A Research on the Relevance of the Crime and the Housing Price

Based on the Linear Regression Model

Jiali Guo

1,*,†

, Zitao Ying

2,*,†

, Zhengqi Sun

3,*,†

and Yuxiang Zhu

4,*,†

1

Shanghai University of Finance and Economics, SUFE Shanghai, China

2

Zhejiang University, ZJU, Hangzhou, China

3

Queen’s University, QU, Wuhan, China

4

Nanjing University Business School, NJU, Nanjing, China

†

These authors contributed equally

Keywords: House Price, Criminal, Manhattan, Regression Model.

Abstract: As the most expensive area to live in the United States, Manhattan's housing prices are influenced by many

factors, with crime rates being one of the most important factors affecting Manhattan's housing prices.

Under this situation, this paper will explore the relationship between house prices and crime rates in

Manhattan through the house prices and crime rate data in 2016-2017, by using python and R to build a

simple linear regression model to find the relationship between the average house price and crime rate. As

for the conclusion section, this paper will give the results of the analysis of the data with the conclusion and

the practical implications of this conclusion.

1 INTRODUCTION

The house is the most important source to every

civilian not only as a place to live but also as a kind

of property. Therefore, it is quite important to know

what affects housing price and how they affect it.

In a market economy, housing price is also

determined by markets, this paper found out what

influence the demanding at the very beginning.

Among those factors, the influx of people could

definitely boost the demand, but this is on a city

level, which is not what this paper is going to

research. When it is on an individual level, the will of

purchasing also makes a difference to the demand.

Both internal and external attributes of a house

affect a buyer’s purchasing will. Internal attributes

include the area, the layout of the room the floor it

locates etc. And the external attributes, namely the

location, which directly decides its traffic and

neighborhood quality, also weigh a lot.

Neighborhood quality includes the infrastructure

around and the security etc.

Considering the real estate market is a highly

complex and challenging one to understand, this

paper chooses one aspect to study. Given that

location and time period become determinants of

real estate prices (Huang, et al. 2010), the paper

decided to pick out a factor influenced by location as

this research objected. This research tries to figure

out whether the security of its neighborhood does

indeed affect the housing price.

Security is a broad concept, here this paper used

crime cases to study on. So, this research will

analyze the relationship between the crime situation

and housing price.

The paper chooses Manhattan’s housing price to

research on. For in the last 5 years, Manhattan was

still one of the most expensive places to live in the

world, while the owner-occupied housing unit rate

from 2015 to 2019 is 24.1%, which means there is at

least 75% of people in Manhattan who need to

purchase or rent houses.

Another reason to choose Manhattan is that the

housing price of Manhattan shows the opposite trend

compared to the crime rate. The crime data from

New York Police Department (NYPD) reflects that

Manhattan has the second-highest crime rate in five

regions of New York.

In this paper, this paper will focus on the

relationship between housing prices in Manhattan

and the crime rate of Manhattan from 2016 to 2017.

The paper believed that the environment will be

an important factor that will cast direct force on the

692

Guo, J., Ying, Z., Sun, Z. and Zhu, Y.

A Research on the Relevance of the Crime and the Housing Price Based on the Linear Regression Model.

DOI: 10.5220/0011754800003607

In Proceedings of the 1st International Conference on Public Management, Digital Economy and Internet Technology (ICPDI 2022), pages 692-698

ISBN: 978-989-758-620-0

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

buyers’ choice of the location of the real estate

which means that they shall have some direct

connection. To make the analysis more accurate and

realistic, the paper assumes that the total supply of

the house is the same in the short term. And all the

other factors that will influence the housing price are

the same in the short term. By comparing the

relevance within the range of the same neighborhood

among all the different neighborhoods, this paper

kept the population and the time at same level,

limiting the effect of the external factors to the

fullest minimize.

