Carbon Tax as One of the Financial Instruments to Stimulate the

Green Economy

S. S. Khasanova

1,2

, Kh. A. Delmikhanova

1

and I. M. Pedaeva

1

1

Kadyrov Chechen State University, Grozny, Russia

2

Southern Federal University, Rostov-on-Don, Russia

Keywords: "Green" economy, "green" technologies, carbon tax.

Abstract: The green economy is an economic model that is characterized by a low level of carbon use, efficient use of

available resources, aimed at ensuring social well–being. In a green economy, employment and income

growth are driven by public and private investments in economic activities, infrastructure and assets that

reduce carbon emissions and pollution, and increase energy and resource efficiency. In order to stimulate this

area, it is necessary to constantly look for mechanisms and tools, one of which is the carbon tax.

1 INTRODUCTION

To date, the situation with environmental pollution

has worsened so much that the search for a solution

to this problem has become a priority for all actors at

the global level. If earlier nature was protected by

individual representatives of enthusiasts and

environmentalists, now every person has felt for

himself what a careless attitude to nature has led to.

We live in a stone jungle and observe how the planet

is getting dirtier every day. On social networks, we

often come across articles about animals that are

recognized as endangered species, how many marine

creatures have become extinct due to polluted waters,

and these lists are getting longer every day.

The Industrial Revolution, undoubtedly, appeared

as a new stage in the development of the world, but it

also gave rise to a number of problems that we, the

people, have to deal with. The destruction of the

ozone layer, tons of oil waste thrown into the seas and

oceans, tons of plastic that does not decompose by

itself and causes the formation of garbage "spots" in

the oceans, all this is ours today.

As the world transforms with the development of

technology, climate, politics and economics,

solutions are emerging that positively balance

environmental and social goals for the benefit of

nature, people and business in particular. The leader

is the "Green Economy", an economic model headed

by the well-being of people and environmental

sustainability.

2 MATERIAL AND METHODS

The main methods used in the course of the study are

the analysis of the results obtained during the study of

articles, journals and books, the derivation of general

patterns, the generalization of the information

obtained during the study of this topic.

3 RESULT AND DISCUSSION

The essence and importance of the "Green" economy

lies in the fact that it contributes to a more sustainable

and low-carbon economy. With the widespread use of

the concept of "Green" economy, the term "green"

technologies also appeared.

Green technologies refer to the type of

technologies that are considered environmentally

friendly based on their production process or supply

chain. The term is also applicable to the production of

clean energy, the use of alternative fuels and

technologies that are less harmful to the environment.

Although the green technology market is relatively

young, it has attracted considerable investor interest

due to the growing awareness of the effects of climate

change and the depletion of natural resources.

(Kamilova).

Green technologies are a broad category covering

several forms of environmental restoration. While

climate change and carbon emissions are now

considered among the most pressing global issues,

312

Khasanova, S., Delmikhanova, K. and Pedaeva, I.

Carbon Tax as One of the Financial Instruments to Stimulate the Green Economy.

DOI: 10.5220/0011571000003524

In Proceedings of the 1st International Conference on Methods, Models, Technologies for Sustainable Development (MMTGE 2022) - Agroclimatic Projects and Carbon Neutrality, pages

312-315

ISBN: 978-989-758-608-8

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

there is also a lot of effort being made to address local

environmental hazards. Some seek to protect certain

ecosystems or endangered species. Others seek to

conserve scarce natural resources by finding more

sustainable alternatives.

To provide a viable alternative to fossil fuels,

many businesses are looking to develop alternative

energy sources that do not produce atmospheric

carbon. Solar and wind energy are currently among

the most inexpensive sources of energy, and solar

panels are available to residents in the US on a

consumer scale (Carbon starvation: how Russia can

adapt to the EU import tax.https://trends.rbc.ru/).

According to the Environmental Protection

Agency, almost a third of greenhouse gas emissions

in the United States are from transportation activities.

Many manufacturers are exploring ways to reduce

automotive emissions either by developing more fuel-

efficient engines or by switching to electricity.

However, electric vehicles require many

innovations in other areas, such as high-capacity

batteries and charging infrastructure. In addition, the

benefits of electric vehicles are limited by the fact that

many power systems still use fossil fuels.

Agriculture and animal husbandry have a

significant impact on the environment, from the high

cost of using land and water to the environmental

consequences of the use of pesticides, fertilizers and

animal waste. As a result, there are many

opportunities for "green" technologies in the field of

agriculture. For example, organic farming methods

can reduce damage from soil depletion, innovations

in livestock feeding can reduce methane emissions,

and meat substitutes can reduce livestock

consumption (Global water pollution: causes,

consequences and ways to solve the problem.

https://militaryarms.ru/).

