Influencing Factors of Housing Price in New York-analysis: Based on

Excel Multi-regression Model

Yuqi Yan

New York University, New York, NY, 10012, U.S.A.

Keywords: Housing Price, GDP, Recession, Housing Bubble, Home Ownership Rate, Urban Economy.

Abstract: Since the beginning of 21th century, the real estate market in New York has experienced rapid growth and

the current housing price index is more than doubled from 2000. To figure out what can be related to the boom

of the real estate market, this paper investigates the factors that influence the housing price index in New

York. Specifically, the investigation focuses on data of recent 20 years (collected from ECONOMIC

RESEARCH of FRED), using EXCEL to construct a linear regression model to find the correlation between

the housing price index and four potential main factors-resident population, per capita personal income, GDP

and home ownership rate. Also, the significance of each factor in the linear regression model is also considered

and the improved model is based on eliminating non-significant factors. The result shows the housing price

index has a strong correlation with GDP and home ownership rate. For this result, a further analysis based on

macroeconomics cycle and housing bubble indicates that the housing price in New York may not correspond

to the GDP growth in recession or recovery period. For home ownership rate, it can affect the housing price

independently, but it is a significant factor that influences the rate of change in housing price.

1 INTRODUCTION

Real estate economy refers to the economic

relationship between people around the production,

distribution, exchange and consumption of real

estate, which is the organic combination of real estate

economic relationship and real estate productivity

(Ahmad, 2021, Taha, 2021, Endut, 2021, Baatwah,

2021). The real estate economy is a key part of the

city economy, and the economic development of New

York state is inseparable from the contribution of the

real estate industry. The good development of real

estate can accelerate the development of the city and

optimize the structure of urban economic

development. In addition, as a necessity of life, a

house also profoundly affects people's life quality

level and satisfaction. There are many factors that

affect home prices in New York State, and the extent

to which these factors affect home prices varies. By

analyzing and comparing the influence of these

variables on the housing price in New York state, we

can not only predict the future trend of housing price,

but also control the housing price by controlling these

factors, so as to prevent its soaring price from

disturbing the market order.

New York state is the nerve center and economic

heart of the United States. It is of great significance

to study the real estate economy of New York State

for better developing the economy of New York state

and improving the living quality of residents. This

report plans to take the House Price Index for New

York as the dependent variable, and select the

Resident Population, per capita personal income,

gross domestic product in New York, and home

ownership rate as independent variables to conduct

multiple linear regression. The purpose of this report

is to find out the important factors influencing the real

estate economy in New York State and analyze their

influence.

2 VARIABLES DESCRIPTION

AND DATA SELECTION

This report plans to take the House Price Index for

New York as the dependent variable, and select the

Resident Population, per capita personal income,

gross domestic product in New York, and home

ownership rate as independent variables.

Yan, Y.

Influencing Factors of Housing Price in New York-analysis: Based on Excel Multi-regression Model.

DOI: 10.5220/0011362000003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 1005-1009

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

1005

2.1 Dependent Variable

House Price Index for New York: The House Price

Index for New York is the best indicator of home

prices in New York State as a whole (Ma, 2021, Liu,

2021, Sing, 2021). Housing price index selected for

this report is all annual data (mathematically

processed from quarterly data), and 1980Q1 is taken

as the base period for research. The variable is

represented by HPI.

2.2 Independent Variable

Resident population: Resident population is the most

important factor affecting the real estate economy.

Generally speaking, it can be considered that the

more permanent population, the higher the demand

for housing, the market will be in short supply,

housing price index will rise. The unit of permanent

population variable is thousand people, and the data

type is annual data. The variable is represented by RP.

Per capita personal income: Per capita personal

income refers to the income that can be completely

used for daily life control, which indirectly reflects

the concern of home buyers on the housing price. It is

generally believed that per capita personal income is

positively correlated with housing price index. The

unit of per capita disposable income is the dollar, and

the data type is annual data. This variable is

represented by PCPI.

Gross Domestic Product in New York: Gross

Domestic Product is a macro reflection of a region's

economic development level. When a region's

economic development is better, people's income

level will continue to increase, indirectly reflecting

the improvement of the ability to buy a house. The

unit of Gross Domestic Product is millions of dollars,

and the data type is annual data. This variable is

represented by GDP.

