ELEVEN Data-Set: A Labeled Set of Descriptions of Goods Captured

from Brazilian Electronic Invoices

Vin

´

ıcius Di Oliveira

1,2 a

, Li Weigang

1 b

and Geraldo Pereira Rocha Filho

1 c

1

TransLab, University of Brasilia, Brasilia, Federal District, Brazil

2

Secretary of Economy, Brasilia, Federal District, Brazil

Keywords:

BERT, Electronic Invoice, Labeled Data-set, Short Text, Supervised Learning, Text Classification.

Abstract:

The task of classifying short text through machine learning (ML) models is promising and challenging for eco-

nomic related sectors such as electronic invoice processing and auditing. Considering the scarcity of labeled

short text data sets and the high cost of establishing new labeled short text databases for supervised learning,

especially when they are manually established by experts, this research proposes ELEVEN (ELEctronic in-

VoicEs in portuguese laNguage) Data-Set in an open data format. This labeled short text database is composed

of the product descriptions extracted from electronic invoices. These short Portuguese text descriptions are

unstructured, but limited to 120 characters. First, we construct BERT and other models to demonstrate the

short text classification using ELEVEN. Then, we show three successful cases, also using the data set we de-

veloped, to identify correct products codes according to the short text descriptions of goods captured from the

electronic invoices and others. ELEVEN consists of 1.1 million merchandise descriptions recorded as labeled

short-texts, annotated by specialist tax auditors, and detailed according to the Mercosur Common Nomencla-

ture. For easy public use, ELEVEN is shared on GitHub by the link: https://github.com/vinidiol/descmerc.

1 INTRODUCTION

There is a vast amount of information on the Web,

including images, videos, documents and a colossal

volume of texts. Most of the text data available are

unstructured, which makes it arduous and onerous

to search, analyze and retrieve valuable information

from this source. A labeling process, such as man-

ual annotation could be an expensive solution, which

in some cases, would be prohibitive as a time-costly

task made by expensive labor (Pandolfo and Pulina,

2021). When it comes to short texts, the scenario is

no different. Domain experts are needed for trust-able

labeling and they are hard to find and hire (Du et al.,

2019; Sugrim, 2020). It is possible to notice a short-

age of short texts labeled in English, which is even

greater in Portuguese.

The challenge to build machine learning models

for classifying short texts is huge, especially when

the task needs to analyse beyond Twitter and other

comments on social networks. To construct relevant

a

https://orcid.org/0000-0002-1295-5221

b

https://orcid.org/0000-0003-1826-1850

c

https://orcid.org/0000-0001-6795-2768

and valuable knowledge it is very important to sur-

pass sentiment analysis and move on to semantic clas-

sification. The use of machine learning algorithms is

mandatory to retrieve structured information from un-

structured texts (Ambika, 2020). Thereby, to thrive

on the supervised learning field, an open and truthful

labeled data-set could contribute significantly.

Even with the impressive progress in these fields,

machines are still far from being able to have a com-

plete semantic understanding of the human language

(Maulud et al., 2021; Hitzler et al., 2020; Lake and

Murphy, 2021), so the supervised machine learning

algorithms are quite useful, if not indispensable, in

achieving relevant results.

Research success, both academic and industry,

grows as findings are shared, tested and debated.

Open and free data sets play a very important role in

this challenge, as they can keep parameters of equal

comparison between different models. So different

algorithms and/or different settings can be trained and

evaluated based on the same information (Gasparetto

et al., 2022; Pintas et al., 2021).

This work introduces the ELEVEN Data-Set

(ELEctronic inVoicEs in the portuguese laNguage)

for that purpose. It presents a set of 1,117,623 la-

Di Oliveira, V., Weigang, L. and Filho, G.

ELEVEN Data-Set: A Labeled Set of Descriptions of Goods Captured from Brazilian Electronic Invoices.

DOI: 10.5220/0011524800003318

In Proceedings of the 18th International Conference on Web Information Systems and Technologies (WEBIST 2022), pages 257-264

ISBN: 978-989-758-613-2; ISSN: 2184-3252

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

257

beled records of merchandise descriptions. The an-

notation process was made by tax auditors specialists

following the Mercosur Common Nomenclature pat-

tern. The descriptions were extracted from the Brazil-

ian Electronic Invoice data base, it was made available

by the Secretary of Economy of Bras

´

ılia - Brazil.

As the contributions of this paper beside the

ELEVEN Data-set, we will construct Bidirectional

Encoder Representations from Transformers (BERT)

and other machine learning models to demonstrate

the short text classification using ELEVEN. Then, we

will show three successful cases in the literature, also

using ELEVEN, to identify correct products codes ac-

cording to the short text descriptions of goods cap-

tured from the electronic invoices (Kieckbusch et al.,

2021) and others (Marinho et al., 2022; Schulte et al.,

2022).

The article is organized as follows. After this

introduction, section 2 describes the Brazilian elec-

tronic invoices and Mercosur Common Nomenclature

(NCM) code. Section 3 studies the related work about

the development of the electronic invoice and short

text data-sets. ELEVEN data-set is presented in sec-

tion 4. To show the possible application, section 5

shows BERT and other two model for text classifi-

cation using the proposed data-set. Section 6 reports

three successful cases using ELEVEN data-set. The

last section gives the conclusions of the article.

2 THE BRAZILIAN

ELECTRONIC INVOICE

All trade transactions of goods in Brazil are elec-

tronically recorded. The digital document that keeps

each transaction’s information is called Nota Fiscal

Eletr

ˆ

onica - NFe - Electronic Invoice or Electronic

Tax Bill as a free translation form Portuguese to En-

glish. This document is a XML file transmitted by the

internet between the issuer (seller/remittent) and the

tax administration system - in the case of Bras

´

ılia, the

Secretary of Economy (CONFAZ, 2013).

