The Impact of Carbon Information Disclosure Level on Enterprise

Financing Cost in the New Economy: Research on the Mediating

Effect of Organizational Reputation

Meng Hu

*

and Chen Zhang

Department of Management, Hefei University of Technology, Hefei, China

*

Corresponding author

Keywords: New Economic Background, Carbon Information Disclosure Level, Financing Cost, Organizational

Reputation.

Abstract: Taking Chinese listed companies that issued social responsibility reports from 2010 to 2019 as research

samples, this paper constructs a carbon information disclosure index system based on the connotation of the

new economic background, and uses Python to mine relevant words to calculate the carbon disclosure score,

empirically tests the impact of carbon information disclosure level on enterprise financing cost, and considers

the impact mechanism of organizational reputation. The results show that the level of carbon information

disclosure is negatively correlated with corporate financing costs, and organizational reputation plays a

intermediary effect in the relationship between carbon information disclosure level and financing costs.

1 INTRODUCTION

At this stage, China's economic development

conditions and environment are undergoing major

changes. From the perspective of development

conditions, China's past advantages in low-cost

factors no longer exist. In order to enhance its

international competitive advantage, in October 2020,

the party proposed to speed up the construction of a

new development pattern with domestic circulation as

the main body and domestic and international double

circulation promoting each other; From the

perspective of development environment, the frequent

occurrence of global extreme climate has caused huge

losses to human production and life. In order to

improve the environment, in March 2021, Premier Li

Keqiang proposed to formulate an action plan for

reaching the peak of carbon emissions by 2030 and do

a solid job in carbon peaking, carbon neutralization

and other work. Therefore, with the changes of

China's economic development conditions and

environment, the new economic background of the

integration of double cycle background and green

low-carbon background came into being. In the

context of the new economy, in order to achieve the

unity of economic and social benefits, enterprises, as

the main participants in the internal and external

economic cycle and the main "perpetrators" of carbon

emissions, need to bear the responsibility of low-

carbon development under the background of internal

and external cycle. Voluntary carbon information

disclosure just provides an opportunity for enterprises

to implement the responsibility of low-carbon

development.

Difficult and expensive financing has always been

a difficult problem perplexing the development of

China's real economy (Zhou, Han, 2020), and the

disclosure of carbon information requires a lot of

costs. With the continuous improvement of investors'

awareness of environmental protection, it is worth

exploring whether enterprises that take the initiative to

disclose carbon can win the public's recognition and

improve their reputation, so as to reduce financing

costs and alleviate financing constraints. At present,

the academic community has not reached a consensus

conclusion on the impact of carbon information

disclosure level on enterprise financing cost. Some

scholars believe that a series of costs such as

measurement, sorting and release will occur in the

process of carbon disclosure, which is easy to lead to

operational risks, so investors demand a higher rate of

return. Moreover, carbon information disclosure will

be understood as a means for enterprises to disguise as

friends of the environment out of "green washing

motivation", so that the financing cost does not

786

Hu, M. and Zhang, C.

The Impact of Carbon Information Disclosure Level on Enterprise Financing Cost in the New Economy: Research on the Mediating Effect of Organizational Reputation.

DOI: 10.5220/0011349400003440

In Proceedings of the Inter national Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 786-794

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

decrease but increases (Lee, Park, Klassen, 2015).

Other scholars believe that carbon information not

only meets the needs of investors for non-financial

information and solves the problem of information

asymmetry, but also helps to show the enterprise's

awareness of environmental responsibility, establish a

good image and improve the recognition (Wen, Zhou,

2017), so as to obtain a lower financing cost. Other

scholars believe that due to the influence of enterprise

life cycle (Ma, Gai, 2019) and environmental

regulatory pressure (Yang, Zhang, et al., 2020), there

is an inverted "U" relationship between carbon

information disclosure level and financing cost.

Therefore, this paper intends to explore the

connotation of the new economy formed by the

integration of internal and external circulation and

green low-carbon, integrate this connotation into the

carbon information disclosure index system, build a

new evaluation system, study the relationship between

enterprise carbon information disclosure and

financing cost, and consider the intermediary role of

organizational reputation, This paper studies whether

enterprises can improve the awareness and level of

carbon disclosure and realize the coordinated

development of enterprises, society and environment

by obtaining lower financing cost.

