Assessment of Innovation Activity in the Field of Environmental

Protection in Russia and the EU Countries

B. A. Demilkhanova

Chechen State University Named After A.A. Kadyrov, Grozny, Russia

Keywords: Responsible investments, sustainable assets, environmental innovations, indicator, innovation activity,

assessment, correlation.

Abstract: The ecological component of technological innovations is the subject of the article. The purpose of the article

was to assess innovation activity in the field of environmental protection in Russia and the EU countries and

to establish a close correlation between indicators of innovation activity in production and implementation

activities and the use of financial potential for environmental innovations and a generalizing indicator

reflecting the level of activity in the implementation of environmental innovations by industrial companies.

This assessment is limited by the lack of a sufficient array of comparable statistical data in the country context

and in the context of industries. As a result of the conducted research, those countries that are characterized

by a pronounced correlation between the considered factor indicators have been identified. The level of

innovation activity in all countries is close to the average level, relative to which there is either a moderate

increase or a moderate decrease in innovation activity. A more specific assessment is possible provided that

there are comparable data from Russian and international statistics on the sources of financing environmental

innovations in various industries, special costs associated with environmental innovations and the results of

joint innovation activities in this area between countries.

1 INTRODUCTION

On a global scale, the developing modern industry

and human life have faced the same global problems

associated with the unreasonable use, exploitation

and overloading of the nature around us: the growth

of waste requiring disposal, emissions of harmful

substances into the atmosphere, immeasurable

consumption of energy and resources, and much

more. Modern challenges put forward great demands

for responsible business conduct (Alexandrov, 2020;

ESG Investment Market in Russia, www.rshb.ru/).

The urgent need for further development of society

based on reasonable production and consumption is

reflected in the global objectives for its sustainable

development, which are set in strategic documents,

programs, agreements at the international and

national levels. The whole world recognizes and

supports investment projects of states and individual

corporations aimed at obtaining, first of all, social and

environmental benefits, and gradually refuses to

invest in productions, industries or sectors of the

economy that do not comply with the norms

(standards) of responsible business. With the current

conjuncture of financial markets and the active

transformation of business models, the influence of

ESG factors will only increase (Khutorova, 2021).

Technological progress, the spread of digital

technologies, the expansion of industrial and

agricultural production cannot be regarded as positive

phenomena if they do not organically fit into the

multidimensional space of our and future societies.

Each new stage of society's progress should develop

simultaneously with the development of methods,

tools and ways of environmental protection for the

future society, ensuring environmental safety,

prevention and control of environmental pollution

(Annenskaya, 2020). Inevitably, in the current

century, technological innovations will take the

leading positions, in which there will be an

environmental component. In other words, the

development of the world economy cannot be

imagined without the introduction of environmental

protection mechanisms into production processes,

without the development and implementation (use) of

environmental innovations. Economic growth should

be balanced with environmental goals: innovation,

environment of innovation, ecological agenda and

198

Demilkhanova, B.

Assessment of Innovation Activity in the Field of Environmental Protection in Russia and the EU Countries.

DOI: 10.5220/0011568500003524

In Proceedings of the 1st International Conference on Methods, Models, Technologies for Sustainable Development (MMTGE 2022) - Agroclimatic Projects and Carbon Neutrality, pages

198-203

ISBN: 978-989-758-608-8

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

social progress should be closely intertwined and

support each other (Kondrashov, 2020; The New

Economy, www.oecd.org).

2 MAIN PART

The modern investment policy of both the state and

large financial and non-financial organizations is

characterized by a decrease in the volume of

investments in unsustainable and carbon-intensive

industries, in particular in the coal and oil and gas

industries, and an increase in investments in projects

aimed at preventing resource depletion, establishing

reasonable environmental management, eliminating

the toxicity of production by modifying harmful

industries, and much more. (Table 1). So, in 2020, the

volume of sustainable investment assets reached $35

trillion.

