Application Analysis and Intelligent Management of Urban Rail

Transit and Affordable Housing Joint Development Projects Under

PPP Mode

Di Shen

1,*

, Yanpeng Jin

2

, Juanjuan Guo

2

and Fang He

2

1

China Institute of Nuclear Industry Strategy, Beijing, China

2

China Urban Development Planning and Design Consulting Co., Ltd., China

Keywords: PPP Model, Urban Rail Transit, Project Financing, Joint Development.

Abstract: This paper takes urban rail transit and affordable housing as the main research objects, starting from the com-

monality of economic attributes of urban rail transit and affordable housing, and analyzes the feasibility of

joint development using PPP financing mode from the perspective of major stakeholders. Taking Beijing

Subway Line 4 as an example, the preliminary idea and scheme are put forward, and the preliminary income

model is given; and the key of joint development is analyzed from the aspects of passenger flow, franchise

period and capital. At the same time, the important role that intelligent management may play in the joint

development mode is discussed.

1 INTRODUCTION

The latest plan of China clearly put forward that the

supply of affordable housing should be effectively in-

creased, and the basic system and support policies for

housing security should be improved. The State

Council further emphasized in 2021 that it is neces-

sary to improve the long-term rental policy and ex-

pand the supply of affordable rental housing. Through

the planning, layout and development during the last

period, Chinese affordable housing planning and con-

struction has completed the task of phased deploy-

ment and completed Phased construction indicators,

the development area still takes the urban fringe as

the main supply area, which coincides with the loca-

tion of the first and last sections of urban rail transit.

The development income of affordable housing is

low, and construction financing is relatively difficult.

With the continuous increase in the construction of

affordable housing in China, the funding gap for af-

fordable housing in China is also increasing. In recent

years, Beijing, Henan Province and other places have

also implemented PPP models. In the exploration of

developing affordable housing, there is a large room

for development of affordable housing by adopting

the PPP model (Huang, 2012). The construction scale

of urban rail transit has grown steadily in recent years.

The long construction period, large investment, and

high operating costs have caused huge financing

problems. Since the construction of Beijing Metro

Line 4 using the PPP model in 2005, PPP mode has

become one of the main modes of urban rail transit

financing.

Urban rail transit and affordable housing have be-

come one of the important ways to live and travel in

big cities, but they face the same problems of financ-

ing difficulties and low returns. Both have the attrib-

utes of quasi-public goods. In the context of the PPP

model, the internalization of external costs is realized,

emphasizing that a subject implements through the

PPP model, and ultimately achieves the purpose of

joint development to increase the interests of the gov-

ernment and social capital.

The joint development discussed in this paper

mainly refers to the organic integration of urban rail

transit and affordable housing development.

2 FEASIBILITY ANALYSIS OF

JOINT DEVELOPMENT

In the PPP model, the joint development of urban rail

transit and affordable housing involves three main

stakeholders, namely social capital, the government,

Shen, D., Jin, Y., Guo, J. and He, F.

Application Analysis and Intelligent Management of Urban Rail Transit and Affordable Housing Joint Development Projects Under PPP Mode.

DOI: 10.5220/0011751700003607

In Proceedings of the 1st International Conference on Public Management, Digital Economy and Internet Technology (ICPDI 2022), pages 545-550

ISBN: 978-989-758-620-0

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

545

and residents of affordable housing. This paper ana-

lyzes the above three aspects and the feasibility of

PPP joint development.

A relatively stable investment with low return and

low risk of affordable housing investment is also a

sound business strategy in the context of tightening

PPP projects. The development income of various

types of affordable housing is low profit or even a

loss. Compared with the affordable housing without

rail transit, after the joint development, the rental and

sales price of the guaranteed housing can be appropri-

ately increased, and the externality can be reduced to

a certain extent to further improve the profit margin.

Conservatively estimate the security The profit mar-

gin of the independent housing sector is not less than

5%, and it will increase the passenger ticket revenue.

It can be seen that the safety factor of this develop-

ment model is very high, because the cost is well con-

trolled, and the construction of social housing and

loan repayment are supported by the government. At

present, the sales revenue of affordable housing and

long-term rental housing is a stable source of capital

recovery, and the affordable housing has very low re-

quirements for rental and sales promotion and design

innovation. This can speed up capital turnover, and

the capital turnover speed is better than other invest-

ment methods.