The research value of this paper lies in: (1) when

constructing the carbon information disclosure

system, innovatively excavate the relevant domestic

and international carbon information disclosed by

enterprises in the social responsibility report by

integrating the connotation of the new economic

background, so as to more comprehensively measure

the level of carbon information disclosure. (2) When

analyzing the relationship between carbon

information disclosure level and financing cost,

consider the intangible asset of organizational

reputation, and enrich the research on the influence

mechanism between carbon information disclosure

level and financing cost from the perspective of

resources

2 MATERIALS AND METHODS

2.1 Theoretical Analysis and Research

Assumptions

2.1.1 Relationship between Carbon

Information Disclosure Level and

Enterprise Financing Cost

According to the stakeholder theory, the stakeholders

of enterprises include shareholders, creditors, the

public and so on. Shareholders, as equity holders,

attach importance to the long-term development of

enterprises. Carbon disclosure can prevent

punishment for failing to comply with carbon

emission requirements, which will affect long-term

development. Therefore, shareholders expect to

reduce risks and require lower return on investment.

As the supplier of funds, creditors can evaluate the

environmental legitimacy and measure the future

repayment ability of enterprises through carbon

information disclosure. When the creditor's loan

collection risk is reduced, the required capital income

also decreases. As product buyers, the public's low-

carbon business information will increase their

positive judgment on high-quality and environmental

protection of products, so as to expand consumer

demand, improve corporate cash flow, reduce

external borrowing, and indirectly reduce financing

costs (Zhou, Zhou, et al, 2018).

H1: the higher the level of carbon information

disclosure, the lower the financing cost of enterprises.

2.1.2 The Relationship Between Carbon

Information Disclosure Level and

Organizational Reputation

Information asymmetry theory holds that there is

information asymmetry between enterprises and

investors. In order to reduce the adverse effects of

information asymmetry before and after the event,

enterprises actively transmit internal information to

the outside world to improve their reputation. On the

one hand, by disclosing relevant information such as

carbon emission reduction strategy, carbon emission

reduction measures and carbon emission reduction

results, enterprises fill the gaps in investors' efforts

and achievements for low-carbon environmental

protection, so as to effectively alleviate information

asymmetry(Mei, Ge, et al, 2020), avoid value

discount and improve enterprise reputation; On the

other hand, the higher the level of carbon information

disclosure, which reflects the higher cultural

conservation and moral standards of the enterprise.

The interest motivation of the management to conceal

bad news is relatively low, and the transparency level

of corporate governance is high, so as to establish a

good image of enterprise integrity and responsibility

and improve the reputation of the enterprise.

Accordingly, hypothesis 2 is put forward.

H2: the higher the level of carbon information

disclosure, the better the reputation of the

organization.

The Impact of Carbon Information Disclosure Level on Enterprise Financing Cost in the New Economy: Research on the Mediating Effect

of Organizational Reputation

787

2.1.3 Mediating Role of Organizational

Reputation

As a reflection of the interactive relationship between

enterprises and investors, carbon information

disclosure actively transmits internal information to

the outside world, affects the enterprise reputation,

and then affects the financing cost. Under the premise

of information asymmetry, the adverse selection of

investors and the moral hazard of managers are not

conducive to the establishment of a good image of

enterprises. The active disclosure of relevant

information is conducive to avoiding value discount

and improving the reputation of enterprises.

According to reputation theory, reputation has asset

attributes and information attributes (Guan, Zhang,

2019). On the one hand, reputation is an important

intangible asset of enterprises, which can help

enterprises obtain commodity premium and cushion

the negative expectation of cost increase. On the other

hand, reputation is the information carrier in the

signal transmission mechanism. A good reputation

can reduce uncertainty and enhance investor

confidence (Li, Tong, et al 2020), reduce the

necessary rate of return required by investors and

reduce the financing cost of enterprises. Accordingly,

this paper puts forward hypothesis 3.

H3: organizational reputation plays an

intermediary role in the process of the impact of

carbon information disclosure level on enterprise

financing cost.