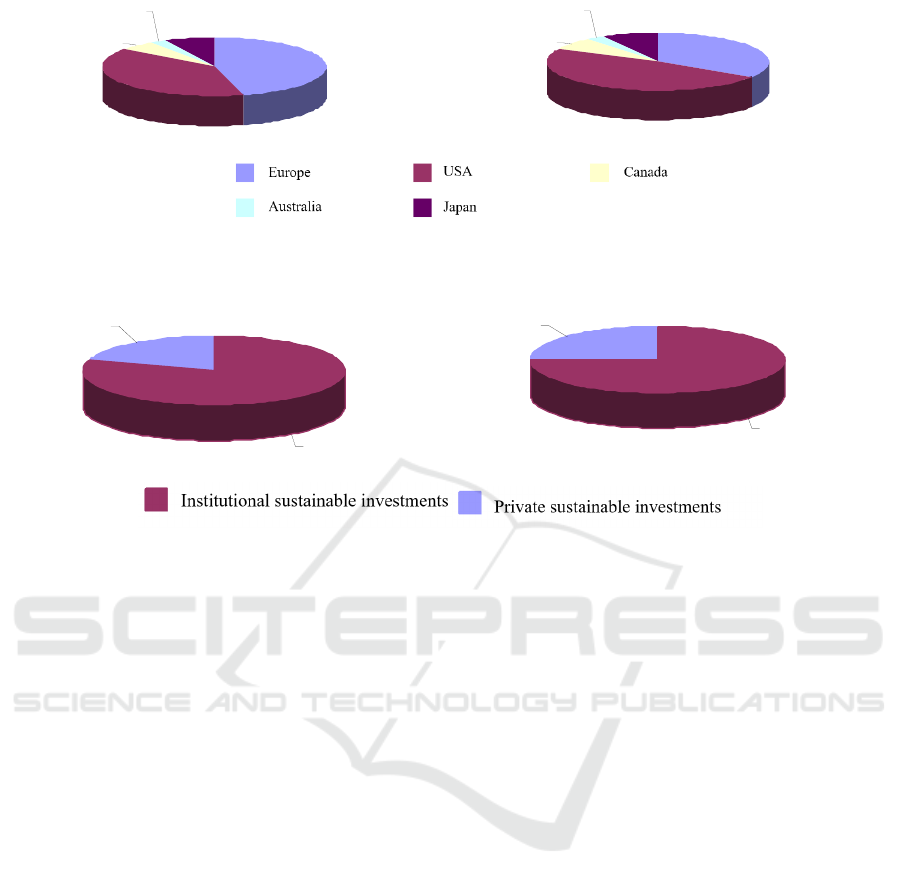

The total increase in the global volume of

sustainable investment assets amounted to USD

4.618 billion in 2018-2020. The structure of

responsible investment has changed towards a

decrease in the share of European assets from 45.9%

to 34.0%, an increase in the share of the United States

from 39.1% to 48.4% and a similar increase in the

share of Canada, Australia and Japan in the global

volume of responsible investment assets (Fig. 1, 2).

The decrease in the share of European assets by 12%

is explained by the revision of the methodology for

their assessment in 2020 in accordance with EU

legislation (Global sustainable investment review

2020, www.gsi-alliance.org/).

Private sustainable investments reached USD

13.8 trillion in 2020 (ESG Investment Market in

Russia: present and future, www.rshb.ru) and

accounted for 25% of the total global volume, 75%

accounted for assets owned by institutional investors

(Fig. 3, 4). The growth of the share of private

sustainable investments is observed on all continents:

North and South America, Western Europe, East and

Central Asia, Australia, Japan, etc.

Many studies by Russian and foreign authors have

been devoted to the interrelationships between the

factors of sustainable development and the

environmental component of technological

innovations. Based on their results, the

interrelationships between ESG issues,

environmental innovations, corporate sustainability

indicators and Sustainable Development Goals

(SDGs) have been established. In particular, it is

Table 1: Global trends in responsible investment

Organizations Measures, methods, tools, directions of ESG investments

Insurance organizations, pension funds,

private companies, major banks,

institutional investors, international

financial organizations

Investing in assets of companies with responsible business conduct;

Termination of investments in non-ecological companies (coal industry,

etc.);

reduction of the share of assets in portfolio investments that do not meet

ESG principles (reduction of the share of "brown" assets in the investment

portfolio to a certain level by the set date);

taking into account ESG factors when making investment decisions;

ESG integration: joint participation in ensuring compliance with the

business culture of companies, the introduction of technologies that

comply with the principles of responsible business conduct;

The largest banks

Creation of financial products (debt instruments, stocks, derivatives,

loans, etc.)

Refusal to lend to projects that have a negative impact on the environment

Central banks (France, the Netherlands,

etc.)

