Research on the Impact of Gree Electric's Mixed Ownership Reform

on Enterprise Performance

Beibei Liu

Jinan University, Guangzhou, Guangdong, 510000, China

Keywords: State-Owned Enterprises Mixed Ownership Reform Diversified Management Enterprise Performance.

Abstract: At present, the mixed ownership reform of state-owned enterprises has entered the pilot and accelerated

stage. Gree Electric Appliances is a key enterprise in the new round of mixed ownership reform of state-

owned enterprises. After the reform, Gree Electric Appliances changed to have no actual controller. The eq-

uity setting, control arrangement and improvement of incentive system in the process of reform have great

reference significance. This case, starting from the study of gree Electric Appliances' mixed-ownership re-

form process, explores the core issues such as why, with whom and the performance after reform, and puts

forward some targeted suggestions for the reform of state-owned enterprises.

1 INTRODUCTION

1.1 Research Background

At present, China's economic development has en-

tered a "new normal", and the mixed ownership

reform of state-owned enterprises has entered a pilot

and accelerated stage. At the present stage, the key

problem facing the mixed ownership reform of state-

owned enterprises lies in how to introduce non-

public economy and at the same time maintain the

business vitality of enterprises, take into account the

improvement of corporate governance structure and

management mechanism, and further improve the

business efficiency of enterprises. In 2019, the State-

owned Assets Supervision and Administration

Commission (SASAC) officially issued the Opera-

tional Guidelines for Mixed-Ownership Reform of

Central Enterprises, which clearly pointed out that it

was necessary to speed up the transformation from

the management of enterprises to the management of

capital, adhere to the separation of government ad-

ministration from enterprise management and gov-

ernment capital management, constantly optimize

the ownership structure of soes, and solve the mech-

anism problems of soes. Especially in the fields and

industries with fierce competition, how to make

state-owned enterprises become relatively independ-

ent economic entities, enhance the vitality and com-

petitiveness of enterprises, and maintain and in-

crease the value of state-owned capital has been

widely concerned.

2 LITERATURE REVIEW

State-owned enterprises have policy burdens. In the

performance assessment of state-owned enterprises,

as the government cannot distinguish political losses

from operational losses, enterprises constantly seek

protection and subsidies from the state to make up

for their losses (Lin, Liu, Zhang, 2004). Performance

assessment of state-owned enterprises is difficult to

carry out, resulting in low efficiency and slow de-

velopment. For China's state-owned enterprises at

present, the related party transactions of state-owned

enterprises are often due to the state-owned enter-

prises bear the policy burden. Therefore, it is neces-

sary to reduce the related party transaction and poli-

cy burden of State-Owned enterprises and restore the

real profits of state-owned enterprises, which is an

important prerequisite for the current reform of

state-owned enterprises and the performance evalua-

tion of state-owned enterprises (Chen, Tang, 2014).

The mixed ownership reform of state-owned en-

terprises is conducive to the good integration of

state-owned capital and private capital, and effec-

tively play the role of resource allocation (Li, 2014).

Through the dividend prediction and calculation of

enterprises implementing mixed reform, it is found

Liu, B.

Research on the Impact of Gree Electric’s Mixed Ownership Reform on Enterprise Performance.

DOI: 10.5220/0011750500003607

In Proceedings of the 1st International Conference on Public Management, Digital Economy and Internet Technology (ICPDI 2022), pages 495-498

ISBN: 978-989-758-620-0

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

495

that mixed reform can indeed effectively improve

the growth rate of economic benefits of enterprises

(He, Ji, 2014). After the reform of state-owned en-

terprises, the first problem to be solved is the redis-

tribution of control rights. Ou Ruichao et al. studied

the problem of partial privatization between "com-

plete state-owned" and "complete private", and

found that partial privatization is the optimal privati-

zation strategy of State-Owned enterprises, and its

balanced social welfare level is the highest among

the three competition modes (Ou, Li, Li, Li, 2014).

Hao Yunhong and Wang Qian found that if the

private capital can play the proper governance effi-

ciency in the chaotic reform, the second largest pri-

vate shareholder and the largest state-owned share-

holder need to balance each other (Hao, Wang,

2015). Therefore, the basic idea of state-owned en-

terprise reform should be as follows: State-owned

enterprises from leading the market supply role to

supplement the market supply role of the follower.