2.2 Research Design

2.2.1 Sample Selection and Data Source

This paper selects listed companies in all A-share

industries in Shanghai and Shenzhen from 2010 to

2019 as the research sample, and further screens and

arranges the samples: (1) eliminate financial listed

companies; (2) Eliminate abnormal data or ST, * ST

listed companies; (3) Excluding the listed companies

with incomplete data, 3270 effective observations

were finally obtained. The financial data of the

company involved in this paper mainly comes from

guotai'an database (CSMAR). The data in the carbon

information disclosure index system mainly comes

from the social responsibility report, and the scores

are collected by text mining. In order to eliminate the

influence of extreme values, this paper winsorize all

variables at 1% and 99% quantiles.

2.2.2 Variable Design

a). Explained variable - financing cost. Equity

financing and bond financing are the most common

financing methods.

Therefore, this paper uses their weighted average

capital cost to reflect the financing cost of listed

companies, that is, financing cost = (debt / total

capital) * debt cost * (1-corporate income tax rate) +

(net asset value / total capital) * equity cost.

b). Explanatory variable - carbon information

disclosure level.

In the context of the new economy, green and

low-carbon refers to a sustainable development

concept to alleviate the greenhouse effect and reduce

air pollution; The connotation of internal and external

circulation is: a preliminary consensus has been

reached on the connotation of internal circulation,

that is, considering the national boundary of

economic activities, internal circulation refers to the

cycle formed by domestic production, distribution,

circulation and consumption in reproduction

activities and taking meeting domestic demand as the

starting point and foothold (Liu 2020). The

connotation of external circulation has been

continuously improved with the development of the

times. Under the suppression of current international

trade, external circulation is no longer limited to the

"export-oriented" of raw materials and markets in the

past, but refers to the process in which one or more

links in reproduction activities participate in

international value creation (Lu 2020).

Based on the above connotation, this paper

interprets the corporate social responsibility report

and measures it according to the four dimensions of

low-carbon awareness, emission reduction

management, emission reduction performance and

carbon emission verification. Considering that the

internal and external circulation is mainly divided by

the national boundary of reproduction activities, this

paper uses the method of text analysis to mine the

carbon information related to these four dimensions

at home and abroad, So as to reflect the carbon

information disclosure under the new economic

background. The specific steps are as follows:

first, data acquisition. Crawl the PDF files of the

social responsibility reports of Listed Companies in

Shanghai and Shenzhen stock markets from 2010 to

2019 through Python software on hexun.com;

Secondly, basic keyword extraction. Since the

format and content of the social responsibility report

disclosed by the same enterprise in different years are

basically the same, and the number of enterprises

disclosing the social responsibility report is

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

788

increasing year by year, taking the 2019 social

responsibility report as the sample, referring to the

carbon information disclosure requirements of

domestic and foreign authorities, the basic key

phrases or phrases related to each secondary index are

preliminarily extracted through manual reading;

Thirdly, word segmentation. Jieba library, an

open source tool library of Python language, is used

to segment Chinese words for the sorted basic

keywords, and regular expressions are constructed to

obtain training corpus. The basic keywords are used

to match the corresponding sentences in txt. The

matched sentences are segmented again, and the

mood auxiliary words, connectives, punctuation

marks, numbers and other stop words without clear

meaning are removed, then we use word2vec

algorithm to expand the most similar word, take top5

as the extension word, and add the word to the

existing category, so as to expand the keyword.

Finally, summarize the scores. Use the expanded

keywords to match the responsibility report to obtain

the corresponding score: when the enterprise

discloses domestic relevant carbon information, it is

assigned 1 score, and when it discloses international

relevant carbon information, it is assigned 2 score,

otherwise it is 0 score, and then sum up all scores.

The total score of the index system is 24 points. The

carbon information disclosure level index can be

obtained by dividing the score obtained by each

company by the total score. At the same time, in order

to ensure the reliability of the data results, this paper

uses manual reading to score again to eliminate major

errors.