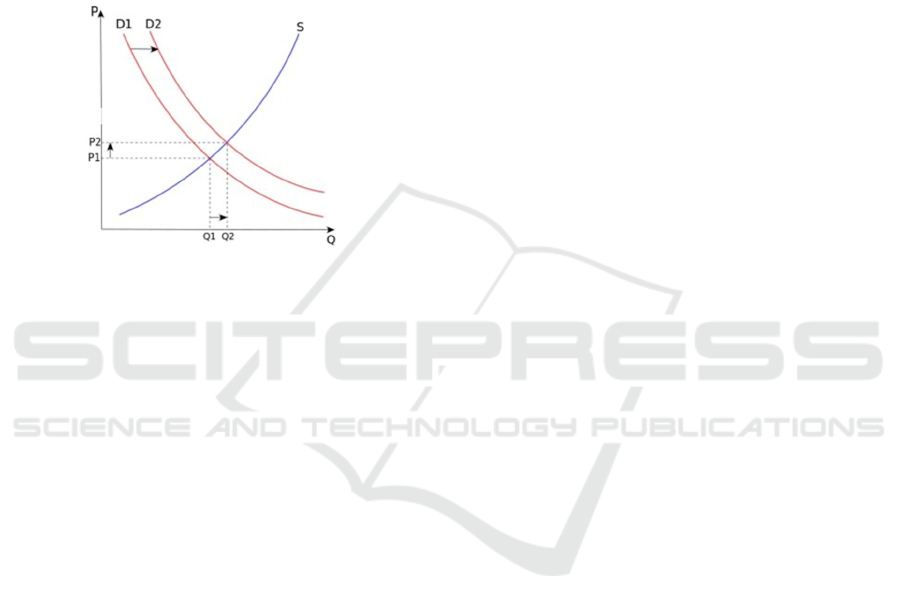

Figure 1: Change of the equilibrium output in a common

market.

Just as the graph is shown above (Varian 2004),

the supply level of houses in Manhattan at moment

t1 is S and the demand level is D1, which together

determine the local equilibrium house price as P1.

According to the conclusion that this paper make,

this paper can clearly find the crime rate is

negatively correlated with the level of house demand.

It is quite apparent that the crime will influence the

demand for the house, for the higher rate of the

crime means the more dangerous the neighborhood

would be. Then the demand decline which means

definitely the decline in the price of the house. As a

result, lower the crime rate will increase the total

demand of the house and consequently increase the

equilibrium prices of the house in the market.

Although it seems to be theoretically true and

logical, the research in this area is not to the full.

The crime rate will change through time and so as

the house price. It is worthwhile to work to continue

to focus on the relevance of the crime rate and the

house price, find problems and analyze the reasons.

This paper used python to clean the data by

dropping the useless data as well as matching the

value with time period and the boroughs. Data

processed fits into the linear regression model, in

which housing price is the dependent variable and

number of local crime case is the independent

variable. The negative relationship between the two

variables shows the negative effective the crime

level has on the house marketing. According to this

conclusion, this paper provides suggestions for three

parties concerned—the consumers, real estate

developers and investors and the government.

2 LITERATURE REVIEW

The rates of crime in different blocks will make a

difference to the local housing price in Manhattan.

Thaler (1978) (Thaler 1978) was the first one who

estimates the cost of crime with an implicit price

model using data from Rochester, NY. He finds that

the average property crime lowered house prices by

approximately $1930 in 1995 prices. Studies by

Hellman and Naroff (1979) (Hellman 1979) and

Rizzo (1979) (Rizzo 1979) used census tract data

from Boston and Chicago respectively and confirmed

that crime had a significant impact on house prices.

As a result, this paper believes that there is a

relationship between crime and housing prices. But

when studying whether the effect is negative or

positive, the researchers have given different ideas.

The researchers at first didn’t draw a clear

conclusion on the influence. Keith’s study (2009)

(Ihlanfeldt, Mayock 2009) gave the first critical

review on the extensive literature which has

researched the impact of crime on housing prices,

where he summarized 18 hedonic price studies that

have included neighborhood crime as one

explanatory variable, 14 of the studies found a

negative, relationship between one or more measures

of crime and house value and the other 4 studies did

not find a negative effect. Among all the studies,

only one (Case and Mayer 1996) found a positive

effect.