At present, in the process of state-owned enterprises'

mixed ownership reform, strategic investors are

mainly used to increase capital and become share-

holders.

3 MATERIALS AND METHODS

3.1 Case Background and Mixed

Causes

(I) Basic information of Both Parties

Zhuhai Gree Electric Appliances Co., Ltd. was es-

tablished in 1991. Now, gree has developed into a

diversified and technology-based global industrial

manufacturing group, covering two fields of con-

sumer goods and industrial equipment, and its prod-

ucts are sold to more than 160 countries and regions.

Zhuhai Mingjun was established in May 2017,

engaged in equity investment business. The compa-

ny's two major shareholders are Zhuhai Botao Zhi-

heng Enterprise Management Consulting Center and

Shenzhen Hillhouse Heying Investment Consulting

Center. The executive partner is Zhuhai Xianying

Equity Investment Partnership (limited partnership).

(2) Analysis of Mixed Factors

In April 2019, Gree Electric Appliances started a

new round of mixed-ownership reform. This mixed-

ownership reform is a development choice under the

background of the state's efforts to promote the re-

form of state-owned enterprises. It is also a strategic

move promoted by The State-owned Assets Supervi-

sion and Administration Commission of Zhuhai

based on the current economic development situa-

tion of Zhuhai city and the bottleneck of enterprise

development faced by Gree. Gree Electric Appli-

ances chooses to carry out mixed reform at this time

mainly for the following reasons:

① Optimize ownership structure and improve

corporate governance. In this reform, Gree Electric

Appliances introduced strategic investors and en-

tered the state of no real controller. This change

makes it easier for social capital to enter state-owned

enterprises, enabling the high-quality development

of state-owned enterprises.

② Air conditioning market gradually saturated,

fierce competition. Gree's main product is air condi-

tioning business, which is in the highly competitive

home appliance industry. In recent years, the overall

sales scale of the domestic air conditioning market

has decreased while the competition between indus-

tries has intensified. The introduction of strategic

investors can bring abundant new market resources

for the company to meet the development needs of

air conditioning business.

③ Break the single situation of business and

promote the implementation of diversified business.

Gree Electric Appliances' business model is relative-

ly centralized and single, and air conditioning busi-

ness has always been the main source of business

income. The introduction of strategic investors in the

mixed reform can bring high-quality new resources

and technologies to enterprises, improve their ability

to resist risks, accelerate the layout of diversified

businesses, enhance competitive advantages and

break through the existing development bottlenecks.

3.2 Business Performance Analysis

Method

When evaluating the operating performance of Gree

Electric Appliances after the change of control right,

it is necessary to adopt relative performance evalua-

tion, considering not only the change of its own

performance, but also the change of other similar

companies in the same industry. The main criteria

for the selection of control samples are the same

industry, state-owned enterprises, and performance

close to Gree Electric Appliances. Due to gree Elec-

tric Appliances' leading position in the household

appliance industry, there is no state-owned enter-

prise whose performance is similar to Gree Electric

Appliances among the enterprises whose main busi-

ness is air conditioning. Therefore, midea and Haier,

two non-state-owned enterprises with similar busi-

ness composition and revenue scale to Gree, are

included in the control sample.

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

496

3.3 Analysis of Business Performance

after Mixed-Ownership Reform

(I) Changes in Financial Performance

According to the financial performance of Gree

Electric Appliances before and after the mixed-

ownership reform, the influence of the change of

control right on the short-term financial performance

of the company can be clearly concluded. This pa-

per studies the change of short-term financial per-

formance from product competitiveness, growth and

profitability respectively, and compares it with con-

trol samples. Through comprehensive analysis of the

financial indicators in the table below, it can be con-

cluded that gree Electric Appliances' financial indi-

cators show a downward trend due to the impact of

the epidemic, saturation of the air conditioning mar-

ket and increased competition. The financial perfor-

mance of Gree Electric Appliances has not changed

significantly after the reform, and the effect of the

reform needs a longer time window to test.