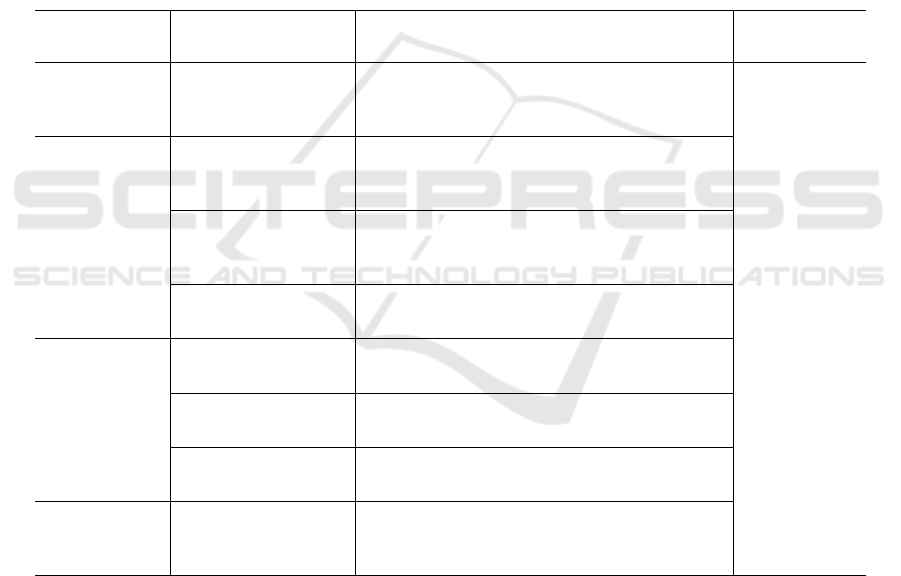

Table 1: Carbon information disclosure indicator system in the context of the new economy.

First level

indicator

Secondary indicators Indicator meaning Scoring

Low carbon

awareness

Energy saving and

emission reduction

concept

Disclosure of green and low-carbon development

in the corporate spirit and values, and the concept

of becoming a first-class enterprise

1 point is

assigned to

carbon

information

related to the

country, and 2

points are

assigned to

carbon

information

related to the

world.

Emission

reduction

management

Functional

organization

Set up energy-saving and emission-reduction

leading groups, energy-saving committees and

other functional organizations

Management System

Develop and implement management systems

such as energy saving and emission reduction

documents and manuals

Publicity and

education

Adopt management measures such as publicity

and education

Emission

reduction

performance

Economic

performance

Gain economic performance from selling low-

carbon products and obtaining tax incentives

Environmental

performance

Environmental performance such as reduction in

COD emissions

Social performance

Obtained social performance such as the honorary

title of energy saving and emission reduction

Carbon

Assurance

Energy-saving

management system

certification

Through environmental management system or

energy management system

c) Intermediary variable - organizational

reputation. Referring to the practices of Zhen HX and

Wang S (2021), according to the public's evaluation

of corporate reputation, this paper selects 14

corporate reputation evaluation indexes, calculates

the corporate reputation score by factor analysis

method, and then sorts the scores from low to high,

divides them into 10 groups, and assigns them l to 10

in turn.

d) Control variables. At the level of corporate

governance, control the size and age of enterprises.

At the level of company performance, control the

asset liability ratio, return on assets, operating cash

flow and operating income growth rate. Because the

capital return rate and financing cost of enterprises

are different in different industries and years, this

paper introduces industry and year variables to

control. The specific description of variables is

shown in Table

2.

The Impact of Carbon Information Disclosure Level on Enterprise Financing Cost in the New Economy: Research on the Mediating Effect

of Organizational Reputation

789

Table 2: Variable definition table.

Variable Variable name Variable definitions

Explained variable

Financing costs(𝑊𝐴𝐶𝐶)

Financing cost = (debt/total capital) * cost of debt *

(1- corporate income tax rate) + (net asset

value/total capital) * cost of equity

Explanatory variable

Level of carbon information

disclosure(𝐶𝐼𝐷𝐿)

Calculate the score from the carbon information

disclosure indicator system

Intermediary variable

Organizational reputation

(CR)

Build reputation system, calculate scores and assign

values

Control variables

Enterprise size(𝑆𝐼𝑍𝐸)

Natural logarithm of total assets at the end of the

period

Enterprise age(𝐴𝐺𝐸)

Years of listing

The asset

–

liability ratio

(𝐿𝐸𝑉)

Total liabilities at the end of the period/Total assets

at the end of the period

Asset yield(𝑅𝑂𝐴)

Net profit/average total assets

Operating cash flow(𝐶𝐹𝑂)

Net cash flow from operating activities/total assets

at the end of the period

Operating income growth rate

(𝑂𝐼𝐺𝑅)

Business revenue growth this year/previous year

business revenue

Industry(𝐼𝑁𝐷)

virtual variable

Year(𝑌𝐸𝐴𝑅)

virtual variable

2.2.3 Model Design

In order to test the relationship between carbon

information disclosure and enterprise financing cost

and the intermediary role of organizational reputation

between carbon information disclosure and financing

cost, this paper constructs the following three

regression models with reference to the intermediary

effect analysis method of Wen Zhonglin et al. (2005).

