Fiscal Decentralization and Public Services: Deli Serdang Regency

Government Education Sector Expenditure

Mohammad Ridwan Rangkuti, Marlon Sihombing, Heri Kusmanto and Hatta Ridho

Universitas Sumatera Utara, Indonesia

Keywords: Fiscal Decentralization, Public Services, Education Expenditure, Education Personnel, School Buildings,

Pure Enrolment Rate

Abstract: This research was conducted in Deli Serdang Regency, with the aim of obtaining an overview of the problems

in the Fiscal Decentralization Policy and Public Services in the Education Sector. How is the Education

Service in Deli Serdang Regency? Are Education Services related to Deli Serdang Regency Government

Education Expenditures? The research paradigm used is the Constructivist Paradigm, with Qualitative

Research Methods. Data were collected through in-depth interviews, discussions with several district

informants, DPRD, sub-district, schools (SD, SMP), and community leaders. In addition, data were also

collected through literature study, document study, and secondary data. The results of this study can be

concluded, as follows: First, that Public Perception of Services in the Education Sector in Deli Serdang

Regency is still bad; Second, mandatory spending on education spending is still focused on education

personnel (teachers), not much for infrastructure spending (physical/building), as well as for increasing the

NER (pure participation rate). Based on Bartley and McLoughlin (2015), "Political incentives to provide

increase where services offer..." "High visibility: outputs are physically visible or problem has high public

profile." physically visible to the public. For the Government, measurable output will facilitate control and

encourage greater spending allocations. Physical school buildings (SD, SMP) in the Regency are a service

sector with measurable output (measured), and easy to see by the community (high visibility). In addition, the

development of education infrastructure (SD, SMP) is still a concern of the Government, so that it will

encourage an increase in the allocation of spending on education infrastructure.

1 INTRODUCTION

This study aims to determine the public's perception

of public services in the Education Sector of Deli

Serdang Regency Government; as well as the linkage

of problems in the Public Service in the Education

Sector of the Deli Serdang Regency Government with

the Education Sector Expenditure of the Deli Serdang

Regency Government. As well as, community

participation in the Education Sector in Deli Serdang

Regency.

The emergence of a sense of regional

dissatisfaction due to the strong control of the State

(Central) over the management of SDA (Natural

Resources) in the Region, as well as the insensitivity

of the Center to the existence of development gaps

between regions (Java-Outer Java), has encouraged

the emergence of a strong desire from the Regions for

distribution power/authority between the Center and

the Regions. Various proposals for Fiscal

Decentralization have actually been made since the

early 1970s. However, the main elements of Fiscal

Decentralization were never realized (Delay, et.al,

1995; Devas, 1997; Rohdehwold, 1995).

The dissatisfaction felt by this region, then

peaked, triggered by the economic crisis and political

upheaval that occurred from mid-1997 to early 1998.

The economic crisis was marked by the weakening of

the Rupiah exchange rate against the US dollar,

followed by soaring inflation rates (77 ,63%) in 1998.

There was an increase of 66.53% from the previous

years. As a result, there was a political crisis during

the Soeharto era. Demonstrations took place

everywhere. The community was dissatisfied with the

current situation at that time. The political situation

got worse when the Government made a number of

policies which were deemed illogical and not in favor

of the people. For example, the reduction of fuel

subsidies. Meanwhile, violence occurred on a broad

Rangkuti, M., Sihombing, M., Kusmanto, H. and Ridho, H.

Fiscal Decentralization and Public Services: Deli Serdang Regency Government Education Sector Expenditure.

DOI: 10.5220/0011564700003460

In Proceedings of the 4th International Conference on Social and Political Development (ICOSOP 2022) - Human Security and Agile Government, pages 219-232

ISBN: 978-989-758-618-7; ISSN: 2975-8300

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

219

and massive scale. Violence is caused by a feeling of

injustice in society.

The economic crisis and political upheaval that

occurred at that time forced Suharto to resign as

President of the Republic of Indonesia. Since then,

there has been a change from the Suharto

government, which was known to be authoritarian

and centralized, to a democratic and decentralized

Reform Government. Indonesia is undergoing a phase

of fundamental change in political life and

governance.

One of the changes that occur is the

implementation of Regional Government and the

political system. There has been a change in the

pattern of relations between the Central Government

and Regional Governments. This change is known as

Regional Autonomy. The government responded to

the growing demands for Regional Autonomy

(Decentralization) by quickly discussing and

approving 2 (two) laws (UU) in April 1999 and

setting January 1, 2001 as the start of the

implementation of Regional Autonomy

(Decentralization).

The implementation of Regional Autonomy and

Fiscal Decentralization which came into effect on

January 1, 2001 has implications for the delegation of

authority/affairs between the Center and the Regions

in various fields. This delegation of authority is

regulated in Law No. 22/1999 on Regional

Government; and Law Number 25 of 1999

concerning Financial Balance between the Central

and Regional Governments. This Law in its

subsequent development underwent changes, with the

issuance of Law Number 32 of 2004 concerning

Regional Government, and Law Number 33 of 2004

concerning Financial Balance between Central and

Regional Governments.

Decentralization according to Law Number 33 of

2004 is the transfer of government authority by the

Government to an Autonomous Region to regulate

and administer government affairs within the system

of the Unitary State of the Republic of Indonesia. In

Law Number 33 of 2004 it is stated that the

establishment of the Law on Fiscal Balance between

the Central Government and Regional Governments

is intended to support funding for the transfer of

affairs to the Regional Government as regulated in the

Law on Regional Government.

Based on Law Number 33 of 2004, the Balancing

Fund consists of the Revenue Sharing Fund (DBH),

the General Allocation Fund (DAU), and the Special

Allocation Fund (DAK). The provision of Balancing

Funds is intended to reduce the vertical fiscal

disparity between the Central Government and

Regional Governments, and also to assist the Regions

in financing their authority.

These two laws are known as the Regional

Autonomy Law. The two laws are the legal basis for

the implementation of Fiscal Decentralization in

Indonesia. Law Number 32 of 2004 has the core of

the division of authority and functions (power

sharing) between the Central and Regional

Governments. Meanwhile, Law Number 33 of 2004

regulates the distribution of financial resources

(financial sharing) between the Center and the

Regions designed using the principle of money

following the authority (money follow function). This

means that the transfer of regional authority is also

accompanied by the transfer of financing sources

previously held by the central government (Mahi et

al, 2001).

Financing/Funding adheres to the principle of

money follows function, which also means that

financing follows the functions of government which

are the obligations and responsibilities of each level

of government.

With the enactment of Law Number 32 of 2004,

there will be an expansion of the authority of the

Regional Government. Meanwhile, Law Number 33

of 2004 will create an increase in regional financial

capacity. Therefore, Regional Autonomy is expected

to be a bridge for Regional Governments to

encourage economic efficiency, efficiency of public

services so as to encourage regional economic

growth, as well as improve the welfare of local

residents through various multiplier effects of

decentralization which are expected to be realized

(Khusaini in Ladjin, 2008).

The main objective of Fiscal Decentralization is

to improve public services. Dillinger (1994) in

Hirawan (2007), that the implementation of

Decentralization in various parts of the world found

that the trigger for this policy was the desire or effort

to obtain better public services.

The policy of decentralizing revenues and

expenditures is part of a way to increase public sector

efficiency, reduce budget deficits, and increase

economic growth (Bird, 1993; Bird and Wallich,

1993; Bahl and Linn, 1992; Gramlich, 1993; and

Oates, 1993 in Zhang). and Zou, 1998).

According to Law Number 33 of 2004, that the

sources of financing for the implementation of

Regional Government consist of Regional Original

Income (PAD), Balancing Funds, Regional Loans,

and Other Legitimate Income. Regional Original

Income (PAD) is Regional Revenue sourced from

Regional Taxes, Regional Levies, results of separated

regional wealth management, and other legitimate

ICOSOP 2022 - International Conference on Social and Political Development 4

220

Regional Original Income, which aims to provide

flexibility to the Regions in digging for funding in the

implementation of autonomy. regions as an

embodiment of the principle of Decentralization.

To follow up on the authority of the regions in

increasing PAD, Law Number 28 of 2009 concerning

Regional Taxes and Levies was issued. Law Number

28 of 2009 regulates the authority of the Regional

Government to collect local people in order to obtain

funding sources for Regional Development.

The Balancing Fund is a regional funding sourced

from the APBN which consists of the Revenue

Sharing Fund (DBH), the General Allocation Fund

(DAU), and the Special Allocation Fund (DAK).

DAU is a fund sourced from the APBN which aims

to equalize financial capacity between regions, which

is intended to reduce inequality in financial capacity

between regions through the application of a formula

that takes into account the needs and potential of the

regions.

Based on Law No. 33 of 2004, the DAU needs of

a region (province, district, city) are determined using

the fiscal gap concept approach and basic allocation.

The fiscal gap is calculated based on the fiscal need

minus the regional fiscal capacity. In other words, the

DAU is used to close the fiscal gap that occurs due to

regional needs that exceed the potential revenue of

the region concerned. Usually, the distribution of

DAU for regions with relatively large capacity will be

smaller, on the other hand, regions with relatively

small capacity will receive relatively large DAU. For

the concept of basic allocation, DAU is calculated

based on the number of Civil Servants (PNS) in the

Region.