Homeownership rate: home ownership rate is a

commonly used index to examine the living

conditions of residents in the world. It refers to the

number of households living in their owner-occupied

housing as a proportion of the total number of social

housing households (Margo, 1996). The residential

ownership rate is reflected in the form of a

percentage, and the data type selected is annual data.

This variable is represented by HWR.

2.3 Data Selection

This report selects the annual data of various

variables in New York State from 2000 to 2020 as

data, with a total of 105 data values, and all data are

not seasonally adjusted. Data source of ECONOMIC

RESEARCH (Valadez, 2011).

Year

NYSTHPI

(1980:Q

1=100)

NYPOP

(Reside

nt

Populatio

n,Thousa

nds of

Persons

)

NYPCPI

(Per

Capita

Personal

Income

in New

York,doll

ar)

NYNGSP

(Gross

Domestic

Product,

Millions

of

Dollars)

NYHOW

N

(Home

ownershi

p Rate

for New

York,%)

2000 349.7 19001.78 36090 841181.3 53.4

2001 382.56 19082.84 37283 878346.5 53.9

2002 422.86 19137.8 37088 890258.1 54.8

2003 466.38 19175.94 37576 912474.6 54.3

2004 526.39 19171.57 39329 967151.9 54.8

2005 594.68 19132.61 40884 1016038 55.9

2006 633.38 19104.63 44128 1075155 55.7

2007 637.05 19132.34 47428 1119382 55.9

2008 618.18 19212.44 48184 1116591 55

2009 591.69 19307.07 47027 1160081 54.4

2010 574.95 19399.96 48818 1223530 54.5

2011 563.01 19499.92 51167 1247606 53.6

2012 555.89 19574.36 53599 1328234 53.6

2013 559.92 19626.49 54117 1365529 53

2014 571.07 19653.43 56270 1430923 52.9

2015 591.07 19657.32 58743 1487628 51.5

2016 611.52 19636.39 60833 1551354 51.5

2017 640.08 19593.85 64964 1603903 51.1

2018 672.59 19544.1 67357 1694958 51

2019 701.64 19463.13 69951 1777752 52

2020 736.75 19336.78 74472 1724759 53.6

Figure 1: The Data of NY Housings Price Index, Resident Population, Per Capita Personal Income, GDP and Homeownership

rate from 2000-2020.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

1006

3 EMPIRICAL METHODS

This report uses multiple linear regression to conduct

regression analysis on the influencing factors of real

estate price in New York state, and the main formula

is shown in Equation (1).

HPI = β

+β

RP + β

PCPI + β

GDP + β

HWR + ε (1)

Where, β

,β

,β

,β

are the regression

coefficients, β

is a constant term, ε is the random

error term. To eliminate possible multicollinearity,

the logarithm of all data is taken to eliminate

multicollinearity. The formula after treatment is

shown in Equation (2)

lnHPI = β

+β

lnRP + β

lnPCPI + β

lnGDP +

β

lnHWR + ε (2)