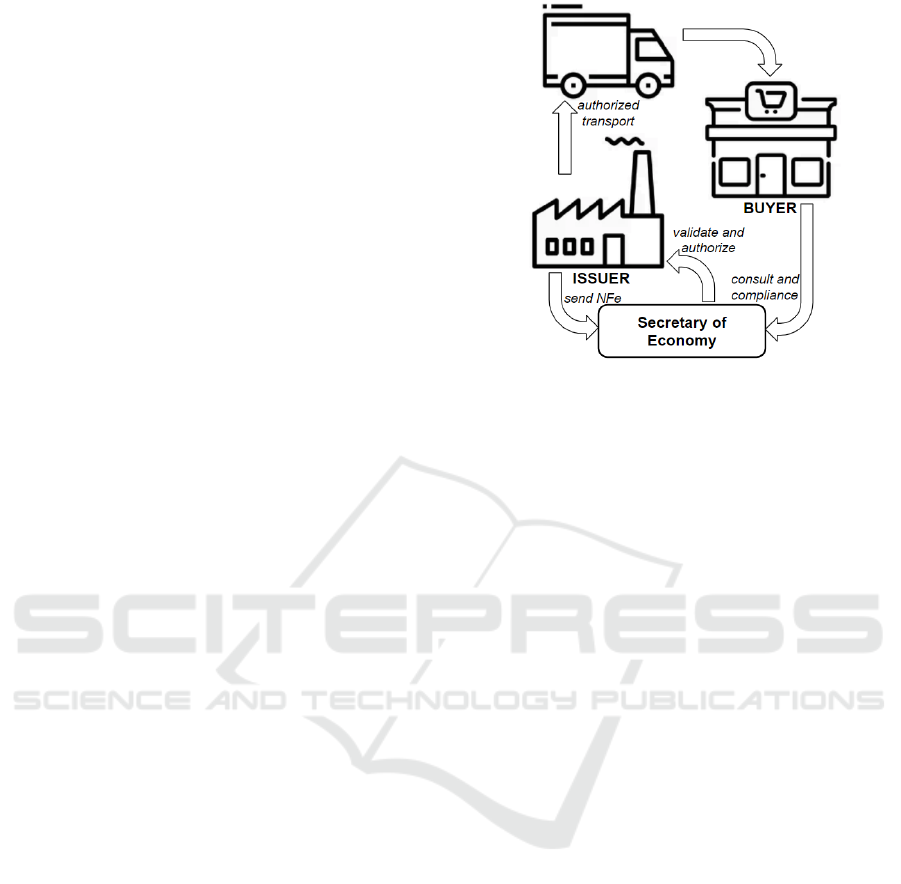

As shown in Figure 1, the issuer sends the NFe file

to the tax administration system which validates, au-

thorizes, and records the transaction. The transport of

the goods is authorized and the delivery to the buyer is

completed. After, the buyer can confirm the compli-

ance requirements consulting the tax administration

website. The communication between the companies

and the tax administration system are made by a web

service link (da Rocha et al., 2018).

The NFe document contains all the information

to identify the seller (or sender), the buyer (or ad-

dressee), the tax information related, the transport

Figure 1: NFe generation and operation flow.

and freight information, and, finally our study ob-

ject, the goods linked to that transaction, including

descriptions, quantities, volumes, tax rate, tax value,

tax codes, accounting codes and NCM code (Merco-

sur Common Nomenclature - NCM).

The NFe document is free to fill, i.e., there is no

validation rule for the inputs. This feature is due to the

declaratory nature of this document. The validation of

the document’s compliance is carried out later by the

tax inspection. So, there is no guarantee that the input

codes (e.g., tax, accounting, and NCM) are correct.

Hence, there is no parameterized reference to com-

pare the correctness of what has been declared. Fill-

ing errors or the intention to deceive the tax authori-

ties can happen. Anyway, the description of the goods

must correspond correctly with the goods to which

that NFe refers, after all, the buyer will check the

correctness of the description, as he needs to confirm

what was actually purchased and delivered (de Aguiar

and Gouveia, 2020).

Machine learning models that can read the goods’

description field would be extremely useful, as they

would be used to detect fraud and errors in filling

out invoices, consequently contributing greatly to re-

ducing tax losses currently verified (Sinayobye et al.,

2018; Raghavan and El Gayar, 2019).

The tax administration of Bras

´

ılia began recording

and labeling descriptions to facilitate the automated

process of data cross-referencing. The database pro-

duced resulted in the first version of ELEVEN.

3 RELATED WORK

The adoption of the NFe framework for recording and

controlling all the merchandise transactions in Brazil

WEBIST 2022 - 18th International Conference on Web Information Systems and Technologies

258

increased the tax revenue (Vieira et al., 2019), en-

hanced mechanisms to face tax evasion (de Aguiar

and Gouveia, 2020) and, by companies’ side, it im-

proved the tax compliance systems and internal au-

dit procedures (Codesso et al., 2020). In the Logistic

field, as the NFe document has the information of the

sender and the receiver, the data stored in electronic

tax invoices were used as the main input for the al-

location process for generating distribution routes for

cargo vehicles in urban areas (Pipicano et al., 2021).

As this work presents a data-set of labeled short

texts extracted from the Brazilian electronic invoices

(NFe), the following subsections will show works that

illustrate de NFe relevance in information technolo-

gies applications and point out some short text data

sets.

