Current Issues of Transboundary Carbon Regulation

Ruslan Batashev

and Amir Bisultanov

Kadyrov Chechen State University, Grozny, Russia

Keywords: Climate policy, cross-border carbon tax, greenhouse gas emissions, carbon leakage, European Union, Russian

Federation, consequences, adaptation possibilities.

Abstract: The transformational changes in the economic system that are currently taking place around the world are

accompanied by a paradigm of the speed of consumption associated with the desire for an increase in the

dynamics of consumption of carbon intensity bringing together in the distant climate ambitions of various

countries the scope and mechanisms for the development of transboundary carbon regulation. This approach

is currently being adopted by the countries of the European Union. In this regard, there is a persecution of

mechanisms for cross-border regulation of carbon impact in the adaptation countries included in the action

(countries importing energy-intensive products to the EU). The relevance of the study for the Russian

Federation is beyond doubt. Thus, the purpose of this article is to study the features of transboundary

regulation of carbon emissions and the prospects for the development of domestic climate policy, taking into

account the peculiarities of international cooperation in a standard issue.

1 INTRODUCTION

Climate regulation in one form or another is

becoming an integral element of the transformational

changes that are normal in the economies of many

countries. This is the International Institute for the

Control of Gas Emissions, which involves the

application of a mechanism for cross-border carbon

adjustment in relation to products that use

technologies with a high carbon footprint. One such

tool is the cross-border carbon tax. The carbon tax is

a project of cross-border carbon corrective regulation,

intended and expected to be implemented in the

territory of application in producing countries, which

include imports to countries. From the point of view

of economic theory, consideration of cross-border

fundraising in the understanding of countries,

investing large amounts of financial resources in

"green programs", intensifying competition between

producers of products that pay a carbon tax, and

producers that are not taken into account in their

countries by carbon regulation (Christians, 2022).

Therefore, a cross-border carbon tax reduces the

reduction in global carbon emissions. The mechanism

of customs carbon adjustment in countries with a low

carbon cap standard and untapped modern

technologies for capturing and cleaning polluting

emissions will be applied by 2023. Currently, the

mechanism and format of its application are not

applied and are not repeated and are used in the mode

of ongoing improvements (Cheng, 2021;

Dorsey-

Palmateer

, 2020).

Thus, the purpose of this article is to study the

features of transboundary carbon regulation and

determine promising directions for the development

of domestic climate policy, taking into account the

peculiarities of international cooperation in this

matter.

2 MATERIALS AND METHODS

The research methodology is found on the basis of the

analysis of statistical data reflecting the directions and

specifics of the possible impact of the transboundary

carbon measurement in the EU within the framework

of the expected change in the frequency of the

Russian Federation and transformational processes in

the assessment in the measurements of the climate

measurement. Information base of the study of the

data registry of Rosstat, the Federal Customs Service

of Russia, coverage of the commission, monitoring

reports and studies of the group on climate regulation

and energy efficiency of the economies of countries.

The scientific observations of domestic researchers

devoted to the analysis and assessment of the impact

Batashev, R. and Bisultanov, A.

Current Issues of Transboundary Carbon Regulation.

DOI: 10.5220/0011568100003524

In Proceedings of the 1st International Conference on Methods, Models, Technologies for Sustainable Development (MMTGE 2022) - Agroclimatic Projects and Carbon Neutrality, pages

177-182

ISBN: 978-989-758-608-8

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

177

of the transboundary carbon tax formed the basis for

the formation of the author's idea of the existing

approaches to carbon transboundary regulation and

strategic directions for the development of domestic

climate policy and integration into international anti-

carbon mechanisms.

3 RESULTS

Issues of cross-border carbon tax regulation have

recently received close attention in the academic

literature. The increased interest of domestic

researchers is explained by the fact that this issue is

extremely important for Russian exporting

manufacturers, which account for a significant part of

European imports. Also, scientific concern is

manifested against the background of the prospects

for the introduction of carbon tax regulation within

the Russian Federation.

A significant layer of scientific research is related

to the study of the consequences of the introduction

of carbon regulation mechanisms on the development

of industry in Russia. So, in the study of M.M.

