The Influence of COVID-19 on Emerging and Mature Stock Market

Based on Time-Fixed Effects Model

Nexus Ikeda

75 3

rd

Avenue, NY 10003, New York, U.S.A.

Keywords: COVID-19, Stock Market, Panel Data Analysis, Emerging Economy, Mature Economy.

Abstract: The outbreak of COVID-19 pandemic has caused irriversable impact the entire social aspects, especially in

stock markets. Under this background, understanding the relationship between the COVID-19 pandemic and

stock performance has become increasingly important. This paper examines the effects of the COVID-19

pandemic on the stock markets, including both emerging and mature stock markets. By systematically

reviewing daily data of the number of COVID confirmed cases and stock market returns from March 10,

2020, to April 30, 2020, in ten different countries (five emerging countries and five mature countries), this

paper conducts the quantitative assessment using time-fixed effects model and unit root test, and finds that

there is a negative relationship between the growing number of COVID confirmed cases. When looking at

emerging and mature stock markets respectively, our findings suggest that emerging markets responded

more strongly compared with mature markets. Understanding the link between the severity of the pandemic

and the performance of the stock market will help governments around the world improve market

adjustment mechanisms and maintain the stability of stock markets.

1 INTRODUCTION

The outbreak of pandemics has long been regarded as

an uncontrollable factor in affecting the performance

of stock markets. It refers to a widespread occurrence

of a novel, contagious disease over a large area or

across the world (Wikipedia 2021). At the end of

2019, the outbreak of COVID-19 in Wuhan, China

has rapidly swept across the globe. According to the

World Health Organization, as of August 2021, there

have been more than 202,000,000 confirmed cases of

COVID-19 globally, with over 230 countries

suffering from it (who.int 2021). Due to its extreme

infectiousness and high pathogenicity, pandemics

may have extensive and disruptive consequences in

healthcare services, social activities, and the global

economy. Among these aspects, one of the hardest-

hit components is undoubtedly the global stock

market. Apart from controlling the spread of the

disease, governments also implemented national

stimulus plans or programs to recover the economic

loss. Although the impact of COVID-19 on financial

stock markets came as no surprise, a systematic

understanding of their quantitative relation is still not

sufficient. Therefore, the purpose of this

investigation is to evaluate the influence of COVID-

19 on stock markets, compare the diverse impact on

emerging and mature economies, and further address

the research gaps in this field.

The remaining part of the paper proceeds as

follows: Section 2 presents the literature review and

current academic progress. Section 3 displays data,

methodology, and findings. Section 4 summarizes

the concluding remarks.

2 LITERATURE REVIEW

2.1 Literature Analysis

A growing body of research has paid particular

attention to many public health emergencies in

history, including the Spanish Influenza, the severe

acute respiratory syndrome (SARS), the Swine flu

(H1N1 flu), etc. To date, many have begun to

consider their implications on the stock market, such

as disruptions on the supply chain of products, losses

in international business and trade, as well as poor

cash inflow toward the stock markets. This section

sets out to conduct a comprehensive literature

analysis on the current academic progress regarding

the relationship between pandemics and the stock.

846

Ikeda, N.

The Influence of COVID-19 on Emerging and Mature Stock Market Based on Time-Fixed Effects Model.

DOI: 10.5220/0011769800003607

In Proceedings of the 1st International Conference on Public Management, Digital Economy and Internet Technology (ICPDI 2022), pages 846-852

ISBN: 978-989-758-620-0

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

Table 1: Search Queries and Results.

Ke

y

word Strin

g

s Results

(pandemic AND stock) OR (pandemic AND

market) OR (epidemic AND stock) OR

(epidemic AND market)

921 document results

(pandemic AND stock) OR (pandemic AND

market) OR (epidemic AND stock) OR

(epidemic AND market) AND (COVID*)