3.1 NFe for Information Technology

Ground

In the field of high-performance processing of large

data-sets, (da Rocha et al., 2018) analyzes the perfor-

mance of SQL queries on Hadoop comparing it with

an RDBMS-based approach. The study focuses on a

large set of NFe electronic invoice data.

The Brazilian electronic invoices have been used

in several studies across other fields, especially in Ar-

tificial Intelligence. A work (dos Santos Neto et al.,

2022) proposes that using Artificial Intelligence it

is possible to find potential customers for a prod-

uct. They present a methodology developed to iden-

tify pent demand by analyzing the NFe electronic in-

voices. Using the information collected in the elec-

tronic invoices, it was possible to quantitatively evalu-

ate the existence of pent-up demand for some product

in a specific region and then create decision support

mechanisms. The experiment observed that 13,6% of

products presented a strong indication of pent-up de-

mand.

More about Artificial Intelligence applications,

(Lucena et al., 2022) proposes an approach to inspect

invoices and extract information about measures and

units from goods descriptions. They used a neural

network with the BiLSTM-CRF architecture, a com-

bination of a long short-term memory (LSTM) and

a conditional random field (CRF). This method vali-

dates product quantity information to verify whether

any product was bought or sold by the enterprise with-

out issuing an NFe electronic invoice.

Other study (Mendes Thame Denny et al., 2021)

defined the creation of a tax credit clearinghouse

and analyzes the applicability of blockchain and Dis-

tributed Ledger Technology - DLT to the Brazilian

Electronic Invoice System. They set the adoption of

Hyperledger Composer Fabric as an encrypted frame-

work that would be able to create a secure environ-

ment for the storage and analysis of information by

using DLT, so it presents itself as a solution to address

privacy and security concerns of the stakeholders.

3.2 Short Text Data-Sets

Other relevant data-sets are embodying short texts.

The term “common data sets” was used by (Tang

et al., 2022) when referring to three well-known data

sets: Yago (Suchanek et al., 2008), Freebase (Bol-

lacker et al., 2007), and Probase (Wu et al., 2012).

They are called “common” because they represent

general content and can be used by non-professional

information and any researcher.

YAGO, A Large Ontology from Wikipedia and

WordNet, presents with high coverage and precision a

large ontology. It brings content from Wikipedia and

WordNet in more than 1.7 million entities and 15 mil-

lion facts. There is a taxonomic hierarchy as well as

semantic relations between the entities. It maintains

compatibility with RDFS while allows representing n-

ary relations in a natural way (Suchanek et al., 2008).

Freebase, a Shared Database of Structured Gen-

eral Human Knowledge, is a graph-shaped database

of structured general human knowledge. It is a store

of large data objects such as text documents, images,

sound files, and software. The primary method of

access to Freebase is through its public HTTP-based

API which contains tools for the collaborative design

of simple types and properties. The data in Freebase

consists of millions of topics and tens of millions of

relationships between them (Bollacker et al., 2007).

Probase, a Probabilistic Taxonomy For Text Un-

derstanding, contains 2.7 million concepts harnessed

automatically from a corpus of 1.68 billion web pages

as well as it uses probabilities to model inconsistent,

ambiguous, and uncertain information it contains (Wu

et al., 2012). It was used as a source for short text un-

derstanding studies with semantic concepts (Ji et al.,

2019; Shi et al., 2018) and used to empower an engine

for products review analysis as a knowledge source

(Luo et al., 2019).

There are other short text data-sets for specific

themes. The Twitter data set could be set or sec-

tioned by specific subjects, e.g. for COVID-19 re-

search (Chen et al., 2020), natural disaster perception

(Alam et al., 2018), and the foremost use for senti-

ment analysis (Zimbra et al., 2018). And the Amazon

Fine Foods reviews (McAuley and Leskovec, 2013).

Those were just examples, as the whole list would be

too extensive and uncountable.

ELEVEN Data-Set: A Labeled Set of Descriptions of Goods Captured from Brazilian Electronic Invoices

259

4 THE ELEVEN DATA-SET

The ELEVEN construction started in 2017 with a

team of tax auditors specialists in the inspection of

that kind of operations. Every month the data-set is

updated with new descriptions captured by the tax

administration system and so on. The result of that

work, the more than one million labeled descriptions

data-set, was shared with the authors for academic

study purposes.

The verification and calculation of the tax due is

done electronically on large masses of data. Such

analysis depend on reading the fields filled in the NFe.

The field referring to the product description, named

XPROD, is the most reliable as it is printed and sent

attached with the merchandise, so the purchaser of

the goods usually checks it for order compliance rea-

sons or warranty issues, on the other hand, it is a text

(field of type string), and upper limit of 120 char-

acters, without any filling pattern, so its automatic

reading and classification become unfeasible by tra-

ditional means of data crossing.

That said, it can be seen that the current main

use of the database has its pros and cons. The di-

rect comparison works effectively but is limited to

perfect matching, character by character, between the

checked fields. Therefore, to solve the problem of the

perfect match must, an artificial intelligence capable

of comparing text descriptions and tax codes, with-

out the perfect match restriction, would improve the

tax inspection actions. Finally, the ELEVEN Data-

Set can be the necessary piece to build that artificial

intelligence.

The ELEVEN Data-Set is composed by four

mains columns in which the 1,117,623 elements are

distributed. The columns are described below.

• XPROD: goods description in the NFe, max.

length of 120 characters. The text is raw, exactly

as it was inserted by the issuer;

• NCM: NCM code inserted in the NFe, 8 fix digits;

• Rotulo: specification of the goods identified by

specialists according to the Common Mercosur

Nomenclature - NCM, i.e., the label, text string;

• Item: A label code annotated by the experts, 2

digits. This can be read as the class label.