Balashov (Balashov, 2020) notes that the introduction

of a cross-border tax carries significant risks for the

manufacturing industry in Russia, predicting that

such areas as petrochemistry, metallurgy and

fertilizer production will suffer the most. At the same

time, it is noted that the European policy of carbon

adjustment will have much more serious

consequences for the Russian economy, affecting not

only carbon-intensive and electricity-intensive

industries, but will also affect all other sectors of the

country, leading to a rise in the cost of producing

carbon-intensive export products (Kuzminykh,

2022). The author rightly, in our opinion, notes that

the main economic "subtext" of the cross-border

carbon tax on imported into the EU is to ensure the

competitiveness of producers of European products

with a carbon footprint, which has lost its price

advantage. Particularly relevant is the problem of

protecting European producers against the backdrop

of aggravated international relations and trade wars,

which have now led to an increase in the cost of

products, the raw material base of which is resources

exported from the territory of the Russian Federation.

Analyzing the main theses set out in (Balashov,

2020), there is no doubt that the mechanism of cross-

border tax regulation of the carbon consequences of

production activities is becoming an economic

instrument of political pressure on trade partners of

the EU countries by imposing on them a similar

model of carbon regulation. As a result, Russian

export-oriented producers with this approach will

lose their price advantages, which are available,

among other things, due to the resource base on which

production is based.

The European "carbon" policy is at odds with the

"Strategy for the development of the manufacturing

industry of the Russian Federation until 2024 and for

the period until 2035" adopted in Russia in 2020.

According to this strategy, the economic policy of the

Russian Federation will be aimed at creating high-

performance export-oriented sectors in the

manufacturing industry, developing on the basis of

modern technologies and provided with qualified

personnel. At the same time, the transformation of

export-oriented areas is the second stage in the

development of the manufacturing industry based on

the development of the domestic market and domestic

technologies. Thus, sharing the views of the author

(Balashov, 2020) regarding the threat to the economic

security of the country, we note that it is necessary to

take preventive measures, taking into account the

prospect of introducing hydrocarbon regulation in the

EU countries and reflect them in the Strategy, which

will allow us to adapt to changing economic and

geopolitical conditions and ensure the leadership of

the Russian Federation in energy intensive industries.

Some researchers agree that the GBAM

mechanism (transboundary carbon collection

mechanism) will become a catalyst for the

development of ESG regulation in the Russian

Federation (Anankina, 2021). The ratification of the

2019 Paris Agreement has intensified the

development of ESG principles for regulating the

production activities of carbon-intensive industries in

Russia. Thus, a draft low-carbon development

strategy has been prepared. The mechanism for

introducing carbon payments within the country is

under discussion, the Central Bank has given market

participants recommendations on carbon regulation,

on accounting for climate risks in the insurance

sector. This process is considered by the author as one

of the effective tools to stimulate investment in low-

carbon technologies. This will increase the efficiency

of production in the country and prepare domestic

enterprises for sustainable production processes.

In addition, a number of positive effects

(opportunities) are highlighted from the introduction

of a cross-border carbon tax for Russian companies

with flexible development strategies. First of all, we

are talking about the development of renewable

energy in Russia. In an environment where the cost of

carbon emissions will have a significant impact on the

cost of production, renewable energy sources will

acquire additional economic attractiveness for

MMTGE 2022 - I International Conference "Methods, models, technologies for sustainable development: agroclimatic projects and carbon

neutrality", Kadyrov Chechen State University Chechen Republic, Grozny, st. Sher

178

industrial consumers. The carbon tax can become an

additional incentive for the development of

technologies for capturing, storing and utilizing

carbon dioxide in the Russian Federation. The timely

introduction of ESG regulation in Russia will allow

us to occupy niches in the markets of consumers

focused on hydrocarbon emissions in the supply

chains.

The lack of a flexible strategy for carbon

regulation can have an extremely negative impact on

the availability of financial resources and the

investment attractiveness of Russian industrial

enterprises. Similar risks are predicted in the works of

E.A. Motosova, I.M. Potravny (Motosova, 2014), E.