𝑊𝐴𝐶𝐶

,

=𝛼

+𝛼

𝐶𝐼𝐷𝐿

,

+𝛼

𝑆𝐼𝑍𝐸

,

+𝛼

𝐴𝐺𝐸

,

+

𝛼

𝐿𝐸𝑉

,

+𝛼

𝑅𝑂𝐴

,

+𝛼

𝐶𝐹𝑂

,

+𝛼

𝑂𝐼𝐺𝑅

,

+

∑

𝐼𝑁𝐷 +

∑

𝑌𝐸𝐴𝑅 + 𝛼

,

(1)

𝐶𝑅

,

=𝛽

+𝛽

𝐶𝐼𝐷𝐿

,

+𝛽

𝑆𝐼𝑍𝐸

,

+𝛽

𝐴𝐺𝐸

,

+

𝛽

𝐿𝐸𝑉

,

+𝛽

𝑅𝑂𝐴

,

+𝛽

𝐶𝐹𝑂

,

+𝛽

𝑂𝐼𝐺𝑅

,

+

∑

𝐼𝑁𝐷 +

∑

𝑌𝐸𝐴𝑅 + 𝛽

,

(2)

𝑊𝐴𝐶𝐶

,

=𝛾

+𝛾

𝐶𝐼𝐷𝐿

,

+𝛾

𝐶𝑅

,

+𝛾

𝑆𝐼𝑍𝐸

,

+

𝛾

𝐴𝐺𝐸

,

+𝛾

𝐿𝐸𝑉

,

+𝛾

𝑅𝑂𝐴

,

+𝛾

𝐶𝐹𝑂

,

+𝛾

𝑂𝐼𝐺𝑅

,

+

∑

𝐼𝑁𝐷 +

∑

𝑌𝐸𝐴𝑅 + 𝛾

,

(3)

3 RESULTS& DISCUSSION

3.1 Descriptive Statistics

Table 3 shows the descriptive statistical results of the

main variables. The average value of financing cost

is 0.093, the minimum value is 0.018 and the

maximum value is 0.640, indicating that there are

great differences in financing costs among different

sample enterprises. The average carbon information

disclosure level is 0.227, indicating that the carbon

information disclosure level of the sample enterprises

is generally low, and the minimum value is 0 and the

maximum value is 0.375, indicating that there are

great differences in the carbon information disclosure

level among the sample enterprises. The average

values of domestic carbon information disclosure

level and international carbon information disclosure

level are 0.151 and 0.076 respectively, indicating that

the domestic carbon information disclosure level of

the sample enterprises is higher than the international

carbon information disclosure level. The median of

organizational reputation are 5, indicating that the

sample enterprises have good reputation.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