The class label codes are indicated in the Item

meaning column on the Table 1.

The ELEVEN Data-Set is available on GitHub in

a zipped csv file named BaseDesc NCM.zip.

[https://github.com/vinidiol/descmerc]

The Common Mercosur Nomenclature - NCM is a

regional nomenclature for the categorization of goods

adopted by Brazil, Argentina, Paraguay, and Uruguay

Table 1: Label code annotated by the experts.

Code Meaning

30 Cachac¸a and spirits

31 Wines, vermouths, ciders, other beverages

38 Perfumery, personal care and cosmetics

39 Cleaning materials

40 Food products

41 Building materials

42 Electrical Material

since 1995. It is used in all foreign trade operations of

Mercosur countries. This nomenclature is an ordered

structure that allows determining a single numerical

code for a given commodity. This code, once known,

starts to represent the commodity itself (Brazil, 2019).

By way of illustration, the sequence of NCM

codes for “Milk” identification can be seen by the fol-

lowing:

• 40: Milk;

• 4002: Milk and cream concentrated or with added

sugar or other sweeteners.;

• 400221: Milk with no sugar and no sweeteners;

• 40210210: Whole milk.

The Figure 2 illustrates the distribution of records

among code classes, as well as shows the number of

records per code class in descending order of occur-

rences.

Figure 2: Illustration of records occurrences.

Data Protection and Tax Secrecy. The data exposed

does not violate the tax secrecy of companies issu-

ing and/or receiving the invoices, as they only show

the description of the goods listed in the electronic in-

voices, as can be verified by any consumer when pur-

chasing a product, as well as no financial reference

that can demonstrate pricing values or profit rates.

The NCM codes are in the public domain and widely

available. There will be mentions of product brands in

the descriptions, but for the reasons explained above,

WEBIST 2022 - 18th International Conference on Web Information Systems and Technologies

260

this indication remains to assure the tax secrecy of

the brands. The authors had authorized access to the

database by the Sub-Secretariat of Revenue of the

State Department of Economy of Brasilia, respecting

the premises indicated above regarding tax secrecy.

All references to values, units, and quantities have

been removed.

5 CLASSIFICATION CASE

MODELING

In order to demonstrate the feasibility of using the

Data-Set as a basis for a text classifier, a modeling

essay was built and shared in this section. The cho-

sen task was text classification, where the models will

classify the goods’ descriptions (inputs, “XPROD”)

conforming to the given label (outputs, “Item”). Ac-

cording to the nature and purpose of this Data-Set, the

chosen models are supervised learning algorithms.

A sample of 15,000 labeled descriptions is also

shared at the same GitHub page in another csv file

named AmostraDescMerc.csv. This file is a random

sample of three item categories: 38 - Perfumery, per-

sonal care, and cosmetics; 39 - Cleaning materials;

and 40 - Food products. The file is composed of 5,000

records from each category. It is also available a R

code for modelling the sample data-set, the results are

shown in this section.

These are the tested classification prediction mod-

els: KNN, GBM, ANN, and BERT.

The sample data-set was splitted in three parts

on the following proportions, 70%, 20% and 10%

for training, validation and test, respectively. The

Gradient Boosting Machine (GBM), Artificial Neu-

ral Network (ANN) and Pre-training of deep bidi-

rectional transformers for language understanding

(BERT) models settings are presented as follow.

• GBM: ntrees = 1000, max depth = 3;

• ANN: 3 layers of 150, 300, 150 neurons, in 20

epochs.

• BERT: Number of Word = 5000, max length =

150, batch size of 8, and learning rate of 2× 10

−5

in three epochs of training.

