Assessing Energy-related Markets through Multifractal Detrended

Cross-correlation Analysis

Andrii Bielinskyi

1a

, Vladimir Soloviev

1b

, Serhiy Semerikov

1c

, Victoria Solovieva

2d

,

Andriy Matviychuk

3e

and Arnold Kiv

4f

1

Kryvyi Rih State Pedagogical University, 54, Gagarin av., Kryvyi Rih, Ukraine

2

State University of Economics and Technology, 16, Medychna str., Kryvyi Rih, Ukraine

3

Kyiv National Economic University named after Vadym Hetman, 54/1, Peremogy pr., Kyiv, Ukraine

4

Ben-Gurion University of the Negev, 653, P.O.B., Beer-Sheva, Israel

Keywords: Crude Oil, Natural Gas, Sustainable Development, Multifractality, Multifractal Detrended Cross-Correlation

Analysis, Cross-Correlations.

Abstract: Regulatory actions aimed the sustainable development force ordinary traders, policymakers, institutional

investors to develop new types of risk management strategies, seek better decision-making processes that

would allow them more effectively reallocate funds when trading and investing in energy markets such as oil

and gas. Due to their supply and demand, they are presented to non-equilibrium, chaotic, long-range

dependent, etc. Oil and gas play an important role not only in the financial markets, but they are important in

many goods and services, and their extensive usage leads to environmental damage. Thus, the dynamics of

the corresponding energy-related indices is a useful indicator of the current environmental development, and

their modeling is of paramount importance. We have addressed one of the methods of multifractal analysis

which is known as Detrended Cross-Correlation Analysis (DCCA) and its multifractal extension (MF-DCCA)

to get reliable and efficient indicators of critical events in the oil and gas markets. For example, we have taken

daily data of Henry Hub natural gas spot prices (US$/MMBTU), WTI spot prices (US$/BBL), and Europe

Brent spot prices (US$/BBL) from 7 February 1997 to 14 December 2021. Regarding their (multifractal)

cross-correlations, we get such indicators as the DCCA coefficient 𝜌

, the cross-correlation Hurst

exponent, the maximal, minimal, and mean singularity strength, the width of multifractality, and its

asymmetry with the usage of sliding window approach. Our empirical results present that all of the presented

indicators respond characteristically during crashes and can be effectively used for modeling current and

further perspectives in energy markets and sustainable development indices.

1 INTRODUCTION

The largest and most developed countries are aimed

at sustainable development. Both natural gas and

crude oil prices demonstrate the general pattern of

current trends in the world, particularly, in the

development of our environment.

There were some discussions about whether

natural gas and oil prices appear to be price-related.

a

https://orcid.org/0000-0002-2821-2895

b

https://orcid.org/0000-0002-4945-202X

c

https://orcid.org/0000-0003-0789-0272

d

https://orcid.org/0000-0002-8090-9569

e

https://orcid.org/0000-0002-8911-5677

f

https://orcid.org/0000-0002-0991-2343

Compared to natural gas, which tends to be regionally

determined, the crude oil market represents the state

of the whole world. Therefore, it is discussible which

indices of the energy-related market to use for

identification of possible trends in the green

economy.

Both supply and demand on the energy market

form complex, non-stationary, irreversible, non-

equilibrium, and multifractal dynamics in these

456

Bielinskyi, A., Soloviev, V., Semerikov, S., Solovieva, V., Matviychuk, A. and Kiv, A.

Assessing Energy-related Markets through Multifractal Detrended Cross-correlation Analysis.

DOI: 10.5220/0011365500003350

In Proceedings of the 5th International Scientific Congress Society of Ambient Intelligence (ISC SAI 2022) - Sustainable Development and Global Climate Change, pages 456-467

ISBN: 978-989-758-600-2

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

markets. These characteristics are reflected in fat-tails

(Mandelbrot, 2021) of the probability distribution of

these markets and their autocorrelation functions

(Aloui and Mabrouk, 2010; Herrer et al., 2017).

Mandelbrot presented “fractals” to deal with such

irregularities (Mandelbrot, 1967).

Then, there was proposed and revised Rescaled

Range Analysis (R/S) by (Hurst, 1951), and it was

revised by (Lo, 1991) for studying short- and long-

range dependences in a time series. Then, there was

proposed Detrended Fluctuation Analysis by (Peng et

al., 1994), and (Kantelhardt et al. 2002) extended it to

the multifractal version (MF-DFA), which can

explore efficiency, short- and long-term memory, etc.

over multiple scales. This approach is one of the most

reliable in defining multifractal characteristics in non-

stationary time series. Except for previous ones,

(Podobnik & Stanley, 2008) proposed to study

power-law cross-correlations between several series.

That method was called Detrended Cross-

Correlational Analysis (DCCA). Then, (Zebende

2011) proposed DCCA cross-correlation coefficient

for detrended covariance fluctuation functions of time

series.

Previously, we devoted our papers to stock,

crypto, and sustainable development indices. We

studied them using different measures of complexity:

Information entropy and its modifications,

Recurrence analysis, graph-based measures,

irreversibility measures, quantum indicators, and

particularly, classical MF-DFA method and random

matrix theory to study cooperative behavior among

different cryptocurrencies and stock indices

(Bielinskyi et al., 2021b; Bielinskyi et al., 2020;

Soloviev et al., 2019; Bielinskyi et al., 2021;

Bielinskyi et al., 2021). In this paper, we would like

to make an analysis of energy-related markets such as

WTI and Europe Brent crude oil with Henry Hub

natural gas spot markets in terms of the (MF-)DCCA

approach. According to this method, we expect to get

reliable indicators of crash phenomena in the

mentioned market. Such indicators of complexity

would be useful for traders, institutional investors,

governments, who are looking for better decision-

making processes, more effective risk management

strategies during trading, and it would be useful for

those who care about modeling and forecasting the

sustainable development in the world.

2 REVISION OF THE PREVIOUS

STUDIES

Different studies were devoted to the monitoring and

forecasting of the crude oil and natural gas prices,

CO₂ emissions.