Anankina (Anankina, 2021). Despite the fact that the

ratified Kyoto Protocol (2004) did not bring the

Russian Federation the predicted political integration

into the mechanism of international environmental

regulation, a number of authors agree that the refusal

to accept obligations under subsequent international

climate agreements will lead to the fact that for

Russian carbon-intensive industrial enterprises will

face serious risks in a number of industries, primarily

due to limited access to promising sources of

financing for the reconstruction and modernization of

production facilities and advanced production

technologies that meet the principles of ESG

regulation (Main indicators of environmental

protection, https://rosstat.gov.ru/). The degree of

financial risk due to ESG factors is characterized by

the fact that currently domestic companies are less

subject to pressure within the concept of carbon

regulation than others. This is largely explained by

the fact that they have more differentiated sources of

cheap investment. We have to agree with the author

(Anankina, 2021) that it is not very likely that Russian

carbon-intensive industries can avoid investor

pressure to require companies to participate in carbon

regulation and reporting.

Currently, the development of international

relations with counterparties and investors interested

in ESG transformation has an impact on the

transformation of the development strategies of some

Russian banking structures. Thus, Sberbank

announced its readiness to finance the agro-industrial

complex through concessional lending to enterprises

that invest in low-carbon technologies. It should be

noted that today Sberbank is one of the largest

creditors of the domestic economy, which accounts

for up to 33.9% of loans issued to legal entities. At

the same time, the bank itself has developed an ESG

transformation strategy at Sberbank, within which

work has begun to develop practices for managing

climate risks and opportunities (Impact assessment

report, 2021).

Assessing the prospects and consequences of the

introduction of a cross-border tax for the Russian

Federation, the author (Grishchenko, 2021) cites a

hypothesis according to which the introduction of a

mechanism for a cross-border carbon tax will become

a serious factor that in the future will have an impact

on the economic stability of the Russian Federation.

The author's key arguments in favor of this hypothesis

are that the European Union is one of Russia's key

partners. According to Eurostat in 2021. in the

structure of foreign trade of the Russian Federation,

the EU accounted for 36% of external trade. The

share of Russian exports to EU countries was 38.3%

(Eurostat, https://ec.europa.eu). According to

Grishchenko Yu.Yu. The Russian Federation, in the

context of the transformation of international trade

under the influence of ESG principles, needs to act

preventively on an integrated basis. In particular, it is

necessary to provide for the mandatory inclusion in

the reporting of organizations of information on

greenhouse gas emissions produced on the basis of

approved emission measurement standards.

Sustainable economic development should be

ensured through the diversification of export

products. Fuel and energy products traditionally

remain predominant in the structure of Russian

exports (54.3% in 2021). Metallurgical and chemical

products also occupy a significant share in Russian

exports (18.1% in 2021). Considering that a

significant part falls on European markets, there is a

threat of losing key markets.

A number of authors (Medvedev, 2021) in their

studies, when assessing the consequences for the

Russian Federation of the introduction of the EU

carbon tax regulation, focus on the analysis of the

future competitiveness of the sectors of the economy

that will be the object of carbon regulation. In

particular, the authors predict that industries such as

the glass industry, fertilizer production, pulp and

paper, metallurgy, and the chemical industry will

suffer the most. The technological backwardness of

domestic steel companies, which leads to an increase

in the carbon intensity of this industry, reduces the

competitiveness in front of producing countries

whose steel industry is much more efficient in terms

of carbon emissions concentration (India, Turkey, EU

countries). The countries of the European Union will

clearly benefit from carbon tax regulation, as they

have already reduced the concentration of carbon

emissions by investing more resources in

environmentally efficient production. “Thus, the EU

border tax could transform the market for high

Current Issues of Transboundary Carbon Regulation

179

footprint producers in favor of European or low

footprint companies.”