The complete code used in this study is shared on

the GitHub folder indicated above. The predictions

results of the three models are presented below. The

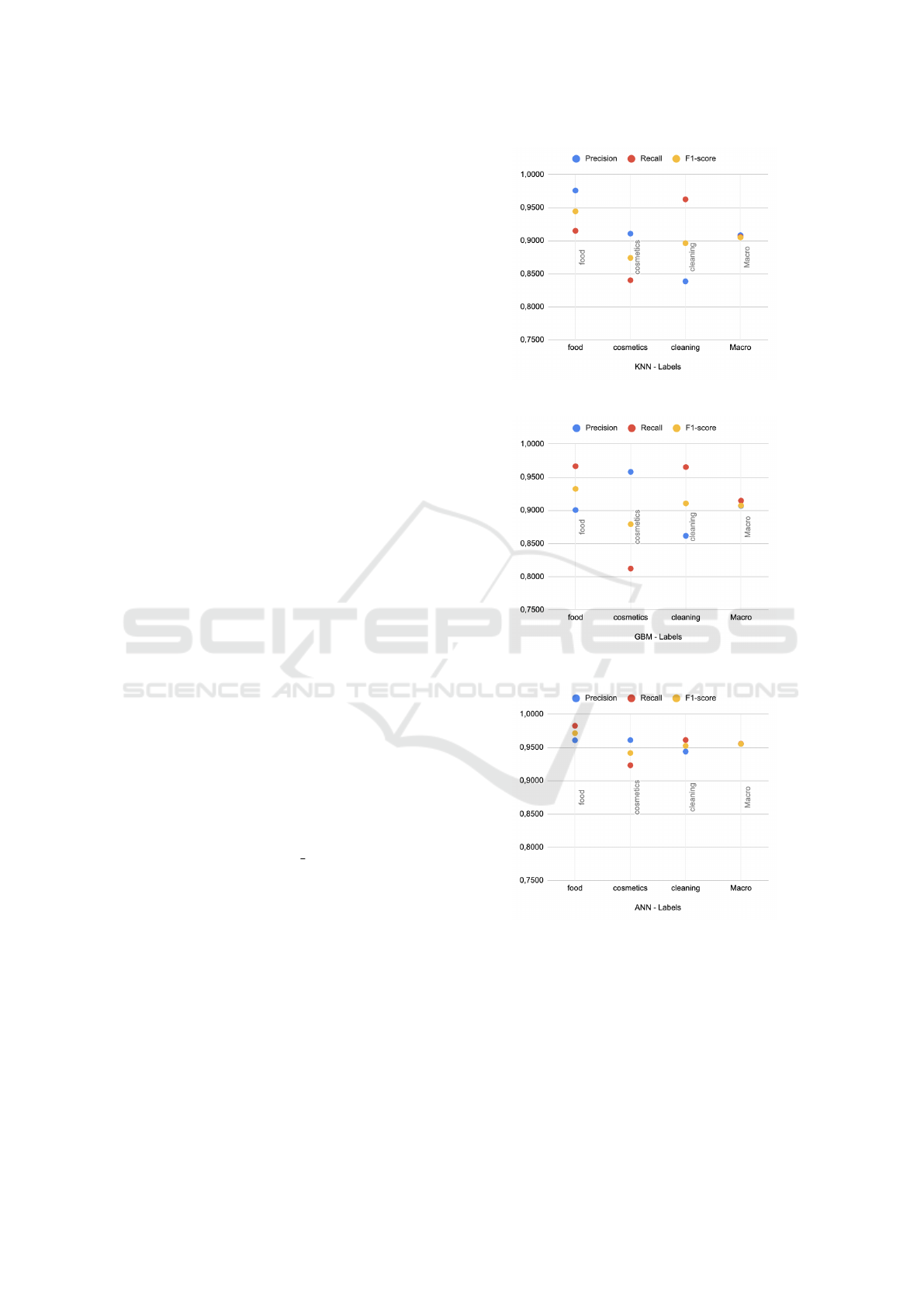

KNN in Figure 3, the GBM in Figure 4, and the ANN

in Figure 5. In those figures, the “Macro” value con-

cerns the metrics of the model as a whole.

The neural network architecture was conceived by

testing various layouts, some of them are shown in the

Figure 3: KNN model results.

Figure 4: GBM model results.

Figure 5: ANN model results.

Table 2. The choice criterion was the best accuracy,

so the Table 2 shows the architectures in descend-

ing order of the achieved accuracy values. Therefore,

the architecture chosen was one of three layers with

150, 300, and 150 neurons respectively, in 20 train-

ing epochs. The accuracy achieved is 95.52% and the

AUC is 0.9998. The GBM model achieved an accu-

racy of 90.63% and the AUC of 0.9892.

The results presented indicates consistency with

ELEVEN Data-Set: A Labeled Set of Descriptions of Goods Captured from Brazilian Electronic Invoices

261

the purpose of the ELEVEN Data-Set and with the re-

sults of these algorithms found in similar tasks of text

classification (Kadhim, 2019; Kowsari et al., 2019;

Thangaraj and Sivakami, 2018).

Relevant results have already been achieved with

a CNN model using the ELEVEN Data-Set in another

study by (Kieckbusch et al., 2021). The sampling

classes chosen were different from those picked for

this study, however the Accuracy achieved with the

CNN model was 0.97. More details about this work

are in the next section.

Table 2: ANN Architectures (20 epochs).

