Pork Price Prediction using LSTM Model: Based on a New Dataset

Ziya Yang*

1

, Ruijie Zhang

2

, Zheng Yin

3

and Yucheng Zhu

4

1

Business college, Sichuan Agricultural University, Chengdu, China

2

School of Civil Engineering, Sichuan Agricultural University, Yibin, China

3

School of Architecture and Planning, Sichuan Agricultural University, Chengdu, China

4

School of Architecture and Planning, Sichuan Agricultural University, Luzhou, China

202008345@stu.sicau.edu.cn, 174062498@qq.com, 3344267732@qq.com

Keywords: ARIMA Model, LSTM, Covid-19, Computer Technology, Agricultural Prediction.

Abstract: During the epidemic period, some of prevention and control measures have exacerbated the contradiction

between supply and demand, which seriously affected the national economy and people's livelihood. In recent

years, with the development of computer science and the spread of the digital economy, many studies have

turned their attention to agricultural product price forecasting. Nevertheless, the application of intelligent

method in this area is still lacking. Thus, this paper uses ARIMA model and LSTM model for pork price

prediction based on a new dataset, trying to figure out a better model and provide guidance for national price

management. According to the analysis, LSTM model outperforms ARIMA model in both short-term and

long-term prediction, which overcomes the problem of long-term dependency. However, the data under the

epidemic is not sufficient, which limits the extraction of effective information, affecting the accuracy of model

predictions to some extent. It is suggested that following research should collect more data in the context of

covid-19 and adopt better dimensionality reduction method to achieve better results.

1 INTRODUCTION

With rapid spread and high mortality, the current

coronavirus disease outbreak is seen as a worldwide

emergency, causing severe disruptions in various

fields. (Yang, 2020) Especially in agriculture. Agri-

culture is the foundation of a country and is of vital

significance to the economy development. The covid-

19 has caused a huge blow to agriculture from all as-

pects. Typically, take transportation for an example,

the measures to control the pandemic have created

new challenges for transportation systems. (Gray,

2020) That seriously affect the agriculture and food

supply chain, which has exacerbated the contradiction

between supply and demand and consequently broken

the food security. (Raúl, 2020) Moreover, influenced

by the trade, distribution of inputs, labor availability,

and transportation control, agricultural commodity

production may experience destruction. (Mouloudj,

2020) All the above factors make price fluctuations

more and more violent, ultimately, forming a vicious

circle between Price, supply and demand. Therefore,

the research of agricultural products price prediction

is of great significance, especially in the context of

the current epidemic.

Price Prediction, which is to be carried out only

based on the available data, has become significantly

agricultural problem recently. (Kaur, 2014) With the

development of information technology and artificial

intelligence, accurate price prediction can help farm-

ers plan their production arrangements in advance,

provide policymakers with a basis for decision-mak-

ing, and price references for consumers. Contempo-

rary the most widely used parsimonious form of price

forecasting is time series model. Time series models

do not require cumbersome data input and only rely

on information provided by past price data. (Jha,

2013) Meanwhile, as the core algorithms in machine

learning algorithms, BP (Back Propagation) neural

network algorithm and genetic algorithm are widely

applied in different kinds of filed, such as stock price

forecast and rainfall forecast. (Yu, 2018) Ganqiong Li

used ANN (Artificial Neural network) model to pre-

dict Tomatoes price, the accuracy of ANN model is

more than 80%, and daily price forecasting is even

more than 90%. (Li, 2010) Nevertheless, the applica-

tion of LSTM (Long short-term memory) model is

still insufficient, which shows great accuracy in other

fields.

Yang, Z., Zhang, R., Yin, Z. and Zhu, Y.

Pork Price Prediction Using LSTM Model Based on a New Dataset.