As an example, the study of (Hoayek et al., 2020)

aimed to measure the power and efficiency of

information reflected in gas prices using different

econometric and mathematical models of the

information, records, and game theories. In their

paper, they studied the dynamics of Henry Hub and

National Balancing point gas markets as they are

considered to be one of the most developed hubs in

the U.S. and Europe. For both markets, the authors

chose three indicators: level of competition, price

stability, and price uncertainty. Regarding

conditional and Shannon entropy, the authors reduced

the amount of uncertainty in the given indicators and

defined how informative and reliable was their

recommendations from given metrics. Their approach

emphasized that additional measures need to be

applied to the European gas market. For the U.S. gas

market, the situation is stable. As authors point out,

their study needs additional growth: to include more

mathematical/statistical analysis, the greater number

of observations, indicators. Also, they mention that

problems appear with the probability distribution

needed for Shannon entropy and its analogs, which

requires additional work on creating methods for the

computation of the underlying probability

distribution of each indicator. The study made by (Joo

et al., 2020) examined the effect of the 2008 global

financial crisis on the crude oil market (WTI crude oil

spot prices) with the usage of Hurst exponent,

Shannon entropy, and the scaling exponent. They

investigated how changed efficiency, long-term

equilibrium, and collective phenomena before and

after the crash. According to their analysis, there was

not much difference in volatility of the crude oil

market before and after the crash. Period before crash

remained efficient according to Hurst exponent

(

𝐻=0.50 ± 0.01

)

, displaying a random walk of

WTI prices. After the crash oil prices remained

persistent

(

𝐻=0.55 ± 0.01

)

, and then, after 2010,

prices started to behave anti-persistently

(

𝐻=

0.45 ± 0.01

)

. According to Shannon entropy, the

overall market behavior was closer to long-term

equilibrium (higher entropy). However, after the

crash its entropy started to reduce, indicating the

presence of long-term memory effect, dynamics far

from equilibrium. Scale-free properties remained

after that outbreak, which demonstrates the power-

Assessing Energy-related Markets through Multifractal Detrended Cross-correlation Analysis

457

law exponent. This exponent decreased, implying that

the probability of observing double returns became

higher. (Lautie et al., 2019) investigated price

relationships across WTI crude oil futures using the

concept of mutual information and information flows.

Their study presents rolling window dynamics for

mutual information to investigate how it behaves

during several structural shocks in this market.

Mutual information increased noticeably in 2004 but

dropped sharply in 2012-2014. Thus, different parts

of the term structure of WTI futures prices became

less correlated. Also, the researchers applied the

concept of Transfer entropy to study information

flows between contracts with different periods. They

found that short-dated contracts emit more

information, and, after 2012, flows in forward and

backward directions were almost the same, but if to

look at the whole trading period, they are presented to

be more volatile compared to middle-dated contracts.

(Hu et al., 2021) said about a common method for

evaluating energy use in energy resource exploitation

and method for evaluating it which is called energy

return on investment. There, they proposed an

interpretation of this method in terms of entropy.

They considered an energy resource exploitation

system to be a kind of dissipative system. Then, they

derived a relation between energy return on

investment and entropy change. The authors

emphasized that future development of energy return

on investment and its related indicators must be done

in terms of entropy theory.

Some of the studies devoted to oil and gas markets

included methods of fractal and multifractal analysis.

As an example, (Engelen et al., 2011) studied the spot

rate dynamics of Very Large Gas Carriers regarding

MF-DFA and rescaled range analysis. Studying

logarithmic returns of the daily spot rates, they

concluded that freight rates exhibited persistent

behavior. Most of the time time-depended Hurst

exponent was around 0.7. Comparing multifractal

characteristics of initial and shuffled data, they found

long-range correlations to prevail rather that fat tails

in the probability distribution. The impact of the

coronavirus pandemic on the multifractality of gold

and oil prices based on upward and downward trends

was examined by (Mensi et al., 2020). Such an

interesting approach was applied as asymmetric

detrended fluctuation analysis to study 15-min

interval intraday data. Results presented that as time

scale increased, asymmetric multifractality also

increased. According to their conclusions,

multifractality is especially high for the downtrend of

Brent oil and upward trend of gold. That

asymmetrical multifractality was strengthened during

COVID-19. Interestingly, during the pandemic

period, both markets became more inefficient (less

complex). Overall, the asymmetric analysis is also a

powerful instrument for tracking the investor’s

sentiments and applying more wise decisions when

trading at high-frequency time scales. (Garnier &

Solna, 2019) studied WTI and Brent oil price data for

the period 1997-2016 with the usage of wavelet-based

decomposition, Hurst exponent, and volatilities. The

estimated exponent for Brent is 0.46 and for WTI is

0.44, which told about their mean-reverting behavior.

The estimated volatilities were 34% for Brent and

32% for WTI. Analysis of Hurst exponent and

volatilities using sliding window procedure presents

that the nature of both indices is presented to be non-

constant. During crashes volatility is the biggest and

Hurst exponent increases, indicating that those events

are presented to be less efficient (more persistent).

Mass Hub, Mid C, Palo Verde, and PJM West are the

four major electricity indices of the U.S. that were

studied in (Ali et al., 2021) using multifractal

analysis. Researchers found the significant presence

of multifractality in the electricity market. However,

their analysis included a sliding window procedure

that presented varying degrees of multifractality.

According to their results PJM West had the highest

degree of multifractality and Mass Hub had the

lowest i.e., it was presented to be the most efficient,

while PJM was the least efficient. Moreover,

according to the generalized Hurst exponent, at 𝑞=

2, all indices appeared to be anti-persistent (mean-

reverting). The rolling window procedure presents

that even not for the whole time series but its sub-

series, the dynamics still demonstrate mean-reverting

property.

Graph theory plays an important role in different

fields of science. Its instruments are of paramount

importance when we study collective non-linear

phenomena among different indices, especially, for

the energy market. (Fang et al., 2018) applied some

of the methods for converting time series into a

complex network and applied some graph-based

indicators such as average shortest path and density

with the sliding window procedure. Time series of

natural gas, coal, and crude oil were chosen. Between

each pair were calculated the correlation coefficients.

Also, they defined correlation models based on

correlation coefficients and a coarse-graining

procedure. They improved the betweenness centrality

algorithm to measure the evolution direction of the

correlation modes in different clusters of energy

prices. Such correlations between clusters were

explored for different time lengths of the sliding

window. For smaller time windows both positive and

ISC SAI 2022 - V International Scientific Congress SOCIETY OF AMBIENT INTELLIGENCE

458

negative correlations were observed. When the size of

the window increased, positive correlations also

became higher. That indicates the interrelationships

between the closing prices of the three types of energy

to be higher in the long term. Multilayer networks are

important for studying complex systems of complex

systems. One general graph may consist of several

and more subgraphs. (Xu et al., 2020) introduced a

multilayer recurrence network for examining energy

and carbon markets. Also, after they defined the

information linkage coefficient and time-delayed

information linkage, they measure interrelationships

between carbon and energy markets in different

stages of the EU carbon market. Data for the period

from 2011 to 2019 were subdivided into four periods

and multilayer recurrence networks within each stage

were built. The general trend remained U-shaped

trend: co-movement of crude oil, coal, natural gas,

and carbon prices were decreasing at the first stage,

and then it grew progressively during other stages.

Also, there is a study in which (Kassouri et al.,

2022) used a method based on wavelet analysis to

investigate the interaction between oil shocks and

CO₂ emissions intensity for the period 1975-2018.

Their study presents that wavelet-based for studying

the level of co-integration between several markets.

Also, they found that supply and demand in the oil

market had an inhomogeneous influence on CO₂

emissions. The demand-related shocks in the oil

market lead to a decrease in CO₂ emissions in the U.S.

Increase in emissions is followed by uncertainty in

the global oil market. One of the main conclusions

that we would like to emphasize is that high oil prices

for mitigating CO₂ do not work for the U.S. case.

Thus, policymakers should be aware when attaching

the influence of shocks in the oil market to the

environment’s resilience. (Hussain et al., 2021)

employed dynamic copulas and Extreme Value

Theory to analyze relationships between oil and stock

markets with the highest number of COVID-19 cases.