But as time passed, the researchers gradually

thinking the impact might be negative. Economists

have long documented the negative effects of

reported crime levels on housing prices, and this

effect was especially pronounced during the 1990s

(Hellman 1979, Pope 2012, Schwartz, Ellen, Susin,

and Voicu 2003). Just as Kumar in 2012 resulted,

the number of factors that influence the

identification of a favorable location easily runs into

a few hundred (including floor space area, crime in

the locality and so on) (Kumar, Talasila &

Pasumarthy 2021). Mateusz Tomal in 2020, using

the generalized ordered logit (gologit) model to

explore the factors influencing cluster formation.

And this research concluded that the level of crime

determined the membership of a given housing

market in a given cluster, attributed to bringing

A Research on the Relevance of the Crime and the Housing Price Based on the Linear Regression Model

693

about the classification of the homogeneous clusters

in terms of the size and quality of the housing stock

and price level (Tomal 2021). Researchers illustrated

the unable of the finding the connection might

because of the difficulty to identify different styles

of the crime. Allen (2001) reported that the impact

of the cost of crime on house prices is not uniform

throughout the market (Lynch, and David 2001).

According to Allen’s research, the seriousness of the

crime should be taken into consideration, besides the

crimes reported to the police divided by the

population.

Not only the seriousness of the crime was

regarded as one of the explanations, the kind of

crime also does. Keith selects 2 major categories of

crime —property and violent— finds only violent

crimes exert a meaningful influence upon

neighborhood housing values. Troy Austin (2008)

evaluating the influence of the combined robbery

and rape rates through models were estimated,

including one where selling price was log-

transformed but the distance to park was not, one

where both were log-transformed, a Box-Cox

regression, and a spatially adjusted regression (Troy

and Morgan Grove 2008). And they found that the

further the crime index value is from the threshold

value for a particular property, the steeper the

relationship is between park proximity and home

value.

To sum, crime is a hazard factor that is greatly

likely to hinder the safety of the local residents’ life

and property. So, the customers and the hosts will

both take this factor into their consideration. As a

hypothesis, this paper supposes that the higher the

crime rate the lower the house price will be.

From another perspective, Beck, B. and A.

Goldstein (2018) found the impact the house price

had on the crime rate. They conducted their research

basing on the doubt about the fact that the police

budget continues to grow even after the crime level

reach to the peak. Their data told the fact that the

increase of the economy relies more heavily on the

house price appreciation between the 1990s to the

2000s. And the budget of the police increases

correspondingly. And they made the conclusion that

the housing price growth and mortgage originations

in a city are associated with subsequent growth in

the city’s police expenditure (Troy and Morgan

Grove 2008). And also, it is quite clear that the

opposite direction of the change of the number of

police spending and the crime rate. While the police

spending increases, the crime rate drop dramatically.

Consequently, this paper believed that the house

price might cast some impacts on the crime rate

because of the important role the house price plays

in the housing market.

In summary, to confirm the relationship between

the house price and the criminal may provide some

information to the investors, the house buyers or the

hosts of the houses.

3 METHOD

3.1 Research Design

The subject of this study is the average house price in

the housing market in Manhattan, New York City

and its connection with the crime rate. This study

includes using python and R to build a simple linear

regression model to find the relationship between the

average house price and crime rate. The average

house prices in Manhattan will be classified by

communities and time to compare with crime rate

correspondingly. Manhattan, as the center of New

York, has a more remarkable effect between the

crime rate and the house price. And the premises this

paper chooses Manhattan are based on the following

factors. First of all, Manhattan is the district with the

highest population density among all the five

administrative districts of New York City. As a

result, the influence of the crime rate on the house

price would be more apparent and also applies to the

other districts, even the other cities. Secondly,

Manhattan is described as the economic and cultural

center of the whole United States. It is the central

business district of New York City. Manhattan's real

estate market is also one of the most expensive areas

in the world. Consequently, the fluctuation will cast

an impact on other house markets. Thirdly, it is

notable that the Manhattan is being interrupted by the

increasing number of the crime. Despite the dramatic

growth of the house price, the number of the crime is

growing as well. This result indicates that the house

price and crime rate show a negative correlation with

multiple reasons. Therefore, relation between the

crime and the house price is extremely helpful to give

the house hosts and the property developers to

choose a suitable price for their real estate.