790

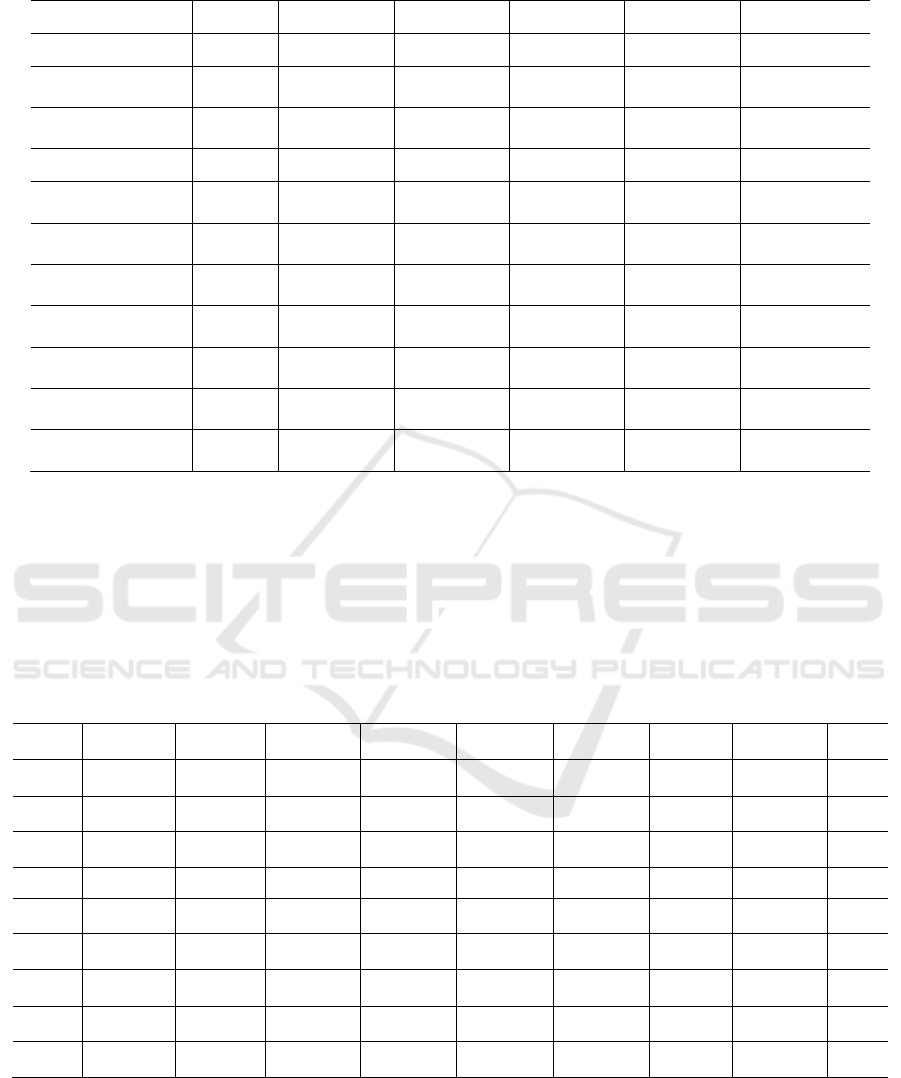

Table 3: Descriptive statistics of main variables.