779 cument results

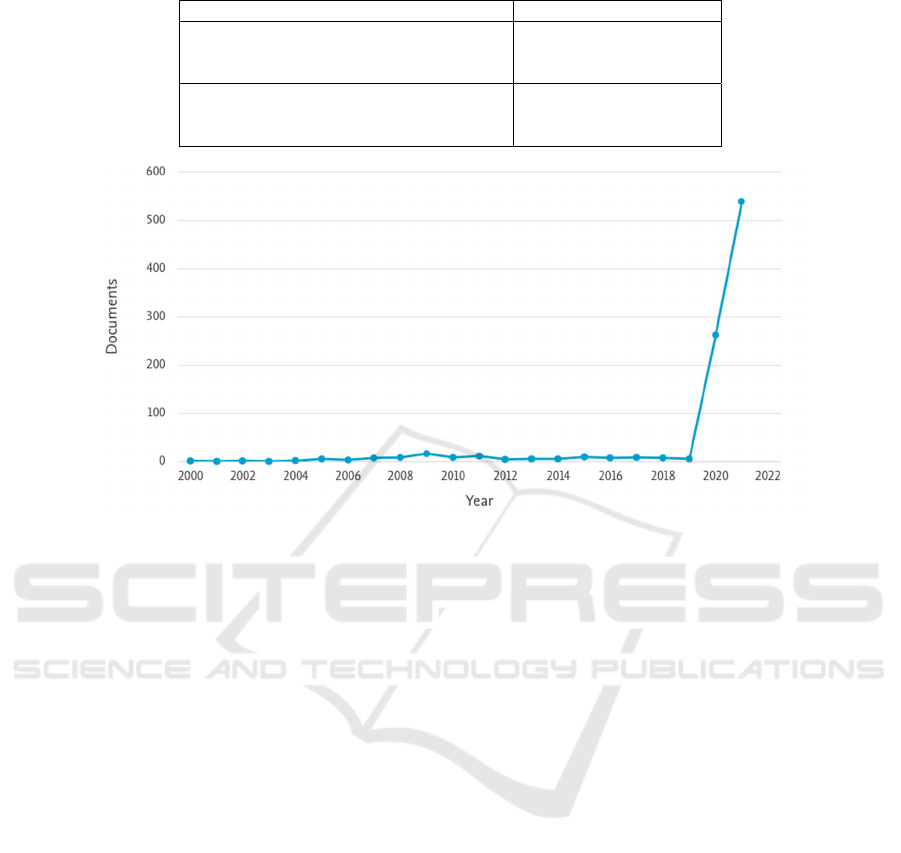

Figure 1: Documents by Year.

market. The methodology is to utilize keyword

search and text analysis to retrieve and review

related academic literature through Web of Science

and Elsevier’s Scopus, the two largest online journal

archives and databases. The search queries and

results are shown in the Table 1.

As presented in Figure 1, by looking at the

changes in the number of published articles,

journals, and papers by year, it is obvious that the

statistics remained steady from 2000 to 2019, with

an average of 1 or 3 documents each year. However,

the number of documents has soared in the past three

years and is now at a record high, with 539

publications over the first-half year of 2021. This

may be explained by the outbreak of COVID-19 in

2019, which sets off a great wave of academic

discussions and refocus their efforts on analyzing its

series of social, economic, and environmental

influences.

