Financial Management and Risk Assessment of Electric Power

Scientific Research Projects based on PDCA Analysis Method

Yingcui Chen, Wangyuan Xie, Sijia Lao and Xinru Yu

China Electric Power Research Institute,Beijing, China

Keywords: Electric Power Enterprise, Science Technology Project, Financial Management, PDCA, Risk Analysis.

Abstract: The power industry is an important supporting industry of the energy revolution. Because of traditional energy

demand, it is also facing industry innovation brought by various emerging technologies. Power grid

enterprises have great demand for science and technology R & D, and the annual scientific research

investment in the power industry reaches billion yuan. With the increase of science and technology R & D

investment by power enterprises year by year, the demand for scientific and efficient management of science

and technology project funds is becoming more and more urgent. By analysing the characteristics of science

and technology project management in power enterprises, this study combs and discusses the management

methods in each stage of science and technology project implementation by using PDCA analysis method.

On this basis, the implementation risk of each stage is established and scored, and the risk level of risk control

point is calculated. This study puts forward the optimization ideas and paths of financial management based

on PDCA cycle theory, guides budget adjustment and project implementation through information feedback,

and strengthens risk point control, which provides a practical reference for the practical application of

financial management in scientific research project management.

1 INTRODUCTION

With the great leap forward development of science

and technology in the world, the continuous

expansion of the scale of investment in science and

technology, the sharp increase in the number of

scientific research practitioners, and the continuous

great changes in the financial management mode of

scientific research institutions and scientific research

projects, all these have increased the difficulty of

science and technology management and exposed

many specific problems in management, It also

gradually highlights various imperfections in

professional management and internal control of

scientific research projects. From the research

situation at home and abroad, in the financial

management research involving scientific research

project management and performance appraisal,

more attention is paid to the standardization and

safety of fund use management. There are few

theories and methods based on PDCA cycle theory

and professional risk analysis tools to track the

project progress from the perspective of management,

and carry out research on the practical application of

financial management such as scientific research

project process management, auxiliary decision-

making, performance appraisal and guiding budget

preparation. This paper studies and analyses scientific

research projects based on PDCA cycle theory.

During the implementation of scientific research

projects, starting with the analysis of the current

situation and practical problems of financial

management application, this paper analyses the

objective practical problems, puts forward the

optimization ideas and paths of financial

management based on PDCA cycle theory, and

focuses on the application of comprehensive budget

method in budget preparation in the planning stage of

scientific research projects, the dynamic change of

financial data starts research and analysis on the

optimization of project progress and performance

evaluation, the establishment of a closely integrated

financial management system between the project

and the Research Institute, and the establishment of a

‘industry finance integration’ financial management

system has important reference significance for the

scientific research financial management of the

research institute and scientific research projects.

Another remarkable feature of power science and

technology project management is that science and

912

Chen, Y., Xie, W., Lao, S. and Yu, X.

Financial Management and Risk Assessment of Electric Power Scientific Research Projects based on PDCA Analysis Method.

DOI: 10.5220/0011358100003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 912-917

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

technology projects have uncertainty, which exists

objectively, as shown below:

1) The goal is uncertain. The creative

characteristics of science and technology projects in

power enterprises determine the important position of

timeliness in research and development. In the

process of implementation, due to the constraints of

related technologies, the realization of R & D

objectives of science and technology projects is

limited. It is very difficult to grasp the planning

control, fund control and quality control of science

and technology project management. There are many

unknown factors in the implementation, and there

may be a certain gap between the research results and

the expected objectives.

2) Technical uncertainty. With the development

of information technology and intelligent technology,

the technology with low maturity will increase the

workload and difficulty of scientific research on the

one hand, and increase the possibility of failure on the

other hand. At the same time, the operability of some

advanced technologies needs to be verified, so it may

not produce the expected results for the scientific

research projects.