Their study, first of all, confirmed that analyzed data

is presented to be non-linear, non-stationary, and

heavy-tailed. Moreover, they found that, probably, it

was insufficient to represent the influence of COVID-

19 on the dependence of two markets. Their findings

showed that the degree of dependence between oil

and stock markets was shifting. Before the pandemic,

their correlation was presented to be higher and

became lower during the pandemic. Studying the left

and right tails of that dependence, scientists found

that for the right tail there was no significant change,

while for the left tail there was a significant increase,

which told about a higher probability of extreme risks

(downward trend) between oil and stock markets.

That is, if there was a crisis in the oil market, there

would be in the stock market. The study of (Wang et

al., 2014) made important research on (multifractal)

detrended cross-correlation analysis. In this paper,

scientists studied standard and multifractal detrended

cross-correlation characteristics for pairs oil-gas, oil-

CO₂, and gas-CO₂. First of all, we would like to note

that the cross-correlation scaling exponent i.e.,

generalized Hurst exponent, demonstrated week

persistent behavior for all pairs. Using rolling

window dynamics, they presented that in average

scaling exponent for almost all pair were close to 0.5,

while for oil-CO₂ dynamics was more persistent with

different window lengths. Cross-correlation

coefficient 𝜌

remained close to zero for scales

less than 100 and then started to increase. Thus, for

short-term scales correlations were weak, while for

long-term scales they were stronger. (Zou and Zhang,

2020) also studied energy and carbon markets using

cross-correlation analysis based on multifractal

theory. Their relation was presented to be non-linear

and multifractal. Also, short-term memory of those

markets was significantly stronger compared to long-

term memory. Their findings demonstrated that fat-

tails of the probability distribution were the main

source of multifractality if compare to long-term

memory. Under normal circumstances, their

dependence was presented to be anti-correlated.

(Quantino et al., 2021) devoted their study to

Brazilian ethanol and other energy-related

commodities such as Brent oil, natural gas prices,

CO₂ emissions, and sugar for the period 2010-2020.

In their study, they also used DCCA with the sliding

window algorithm to study correlation characteristics

during different periods. For the whole period, they

observed weak correlations in short term between

Brazilian ethanol and CO₂ emissions. For large

scales, there are strong correlations for sugar. For oil

prices, there are statistically significant correlations

up to 128 days, and for natural gas, there are no

significant correlations. For rolling window

dynamics, there is a need for additional research, but

their analysis showed that correlations vary across

time.

3 MATERIALS AND METHODS

Regarding previous studies, we will try to confirm the

results of previous researchers, present additional

analysis on co-movement between 3 energy-related

prices, and construct indicators or indicators-

precursors based on the (MF-)DCCA.

Assessing Energy-related Markets through Multifractal Detrended Cross-correlation Analysis

459

The presented work uses daily data of Henry Hub

natural gas spot prices (US$/MMBTU), Cushing, OK

WTI spot prices FOB (US$/BBL), and Europe Brent

spot prices FOB (US$/BBL) (Natural Gas Futures

Prices (NYMEX), 1997–2021; Spot Prices for Crude

Oil and Petroleum Products, 1986–2021). The sample

period of initial data ranged from 7 February 1997 to

14 December 2021. The dynamics of the

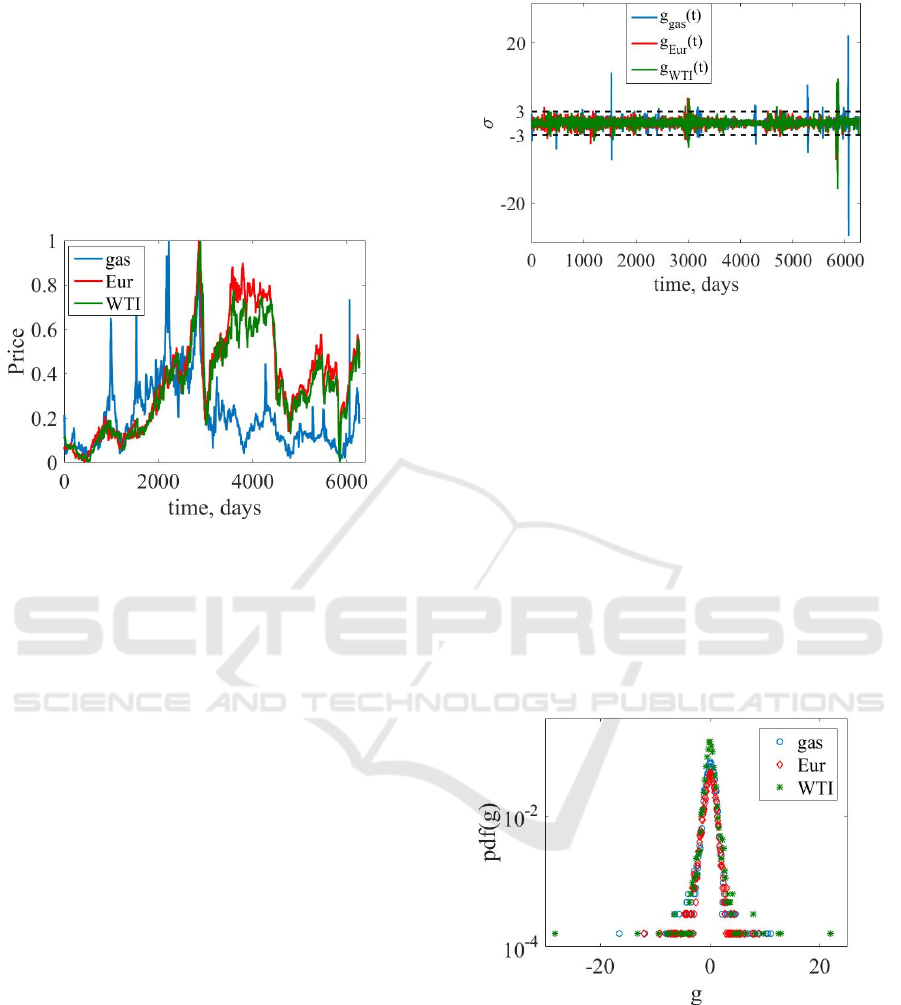

corresponding data are presented in Figure 1.

Figure 1: Initial time series of Henry Hub natural gas spot

prices (gas), Europe Brent spot prices (Eur), and WTI spot

prices (WTI).

According to previous studies, exactly

logarithmic (standardized returns) exhibit

multifractal characteristics. Therefore, we will

calculate further indicators regarding the

standardized returns defined by

𝐺(𝑡)=

𝑥(𝑡 +∆𝑡)−𝑥(𝑡)

/𝑥(𝑡)

and

𝑔(𝑡) ≡

𝐺(𝑡)−

〈

𝐺

〉

/𝜎,

(1)

where 𝑥(𝑡) is a value of our time series; ∆𝑡 is a time

shift (in our case ∆𝑡=1);

〈

𝐺

〉

is the average of

returns 𝐺; 𝜎 is the standard deviation of 𝐺.