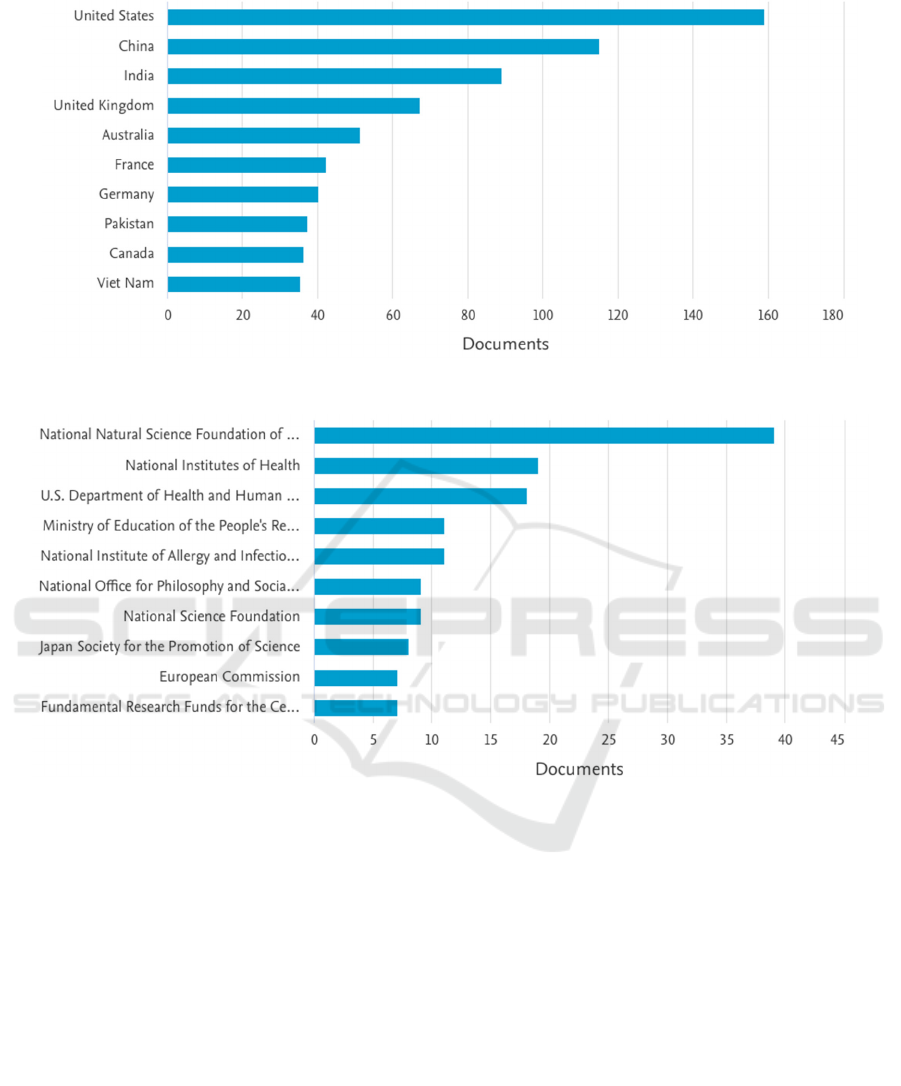

Figure 2 describes the geographical spread of the

retrieved list of key references and presents the top

fifteen countries with the highest number of them.

The results have covered most continents of the

world, including Asia, Europe, North America, and

Oceania. 159 documents are published in the United

States, while China is running a close second with

115 published literature. However, when taking a

closer look at the finished documents from 2020 to

2021, which is also referred to as the post-COVID

times, we noticed that the number of publications in

China is almost the same as in the United States.