Large investments in "green" bonds, funds;

Application of financial technologies for:

1) promoting sustainable development goals and stimulating the

green finance market;

2) the exchange of reports on "green" loans between banks and

regulators;

3) facilitating investors' access to the sustainable financing market;

4) verification of data on emission reduction, verification of

greenhouse gas absorption projects, etc.;

5) ensuring disclosure of information about ESG factors in

companies' financial statements;

Assessment of Innovation Activity in the Field of Environmental Protection in Russia and the EU Countries

199

Figure 1: Structure of the global volume of sustainable

investment assets in 2018.

Figure 2: Structure of the global volume of sustainable

investment assets in 2020.

Figure 3: Structure of the global volume of sustainable

investment assets in 2016 by private and institutional

investors.

Figure 4: Structure of the global volume of sustainable

investment assets in 2018 and 2020 by private an

d

institutional investors.

concluded that an environmentally sustainable

approach to economic growth and industrial

development is provided by:

− innovations in "clean" innovations and their

spread in industries (Cheng, 2021; Stern,

2021);

− entrepreneurship at the micro level,

entrepreneurial ecosystems at the meso level

and state support for entrepreneurship at the

macro level (Shlichter, 2020; Andreas

Kuckerz, 2020);

− implementation of "green" innovations related

to a wide range of SDGs by the largest

companies (Khaled, 2021; Thijssens, 2021);

− state financing of research and development in

the field of environmental innovations, as well

as the participation of institutional investors in

financing sustainable assets through

investments in stocks and bonds of companies

that conduct responsible business (Polzin,

2021);

− by investing venture capital in environmentally

friendly companies, considered as a "... long-

term strategic tool ..." for investments in these

companies (Dong, 2021).

Meanwhile, the scientific literature does not

sufficiently cover the issues of factors that have a

direct, downright impact on the activity of industrial

companies in the implementation of environmental

innovations, which, in the framework of the article, is

understood as a created new business process (new

product) that significantly reduces the degree of

environmental pollution (air, water and land

resources, etc.).

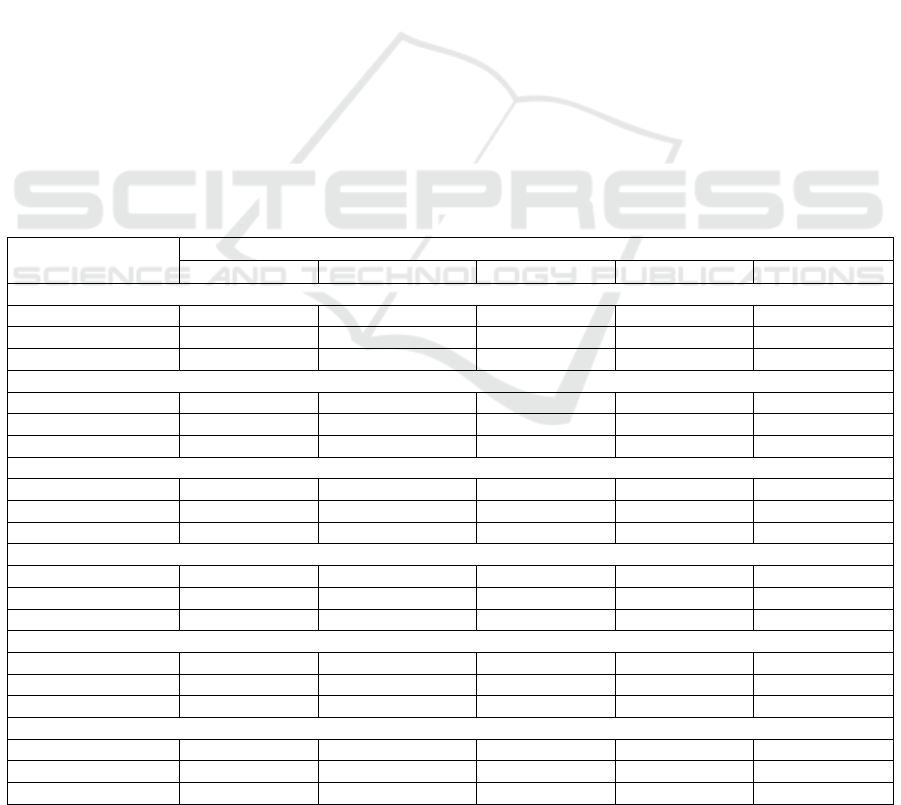

In order to study the relationship between the

indicators of innovation activity characterizing the

scale of implementation of environmental

innovations and the volume of their financing, a

representative group of EU countries has been

identified, which in recent years have a high level of

environmental expenditures in GDP (from 0.7 to

1.7% of GDP) (in Russia – 0.9% in 2020). As

indicators of innovation activity, the following

indicators are used:

1) indicators of production and

implementation activities (PIA) (Table 2):

1.1. the share of manufacturing companies

that have achieved a reduction in environmental

pollution (Manufacturing companies that have

created a new business process - MC

b-pr.