It should be noted that some of the studied values

were repeated in our series. Therefore, before

calculating returns, we preprocessed our data by

smoothing it, using the moving average of 5 days.

Figure 2 presents standardized returns of our time

series data.

Figure 2: The standardized returns of gas, Eur, and WTI.

Events with ±3𝜎 are marked by dashed lines.

From the figure above it can be seen that most of

the time our data is presented to be correlated to each

other, but some of the critical events, as an example,

of WTI spot market cannot be associated with Euro

Brent or Henry Hub prices. Nevertheless, our

correlational and multifractal measures should give a

more comprehensive and clearer picture.

Also, we can see that most periods in energy

markets are defined by events that exceed ±3𝜎. The

WTI returns are characterized by much more

extensive crashes. Previous studies pointed out that

such events are located in fat-tails of the probability

distribution. Figure 3 presents the probability

distribution of 𝑔(𝑡).

Figure 3: Probability density functions (pdf) of the

standardized returns.

Fat-tails, as it was mentioned, are the main source

of multifractality and multifractal analysis is of the

possible solutions for dealing with such risk

phenomena.

Further, we apply multifractal analysis of cross-

correlational characteristics for such pairs as WTI-

Eur and WTI-Hub. Most of our results are based on

the sliding window approach. The idea here is to take

ISC SAI 2022 - V International Scientific Congress SOCIETY OF AMBIENT INTELLIGENCE

460

a sub-window of a predefined length 𝑤. For that sub-

window, we perform (multifractal-)detrended cross-

correlation analysis, get necessary metrics that are

appended to the array. Then, the window is shifted by

a predefined time step ℎ , and the procedure is

repeated until the time series is completely exhausted.

Our results will be presented for 𝑤∈

250, 500

and ℎ=1.

4 ESTIMATION PROCESS

4.1 DCCA Approach

For further calculations we consider two time series

𝑥

| 𝑖=1,2,… ,𝑁

and

𝑦

| 𝑖=1,2,… ,𝑁

. Then,

MF-DCCA considers the following procedure:

• Construct the cumulative time series

𝑋(𝑖) =

𝑥

−

〈

𝑥

〉

and

𝑌(𝑖) =

𝑦

−

〈

𝑦

〉

(2)

where

〈

𝑥

〉

and

〈

𝑦

〉

are the mean values of the

analyzed time series.

• Divide the time series into 𝑁

≡𝑖𝑛𝑡(𝑁/𝑠) non-

overlapping segments of equal length 𝑠. We repeat

the procedure from the end of a time series, since 𝑁

is usually not an integer multiple of 𝑠, and because of

it we may neglect the last part of a time series.

Therefore, we will obtain 2𝑁

sub-series.

• Subsequently, we find local trends 𝑋

(𝑖) and

𝑌

(𝑖) with 𝑚-order polynomials for each sub-series

𝑣 ( 𝑣=1,…,2𝑁

) and detrend each of those

segments. Thus, the detrended covariances of the

variances of each box for both time series are given

by

𝑓

(𝑣,𝑠)=

1

𝑠

𝑋

(

𝑣−1

)

𝑠+𝑖

−𝑋

(𝑖)

×

𝑌

(

𝑣−1

)

𝑠+𝑖

−𝑌

(𝑖)

(3)

for each interval 𝑣,𝑣= 1,…,𝑁

and

𝑓

(𝑣,𝑠)=

1

𝑠

𝑋

𝑁−(𝑣−1)𝑠+𝑖

−

𝑋

(𝑖)

×

𝑌

𝑁−

(

𝑣−1

)

𝑠+𝑖

−𝑌

(𝑖)

(4)

for 𝑣=𝑁

+1,𝑁

+2,…,2𝑁

.

• The detrended covariance fluctuation function

can be calculated according to

𝐹

(𝑠)=

1

2𝑁

𝑓

(𝑣,𝑠)

.

(5)

• By analyzing the log-log plots of 𝐹

(𝑠)

versus 𝑠, we can get the scaling behavior of the

fluctuation function. Particularly, if time series are

power-law cross-correlated, then we get the relation

𝐹

(𝑠)∝𝑠

,

(6)

where ℎ

is the cross-correlation scaling exponent,

which is also known as the Hurst exponent 𝐻 (Hurst,

1951).

This extension of the Hurst exponent works at the

same way:

1) If ℎ

>0.5, the cross-correlations

between time series are presented to be persistent: an

increase (a decrease) in one time series is followed by

an increase (a decrease) in other time series.

2) If ℎ

<0.5, the cross-correlations

between time series are presented to be anti-

persistent: an increase in one time series is likely to

be followed by a decrease in the other time series.

3) If ℎ

≈0.5, both time series follows a

random walk, i.e., there are no correlations between

them.

4) If ℎ

>1, both time series are presented to

be highly correlated and non-stationary.

Except for the cross-correlational Hurst exponent,

the DCCA algorithm proposes to calculate the DCCA

cross-correlation coefficient between time series

(Zebende, 2011). For each time scale 𝑠, the DCCA

coefficient is defined as

𝜌

(𝑠)=

𝐹

(𝑠)

𝐹

(𝑠) ×𝐹

(𝑠)

,

(7)

where 𝐹

(𝑠) can be found according to

equation (5); 𝐹

(𝑠)is the standard detrended

fluctuation function and −1≤𝜌

(𝑠)≤1 (Peng

et al., 1994). In a similar way to the classical

correlation coefficient, 𝜌

=1 means that time

series are positively correlated and co-move

synchronically; 𝜌

=−1 denotes that time series

move asynchronically (anti-persistently); 𝜌

=0

presents that there is no correlation between two time

series.

Assessing Energy-related Markets through Multifractal Detrended Cross-correlation Analysis

461

In section 5 we will present empirical results

related to the rolling window dynamics of ℎ

and

𝜌

. In the next sub-section, we would like to

describe the modified DCCA method which

considers multifractal cross-correlation

characteristics.

4.2 MF-DCCA Approach

Multifractal detrended cross-correlation analysis that

was derived from standard DCCA gives multifractal

characteristics derived from power-law cross-

correlations of time series (Zhou, 2008). This

approach modifies standard detrended covariance

fluctuation function to 𝑞th order:

𝐹

(𝑠)=

1

2𝑁

𝑓

(𝑣,𝑠)

/

/

(8)

for 𝑞≠0 and

𝐹

(𝑠)=𝑒𝑥𝑝

1

4𝑁

ln

𝑓

(𝑣,𝑠)

(9)

for 𝑞=0.

As in equation (6), 𝐹

(𝑠) will follow power-law

behavior:

𝐹

(𝑠)∝𝑠

()

,

(10)

where ℎ

(𝑞) represents a multifractal generalization

of power-law cross-correlation Hurst exponent.

Values of 𝑞 emphasize the density of small (large)

fluctuations. If those values are negative, we make an

ascent on scaling properties of small fluctuations. For

positive values, scaling properties of the large

magnitudes dominate. Generally, if our multifractal

characteristics do not depend on 𝑞 values, the studied

time series is presented to be monofractal.