The passenger flow of the first and last sections is

guaranteed, and the ticket revenue generates addi-

tional income compared with the original develop-

ment model. Before the implementation of the pro-

ject, there is a good expectation for the financial sub-

sidies during the operation period, which reduces the

financial pressure. In addition, the joint development

of PPP projects reduces the management workload of

the government, and the government can realize the

transformation from pre-coordination, investment

management to process supervision, and the govern-

ment has the potential for joint development.

Under the background that the main contradiction

in Chinese society has been transformed into the con-

tradiction between the people's growing needs for a

better life and unbalanced and insufficient develop-

ment, affordable housing should not be synonymous

with low-quality, low-cost, remote and inconvenient

housing It should be a livable housing like ordinary

commercial housing, and its geographical location

and traffic conditions should meet the basic require-

ments of the people for convenient travel. After the

joint development, the convenience of living and em-

ployment for some families with housing difficulties

has been improved.(Yu, 2009)

Affordable housing and urban rail transit have

certain income potential. (Xiong, 2006) For afforda-

ble housing, the existing market will not lead to mo-

nopoly, and there is a certain degree of competitive-

ness; the cost of the two can be recovered to a high

degree, and there is a certain profit; the project risk is

not high, and the income is stable. Therefore, the pro-

ject risk/benefit of the two projects is relatively small,

which is suitable for marketization. Urban rail transit

development has certain risks in project operation due

to errors in passenger flow forecast and long franchise

period, especially the lack of passenger flow in the

first and last sections; simultaneous development

with affordable housing has become an effective sup-

plement, and the financing model of both can be

adopted PPP mode The common economic attributes

of the two are the same, and the passenger ticket in-

come and the house price promote each other. After

the joint development, the external cost will be further

internalized to form a win-win situation.

3 PRELIMINARY PLAN OF

JOINT DEVELOPMENT

MODEL

3.1 Financing Plan

The PPP social capital parties of subway projects are

usually local state-owned subway investment groups

and general contractor groups. At the general contrac-

tor group level, there are usually professional real es-

tate development companies, such as China Commu-

nications Real Estate, etc. Social capitals of urban rail

transit PPP projects generally have the prerequisites

for real estate development and affordable housing

development.

The main investor of the PPP project is the SPV

company, and the SPV company can set up a wholly-

owned subsidiary to develop affordable housing. At

the same time, in order to enhance the security of af-

fordable housing development, SPV's wholly-owned

real estate development subsidiary can sign an agree-

ment with the shareholder company to participate in

the development of affordable housing as a real estate

development consultant.

Taking Beijing Metro Line 4 as an example, the

financing plan determined in the 2005 franchise

agreement is compared with the joint development

plan for the first and last sections of the station and

affordable housing.

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

546

Beijing Line 4

Investment Company

Beijing MTR

(SPV)

