol-

lars, the exchange rate of the hryvnia against the US

dollar (HR) and the level of average wages (AW),

converted in US dollars for the period from 2002

to 2021. The array of data was compiled on the

basis of the reports of the State Statistics Service

of Ukraine (SSSU, 2022) and the National Bank of

Ukraine (NBU, 2022). The resulting array of data is

shown in table 1.

To build a model and forecast the level of inflation,

we first find the main statistical characteristics of the

dynamic series under investigation. They are shown

in table 2.

Numerical characteristics of the CPI range show

that the consumer price index fluctuated in the interval

from 99,4% to 143,3% during the studied period. The

mean square deviation of 6,63 shows that the variation

of the consumer price index for the studied period is

quite small.

The characteristics of the GDP series show that

during the studied period the volume of the gross do-

mestic product gradually increased from 50 133 mil-

lion US dollars to 183 310 million US dollars. The

mean square deviation of 32130,572 indicates the ab-

sence of anomalous values of the indicator except for

certain years.

The statistics of the HR series show a gradual de-

preciation of the national currency from 5,05 to 27,2

per US dollar. The mean square deviation of 8,344

shows that hryvnia exchange rate jumps in some years

were quite insidious.

Numerical characteristics of a number of wage

earners show that the average wage in Ukraine grad-

ually increased from USD 70,59 to USD 430,21. The

mean square deviation of 83,025 indicates that the

growth of the indicator occurred gradually.

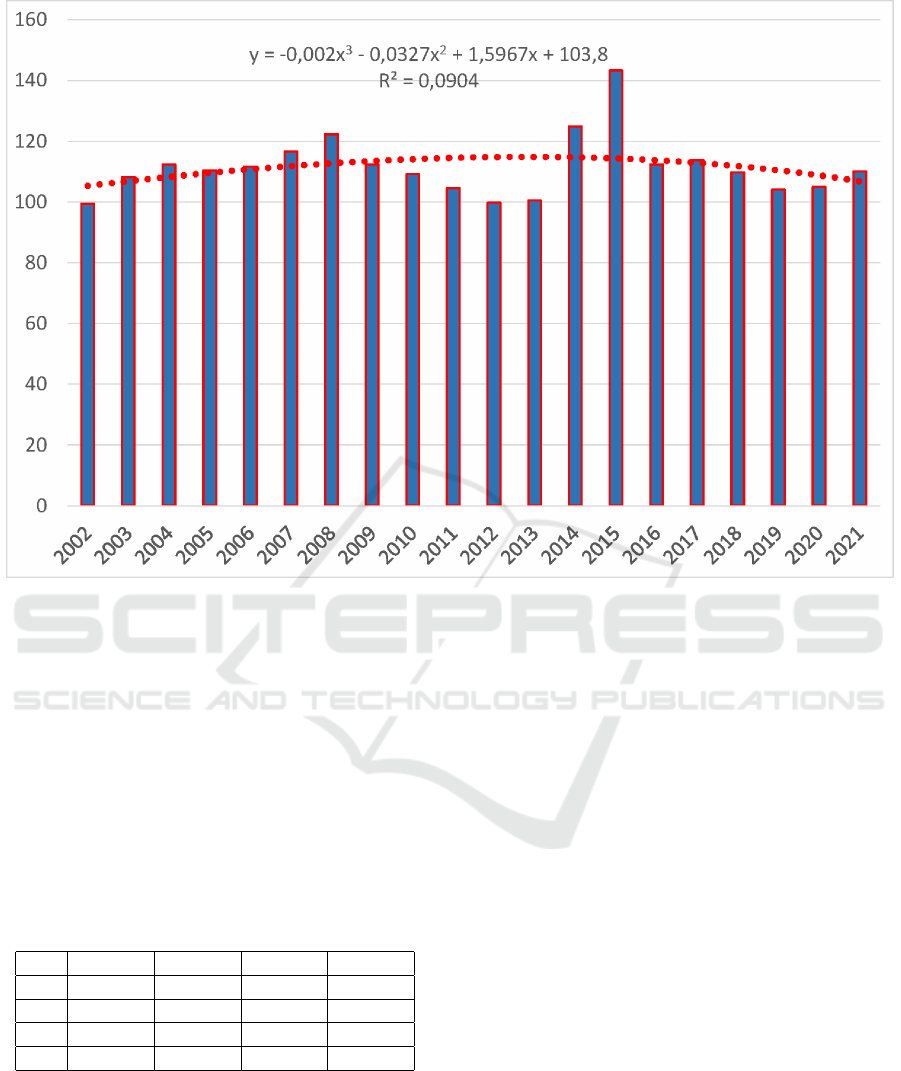

In order to clearly display the dynamics of the

consumer price index in Ukraine during 2002-2021,

a diagram of the indicator was constructed (figure 1).