4 EMPIRICAL RESULTS AND

ANALYSIS

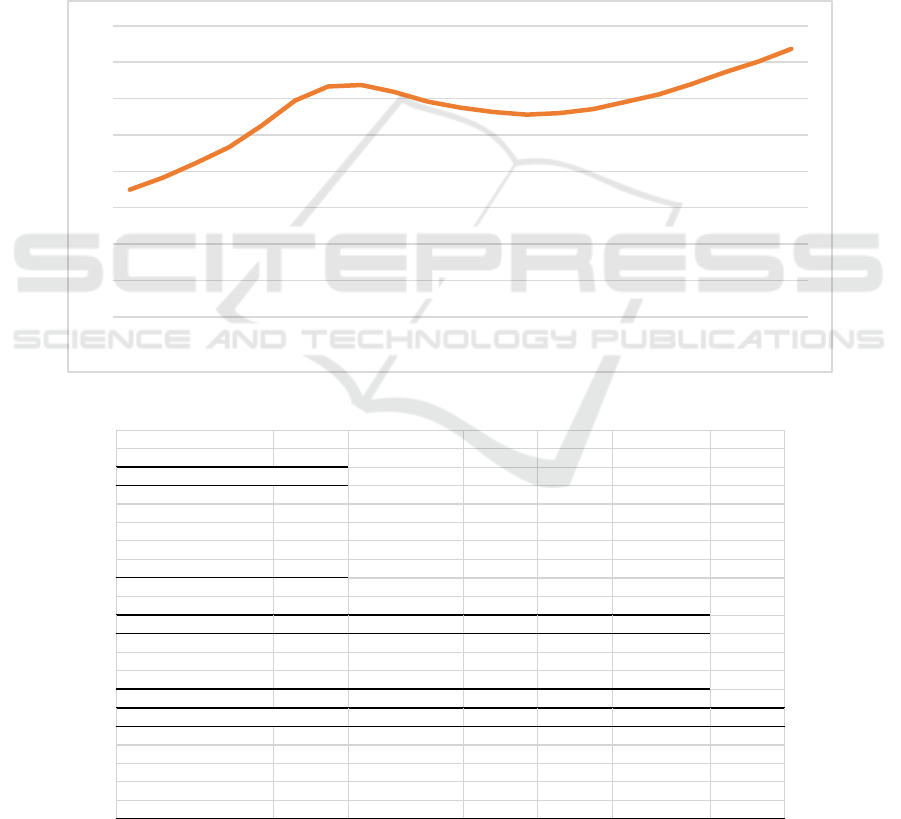

Figure 1 shows the trend of the housing price index

over the past 21 years. It can be seen that the overall

housing price index has an upward trend, although

there has been a slight decline in the intervening

years. The data analysis function in Excel is used to

fit the multiple linear regression equation, and the

fitting results are shown in Equation (3).

lnHPI = 16.053 + 4.683lnRP + 0.967lnPCPI +

2.097lnGDP + 4.414lnHWR (3)

Figure 2: The trend of the house price index over the past 20 years in New York.

SUMMARY OUTPUT

Regression Statistics

Multiple R 0.950938

R Square 0.904283

Adjusted R Square 0.880353

Standard Error 0.065641

Observation 21

ANOVA

df SS MS F Significance F

Regression 4 0.651304759 0.162826 37.78969 5.8016E-08

Residual 16 0.068939943 0.004309

Total 20 0.720244702

Coefficient

s

Standard Error t Stat P-value Lower 95% Upper 95%

Intercept 16.05312 29.6190269 0.541987 0.595296 -46.73641 78.84265

X Variable 1 -4.68314 3.074900623 -1.52302 0.147272 -11.201642 1.835354

X Variable 2 -0.96747 0.684125639 -1.41417 0.176477 -2.4177485 0.482815

X Variable 3 2.096999 0.716019445 2.928691 0.009837 0.57910594 3.614893

X Variable 4 4.414207 0.804317998 5.488137 4.96E-05 2.70912926 6.119285

Figure 3: Excel regression results.

0

100

200

300

400

500

600

700

800

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

Influencing Factors of Housing Price in New York-analysis: Based on Excel Multi-regression Model

1007

According to Excel regression results, the

determination coefficient is 0.951, indicating that the

model has a good fitting effect, and the F value is

37.790. The model as a whole passes the significance

test. As can be seen from the results, the coefficient

of the resident population is 4.683, which means that

the housing price index increases by 4.683% when

the resident population increases by 1%. The

coefficient of per capita personal income is 0.967,

which means that the house price index increases

0.967% for every 1% increase in per capita personal

income. The coefficient of Gross Domestic Product

is 2.097, which means that for every 1% increase in

Gross Domestic Product, the house price index

increases by 2.097%. The coefficient of the home

ownership rate is 4.414, meaning that with every 1%

increase in the homeownership rate, the house price

index increases by 4.41 %. Furthermore, according to

the result, if the significant level is set as α=0.05,the

p-value for x variable 1(resident population) and x

variable 2(per capita personal income) are much

greater than the significance level. Therefore, these

two values can be considered as not significant in this

multiple linear regression model. If they are

eliminated, the new regression equation is shown in

Equation (4)

lnHPI = −27.184 + 1.038lnGDP +

4.764lnHWR (4)