);

1.2. the share of manufacturing companies

that have created an innovative product that has

played a significant role in improving

environmental safety when used by the consumer

45,9

39,1

5,5

2,4

7,1

34

48,4

6,9

2,6

8,1

20

80

25

75

MMTGE 2022 - I International Conference "Methods, models, technologies for sustainable development: agroclimatic projects and carbon

neutrality", Kadyrov Chechen State University Chechen Republic, Grozny, st. Sher

200

(Manufacturing companies that have created the

product - MC

pr.

).

2) the indicator of the use of the financial

potential (FP) of innovation activity in the field of

improving environmental safety is the amount of

environmental protection costs.

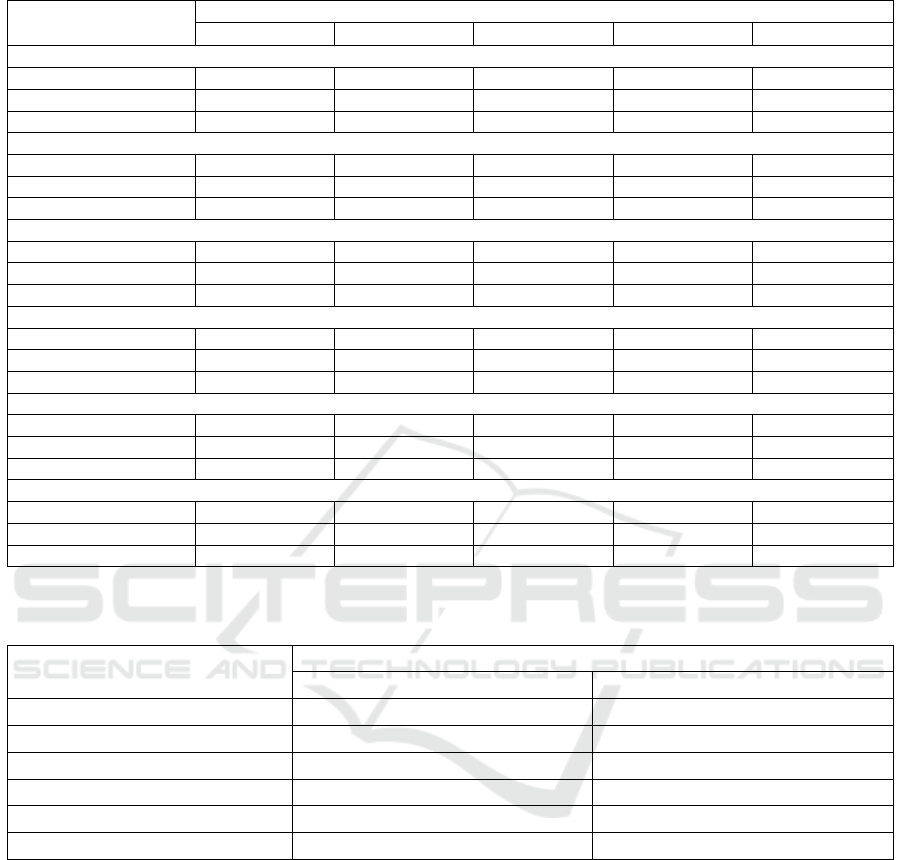

Based on the author's methodology described in

(Demilkhanova, 2013) and data from Russian and

foreign statistics (Indicators of innovation activity:

2015-2020, www.hse.ru; Eurostat, ec.europa.eu), the

level of innovation activity in the field of

environmental protection in Russia and the EU

countries is estimated (Table. 3) and the closeness of

the correlation between the indicators of innovation

activity in production and implementation activities

(InA

PIA

) and the use of financial potential for

environmental innovation (InA

FinP

) and a generalizing

indicator reflecting the level of activity in the

implementation of environmental innovations (InA

EnI

) (Table 4).