DOI: 10.5220/0011738900003607

In Proceedings of the 1st International Conference on Public Management, Digital Economy and Internet Technology (ICPDI 2022), pages 423-429

ISBN: 978-989-758-620-0

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

423

Thus, this paper takes pork prices in Sichuan

Province, China as an example, collects relevant data

from 2015-2020 to predicts long-term and short-term

pork prices with ARIMA time series model and

LSTM neural network model based on Python. Given

that the ARIMA model is quite common in agricul-

tural price forecasting, which is widely used in many

fields, we will not elaborate on ARIMA here. The em-

phasis on the eigenvalue’s selection and model build-

ing of the LSTM.

2 METHODOLOGY

2.1 Data

As one of the most important sources of food in

China, the fluctuation of pork price significantly af-

fects China’s consumer price index (CPI), playing a

vital role in China’s economic system, which ulti-

mately influence the national macroeconomic policy.

(Zhao, 2015) Sichuan province is one of the largest

hog breeding bases in China, holding an important

place in the domestic pork supply. Considering that,

we collect a new dataset of pork price, which is shown

in the table 3.

2.2 Arima Model

ARIMA model (Auto Regressive Moving Average

model) are often applied on time series whose prop-

erties do not change over time, which means stable

time series. The ARIMA model is proposed to esti-

mate, test and predict the future value based on sta-

tionary time series which includes Autoregressive

(AR) model, Moving average (MA) model, and Sea-

sonal Autoregressive Integrated Moving Average

(SARIMA) model. (Benvenuto, 2020) In term of the

identification step, we are supposed to acquire a sta-

tionary time series, which is an exquisite condition to

construct the ARIMA model, so, data transformation

is needed in advanced. (Fattah, 2018) This process is

usually done by differencing and power transfor-

mation, and the terms of differencing is parameter d.

The ARIMA model is expressed as followed:

X

= α

X

+ α

X

+ ⋯ + α

X

+ ε

+

β

ε

+ ⋯ + β

ε

(1)

2.3 LSTM Model

To better explain LSTM (Long Short-Term Memory),

let’s begin with RNN (Recurrent Neural Network).

Introduced by Jordan in 1997, RNN is a neural net-

work that can being trained to predict the next symbol

in a sequence and learn the probability distribution

over a sequence. (Cho, 2014) However, affected by

short-term memory, it’s difficult to address the prob-

lem of long-term dependencies, leading to exploding

gradient and vanishing gradient. In 1997, Hochreiter

and Schmidhuber proposed the LSTM cell, which can

handle the problem of long-term dependencies effec-

tively.

As a special kind of RNN, LSTM can deal with

the correlation within time series in both short and

long term by transforming the hidden layer into a

memory unit. (Zhao, 2017) In other words, the

memory unit gives LSTM the ability to remember and

screen, enabling LSTM to store critically important

information about them and erase unrelated infor-

mation, in which way it can preserve information

from a long time ago. Thus, it effectively prevents the

gradient vanishing problem which exists in the tradi-

tional RNN by devising the creative gating structure

of LSTM block. (Akbari, 2018) The LSTM can be

described into 3 parts, the forget gate, the input gate

and the output gate.