Beijing Government

Part A assets Part B assets

BIIC BCG MTR

hold

hold

three joint

ventures

Franchise

Agreement

Supervision

lease

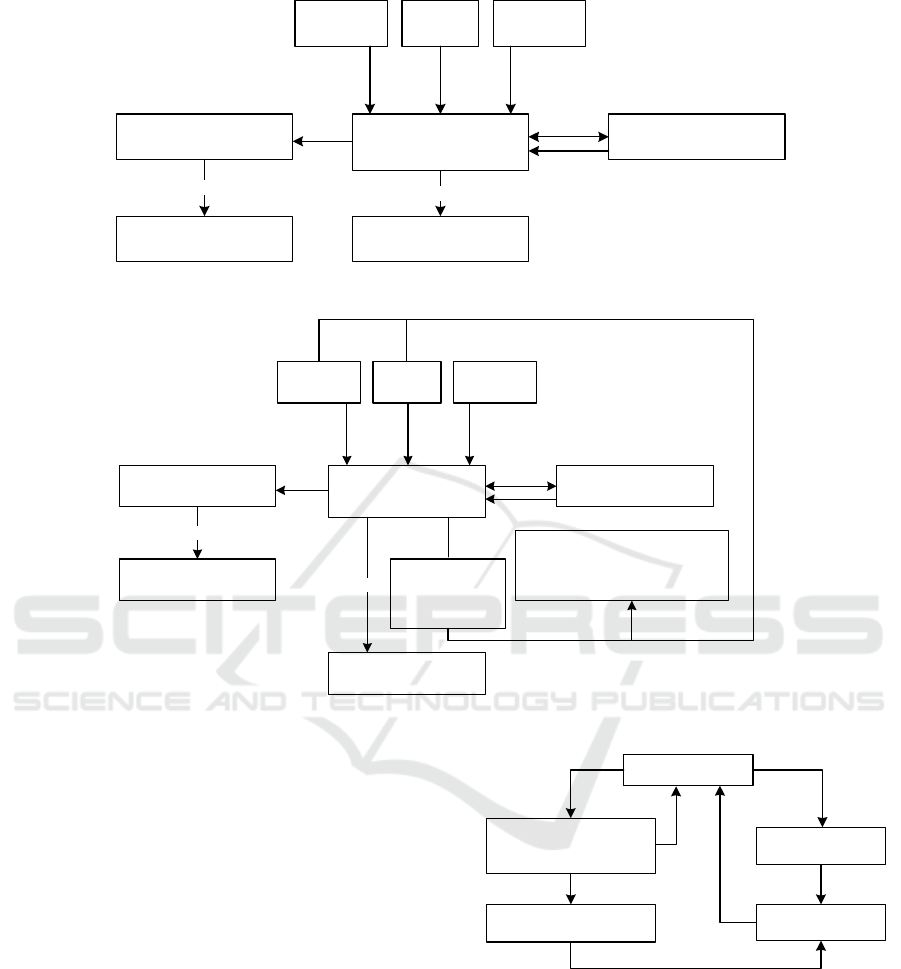

Figure 1: Financing model of Beijing Metro Line 4 (drawn by author).

Beijing Line 4

Investment Company

Beijing MTR(SPV)

Beijing Government

Part A assets

Part B assets

BIIC BCG MTR

hold

three joint

ventures

Franchise

Agreement

Supervision

lease

Affordable housing development

project for the first and last

sections of the site

hold

Real Estate

Development

Company

(Suppose)

Development of

affordable housing

Signed a development consulting

agreement with SPV company, and

the shareholder companies ( B I I C ,

BCG) were the consultants

Wholly-owned

establishment

Figure 2: Simulation diagram of financing mode of Beijing Metro Line 4 (drawn by author).

The original development model of Beijing Metro

Line 4 is shown in Figure 1.

BIIC: Beijing Infrastructure Investment Co., Ltd.;

BCG: Beijing Capital Group; MTR: Hongkong Mass

Transit Railway Co., Ltd.

The financing model (assumption) after the joint

development of the first and last sections of the site

and the affordable housing is shown in Figure 2.

It can be seen that the financing complexity of af-

fordable housing development is not high, it will not

affect the main structure of financing, and it can give

full play to the real estate development advantages of

the shareholder company.

3.2 Revenue Model

The joint development of the first and last sections of

the site under the PPP mode brings more diverse ben-

efits and forms a complementary cycle. The schematic

diagram of the revenue model is shown in Figure 3.

Develop affordable

housing for the first and

last sections of urban rail

Construction of

urban rail transit

PPP SPV company

Affordable Housing

Residents Passenger Flow

Passenger flow

income

High-density passenger flow will

increase additionally

income2

income1

Figure 3: Schematic diagram of possible revenue models

(drawn by author).

The impact of the project decision-making period,

construction period, and operation period on funds af-

ter joint development is shown in Table 1.

Application Analysis and Intelligent Management of Urban Rail Transit and Affordable Housing Joint Development Projects Under PPP