L1 L2 L3 L4 Acc. AUC

150 300 150 - 0.9552 0.9998

100 200 100 - 0.9514 0.9998

40 40 - - 0.9511 0.9999

30 60 60 30 0.9481 0.9999

30 60 30 - 0.9474 0.9998

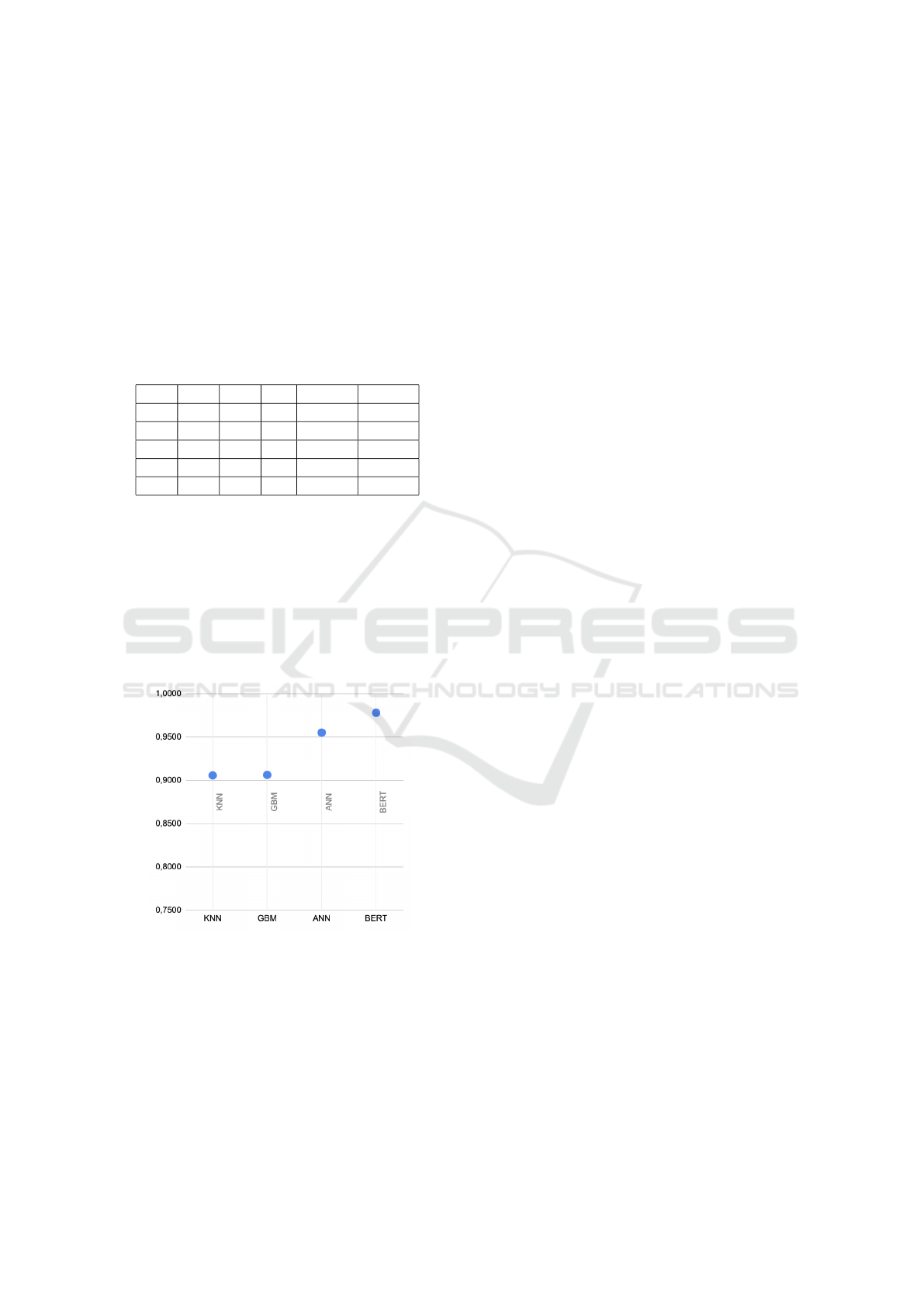

The BERT model (Devlin et al., 2018), one of

the most prominent state-of-art models (Acheampong

et al., 2021; Bhavani and Santhosh Kumar, 2021; Mi-

naee et al., 2021), achieved the best result with the

data sample used for this experiment, an accuracy of

0.98. The Figure 6 compares the accuracy results

from the models tested. The script used for the BERT

model is also available on the aforementioned GitHub

page.

Figure 6: Tested Models Accuracy.

Although some advances achieved in how to inter-

pret neural networks, they are still hard to explain and

understand (Oh et al., 2019; Buhrmester et al., 2021).

Explain why and how the model classified one de-

scription different from another one is not simple, es-

pecially when facing stakeholders’ inquiries, explain-

ability is a very important issue (Sokol and Flach,

2020). In some cases, there are legal requirements

that demand machine learning model interpretability

(Bibal et al., 2021), i.e., the algorithm predictions

(outputs) would be understood somehow by the users.

That said, looking for the best implementation op-

tions, other models must be taken into account when

their performance is close to the neural networks.

6 THE ELEVEN APPLICATION

IN OTHER STUDIES

Recently, the labeled data-set from descriptions of

goods, extracted from this electronic invoices, has

been a source of data support for published studies.

ELEVEN data-set has been applied in three cases in

literature.

A Convolutional Neural Network (CNN) based

system, named SCAN-NF (Kieckbusch et al., 2021),

thrived to classify Electronic Invoices based on goods

descriptions. SCAN-NF was built to identify cor-

rect products codes based on the short-text descrip-

tions of goods captured form the electronic invoices.

The SCAN-NF presents and compares two models.

The first is a single CNN. The second is an ensem-

ble model built from two binary classifiers which had

achieved the best performance.

For Data visualization purpose, Marinho and oth-

ers presented a method for visualizing electronic in-

voices to support tax inspectors to detect suspicious

cases of tax frauds using point placement strategies

(Marinho et al., 2022). Their experimental results

with ELEVEN validated that proposed method ac-

cording to the visualizations’ quality by introducing a

case study which simulate the discovery of suspicious

invoices considering a subset of selected products.

A framework for clustering short-text data in the

NF-es using an automatic encoder to cluster data was

proposed by (Schulte et al., 2022) so called ELINAC.

It makes the task of clustering similar data by the

short-text descriptions and improve anomaly detec-

tion in numeric fields.

7 CONCLUSIONS

This research emphasizes the importance of providing

open access to large labeled data sets for the develop-

ment of machine learning algorithms in economic re-

lated applications. Especially because there are a few

data sets of this type and they are expensive to build.

Similarly, the challenge faced by the tax authorities

in verifying the correctness of the electronic invoice

information have also been proved. It is worth noting

WEBIST 2022 - 18th International Conference on Web Information Systems and Technologies

262

that the description text is not structured and there are

no filling rule, but it is very small, with a maximum

of 120 characters.

The ELEVEN Data-Set was introduced as data re-

sources and a tool to improve the solutions to both

problems. It can be used as a benchmark to enhance

machine learning models for short text classification,

and to improve tax inspection behavior on fraud de-

tection in electronic invoices. According to the de-

scriptive nature of the labeled records themselves, the

prediction tasks could focus on the semantic meaning

of the analyzed text.

Given the presented results, it was shown that the

product descriptions indicated in the electronic in-

voices could be input into the machine learning mod-

els used for goods classification. To demonstrate that

fact, this research shows that the BERT model has

satisfactory performance for this kind of text mining

task. Three successful case studies in literature were

also reported to show the applicability of ELEVEN

Data-set for economic related applications.