To reduce inequality in financing needs and tax

control between the Center and the Regions, DAU is

given to regions at least 26% of net domestic revenues

(Ndadari and Adi, 2008).

The Balancing Fund, apart from being intended to

assist the Regions in funding their authority, also aims

to reduce the gap in the sources of Government

funding between the Center and the Regions, as well

as to reduce the funding gap of Inter-Regional

Government funding. These three components of the

Balancing Fund constitute a system of transfer of

funds from the Government and form a unified whole.

The transfer policy of the Central Government to

the Regional Government has actually been going on

since the New Order era. The amount of transfers

from the Central Government to Regional

Governments during the New Order was carried out

in 3 (three) forms, namely: (1) Autonomous Regional

Subsidies (SDO); (2) Presidential Instruction

Assistance; and (3) Project Contents List (DIP). The

Autonomous Region Subsidy (SDO) is intended to

support the routine budget of the Regional

Government to help create a financial balance

between levels of government. About 95% is used to

finance the salaries of government employees in the

regions. Others are used for other purposes, namely

subsidies for routine expenditures in the field of basic

education, remuneration for rural employees,

subsidies for the operation of hospitals in the regions,

and subsidies for financing the training of

government employees. SDO is categorized in the

Central Transfer which is specific (specific grant),

because the Regions do not have the authority to

determine the use of SDO. The purpose of this

transfer has been determined by the Central

Government. Since the 1999/2000 fiscal year, in

order to clarify the budgets managed by the Central

and Regional Governments, the term Regional

Routine Fund (DRD) has been used as a substitute

name for SDO. All components and mechanisms in

SDO are the same as those in DRD.

Inpres assistance is intended to provide regional

development assistance, both general and specific in

nature, which is given by Presidential Instruction. The

purpose of the Presidential Instruction is to achieve

equity, especially in terms of employment

opportunities, business opportunities, and

participation in development. The basis for providing

assistance is the handing over of some affairs to the

regions and the limited financial capacity of the

Regional Government to finance these affairs. For the

1999/2000 fiscal year, the budget managed by the

regions was known as the Regional Development

Fund (DPD) as a substitute for Presidential

Instruction Assistance. Meanwhile, the Project List

(DIP) is classified into in-kind allocation. Although

the funds flow to the regions, they are not included in

the regional government budget. Meanwhile,

subsidies (SDO) and assistance (Inpres) can be

categorized as intergovernmental grants because they

are part of the Regional Government Budget.

The central and regional financial balance policy

is a derivative of the Regional Autonomy policy as

the delegation of part of the government's authority

from the center to the regions. The more authority

delegated, the greater the costs required by the

Region. Therefore, in the management of

decentralization, the principle of efficiency becomes

a provision that must be implemented. Budgets for the

implementation of government tasks or public

services must be managed efficiently, but produce

maximum output. Another important thing that must

be understood is that Fiscal Decentralization in

Indonesia is Fiscal Decentralization on the

Fiscal Decentralization and Public Services: Deli Serdang Regency Government Education Sector Expenditure

221

expenditure side which is funded mainly through

transfers to the Regions (Rochjadi 2006, in Badrudin

2012).

The implementation of Fiscal Decentralization in

Indonesia since 2001 has been marked by the process

of transferring financial resources in the form of

transfers to Regional Governments and in a fairly

large total amount to the Regions.

Balancing Funds (DBH, DAU, and DAK) are

provided by the Center in the form of transfers to

Regional Governments. DBH and DAU are classified

as unconditional transfers. Meanwhile, DAK is

classified in the form of conditional transfers

(Azwardi, 2007 in Ndadari and Adi, 2008).

Since the commencement of Fiscal

Decentralization in 2001, the Balancing Fund

provided to the Regions in the form of transfers

amounted to Rp. 81.1 trillion. In 2012, the Balancing

Fund of Rp. 411.2 trillion. In 2020, Transfers to

Regions and Village Funds (TKDD) will reach Rp.

856.94 trillion. This TKDD consists of transfers to the

Regions in the amount of IDR784.94 trillion, and

Village Funds in the amount of IDR72.00 trillion.

The implementation of Fiscal Decentralization in

Indonesia since 2001 has resulted in various impacts

in several locations. Such as, DBH, DAU, DAK,

PAD, Regional Shares, Regional Loans, Fiscal

Capacity, APBD, Regional Government, DPRD,

Public Services, Regional Expansion (DOB), and

Regulations.

Identification of producing regions (by origin

principle) is often delayed due to delays in providing

calculation data. The distribution of DBH is based on

the realization that is only known in the following

year, thus causing the problem of underpayment.

There are many regional proposals to get profit

sharing that have not been regulated in the law, for

example export taxes, plantations, oil and gas

processing areas. DAU Basic allocation which is

calculated based on the salaries of PNSD, causing

inefficiency in regional personnel expenditures. DAU

formulations and policies that are automatically

allocated to New Autonomous Regions (DOB)

encourage regional expansion. The results of the

DAU allocation can only be informed to the Regions

in November (after the determination of the APBN at

the end of October) making it difficult for the Regions

to prepare the APBD. DAK has confusion regarding

the focus of DAK, equalization, national priority, or

support for regions with low fiscal capacity. Rigid

and often late DAK technical guidelines make it

difficult for regions to implement DAK activities.

Provision of Companion Funds is considered

burdensome for some regions. Determination of

recipient regions and the amount is unpredictable and

can only be informed to regions in November (after

the determination of the APBN at the end of October)

making it difficult for regions to prepare APBD.

Meanwhile, PBB, only 18 of the 492 Regions that

have collected Rural and Urban PBB (PBB-P2) as a

Regional tax in 2012, although the transfer deadline

is until January 2014. By the end of 2012 50.2% of

Local Governments are ready to collect PBB -P2,

which in terms of potential has covered 91.3%. Some

regions are constrained by the small potential of PBB-

P2, the readiness of human resources, facilities and

infrastructure, and other supporting devices.

Case of Regional Share ownership. For example,

the case of Newmont's shares in West Nusa Tenggara

(NTB). Central and Regional vertical conflicts over

the (single) ownership of Newmont Nusa Tenggara

Barat shares. The Central Government, Regional

Government (NTB), and the DPR are competing for

a 31% stake in Newmont, a multi-national company

operating in the copper and gold mining sector. The

DPR tried to block the Government's purchase of

Newmont shares, by asking BPK for assistance to

support their claim (Rahardjo, 2012: 26). In general,

this share ownership conflict is not only for economic

reasons, but rather for reasons related to elite political

interests.

Regarding Regional Loans, the Regions have not

dared to make regional loans to finance part of the

regional expenditure needs in the APBD. Even so,

regional income is still not sufficient to finance the

increase in regional spending in the APBD, and it is

possible for regions to make regional loans.

The Fiscal Decentralization Policy has been

implemented for 20 years, but the capacity or fiscal

capacity of the regions (Kabupaten/City) is not

sufficient in helping to finance regional expenditure

needs in the APBD. As a result, regional dependence

is very high on fiscal transfers from the center

(APBN).

The management of the APBD should be

determined no later than December 31 before the

current fiscal year. However, in 2012, 524 regions,

which set the APBD on time, were only 274 regions

(52% regions). In 2011 there were only 211 regions

(40%) and 2010 as many as 214 regions (41%). The

largest proportion of regional expenditures is

personnel expenditure, with the proportion above

40% (for Provinces in the range of 25% and for

districts/cities in the range of 51%) and continues to

increase until 2011. It was only in 2012 that personnel

expenditures decreased in proportion to total

expenditures. The proportion of capital expenditures

ICOSOP 2022 - International Conference on Social and Political Development 4

222

increased in 2011 and 2012, where the proportion of

capital expenditures was above 20%.

Another growing phenomenon is the increasing

flexibility of regencies/municipalities to add to the

budget for regional personnel expenditures in the

APBD which is sourced from the fiscal transfer

budget, particularly the DAU budget. There are

indications that the Regency/City Regional

Government cannot be regulated/not subject to the

Government above it. That the fiscal decentralization

policy was issued within the framework of

strengthening regional fiscal capacity to help boost

the regional economy and regional economic growth

(GDP).

In addition, there are obstacles to fiscal

implementation in regional governments, such as the

lack of competence of regional leaders, politicians,

and regional officials in implementing regional

revenue instruments. Central supervision of local

governments is still weak. This can be seen from the

implementation of the Regional Regulation on Taxes

and Levies that is less effective.

The implementation of Fiscal Decentralization is

always colored by the number of corruption cases

appearing in the regions. Corruption is perpetrated by

public officials. Literally, corruption means

rottenness, ugliness, depravity, dishonesty, bribery,

immorality, deviation from chastity. There are

indications that corruption is increasing after fiscal

decentralization in the implementation of regional

autonomy. And there are many cases of corruption in

the regions, as a result of which good and quality

public services as an effort to improve people's

welfare are disrupted. The idiom that emerged later

was that fiscal decentralization and regional

autonomy were nothing but a transfer of negative

externalities (inefficiencies) from the Central

Government in the New Order era to Regional

Governments (Pemda) in this Reformation era.