3) The evaluation criteria are uncertain. The

formulation of evaluation standards for traditional

projects is relatively simple. It is necessary to

calculate the deviation between the expected time and

budget cost of the project and the specified standards.

The evaluation indicators can be evaluated

quantitatively according to the operation data. For

power science and technology projects, the

evaluation indicators are mostly non quantifiable

indicators, and the evaluation index system is

difficult to standardize and unify. Therefore, it is

necessary to formulate corresponding evaluation

standards for different types of projects, or conduct

project evaluation by adding scientific and reasonable

elastic indicators.

2 PDCA ANALYSIS METHOD

FOR FINANCIAL

MANAGEMENT

In the process of completing scientific research

projects, funds must be used to ensure various labour

consumption. Project financial management is to

ensure that the scientific research project achieves the

established objectives and carry out the financial

management process and activities of the project

within the budget prepared according to the project

tasks. In order to carry out the financial management

of scientific research projects objectively,

scientifically and standardized, we must first

establish the concept of "full life cycle cost

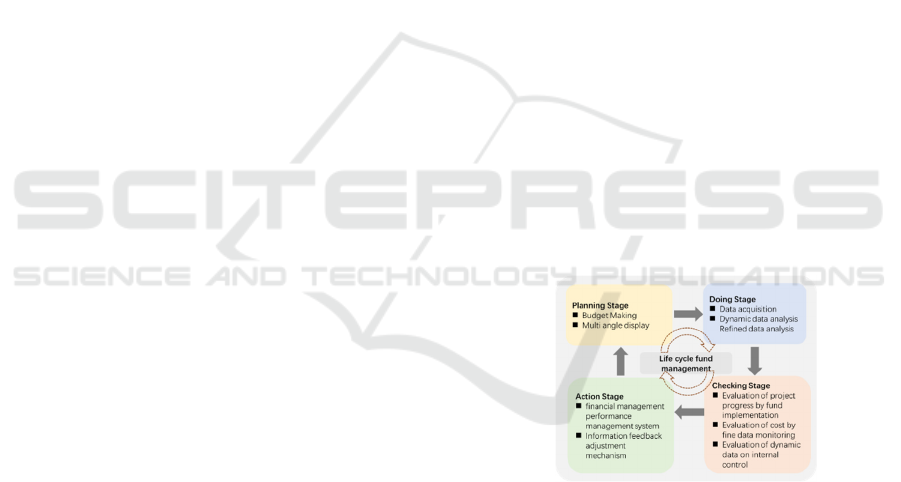

management". PDCA is plan do check action. PDCA

cycle is a scientific program that is managed in this

order and goes on continuously. Using PDCA model,

the control method of project management quality is

shown in Figure 1, as follows.

1) The preparation of the budget for science and

technology projects shall be carried out before or at

the end of the science and technology project. The

main methods are the analysis of the technical

scheme of the project research, the basis for the

preparation of funds, the law of fund use in the

process of previous science and technology projects,

the problems encountered and the experience in

solving them.

2) Implement the financial management system of

science and technology projects in the stages of

science and technology project initiation, feasibility

study and project implementation, and check the

monthly, quarterly and annual use of funds during the

implementation of science and technology projects.

3) In the closing stage of science and technology

projects, it is necessary to analyze and sort out the

inspection results in the process of each science and

technology project, formulate the revision scheme of

relevant science and technology project management

system, complete the financial settlement and audit of

project funds, and put forward the use of funds.

Figure 1: Cost elements of power science and technology

project budgeting.

4) The cycle period is generally synchronized

with the financial year, that is, once a year. In case of

national policy adjustment or major problems in the

management system of science and technology

projects, a new cycle can be started at any time.