3.2 Data Collection

While the data of the crime is from the New York

Police Department (NYPD), containing the content

of the gender, the type of the complaint, the location,

etc., the data of the house price is from the

government of the New York City. This attention is

paid to the fluctuation of both the crime rate and the

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

694

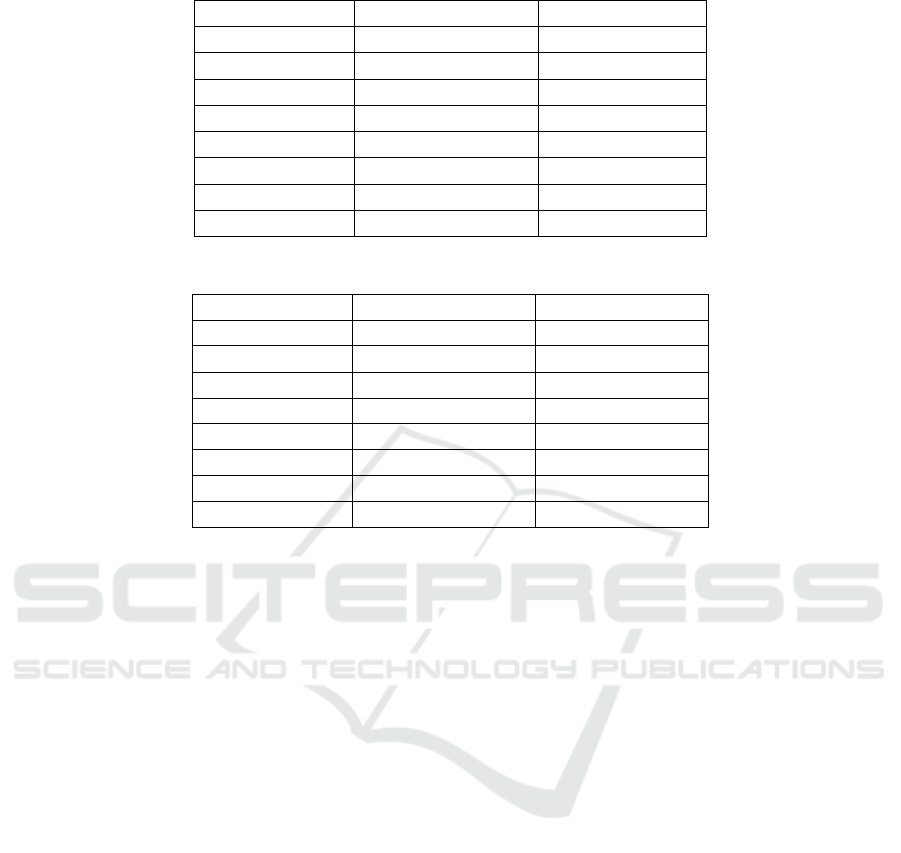

Table 1: Data of the crime and the house price in 2016.

Year 2016 sale price case number

count 39 39

mean 5491155 696.205128

std 8406232 723.948609

min 125000 1

25% 1983582 193.5

50% 3040352 415

75% 5178752 987

max 40710580 3231

Table 2: Data of the crime and the house price in 2017.

Year 2017 sale price case number

count 41 41

mean 3572567 581.6585

std 3593408 618.3382

min 400000 1

25% 1760632 172

50% 2613625 344

75% 4022578 899

max 21248470 2579

house price. The data take both the sales price and the

time into consideration. The crime database, on the

other hand, refers to the number and the place in New

York City. Table 1 describes some data of the time,

the average of the house and the time in 2016 while

Table 2 displays the data of 2017.

On the basis of the statistics, the conclusion can

be drawn that the price in the year 2016 and 2017 are

bot correspond with the change of the number of

3.1the crime in different blocks and neighborhoods.

The aim of this article is to identify the

relationship between crime and house price. In this

article, as a result of taking the same neighborhoods

as the research objects, this paperdo not need to

consider the population or the other factors that

would influence the house price. The selection of the

house price is determined by the blocks.

3.3 Data Analysis

The core idea of the method of analyzing data is to

separate the criminal cases and house prices in both

dataset by time and different neighborhoods in

Manhattan in New York City and using linear

regression model by python or R to find out if there is

any linear relationship between the total number of

criminal cases as well as the number of danger cases

and the mean value of house prices in a specific

neighborhood in Manhattan in New York City.