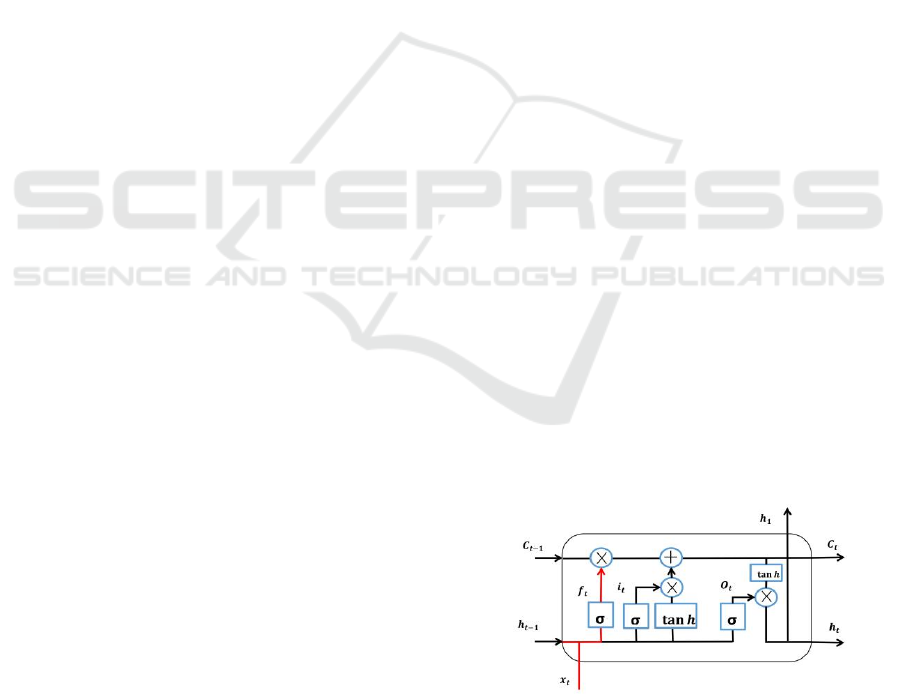

The Forget Gate.

As shown in the Fig. 4, the line marked in red is the

path for forget gate to delete irrelevant information.

The first step in the LSTM is to decide what infor-

mation we need to discard from the previous cell

state. This step is usually determined by the forgot

gate, which does a nonlinear sigmoid mapping by

reading the previous output h

and the current in-

put X

, and finally obtain f

(forget gate output),

which is shown in the Fig 1.

The mathematical form can be written as:

f

= σ(w

⋅ [h

,X

]+b

) (2)

Figure 1: The forget gate (author self-draw).

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

424

The Input Gate.

The input gate consists of two parts, one determined

by the sigmoid mapping decides which values need

to be updated and added to the previous matrix, and

the other part by reading h

and X

to create a new

candidate matric through the tanh layer to join the

current state. The whole process is shown in the Fig.2

which can be written as followed.

i

= σ(W

⋅ [h

,X

]+b

) (3)

C

=tanh(W

⋅ [h

,X

]+b

) (4)

C

=f

∗ C

+i

∗ C

(5)

Figure 2: The input gate (author self-draw).

The Output Gate.

The final output is determined by the sigmoid gate

and the cell state processed by the tanh layer.

Through sigmoid activation function we can figure

out which part needs to be outputted. Then, map the

current cell state to [-1, 1] through the tanh activation

function. Finally multiply the two parts to get the out-

put gate value. Still, it can be expressed by two for-

mulas, shown as Fig. 3.

Figure 3: The output gate (author self-draw).

O

= σ(W

⋅ [h

,X

]) + b

) (6)

H

=O

∗ tanh

(

C

)

(7)

2.4 ARIMA Model

It is clearly that the time series data has a clear trend

but no obvious seasonality which needs to be differ-

entiated to be stabilized. Therefore, after the first-or-

der difference, we performed the ADF test to see if it

is stationary. The result is shown in table 1that the P

value is less than 0.01, which means there is insuffi-

cient evidence to prove that the time series data is not

stationary.

Next, the p parameter and the q parameter are sup-

posed to be selected. By drawing the graphs of the

ACF and PACF of the residual terms, it can be clearly

seen that the data residuals are all tailed-off to zero

after the first-order difference, which also means that

ARIMA model can be applied on the data. Based on

this, we selected ARIMA (5, 1, 2) Model, with the

minimal BIC. The R2 of the training model is 0.992.

Finally, we apply the established ARIMA (5,1,2)

model to the test set, and obtain the prediction of the

next 7days and next 30days. On the test set, the good-

ness of fit of the model is still very high, up to 0.96.

The detailed results are shown in the table 2.

Table 1: ADF Inspection Form.

