Research on Informatization Innovation of Enterprise Financial

Management under the Background of "Internet+" and Big Data

Yixi Zhang

a

, Yiran Tao

b

and Xiaoqian Wang

*c

Chongqing College of architecture and technology, Chongqing, China

Keywords: Internet +, Big Data Background, Enterprise Financial Management, Informatization, Innovation, Effective

Measures.

Abstract: This article briefly introduces the characteristics of corporate financial management in the context of "Internet

+" and big data, and expounds the necessity of innovative corporate financial management information in the

context of "Internet +" and big data. The author studied the impact of "Internet +" and big data on the

informatization of corporate financial management. The author analyzes the existing problems in corporate

financial management at this stage to explore effective measures for corporate financial management

information innovation in the context of "Internet +" and big data. This article hopes to transform the

traditional corporate financial management model, adapt to the development requirements of the new era, and

improve the information level of corporate financial management. In order to achieve good financial

management results, people need to maximize the economic benefits of the enterprise.

1 INTRODUCTION

The 21st century is an information age. Computer

information technology has been integrated into

people's production and life, bringing new

opportunities and challenges to the development of

all walks of life. In the context of "Internet +" and big

data, in order to enhance their comprehensive

strength and gain a place in the increasingly fierce

market competition, companies should follow the

trend of the times and change their management

strategies. In particular, it is necessary to strengthen

financial management, no longer use traditional

management models, and at the same time innovate

management concepts and integrate computer

information technology into financial management.

In order to gradually realize the informatization of

financial management, improve the efficiency of

financial management, and strengthen the function of

financial management. This can make it strategic and

scientific, thereby ensuring the level of corporate

financial management and improving the economic

benefits of the company.

a

https://orcid.org/0000-0002-3344-5255

b

https://orcid.org/0000-0002-4657-788X

c

https://orcid.org/0000-0002-5565-6926

2 THE CHARACTERISTICS OF

CORPORATE FINANCIAL

MANAGEMENT UNDER THE

BACKGROUND OF

"INTERNET +" AND BIG DATA

2.1 Innovation Is the Key

In the context of "Internet +" and big data, traditional

enterprises have suffered a certain impact on

management thinking. In order to meet the

requirements of the new era and promote the

sustainable development of enterprises, it should

continue to innovate the financial management of

enterprises. In the process of business operations and

internal management, traditional industries must be

integrated into Internet ideas. Internet technology has

brought a great impact on the operation and

management of enterprises, and innovation and

change have become the keywords of the current

operation of enterprises. Enterprises must change the

traditional management model, aiming at the existing

Zhang, Y., Tao, Y. and Wang, X.

Research on Informatization Innovation of Enterprise Financial Management Under the Background of "Internet+" and Big Data.

DOI: 10.5220/0011350300003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 825-830

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

825

market environment, and combining the

characteristics of their own operations to make

improvements. At the same time, traditional

enterprises should also estimate the future

development of Internet technology, make correct

judgments, and find the direction of innovation. And

then to meet the development requirements of the

Internet era, to obtain more long-term development

opportunities (Lv 2018).

2.2 Cross-domain Interaction

The application of Internet technology not only

breaks through the limitations of time and space, but

also allows companies to break the barriers between

different fields. The manifestation of business value

of an enterprise is not only in the application of

Internet technology, but also in the need to optimize

the allocation of enterprise resources based on the

Internet and improve the level of informatization of

business management. In other words, it is necessary

to integrate Internet technology into the business

management and combine the unique advantages of

the company with other industries. And then jointly

promote and develop, looking for a broader market

space (Li 2019).