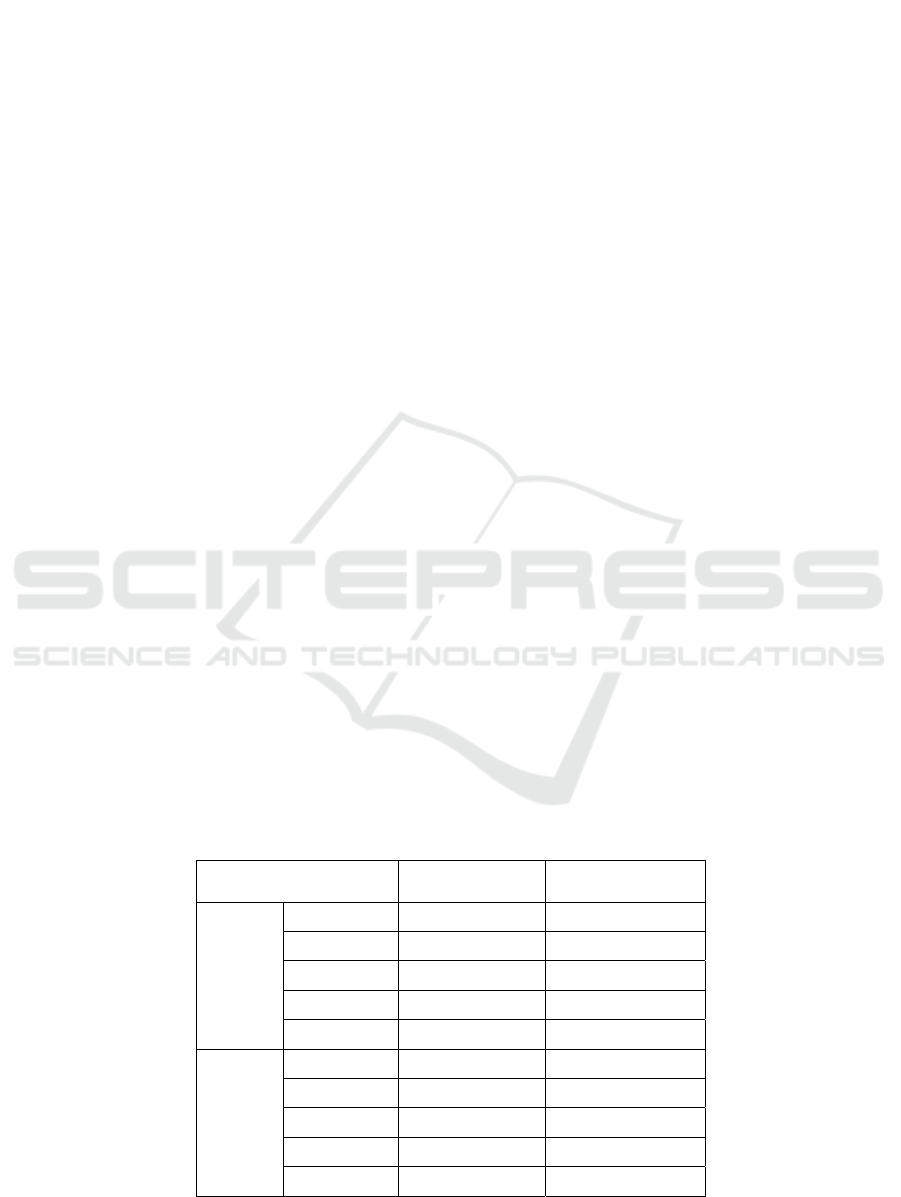

Furthermore, Figure 3 provides the breakdown of

funding sponsors behind the literature progress.

Nearly 80% of these researches are supported by

national foundations or national institutes focusing

on natural science, healthcare, and human services.

What stands out in the figure is that many studies are

funded or cooperated with government departments

and institutions, such as the European Commission,

the Ministry of Education of the People’s Republic

of China, U.S Department of Health and Human

Services. This reflects that descriptive research

analysis and scientific guidance on the effects of

pandemics have become significant issues that

academic and political circles face commonly.

2.2 How Pandemics Affected Stock

Markets

Apart from literature analysis, this paper also delved

into text analysis and attempted to conclude the

impact of various pandemics on stock markets that

we have investigated so far. It is commonly agreed in

the academic circle that pandemics can bring about

tremendous uncertainty in the world situation and

The Influence of COVID-19 on Emerging and Mature Stock Market Based on Time-Fixed Effects Model

847

Figure 2: Documents by Country or Region.

Figure 3: Documents by Funding Sponsor.

may provoke a prudential and even pessimistic

atmosphere in a wide range of industries with

intensified fear among a majority of investors,

causing further economic losses and sharp

movements in stock markets. For instance, Chen et al.

investigated how the SARS pandemic in 2003

affected the Taiwan stock market by comparing the

stock prices and market returns of listed companies

in multiple industries on and after the day of the

SARS outbreak (Chen, Chen, Tang and Huang 2009).

Their findings indicated that the disease had a

significantly negative impact on the market

performance of tourism, retail sector, and hotel

businesses, which all showed unfavorable returns.

However, it has played a positive role in accelerating

the development of biotechnology and health science

with higher stock returns. Jiang et al. analyzed the

relationship between the pandemic H7N9 outbreak

and the stock performance in China using distributed

non-linear model, and found out that, as the daily

number of cases rises, stock prices and market

indexes have been negatively affected, ranging from

the biomedicine sector to tradition medicine sector

(Sun 2017). Verikios et al. applied the Monash health

model to explore the financial impact of two H1N1

epidemics on the Australian economy, and believed

that the increased scope of pandemics could result in

a drastic reduction in domestic investment, GDP, and

employment

(Wong and Deng 2011).