For further calculations, through the multifractal

exponent 𝜏

(𝑞)=𝑞ℎ

(𝑞) − 1, we can define the

singularity strength 𝛼

(𝑞) and the multifractal

spectrum 𝑓

(𝛼):

𝛼

(𝑞)=ℎ

(𝑞) + 𝑞

𝑑ℎ

(𝑞)

𝑑

𝑞

(10)

and

𝑓

(𝛼)=𝑞𝛼

(𝑞) − ℎ

(𝑞) + 1.

(11)

Here, 𝛼

(𝑞) can be considered as the local

fractal dimension, and 𝑓

(𝛼) can be considered as

the “box-counting” dimension of regions with

particular singularity strengths.

According to the study of (Ito and Ohnishi, 2020),

the greater the level of 𝑞, the lower the value of

𝛼

(𝑞). If we approach the event with extremely high

densities (fluctuations), compared to neighboring

boxes (windows), we will have a low value of 𝑓

(𝛼).

If critical events would dominate in our system, the

singularity spectrum would have a long-left tail that

would indicate the dominance of large events. Right-

tailed multifractal spectrum would indicate

sensitivity to small events. The symmetrical spectrum

would show equal distribution of patterns with small

and large fluctuations.

Except for those characteristics that were

presented before, we would like to calculate the width

of the multifractal spectrum which can be defined as

Δ𝛼=𝛼

−𝛼

.

(12)

The wider it is, the more complex structure, the

more uneven distribution we have, and the more

violent fluctuations on the surface of our time series.

On the contrary, smaller multifractal width indicates

that the time series are uniformly distributed. Thus,

their structure is much simpler.

Another option is to calculate the proportion of

small and large peak values that are addressed to the

multifractal spectrum:

Δ

𝑓

=

𝑓

(𝛼

)−

𝑓

(𝛼

),

(13)

where 𝑓(𝛼

) and 𝑓(𝛼

) are the multifractal

spectrum’s values that correspond to the smallest and

the largest singularity values. For Δ𝑓<0, the larger

fluctuation amplitude occurs with a higher possibility

and for Δ𝑓>0, we have the opposite relation (Zhang

et al., 2019).

5 EMPIRICAL RESULTS AND

ANALYSIS

In this section, we would like to present empirical

results. which were obtained with the usage of the

(MF-)DCCA. Our figures present comparative

dynamics of

• the cross-correlation coefficient (𝜌

);

• the generalized cross-correlation Hurst exponent

(ℎ

);

ISC SAI 2022 - V International Scientific Congress SOCIETY OF AMBIENT INTELLIGENCE

462

• the minimal, maximal, and mean singularity

strength (𝛼

, 𝛼

, 𝛼

);

• the width of the multifractal spectrum (Δ𝛼);

• the asymmetry of the multifractal spectrum (Δ𝑓).

According to our expectations, (MF-)DCCA

indicators should behave particularly during crisis

events, i.e., increase or decrease during them. The

mentioned indicators were calculated for the

following parameters:

• sliding windows 𝑤=250 days for studying the

dynamics of short-term periods for the entire set of

the presented here indicators. In this case, we avoid

the influence of the dynamics of crises close to each

other. At the same time, we get more insufficient

statistics;

• sliding window 𝑤=500 days for studying

long-term behavior of the DCCA coefficient. In this

case, the data of previously happened events

influence the dynamics of currently studied crashes,

but we get more statistics;

• time step ℎ=1 day to get more comprehensive

statistics;

• 𝑚=2 for fitting local trends in equations (3)

and (4);

• time scales 𝑠 are defined in a range from 10 to

250 and 500 days;

• the values of 𝑞∈

−10;10

with a delay 1 to

have a better view on scales with small and large

fluctuation density. Nevertheless, the experiments

with smaller and larges ranges are possible;

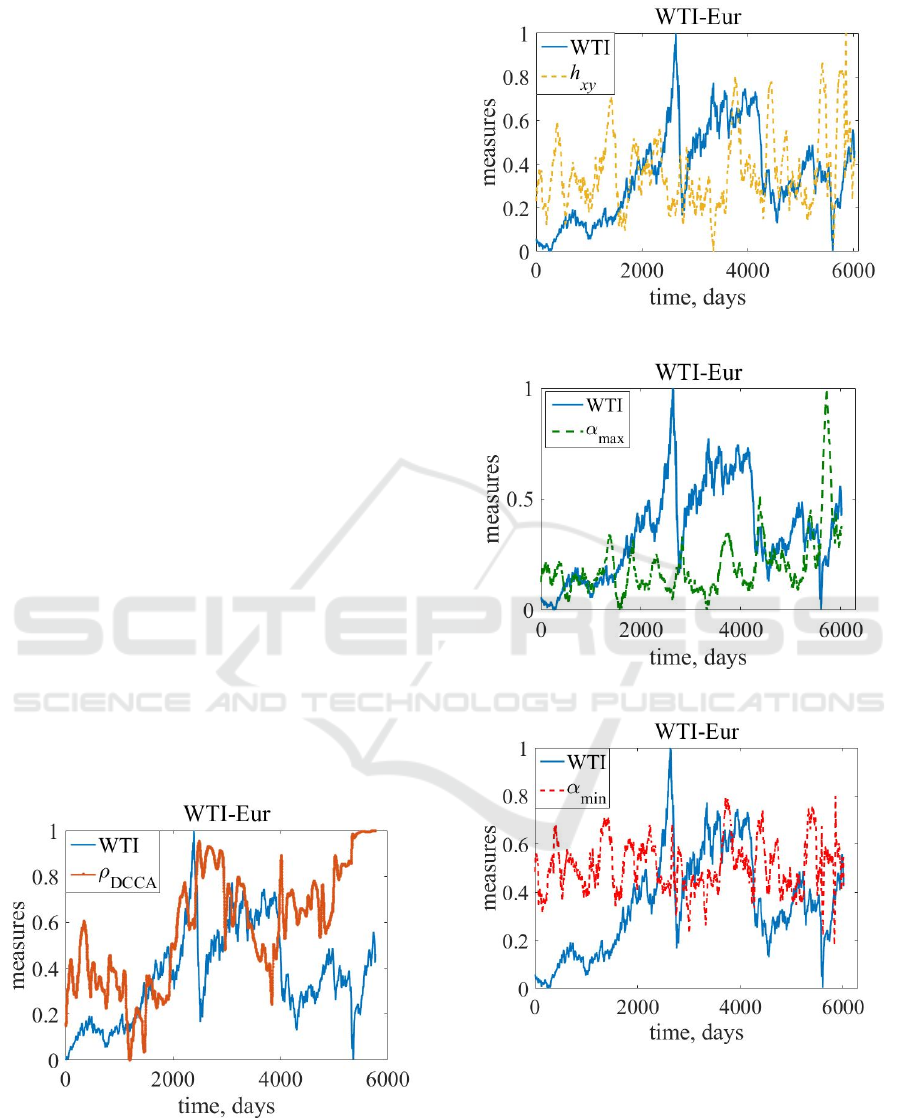

Figure 4 presents the comparative dynamics of the

(MF-)DCCA indicators for WTI-Eur pair with 𝑤=

250 days for all of them and 𝑤=500 days for the

DCCA coefficient.