The constructed trend equation shows that CPI

forecasting using standard time series forecasting

methods is not possible, as the correlation coefficient

is very small. The series has neither a trend nor a

seasonal component, therefore, in order to make an

adequate forecast, it is necessary to identify the fac-

tors that have the greatest influence on the dynamics

of the CPI.

Since the indicators chosen for the model have

fundamentally different dimensions, it is impossible

Research of Inflation Processes in Ukraine in Crisis Conditions

157

Table 1: Some macroeconomic indicators in Ukraine for 2002-2021.

Years CPI GDP HR AW CPI GDP HR AW

2002 99,4 59286 5,29 70,59 - - - -

2003 108,2 50133 5,33 86,74 1,082 1,183 0,992 1,229

2004 112,3 64883 5,32 111,02 1,123 1,294 0,997 1,280

2005 110,3 86142 5,12 157,3 1,103 1,328 0,963 1,417

2006 111,6 107753 5,05 206,51 1,116 1,251 0,985 1,313

2007 116,6 142719 5,05 267,87 1,166 1,325 1,000 1,297

2008 122,3 179992 5,27 343,43 1,223 1,261 1,043 1,282

2009 112,3 117228 7,79 245,05 1,123 0,651 1,479 0,714

2010 109,1 136419 7,94 283,12 1,091 1,164 1,019 1,155

2011 104,6 163160 7,97 331,24 1,046 1,196 1,004 1,170

2012 99,8 175781 7,99 379,42 0,998 1,077 1,003 1,145

2013 100,5 183310 7,99 409,59 1,005 1,043 1,000 1,080

2014 124,9 131805 11,89 292,32 1,249 0,719 1,487 0,714

2015 143,3 90615 21,84 162,60 1,433 0,687 1,838 0,556

2016 112,4 93270 25,55 203,02 1,124 1,029 1,170 1,249

2017 113,7 112154 26,60 267,16 1,137 1,202 1,041 1,316

2018 109,8 130832 27,20 325,99 1,098 1,167 1,023 1,220

2019 104,1 153781 25,85 406,40 1,041 1,175 0,950 1,247

2020 105,0 155568 26,96 430,21 1,050 1,012 1,043 1,059

2021 110,0 200090 28,78 506,42 1,100 1,286 1,068 1,177

Table 2: Characteristics of dynamic series for 2002-2021.

Indicator Average value Average deviation Minimal value Maximal value

CPI 112,3 6,630 99,4 143,3

GDP 126419,1 32130,572 50133 183310

HR 13,2 8,344 5,05 27,20

AW 272,7 83,025 70,59 430,21

to build a function that will accurately reflect the im-

pact of GDP, HR and SP on the CPI. In such cases, it

is necessary to standardize the data. Methods of stan-

dardization of research factors are described in detail

in works (Shinkarenko et al., 2019; Matskul et al.,

2020). The method of eliminating different dimen-

sions is also used, which is based on the comparison

of growth rates of time series (for example, (Kozak

et al., 2017)). This is what we used in our work to

analyze inflationary processes.

When modeling relationships in dynamic series,

relative values are widely used. This is due to their

greater elasticity in time compared to absolute val-

ues. In addition, it helps eliminate multicollinearity

and autocorrelation of the residuals. We will assume

that the CPI is modeled by a function of the Cobb-

Douglas-Tinbergen type (Yankovoy and Yankovoy,

2019):

I = γ · Q

α

· G

β

· K

λ

· e

µt

. (1)

where I is the consumer price index (%), Q is GDP

(millions of US dollars),G is the hryvnia exchange

rate (US dollars), K is the average wage (US dollars).

Parameters α, β, γ and µ are elasticity coefficients: α

characterizes the increase in the CPI per unit of GDP

growth at unchanged HR and SP, β is the increase in

CPI per unit of increase in HR at unchanged GDP and

SP, Λ is the increase in CPI per unit of increase in SP

at unchanged GDP and HR, µ — CPI growth due to

factors not included in the model.