2.3 How COVID-19 Affected Stock

Markets

Meanwhile, as the COVID-19 pandemic phases

progress, numerous studies have been undertaken to

examine its negative impact on stock markets around

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

848

the world. Takyi et al. examined the quantitative

relationship between the COVID-19 and stock

performance in thirteen African countries

(Takyi and

Bentum-Ennin 2021). Based on their time-series

findings, the pandemic posed restrictive effects on

multiple stock markets in Africa and the stock returns

have experienced a notable deduction during and

after the outbreak. Ashraf et al. further explored how

the stock markets reacted to the COVID-19

pandemic using statistics from 64 countries and

verified a negative relationship between confirmed

cases and stock returns. They also found out even

though stock markets generally responded quickly to

any of the dynamic aspects of the pandemic

(Ashraf

2020).

On the other hand, the outbreak of COVID-19 is

also accompanied by legislative and policy changes,

including lockdowns, travel restrictions, and short-

sales bans, to reduce infection risk and maintain the

stability of the market. Several studies also analyzed

how these policies may influence stock markets. For

example, Bannigidadmath et al. analyzed the impact

of policy incentives, lockdowns, and travel bans in

25 countries and suggested negative returns in most

countries

(Bannigidadmath, Narayan, Phan and

Gong 2021). Anh et al. investigated a positive

impact of the nationwide lockdown in Vietnam on

its stock markets, and concluded that the favorable

returns came from investors’ confidence in

government decisions (Anh and Gan 2020).

However, considering the scope and severity of the

COVID-19 pandemic, it definitely needs more

studies to offer both theoretical and practical

guidance compared with the other pandemics.

Therefore, this paper aims to further assess the

influence of the COVID-19 pandemic on stock

markets, both emerging and mature markets

included, and enhance the process of epidemic

response, scientific policy-making, and financial

control.

3 DATA AND METHODOLOGY

In order to accurately measure the impact of the

COVID-19 pandemic on the stock performance, this

paper seeks to conduct quantitative analysis on

correlated variables and gain insights into market

responses to the ongoing spread of the pandemic and

the dynamic mechanism of the global stock market.

Previous studies have based their measurement on

time-series methods and panel data analysis, and

these techniques are particularly useful in tracking

changes over time and studying diverse subjects in

selected countries. Thus, this paper will follow the

same analytical path to capture the complexity of this

issue and to obtain additional research evidence in

the academic arena.

3.1 Data Collection

This paper started by identifying several variables

and public websites and databases. To ensure that the

obtained results have universality and our dataset is

complete and reliable, this paper selected ten stock

markets spanning all five continents as our research

samples, and they include five emerging stock

markets and five mature stock markets. The detailed

information is as follows:

Table 2: Sample Description.

Country Stock Index

The Date of 1st

Confirmed Case

Mature

Stock

Markets

USA S&P 500 Jan 22, 2020

UK FTSE 100 Jan 31, 2020

Japan Nikkei 225 Jan 22, 2020

Australia S&P_ASX 200 Jan 26, 2020

South Africa TOP 40 Mar 5, 2020

Emergin

g Stock

Markets

Brazil Bovespa Feb 26, 2020

Russia MOEX Jan 31, 2020

India BSE Sensex 30 Jan 30, 2020

China Shanghai Stock Jan 22, 2020

Chile S&P CLX IPSA Mar 3, 2020

The Influence of COVID-19 on Emerging and Mature Stock Market Based on Time-Fixed Effects Model

849

Table 3: Summary Statistics.

Variables

Stock Market

Returns

Oil Prices

Confirmed

COVID cases

Observations 350 350 350

Mean 0.00090463 60.6608 64661.5314

Median 0.00408785 64.86 6578.5

Standard Deviation 0.00215329 0.77139797 9213.33806

Minimum -0.1477968 -37.63 7

Maximum 0.13908215 69.63 1081105

Table 4: Unit Root Test Results.