(a)

(b)

(c)

(d)

Assessing Energy-related Markets through Multifractal Detrended Cross-correlation Analysis

463

(e)

(f)

(g)

Figure 4: The comparative dynamics of pair WTI crude oil

spot prices and Europe Brent crude oil prices (WTI-Eur)

with the DCCA coefficient (a), the cross-correlated

generalized Hurst exponent (b), the maximal singularity

strength 𝛼

(c), the minimal singularity strength 𝛼

(d), the mean singularity strength 𝛼

(e), the width of

the singularity spectrum Δ𝛼 (f), and its asymmetry Δ𝑓 (g).

Generally, according to Figure 4, we can that our

indicators respond in a particular way to our crashes.

The cross-correlational coefficient, in Figure 4 (a)

demonstrated co-movement of our time series for a

long-term period. From Figure 4 (b) we can see that

ℎ

increases before the crash, i.e., they demonstrate

persistent behavior, and decreases after it, that is, both

time series become more mean-reverting during the

crash. Before the critical event, both commodities

seem attractive for trading, but the crash that may be

caused by certain geopolitical events forces users to

transfer their funds from those energy commodities to

another product.

Figure 4 (c-f) demonstrates that singularity

exponents and the width of 𝑓(𝛼) become higher. It

means that during critical phenomena different time

scales in the studied time series respond

inhomogeneously: their cross-correlated dynamics

start to exhibit different patterns and more fluctuated

(rough) behavior.

Figure 4 (g) demonstrates a decrease during

critical events. That is a signal that the ends of 𝑓(𝛼)

become more uneven. If Δ𝑓 decrease, it means that

the multifractal spectrum has a longer left-tail. More

left-tailed 𝑓(𝛼) demonstrates multifractal

predominance of the fluctuations with large

magnitudes. In the opposite case, if Δ𝑓 increases, our

spectrum can be distributed more symmetrically or

closer to the right side. In other words, fluctuations

can be distributed homogeneously or small

fluctuations will have greater density.