3 THE NECESSITY OF

INNOVATIVE ENTERPRISE

FINANCIAL MANAGEMENT

INFORMATIONIZATION

UNDER THE BACKGROUND

OF "INTERNET +" AND BIG

DATA

3.1 The Needs of Corporate

Sustainable Development

If an enterprise wants to achieve more long-term

development, it must keep pace with the times,

conform to the development trend of the times, and

change its business direction and strategy according

to the current market environment. In this way, it can

continuously improve its competitiveness to occupy

more market share and avoid being eliminated by the

market. As a result, it should follow the emergence of

computer information technology to reform and

innovate financial management, and integrate

advanced computer information technology with

financial management to improve financial

management efficiency. This can give full play to the

functions of the financial management department

and create a correct path suitable for enterprise

development. Companies need to implement efficient

financial management based on the background of

"Internet +" and big data, combined with their own

operating status and corporate business culture

concepts. This can gradually realize the

informatization of financial management, optimize

the allocation of corporate resources, and increase the

utilization rate of funds, thereby promoting the

sustainable development of the enterprise.

3.2 Requirements for using Innovative

Tools

With the innovation of computer information

technology, a large number of new technical tools

appear. Corporate financial managers can apply these

tools to management work to accurately analyze

corporate financial sources, scientifically analyze

corporate financial data, and improve the quality of

corporate financial management. Corporate financial

managers should learn to use new tools in the context

of "Internet +" and big data to ensure the authenticity,

timeliness and accuracy of financial data. If corporate

financial managers want to follow the development

trend of the times and achieve better management

results, they should be familiar with new financial

tools. Otherwise, they also need to learn to use new

financial management techniques, change traditional

financial management methods, and proficiently use

financial accounting information software. This

facilitates centralized accounting work, flexible

turnover of corporate funds, and guarantees the

smooth development of corporate business activities

(Xiao 2019).

3.3 Time Requirements

In the information age, information transmission is

very fast, and it can complete information

transmission in a short time. This requires corporate

financial managers to continuously improve their

professional level and increase the speed of

calculation. So as to meet the requirements of the

characteristics of the times and implement efficient

financial management. Financial management

personnel must handle various financial data and

information in a short time. Moreover, the

transmission of the content covered by it to other

departments in the business management activities

will speed up the transmission of information and

information, and gradually realize office automation.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

826

4 "INTERNET+" AND BIG

DATA'S IMPACT ON THE

INFORMATIZATION OF

ENTERPRISE FINANCIAL

MANAGEMENT

4.1 Change in Management Thinking

"Internet+" and big data have changed the financial

management thinking of enterprises and promoted

different behaviors. In this context, companies found

that traditional financial management concepts could

not meet the needs of current companies, and began

to realize the application value of new technologies.

With the continuous innovation of science and

technology, people's ideas have also changed, and

people have begun to emphasize the integration of

computer information technology and financial

management. It aims to give full play to the role of

big data in the process of practice, and based on the

Internet system, to coordinate the work of various

stages of business operations and achieve business

goals (Dai 2017). Hence, under the background of

"Internet +" and big data, enterprises should establish

the concept of informatization, and conduct value

guidance based on their own operating characteristics

and their advantages and uniqueness in operation. In

the meantime, companies are also responding to

current business challenges, exploring an exclusive

development path based on information technology,

and improving financial management.

4.2 Increased Demand for Professional

Talents

Enterprise financial management under the

traditional concept does not have high requirements

for related staff, and only needs to master basic

financial accounting knowledge. However, under the

background of "Internet +" and big data, the financial

information management implemented has increased

the demand for financial professionals. Meanwhile, it

has higher professional requirements for related staff.

Relevant financial management personnel must not

only have a solid theoretical knowledge of financial

accounting, but also master basic computer

information technology operations, and know how to

organize and analyze information and data, and

gradually move towards management accounting and

strategic financial management. Financial

information managers must learn to use advanced

information software and actively participate in the

practical work of information management. In this

way, they can put forward reliable decision-making

basis and suggestions according to the actual situation

of the market and combined with the company's own

operating conditions to ensure the rationality of the

decision-making plan (Hao 2019).

5 PROBLEMS IN THE

FINANCIAL MANAGEMENT

OF ENTERPRISES`

At this stage, there are still certain problems in

corporate financial management, which need to be

further resolved. The main problems are as follows.

Firstly, the traditional corporate financial

management model is no longer suitable for the

modern development environment. Outdated

financial management concepts and backward

financial management methods have directly affected

the improvement of corporate financial management.