Corruption in Indonesia has become a national

problem that has taken root from the lowest layers of

the government structure to the highest levels. The

APBN and APBD in Indonesia are still considered to

lack supervision in their implementation, causing

budget inefficiencies. So far, the public budget has

always leaked both in terms of revenue and

expenditure.

Fiscal decentralization has encouraged the

emergence of criminal acts of corruption because it

provides opportunities for local governments to

manage the potential benefits of their regions. For

perpetrators of corruption in the regions, in addition

to the APBD, the budget that is often the target of

corruption is the regional expansion budget (Saputra,

2012). One recent case is the corruption of the APBD

by 45 members of the Malang DPRD against funds

used to build public facilities. This deserves mutual

attention from the central government and the

community because the APBD is the fundamental of

the regional economy (Putra, 2018).

Fiscal Decentralization from the Center to

Regional Governments, whether in the form of DAK,

Bansos (Social assistance), and other budgets, is only

enjoyed by local elites. For example, the executive,

and the legislature. Meanwhile, the local community

has not yet enjoyed the benefits.

The implementation of the Musrenbang in the

regional development planning process tends to be

carried out only to fulfill a formal process based on

regulations, and even seems to be a ritual process as

if community involvement in development planning

has actually taken place. This condition certainly has

an impact on the government's budgeting process,

which tends to be status quo, unresponsive to

dynamic community desires or expectations, in line

with the dynamics that occur in the community.

Participatory budgeting and discourse on good

governance, which are the slogans of the government

in the reform era, should place people not only as

objects of development, but also as subjects of

development.

DPRD does not fight for fiscal policy for the

benefit of the community, but only fights for personal

aspirations, businessmen, and the interests of political

parties. DPRD as a legislative body (the organizing

element of Regional Government), People's

Representatives in the regional power structure, do

not consider the issue of political stability as an

important issue, they should encourage the

Musrenbang mechanism to be more effective. As a

result, this fiscal policy only benefits a few people,

and public services do not increase.

Economic impact on a national basis (aggregate),

per capita transfers are increasing very sharply from

year to year. The occurrence of a reduction in the

level of poverty and unemployment. Some regions

with very high per capita transfer rates have actually

experienced a higher reduction in poverty than other

regions. Fiscal decentralization has actually had a

catch-up impact for underdeveloped regions.

Local Public Services: Education and Health.

There has been an increase in the output of public

services in the regions. For example: education output

(Pure Enrollment Rate/Elementary School NER)

increased in all provinces. Health Output (Infant

Mortality Rate/IMR) decreased significantly in all

provinces in Indonesia.

Fiscal Decentralization and Public Services: Deli Serdang Regency Government Education Sector Expenditure

223

A number of cases show that Fiscal

Decentralization does not have an impact on the

community in economic development and public

services. Local communities do not have influence

and control over regional fiscal policies. Local

government services to the community have not been

maximized.

Furthermore, from a number of cases it shows that

the dependence of the regions is even higher on the

central government. The emergence of the practice of

dynastic politics in the Region. The phenomenon of

the emergence of a strong desire of local elites to form

a New Autonomous Region (DOB). The emergence

of new autonomous regions is not based on a desire

to improve people's welfare, but rather as a way to

obtain fiscal transfers from the center. The highest

number of new autonomous districts/cities were born

compared to provincial new autonomous regions.

With the increasing number of new autonomous

districts/cities through the expansion process, the

budget for fiscal transfers to the regions will be even

greater. Regency/City DOB will depend heavily on

fiscal transfers from the Center. The Parent Province

does not provide financial assistance to new

autonomous regions in its territory.

Bappenas and UNDP (2008), stated that the

overall financial performance of the newly created

regions appears to be lower than that of the control

regions, due to a number of problems in regional

finances. Among other things, the greater fiscal

dependence in the new regions, especially new

autonomous regions, is persistently related to the

large allocation of capital expenditures in the new

regions.

The role of the central government's finances in

the development of the new regions is still very large.

With regard to fiscal decentralization and regional

autonomy, the expansion should be able to encourage

the independence of regional governments in carrying

out development in their regions through optimizing

sources of regional economic growth. The allocation

of central government funds should be an incentive

and initial capital for the new autonomous region

government to optimize its own income, so that in

time it can reduce dependence on central government

finances.

In reality, Central Government funds as the

implementation of fiscal decentralization, for new

autonomous regions, cannot be absorbed and

managed properly because of the political stability in

the new autonomous regions which is not well

established and conducive to the current government.

Sjafrizal (2008), the political aspect that often

arises in the expansion of regions is in the form of the

desire of several political figures to get new positions,

both as Regional Heads and Deputy Regional Heads

as well as DPRD members in the expansion areas.

Abdullah (2011), the majority of the new

autonomous regions formed after the reform failed to

achieve the goal of people's welfare. The formation of

the New Autonomous Region generally only benefits

a few local elites. The majority of the New

Autonomous Regions failed, because in fact political

reasons were more dominant than other reasons. It is

evident that it is the elite who are pushing for regional

expansion. However, its orientation is to pursue

political and economic gains (in this case the fiscal

flexibility granted by the center). Political gain by

controlling the government and economic gain by

controlling development projects in the Region. The

division of territory is made into the business of

political elite groups in the regions who just want

positions and positions in government. The euphoria

of democracy and the growth of political parties is

used by this elite group to voice their “aspirations”,

namely to encourage the expansion of the

government. Meanwhile, transfer funds to the regions

in nominal terms continued to increase, and when

viewed from the growth point of view, growth was

always positive. The increase in transfer funds to the

regions was caused by an increase in the salaries of

civil servants, an increase in revenue for profit

sharing, and the addition of the number of new

autonomous regions, and so on. The addition of the

number of New Autonomous Regions will certainly

increase the budget burden for the central

government, this can be seen from the increase in the

number of transfer funds to the regions through the

General Allocation Fund (DAU).

Central-Regional Financial Balance Pattern. The

issue of implementing Fiscal Decentralization is

related to the Central-Regional balance pattern. The

current pattern of central-regional financial balance is

still not acceptable to all parties. Many parties see that

the pattern of Central-Regional financial relations is

not yet good, especially in the implementation of

policies. The Center needs to continuously evaluate

and refine its implementation of the Central-Regional

financial balance pattern policy.

The journey of fiscal decentralization in Indonesia

still has various weaknesses and shortcomings both in

concept and in implementation. There are still various

kinds of conflicting regulations that cause the

implementation of decentralization in Indonesia to

not run well.

Deli Serdang Regency is one of the regencies in

North Sumatra Province. Deli Serdang has an area of

2,808.91 sq km, with a population of 1,886,388

ICOSOP 2022 - International Conference on Social and Political Development 4

224

people. In 2015 Deli Serdang Regency had 22 sub-

districts and 394 villages/kelurahan. Of the 394

villages, they can be grouped into 148 urban (urban)

villages and 246 rural (rural) villages.

Deli Serdang Regency is also an area that has a

strategic position because it is directly adjacent to the

city of Medan. Part of the Deli Serdang area is a

business area because it is located directly adjacent to

the outskirts of Medan City. In addition, a number of

national projects are located in Deli Serdang

Regency. For example, KNIA Airport (Kuala Namu

International Airport), MEBIDANGRO project, Lau

Simeme Dam, Dls. Deli Serdang Regency covers the

coastal area of the Malacca Strait, plantation areas,

and mountainous areas. Some tourist areas are in

mountainous areas. For example, the Sibolangit

Tourism area.

Since the commencement of Fiscal

Decentralization in 2001, the National Balance Fund

given to regions in the form of transfers amounted to

Rp. 81.1 trillion. In 2012, the Balancing Fund of Rp.

411.2 trillion. In 2020, Transfers to Regions and

Village Funds (TKDD) will reach Rp. 856.94 trillion.

This TKDD consists of transfers to the Regions in the

amount of IDR784.94 trillion, and Village Funds in

the amount of IDR72.00 trillion.

Since 2001 Deli Serdang Regency has received

the Balancing Fund. For the last 4 (four) years (2018,

2019, 2020, 2021) Deli Serdang Regency has

received the Balancing Fund. TKDD FY 2020 Deli

Serdang Regency received as much as IDR

2,417,551,946,000 - This Balancing Fund was

allocated in the Deli Serdang Regency APBD, both in

Regional Revenue and Expenditures. Both direct

shopping and indirect shopping. Deli Serdang

Regency RAPBD for FY 2018, amounting to Rp.

3,733,345,654,763, FY 2019, amounting to Rp.

4,016,480,823,937,-. FY 2021 amounting to Rp.

3,999,683,294,443.00., And, Deli Serdang Regency

RAPBD TA. 2022 amounting to

Rp.4,202,535,350,834.00.