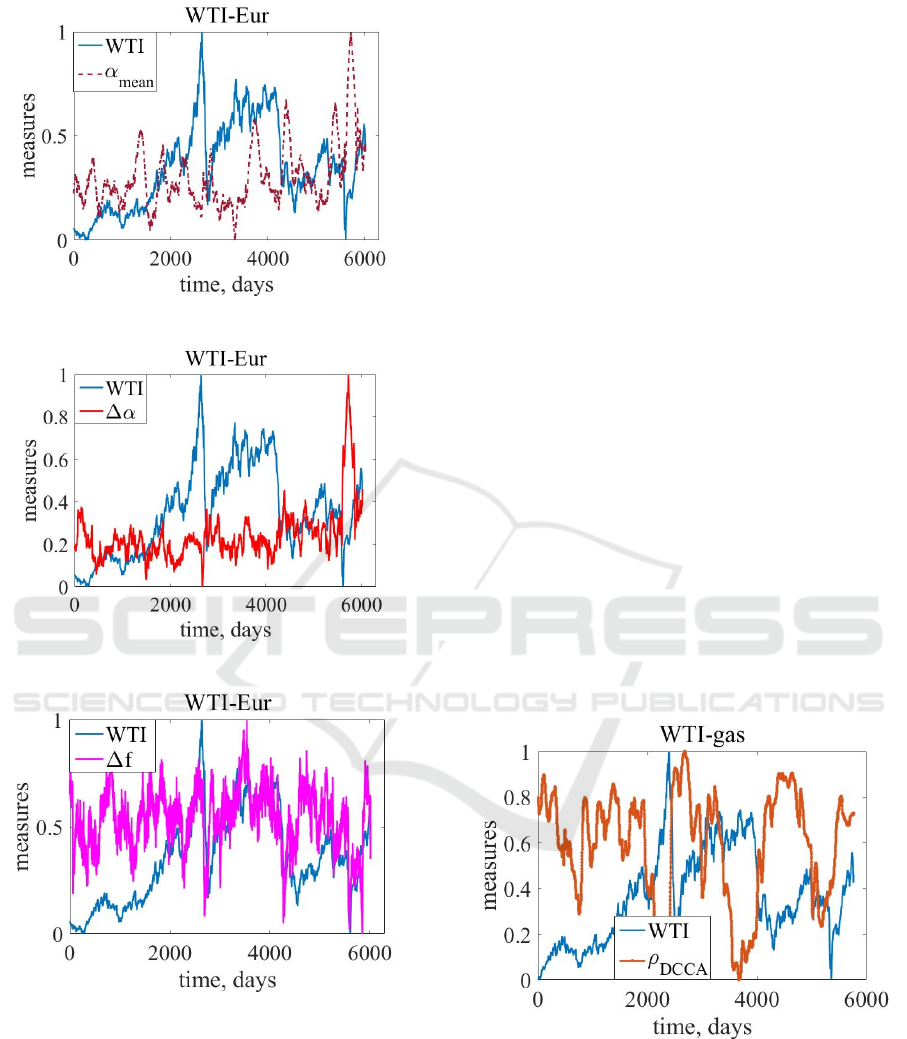

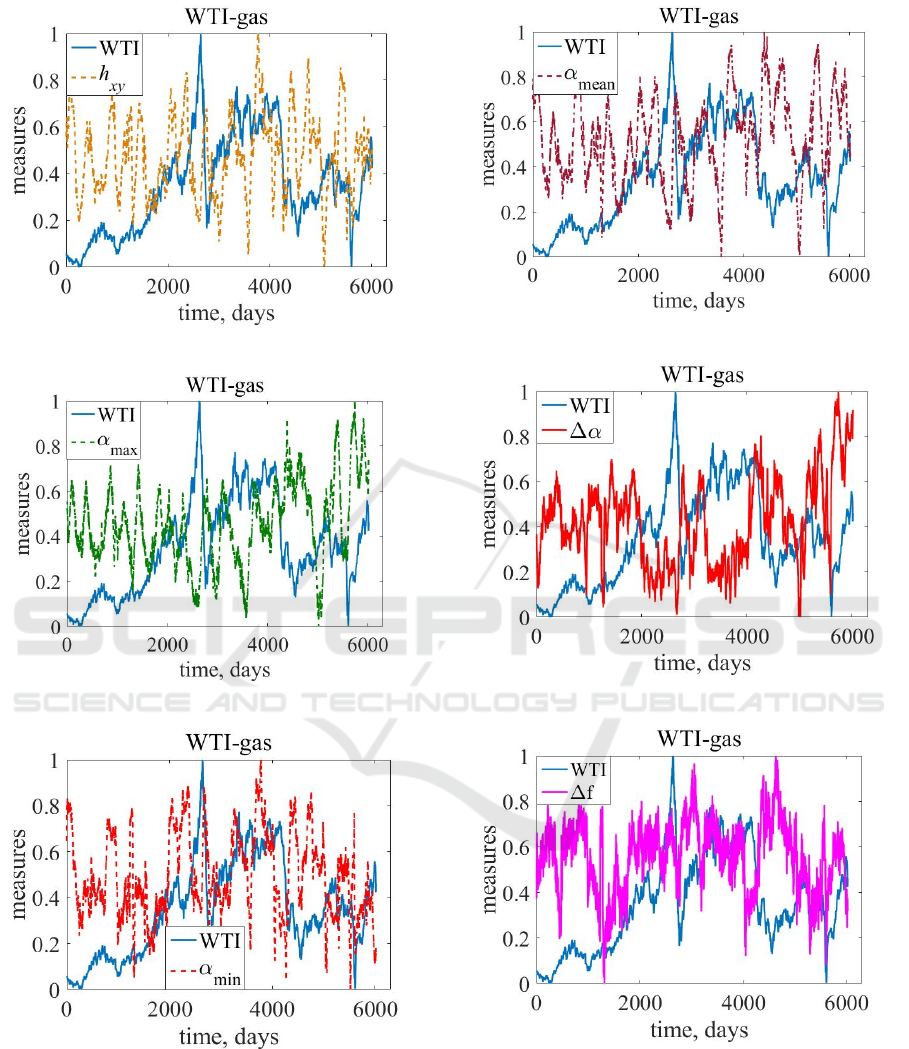

Next, in Figure 5, let us present (MF-)DCCA

measures for WTI-gas pair.

(a)

ISC SAI 2022 - V International Scientific Congress SOCIETY OF AMBIENT INTELLIGENCE

464

(b)

(c)

(d)

(e)

(f)

(g)

Figure 5: The comparative dynamics of pair WTI crude oil

spot prices and Henry Hub natural gas spot prices (WTI-

gas) with the DCCA coefficient (a), the cross-correlated

generalized Hurst exponent (b), the maximal singularity

strength 𝛼

(c), the minimal singularity strength 𝛼

(d), the mean singularity strength 𝛼

(e), the width of

the singularity spectrum Δ𝛼 (f), and its asymmetry Δ𝑓 (g).

Assessing Energy-related Markets through Multifractal Detrended Cross-correlation Analysis

465

According to the results in Figure 5, we can see

the same patterns in our indicators. The DCCA

coefficient grows during abnormal phenomena for

short- and long-term periods. The cross-correlational

Hurst exponent demonstrates anti-persistent behavior

of time series during crisis. Their multifractality

becomes stronger and wider. Finally, 𝑓(𝛼)

demonstrates left-tailed asymmetry during critical

phenomena for both time series.

6 CONCLUSIONS

Energy-related markets incorporate necessary

information about sustainable development not only

in the particular state but in the whole world in

general. Policymakers and ordinary traders should

have full knowledge about all the supply and demand

shocks, which lead to irreversible, non-equilibrium,

chaotic, and, studied in this paper, multifractal

properties.

In this paper, we have analyzed previous studies

related to the topic of the analysis of complex

phenomena in energy-related time series, and

considering it, we have applied the (MF-)DCCA

method to present own analysis of these markets and

their varying efficiency.

In this study, we have analyzed (multifractal)

cross-recurrent characteristics of such systems as

daily data of Henry Hub natural gas spot prices, WTI

spot prices, and Europe Brent spot prices. We have

compared WTI with Euro Brent and WTI with Henry

Hub natural gas.

Using the sliding window approach, we have

calculated such measures as the cross-correlation

coefficient for long-term scale, the Hurst exponent,

the minimal, maximal, and mean singularity

exponents, the width of the multifractal spectrum, and

its asymmetry. All of the presented indicators give

reliable information on the shocks in the energy

markets. As expected, the correlation coefficients

demonstrate collective behavior between studied time

series during crisis events. The Hurst exponent ℎ

as

the classical one increases before the crash,

demonstrating trending behavior and decreases

during it. Multifractal indicators presented that time

series demonstrate extensive multifractality during

crisis states.

These results may be useful for regulators,

governments, institutional investors who invest or

trade in energy-related markets. This will help them

to develop portfolios for better decision-making

processes during worldwide trends aimed at

improving sustainable development. In the future, on

the basis of such indicators of the cross-correlation

and multifractal properties, it will be possible to

create highly reliable risk management systems that

will allow to identify and forecast crashes more

precisely.

REFERENCES

Zebende, G. (2011). DCCA cross-correlation coefficient:

Quantifying level of cross-correlation. Physica A:

Statistical Mechanics and Its Applications, 390(4),

614–618. https://doi.org/10.1016/j.physa.2010.10.022

Peng, C. K., Buldyrev, S. V., Havlin, S., Simons, M.,

Stanley, H. E., & Goldberger, A. L. (1994). Mosaic

organization of DNA nucleotides. Physical Review E,

49(2), 1685–1689.

https://doi.org/10.1103/physreve.49.1685

Zhou, W. X. (2008). Multifractal detrended cross-

correlation analysis for two nonstationary signals.

Physical Review E, 77(6).

https://doi.org/10.1103/physreve.77.066211

Ito, M. I., & Ohnishi, T. (2020). Evaluation of the

Heterogeneous Spatial Distribution of Population and

Stores/Facilities by Multifractal Analysis. Frontiers in

Physics, 8. https://doi.org/10.3389/fphy.2020.00291

Zhang, X., Liu, H., Zhao, Y., & Zhang, X. (2019).

Multifractal detrended fluctuation analysis on air traffic

flow time series: A single airport case. Physica A:

Statistical Mechanics and Its Applications, 531,

121790. https://doi.org/10.1016/j.physa.2019.121790

Mandelbrot, B. B. (2021). The Fractal Geometry of Nature.

Echo Point Books & Media, LLC.

Aloui, C., & Mabrouk, S. (2010). Value-at-risk estimations

of energy commodities via long-memory, asymmetry

and fat-tailed GARCH models. Energy Policy, 38(5),

2326–2339.

https://doi.org/10.1016/j.enpol.2009.12.020

Herrera, R., Rodriguez, A., & Pino, G. (2017). Modeling

and forecasting extreme commodity prices: A Markov-

Switching based extreme value model. Energy

Economics, 63, 129–143.

https://doi.org/10.1016/j.eneco.2017.01.012

Mandelbrot, B. (1967). The Variation of Some Other

Speculative Prices. The Journal of Business, 40(4), 393.

https://doi.org/10.1086/295006

Hurst, H. E. (1951). Long-Term Storage Capacity of

Reservoirs. Transactions of the American Society of

Civil Engineers, 116(1), 770–799.

https://doi.org/10.1061/taceat.0006518

Lo, A. W. (1991). Long-Term Memory in Stock Market

Prices. Econometrica, 59(5), 1279.

https://doi.org/10.2307/2938368

Kantelhardt, J. W., Zschiegner, S. A., Koscielny-Bunde, E.,

Havlin, S., Bunde, A., & Stanley, H. (2002).