2.1 Plannning Stage

In the process of completing scientific research

projects, funds must be used to ensure various labor

consumption. Project financial management is to

Financial Management and Risk Assessment of Electric Power Scientific Research Projects based on PDCA Analysis Method

913

ensure that the scientific research project achieves the

established objectives and carry out the financial

management process and activities of the project

within the budget prepared according to the project

tasks. In order to carry out the financial management

of scientific research projects objectively,

scientifically and standardized, we must first

establish two basic management concepts of ‘full life

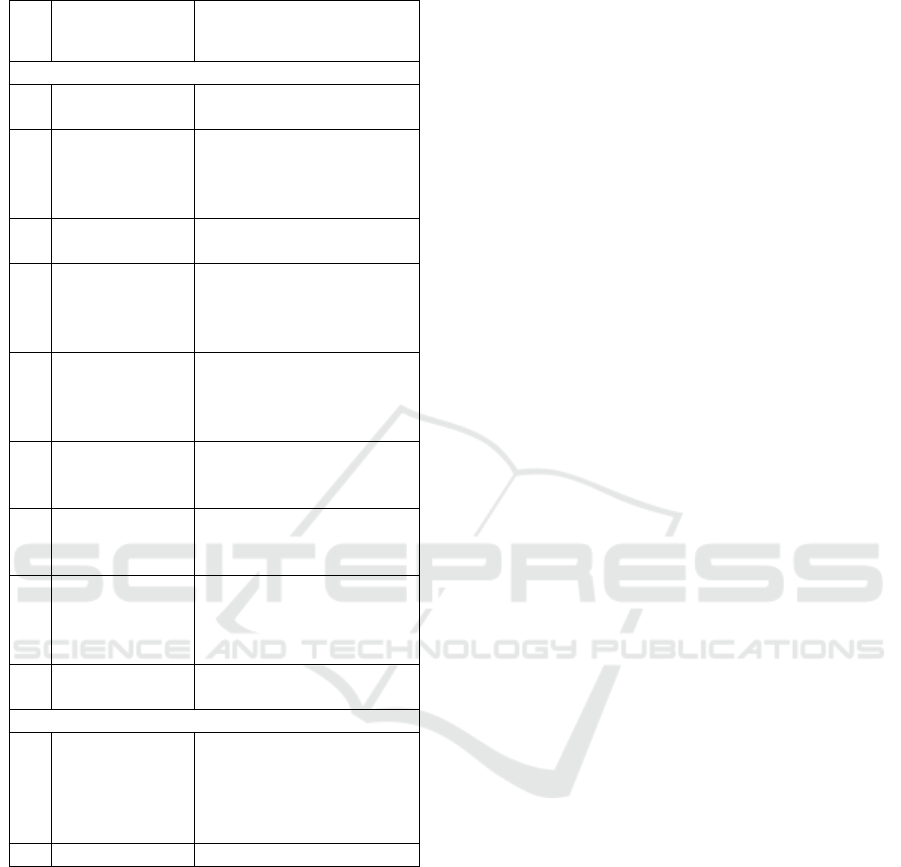

cycle cost management’. The comprehensive budget

of scientific research projects shall be classified

according to the accounting subjects involved in the

completion of the project, and the relevant cost

elements shall be clearly divided in each type of

accounting subjects and analysed one by one. Cost

elements are the basis of comprehensive budget

preparation of scientific research projects, as shown

in Table 1.

2.2 Doing Stage

For scientific research projects, building a scientific

project financial management system can provide

useful project information for project leaders and

institute managers and effectively control project

risks. Strengthening the management and analysis of

refined financial data in project management will

provide auxiliary decision-making for project

progress.