Moreover, creating some data visualizations about

criminal cases and the mean value of house prices.

The linear regression model is a branch of

regression models. Regression analysis is a statistical

technique for investigating and modeling the

relationship between variables (Hellman and Naroff

1979). Regression is the study of dependence, the

goal of regression is to summarize observed data as

simply, usefully and elegantly as possible (Huang, et

al. 2010). Since there is only one independent

variable in this research, which is the total number of

crime cases, hence the model that is used is called the

simple linear regression model.

𝑦 = 𝛽

+ 𝛽

𝑋 + 𝜀 ·························

1

Equation (1.1) is the basic equation of a simple

linear regression model, where the y is a dependent

variable, which means it will be affected by the

change of X. X is the independent variable, the value

of X will change by itself during the process. In this

research, housing prices in Manhattan will be a

dependent variable, the number of criminal cases

will be an independent variable.

𝐸

𝑦

|

𝑥

= 𝜇

𝑦

𝑥

= 𝐸

𝛽

+ 𝛽

𝑋 + 𝜀

= 𝛽

+ 𝛽

𝑋 ···

2

𝑉𝑎𝑟

𝑦

|

𝑥

= 𝜎

𝑦

𝑥

= 𝑉𝑎𝑟

𝛽

+ 𝛽

𝑋 + 𝜀

= 𝜎

···· (3)

The above two equations show that the expected

value of y and the variance while X is fixed, and the

linear regression model shows that the expected

value of y when X is changed. Hence the linear

regression model usually gives us a straight line that

A Research on the Relevance of the Crime and the Housing Price Based on the Linear Regression Model

695

represents the ideal situation, if the distribution of

data is approximately followed the line, this paper

can say that it can be proven that the fitting of a

linear regression model is successful.

It is clear to see if there is a relationship between

crime cases and house prices by looking at the plot

created by fitting a simple linear regression model.

Before fitting the linear regression model to this

data, it is required to do some work to it. There are

two datasets, one of them represents the total crime

cases in different neighborhoods in New York City

from 2016 to 2017, the other one represents the

house prices and other information from 2016 to

2019 in Manhattan, both data sets are from NYC

open data. Firstly, it is necessary to clean the

datasets before analyzing them, dropping the missing

value is one of the most effective ways to clean the

data, by using the. isnull () function in python, this

paper can drop the missing value in datasets.

The first thing is making sure that the time limit

for both data sets is the same, hence by using

python, it can be done to select data that from 2016

or 2017 in both data sets and automatically drop

those data from other years. The second thing is

setting the geographic range, by the main idea of this

research, it should be limited in Manhattan, hence by

using the unique function in python, it is convenient

to drop the neighborhoods that are not in Manhattan

by comparing the neighborhoods in the dataset to all

neighborhoods in Manhattan. After that, this paper

can write the function in python to calculate the

mean value of housing price and the total number of

criminal cases that are separated by different

neighborhoods in Manhattan.

Lastly, this paper can get a table that shows the

number of criminal cases and a corresponding mean

value of house price in different neighborhoods in

Manhattan, then it satisfies the condition to fit the

simple linear regression model, the plot that is

created by linear regression model shows that the

linear relationship between the mean value of

housing price and the total number of crime cases in

2016 and 2017 exists, which is as the number of

cases increases in a neighborhood, the mean value of

housing price in this neighborhood will decrease.

There are two outliers in these graphs, which are

midtown CBD area and financial in Manhattan,

which is pretty reasonable, since Manhattan is the

financial center of the world, the CBD area and

financial area in Manhattan have the same places as

The Bund in Shanghai, the housing prices in these

areas will be extremely higher than other

neighborhoods.

