A Study on the Factors of Mergers and Acquisitions of Listed Real

Estate Companies and the Mode of Mergers and Acquisitions Based

on the Implementation of Development Policies

Shuhui Zhang

School of Business, East China University of Science and Technology, Shanghai, China

Keywords: Listed Real Estate Companies, M&A Factors, M&A Patterns.

Abstract: With the frequent emergence of M&A activities of real estate listed companies, M&A is increasingly be-

coming an important means for China's real estate industry to optimize resource allocation and regulate in-

dustrial structure, not only for the needs of the real estate industry, but also for the survival and operation of

real estate companies (Liu 2020). This paper summarizes the current situation of M&A of real estate listed

companies in China through a series of data, and on this basis, empirical research is conducted on M&A

performance and some suggestions are made on M&A activities in real estate industry (Jiang, Wei 2018).

1 INTRODUCTION

The history of mergers and acquisitions of real estate

listed companies in China. The mergers and acquisi-

tions of real estate listed companies in China have

developed along with the development of China's real

estate market, and have been developed in the course

of China's reform and opening up and the reform of

the socialist economic system (Hou 2018). From the

reform and opening up to the present, the mergers and

acquisitions of real estate listed companies in China

can be roughly divided into three stages: the primary

starting stage, the transformation and development

stage, and the high-speed development stage (Che

2018).

2 CURRENT STATUS OF M&A IN

CHINA'S REAL ESTATE

INDUSTRY

In recent years, in order to achieve scale expansion

and profit growth, many real estate companies have

started to find new breakthroughs through mergers

and acquisitions (Wu 2017).

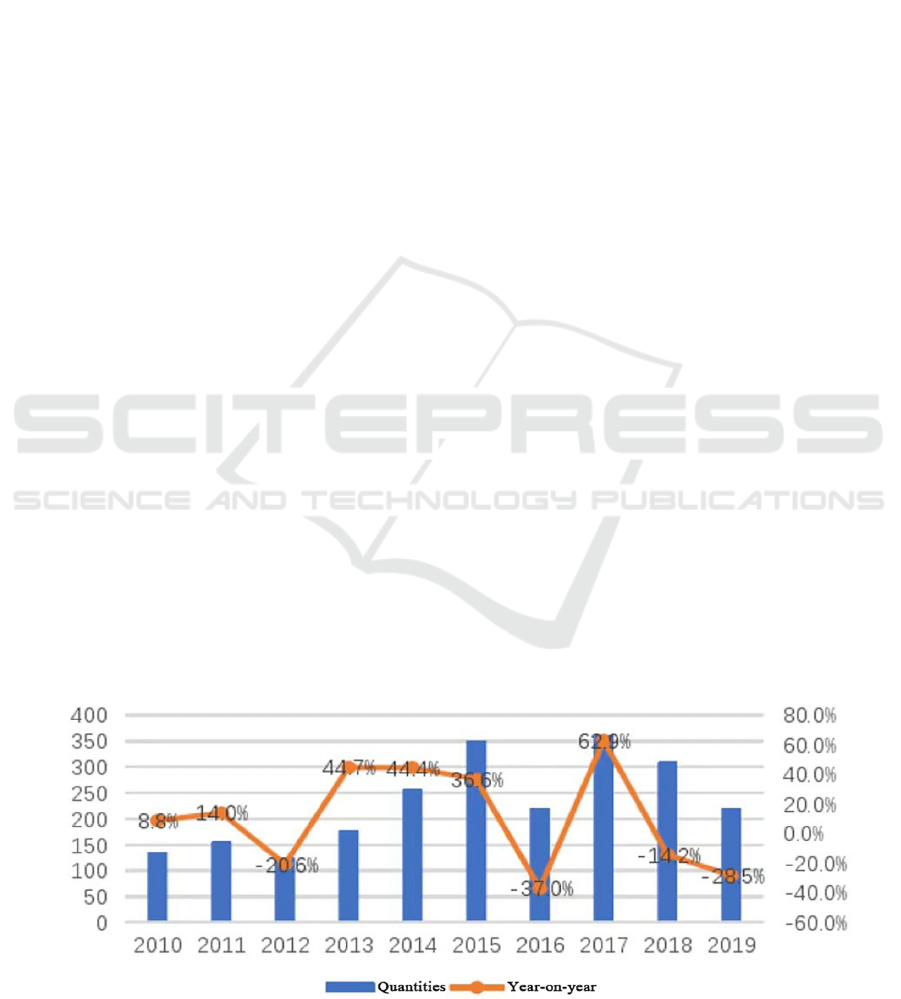

Figure 1: 2010-2019 Number of mergers and acquisitions in China's real estate industry and year-on-year growth

[self-drawn].