𝑉𝑎𝑟𝑖𝑎𝑏𝑙𝑒

N Mean SD Min Median Max

𝑊𝐴𝐶𝐶

3270 0.093 0.074 0.018 0.079 0.640

𝐶𝐼𝐷𝐿

3270 0.227 0.082 0 0.250 0.375

𝐷𝐶𝐼𝐷𝐿

3270 0.151 0.061 0 0.167 0.250

𝑁𝐶𝐼𝐷𝐿

3270 0.076 0.044 0 0.083 0.167

CR 3270 5.468 2.873 1 5.000 10

𝑆𝐼𝑍𝐸

3270 23.266 1.407 20.555 23.147 27.028

𝐴𝐺𝐸

3270 13.069 6.359 1 14 26

𝐿𝐸𝑉

3270 0.487 0.196 0.063 0.502 0.857

CFO 3270 0.058 0.068 -0.131 0.057 0.250

𝑅𝑂𝐴

3270 0.059 0.048 0.002 0.046 0.236

𝑂𝐼𝐺𝑅

3270 0.182 0.289 -0.351 0.128 1.573

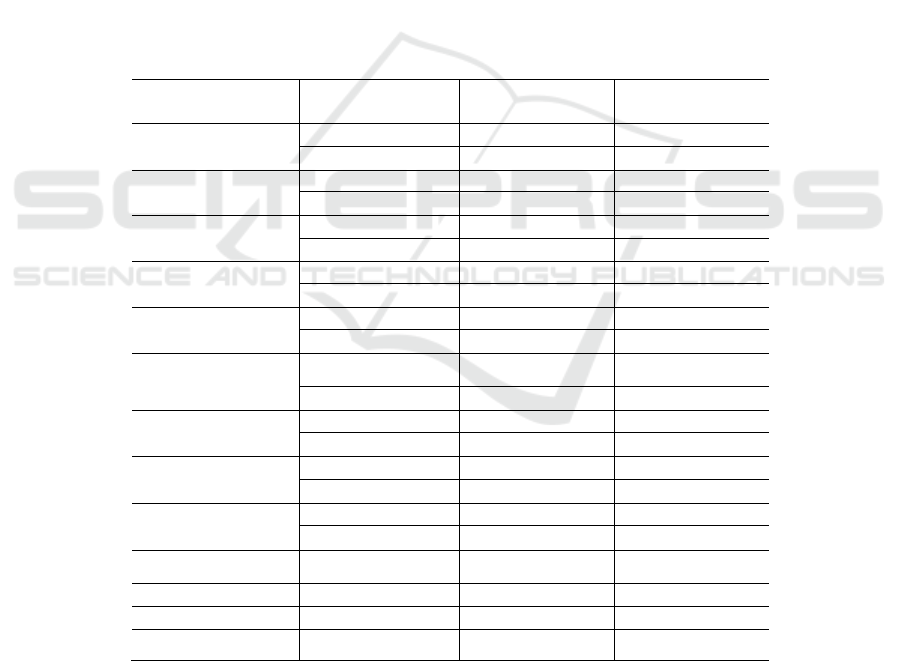

3.2 Correlation Analysis

Table 4 shows the Pearson correlation analysis results

between the main variables. The level of carbon

information disclosure is significantly negatively

correlated with the financing cost at the level of 5%,

and the correlation coefficient is -0.044, which

preliminarily verifies the hypothesis H1. There is a

significant correlation between organizational

reputation and carbon information disclosure level,

and there is also a significant correlation between

most control variables and financing cost. The

absolute values of correlation coefficients among

variables are less than 0.8, indicating that there is no

collinearity problem among variables.

Table 4: Correlation analysis results between variables.

𝑊𝐴𝐶𝐶 𝐶𝐼𝐷𝐿

CR

𝑆𝐼𝑍𝐸 𝐴𝐺𝐸 𝐿𝐸𝑉 𝐶𝐹𝑂 𝑅𝑂𝐴 𝑂𝐼𝐺𝑅

𝑊𝐴𝐶𝐶

1

𝐶𝐼𝐷𝐿

-0.044** 1

CR -0.032* 0.051* 1

𝑆𝐼𝑍𝐸

-0.058*** 0.037** 0.758*** 1

𝐴𝐺𝐸

0.023 -0.008 0.102*** 0.298*** 1

𝐿𝐸𝑉

-0.141*** -0.022 0.333*** 0.592*** 0.242*** 1

𝐶𝐹𝑂

0.100*** -0.000 0.172*** -0.044** -0.021 -0.247*** 1

𝑅𝑂𝐴

0.158*** -0.027 0.148*** -0.247*** -0.154*** -0.471*** 0.465*** 1

𝑂𝐼𝐺𝑅

-0.028 -0.014 0.042** 0.005 -0.071*** 0.095*** -0.018 0.155*** 1

Note: ***, **, * indicate significant at the level of 1%, 5%, and 10%, respectively. The t value is in parentheses.

The Impact of Carbon Information Disclosure Level on Enterprise Financing Cost in the New Economy: Research on the Mediating Effect