4 RESULTS

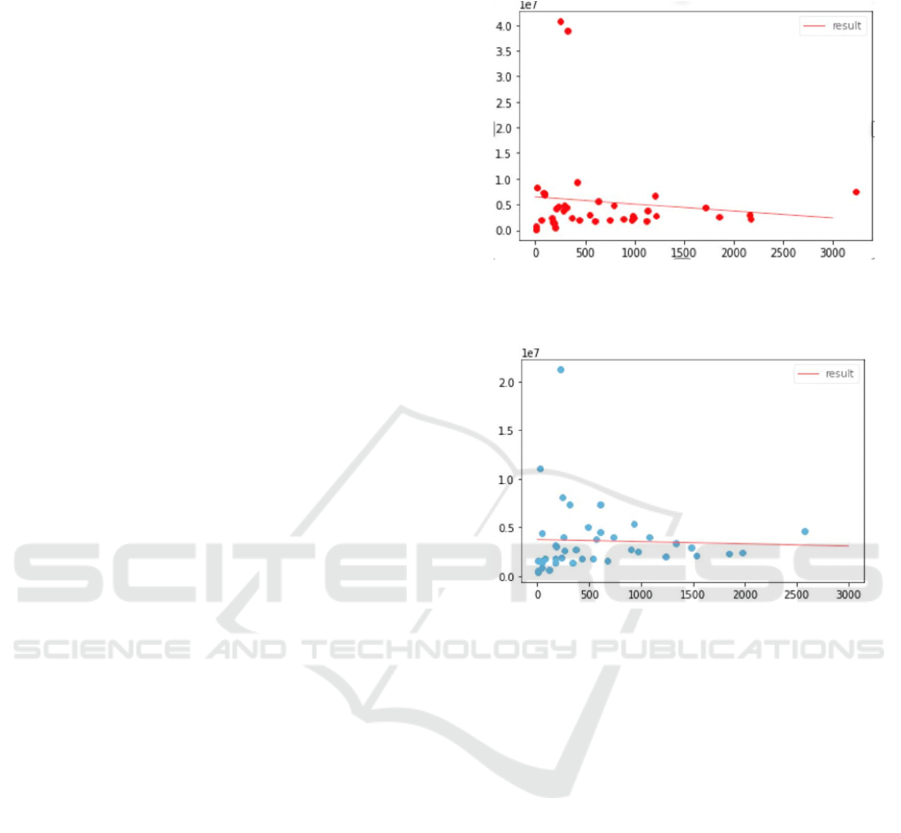

Figure 2: The corresponding point of the house price and

the criminal in 2016 and the regression line.

Figure 3: The corresponding points of the house price and

the criminal in 2017 and the regression line.

Using a Python-based linear regression method, the

correspondence between the number of crimes and

house prices in Manhattan during different time

periods in 2016 and 2017 were analyzed separately

(the left graph shows the results of the analysis in

2016 and the right graph in 2017). As can be seen in

both graphs, house prices and crime rates show a

negative correlation.

The Figure 4 below shows the relationship

between crime rates and housing prices by

combining all data from 2016 and 2017 and using

linear regression methods. From the analysis of the

above data, it can be concluded that there is an

approximate negative relationship between the crime

rate and house prices in Manhattan. This conclusion

is perfectly consistent with the theory of supply and

demand in the real estate market in the introduction.

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

696

Figure 4: The relationship between crime rates and

housing prices by combining all data from 2016 and 2017

5 DISCUSSION

Meanwhile, this finding has important practical

implications:

a. For consumers, this finding can provide

important information for consumers to

choose whether to buy a house and choose

the time to buy a house, so that they can make

a more rational decision;

b. For real estate developers and investors, this

finding provides a good entry point and

method to predict the prospects of the local

real estate market, as cities with lower crime

rates tend to have higher house prices and the

market will also be more prosperous and the

return on investment will be greater;

c. For the government, this finding helps the

government to play an economic control role

to assist the market in regulating housing

prices. Since the government has the ability

to obtain more complete and correct crime

rate data, the government can make certain

predictions about the future trend of local

house prices based on the trend of crime rate,

and when house prices may rise or fall too

fast, the government can reduce the

fluctuation of house prices through macro

policies in advance, thus avoiding the huge

losses that may be brought by market failure.

To make this analysis more accurate and realistic,

this paper assumes that the total supply of the house

was the same in the short term. And all the other

factors that will influence the housing price are the

same in the short term. By comparing the relevance

within the range of the same neighborhood among

all the different neighborhoods, this paper keeps the

population and the time the same level, limiting the

effect of the external factors to the fullest minimize.