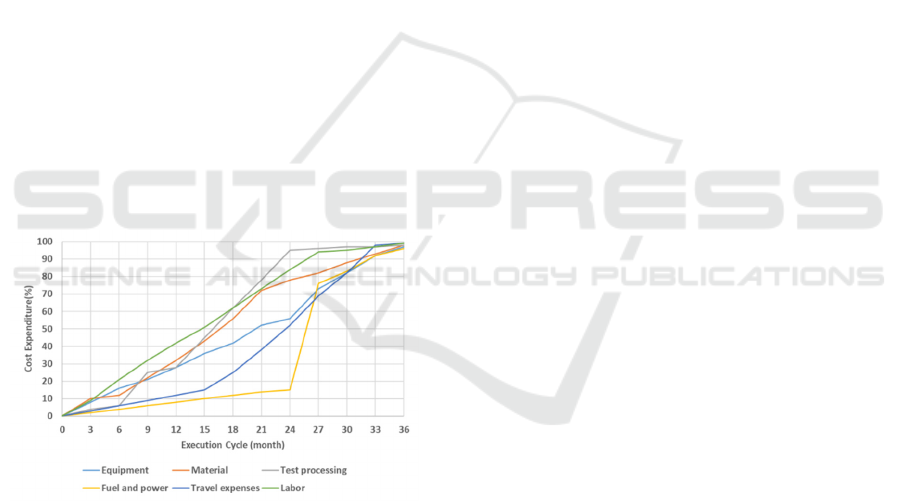

Figure 2: Reference for fund implementation rate of power

science and technology projects.

2.3 Checking Stage

The current implementation of scientific research

project funds is reflected by the budget

implementation rate. The budget implementation rate

is measured and determined by the ratio between the

approved implementation amount of funds and the

budget allocation amount when the project is

completed. The ratio is the static data when the

project is completed. The fund implementation rate

reflects the difference between the actual expenditure

of the project and the budget allocation, and cannot

reflect the progress of the project. In order to evaluate

the project progress from the perspective of fund

implementation more comprehensively, scientifically

and objectively, the evaluation standard of Dynamic

Fund implementation on project progress should be

constructed. Dynamic Fund implementation is to

combine the current expenditure (or current budget

implementation rate) during project implementation

with the project plan implementation time to form the

current fund implementation, which is used to

evaluate the current project progress. At the same

time, the budget implementation rates at multiple

time points are used to evaluate the trend of project

progress in one stage of the project implementation

period. Figure 2 shows the fund implementation of

general power science and technology projects, in

which the project implementation cycle is three years.

2.4 Action Stage

After the completion of the project, the whole process

multi-dimensional project financial management

performance evaluation will help the project leader

and institute managers summarize and accumulate

project financial management experience, further

improve the project management chain, and play an

enlightening and guiding role in the future institute

project management. The performance evaluation of

project financial management should not only stay on

the static financial data at the conclusion of the

project, but also fully combine the dynamic financial

data indicators in the process of project

implementation to form a dynamic and static,

comprehensive and reasonable evaluation system. At

the same time, build the project financial

management inspection and evaluation model in

three aspects: fund implementation, project progress,

refined financial data monitoring, project cost, whole

process financial dynamic data and internal control,

and form the project financial management

performance evaluation system. The performance

evaluation of project financial management should

reflect the positive incentive effect, respect the labor

achievements of scientific research workers, fully

mobilize their work enthusiasm, change the passive

situation of project financial management of the

Institute, link performance with bonus and

performance with promotion through evaluation,

continuously improve the implementation effect of

project funds and support the ability of scientific

research project implementation.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

914

Table 1: Cost elements of power science and technology

project budgeting.

Accounting

sub

j

ect

Cost element

Direct cost

1

Equipment

cost

Equipment purchase,

trial production and leasing

2 Material cost

Instrument consumables

and utensils, testing and

analysis drugs and reagents,

electronic components

4

Testing and

processing fee

Test processing items 1,

2,...