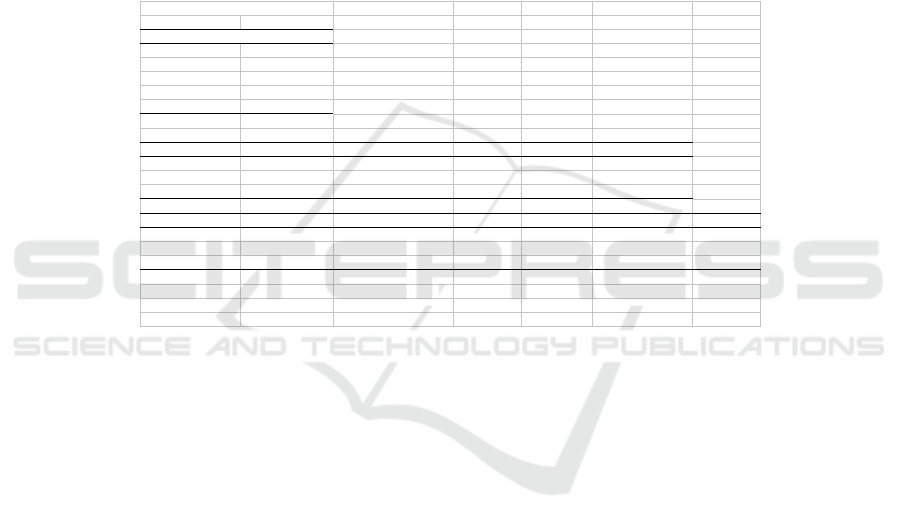

SUMMARY OUTPUT

Regression Statistics

Multiple R 0.94232648

R Square 0.887979194

Ad

j

usted R S

qu

0.875532438

Standard Error 0.066950393

Observations 21

ANOVA

df SS MS F Significance F

Regression 2 0.63956231 0.319781 71.34222 2.77772E-09

Residual 18 0.080682392 0.004482

Total 20 0.720244702

Coefficients Standard Error t Stat P-value Lower 95% Upper 95%

Intercept -27.1842815 3.92342295 -6.92872 1.78E-06 -35.42708725 -18.9415

X Variable 1 1.037680143 0.08895842 11.66478 7.95E-10 0.850785438 1.224575

X Variable 2 4.764216468 0.738255601 6.453343 4.51E-06 3.213199004 6.315234

Figure 4: Improved regression results.

After improving the model by eliminating

resident population and per capita personal income,

the R value and R Square still remain the same which

indicates a strong relationship. For F-value, it

improved from 37.790 to 71.342. For both variables,

Gross Domestic Product and house owner rate, shows

very low p-value which means a high significance.

The coefficient of Gross Domestic Product is 1.038

saying that if the increase ratio of GDP is 1%, the

housing price index may increase 1.038%. The

coefficient of house ownership rate is 4.762

suggesting that 1% increase in house owner rate

would indicate the house price index is increased by

4.762%.

5 DISCUSSION

The regression model tells us the house prices in New

York largely depends on

Gross Domestic Product and home ownership

rate. Based on the model, we may approximately

approach the truth of what can predict the housing

price. But what larger stories does the truth tell us?

The reason why these two factors make an effect on

the housing price may be the pivot to figure out the

development of the New York real estate market in

recent 20 years. Gross Domestic Production evaluate

the total good and services in a region. From another

perspective, it shows the consumptions, investments,

government income and net import- a higher GDP

means more flourishing economic activity. Housing

price reflects the demand for houses to some extent.