Recycling is aimed at preserving scarce resources

through the reuse of materials or the search for

sustainable substitutes. While plastic, glass, paper and

metal waste are the most common forms of recycling,

more complex operations can be used to extract

expensive raw materials from electronic waste or

automotive parts.

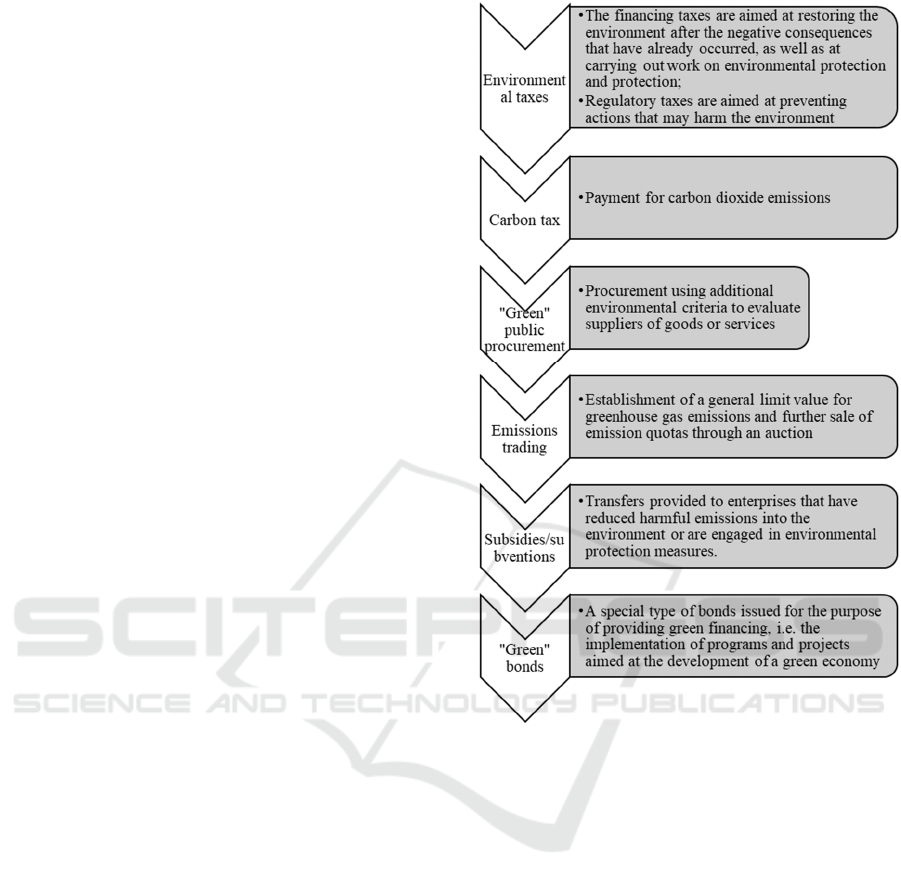

"Green" technologies require a significant amount

of infused funds, or rather financing in various forms,

both at the public and private, and at the international

level (figure 1).

Figure 1: Financial instruments for stimulating "green"

industries.

Of all the financial instruments presented above to

stimulate the economy, special attention should be

paid to the carbon tax.

A carbon tax is a fee for burning carbon—

containing fuels (coal, oil, gas). Moreover, the carbon

tax is the main policy of reducing and, ultimately,

ending the use of fossil fuels, the burning of which

destabilizes and destroys our climate (Investlab,

https://invlab.ru/texnologii/zelyonye-tehnologii/).

The carbon tax is the most effective way to

encourage consumers and users of carbon fuels to pay

for the climate damage caused by the emission of

carbon dioxide and vapors into the atmosphere. If the

tax rates are high, it will force everyone to switch to

clean energy, since the use of carbon will simply

become unprofitable (Sleptsova, 2021).

The introduction of a carbon tax gives consumers

and producers a monetary incentive to reduce carbon

dioxide emissions (figure 2).

Carbon Tax as One of the Financial Instruments to Stimulate the Green Economy

313

Figure 2: Pros and cons of introducing a carbon tax.

Taxes allow industries to find the most cost-

effective ways to reduce carbon emissions. This is a

better alternative to a market economy than

government regulation. The carbon tax also

contributes to economic growth. For example, the

carbon tax in Sweden has reduced emissions by 26%

over the past 27 years. During the same period, its

economy grew by 78% (Kanunnikova, 2021).