5

Travel

expenses

Research staff travel,

invited experts travel,

academic conference travel,

transportation travel

6

Conference

expenses

Project kick-off meeting,

project demonstration

meeting, review meeting,

final acceptance meeting

7

International

cooperation and

exchange fee

International exchanges

and visits, and invite foreign

experts to visit and exchange

8 Publishing

Literature retrieval, data,

publishing, intellectual

property matters

9 Labor cost

The project employs

technicians, master students,

doctoral students and

temporary employees

10

Expert

consultation fee

Conference consultation

Indirect costs

11 Indirect costs

Incentive of scientific

research personnel,

management expenses, daily

water, electricity and gas

consumption

12 Taxes

3 RISK ANALYSIS OF SCIENCE

AND TECHNOLOGY PROJECT

MANA.GEMENT

3.1 Analysis of Risk Sources of

Scientific Research Projects

R & D risk: because there are many uncertain factors

in the research process of scientific research projects

and the project covers a wide range, the progress of

synchronous similar projects will affect the

timeliness of the project, delay the project and

insufficient time progress. At the same time, it should

be considered that the uneven level of designers will

also lead to problems in the links of the project,

making it difficult for R & D and difficult to move

forward. These are two important points in the R & D

risk of the project.

Production risk: production risk is also a very

important point in the project. In the first project

procurement stage, due to the untimely procurement,

the purchase of some key devices is slow, sometimes

delayed for a year and a half. At this time, the whole

project will stagnate. This problem is also often

encountered in the progress of the project, constantly

delaying the nodes and causing the accumulation of

projects, If the purchase is not applied in time, it will

take two to three years from development to

production, so that the capital cannot be turned

around. In fact, there are also correlations between

various risks and contain each other. Second, a very

important point in the production process is the

process problem. For example, when making the

structural chassis, the explosion connection problem

caused by the dislocation of an empty or poor process

level will also cause the project to be reworked

continuously, and all aspects of coordination,

communication and reprocessing will be carried out.

Risk management: from the previous risk type, we

can think that coordination and communication also

play a great role in the process of the project. For

example, some design processes require the

cooperation and guidance of designers from other

departments, which requires good communication

between department leaders to prevent being closed.

Because some projects often have no interest in other

departments, which leads to mutual push and quarrel,

so it is very important to do a good job of

communication and coordination.

Environmental risk: sometimes environmental

risk should also be considered, because there is a

certain probability, such as the transfer of department

personnel, resignation, leave for business and other

irresistible factors. If this happens, the project team

leader should arrange other personnel to take over in

time, which will lead to time delay and lack of

understanding of the project situation, requiring

continuous consultation and communication, It will

affect the progress of the whole project.

Financial risk: first, in terms of contract

management, including the lack of prior qualification

examination or lax examination by the contract

signing party; The wording of the agreed terms of the

contract is not clear or the agreement is not clear

enough, so that the legal binding force of the contract

Financial Management and Risk Assessment of Electric Power Scientific Research Projects based on PDCA Analysis Method

915

is not strong; Lack of in-process tracking and

implementation effect tracking during contract

implementation; The signing and performance of

some contracts are not strict, and the contract terms

of the same matter are contradictory, etc. Second,

budget management. Lack of budget execution

analysis and assessment management, and failure to

carry out real-time tracking, process supervision,

feedback and early warning in the actual expenditure

process of scientific research funds. Such as illegal

expenditure, inflated expenditure, excessive use of

budget, sudden spending, misappropriation of funds,

etc.