Differential

order

t p

Critical value

1% 5% 10%

0 -0.678 0.36 -3.441 -2.092 -2.695

1 -8.849 0.000 -3.499 -2.892 -2.583

Table 2: Metrics for ARIMA Model.

ARIMA MODEL

Se

t

MSE (%) RMSE (%) MAE (%) MAPE (%)

Train

1.201 1.194 1.111 4.712

Tes

t

1.342 1.301 1.204 4.613

Predictive value

short 1.059 1.029 1.019 2.212

long 2.013 1.419 1.348 2.219

Pork Price Prediction Using LSTM Model Based on a New Dataset

425

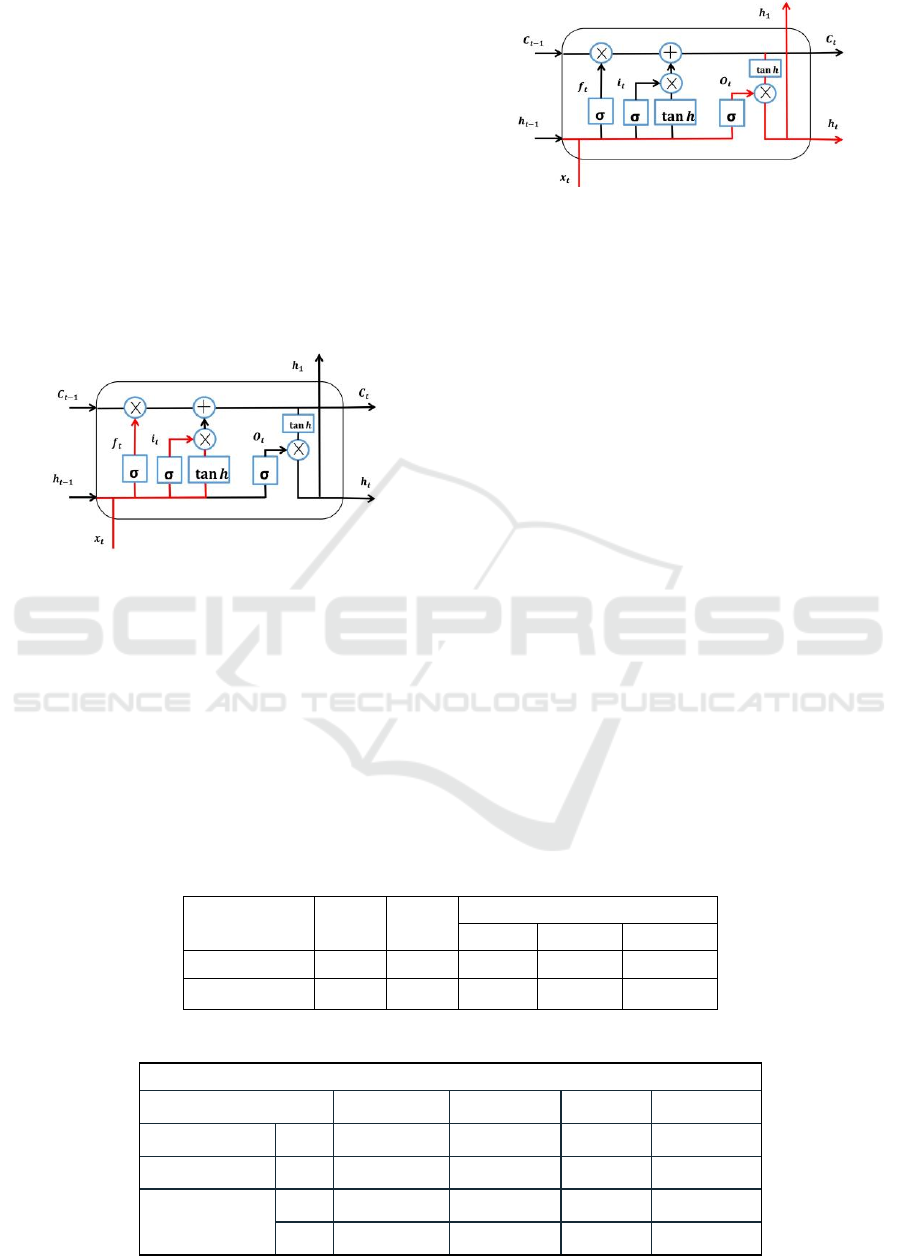

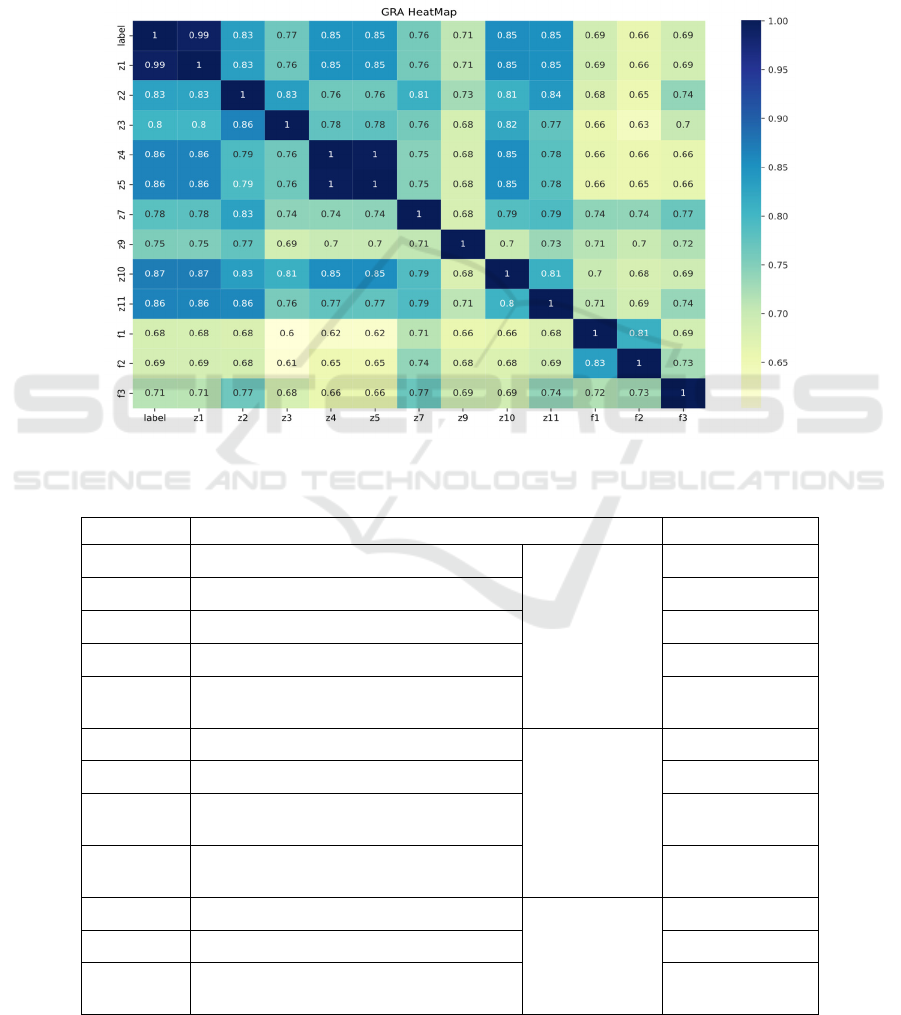

2.5 LSTM Model

For LSTM, selecting the appropriate feature values is

particularly important for the accuracy of prediction.

Hence, we will perform GRA method to filter the best

feature variables for LSTM model. After preliminary

data sorting and data cleaning, we conduct a simple

correlation analysis. According to the positive and

negative signs of the results, the data can be divided

into two parts, the positive part and negative part. The

next step is to carry out gray correlation analysis re-

spectively.