Multifractal detrended fluctuation analysis of

nonstationary time series. Physica A: Statistical

Mechanics and Its Applications, 316(1–4), 87–114.

https://doi.org/10.1016/s0378-4371(02)01383-3

ISC SAI 2022 - V International Scientific Congress SOCIETY OF AMBIENT INTELLIGENCE

466

Podobnik, B., & Stanley, H. E. (2008). Detrended Cross-

Correlation Analysis: A New Method for Analyzing

Two Nonstationary Time Series. Physical Review

Letters, 100(8).

https://doi.org/10.1103/physrevlett.100.084102

Bielinskyi, A. O., Khvostina, I., Mamanazarov, A.,

Matviychuk, A., Semerikov, S., Serdyuk, O.,

Solovieva, V., & Soloviev, V. N. (2021b). Predictors of

oil shocks. Econophysical approach in environmental

science. IOP Conference Series: Earth and

Environmental Science, 628(1), 012019.

https://doi.org/10.1088/1755-1315/628/1/012019

Bielinskyi, A., Semerikov, S., Serdiuk, O., Solovieva, V.,

Soloviev, V., & Pichl, L. (2020). Econophysics of

sustainability indices. In A. E. Kiv (Ed.), Proceedings

of the Selected Papers of the Special Edition of

International Conference on Monitoring, Modeling &

Management of Emergent Economy (M3E2-MLPEED

2020) (pp. 372–392). CEUR-WS.org.

Soloviev, V. N., & Belinskiy, A. O. (2019) Complex

Systems Theory and Crashes of Cryptocurrency

Market. In: Ermolayev V., Suárez-Figueroa M.,

Yakovyna V., Mayr H., Nikitchenko M., Spivakovsky

A. (eds) Information and Communication Technologies

in Education, Research, and Industrial Applications.

ICTERI 2018. Communications in Computer and

Information Science, vol 1007. Springer, Cham.

https://doi.org/10.1007/978-3-030-13929-2_14

Hoayek, A., Hamie, H., & Auer, H. (2020). Modeling the

Price Stability and Predictability of Post Liberalized

Gas Markets Using the Theory of Information.

Energies, 13(11), 3012.

https://doi.org/10.3390/en13113012

Joo, K., Suh, J. H., Lee, D., & Ahn, K. (2020). Impact of

the global financial crisis on the crude oil market.

Energy Strategy Reviews, 30, 100516.

https://doi.org/10.1016/j.esr.2020.100516

Lautier, D. H., Raynaud, F., & Robe, M. A. (2019). Shock

Propagation Across the Futures Term Structure:

Evidence from Crude Oil Prices. The Energy Journal,

40(3). https://doi.org/10.5547/01956574.40.3.dlau

Hu, Y., Chen, Y., Tang, S., Feng, L., & Huang, C. (2021).

An Explanation of Energy Return on Investment From

an Entropy Perspective. Frontiers in Energy Research,

9. https://doi.org/10.3389/fenrg.2021.633528

Engelen, S., Norouzzadeh, P., Dullaert, W., & Rahmani, B.

(2011). Multifractal features of spot rates in the Liquid

Petroleum Gas shipping market. Energy Economics,

33(1), 88–98.

https://doi.org/10.1016/j.eneco.2010.05.009

Garnier, J., & Solna, K. (2019). Emergence of turbulent

epochs in oil prices. Chaos, Solitons & Fractals, 122,

281–292. https://doi.org/10.1016/j.chaos.2019.03.016

Ali, H., Aslam, F., & Ferreira, P. (2021). Modeling

Dynamic Multifractal Efficiency of US Electricity

Market. Energies, 14(19), 6145.

https://doi.org/10.3390/en14196145

Fang, W., Gao, X., Huang, S., Jiang, M., & Liu, S. (2018).

Reconstructing time series into a complex network to

assess the evolution dynamics of the correlations

among energy prices. Open Physics, 16(1), 346–354.

https://doi.org/10.1515/phys-2018-0047

Xu, H., Wang, M., & Yang, W. (2020). Information

Linkage between Carbon and Energy Markets:

Multiplex Recurrence Network Approach. Complexity,

2020, 1–12. https://doi.org/10.1155/2020/5841609

Kassouri, Y., Bilgili, F., & Kuşkaya, S. (2022). A wavelet-

based model of world oil shocks interaction with CO2

emissions in the US. Environmental Science & Policy,

127, 280–292.

https://doi.org/10.1016/j.envsci.2021.10.020

Hussain, S. I., Nur-Firyal, R., & Ruza, N. (2021). Linkage

transitions between oil and the stock markets of

countries with the highest COVID-19 cases. Journal of

Commodity Markets, 100236.

https://doi.org/10.1016/j.jcomm.2021.100236

Wang, G. J., Xie, C., Chen, S., & Han, F. (2014). Cross-

Correlations between Energy and Emissions Markets:

New Evidence from Fractal and Multifractal Analysis.

Mathematical Problems in Engineering, 2014, 1–13.

https://doi.org/10.1155/2014/197069

Zou, S., & Zhang, T. (2020). Cross-correlation analysis

between energy and carbon markets in China based on

multifractal theory. International Journal of Low-

Carbon Technologies, 15(3), 389–397.

https://doi.org/10.1093/ijlct/ctaa010

Quintino, D. D., Burnquist, H. L., & Ferreira, P. J. S.

(2021). Carbon Emissions and Brazilian Ethanol Prices:

Are They Correlated? An Econophysics Study.

Sustainability, 13(22), 12862.

https://doi.org/10.3390/su132212862

Natural Gas Futures Prices (NYMEX). (1997–2021).

[Dataset]. U.S. Energy Information Administration.

https://www.eia.gov/dnav/ng/ng_pri_fut_s1_d.htm

Spot Prices for Crude Oil and Petroleum Products. (1986–

2021). [Dataset]. U.S. Energy Information

Administration.

https://www.eia.gov/dnav/pet/pet_pri_spt_s1_d.htm

Bielinskyi, A. O., Serdyuk, O. A., Semerikov, S. O., &

Soloviev, V. N. (2021, December). Econophysics of

cryptocurrency crashes: a systematic review. In A. E.

Kiv, V. N. Soloviev, & S. O. Semerikov (Eds.),

Selected and Revised Papers of 9th International

Conference on Monitoring, Modeling & Management

of Emergent Economy (M3E2-MLPEED 2021) (pp.

31–133).

Bielinskyi, A. O., Hushko, S. V., Matviychuk, A. V.,

Serdyuk, O. A., Semerikov, S. O., & Soloviev, V. N.

(2021, December). Irreversibility of financial time

series: a case of crisis. In A. E. Kiv, V. N. Soloviev, &

S. O. Semerikov (Eds.), Selected and Revised Papers of

9th International Conference on Monitoring, Modeling

& Management of Emergent Economy (M3E2-

MLPEED 2021) (pp. 134–150).

Mensi, W., Sensoy, A., Vo, X. V., & Kang, S. H. (2020).

Impact of COVID-19 outbreak on asymmetric

multifractality of gold and oil prices. Resources Policy,

69, 101829.

Assessing Energy-related Markets through Multifractal Detrended Cross-correlation Analysis

467