3 CONCLUSION

The production and implementation innovation

activity of industrial companies for the

implementation of environmental innovations in the

studied countries in 2019-2020 is characterized by a

moderate increase, with the exception of Russia,

where the level of innovation activity remained at

0.479, which means a moderate decrease relative to

the average level. The level of innovation activity on

the use of financial potential for the implementation

of environmental innovations is characterized by a

moderate increase in all countries relative to the

average value.

The study of the closeness of the correlation

between the level of innovation activity in production

and innovation activities, innovation activity in the

use of the financial potential of environmental

innovation and the generalizing indicator of

innovation activity in the field of environmental

protection shows that there is a pronounced

relationship between (Table 4):

− InA

PIA

and InA

EnI

(Russia, Malta and Czech

Republic);

− InA

FinP

and InA

EnI

(Bulgaria, Greece, Malta).

Table 2: Assessment of innovation activity in Russia and the EU countries on production and implementation activities in the

field of environmental protection in 2015-2020.

Years

16/15 17/16 18/17 19/18 20/19

Russia

MC

b-pr.

0.290 0.250* 0.211 0.250 0.229

MC

pr.

0.250 0.250 0.195 0.250 0.250

InA

PIA

0.540 0.500* 0.406 0.500 0.479

Bulgaria

MC

b-pr.

0.192 0.250 0.294 0.250 0.250

MC

pr.

0.250 0.250 0.229 0.250 0.250

InA

PIA

0.442 0.500 0.523 0.520 0.511

Greece

MC

b-pr.

0.305 0.250 0.269 0.250 0.250

MC

pr.

0.268 0.250 0.233 0.250 0.250

InA

PIA

0.573 0.500 0.501 0.512 0.507

Ital

y

MC

b-pr.

0.280 0.250 0.309 0.250 0.250

MC

pr.

0.301 0.250 0.214 0.250 0.250

InA

PIA

0.581 0.500 0.524 0.502 0.514

Malta

MC

b-pr.

0.284 0.250 0.263 0.250 0.250

MC

pr.

0.291 0.250 0.129 0.250 0.250

InA

PIA

0.574 0.500 0.392 0.503 0.505

Czech Republic

MC

b-pr.

0.300 0.250 0.299 0.250 0.250

MC

pr.

0.274 0.250 0.248 0.250 0.250

InA

PIA

0.573 0.500 0.546 0.514 0.509

Note: *values of 0.250 and 0.500 mean that the level of innovation activity has not changed;InA – innovative activity.

Assessment of Innovation Activity in the Field of Environmental Protection in Russia and the EU Countries

201

Table 3: Assessment of innovation activity in Russia and the EU countries to improve environmental safety in 2015-2020.

Years

16/15 17/16 18/17 19/18 20/19

Russia

InA

PIA

0.540 0.500 0.406 0.500 0.479

InA

FinP

0.590 0.505 0.537 0.531 0.564

InA

EnI

0.564 0.503 0.467 0.515 0.520

Bul

g

aria

InA

PIA

0.442 0.500 0.523 0.520 0.511

InA

FinP

0.570 0.461 0.358 0.549 0.478

InA

EnI

0.502 0.480 0.432 0.524 0.489

Greece

InA

PIA

0.573 0.500 0.501 0.512 0.507

InA

FinP

0.549 0.485 0.443 0.496 0.523

InA

EnI

0.560 0.492 0.471 0.498 0.512

Ital

y

InA

PIA

0.581 0.500 0.524 0.502 0.514

InA

FinP

0.489 0.517 0.537 0.507 0.508

InA

EnI

0.532 0.508 0.530 0.504 0.503

Malta

InA

PIA

0.574 0.500 0.392 0.503 0.505

InA

FinP

0.554 0.611 0.384 0.517 0.532

InA

EnI

0.564 0.553 0.388 0.508 0.516

Czech Republic

InA

PIA

0.573 0.500 0.546 0.500 0.500

InA

FinP

0.556 0.520 0.507 0.535 0.532

InA

EnI

0.573 0.500 0.546 0.500 0.500

Table 4: Correlation coefficients between indicators of activity in the implementation of environmental innovations in Russia

and individual EU countries for 2015-2020.