Variables

P-value

(Ori

g

inal Data)

P-value

(After Firs

t

-

Order Difference)

Stock Market Returns 0.9925 0.0000

COVID 0.7835 0.0095

Oil Price 0.9983 0.0000

Firstly, this paper used the number of confirmed

cases as a share of total population to evaluate the

severity of COVID-19. The statistics are

downloaded from Johns Hopkins Coronavirus

Resource Center by country from March 10, 2020 to

April 30, 2020. Secondly, to record stock market

indices and returns, we acquired daily stock market

data from Investing Database and Yahoo Finance

database. Considering the data availability,

consistency, and integrity, we only adopted one

major stock market index as shown in Table 2.

Thirdly, this model also takes the oil price into

account for it is another important factor that

influences the macro economy and the stock market.

A popular benchmark for oil price shocks is the

Brent crude oil prices in U.S. dollars per barrel, and

its daily data over the same time span are retrieved

directly from www.investing.com. Lastly, even

though the number of confirmed COVID cases can

be easily observed after the first case is detected in a

country, data of stock markets can be unavailable

when stocks close during the weekends or national

holidays. After removing these missing or

incomplete values, the dataset has also been

reviewed multiple times before being put into our

model. The summary statistics are presented in the

Table 3.

3.2 Model Building

Since our dataset includes observations of numerous

subjects at different points in time, this paper chose

to conduct panel data analysis and establish a fixed-

effects estimated model to control time-invariant

variables. An advantage of panel data analysis is that

it performs better in reflecting time-varying

relationship as well as reducing the possibility of

multicollinearity and estimation bias. Hence, we

propose the following model:

d.𝑆𝑀𝑅

= 𝛼

+ 𝛽

𝑑. 𝐶𝑂𝑉𝐼𝐷

+ 𝛽

𝑑. 𝑂𝑃

+ 𝑢

+ 𝜀

(1)

Here, the subscript i (i=1,…., N) denotes each

country, and the subscript t (t=1,….,T) denotes the

time period. 𝛼

refers to the constant term that

contains no variables or does not change accordingly,

𝜀

means an idiosyncratic error, and 𝑢

stands for

the time fixed effects. The dependent variable 𝑆𝑀𝑅

represents the stock market returns in country i on

the day t. Similarly, independent variables 𝐶𝑂𝑉𝐼𝐷

represents the number of confirmed COVID-19 cases

as a share of total population in country i on the day t,

while 𝑂𝑃

represents the oil price confirmed COVID-

19 cases in country i on the day t.

3.3 Empirical Analysis

This section will present our data analysis process

and final empirical results. To test time-series

stationarity, we initially conducted the unit root test

using the most common method ADF test. In view of

the test results documented in Table 4, it is clear that

we cannot reject the null hypothesis of the unit root

of 5% significance because all the p values far

exceed this confidence level. Therefore, this paper

processed the original data using the first-order

numeric difference method and then inputed them

into the model (1). The processed data show their

first-order difference stationary and were ready for

further investigation.

The final empirical results are shown in the

Table 5. Our findings indicate that the relationship

between the stocking performance and the COVID-

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

850

Table 5: Empirical Results.

d. SMR d. COVID d. OP

Coef. -.0076627 .000145

Robust Std. Err. .003882 .0005369

t -1.97 0.27

P > | t | 0.084 0.794

[95% Conf.

Interval]

[-.0166146,

.0012893]

[-.0010932,

.0013832]

Table 6:Results in Emerging and Mature Market.

d. SMR

d. COVID

(Emerging Market)

d. OP

(Mature Market)

Coef. -.030182 -.006134

Robust Std. Err. .0060845 .0020844

t -1.36 -1.11

P > | t | 0.045 0.082

19 pandemic is still significant. Furthermore, it is

clear that the growth in the number of COVID

confirmed cases as a share of total population can

negatively impact the stock market returns.

Specifically, for each unit increase of 𝑑. 𝐶𝑂𝑉𝐼𝐷, the

stock market returns are expected to decrease

0.0076627. This negative relationship remains the

case when we add daily fixed effects variables in the

model (1). On the other hand, for each unit increase

of 𝑑. 𝑂𝑃, the stock market returns will rise 0.000145,

suggesting that a positive correlation is in existence

between the stock market and oil prices.