It also cannot provide a reliable strategic basis for the

development of the enterprise, which restricts the

sustainable development of the enterprise. Some

companies currently do not have good Internet

thinking and do not pay attention to the

informationization of financial management.

Although financial information management has

been tried in the enterprise, it is actually too formal to

highlight the effective role of financial information

management. As a result, the quality of corporate

financial management work cannot be guaranteed,

and a sound financial risk prevention system is not

established, which is prone to financial loopholes. In

addition, it ignores the construction of the value chain

management system, lacks effective communication

and communication between various departments,

and fails to implement effective measures to manage

the receivables, so that the economic benefits of the

enterprise are damaged (Wu 2018).

Secondly, the current financial management

personnel of the enterprise are not satisfied with the

needs of the new financial management work. It only

possesses the most basic financial accounting

knowledge, but fails to master the basic computer

information technology, so that it still performs

operations in the traditional way when carrying out

financial management. In this way, modern financial

information management software has not been fully

utilized, it has also failed to speed up the transmission

of financial information, and failed to improve the

efficiency of financial management. Moreover, the

company did not pay attention to the training of

Research on Informatization Innovation of Enterprise Financial Management Under the Background of "Internet+" and Big Data

827

existing financial personnel, and the financial

management technology adopted was relatively

backward and failed to introduce advanced science

and technology, which was not conducive to the

sustainable development of the company.

Thirdly, in the context of "Internet +" and big

data, the financial management system implemented

by enterprises does not meet actual requirements.

This has led to the failure of enterprises to formulate

appropriate management systems according to the

actual situation of corporate financial management,

so that corporate financial management is unfounded

and unreliable, and it is difficult to reflect the

advantages and functions of financial management

information. Otherwise, some companies have not

established a sound financial information platform,

and have failed to rationally plan the data

management section according to the functions of the

corporate financial department. This is not conducive

to improving the efficiency of corporate financial

management.

6 UNITSEFFECTIVE MEASURES

FOR ENTERPRISE FINANCIAL

MANAGEMENT

INFORMATION INNOVATION

UNDER THE BACKGROUND

OF "INTERNET +" AND BIG

DATA

6.1 Pay Attention to the

Informationization of Financial

Management and Build A Value

Chain Management System

Inder the background of the new era, business

management has encountered certain challenges. If

an enterprise is unable to adapt to the new

requirements and still adheres to the traditional

financial management model, it will not be conducive

to the sustainable development of enterprise

management. Enterprises should attach importance to

the construction of financial management

information and give full play to the role of modern

science and technology. Based on the Internet,

companies can apply big data technology to

transform a single financial management category,

give full play to the advantages of high-tech,

gradually realize corporate financial information

sharing, and integrate and analyze financial

information in different categories. Enterprises can

intuitively and truly reflect the current business

development status of the enterprise through the

collected financial information, and understand the

actual operation of each department in the enterprise.

Both corporate leaders and corporate financial

management staff must have a good sense of financial

management informatization and clarify the

importance of implementing corporate financial

management informatization. Only when enterprises

have a correct understanding of financial

management informationization, keep pace with the

times, and effectively use information software to

process relevant information, can they provide a

reliable basis for business decision-making. For

example, after years of development, a certain

company has gradually opened up markets and

channels, and its business scale has continued to

expand. How to solve various problems in business

operations in the new era is an important challenge in

current development. To this end, the company has

fully applied computer information technology and

formulated a complete ERP system. Each department

of the enterprise implements a block operation model,

and financial management information is organized

according to different categories. Simultaneously, the

company also formulated corresponding financial

assessment indicators to stimulate employees'

enthusiasm for work (Chen 2018).

Furthermore, companies also need to establish a

sound value chain management system. Enterprises

should build a basic value chain based on the actual

conditions of their business activities. The enterprise

allows the financial management department to

strengthen risk prevention and control, and

coordinate and cooperate among various departments

to strengthen the risk management of receivables. So

as not to reduce the value of business activities of the

enterprise due to inadequate financial management.