However, the Fiscal Decentralization which has

been implemented by the Deli Medium Government

since 2001, in its implementation, has caused various

kinds of problems in public services in the

community. This can be seen in various kinds of

reactions that arise in the community for a number of

public services in Deli Serdang Regency. Both

services in the field of education, health, and

infrastructure. Such as, Road Infrastructure and

Irrigation.

Especially in services in the field of Education, for

example. Based on reports from a number of online

media, school buildings were damaged and students

did not go to school to go to sea, in Karang Gading

Village, Labuhan Deli District. (Source: Visiting a

remote school in Deli Serdang, the roof was destroyed

and some students skipped to go to sea Kompas.com

- 07/25/2016, 08:57 WIB).

Meanwhile, in the coastal area of Deli Medium

Regency, a high number of children dropping out of

school was also found, especially in the coastal area

of Deli Serdang Regency. And this condition is

recognized by the Education Office of Deli Serdang

Regency. (The Number of Children Dropping Out of

High School on the Deliserdang Coast, This is the

Government's Step Tuesday, June 29, 2021 | 23:37).

According to the Secretary of the Education Office,

Yusnaldi, the high dropout rate in coastal areas is due

to economic factors. Because children work to help

their parents' economy as fishermen, laundry

workers, to work in chicken coops, housemaids, and

some other menial jobs. In addition to economic

factors, this includes children who are involved in

drugs at school. Usually they are dismissed from

school, some are rehabilitated at special drug

rehabilitation sites, but they do not receive education

services and eventually drop out of school. Children

who have legal problems. Then the inmates do not get

educational services and eventually drop out of

school. The Deliserdang Regency Government will

provide access to inclusive education for children

who experience social and marginal problems,

namely children in coastal areas, children living in

rehabilitation and children living in prisons.

In addition, public services in the field of road

infrastructure in Deli Serdang Regency also face a

number of problems. People complain about poor

road infrastructure. Poor road infrastructure in

Namorambe Subdistrict, Percut Sei Tuan.

Meanwhile, people in Namurambe and Percut

Seituan sub-districts complained about poor road

infrastructure. Thus, disrupting the economic

activities of farmers in the distribution of agricultural

products. Damage to road infrastructure due to trucks

carrying excavated goods C. (Residents of

Deliserdang Complain about Poor Road

Infrastructure Wednesday, Antara, March 16 2016

8:49 WIB).

Likewise, damage to road infrastructure occurred

in the Biru-biru District to Bandar Baru, Sibolangit.

And the road in Biru-biru District, from Srilaba

Village to Penen, was badly damaged. About 30

comm long. (Alternative Blue-blue Road -

Bandarbaru Damaged. Analysis, Friday, 11 Nov 2016

17:31 WIB). (Sumatra City Post. Com, Blue-Penen

Road, Deli Serdang Regency, was badly damaged

Tuesday, 15 December 2020 / 17.25.00 WIB.

Fiscal Decentralization and Public Services: Deli Serdang Regency Government Education Sector Expenditure

225

Damage to road infrastructure also occurred in

Patumbak District, Patumbak Kampung Village,

which is on the outskirts of Medan City. The road is

muddy, muddy and waterlogged. (The Bad Section of

the Medan Deli Serdang Border Road The road

connecting Deli Serdang Regency and Medan City,

North Sumatra, is damaged.

Damage to road infrastructure also occurred in Sei

Semayang Village, Sunggal District. People plant

banana trees in the middle of a damaged road as an

outburst of emotion because the road has been left

damaged for a long time. (A hole like a puddle, a

damaged road in Deli Serdang is planted with banana

trees by Datuk Haris Molana – detikNews Friday, 11

Jun 2021 18:26 WIB). The damaged road

infrastructure in Sei Semayang Village, is being

addressed by the Sunggal sub-district head and will

be repaired as soon as possible. (Broken Road Planted

with Banana Trees and Residents Fishing, Camat:

Repaired Next Month, Tribun-Medan.Com,

Saturday, June 12 2021 12:05).

Meanwhile, farmers' irrigation infrastructure was

also damaged. Irrigation gate valves in coastal areas

to prevent sea water from entering farmers' land are

damaged. As a result, sea water enters the farmers'

rice fields. Farmers' irrigation in mountainous areas,

Gunung Paribuan Village, Gunung Meriah District

was damaged by landslides. (Republika.Co.Id, Deli

Serdang Farmer Complains of Damage to Seawater

Preventing Valve. Friday 12 Feb 2016 10:07 WIB).

Saturday, January 23, 2021 - 07.06). As well as,

damage to the village irrigation canal due to

landslides in Gunung Paribuan Village, Gunung

Meriah District. (metrokampung.com, January 22,

2021).

Services in the health sector also cause many

problems. Community groups held demonstrations at

the DPRD Office and the Deli Serdang Regent's

Office, regarding the poor health services in Deli

Serdang Regency. They questioned the construction

of the Bangun Purba Health Center, and the services

of the Tanjung Rejo Health Center, Deli Serdang.

(Daily.com analysis, Aspirations not responded,

Mass seals Deli Serdang Regent's Office Thursday,

13 Aug 2020 19:39 WIB).

Observing the initial information obtained from a

number of online media, it can be concluded

(temporarily) that there are a number of problems in

public services in Seli Serdang Regency. Starting

from services in the fields of Education, Health to

Infrastructure services. Such as, Road and Irrigation

infrastructure. The public responds to this poor public

service in various forms. Starting from complaints to

the mass media, the action of planting trees and

fishing on the road. Until, the demonstration to the

Office of the Regent and DPRD Deli Serdang. And

the distribution of public service problems that arise

includes a number of villages in several sub-districts.

Starting from Percut Sei Tuan District, Pantai Labu

District, Batang Kuis District, Labuhan Deli District,

Sunggal District, Biru-biru District, Namurambe

District, Sibolangit District, Patumbak District,

Bangun Purba District, Gunung Meriah District.

2 RESEARCH METHODS

The research paradigm used is the Constructivist

Paradigm, with Qualitative Research Methods. Data

were collected through in-depth interviews,

discussions with several district informants (Regional

Secretary, Assistant, Head of Agency, Head of

Service), DPRD (Budget Agency), District (Branches

of Service), Schools (SD, SMP), and Community

Leaders (Kabupaten). In addition, data were also

collected through literature study, document study,

and secondary data.

3 RESULTS AND DISCUSSION

3.1 Public Perception

Based on reports from a number of online media,

services in the field of education, for example. School

buildings were damaged and students who did not go

to school went to sea in Karang Gading Village,

Labuhan Deli District. (Source: Visiting a remote

school in Deli Serdang, the roof was destroyed and

some students skipped to go to sea Kompas.com -

07/25/2016, 08:57 WIB).

Meanwhile, the number of children dropping out

of school in Deli Serdang Regency is quite high,

especially in the coastal area of Deli Serdang

Regency. The information was obtained from the

results of the Deli Serdang Regency regional

leadership meeting in June 2021. As later released by

the following online media:

Angka Anak Putus Sekolah Tinggi di

Pesisir Pantai Deliserdang, Ini Langkah

Pemerintah

DELISERDANG | Pemerintah Kabupaten

Deliserdang yang dipimpin oleh Bupati Deliserdang

Ashari Tambunan membahas tentang langkah

menekan tingginya angka anak putus sekolah yang

tinggal di daerah pesisir pantai Kabupaten

Deliserdang.

ICOSOP 2022 - International Conference on Social and Political Development 4

226

Pertemuan digelar di lantai II Kantor Bupati

Deliserdang yang di ikuti oleh sejumlah pejabat

Pemkab Deliserdang diantaranya Sekretaris Dinas

Pendidikan Deli Serdang

Yusnaldi M.PD, Asisten III Dedi Maswardy, Kepala

Bappeda Ir. Remus Hasiholan Pardede, Kadis

Kominfo Dr. Dra. Hj. Miska Gewasari, MM. dan

Kabag Orta Drs. Syahrul M.Pd, Selasa (29/06/2021).

Dalam paparannya, Sekretaris Dinas Pendidikan

Yusnaldi menjelaskan, tingginya angka putus sekolah

di kawasan pesisir pantai disebabkan faktor ekonomi.

Karena anak bekerja membantu ekonomi orang tua

sebagai nelayan, tukang cuci, sampai bekerja di

kandang ayam, pembantu rumah tangga, dan

beberapa pekerjaan kasar lainnya. Selain faktor

ekonomi juga termasuk anak anak yang terlibat

narkoba di sekolah, Biasanya diberhentikan dari

sekolah, sebagian di rehab di lokasi rehabilitasi

khusus narkoba, tetapi mereka tidak mendapat

layanan pendidikan dan akhirnya putus sekolah. Anak

yang mengalami masalah hukum. Kemudian menjadi

warga binaan tidak mendapatkan layanan pendidikan

dan akhirnya putus sekolah , Sebut Yusnaldi. Adapun

langkah-langkah yang diambil Pemerintah Pemkab

Deliserdang nantinya adalah menyediakan akses

pendidikan inklusif bagi anak yang mengalami

masalah sosial dan marjinal yaitu anak kawasan

pesisir, anak penghuni rehabilitasi dan anak penghuni

lapas.