Mode

547

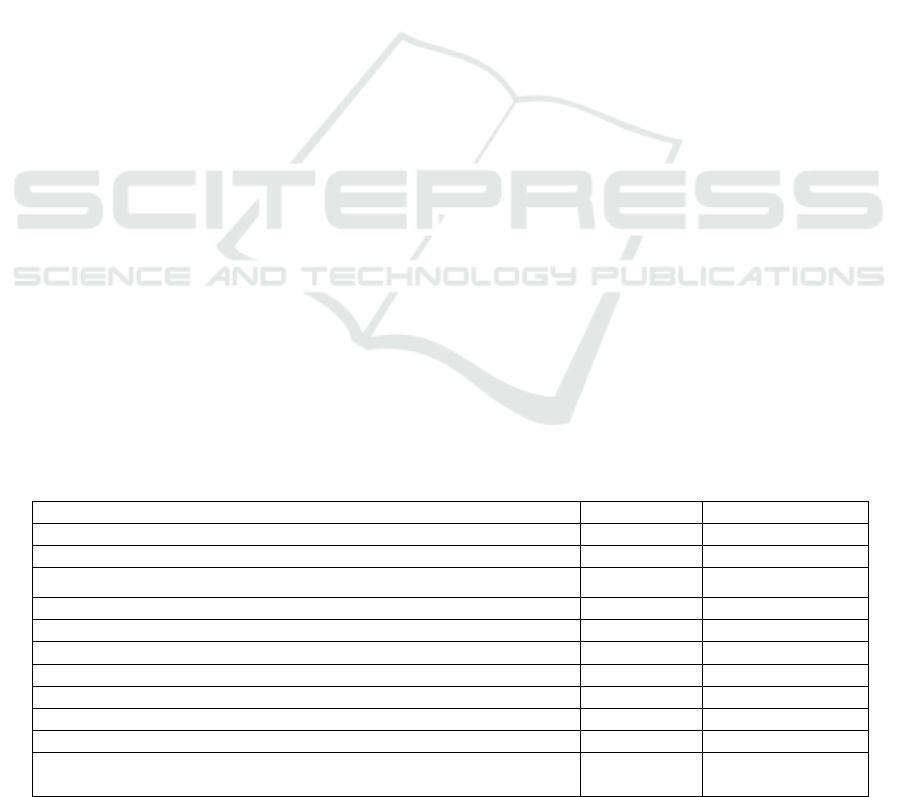

Table 1: Comparison table of financial impact of two modes (drawn by author).

Regular PPP Joint Development

Investment

Subway Investment Regular investment

Regular investment + part of social capital in-

vestment in affordable housing (relatively tiny)

Government investment in the develop-

ment of affordable housing

-

Partial government investment in guaranteed

housing

Income

Ticket revenue Regular revenue Regular revenue +I

1

+I

2

Affordable housing sales income -

Income from the sale of affordable housing with

a relative increase in selling price

VGF or ticket subsidy Regular supplement Regular supplement

Residential property management in-come - Property management fee

Expenditure

Operating cost Regular cost Regular cost

Debt service Match total investment Match total investment

Note: I

1

=Additional passenger flow brought by short occupancy period and high relative density of residence; I

2

=Additional

passenger flow brought by strong travel willingness.

Due to the joint development under the PPP

model, the SPV company has more sources of in-

come, and the source of income of the project com-

pany has been greatly expanded.

4 THE KEY ANALYSIS OF THE

JOINT DEVELOPMENT

MODEL

The occupancy period is short, and it is easy to

quickly form passenger flow in a short period of time.

The sales of affordable housing are generally con-

trolled by the government. Compared with commer-

cial housing, the sales cycle of affordable housing is

short, and residents can move in quickly and can

move in in a short period of time.

The high density of living is conducive to the ac-

cumulation of passenger flow. Affordable housing is

a medium and high-density community, and the floor

area ratio is generally about 3.0, which is higher than

that of commercial housing (commercial housing pur-

sues living comfort, and the floor area ratio is gener-

ally less than 2). Affordable housing has a high den-

sity of residents, which can provide a stable source of

passengers for the first and last sections of rail transit.

Residents have a strong willingness to travel,

which is convenient for continuous passenger flow.

The traffic congestion on the ground in the morning

and evening peak hours and the high requirements for

commuting on time have caused the residents of af-

fordable housing to have a strong willingness to

choose rail transit. Therefore, under the same condi-

tions, in the socio-economic analysis, the shadow

price of rail transit for residents of affordable housing

is higher than the shadow price of passengers in com-

mercial housing, which increases the fare income to a

certain extent and reduces the financial burden of

government subsidies.

5 EMPIRICAL ANALYSIS

Rail transit investment parameters: According to the

common rail transit length of 20 kilometers, the con-

struction cost is 1 billion yuan/km. The annual pas-

senger flow in recent years is 300,000 person-times

per day, the per capita passenger ticket is 5 yuan, and

the recent line passenger ticket income is 500 million

yuan per year after rounding up. The passenger ticket

subsidy is 10%-100% of the passenger ticket revenue

(refer to the 2020 Statistics and Analysis Report of

Urban Rail Transit of the China Urban Rail Transit

Association), which is temporarily estimated at 20%,

or 100 million yuan.