According to the authors, the regulation of the

negative consequences of the introduction of the

carbon tax is possible through the development of

measures of the main nature, including: low-carbon

development of the Russian economy through

environmentally friendly and energy-efficient

technologies; development and legislative

consolidation of methodological approaches to

measuring the absorption capacity of Russian

ecosystems and forests in order to offset when paying

the EU transboundary carbon tax; domestic carbon

market and development of mechanisms for its

regulation. The importance of developing a

methodological framework for determining the

volume of greenhouse gas absorption by domestic

ecosystems is also noted in the study by the authors

Bobylev P., Semeykin A. (Bobylev, 2020), who

consider the introduction of a transboundary carbon

tax as an exclusively instrument of EU protectionism.

The authors rightly note that cross-border regulation

is aimed not only at reducing greenhouse gas

emissions, but also at reducing the EU's import

dependence on energy resources from other countries.

For example, the stability of the European auto

industry and the construction sector depends on the

supply of Russian steel, iron and non-ferrous metals.

At present, Russian steel exports to the EU account

for 10-15%.

Analyzing the status, risks and possible options

for Russia's response to the introduction of a border

corrective carbon mechanism, representatives of the

Institute of Europe of the Russian Academy of

Sciences (Bazhan, 2020) describe the subject of

discussion of this article as a dubious initiative from

a legal point of view, which carries clear risks for

domestic exporters. At the same time, the authors of

the study point out the specific features of the EU

approach in matters of methodology for the

implementation of cross-border tax regulation. In

particular, the closed nature of the adoption of key

decisions on the mechanism of cross-border

regulation, the low level of development of the

initiative, the short time for obtaining the opinion of

interested parties, etc.

A decade ago, Russia ranked fifth in the world in

terms of emissions (Energy efficient Russia, 2009).

Research conducted in 2021 by the Carbon Brief

organization in the field of global climate regulation

suggests that the Russian Federation has moved to

third place after the United States and China in the

ranking of the world's main environmental polluters.

Volumes of greenhouse gas emissions of the

Russian Federation for the time interval 2010-2019

changed significantly (-22.8%), and the annual

dynamics is characterized by an oscillatory

increase/decrease in greenhouse gas emissions. If we

compare the current state of carbon intensity in

Russia, compared with 1990, the volume of

greenhouse gas emissions into the atmosphere has

decreased by one and a half times.

The statistics of greenhouse gas emissions by

sectors of the Russian economy has the following

structure (Figure 2).

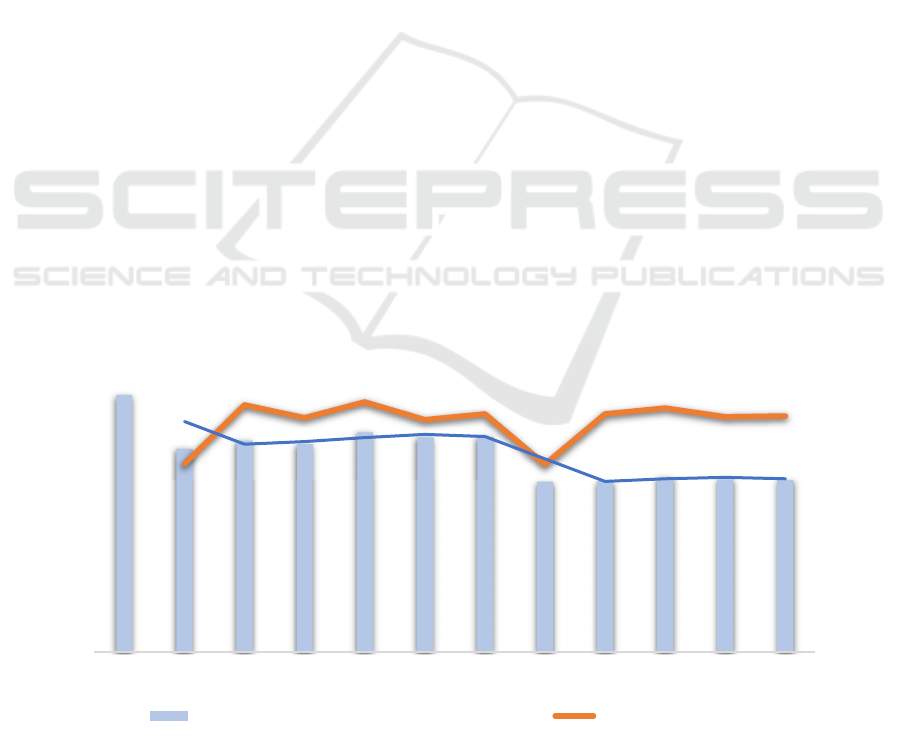

Figure 1: Volumes and dynamics of greenhouse gas emissions in Russia.