Applying logarithmic differentiation to the Cobb-

Douglas-Tinbergen function, taking into account that

each factor depends on time, we obtain a linear model

that describes the relationship between growth rates:

i = µ + α · q + β · g + λ · k. (2)

where i, q, g, k are the growth rates of CPI, GDP, HR

and AW, respectively. In the future, the rate of growth

of the indicator will be understood as the ratio of its

next level to the previous one. Note that this approach

avoids reducing the indicators to one dimension. Ta-

ble 1 shows the growth rates of each of the studied

indicators.

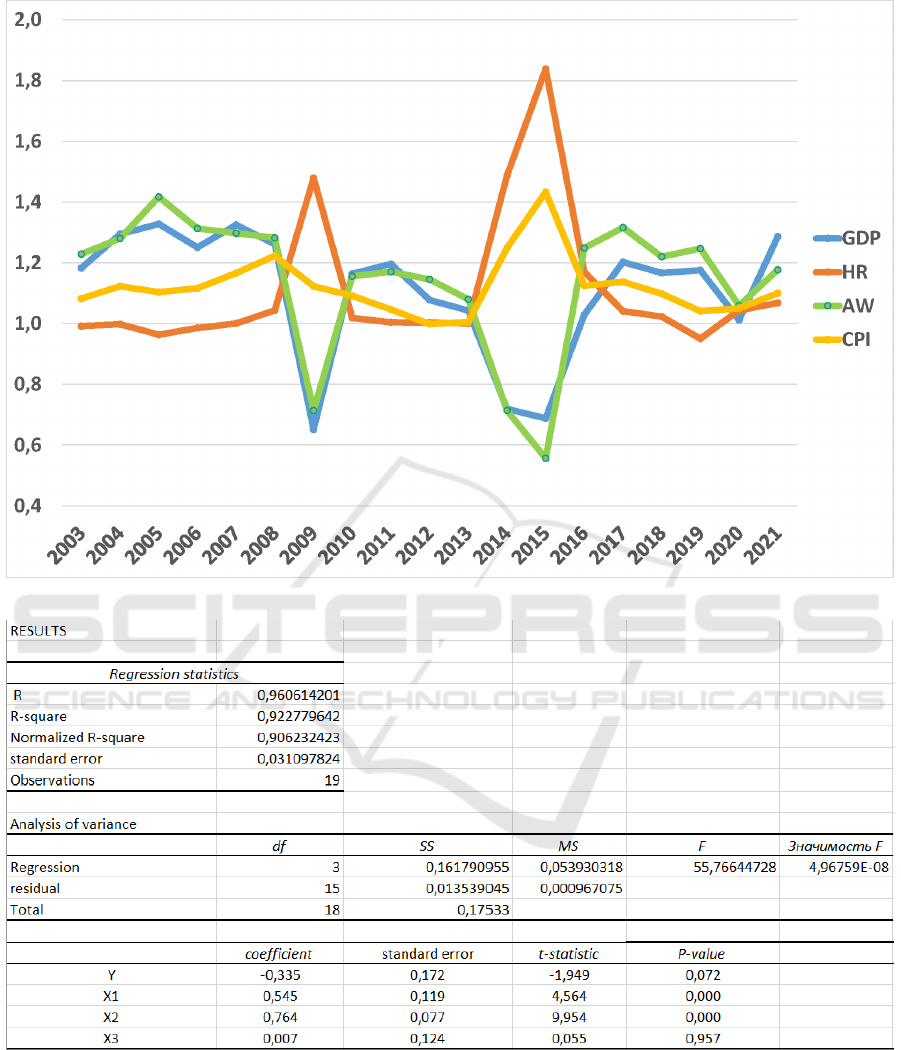

To determine the general trend of the behavior of

the time series, a diagram was constructed that reflects

the dynamics of the growth rates of the consumer

M3E2 2022 - International Conference on Monitoring, Modeling Management of Emergent Economy

158

Figure 1: Dynamics of the consumer price index in Ukraine for 2002-2021.

price index, the gross domestic product, the hryvnia

exchange rate, and the average wage (figure 2).

The analysis of the constructed trend lines shows

that fluctuations in the level of the consumer price in-

dex are closely related to the behavior of the volume

of the gross domestic product, the hryvnia exchange

rate, and the average wage. To confirm the hypothesis

about the presence of a close relationship between the

specified factors, the correlation coefficients between

the indicators were calculated. The obtained coeffi-

cients are shown in table 3.

Table 3: Correlation matrix of CPI, GDP, HR and AW.