Future works. Beyond text classifications by su-

pervised learning, the ELEVEN Data-set could be

used for web scraping tasks as the descriptions sets

could be reference for searching rules. It would be

valuable to use ELEVEN in the pre-training task of

investigating deep learning model. The fitness of data

sets of other Latin languages could also be verified

and measured.

ACKNOWLEDGEMENTS

Our sincere gratitude to the Secretary of Economy

of Bras

´

ılia, especially the auditor Ary Silva J

´

unior,

who, in addition to leading the data-set construction

project, kindly shared the data for this study.

REFERENCES

Acheampong, F. A., Nunoo-Mensah, H., and Chen, W.

(2021). Transformer models for text-based emotion

detection: a review of bert-based approaches. Artifi-

cial Intelligence Review, 54(8):5789–5829.

Alam, F., Ofli, F., and Imran, M. (2018). Crisismmd: Mul-

timodal twitter datasets from natural disasters. In

Twelfth international AAAI conference on web and so-

cial media.

Ambika, P. (2020). Machine learning and deep learning

algorithms on the industrial internet of things (iiot).

Advances in computers, 117(1):321–338.

Bhavani, A. and Santhosh Kumar, B. (2021). A review

of state art of text classification algorithms. In 2021

5th International Conference on Computing Method-

ologies and Communication (ICCMC), pages 1484–

1490.

Bibal, A., Lognoul, M., De Streel, A., and Fr

´

enay, B.

(2021). Legal requirements on explainability in

machine learning. Artificial Intelligence and Law,

29(2):149–169.

Bollacker, K., Cook, R., and Tufts, P. (2007). Freebase: A

shared database of structured general human knowl-

edge. In AAAI, volume 7, pages 1962–1963.

Brazil, R. F. d. (2019). Ncm - nomenclatura comum do

mercosul. url: https://www.gov.br/receitafederal/pt-

br/assuntos/aduana-e-comercio-

exterior/classificacao-fiscal-de-mercadorias/ncm.

Buhrmester, V., M

¨

unch, D., and Arens, M. (2021). Analysis

of explainers of black box deep neural networks for

computer vision: A survey. Machine Learning and

Knowledge Extraction, 3(4):966–989.

Chen, E., Lerman, K., and Ferrara, E. (2020). Tracking

social media discourse about the covid-19 pandemic:

Development of a public coronavirus twitter data set.

JMIR public health and surveillance, 6(2):e19273.

Codesso, M., de Freitas, M. M., Wang, X., de Carvalho,

A., and da Silva Filho, A. A. (2020). Continuous au-

dit implementation at cia. hering in brazil. Journal

of Emerging Technologies in Accounting, 17(2):103–

118.

CONFAZ, B. (2013). Sistema integrado de informac¸

˜

oes

econ

ˆ

omicas e fiscais SINIEF. Minist

´

erio da

Fazenda/CONFAZ conv

ˆ

enio s/n de 15 de dezembro

de 1970.

da Rocha, C. C., Boufleur, M. P., da Silva Fornasier, L.,

Narciso, J. C., Charao, A. S., Maran, V., Lima, J.

C. D., and de Oliveira Stein, B. (2018). Sql query

performance on hadoop: An analysis focused on large

databases of brazilian electronic invoices. In ICEIS

(1), pages 29–37.

de Aguiar, G. N. and Gouveia, L. B. (2020). The bene-

fits’ program of electronic invoice as a tool to tackle

tax evasion. International Journal of Advanced Engi-

neering Research and Science, 7(11):391–400.

Devlin, J., Chang, M.-W., Lee, K., and Toutanova, K.

(2018). Bert: Pre-training of deep bidirectional trans-

formers for language understanding. arXiv preprint

arXiv:1810.04805.

dos Santos Neto, A. B., Batista, M. d. C. M., and Fer-

reira, T. A. (2022). Support decision system based

on invoices data mining to estimate commercial pent-

up demands. Expert Systems with Applications, page

117204.

Du, M., Liu, N., and Hu, X. (2019). Techniques for in-

terpretable machine learning. Communications of the

ACM, 63(1):68–77.

Gasparetto, A., Marcuzzo, M., Zangari, A., and Albarelli,

A. (2022). A survey on text classification algorithms:

From text to predictions. Information, 13(2):83.

Hitzler, P., Bianchi, F., Ebrahimi, M., and Sarker, M. K.

(2020). Neural-symbolic integration and the semantic

web. Semantic Web, 11(1):3–11.

ELEVEN Data-Set: A Labeled Set of Descriptions of Goods Captured from Brazilian Electronic Invoices

263

Ji, L., Wang, Y., Shi, B., Zhang, D., Wang, Z., and Yan,

J. (2019). Microsoft concept graph: Mining semantic

concepts for short text understanding. Data Intelli-

gence, 1(3):238–270.

Kadhim, A. I. (2019). Survey on supervised machine learn-

ing techniques for automatic text classification. Artifi-

cial Intelligence Review, 52(1):273–292.

Kieckbusch, D. S., Geraldo Filho, P., Di Oliveira, V., and

Weigang, L. (2021). Scan-nf: A cnn-based system for

the classification of electronic invoices through short-

text product description.

Kowsari, K., Jafari Meimandi, K., Heidarysafa, M., Mendu,

S., Barnes, L., and Brown, D. (2019). Text classifica-

tion algorithms: A survey. Information, 10(4):150.

Lake, B. M. and Murphy, G. L. (2021). Word meaning in

minds and machines. Psychological review.