Just as figure1 shown above, the supply level of

houses in Manhattan at moment t1 is S and the

demand level is D1, which together determine the

local equilibrium house price as P1. According to the

conclusion that this paper make, this paper can

clearly find the crime rate is negatively correlated

with the level of house demand. It is quite apparent

that the crime will influence the demand of the house,

for the higher rate of the crime means the more

dangerous the neighborhood would be. Then the

demand decline which means definitely the decline

of the price of the house. As a result, lower the crime

rate will increase the total demand of the house and

consequently increase the equilibrium prices of the

house in the market.

To a certain extent, this finding can help

consumers predict the trend of Manhattan house

prices, so that they can choose more rationally

whether and when to buy a house. For the

government, this finding can help the government

use macroeconomic policies or remain the trend of

the police expenditure between 1992 and 2010 (Beck

and Goldstein 2018) to regulate the local supply and

demand market and balance house prices, so as to

better perform its functions.

This paper still want to take a more step further

after considering the impact the crime has on the

house price. This paper believe the house price

would also has an influence on the crime rate. It is

clear that as the rise of the crime level will combine

with the decrease of the house price. So, naturally

this paper wants to control the crime level with the

intention to manage the house price. As a result, the

limitation of this research is that this paper does not

use the data which contains adequate samples to

make an accurate forecast. Furthermore, this paper

does not take the difference of the number of the

police and some other factors that will make a

difference to the house price.

6 CONCLUSIONS

The connection between the house price and the

crime level is apparent, while both of them will be

the factors that have influence on the other.

The increase of the house price provides the

space for the budget of the police to increase.

Consequently, the number of the police increase

because of the higher of the salary, representing the

effective restrain of the potential crime and the quick

A Research on the Relevance of the Crime and the Housing Price Based on the Linear Regression Model

697

crack-down on the immediate crime even when the

crime level continue to decrease yearly.

On the other hand, the crime level means the

threat of personal and property safety, reducing the

customers’ willing of the purchase, thus decreasing

the house price. It is no wonder the negative

effective the crime level has on the house marketing.

REFERENCES

Beck, B. and A. Goldstein, “Governing Through Police?

Housing Market Reliance, Welfare Retrenchment, and

Police Budgeting in an Era of Declining Crime.”

Social Forces, 96(3): p. 1183-1209, 2018.

Huang, B., et al., "Geographically and temporally

weighted regression for modeling spatio-temporal

variation in house prices." International Journal of

Geographical Information Science 24(3): 383-401,

2010.

Hal R.Varian, “Intermediate Microeconomics: A Modern

Approach, Ninth Edition”, 204-205, 2004.

Hellman, Daryl A. and Joel L. Naroff, “The impact of

crime on urban residential property values”, Urban

Studies 16, 105-112, 1979.

Kei Ihlanfeldt, Tom Mayock, “Crime and Housing Prices”,

Department of Economics and DeVoe Moore Center,

2009.

Kumar, E. S., Talasila, V., & Pasumarthy, R. “A novel

architecture to identify locations for Real Estate

Investment”. International Journal of Information

Management, 56, 17, 2021.

Lynch, Allen K. and David W. Rasmussen, “Measuring

the impact of crime on house prices”, Applied

Economics 33, 1981-1989, 2001.

Pope, Devin, and Jaren Pope. “Crime and Property Values:

Evidence from the 1990s Crime Drop.” Regional

Science and Urban Economics 42(1): 177–88. 2012.

Rizzo, Mario J., “The cost of crime to victims: An

empirical analysis”, Journal of Legal Studies 8,177-

205,1979.

Schwartz, Amy Ellen, Scott Susin, and Ioan Voicu. “Has

Falling Crime Driven New York City’s Real Estate

Boom?” Journal of Housing Research 14(1): 101–37.

2003.

Thaler, Richard, “A note on the value of crime control:

Evidence from the property market”, Journal of Urban

Economics 5, 137-145, 1978.

Tomal, “Housing market heterogeneity and cluster

formation: evidence from Poland.” International

Journal of Housing Markets and Analysis, ahead-of-

print(ahead-of-print), 2021.

Troy, Austin, and J. Morgan Grove. “Property values,

parks, and crime: A hedonic analysis in Baltimore,

MD.” Landscape and urban planning 87.3, 233-245,

2008.

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

698