In addition, public services in the field of road

infrastructure in Deli Serdang Regency also face a

number of problems. People complain about poor

road infrastructure. Poor road infrastructure in

Namorambe Subdistrict, Percut Sei Tuan.

Based on the online media coverage above, as

well as the results of interviews with several

community leader informants, it can be concluded

that public perception of the Education Sector Service

in Deli Serdang Regency is still bad.

3.2 Fiscal Fund Balancing Fund and PAD

Since the commencement of Fiscal Decentralization

in 2001, the National Balance Fund given to regions

in the form of transfers amounted to Rp. 81.1 trillion.

In 2012, the Balancing Fund of Rp. 411.2 trillion. In

2020, Transfers to Regions and Village Funds

(TKDD) will reach Rp. 856.94 trillion. This TKDD

consists of transfers to the Regions in the amount of

IDR784.94 trillion, and Village Funds in the amount

of IDR72.00 trillion.

Since 2001 Deli Serdang Regency has received

the Balancing Fund. For the last four years (2018,

2019, 2020, 2021) Deli Serdang Regency has

received the Balancing Fund. Balancing Fund

originating from DBH (Profit Sharing Fund) Taxes

and DBH SDA (Natural Resources). Also, DAU

(General Allocation Fund) and Physical DAK

(Special Allocation Fund). TKDD FY 2020 Deli

Serdang Regency received as much as Rp.

2,417,551,946,000 - with details of Rp.

2,105,274,617,000 - for transfers to the Region and

Village Fund of Rp. 312,277,329,000-.

This Balancing Fund is allocated in the Deli

Serdang Regency APBD, both in revenue and

expenditure. Both direct shopping and indirect

shopping. The Deli Serdang Regency 2018 Budget

Draft, amounting to Rp. 3,733,345,654,763, with an

indirect expenditure composition of Rp.

2,077,978,733,759. (55%), and direct spending of Rp.

1,688,379,519,365. (45%). The 2018 FY regional

income is projected to be Rp. 3,733,345,654,763. or

increased by Rp. 234.917.232.730. (6.7%) compared

to the 2017 PAPBD realization of Rp.

912,593,775,000. Regional Revenue for FY 2018,

consists of: PAD of Rp. 1,000,927,060,000. There

was an increase of IDR 88,333,285,000 (9.7%)

compared to the 2017 PAPBD of IDR

912,593,775,000. The balancing fund is projected to

be IDR 2,277,174,628,000, and other legitimate

regional income is projected at IDR 455,243,966,763.

The Deli Serdang Regency Budget for the 2019

fiscal year, amounting to Rp. 4,016,480,823,937,

with the composition of indirect expenditures of Rp.

2,000,496.35,123 (49.8%), and direct expenditures of

Rp. 2,015,984,472,814. (50,2). TA regional income.

2019 is projected to be Rp. 3,986,480,823,937, or an

increase of Rp. 345,900..902,127 (10%) compared to

PAPBD for FY 2018. Regional income for FY 2019,

consists of: PAD of Rp. 1,168,365,751,320 or an

increase of Rp. 242,843. 226,241 (26%). The

balancing fund is projected to be IDR

2,063,665,999,250, and other legitimate regional

income is projected at IDR 754,449,073,367.

FY 2020, the realization of Deli Serdang Regency

Revenue in the Year, amounting to Rp.

3,335,349,826,580.82, consisting of: PAD, Balancing

Fund, and other legitimate income. Regional

Expenditure Realization, amounting to Rp.

2,770,409.994,709.19, consisting of: Operational

Expenditure, Capital Expenditure and Unexpected

Expenditure. Transfer realization, amounting to Rp.

503,751,226,013.00, which consists of Transfer of

Regional Tax Revenue Sharing, and Transfer of

Financial Aid to Villages. Receipt of Rp. 83,358,701.

Financing Income, amounting to Rp. 4,3300,000.00.

Fiscal Decentralization and Public Services: Deli Serdang Regency Government Education Sector Expenditure

227

Excess Budget Financing (SiLPA), amounting to Rp.

140,217,596.42.

Deli Serdang Regency Budget Draft FY2021,

with a projected regional income of Rp.

3,999,683,294,443.00., consisting of: PAD, transfer

income, and other legitimate regional income.

Regional expenditures amounted to Rp.

4,026,683,296,443, consisting of: operating

expenditures, capital expenditures, unexpected

expenditures and transfer expenditures. Regional

financing receipts amounting to Rp.

45,000,000,000.00. Meanwhile, regional financing

expenditures are Rp. 18,000,000,000.00, so that the

net financing is Rp. 27,000,000,000.00.

Deli Serdang Regency APBD Draft TA. 2022,

Regional Income of Rp.4,202,535,350,834.00

consisting of: PAD, transfer income, and other

legitimate regional income. Regional expenditures

amounted to Rp.4.229,535,350,834.00, consisting of:

operating expenditures, capital expenditures,

unexpected expenditures, and transfer expenditures,

regional financing receipts amounting to

Rp.45,000,000,000.00. Meanwhile, regional

financing expenditures are Rp. 18,000,000,000.00 so

that the net financing is Rp. 27,000,000,000.00.

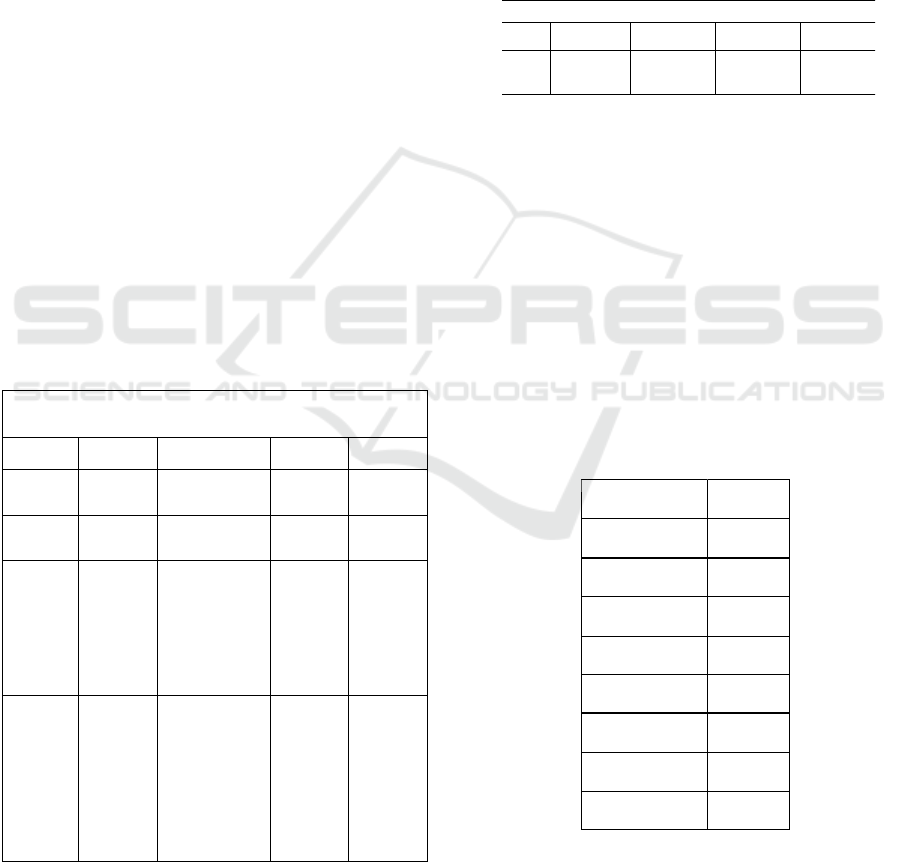

For more details, the Deli Serdang Regency

Balance Fund (2018-2021), see Table 1 below:

Table 1: DAU, DAK, DBH, Deli Serdang Regency

(2018-2021)

REGENCY BALANCED FUND. DELI

SERDANG 2018-2021

2018 2019 2020 2021

DBH

PAJAK

67.901.641.7

42,00

58.101.539

.036,00

62.265.354.1

32,00

51.723.141.4

18,00

DBH SDA

2.338.865.90

2,00

1.144.676.778,00 3.787.195.86

5,00

3.991.671.50

9,00

DAK

(Regular

Physical

:

Education

, Health &

Family

Planning)

31.552.035.0

00

(education)

18.614.912.0

00 (Health

&

Family

Planning)

DAK

(Physical

Assignme

nt:

Sanitation

,

Environm

ent,

Forestry)

Meanwhile, in 2021 Deli Serdang Regency will

only receive Regular Physical DAK. Regular

Physical DAK covers the fields of Education, Health

and Family Planning. Education consists of PAUD,

SD, SMP, SKB. Health includes basic services,

referral services, pharmaceutical services and

consumables, improving health system readiness, and

family planning.

Revenue from PAD (Regional Original Opinion)

of Deli Serdang Regency in the last four years, seen

from the realization rate has increased. Except for

2020, there was a decrease due to reasons related to

the Covid-19 Pandemic. See Table 2 below.