Affordable housing investment parameters: Ac-

cording to the map query results, generally the first

and last sections of the site can cover 4-5 affordable

housing communities. (Tang, 2021) In this calcula-

tion, the scale of common affordable housing com-

munities is calculated as 100,000 square meters per

community, the construction and installation cost is

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

548

5,000 yuan/square meter (the cost of land transfer is

temporarily excluded), the investment in a single af-

fordable housing community is 500 million yuan, and

the number of projects is 4. The government partial

guaranteed housing capital ratio is 20%. The unit

price of affordable housing near the subway is 10%

higher than that far from the subway. Taking an af-

fordable housing community of 100,000 square me-

ters as an example, it is estimated based on the living

area index of 25 square meters per person, that is, a

population of 4,000 living people, in addition to a

supporting service population of 200 people, accord-

ing to the daily population of 70% of the population

passes through rail transit Entering the city, since the

guaranteed room is in the first and last stages, the

transportation distance is long. Assuming that the fare

is 5 yuan/person, the guaranteed room ticket income

is 28,000 yuan/day. Calculated based on 240 working

days/year, the passenger ticket income is 6.72 million

yuan/year. In addition, considering factors such as

service personnel, family visits, and weekend trips,

the annual ticket revenue is about 7 million yuan, the

30-year franchising period, the passenger ticket reve-

nue brought by only one affordable housing commu-

nity is 210 million.

It is obvious that the joint venture model has better

profitability and can be researched and promoted.

The preliminary financial estimates of the two models

are shown in Table 2.

6 THE IDEA OF INTELLIGENT

MANAGEMENT

Under the PPP model, due to the joint development

of affordable housing and rail transit in the first and

last sections, the subway operating company and the

property management company have become a com-

munity of interests with the same profit goal. In the

operation stage, the property management unit of af-

fordable housing can fully analyze and study the

travel habits of residents through big data technology

and intelligent algorithms. Intelligent decision-mak-

ing for operation arrangements, optimal arrangement

of passenger flow and transportation, and exploration

of special subway trains with characteristics, such as

station express trains and special travel trains for hol-

idays, improve the happiness of residents in the first

and last sections, and further improve the competi-

tiveness of the real estate market in the first and last

sections. (Zhang, Wang, 2022)

7 CONCLUSION

The government should encourage social capital to

invest in the construction of low-cost affordable hous-

ing. In the process, the government will give some fi-

nancial preferential measures, such as long-term,

preferential loan interest rate or loan interest compen-

sation, to ensure the continuity of the joint develop-

ment model. Under the joint development mode,

more application space is given to intelligent manage-

ment, forming a new and more efficient management

mode.

Since the land transfer metal is an important

source of government revenue, the transfer of land for

affordable housing development will result in a loss

of the transfer fee. It is suggested that the government

should scientifically and rigorously verify the project

before the project. The first and last sections of the

site are transferred to commercial housing and afford-

able housing land. The reduced amount of gold in

come and the increased amount of income due to ad-

ditional passenger flow during the franchise period of

Table 2: Financial calculation data comparison table (drawn by author).

Regular PPP Joint Development

Investment

Subway Investment(

b

illion¥) 20 22

Government investment in the development of affordable housing (billion¥) - 2×20%=0.4

Income

Ticket revenue(

b

illion¥) 0.5 0.5+0.005×4=0.52

Affordable housing sales income(billion¥) - 0.2

VGF or Ticket subsidy(billion¥) 0.1 0.1

Residential property management income(billion¥) - 4×3=12

Expenditure

Operating cost(including debt service) (billion¥) 0.4 0.4

Comprehensive rate of return(including government subsidie) 7% 8.1%

Application Analysis and Intelligent Management of Urban Rail Transit and Affordable Housing Joint Development Projects Under PPP

Mode

549

the subway line after full occupancy, the two amounts

are compared to fully verify the economic benefits of

the project implementation.

REFERENCES

Huang Na. Research on diversified financing methods for

the development of affordable housing in my country

[D]. Beijing Jiaotong University, 2012.

Tang Tang. Analysis on the construction and development

of affordable housing [J]. Housing and Real Estate,

2021(30):11-12.

Xiong Ruizhi. Research on the joint development strategy

of urban rail transit and real estate in my country [D].

Huazhong University of Science and Technology,

2006.

Yu Jinyao. Incorporating affordable housing land into ur-

ban rail transit construction planning [N]. People's Po-

litical Consultative Conference, 2009-06-29 (B01).

Zhang Wanning, Wang Jingrong. Analysis of Urban Public

Transportation Development under the Background of

Intelligent Transportation [C]//. Proceedings of the

2022 World Transportation Conference (WTC2022)

(Transportation Planning and Interdisciplinary).,

2022:782-785. DOI: 10.26914.

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

550