(2) Diversified Business Performance Analysis

From the perspective of Gree Electric Appliances'

revenue composition, the product composition and

the revenue proportion of each product before and

after the reform remain stable. Air conditioning

business has always been an important revenue

source of Gree Electric Appliances, accounting for

about 70%. In terms of product gross margin, the

gross margin of air conditioning products in 2021

was 31.23%, down 3.09% year on year. On the

whole, the gross margin of the air conditioning busi-

ness has declined for two consecutive years, and the

overall revenue scale and profitability of the air

conditioning business are in a declining state, which

is largely related to the gradual saturation of the air

conditioning market and the impact of the epidemic.

At the same time, gree Electric Appliances' non-air

conditioning products achieved a higher gross mar-

gin in 2020 than in the previous period to varying

degrees, which can reflect gree Electric Appliances'

improvement in promoting diversification after the

mixed-ownership reform, but in general, no signifi-

cant breakthrough has been made.

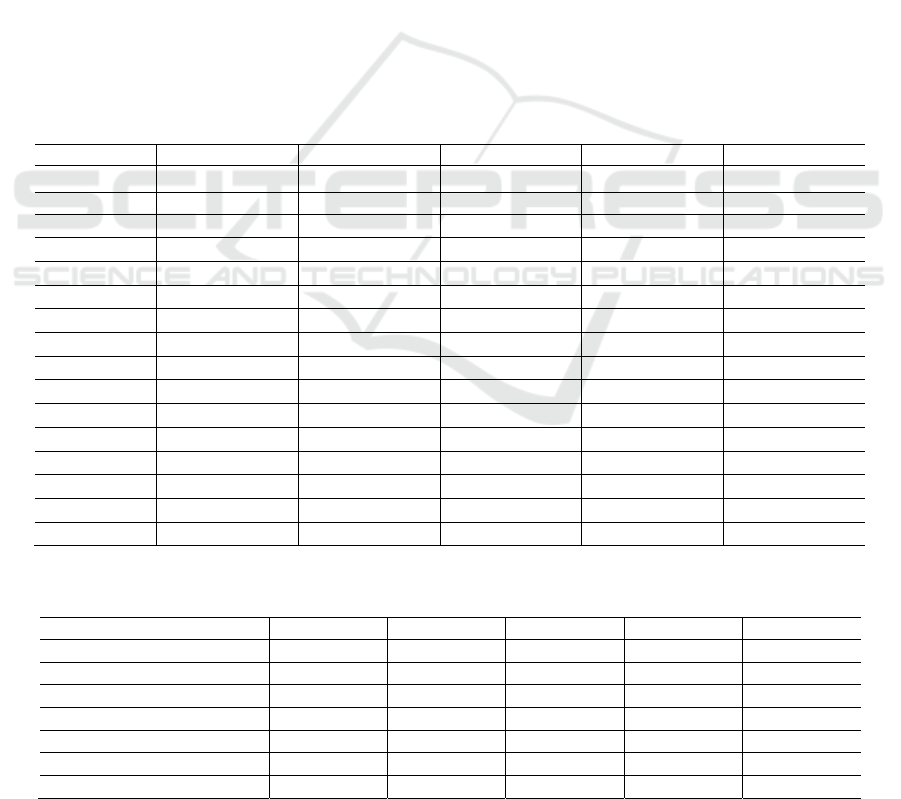

Table 1: Financial performance changes of Gree Electric Appliances before and after.

Yea

r

2017 2018 2019 2020 2021

Revenue Growth Revenue Growth Revenue Growth Revenue Growth Revenue Growth

GREE 36.92% 33.61% 0.02% -15.12% 11.69%

sample mean 35.96% 17.13% 9.32% 6.71% 14.24%

sample median 33.75% 7.87% 7.14% 4.46% 8.50%

Gross Margin Gross Margin Gross Margin Gross Margin Gross Margin

GREE 32.86% 30.23% 27.58% 26.14% 24.28%

sample mean 19.86% 18.86% 19.41% 18.90% 17.37%

sample median 19.46% 19.01% 21.44% 24.05% 19.70%

Net Profit Rate Net Profit Rate Net Profit Rate Net Profit Rate Net Profit Rate

GREE 15.18% 13.31% 12.53% 13.25% 12.15%

sample mean 7.35% 3.97% 4.28% 4.46% 4.02%

sample median 6.19% 3.95% 5.21% 5.40% 3.47%

ROE ROE ROE ROE ROE

GREE 33.68% 28.45% 22.16% 19.06% 21.16%

sample mean 27.25% 13.87% 12.62% 12.93% 12.77%

sample median 22.44% 17.72% 15.63% 16.62% 15.03%

mixed-ownership reform Data source: CSMAR Database

Table 2: Ratio of operating income of gree Electric Appliances products.