Lucena, L. F., de Menezes e Silva Filho, T., do R

ˆ

ego, T. G.,

and Malheiros, Y. (2022). Automatic recognition of

units of measurement in product descriptions from

tax invoices using neural networks. In Pinheiro, V.,

Gamallo, P., Amaro, R., Scarton, C., Batista, F., Silva,

D., Magro, C., and Pinto, H., editors, Computational

Processing of the Portuguese Language, pages 156–

165, Cham. Springer International Publishing.

Luo, Z., Huang, S., and Zhu, K. Q. (2019). Knowledge

empowered prominent aspect extraction from prod-

uct reviews. Information Processing & Management,

56(3):408–423.

Marinho, M., Oliveira, V., Neto, S., Weigang, L., and

Borges, V. (2022). Visual Analysis of Electronic In-

voices to Identify Suspicious Cases of Tax Frauds,

chapter ICITS 2022 Lecture Notes in Networks and

Systems, pages 185–195. Springer.

Maulud, D. H., Zeebaree, S. R., Jacksi, K., Sadeeq, M.

A. M., and Sharif, K. H. (2021). State of art for seman-

tic analysis of natural language processing. Qubahan

Academic Journal, 1(2):21–28.

McAuley, J. and Leskovec, J. (2013). From amateurs to

connoisseurs: Modeling the evolution of user exper-

tise through online reviews. International World Wide

Web Conference Committee IW3C2.

Mendes Thame Denny, D., Ferreira Paulo, R., and Crespo

Queiroz Neves, F. (2021). Technological alternative

to tax compensation (icms credits): Case study of the

feasibility of using dlt in the brazilian electronic in-

voice system. Braz. J. Pub. Pol’y, 11:520.

Minaee, S., Kalchbrenner, N., Cambria, E., Nikzad, N.,

Chenaghlu, M., and Gao, J. (2021). Deep learning–

based text classification: a comprehensive review.

ACM Computing Surveys (CSUR), 54(3):1–40.

Oh, S. J., Schiele, B., and Fritz, M. (2019). Towards

reverse-engineering black-box neural networks. In

Explainable AI: Interpreting, Explaining and Visual-

izing Deep Learning, pages 121–144. Springer.

Pandolfo, L. and Pulina, L. (2021). Arkivo dataset: A

benchmark for ontology-based extraction tools.

Pintas, J. T., Fernandes, L. A., and Garcia, A. C. B. (2021).

Feature selection methods for text classification: a

systematic literature review. Artificial Intelligence Re-

view, 54(8):6149–6200.

Pipicano, E. F. M., Arias-Rojas, W., dos Santos, E. M., and

Fonseca, A. P. (2021). Roterisation allocation for ur-

ban freight transport, using data from electronic tax

invoices: Case study federal district of brazil. Journal

of Tianjin University Science and Technology, 54(11).

Raghavan, P. and El Gayar, N. (2019). Fraud detection us-

ing machine learning and deep learning. In 2019 in-

ternational conference on computational intelligence

and knowledge economy (ICCIKE), pages 334–339.

IEEE.

Schulte, J., Giuntini, F., Nobre, R., Nascimento, K.,

Meneguette, R., Weigang, L., Gonc¸alves, V., and

Filho, G. (2022). Elinac: Autoencoder approach for

electronic invoices data clustering. Applied Sciences,

12:3008.

Shi, Q., Wang, Y., Sun, J., and Fu, A. (2018). Short text un-

derstanding based on conceptual and semantic enrich-

ment. In International Conference on Advanced Data

Mining and Applications, pages 329–338. Springer.

Sinayobye, J. O., Kiwanuka, F., and Kyanda, S. K.

(2018). A state-of-the-art review of machine learn-

ing techniques for fraud detection research. In 2018

IEEE/ACM symposium on software engineering in

africa (SEiA), pages 11–19. IEEE.

Sokol, K. and Flach, P. (2020). Explainability fact sheets:

a framework for systematic assessment of explainable

approaches. In Proceedings of the 2020 Conference

on Fairness, Accountability, and Transparency, pages

56–67.

Suchanek, F. M., Kasneci, G., and Weikum, G. (2008).

Yago: A large ontology from wikipedia and wordnet.

Journal of Web Semantics, 6(3):203–217.

Sugrim, S. (2020). Robust models and evaluation for sys-

tems security research. PhD thesis, Rutgers The State

University of New Jersey, School of Graduate Studies.

Tang, Z., Dai, D., Chen, Z., and Chen, T. (2022). Short

text classification combining keywords and knowl-

edge. In 2022 2nd International Conference on Con-

sumer Electronics and Computer Engineering (IC-

CECE), pages 662–665.

Thangaraj, M. and Sivakami, M. (2018). Text classifi-

cation techniques: a literature review. Interdisci-

plinary Journal of Information, Knowledge, and Man-

agement, 13:117.

Vieira, P. A., Pimenta, D. P., Cruz, A. F. d., and Souza, E.

M. S. d. (2019). Effects of the electronic invoice pro-

gram on the increase of state collection. Revista de

Administrac¸

˜

ao P

´

ublica, 53:481–491.

Wu, W., Li, H., Wang, H., and Zhu, K. Q. (2012). Probase:

A probabilistic taxonomy for text understanding. In

Proceedings of the 2012 ACM SIGMOD International

Conference on Management of Data, pages 481–492.

Zimbra, D., Abbasi, A., Zeng, D., and Chen, H. (2018). The

state-of-the-art in twitter sentiment analysis: A review

and benchmark evaluation. ACM Trans. Manage. Inf.

Syst., 9(2).

WEBIST 2022 - 18th International Conference on Web Information Systems and Technologies

264