However, the disadvantages of introducing a

carbon tax should also be disclosed. As noted above,

the carbon tax is regressive, and when gasoline and

gas prices rise, these high percentages will become a

heavy burden for the population who will not be able

to switch to "Green Technologies", that is, everyday

things will become inaccessible to them. Based on

this, it is necessary to introduce a carbon tax gradually

so that people get used to the fact that prices will only

rise and look for alternative options.

The European Union also announced the

"European Green Course", which aims to create a

climate–neutral EU economy by 2050. As one of the

measures, it is planned to introduce a carbon tax on

imports to EU countries. If everything is implemented

according to the plan, importers will have to buy

carbon certificates corresponding to the carbon price

that would be paid in the EU if the goods were

produced locally. The EU has proposed to introduce

a tax on imported carbon-intensive products, which

will determine the role of trade in the fight against

climate change (The EU introduces a carbon tax.

What is its essence and how it works: Ecology News.

https://finance.rambler.ru/). These measures are

causing controversy among EU trading partners,

some of whom consider it "green protectionism". At

best, the proposed carbon tax should promote a

common understanding of carbon-based trade

policies, maximizing both environmental and

economic benefits (Kamilova).

Reducing carbon emissions into the atmosphere is

a global trend, not just a whim of the European Union.

For example, China, Japan and South Korea declare

carbon neutrality as a national goal (Burko, 2013). As

emission control practices are implemented in

different countries, the establishment of cross-border

regulations will become more likely.

In order for exporting countries to survive in the

"green" market, it will be necessary to create their

own state system of accounting and evaluation of

carbon gas, develop tariffs, as well as a system of

incentives for enterprises that have abandoned the use

of carbon gas, thereby minimizing possible climate

damage (Kanunnikova, 2021). Only in this case,

when the state responds promptly to rapidly growing

changes in all areas of the world market, it will be

possible to maintain the competitiveness of the

country, as well as ensure sustainable development.

4 CONCLUSIONS

The essence and importance of the "Green" economy

lies in the fact that it contributes to a more sustainable

and low-carbon economy. In order to stimulate this

area, it is necessary to constantly look for

mechanisms and tools, one of which is the carbon tax.

The introduction of a carbon tax has both

advantages and disadvantages.

The Russian economy is not ready for such

structural shifts as the introduction of a carbon tax, as

it will have to revise all directions, starting with the

regulatory and legislative framework.

However, it cannot fail to react to the changes

taking place around the world, since the cross-border

tax introduced in the EU countries will primarily

negatively affect the Russian economy and its

competitiveness.

REFERENCES

Sleptsova, E.V., Glubokaya, Ya. Ya., 2021. Analysis of the

experience of using financial instruments to stimulate

"green" technologies. Economics and Business: theory

and practice. 4-2.

Kanunnikova, K. I., 2021. Formation of a "green" economy

in Russia. Skif. 5 (57).

Positive:

•Added value reduces

emissions,

motivating

consumers to seek

cleaner energy;

•Accelerates

economic growth

due to a significant

increase in

government

revenues;

•Funds of agencies

managing the effects

of climate change

are increasing.

Negative:

•The carbon tax is

regressive;

•Its sudden increase

shocks the economy;

•Punishes those who

cannot switch to

alternative forms of

energy. Often these

are city-forming

enterprises.

MMTGE 2022 - I International Conference "Methods, models, technologies for sustainable development: agroclimatic projects and carbon

neutrality", Kadyrov Chechen State University Chechen Republic, Grozny, st. Sher

314

Burko, R. A., 2013. Ecological problems of modern society

and their solutions. Young scientist. 11 (58). pp. 237-

238

Kamilova, N. A., Musinova, Z. The problem of poverty and

ways to solve it in the modern world.

Global water pollution: causes, consequences and ways to

solve the problem. https://militaryarms.ru/.

Investlab, https://invlab.ru/texnologii/zelyonye-tehnologii/.

The EU introduces a carbon tax. What is its essence and

how it works: Ecology News.

https://finance.rambler.ru/economics/46827367-es-

vvodit-uglerodnyy-nalog-v-chem-ego-sut-i-kak-on-

rabotaet-novosti-ekologii-1-15-07-2021/.

Carbon starvation: how Russia can adapt to the EU import

tax.https://trends.rbc.ru/trends/green/cmrm/617a91d89

a79477d74afe1e0.

Carbon Tax as One of the Financial Instruments to Stimulate the Green Economy

315