Year 2017 2018 2019 2020 2021

Air conditioner 83.22% 78.58% 69.99% 68.71% 70.11%

Life electric appliance 1.55% 1.91% 2.81% 2.69% 2.60%

Industrial products — — — 1.37% 1.70%

Intelligent equipment 1.43% 1.57% 1.08% 0.36% 0.46%

Green energy — — — 1.06% 1.55%

The other main 2.94% 4.04% 5.30% 3.35% 0.68%

Other business 10.86% 13.90% 20.82% 22.46% 22.90%

Data source: Gree Electric Appliances Annual Report

Research on the Impact of Gree Electric’s Mixed Ownership Reform on Enterprise Performance

497

Table 3: Gross margin of Gree Electric Appliances' main products.

Year 2017 2018 2019 2020 2021

Air conditioner 37.07% 36.48% 37.12% 34.32% 31.23%

Life electric appliance 20.65% 18.23% 23.40% 31.81% 33.16%

Intelligent equipment 5.85% 6.48% 5.94% 23.70% 29.34%

Else 22.43% 6.28% 2.67% 5.94% 4.18%

Data source: CSMAR Database

4 CONCLUSION

Gree Electric Appliances is a benchmark enterprise

in soE mixed ownership reform. In the new round

of mixed reform, Gree Electric Appliances adopts

the mixed ownership mode of equity transfer and

introduction of strategic investors. In the process of

mixed ownership reform, it took the lead in solving

the core problem of the consistency of interests

among the government, enterprises and introduced

investors, and built a control structure of "ownership

structure, board of directors and management",

which has become an important case of the mixed

ownership reform of state-owned enterprises. There

is no significant change in financial performance

before and after mixed-ownership reform, which

requires long-term performance in the future. At

present, China is in a critical period of state-owned

enterprise reform. The government, enterprises and

investors should realize that state-owned enterprises

are the core of China's economy and should play a

pillar role in China's economic transformation and

upgrading. The mixed reform of state-owned enter-

prises cannot simply adopt privatization or privatiza-

tion policies. The reform of state-owned enterprises

needs more exploration and practice to reduce gov-

ernment intervention and activate the vitality of

state-owned executives and shareholders, improve

corporate governance structure and stimulate enter-

prise vitality. The research on the flexible form of

mixed ownership reform and its relationship with

corporate performance and corporate governance

needs to be further deepened.

REFERENCES

Lin Yifu, Liu Mingxing, Zhang Qi, "Policy Burden and

Soft Budget Constraint of Enterprises: An Empirical

study from China", Management World, no.8, 2004.

Chen Lin, Tang Yangliu, Mixed Ownership Reform and

Policy Burden of State-owned Enterprises: An Empir-

ical Study based on Big Data of Early State-owned

Enterprise Property Rights Reform, The Economist,

No.11, 2014.

Li Weian. Classified Governance: the basis for deepening

reform of state-owned enterprises [J]. Nankai man-

agement review, 2014,17(05): 1.

He Jun, Ji Yulong. Mixed ownership of state-owned en-

terprises: Dividends and paths to realization [J]. Re-

form and strategy, 2014(05): 18-20.

Ou Ruiqiu, Li Jieyu, Li Guangzhong, Li Jie, "Partial Pri-

vatization and State-owned Enterprise Positioning",

World Economy, no.5, 2014.

Hao Yunhong, Wang Xi. A study on the check-and-

balance mechanism of stock ownership in mixed-

ownership Enterprises: a case study based on"The dis-

pute over the control right of E-wu merchants"[J].

China's industrial economy, 2015(3): 148-160.

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

498