Meanwhile, this paper also recognizes the fact

that the impact of COVID may vary across emerging

and mature markets due to market maturity, opening

degree, trading system, and regional conditions, and

putting data from all countries could possibly result

in aggregation bias (Anh and Gan 2020). In this case,

we regrouped the samples by emerging and mature

stock markets to evaluate their effects respectively.

As reported in Table 6, we noticed that emerging

markets are hit the hardest by the pandemic, and the

reason might be contributed to its heavy dependence

on global economic activities. On the other hand, the

impact on stock markets in developed countries is

relatively less severe, especially for those countries

that released stimulus package and implemented

countermeasures promptly to promote the economic

resurgence.

4 CONCLUSION

The present study was undertaken to determine the

effects of the COVID-19 pandemic on the stock

market. We investigated the number of COVID

confirmed cases, total population, oil price, and stock

market data in 10 different countries after the

outbreak from March 10, 2020 to April 30, 2020. Our

findings have shown that the stock markets react

negatively when the number of confirmed cases

grows, and the stock market returns also go through a

significant decline. Overall, this study strengthens the

idea that the spread of the COVID pandemic

adversely impacts stock performance. Besides, to

gain a better understanding on its impact on diverse

economies, this paper grouped samples by emerging

and mature stock markets and analyzed them

separately. The results demonstrate that the growth in

the number of cases has a greater impact on emerging

stock markets than mature stock markets. In general,

therefore, the insights generated in this paper support

the idea that the COVID-19 pandemic could

negatively affect the stock market, contributing to

existing knowledge by providing additional

quantitative evidence.

REFERENCES

B. Ashraf, "Stock markets’ reaction to COVID-19: Cases

or fatalities?", Research in International Business and

Finance, vol. 54, p. 101249, 2020. Available:

10.1016/j.ribaf.2020.101249.

C. Chen, C. Chen, W. Tang and B. Huang, "The Positive

and Negative Impacts of the Sars Outbreak: A Case of

the Taiwan Industries", The Journal of Developing

Areas, vol. 43, no. 1, pp. 281-293, 2009. Available:

10.1353/jda.0.0041.

D. Bannigidadmath, P. Narayan, D. Phan and Q. Gong,

"How stock markets reacted to COVID-19? Evidence

from 25 countries", Finance Research Letters, p.

102161, 2021. Available: 10.1016/j.frl.2021.102161.

The Influence of COVID-19 on Emerging and Mature Stock Market Based on Time-Fixed Effects Model

851

D. Anh and C. Gan, "The impact of the COVID-19

lockdown on stock market performance: evidence

from Vietnam", Journal of Economic Studies, vol. 48,

no. 4, pp. 836-851, 2020. Available: 10.1108/jes-06-

2020-0312.

F. Wong and Y. Deng, "Pandemic H1N1 2009 influenza in

pigs in Australia", Microbiology Australia, vol. 32, no.

1, p. 39, 2011. Available: 10.1071/ma11039.

M. Yousfi, Y. Ben Zaied, N. Ben Cheikh, B. Ben Lahouel

and H. Bouzgarrou, "Effects of the COVID-19

pandemic on the US stock market and uncertainty: A

comparative assessment between the first and second

waves", Technological Forecasting and Social Change,

vol. 167, p. 120710, 2021. Available:

10.1016/j.techfore.2021.120710.

"Pandemic - Simple English Wikipedia, the free

encyclopedia", Wikipedia, 2021. [Online]. Available:

https://simple.wikipedia.org/wiki/Pandemic. [Accessed:

10- Aug- 2021].

P. Takyi and I. Bentum-Ennin, "The impact of COVID-19

on stock market performance in Africa: A Bayesian

structural time series approach", Journal of Economics

and Business, vol. 115, p. 105968, 2021. Available:

10.1016/j.jeconbus.2020.105968.

"WHO Coronavirus (COVID-19) Dashboard",

Covid19.who.int, 2021. [Online]. Available:

https://covid19.who.int. [Accessed: 10- Aug- 2021].

W. Sun, "H7N9 not only endanger human health but also

hit stock marketing", Advances in Disease Control and

Prevention, vol. 2, no. 1, p. 1, 2017. Available:

10.25196/adcp201711.

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

852