6.2 Strengthen Personnel Training and

Introduce Advanced Technology

Under the background of "Internet +" and big data,

the implementation of enterprise financial

management information work requires a large

number of professionals to support. It is different

from traditional financial management work and

requires very high professionalism for related

personnel. Under such circumstances, companies

should strengthen the training of professional

financial management information talents. For one

thing, companies should conduct financial training

activities on a regular or irregular basis for existing

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

828

financial personnel to improve the business

capabilities of financial personnel. It must not only

have agile thinking, effectively organize and analyze

corporate financial information data, but also do a

good job in supervision and management of corporate

financial activities. Financial personnel should have

lifelong learning awareness and learn new knowledge

of financial information. They also need to follow the

pace of the big data information era to meet the needs

of financial management informatization. For

another, companies can learn from the excellent

experience of foreign countries, combine the actual

situation of Chinese corporate financial management,

and introduce advanced financial management

techniques to attract more outstanding talents. In turn,

it improves the feasibility of corporate financial

strategic decision-making and provides an important

guarantee for the long-term development of corporate

management (Duan 2019).

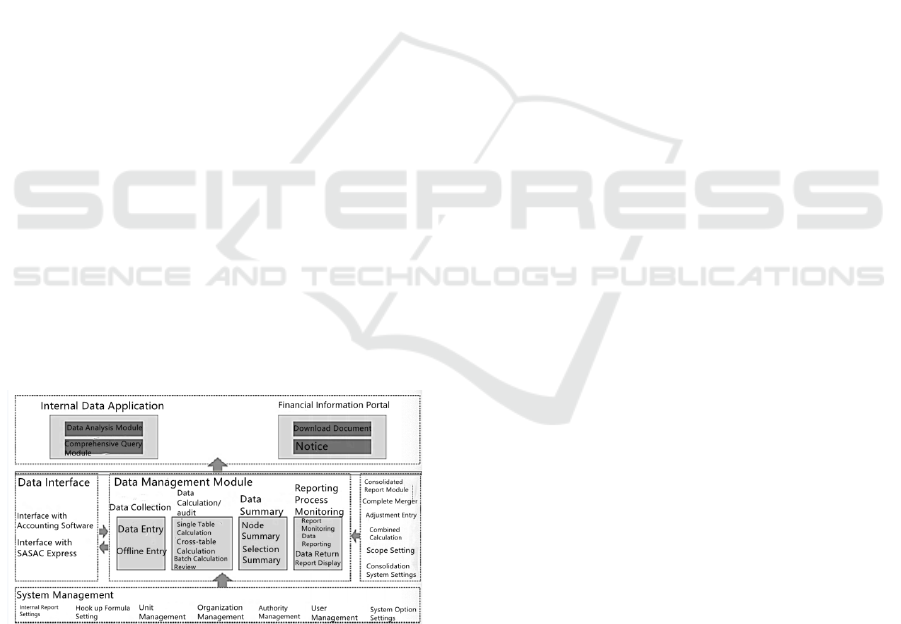

Furthermore, companies must also introduce

advanced information software, and implement high-

level accounting computerization such as financial

system ERP, financial information technology, RPII,

and SAP. For example, when an enterprise

establishes a sound information financial

management system, it divides its atmosphere into six

modules based on its own operating characteristics. It

uses advanced information technology to collect

relevant information and data, correlate the financial

information of various departments, and master the

overall business data of the enterprise. Moreover, the

information data generated in each link of product

production is now associated with the total data. The

enterprise financial information system established

by it is shown in Figure 1 below.

Figure 1: Diagram of An Enterprise Financial Information

System

6.3 Improve the System and Create a

Financial Information Platform

Due to the late start of China's big data technology

development, the level of financial informatization of

Chinese enterprises has yet to be improved. In

addition, the related policies and systems are not

perfect enough. We need to give full play to the

government's regulation and guidance functions to

continuously improve the corporate financial

management information system and provide active

policy support. We must strictly follow the relevant

rules and regulations to perform operations, and

optimize the existing financial management rules and

regulations in conjunction with the internal control

system of the enterprise. We should look at the

informatization of corporate financial management as

a system. Although it has a certain degree of

complexity, it can restrain the behavior of related

personnel to a certain extent. We can use information

software to do a good job of financial data analysis,

so as to truly feedback the actual operating conditions

of the enterprise.