Table 2: PAD of Deli Serdang Rgency (2018-2021)

Meanwhile, the number of schools in Deli Serdang

Regency is 1,914 schools. The number of schools

consisted of 52 MA schools, 190 MI schools, 148

MTs schools, 915 elementary schools, 1 SDTK, 2

SKB schools, 136 SMA schools, 2 SMAK schools,

127 vocational schools, 329 junior high schools. 1

school, SMPTK 1 school, SMATK 2 schools, SPK

SD 4 schools, SPK SMA 1 school, and SPK SMP 4

schools.

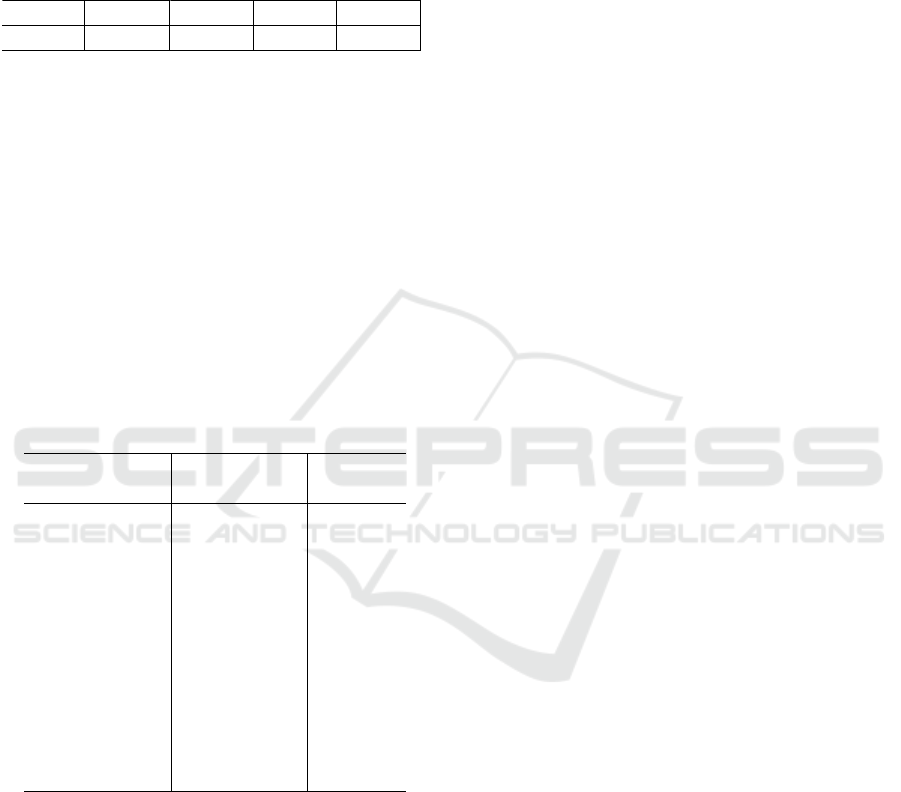

Meanwhile, the number of teachers and education

personnel in Deli Serdang Regency is 20,322 people.

SD 11, 779 people, SMP 4,590, and SMA 1,912

people. See Table 3 below.

Table 3: Teachers and Education Personnel of Deli Serdang

Regency

Center for Data and Statistics Kemendikbud.

Note: Residual Data is the Total GTK that does not

match the Reference Table.

Reg

i

o

n

a

l

O

r

i

g

i

n

a

l

Reve

n

u

e, De

l

i

Se

r

d

a

n

g Rege

n

c

y

YEAR 2018 2019 2020 2021

RESUM E 573.010.351.004,9

6

849.286.151.151,00 729.648.594.488,68 825.375.281.296,75

SD 11,

7

7

9

SM P 4,

5

9

0

SM

A

1,

9

1

2

SM K 1,

9

7

8

SD L B 1

7

SM PL B

0

SM L B

0

DATA RESIDU

4

6

T

O

T

A

LLY

2

0

,

3

2

2

ICOSOP 2022 - International Conference on Social and Political Development 4

228

Services in the Education Sector in Deli Serdang

Regency, seen from the 2019 Pure Participation Rate

(APM) indicator, shows that SD (95.03) and SMP

(70.82). See Table 4 below.

Table 4: Pure Partiviation Rate (APM) of Deli Serdang

Regency in 2019

BPS-National Sosio Economic Survey 2019

Based on the information above, Deli Serdang

Regency's Balancing Fund and PAD (Regional

Original Income) for 4 years (2018-2021), mandatory

spending on Education Sector is still focused on

Education Personnel (teachers), has not touched

infrastructure spending much (physical/building) and

Increasing NER (Pure Participation Rate).

Richard Batley & Claire Mcloughlin (2015: 275-

285), suggest several characteristics of public

services related to politics. Public services that are

high visibility always receive political intervention.

See Table 5 below:

Table 5: The political effects of service characteristics

Richard Batley & Claire Mcloughlin (2015).

Bartley and McLoughlin (2015) mention, "Political

incentives to provide increase where services offer..."

"High visibility: outputs are physically visible or

problem has high public profile." Political incentives

in providing a service sector will increase if the output

of the service is physically visible to the public. For

the Government, measurable output will facilitate

control and encourage greater spending allocations.

Physical school buildings (SD, SMP) in the Regency

are a service sector with measurable output

(measured), and easy to see by the community (high

visibility). In addition, the development of education

infrastructure (SD, SMP) is still a concern of the

Government, so that it will encourage an increase in

the allocation of spending on education infrastructure.

4 CONCLUSIONS

Based on the discussion of the results of previous

research, it can be concluded as follows: First, that

Public Perception of Services in the Education Sector

in Deli Serdang Regency is still bad; Second,

mandatory spending on education spending is still

focused on education personnel (teachers), not for

infrastructure spending (physical/building) and

increasing the NER (pure participation rate).

Bartley and McLoughlin (2015) stated,

"Political incentives to provide increase where

services offer..." "High visibility: outputs are

physically visible or problem has high public profile."

Political incentives in providing a service sector will

increase if the output of the service is physically

visible to the public. For the Government, measurable

output will facilitate control and encourage greater

spending allocations. Physical school buildings (SD,

SMP) in the Regency are a service sector with

measurable output (measured), and easy to see by the

community (high visibility). In addition, the

development of education infrastructure (SD, SMP)

is still a concern of the Government, so that it will

encourage an increase in the allocation of spending on

education infrastructure.

REFERENCES

Alamsyah, 2011. Karakteristik Universal Pelayanan

Publik: Sebuah Tinjauan Teoritik. Jurnal Borneo

Administrator Vol. 7 No. 3. 353-371.

Adisasnita, Rahardjo, 2006. Pembangunan Perdesaan dan

Perkotaan. Yogyakarta: Graha Ilmu.

Aslym, A, 1999. Beberapa Aspek Dalam Pelaksanaan

Otonomi Daerah, Makalah Seminar, Lustrum I MEP–

UGM, Yogyakarta.

Azfar, Omar, et all. 1999. Decentralization and Public

Services: The Impact of institutional Arrangements,

IRIS Paper. University Maryland, USA.

Abdul, Halim, 2001. Manajemen Keuangan Daerah.

Yogyakarta : AMP YKPN.

Akai, Nobuo and Sakata, Masayo, 2002. Fiscal

Decentralization Contributes To Economic Growth:

Evidence From State-Level Cross-Section Data For

The United States. Journal of Urban Economics 52

(2002) 93-108.

T

k

t

P

endidikam

SD SMP SMA PT

APM

95,03 70, 82 67,81 17,77

Poli

t

ical incen

t

ives

t

o

pr ovi de i ncr ease wher e

services offer…

O

rganiza

t

ional con

t

rol

by policy-makers of

providers is greater

wher e ser vi ces off er …

U ser s’ power over

pr ovi der s i s gr ea t er

where services

of f er …

H

i gh

excl udability: possibility of

excluding some users and

targeting services to favor

particular individuals or

groups.

Low information

asymmetr y: benefits can be

clearly attributed to political

intervention.

Hi gh vi sibi lit y: outputs are

physically visible or

problem has high public

profile.

Hi gh

attr ibutabi li ty: outcomes are

clearly attributable to

political intervention.

Low discre

t

ion

:

tas

k

s a

r

e

easy to specify in

advance.

Hi gh

measurability: delivery

is standardized and

outputs are measurable.

Low pr ovider

autonomy: limited

specialist knowledge and

organization by

providers.

Hi gh

territoriality: clearly

defined boundaries of

consumption.

Low

rivalry: (perceived)

competition and

variability of

treatment.

Low

monopoly: choice

or exit option for

users.

Low i nfor mati on

asymmetr y: users

well informed

about rights and

quality.

Hi gh fr equency or

predictability: creat

ing unity of

demand and

common

experience.

Hi gh

territoriality: users

concentrated in

defined areas and

service provides

focal point.

Fiscal Decentralization and Public Services: Deli Serdang Regency Government Education Sector Expenditure

229

Badrudin, Rudy, 2012. Ekonomika Otonomi Daerah.

Yogyakarta: UPP STIM YKPN.