Finally, the variables with correlation values

above 0.65 are selected as eigenvalues for LSTM

model training, presented in the table III. The detailed

information of the GRA results are shown in Fig.4,

Fig.5 and Fig.6.

Figure 4: The GRA Heatmap (author self-draw).

Table 3: The results of the GR.

The label

influencing factor grey relativity

Z1 Historical pork price

supply factor

0.99

F1 Pork stock

0.69

Z3 Refined feed price of pork

0.77

Z5 Total cost of hog production

0.85

Z4

The material and service fees of

hog breeding

0.85

Z2 Average price of chicken

demand factor

0.83

F3 Black-bone chicken

0.69

Z9

The per capital disposable income

of rural residents

0.71

Z7

Fiscal expenditure for agriculture,

forestry and water

0.76

F2 Pork export volume

macro factors

0.85

Z10 Pork import volume

0.66

Z11

CPI-Food (Consumer price index of

food)

0.85

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

426

Figure 5: The line chart of GRA with positive correlation (author self-draw).

Figure 6: The line chart of GRA with negative correlation (author self-draw).

Table 4: Model parameter.

Model Parameter Configuration

name value

inpu

t

15

outpu

t

1

Num Hidden Units 400

LSTM laye

r

2

Max Epochs 100

Optimize

r

Adam

Learn Rate Drop Facto

r

0.2

Consequently, by setting the initial two-layer

LSTM model and multiple initial parameters, the

GridSearchCV function is applied to select the best

parameters. Besides, the number of parameters and it-

erations are passed to the program for training. It is

worth noting that the normalization is 0.05-0.85. That

is because the scale of the data is too large which

shows big differences. For this reason, a certain re-

duction is performed. The selected parameters are

shown in table 4.

Finally, it comes to the predicting step. We are

scheduled to predict the data of the 21st day based on

the data of the previous 20 days. Hence, we use the

data from December 11th to 30th, 2020 to predict the

pork price of January 1st,2020. Accordingly, it is ex-

pected to import the January 1st data, using the data

from December 12th to January 1st to predict January

2nd. Finally, save the data after forecasting the pork

price for the whole January follow the principle. The

results and the indicators are shown in the table 5.

Pork Price Prediction Using LSTM Model Based on a New Dataset

427

Table 5. Metrics For LSTM Model.

LSTM MODEL

Set MSE (%) RMSE (%) MAE (%) MAPE (%)

Train

6.751 2.598 1.586 6 .639

Tes

t

5.099 2.258 1.831 4.294

Predictive

value

short 0.127 0.357 0.267 0.588

long 0.179 0.338 0.422 0.721

As can be seen from Figure, that both the ARIMA

model and the LSTM model curve fit poorly. How-

ever, compared with LSTM model, although the

MAPE of ARIMA model from January 1st to January

30th is 0.0229, which shows great accuracy, the pre-

dicted fluctuation trend changes poorly, showing a

smooth curve. Even the error of the ARIMA model is

relatively small, it does not reflect the trend of the

pork prices. On the other hand, if RMSE is used as

the model indicator, the RSME of the ARIMA model

is about 1.419%, while the RMSE of the LSTM

model in this paper is just about 0.338%. In conclu-

sion, all signs point to that either prediction accuracy

or the trend prediction, LSTM outperforms ARIMA

in all aspects. Besides, both models are better for

short-term prediction than long-term prediction,

which is the same as other papers.

3 CONCLUSION

In general, in the context of covid-19 and the devel-

opment of computer science and digital economy, this

paper focuses on finding a better model for agricul-

ture price prediction, hopping offering some guidance

to governments, farmers and buyers. In this paper, we

discussed the effect of the LSTM model in pork price

prediction and compared with the traditional ARIMA

model. It is worth mentioning that this paper has col-

lected a whole dataset of pork prices, including 16

variables and more than 28,000 data, which is not

seen in previous research, which is also the biggest

innovation of this paper. According to the empirical

analysis, the LSTM model outperforms the ARIMA

model in both model accuracy and trend prediction.