CPI GDP HR AW

CPI 1 -0,43485 0,790091 -0,54429

GDP -0,43485 1 -0,87949 0,954285

HR 0,790091 -0,87949 1 -0,91172

AW -0,54429 0,954285 -0,91172 1

The calculated coefficients allow us to conclude

that the rate of growth of the consumer price index is

most affected by fluctuations in the hryvnia exchange

rate (a 1% devaluation of the hryvnia leads to an in-

crease in the CPI by 0,79%). The influence of the

growth rates of the gross domestic product and av-

erage wages is moderate and negative, that is, an in-

crease in the GDP growth rate by 1% will lead to a

decrease in the CPI by 0,43%, the consequence of an

increase in the growth rate of GDP by 1% is a de-

crease in the CPI by 0,54%.

A regression equation was built using the MS Ex-

cel:

i = −0,335 + 0,545 · q + 0,764 · g + 0,007 · k. (3)

where i, q, g, k are the growth rates of CPI, GDP, HR

and AW, respectively (figure 3).

The equation has good statistical indicators of cor-

relation and regression analysis. The multiple corre-

lation coefficient R = 0,961 shows that the volume

of GDP, the hryvnia exchange rate and the average

salary directly affect the change in the CPI (cover-

ing about 9% of the influencing factors). The stan-

dard error of the regression S

y

= 0,031 is quite small,

which indicates that the model corresponds to the eco-

nomic process. The calculated value of the F-criterion

is F = 55,766, its significance is F = 4,97 · 10

−8

. The

calculated value is significantly less than 0,01, there-

fore, with a 99% level of reliability, it is possible to

assert, according to Fisher’s test, that the constructed

model is adequate to the empirical data.

Let’s check the reliability of each of the coeffi-

cients of the constructed equation: for the first coeffi-

cient

t

1

= 4,564, p

1

= 0,0004 < 0,005,

Research of Inflation Processes in Ukraine in Crisis Conditions

159

Figure 2: Growth rates of the CPI, GDP, HR and AW in Ukraine for 2003-2021.

Figure 3: Results of Regression statistics and Analysis of variance.

therefore, according to the Student’s criterion, the co-

efficient is statistically reliable with a level of 99%,

for the second coefficient

t

2

= 0,077, p

2

= 9,89 · 10

−8

< 0,005,

therefore, according to the Student’s test, the coeffi-

cient is statistically reliable at the 99% level, for the

third coefficient the value

t

3

= 0,124, p

3

= 0,957 > 0,005,

therefore the coefficient is not statistically reliable at

the 99% level. It is more likely that the problem arose

as a result of the close connection between the factors

of GDP and AW.

M3E2 2022 - International Conference on Monitoring, Modeling Management of Emergent Economy

160

To check the reliability of the built model, we will

calculate the forecast value of the consumer price in-

dex for the end of 2022, using the data on the gross

domestic product, the hryvnia exchange rate and the

average salary, which are given on the websites of the

Cabinet of Ministers of Ukraine (Ministry of Finance

of Ukraine, 2022) and the National Bank of Ukraine

(NBU, 2022). According to the given data, a decrease

in GDP is expected by 40%. The hryvnia exchange

rate is set at UAH 40,0 per USD, up 38,7% from the

previous period. The average salary at the end of 2022

is forecast to be UAH 18,535, which at the exchange

rate of UAH 40,0 is 440,48 USD, the growth until

2021 is 12,9%. Let’s calculate the predicted value of

the CPI:

i = −0,335 + 0,545 · 0,6 + 0,764 · 1,39+

0,007 · 0,87 = 1,417.

(4)

The calculated value shows that the consumer

price index in 2022 will increase by 41,7% compared

to 2021.

4 CONCLUSION

The built mathematical model of the dependence of

the growth of the index of social prices on the growth

of the annual volume of the gross domestic product,

the exchange rate of the hryvnia and the level of the

average salary is adequate and reliable. Using the re-

gression equation, it is possible to estimate the influ-

ence of factors on the change in the CPI and calculate

the predicted values of the social price index.

The processing of the array of the consumer price

index with the help of application programs proved

that the indicator is characterized by a random com-

ponent and cannot be approximated by elementary

functions.

The forecast of the indicator for the end of 2022

showed that, taking into account the crisis in the econ-

omy associated with the Russian military aggression,

a significant increase in the level of inflation is ex-

pected in Ukraine.