People prefer to invest in houses in a city with a high

GDP where they can obtain genuine incomes or the

housing price itself potentially would increase which

leads to wealth appreciation. However, because a

strict causation relationship cannot be proven, it is

difficult to assert that GDP is a factor that causes

rising housing prices. In Ray M. Valadez’s research,

he indicates that “ The causes underlying the

relationship between the HPI and GDP may be

indirect or overlap in such a way as to provide pairing

or interdependence.” (Valadez, 2011) Although the

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

1008

regression model presents a strong correlation

between GDP and housing price, the data shows an

anomaly between the period from 2009 to 2012: GDP

recovered but housing prices continuously fall. To

explain this abnormality, the bubble of the US real

estate market since the beginning of 21th century and

the recession in 2008. In the article “The Great

American Housing Bubble: Re-Examining Cause and

Effect”, the author Robert Hardaway concludes that

“over-extended homeowners, greedy Wall Street

financiers and investment bankers, compromised

realtors, accountants, credit rating agencies, and

ineffective and inattentive regulators have all played”

in the housing bubble (Hardaway, 2009). In 2007, the

subprime mortgage industry collapsed and “At least

25 subprime lenders, which issue mortgages to

borrowers with poor credit histories, have exited the

business, declared bankruptcy, announced significant

losses, or put themselves up for sale.”(Hovanesian,

2007). After the burst of the housing bubble, the

Great Recession began. Based on the data, the GDP

obviously recovered in 2009, but the negative effect

of Great Recession on the real estate market still

existed. It is can be considered as a housing price

correction which means the price gradually and

eventually reaches the normal level. When the

housing price reached a comparatively low level, it

raised again accompanied by booming GDP.

Analyzing the recession effect on housing price, we

may primarily conclude that housing price has a

strong correlation with GDP, but when a housing

bubble exists and bursts, the price may not follow

with GDP since the moderation and recovering can

happen at the same time.

Nonetheless, the rate of home ownership cannot

predict the trend of housing prices on its own.

According to the linear regression model for only

house ownership and housing price index, the R-

value is only 0.202 and the p-value is 0.378 which is

not significant. A potential reason behind this is

house ownership rate does not directly reflect the

actual demand and supply on real estate market.

However, the multi regression model shows that

despite in the housing price correction period, when

the GDP increase, a higher house ownership rate

would lead to a more intensive increase, and a lower

house ownership rate may indicate a week increase in

housing price.

6 CONCLUSIONS

In the first regression model, we can see that the

resident population is the most important factor

affecting the housing price index, followed by the

residential ownership rate, followed by Gross

Domestic Product, and finally the per capita

disposable income. Due to the significance test,

resident population and per capita personal income

show low significance. After modifications, the

improved model of how the housing price index

relates to GDP and homeownership rate demonstrates

a strong and significant correlation. Based on the

model, we can conclude that at the situation of

economic growth (booming GDP) and high house

ownership rate (comparatively more residents own a

house), the housing price would continuously

increase. However, during recession and following

recovery period, the housing price would meet a large

correction to a balanced level even though GDP

increase. Moreover, although this model may help to

predict future housing price in New York or other

states with a metropolitan, its own limitations should

be considered. For example, the data is only based on

recent 20 years, which is a short time interval. Also,

the recession period from 2007 to 2009 may affect the

preciseness of the model, since recession is not a high

probability event and the whole economic situations

are different between recessions. More independent

variables, such as interest rate, housing tax, and

unemployment rate, should be added in future

research to build a model that is more likely to reveal

the truth.

REFERENCES

Ahmad, N., Taha, R., Endut, W. A., & Baatwah, S. R. A.

(2021). The effects of house price and taxation on

consumers’ burden: The case of Malaysia. Kasetsart

Journal of Social Sciences, 42(2), 281-286.

Ma, L., Liu, H., & Sing, M. (2021). Responsiveness of

residential construction-production progress to house

price dynamics. International Journal of Housing

Markets and Analysis.

Margo, R. A. (1996). The rental price of housing in New

York City, 1830–1860. The Journal of Economic

History, 56(3), 605-625.

Valadez, R. M. (2011). The housing bubble and the GDP:

A correlation perspective. Journal of Case Research in

Business and Economics, 3, 1.

Hardaway, R. (2009). "The Great American Housing

Bubble: Re-Examining Cause and Effect." University

of Dayton Law Review 35(1): 33-60.

Hovanesian, M. D. (2007). "The Mortgage Mess Spread."

from https://www.bloomberg.com/news/articles/2007-

03-07/the-mortgage-mess-spreadsbusinesswMeek-

business-news-stock-market-and-financial-advice.

Influencing Factors of Housing Price in New York-analysis: Based on Excel Multi-regression Model

1009