526

Zhang, S.

A Study on the Factors of Mergers and Acquisitions of Listed Real Estate Companies and the Mode of Mergers and Acquisitions Based on the Implementation of Development Policies.

DOI: 10.5220/0011751300003607

In Proceedings of the 1st International Conference on Public Management, Digital Economy and Internet Technology (ICPDI 2022), pages 526-529

ISBN: 978-989-758-620-0

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

According to Figure 1, we can see that the number

of mergers and acquisitions completed each year in

the real estate industry fluctuates greatly, and the

growth of real estate enterprises is very rapid, but this

also leads to increasing competition in the industry,

coupled with the tightening of government regulation

of the real estate market, making the survival envi-

ronment of real estate enterprises increasingly harsh,

so real estate companies have begun to take the road

of mergers and acquisitions.

3 DIFFERENT M&A MODES OF

REAL ESTATE ENTERPRISES

There are three specific types of M&A models: hor-

izontal M&A, vertical M&A and hybrid M&A (Gu

2017).

4 EMPIRICAL STUDY OF M&A

PERFORMANCE OF REAL

ESTATE FIRMS UNDER

DIFFERENT M&A MODES

The data used in the empirical study are mainly from:

Guotaian Data (CSMAR) Service Center

(http://www.gtarsc.com/), Wind Financial Database,

Shanghai Stock Exchange (http://www.sse.com.cn/),

Shen-zhen Stock Exchange (http://www.szse. cn/)

(Liu 2017).

4.1 Short-Term M&A Performance

Research Sample Description

Between 2007 and 2016, a total of 133 real estate

M&A events that occurred in Shanghai and Shenzhen

A-shares and for which M&A modes could be iden-

tified were screened and processed to obtain a total of

133 M&A events as a sample for the empirical study

of short-term M&A performance (Li 2017), and the

distribution of the sample after classification ac-

cording to three M&A modes is shown in Table 1.

Table 1: Description of the sample for the empirical study

of short-term M&A performance[self-drawn].

M&A Model Sample size

Percentage of

total sam

p

le

Horizontal M&A 92 69.17%

Vertical M&A 15 11.28%

H

y

brid M&A 26 19.55%

Overall sample 133 100%

4.2 Empirical Study of Short-Term

Performance Under Different M&A

Models

Step 1: Define the event date and determine the event

period and estimation period (Zhang 2015).

Step 2: Calculate the actual daily return Rit of the

sample companies and the actual daily return Rmt of

the market index.

The stock price data of the sample companies in

the event period (-100, -21) and the estimation period

(-20,25) are collected, and the actual daily return of

the sample companies in the stock estimation period

and the event period and the corresponding actual

daily return of the market index are calculated, re-

spectively (Li 2015).

The formula for the actual daily returns of indi-

vidual stocks is as follows.

𝑅

=

𝑃

,

−𝑃

,

−1

𝑃

,

−1

P

i,t

is the closing price of individual stock i on day

t and P

i,t-1

is the closing price of individual stock i on

day t-1.

The formula for the actual daily market return is

as follows (Liu 2020).

𝑅

=

𝑃

,

−𝑃

,

−1

𝑃

,

−1

It is the closing index of the SSE A-share index or

Shenzhen A-share index on day t, and I

t-1

is the

closing index of the SSE A-share index or Shenzhen

A-share index on day t-1.

Step 3: Calculate the expected normal return

formula for each stock for each day in the event

period (-20,25) as follows.

𝑅

= 𝛼

+ 𝛽

× 𝑅

+ 𝜀

α

i

is the constant term; β

i

is the regression coeffi-

cient; and it is the random error.

The estimates of α

i

and β

i

, i.e., α̂ and β̂, are ob-

tained by regression and brought into the model to

obtain the expected normal rate of return E(R

it

) of

individual stock i for each day in the event period as

follows.

𝑅

= 𝛼

+ 𝛽

× 𝑅

+ 𝜀

Step 4: Calculate the AR

it

and AAR

t

of the sample

during the event period with the following equations,

respectively.

𝐴𝑅

= 𝑅

−𝑅

𝐴𝐴𝑅

=

𝐴𝑅

𝑛

AR

it

is the daily excess return of individual stock i

at time t; AAR

t

is the average of the sum of the excess

returns of each stock at time t, i.e., the average daily

A Study on the Factors of Mergers and Acquisitions of Listed Real Estate Companies and the Mode of Mergers and Acquisitions Based on

the Implementation of Development Policies

527

excess return of the stocks of the sample companies at

time t; n is the number of samples.