Bahl Roy, 2008. Modul Tinjauan Dampak Kebijakan

Desentralisasi Fiskal bagi kemampuan Keuangan dan

Pertumbuhan Ekonomi Daerah.

Batley, R., & Mcloughlin, C.,. 2015. The Politics of Public

Services: A Service Characteristics Approach. World

Development, 74, 275-285.

Bird, Richard, M. dan Francois Vaillancourt, 1998.

Desentralisasi Fiskal di Negara-negara Berkembang:

Tinjauan Umum, dalam Richard Bird dan Francois

Vailancourt, (Eds), Desentralisasi Fiskal di Negara-

negara Berkembang. Jakarta: Gramedia Pustaka

Utama.

Biro Pusat Statistik Provinsi Sumatera Utara, 2007.

Sumatera Utara Dalam Angka. Medan: Badan Pusat

Statistik Provinsi Sumatera Utara.

Cavalluzzo, K. S. dan C. D. Ittner, 2004. Implementing

Performance Measurement Innovations: Evidence

From Government. Accounting Organizations ang

Society, 29: 243-267.

Conyers, Diana, 1991. Perencanaan Sosial di Dunia

Ketiga. Yogyakarta: UGM Press.

Conyers, Diana, 1994. Perencanaan Sosial di Dunia

Ketiga: Suatu Pengantar. Yogyakarta: Gadjah Mada

University Press.

Crouch, Harold, 1982. Perkembangan Ekonomi &

Modernisasi. Jakarta: Yayasan Pengkhidmatan.

Desai, R. M., Freinkman, L.M., and Goldbrg, I. 2003.

Fiscal Federalism and Regional Growth Evedience

from Russion Federation in the 1990s.World Bank

Policy Research Working Paper 3138, World Bank,

Washington DC.

Desentralisasi Fiskal dan Kesenjangan Daerah,

siteresources.worldbank.org, diakses tanggal 24

November 2014.

Devas dkk, 1987. Keuangan Pemerintah

Indonesia.Terjemahan Marsi Maris. Jakarta: UI-Press.

Dinas Kesehatan Provinsi Sumatera Utara 2019. Profil

Kesehatan Provinsi Sumatera Utara.

Faisal Tamin, 1998. Reformasi dan Reorientasi Paradigma

Otonomi Daerah. Makalah Seminar HMI Cabang

Malang.

Halim, Abdul, 2012. Akuntansi Sektor Publik: Akuntansi

Keuangan Daerah. Jakarta: Salemba Empat.

Hanan, Djayadi, 2014. Menakar Presidensialisme

Multipartai di Indonesia: Upaya Mencari Format

Demokrasi yang Stabil dan Dinamis dalam Konteks

Indonesia. Bandung: Mizan Media Utama.

Haryatmoko, 2002. Kekuasan melahirkan Anti Kekuasaan.

Jurnal Basis No 01- 02 Tahun ke-51, Januari-Februari

2002

Krishna, Darumurti dan Umbu Rauta, 2000. Otonomi

Daerah Perkembangan Pemikiran dan Pelaksanaan.

Bandung: PT. Citra Aditya Bakti.

Kaelani, H., 2012.Metode Penelitian Kualitatif

Interdisipliner Bidang Sosial, Budaya, Filsafat, Seni,

Agama dan Humaniora.Yogyakarta

: Penerbit

Paradigma.

Kaho, Josep Riwo, 2011. Prospek Otonomi Daerah di

Negara Republik Indonesia, Identifikasi Beberapa

Faktor yang Mempengaruhi Penyelenggaraannya.

Jakarta : Raja Grafindo Persada.

Kaho, Josef Riwu, 2010. Otonomi Daerah di Negara

Republik Indonesia: Identifikasi Faktor-Faktor yang

Mempengaruhi Penyelenggaraan Otonomi Daerah.

Jakarta: Rajawali Pers.

Kaho, Josef Riwu, 1997. Prospek Otonomi Daerah di

Negara Republik Indonesia: Identifikasi Beberapa

Faktor yang Mempengaruhi Penyelenggaraannya.

Jakarta: PT Raja Grafindo Persada.

KPPOD, 2009. Sewindu Otonomi Daerah: Perspektif

Ekonomi. Jakarta: Komite

Pemantauan Pelaksanaan Otonomi Daerah.

Koswara E., 2001. Otonomi Daerah: Untuk Demokrasi dan

Kemandirian Masyarakat. Jakarta: Yayasan Pariba.

Kuncoro, Mudrajad, 2004. Otonomi dan Pembangunan

Daerah. Jakarta: Penerbit Erlangga.

Lewis BD., 2005. Indonesian local government spending,

taxing and saving: an

explanation of pre and post decentralization fiscal

outcomes. Asian Economic Journal.19 (3): 291-317.

Lijphart, Arend, 1984. Democracies: Patterns of

Majoritarian and Consensus Government in Twenty-

One Countries. New Haven and London.

Litvack, Jennie, Ahmad, Jundid, and Bird, Richard, 1998.

Decentralization in Developing Country. The World

Bank, Washington, DC.

Mainwaring, Scott, 1989. Institutional Dilemmas of

Multiparty Presidential Democracy: The Case of

Brazil. Paper for the XV International Congress of

theLatin American Studies Association.

Mardiasmo, 2009. Otonomi dan Manajemen Keuangan

Daerah. Yogyakarta : Penerbit Andi.

Mardiasmo, 2009. Otonomi Dan Manajemen Keuangan

Derah. Yogyakarta : BPFE UGM.

Martini, Hadari, 2012. Perencanaan Pembangunan

Partisipatif. Yogyakarta: Gadjah Mada University

Press.

Marzuki, PM, 2007. Penelitian Hukum. Jakarta: Prenada

Media Group.

Muchtar, Ibnu. 1999. Partai Kuning. Bina Dakwah, No.

228 Maret 1999.

Moch. Mafud MD, 2000 Reformasi Tatanan

Penyelenggaraan Pemerintah Daerah Makalah

Seminar Otonomi Daerah Universitas Brawidjaya.

Marbun, SF, dkk (ed), 2001. Dimensi-Dimensi Pemikiran

Hukum Administrasi Negara. Jogyakarta : UII Press.

Mega Christia, Adisyya, dan Budi Ispriyarso, 2019.

Desentralisasi Fiskal dan Otonomi Daerah di

Indonesia. Law Reform Program Studi Magister Ilmu

Hukum Volume 15, Nomor 1, Tahun 2019 Fakultas

Hukum Universitas Diponegoro.

Modul Tinjauan Dampak Kebijakan Desentralisasi Fiskal

bagi kemampuan Keuangan dan Pertumbuhan

Ekonomi Daerah

.

Nainggolan RE., 2008. Sumatera Utara Membangun,

Informasi Holistik. Medan:

ICOSOP 2022 - International Conference on Social and Political Development 4

230

Badan Perencanaan Pembangunan Daerah Provinsi

Sumatera Utara.

Nurhemi dan Guruh Suryani, 2015. Dampak Otonomi

Keuangan Daerah Terhadap Pertumbuhan Ekonomi di

Indonesia. Buletin Ekonomi Moneter dan Perbankan.

Volume 18, Nomor 2, Oktober 2015, 183-205.

Oates, Wallace E., 1993. Fiscal Decentralization and

Economic Development. National Tax Journal Vol. 46

No. 2 (June, 1993) 237-243.

Paturusi, Idrus A., at.al., 2009..Esensi Dan Urgensitas

Peraturan Daerah Dalam Pelaksanaan Otonomi

Daerah, Kerjasama Dewan Perwakilan Daerah

Republik Indonesia Dan Universitas Hasanuddin,.

Pemerintah Daerah Istimewa Yogyakarta 2011. Laporan

Kegiatan, Penyusunan Pedoman Standar Pelayanan

Publik Pemerintah Propinsi DIY 2011, Proyek

Peningkatan Kapasitas Berkelanjutan Untuk

Desentralisasi Sustainable Capacity Building for

Decentralization (SCBD) Project (ADB Loan 1964-

INO).

Penjelasan Peraturan Pemerintah Republik Indonesia

Nomor 65 Tahun 2005 Tentang Pedoman Penyusunan

dan Penerapan Standar Pelayanan Minimal.

Peraturan Menteri Dalam Negeri Nomor 13 Tahun 2006

tentang Pedoman Pengelolaan Keuangan Daerah.

Peraturan Menteri Dalam Negeri Nomor 55 Tahun 2008

tentang Tata Cara Penatausahaan dan Penyusunan

Laporan Pertanggungjawaban Bendahara serta

Penyampaiannya.

Peraturan Menteri Dalam Negeri Nomor 32 Tahun 2011

tentang Hibah dan Bantuan Sosial.

Peraturan Menteri Dalam Negeri Nomor 77 Tahun 2020

tentang Pedoman Teknis Pengelolaan Keuangan

Daerah.

Peraturan Pemerintah Nomor 105 Tahun 2000 tentang

Pengelolaan dan Pertanggungjawaban Keuangan

Daerah.

Peraturan Pemerintah Nomor 58 Tahun 2005 tentang

Pengelolaan Keuangan Daerah.