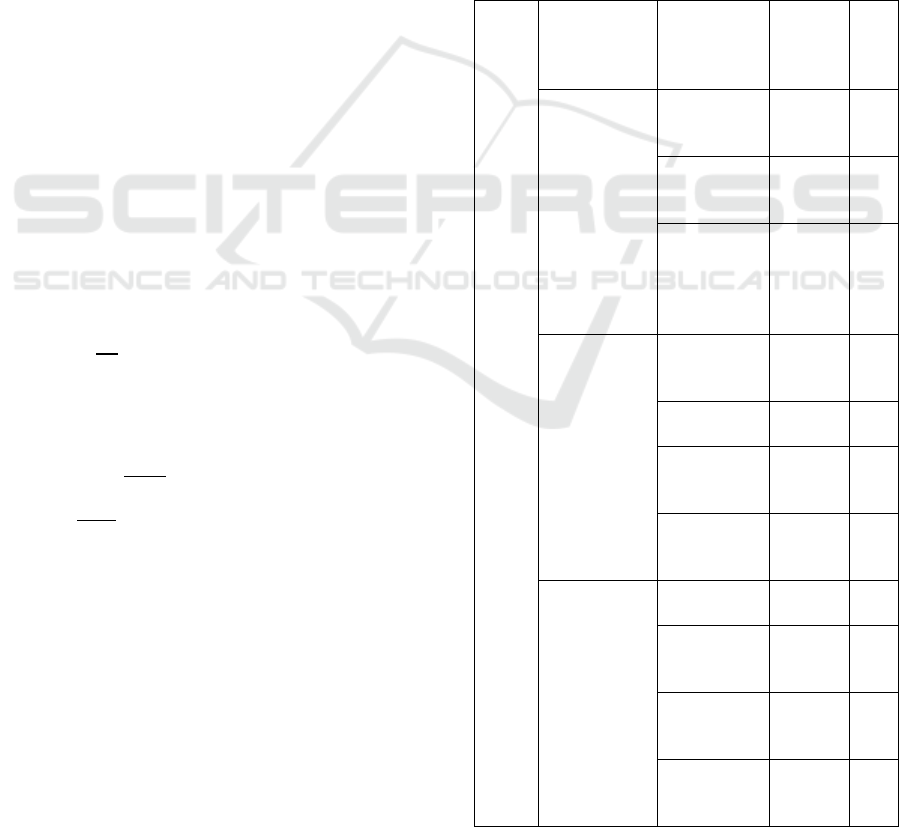

3.2 Risk Identification and Assessment

Implementation

Table 2 shows the risk objective level, the

management process is the criterion level, and the key

control points are the index level. A hierarchical

structure model is established, in which {B

1, B2, B3,

B4, B5, B6} is the first level risk control points {C11,

C12, C13}, {C21, C22, C23, C24}, {C31, C32, C33, C34},

{C

41, C42, C43}, {C51, C52, C53}, {C61, C62, C63}. It

is a secondary risk control point. After establishing

the hierarchical structure index system, the

importance standard of quantitative index is

formulated, and the judgment matrix is constructed

according to the subordinate relationship between the

upper and lower levels.

1)Calculate the product Mi of factors in each row

of the judgment matrix

𝑀

=

∏

𝑢

,

𝑗=1,2,…,𝑛

(1)

𝑤

=

𝑀

(2)

Normalization,

𝑊

=𝑤

∑

𝑤

⁄

(3)

2)Calculate the random consistency index

𝜆

=

∑

(4)

𝐶𝐼 =

(5)

𝐶𝑅 = 𝐶𝐼 𝑅𝐼

⁄

(6)

R represents the average random consistency

index.

3)On the basis of the constructed ladder level,

experts are invited to compare and score the elements

of each level, and calculate the judgment matrix of

each index on the primary risk points B

1, B2, B3, B4,

B5, B6

,

as well as the secondary risk points C11, C12

,

C13... C63, each judgment matrix passes the

consistency test. Finally, the risk proportion of sub

objectives and indicators at the business level is

counted.

4) Through comprehensive analysis, the weighted

possibility of different levels of risk in each index is

obtained, and the risk level of the risk control point of

the university is obtained. In Table 2, H represents

high risk, M represents medium risk and D represents

low risk. For example, the weighted probability of

high risk in contract signing risk C

11 is 0.0061, the

weighted probability of high risk in contract

performance risk C

12 is 0.0053, the weighted

probability of low risk in market recognition and

evaluation risk C

13 is 0.0068, and so on. The risk level

of each key control point in the project level

management process can be calculated. According to

the calculation results, control the points evaluated as

high risk.

Table 2: Risk evaluation hierarchy index of scientific

research projects in power enterprises.