Step 5: Calculate the cumulative average excess

return CAR

t1t2

for the sample during the event period

(-20,25), with the following formula.

4.2.1 Analysis of Empirical Results for the

Overall Sample

The total sample for the M&A performance study is

133 M&A cases of real estate listed companies, and

the overall sample is subjected to a one-sample t-test

at 95% confidence interval for the change in the

average excess return (AAR) and cumulative average

excess return (CAR) for the 46 days of the event

period (-20,25) for the overall sample, as the results

in Table 2 show that the positive effect of M&A

activity in the short term is significant.

4.2.2 Analysis of Empirical Results for

Horizontal M&As

Based on the sample of 92 M&A cases of real estate

listed companies in the horizontal M&A performance

study, its data of AAR and CAR for 46 days in the

event period (-20,25), a one-sample t-test was con-

ducted on the horizontal M&A sample at 95% con-

fidence interval, and the results showed that the

positive effect of horizontal M&A is significant in the

short term. CAR

4.2.3 Analysis of Empirical Results for

Vertical M&A

Based on the sample of vertical M&A performance

study of 15 M&A cases of real estate listed compa-

nies with the number of AAR and CAR for 46 days in

the event period (-20,25), a one-sample t-test is

conducted on the vertical M&A sample at 95% con-

fidence interval and the results show that the positive

effect of vertical M&A is significant in the short

term.

4.2.4 Empirical Analysis of Hybrid M&As

Based on the sample of mixed M&A performance

study of 26 M&A cases of real estate listed compa-

nies, the data of their AAR and CAR for 46 days in

the event period (-20,25), a one-sample t-test was

conducted on the mixed M&A sample at 95% con-

fidence interval, and the results showed that the

positive effect from mixed M&A in the short term is

significant. In terms of statistical significance, the

positive effect of M&A activity in the short term is

significant.

Table 2: Results of the overall sample CAR significance test[self-drawn].

Test value = 0

Test Subjects t Df Sig. (Double Tail) Average value

Difference

Lower Line

Upper 95%

confidence interval

Overall CAR 8.237 45 .000 .00654 .00494 .00814

Table 3: Results of the horizontal sample CAR significance test[self-drawn].

Test value = 0

Test Subjects t Df Sig. (Double Tail) Average value

Difference

Lower Line

Upper 95%

confidence interval

Horizontal M&A

CAR

2.479 45 .017 .00234 .00044 .00425

Table 4: Results of the significance test for Vertical M&A CAR [self-drawn].

Test value = 0

Test Subjects t Df

Sig.

(Double Tail)

Average

value

Difference

Lower Line

Upper 95%

confidence interval

Vertical M&A CAR 10.739 45 .000 .01505 .01223 .01787

Table 5: Results of the significance test for Mixed M&A CAR [self-drawn].

Test value = 0

Test Subjects t Df

Sig.

(Double Tail)