3159

2502

2602

2565

2701

2643

2649

2094

2098

2155

2134

2119

79

104

99

105

98

100

79

100

103

99

99

0

20

40

60

80

100

120

0

500

1000

1500

2000

2500

3000

3500

1990 2005 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

million tons of CO2 equivalent per year Growth/decline rate

MMTGE 2022 - I International Conference "Methods, models, technologies for sustainable development: agroclimatic projects and carbon

neutrality", Kadyrov Chechen State University Chechen Republic, Grozny, st. Sher

180

Figure 2: Structure of greenhouse gas emissions by sectors of the economy.

4 DISCUSSION

The policy of climate regulation in the Russian

Federation has a rich chronology, connected both

with the solution of this issue within the country and

in the process of integration into the international

climate agenda. One of the latest key decisions in the

field of carbon regulation in Russia is the issuance of

Decree of the Presidents of the Russian Federation of

2020 “On reducing greenhouse gas emissions” No.

666. The Decree contains a target for reducing

greenhouse gas emissions by 2030 to 70%.

Thus, the development of Russia's domestic

climate policy in this area goes hand in hand with the

strengthening of international cooperation in the

implementation of climate conservation policy,

which necessitates the development of a

multidirectional strategy to reduce the carbon

intensity of domestic products.

In our opinion, when integrating the Russian

Federation into international programs and

mechanisms of transboundary carbon regulation, it is

necessary to pay attention to the following key points:

− the possibility of creating and developing

domestic carbon markets in order to ensure the

receipt of carbon fees in the country's budget

system, which will make it possible to

subsequently compensate domestic producers

for payments made through various

government programs (subsidizing the

industry, concessional lending, tax preferences

(the most preferable, in our opinion, option,

etc.);

− assessment of the correctness of the proposed

mechanism of transboundary regulation in

terms of compliance with a “clean” climate

policy. In the context of the aggravation of

international economic relations, such

mechanisms of transboundary carbon

regulation should be approached critically,

evaluating them, first of all, as possible

instruments of trade restrictions and unfair

cross-country competition. The recognition of

the presence of an element of economic and

trade barriers in the idea of a transboundary

carbon tax, in our opinion, is quite justified, at

least for one fact: many European countries do

not have a raw material base for the production

of metallurgy, chemical industry, mineral

fertilizers (strategically important in

agriculture) . The European approach should be

carefully assessed when justifying the need for

a cross-border tax as a tool to combat the

phenomenon of "carbon leakage". According

to the European initiators, the "leakage of

carbon" occurs against the backdrop of a

tightening of the European program to combat

harmful emissions, which, however, is refuted

in authoritative studies by domestic scientists.

Thus, representatives of the Russian Academy

of Sciences (Bazhan, 2020) believe that the

"carbon leak" is not confirmed by sufficient

facts, justifying their position, for example, as

50%

55%

60%

65%

70%

75%

80%

85%

90%

95%

100%

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

Energy industrial production Agriculture Waste

Current Issues of Transboundary Carbon Regulation

181

follows: the relocation of energy-intensive

industries ended 10-20 years ago; the

movement of industrial enterprises in energy-

intensive industries is caused, first of all, by the

availability of cheap labor in some countries;

The restructuring of the EU economy is already

largely complete, and the carbon-intensive

products consumed in the EU are mostly

imported.

− the possibility of taking into account the

absorbing potential of Russian ecosystems

when paying a transboundary carbon tax. The

state of the carbon balance is characterized by

the fact that in Russia the emission of harmful

substances significantly exceeds their

absorption by ecosystems. The level of

absorption of harmful substances in the

Russian Federation at present (the latest up-to-

date data from Rosstat) is estimated at 534.8

million tons of CO2 equivalent per year. Thus,

Russian forest ecosystems provide

compensation for up to a quarter (25.2% in

2019) of anthropogenic emissions. "However,

the absence in Russia - unlike the leading

countries of the world - of a reliable, time-

tested forest inventory system is a significant

factor hindering the development of sustainable

use of forest resources and ensuring a full

accounting of greenhouse gas absorption by

forests" (Bazhan, 2020).