For a more detailed study of the causes and rates

of growth of the consumer price index, one should

consider the change in the value of its individual com-

ponents (food, non-food, services and other groups of

goods), the relationship of the indicator with a sim-

ilar indicator in neighboring countries (price growth

on the world market), the influence of the state debt

to the level of inflation in the country.

REFERENCES

Box, G. E. P., Jenkins, G. M., Reinsel, G. C., and Ljung,

G. M. (2015). Time Series Analysis, Forecasting and

Control. Wiley, 5 edition.

Gardner Jr., E. S. (1985). Exponential smoothing: The state

of the art. Journal of Forecasting, 4(1):1–26. https:

//doi.org/10.1002/for.3980040103.

Gitis, T. P., Chemerys, Y. T., Antonova, V. I., and Nosany-

ova, A. S. (2020). Study of the current level of so-

cial protection of the population in ukraine. Economic

Bulletin of Donbass, 1(59):64–81. https://doi.org/10.

12958/1817-3772-2020-(59)-116-122.

Khokhych, D. (2020). Interaction of consumer prices

growth dynamics and inflation expectations in

ukraine. Finance of Ukraine, (4):64–81. https://doi.

org/10.33763/finukr2020.04.064.

Kozak, Y., Matskul, V., and Shengelia, T. (2017). Mathe-

matical methods and models for master of economics.

Practical applications.

Kuzheliev, M., Zherlitsyn, D., Rekunenko, I., Nechy-

porenko, A., and Nemsadze, G. (2020). The im-

pact of inflation targeting on macroeconomic indica-

tors in ukraine. Banks and Bank Systems, 15(2):94–

104. https://doi.org/10.21511/bbs.15(2).2020.09.

Macovei, A.-G. (2020). Impact of the consumer price in-

dex on gross domestic product in romania. Ecofo-

rum, (XXX). http://www.ecoforumjournal.ro/index.

php/eco/article/downloadSuppFile/1053/605.

Macovei, A. G. and Scutaru, L. (2016). The impact of in-

ward fdi on trade: evidence from romania. Academic

Research International, 7(4):95–105.

Matskul, V., Okara, D., and Podvalna, N. (2020). The

ukraine and eu trade balance: prediction via various

models of time series. 73. https://doi.org/10.1051/

shsconf/20207301020.

Ministry of Finance of Ukraine (2022). Official web-site of

the ministry of finance of ukraine. https://mof.gov.ua.

NBU (2022). National bank of ukraine. https://bank.gov.

ua/ua/news/all/rishennya-oblikova-stavka.

Sarel, M. (1996). Nonlinear effects of inflation on economic

growth. IMF Staff Papers, 43(1):199–215. https://doi.

org/10.2307/3867357.

Shinkarenko, V., Hostryk, A., Shynkarenko, L., and Dolin-

skyi, L. (2021). A forecasting the consumer price

index using time series model. SHS Web of Con-

ferences, 107:10002. https://doi.org/10.1051/shsconf/

202110710002.

Shinkarenko, V., Matskul, M., and Linok, D. (2019). In-

vestment attractiveness modeling using multidimen-

sional statistical analysis. In Kiv, A., Semerikov, S.,

Soloviev, V. N., Kibalnyk, L., Danylchuk, H., and

Matviychuk, A., editors, Proceedings of the Selected

Papers of the 8th International Conference on Moni-

toring, Modeling & Management of Emergent Econ-

omy, M3E2-EEMLPEED 2019, Odessa, Ukraine,

May 22-24, 2019, volume 2422 of CEUR Workshop

Proceedings, pages 147–156. CEUR-WS.org. http:

//ceur-ws.org/Vol-2422/paper12.pdf.

Research of Inflation Processes in Ukraine in Crisis Conditions

161

SSSU (2022). State statistics service of ukraine. http://

www.ukrstat.gov.ua.

State Statistics Service of Ukraine (2022). Consumer price

index: perception and reality. https://www.lv.ukrstat.

gov.ua/ukr/themes/13/.

Yankovoy, A. and Yankovoy, V. (2019). Optimization of the

capital-labor ratio of industrial enterprises using pro-

duction functions. Ekonomika Ukrainy, (11-12):34–

48.

Yereshko, J. and Hafarov, E. (2020). Indexed unit of ac-

count. Efektyvna ekonomika, (5). https://doi.org/10.

32702/2307-2105-2020.5.91.

M3E2 2022 - International Conference on Monitoring, Modeling Management of Emergent Economy

162