Otherwise, companies also need to create a

scientific financial information platform, create a

good information management atmosphere, and

improve the level of corporate financial management.

The role of the financial information platform is

mainly reflected in two aspects. Firstly, it helps to

reflect the application value of the financial

management information system. After an enterprise

has created a financial information platform, it uses

advanced information software to perform scientific

accounting management, and uses financial

management information software to automatically

produce financial data statements. This can

strengthen the management of corporate funds, do a

good job in reimbursement, and simplify complex

financial management processes. This greatly

improves the efficiency of corporate financial

management, shortens the time for report review,

relieves the pressure on financial management

personnel, and effectively supervises the financial

activities of the enterprise. Secondly, it can use the

financial and economic data of the enterprise to

discover the problems in the operation and

management of the enterprise in time, and take

effective measures to solve them. In the first half of

2019, a company's revenue increased by 58%, its

market share was 30%, its net profit

increased by 35%,

and its gross profit margin rose to 22.5%. Based on

its financial data report, we can analyze that the

reason for the good results in the first half of the year

is that the company has made new judgments on the

market, optimized the company's product structure,

and locked in the consumer group. Moreover, it does

not only rely on cost reduction, but attaches

importance to input-output efficiency.

Research on Informatization Innovation of Enterprise Financial Management Under the Background of "Internet+" and Big Data

829

7 CONCLUSIONS

In the context of "Internet +" and big data, the

development of informatization of financial

management of innovative enterprises is an inevitable

trend of the development of the times, and it is of

great significance. Whether in terms of the needs of

the enterprise itself or the characteristics of the times,

the use of new financial management technology

tools and the implementation of financial information

management are important means for enterprises to

seek long-term development. "Internet+" and big data

have had a great impact on the financial management

of enterprises. They not only changed the traditional

financial management concepts and integrated

Internet thinking, but also increased the demand for

talents. The professional requirements for financial

personnel have become more higher. In this case, we

should implement effective measures to solve the

current financial management problems of the

enterprise. Meanwhile, we must enhance the

information awareness of corporate financial

managers and leaders, and clarify the importance of

informatization of corporate financial management.

For one thing, we must attach importance to the

training of corporate financial management

personnel, introduce advanced science and

technology, and provide important personnel and

technical support for corporate financial information

management. For another, we must establish sound

rules and regulations, create a scientific financial

information platform, and promote the improvement

of enterprise financial management informatization.

ACKNOWLEDGEMENTS

Humanities and Social Science Research Project of

Chongqing Education Committee Project

No.21SKGH390.

REFERENCES

Chen Xuanjun. (2018) Research on enterprise financial

management innovation under the background of

"Internet+". Consumer Guide, 249,251.

Dai Hongzhen. (2017) Research on Enterprise Financial

Management Innovation under the Internet

Background. Administrative Business Assets and

Finance, 83+85.

Duan Huijun. (2019) Research on enterprise financial

information management under the background of

"Internet +". Chinese Market, 188-189.

Hao Limei. (2019) Research on Enterprise Financial

Management Innovation under the Background of

"Internet +". Finance and Economics, 120.

Li Ying. (2019) Research on enterprise financial

information management under the background of

"Internet +". Think Tank Times, 51+53.

Lv Xin. (2018) Innovative research on the development of

enterprise financial management information under the

background of big data. Science and Technology

Economy Market, 34-35.

Wu Haiyan. (2018) Research on corporate financial

management innovation under the background of

"Internet +". Modern Marketing (Late Period), 199-

200.

Xiao Youquan. (2019) Research on Financial

Informationization in the Context of Internet Big Data.

Modern Business, 134-135.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

830