5 CONCLUSION

In conclusion, we note that the need to ensure

sustainable economic development of the Russian

Federation, the main one of which is currently the raw

material base, against the background of Russia's

significant contribution to greenhouse gas emissions,

requires a balanced approach when making decisions

in the field of international climate cooperation.

REFERENCES

Anankina, E., 2021. Carbon tax - a tangible, but not the

main risk for Russian energy companies. Energy

Policy. 5.

Bazhan, A. I., Roginko, S. A., 2020. EU Border Adjustment

Carbon Mechanism: Status, Risks and Possible

Response. Series “Analytical Notes of the Institute of

Europe of the Russian Academy of Sciences. 4.

Balashov, M. M., 2020. Influence of carbon regulation

mechanisms on the development of industry in the

Russian Federation. Strategic decisions and risk

management. 11(4). pp. 354–365.

Bobylev, P., Semeikin, A., 2020. “Green” protectionism of

Europe. Energy policy. 10.

Cheng, Haitao, Ishikawa, Jota, 2021. Carbon Tax and

Border Tax Adjustments with Technology and

Location Choices. RIETI Discussion Paper Series 21-

E-030.

Christians, A., 2022. Policy Forum: Cross-Border and

Multijurisdictional Issues in Carbon Taxation—

Carbon Pricing and the Income Tax - Canadian Tax

Journal. Revue fiscale Canadienne. papers.ssrn.com.

Energy efficient Russia. Ways to reduce energy intensity

and greenhouse gas emissions. McKinsey &

Company. 2009.

Eurostat. Statistical Office of the European Union.

https://ec.europa.eu/eurostat/web/main/about/who-

we-are.

Grishchenko, Yu. O., 2021. Introduction of a cross-border

carbon tax on imports to the EU countries: prospects

and consequences for the Russian Federation. Actual

problems of tax policy. Collection of articles of the

XIII International Scientific and Practical Conference

of Young Tax Experts. Moscow.

Cheng, Haitao, Ishikawa, Jota, 2021. Carbon tax, cross-

border carbon leakage, and border tax adjustments.

https://voxeu.org/article/carbon-tax-cross-border-

carbon-leakage-and-border-tax-adjustments.

Impact assessment report. Proposal for a regulation of the

European Parliament and of the Council to develop a

mechanism for adjusting carbon frontiers. Brussels,

14.7.2021.

Kuzminykh, Yu. V., Naumova, E. A., 2022. Estimation of

financial losses of Russian exporters of carbon-

intensive products: regional aspect. Bulletin of the

Udmurt university. 32(1).

Main indicators of environmental protection. Official

website of the Federal Statistics Service of the

Russian Federation.

https://rosstat.gov.ru/compendium/document/13294.

Motosova, E. A., Potravny, I. M., 2014. Pros and cons of

introducing a carbon tax: foreign experience and

Russia's position on the Kyoto Protocol. All-Russian

Economic Journal ECO. 7.

Medvedev, O. E., Solovieva, S. V., Stetsenko, A. V., 2021.

World climate agenda: economic challenges for

Russia from the introduction of the EU carbon tax.

Economics and management of the national economy.

2.

Dorsey-Palmateer, R., Niu, B., 2020. The effect of carbon

taxation on cross-border competition and energy

efficiency investments. Energy Economics, Elsevier.

Vaganov, E. A., Porfirev, B. N., Shirov, A. A., Kolpakov,

A. Yu., Pyzhev, A. I., 2021. Assessment of the

contribution of Russian forests to reducing the risks of

climate change. 17(4). pp. 1096-1109.

MMTGE 2022 - I International Conference "Methods, models, technologies for sustainable development: agroclimatic projects and carbon

neutrality", Kadyrov Chechen State University Chechen Republic, Grozny, st. Sher

182