Proje

ct

risk/

A

Level 1

risk/B

Level 2

risk/C

Risk

indicato

rs

Ris

k

typ

e

Project

contract/

B1

Contract

signing risk

/C11

0.0061 H

Contract

performanc

e risk /C12

0.0053 H

Market

identificatio

n and

assessment

risk/ C13

0.0068 L

Project

revenue and

expenditure/

B2

Subcontract

ing risk/

C21

0.0132 D

Authorizati

on risk/ C22

0.0087 D

Income

source risk

/C23

0.0092 D

Business

expenditure

risk/ C24

0.0051 H

Project

budget/

B3

Budgeting

risk/ C31

0.0061 L

Budget

approval

risk/ C32

0.0058 D

Budget

execution

risk /C33

0.0063 H

Budget

adjustment

risk /C34

0.0077 L

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

916

project

implementati

on/

B4

Asset

subscription

risk /C41

0.0052 H

Asset

acceptance

risk /C42

0.0052 D

Asset

collection

risk/ C43

0.0081 L

Scientific

research

procurement/

B5

Business

expense

risk/ C51

0.0069 H

Procuremen

t plan risk

/C52

0.0067 D

Procuremen

t activity

risk/ C53

0.0054 H

Project

acceptance/

B6

Risk of

final

account

preparation/

C61

0.0082 L

Audit risk/

C62

0.0072 H

Post

assessment

risk/ C63

0.0091 D

4 CONCLUSION AND PROSPECT

In view of the growing demand for scientific research

projects in the power industry, this study uses the

PDCA cycle theory and the concept of life-cycle cost

management of scientific research projects, puts

forward the financial management framework for

electric power science and technology projects, and

studies and analyzes how to scientifically prepare the

fund budget of scientific research projects by using

the method of comprehensive budget. Through the

quantitative analysis of financial data in project

implementation, the implementation process of

scientific research project funds is monitored, and the

financial management methods of project auxiliary

decision-making and performance evaluation are put

forward. Through information feedback to guide

budget adjustment and project implementation,

further reduce the work burden of power R & D

personnel, mobilize the work enthusiasm of scientific

researchers, and provide a practical reference for the

practical application of financial management in the

scientific research project management of the

Institute. Through information feedback to guide

budget adjustment and project implementation,

strengthen risk point control, and provide a practical

reference for the practical application of financial

management in scientific research project

management. With the application of information

technology means, the financial management means

for scientific research projects have been further

developed to achieve a more scientific, efficient and

accurate financial management model.

REFERENCES

Ding jieying. Discussion on fund risk management of

scientific research projects of scientific research

institutions under the new situation [J]. Anhui Science

and technology, 2019 (8): 35-37.

Huang Gu, Yang Ke. Application Research on enterprise

scientific research project management based on PDCA

cycle [J]. Enterprise reform and management, 2021

(10): 6-7.

Huang Lingyun. Influencing factors and Countermeasures

of scientific research project fund management risk [J].

Business accounting, 2018 (14): 81-84.

Luo Wen. Research on risk identification and prevention

and control measures of scientific research funds from

the perspective of project management [J]. Business

information, 2019 (1): 169173.

Wang Jianfeng, Guo Lihua. Discussion on the supervision

mode of forestry scientific research funds based on

PDCA cycle [J]. Shandong forestry science and

technology, 2019,49 (3): 122-125128.

Wang Li. Analysis on the risk of scientific research project

fund management [J]. Chinese chief accountant, 2018

(8): 98-100.

Wang Li. Risk assessment of scientific research project

fund management based on BP neural network [J].

Finance and accounting, 2019 (22): 25-31.

Zhang Zhijun, Ma caiwen, Wang Xiuju, et al. Research on

risk identification and prevention and control measures

of scientific research funds from the perspective of

project management [J]. Scientific and technological

progress and countermeasures, 2016 (4): 18-24.

Financial Management and Risk Assessment of Electric Power Scientific Research Projects based on PDCA Analysis Method

917