Average

value

Difference

Lower Line

Upper 95%

confidence interval

Mixed M&A CAR 8.235 45 .000 .01819 .01374 .02264

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

528

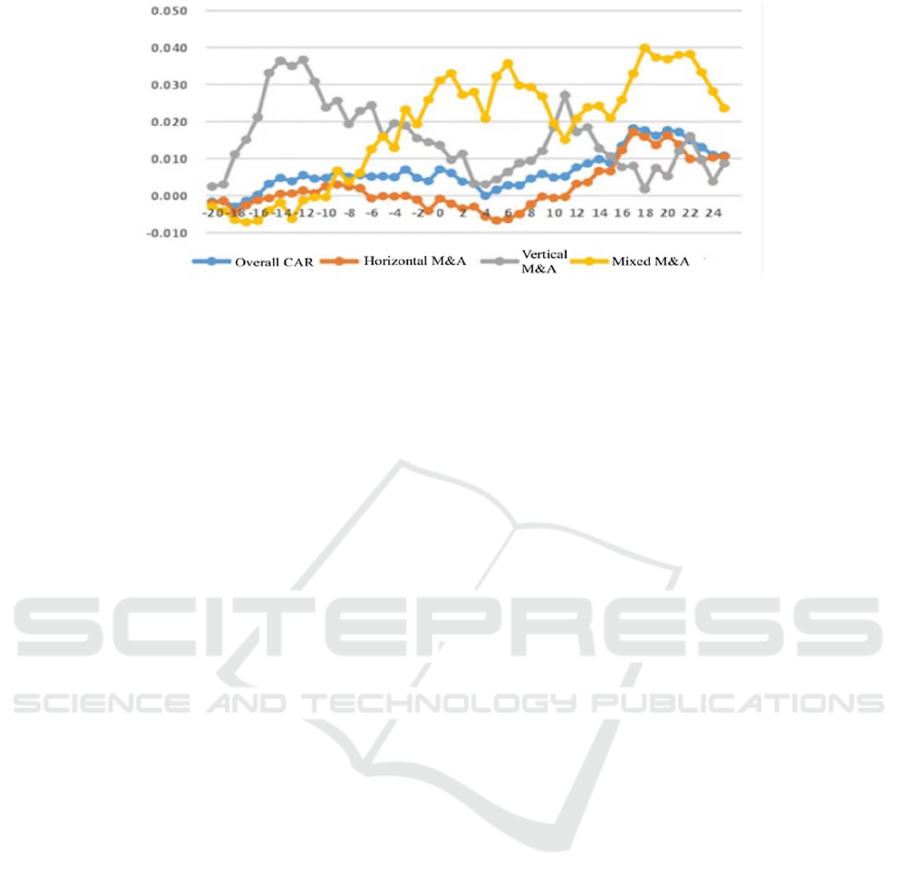

Figure 2: CAR comparison chart for the three M&A models[self-drawn].

4.2.5 Comparative Analysis of Three M&A

Models

As can be seen from Figure 2, the trend of CAR for

the horizontal M&A sample is basically consistent

with that of the overall sample, while vertical and

hybrid M&As differ significantly from the trend of

CAR for horizontal M&As. Overall, CARs for all

three are positive most of the time, indicating that all

three M&A modes have a favorable impact on the

acquirer firm in the short term. The comparison of the

cumulative excess returns of the three M&A models

shows that hybrid M&A brings more short-term

wealth to the shareholders of the company.

5 CONCLUSION

From the above, we can draw the following conclu-

sions: the empirical analysis of the overall sample

shows that M&A activity brings significant positive

effects. And the separate empirical analysis of the

horizontal, vertical and mixed M&A models shows

that all three M&A models bring favorable effects to

the acquiring firm in the short term, but the mixed

M&A brings more short-term wealth.

6 DISCUSSION

This paper analyzes the current situation of M&A of

real estate listed companies in China and introduces

the advantages and disadvantages of three M&A

models. Through empirical analysis it is finally con-

cluded that in the short term, all three modes of M&A

bring significant positive effects to the companies

and mixed M&A brings more short-term wealth to

the companies. A series of problems of real estate

M&A can be found, and based on these problems, the

following suggestions are made: choosing M&A

targets reasonably, ensuring the supply of resources

in the M&A process, and strengthening the

post-M&A integration.

REFERENCES

Che Huihui. An empirical study on the performance of

mergers and acquisitions of real estate listed companies

in China[D]. Yunnan University of Finance and Eco-

nomics,2018.

Gu Bei. Research on M&A performance of real estate listed

companies in China[D]. East China University of Po-

litical Science and Law,2017.

Hou Weiping. M&A motives and short-term M&A per-

formance of real estate listed companies[D]. Nanjing

Agricultural University,2018.

Jiang Junfeng, Wei Ruyao. A study on the M&A perfor-

mance of real estate listed companies in China based on

factor analysis[J]. Journal of Chifeng College (Natural

Science Edition),2018,34(07):20-22.

Liu Hongzhang. An empirical study on the M&A perfor-

mance of China's real estate listed companies under

different M&A models [D]. Southwest University of

Finance and Economics, 2020.

Liu Yanzhi. Research on the evaluation of M&A perfor-

mance of China's real estate listed companies based on

factor analysis[D]. Xinjiang University of Finance and

Economics,2017.

Li Xiao. Research on M&A performance of real estate

listed companies in China and its influencing fac-

tors[D]. Tianjin University,2017.

Li R. An empirical study on the performance of mergers

and acquisitions of real estate listed companies in

China[D]. Xihua University,2015.

Wu Bingbing. Research on M&A performance of real

estate listed companies in China and the main influ-

encing factors[D]. Fujian Normal University,2017.

Zhang XR. Research on the impact of M&A synergy on the

financial value of real estate listed companies[J]. Con-

temporary Economy,2015(33):160-161.

A Study on the Factors of Mergers and Acquisitions of Listed Real Estate Companies and the Mode of Mergers and Acquisitions Based on

the Implementation of Development Policies

529