Peraturan Pemerintah Nomor 65 Tahun 2005 tentang

Pedoman Penyusunan dan Penerapan Standar

Pelayanan Minimal memberikan pedoman kepada

Menteri/Pimpinan Lembaga Non-Departemen

untukmenyusun standar pelayanan minimal dan

penerapannya oleh Pemerintahan Daerah.

Peraturan Pemerintah Nomor 96 Tahun 2012 tentang

Pelaksanaan Undang-Undang No. 25 Tahun 2009

tentang Pelayanan Publik.

Peraturan Pemerintah Nomor 12 Tahun 2020 tentang

Pengelolaan Keuangan Daerah.

Plano, Jack A., 1985. Kamus Analisa Politik. Terj. : Edi S.

Siregar. Jakarta: Rajawali Press.

Plano, Jack C. (et.al), 1989. Kamus Analisa Politik. Cet. II.

Jakarta : Rajawali.

Pradiptyo, R. Suprayitno, B., 2017 Fiscal decentralization

and corruption: The facts in regional autonomy in

Indonesia. Journal Advanced Research of Law and

Economic, Vol. 8, (No.5), pp.1458-1468.

Psycharis, Y. Yoi, M., 2015 Decentralization and local

government fiscal autonomy: evidence from the Greek

municipalities. Environment and Planning.

Government and Policy, Vol. 34, (No.2), pp.262-280.

Pujiati, Amin, 2006. Analisis Pertumbuhan Ekonomi di

Karesidenan Semarang Era desentralisasi Fiskal.

Jurnal Ekonomi Pembangunan, 61-70.

Putra, W. 2018. Perekonomian Indonesia

“SWfvgbPutra, W. (ed). 2018. Tata Kelola Ekonomi

Keuangan Daerah. Depok: Rajawali Pers.

Rasul, S. 2009. Penerapan Good Governance di Indonesia

Dalam Upaya Pencegahan Tindak Pidana Korupsi.

Mimbar Hukum, Vol. 1, (No. 3), pp.538-553.

R. Dye, Thomas, 1960. Understanding Public Policy. Third

Edition Prentice Hall Inc. Englewood Cliffs N.J. 0732.

Rinaldi, Taufik, Marini Purnomo dan Dewi Damayanti,

2007. Memerangi Korupsi Yang Terdesentralisasi:

Studi Kasus Penanganan Korupsi Pemerintahan

Daerah. Bank Dunia: Justice Project.

Saragih, Juli Panglima, 2003. Desentralisasi Fiskal dan

Keuangan Daerah dalam Otonomi. Jakarta: Penerbit

Ghalia Indonesia.

Salangka, Wilson PR. Partisipasi Masyarakat Dalam

MUSRENBANG di Desa Malola Kecamatan

Kumelembuai Kabupaten Minahasa Selatan. Program

Studi Ilmu Pemerintahan FISIP UNSRAT.

file:///C:/Users/hp/Downloads/30760-64007-1-SM.pdf

Sanit, Arbi, 1982. Sistem Politik Indonesia; Kestabilan

Peta Kekuatan Politik dan Pembangunan. Jakarta :

Rajawali Press.

Saputra, Bambang., & Mahmudi. 2012. Pengaruh

Desentralisasi Fiskal Terhadap Pertumbuhan Ekonomi

Dan Kesejahteraan Masyarakat. JAAI, Vol. 9, (No. 1),

pp. 96-111.

Slamet, Y., 1994. Pembangunan Masyarakat Berwawasan

Partisipasi. Surakarta: Sebelas Maret University Press.

Sidik, Machfud, 2001. Studi Empiris Desentralisasi Fiskal

: Prinsip, Pelaksanaan Di Berbagai Negara serta

Evaluasi Pelaksanaan Penyerahan P3D (Personil,

Peralatan, Pembiayaan Dan Dokumentasi) Sebagai

Konsekuensi Kebijakan Pemerintah, Sidang Pleno ISEI

Ke-X, pada 13-14 April 2001, Batam.

Sinaga, NS., 2005. Implementasi Sistem Buttom-Up

Planning dalam Perencanaan Pembanngunan Daerah

di Kota Medan.

Siregar B, Pratiwi N., 2017. The Effect of Local

Government Charasteristics and Financial

Independence on Economic Growt and Human

Development Index In Indonesia. Jurnal Manajemen

Dan Kewirausahaan, Vol. 19, (No.2), pp.65–71.

Sundaram, Meenakeshi, 1994. Decentralization in

Developing Countries. Wikipedia Bahasa Inggeris.

Suriasumantri, Jujun S., 1986. Ilmu Dalam Perspektif

Moral, Sosial dan Politik: Sebuah Dialog Tentang

Keilmuan Dewasa Ini. Jakarta: Gramedia.

Shidarta, 2004, Karakteristik Penalaran Hukum Konteks

ke-Indonesiaan. Disertasi Program Doktor IImu

Hukum. Bandung: Universitas Katolik Parahyangan.

Smoke P., 1996. Fiscal Decentralization in Indonesia: A

New Approach to An Old Idea. World Development.

24(8):1281-1299.

Fiscal Decentralization and Public Services: Deli Serdang Regency Government Education Sector Expenditure

231

Syed U, Khadka N, Wall S., 2008. Care-Seeking Practices

in South Asia: Using Formative Research to Design

Program Interventions to Save Newborn Lives. Journal

of Perinatology. (28): 9-13.

Syamsuddin, Agus, 2000. Mengenal Otonomi Daerah

Berdasarkan Undang-Undang Nomor 22 Tahun 1999

tentang Pemerintahan Daerah. Makalah Seminar

Kadin-PWI Kabupaten Bondowoso.

Suratno, Konsep Pelayanan Publik, diakses melalui

http://sulut.kemenag.go.id/file/file/kepegawaian/ikmo1

341292012.pdf. (accessed on June 2, 2016).

Syafrian, Dzulfian, 2015. Stabilitas Politik dan Demokrasi

Ekonomi di Indonesia. Diakses dari

https://dzulfiansyafrian.wordpress.com/2015/08/12/

stabilitaspolitik-dan-demokrasi-ekonomi-di-indonesia/

pada tanggal 10 Oktober 2018 jam 22.45.

Siddik, Machfud, 2001. Kebijakan, Implementasi, dan

Pandangan Ke Depan Perimbangan Keuangan Pusat

Daerah.

Tarigan, Robinson, 2010. Perencanaan Pembangunan

Wilayah. Edisi Revisi. Jakarta: Bumi Aksara.

Thiessen, Ulrich, 2003. Fiscal Decentralization and

Economic Growth in High Income OECD Countries.

Fiscal Studies Vol. 24 No. 3.

Ter-Minassian, Teresa, 1997. Fiscal Federalism In

Theory and Practice. International Monetary

Fund,Washington.

Trilaksono, N., 2000, Prospek Otonomi Daerah:

Implementasi Undang-Undang No. 22 Tahun 1999

tentang Pemerintah Daerah. Makalah Pentaloka DPRD

Kotamadya Pasuruan.

Ulum, Ulum, 2002. Keuangan Pemerintah Daerah Otonom

di Indonesia. Jakarta: UI Press.

Undang-Undang Nomor 5 Tahun 1974 tentang Pokok-

pokok Pemerintahan di Daerah.

Undang-Undang Nomor 22 Tahun 1999 tentang

Pemerintahan Daerah.

Undang-Undang Nomor 25 Tahun 1999 tentang

Perimbangan Keuangan antara Pemerintah Pusat dan

Daerah.

Undang-Undang Nomor 32 Tahun 2004 tentang

Pemerintahan Daerah.

Undang-Undang Nomor 33 Tahun 2004 tentang

Perimbangan Keuangan antara Pemerintah Pusat dan

Pemerintah Daerah.

Undang-Undang Nomor 25 Tahun 2009 tentang Pelayanan

Publik.

Undang-Undang Nomor 28 Tahun 2009 tentang Pajak

Daerah dan Retribusi Daerah.

Undang-Undang Nomor 23 Tahun 2014 tentang

Pemerintahan Daerah

Warsito 2007. Dinamika Administrasi Publik Analisis

Empiris Seputar Isu-Isu Kontemporer dalam

Administrasi Publik. Yogyakarta: Pustaka Pelajar dan

Program Magister Administrasi Publik UGM.

Wibowo, Puji, 2008. Mencermati Dampak Desentralisasi

Fiskal Terhadap Pertumbuhan Ekonomi Daerah.

Journal Keuangan Publik Vol. 5, No. 1, Oktober 2008.

Woller, Gary M. and Phillips, Kerk., 1998. Fiscal

Decentralisation and LDC Economic Growth; An

Empirical Investigation. The Journal of Development

Studies Vol.34 (4).

Xie, D., Zou, H., and Davoodi, H., 1999. Fiscal

Decentralization and Economic Growth in the United

States. Journal of Urban Economics 45:228-239.

Zhang, Tao and Zou, Heng-fu 1998. Fiscal

Decentralization, Public Spending, and Economic

Growth in China. Journal of Public Economics 67:221-

240.

ICOSOP 2022 - International Conference on Social and Political Development 4

232