Especially in predicting peaks and trends, it is far bet-

ter than traditional time series forecasting models.

Compared with previous studies, the accuracy of the

long-term prediction of the model in this paper has

also been greatly improved.

However, there are still some aspects can be im-

proved. The first is about data collection. Price fluc-

tuates violently due to the covid-19 and the swine fe-

ver, which affects the prediction accuracy of LSTM

model. Subsequent research can focus on collecting

the data in longer time span which can better consider

the epidemic factor. Secondly, the dimensionality re-

duction method adopted is relatively simple. Further

research can make improvements in this regard. In

general, this paper has made certain innovations in the

selection of eigenvalues predicted by the LSTM

model, offering guideline for LSTM in the field of ag-

ricultural price prediction and national price manage-

ment.

REFERENCES

Akbari Asanjan, Ata, et al. "Short‐term precipitation fore-

cast based on the PERSIANN system and LSTM recur-

rent neural networks." Journal of Geophysical Re-

search: Atmospheres 123.22 (2018): 12-543.

Benvenuto, Domenico, et al. "Application of the ARIMA

model on the COVID-2019 epidemic dataset." Data in

brief 29 (2020): 105340.

Cho, Kyunghyun, et al. "Learning phrase representations

using RNN encoder-decoder for statistical machine

translation." arXiv preprint arXiv:1406.1078 (2014).

Fattah, Jamal, et al. "Forecasting of demand using ARIMA

model." International Journal of Engineering Business

Management 10 (2018): 1847979018808673.

Gray, Richard S. "Agriculture, transportation, and the

COVID‐19 crisis." Canadian Journal of Agricultural

Economics/Revue canadienne d'agroeconomie 68.2

(2020): 239-243.

Jha, Girish K., and Kanchan Sinha. "Agricultural price fore-

casting using neural network model: An innovative in-

formation delivery system." Agricultural Economics

Research Review 26.347-2016-17087 (2013): 229-239.

Kaur, Manpreet, Heena Gulati, and Harish Kundra. "Data

mining in Agriculture on crop price prediction: Tech-

niques an Applications. "International Journal of Com-

puter Applications99.12 (2014): 1-3.

Li, Gan-qiong, Shi-wei Xu, and Zhe-min Li. "Short-term

price forecasting for agro-products using artificial neu-

ral networks." Agriculture and Agricultural Science

Procedia 1 (2010): 278-287.

Mouloudj, Kamel, Ahmed Chemseddine Bouarar, and Ha-

mid Fechit. "The impact of COVID-19 pandemic on

food security." Les cahiers du CREAD 36.3 (2020):

159-184.

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

428

Siche, Raúl. "What is the impact of COVID-19 disease on

agriculture?" Scientia Agropecuaria 11.1 (2020): 3-6.

Yang, Li, et al. "COVID-19: immunopathogenesis and Im-

munotherapeutics." Signal transduction and targeted

therapy 5.1 (2020): 1-8.

Yu, Yanfeng, Haibo Zhou, and Jiangfan Fu. "Research on

agricultural product price forecasting model based on

improved BP neural network." Journal of Ambient In-

telligence and Humanized Computing (2018): 1-6.

ZHAO, Guo-qing, and W. U. Qiong. "Nonlinear dynamics

of pork price in China." Journal of Integrative Agricul-

ture 14.6 (2015): 1115-1121.

Zhao, Zheng, et al. "LSTM network: a deep learning ap-

proach for short‐term traffic forecast." IET Intelligent

Transport Systems 11.2 (2017): 68-75.

Pork Price Prediction Using LSTM Model Based on a New Dataset

429