Correlation between InA

EnI

and:

InA

PIA

InA

FinP

Russia 0.9111 0.6966

Bulgaria -0.5314 0.9417

Greece 0.8913 0.9416

Italy 0.8392 0.0525

Malta 0.9354 0.9551

Czech Republic 0.9164 0.6867

Thus, the assessment of the innovation activity of

industrial enterprises in the field of environmental

protection in Russia and the EU countries shows that

its level is close to the average level, relative to which

there is either a moderate increase or a moderate

decrease in innovation activity. The number of

countries according to the degree of factor influence

on the change in innovation activity was equally

distributed:

1) Russia, Malta and the Czech Republic are

characterized by a pronounced relationship

between the processes of creation and use of

innovative technologies and a generalizing

indicator of innovation activity in the field of

environmental innovation;

2) Bulgaria, Greece, Malta are characterized by a

pronounced relationship between the volume

of financing of environmental protection

expenditures and the generalizing indicator of

innovation activity in the field of

environmental innovation.

The assessment of innovation activity in the

environmental sphere is limited by a set of

comparable statistical data in the country context and

in the context of industries. A more specific

assessment is possible provided that there are

comparable data from Russian and international

statistics on the sources of financing environmental

innovations in various industries, special costs

associated with environmental innovations, the

MMTGE 2022 - I International Conference "Methods, models, technologies for sustainable development: agroclimatic projects and carbon

neutrality", Kadyrov Chechen State University Chechen Republic, Grozny, st. Sher

202

results of joint innovation activities in this area

between countries, etc.

REFERENCES

Alexandrov, A. V., 2020. Responsible Investments (ESG)

as a business standard of the XXI century. Banking. 8.

pp. 13-17.

ESG Investment Market in Russia: present and future.

https://www.rshb.ru/download-file/472115.

Khutorova, N. A., Khutorov, A. O., 2021. Development of

socially responsible investment practice in the context

of economic security of the state. Economic analysis:

theory and practice. 10(20). pp. 1914-1932.

Annenskaya, N. E., Nazariants, A. A., 2020. Responsible

investing is a growing trend in the Russian financial

market. Digest – Finance. 4(25). pp. 462-479.

Kondrashov, O., Lapko, B., 2020. Innovation environment

in the system of economic development. Science and

innovation. 12(214). pp. 38-44.

The New Economy: Beyond the Hype. Final Report on the

OECD Growth Project. OECD.

https://www.oecd.org/economy/growth/2380634.pdf.

Global sustainable investment review 2020. Global

Sustainable Investment Alliance 2021. http://www.gsi-

alliance.org/wp-content/uploads/2021/08/GSIR-

20201.pdf.

ESG Investment Market in Russia: present and future.

https://www.rshb.ru/download-file/472115.

Cheng, M., Yang, S., Wen, Z., 2021. The effect of

technological factors on industrial energy intensity in

China: New evidence from the technological

diversification. Sustainable Production and

Consumption. 28.

Stern, N., Valero, A., 2021. Innovation, Growth and the

Transition to Zero Emissions. Policy Research. 50(9).

Shlichter, A. S., 2020. Business strategies of companies in

the context of the concept of sustainable development.

World Economy and International Relations. 4(64). pp.

37-44.

Andreas Kuckerz, A., SK Berger, E., Brendle, L., 2020.

Entrepreneurship and sustainable transformation of the

bioeconomy. Ecological innovations and social

transformations. 37. pp. 332-344.

Khaled, R., Ali, H., Mohamed, K. A., 2021. Echab.

Sustainable Development Goals and Indicators of

Corporate Sustainability: Comparison, Degree and

Determinants. Journal of Clean Production. 311.

Thijssens, T., Maas, K., 2021. The innovative contribution

of multinational enterprises to the Sustainable

Development Goals. Journal of Cleaner Production.

285.

Polzin, F., Sanders, M., Serebriakova, A., 2021. Finance in

global transition scenarios: Mapping investments by

technology into finance needs by source. Energy

Economics. 99.

Dong, W., Li, Y., Yu, C., 2021. How does venture capital

spur the innovation of environmentally friendly firms?

Evidence from China. Energy Economics. 103.

Demilkhanova, B. A., 2013. Methodology for assessing the

innovation activity of the industrial complex. Economic

analysis: theory and practice. 19(322). pp.17-26.

Indicators of innovation activity: 2015-2020: statistical

collections. State University – Higher School of

Economics. HSE. https://www.hse.ru.

Eurostat (Eurostat Science, Technology and Innovation).

http://ec.europa.eu/eurostat/portal/page/portal/statistics

/search_database.

Assessment of Innovation Activity in the Field of Environmental Protection in Russia and the EU Countries

203