of Organizational Reputation

791

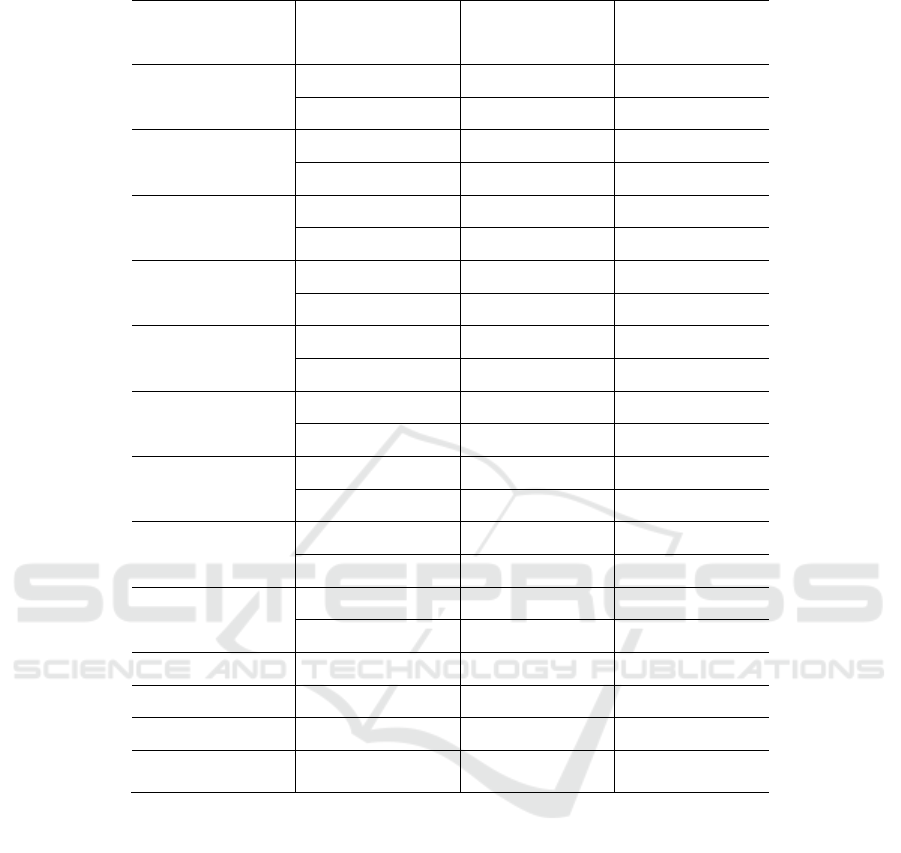

3.3 Multiple Linear Regression

Analysis

Column 2 of table 5 reports the empirical results of

the impact of carbon information disclosure level on

corporate financing costs. It can be seen that the

regression coefficient of carbon information

disclosure level in model (1) is significantly negative

at the level of 1%, which supports hypothesis 1, that

is, the higher the carbon information disclosure level,

the lower the financing cost, indicating that under the

new economic background, the high-level carbon

information disclosure formed by disclosing

enterprises' participation in domestic and

international carbon governance can reduce the

financing cost of companies.

Column 3 of table 5 reports the empirical results

of the impact of carbon information disclosure level

on organizational reputation. It can be seen that the

regression coefficient of carbon information

disclosure level in model (2) is significantly positive

at the level of 1%, which supports hypothesis 2, that

is, the higher the level of carbon information

disclosure, the better the organizational reputation,

indicating that the active disclosure of enterprises'

efforts for carbon emission reduction at home and

abroad is conducive to improving the level of carbon

information disclosure and winning a good

organizational reputation.

Column 4 of table 5 reports the empirical results

of the intermediary role of organizational reputation.

It can be seen that in model (3), the regression

coefficient of carbon information disclosure level

CIDL is significantly negative at the level of 1%, and

the regression coefficient of organizational reputation

Cr is significantly negative at the level of 5%,

indicating that organizational reputation plays an

intermediary role in the relationship between carbon

information disclosure level and financing cost.

Table 5: regression results of the relationship between carbon information disclosure level and financing cost.

𝑉𝑎𝑟𝑖𝑎𝑏𝑙𝑒

Model (1)

WACC

Model (2)

CR

Model (3)

WACC

𝐶𝐼𝐷𝐿

-0.052*** 1.167*** -0.050***

(-3.291) (3.585) (-3.126)

CR

-0.002**

(-2.555)

𝑆𝐼𝑍𝐸

0.001 1.746*** 0.005**

(0.653) (63.554) (2.344)

𝐴𝐺𝐸

0.001*** -0.046*** 0.001***

(3.339) (-9.687) (2.861)

𝐿𝐸𝑉

-0.040*** 0.451** -0.039***

(-3.859) (2.123) (-3.764)

𝐶𝐹𝑂

0.042* 1.031** 0.044*

(1.799) (2.168) (1.897)

𝑅𝑂𝐴

0.135*** 20.205*** 0.180***

(3.657) (26.721) (4.402)

𝑂𝐼𝐺𝑅

-0.000 -0.287*** -0.001

(-0.055) (-2.998) (-0.190)

𝐶𝑜𝑛𝑠𝑡𝑎𝑛𝑡

0.032 -36.400*** -0.049

(0.916) (-51.406) (-1.042)

IND Yes Yes Yes

YEAR Yes Yes Yes

𝑁

3270 3270 3270

2

R

0.072 0.742 0.073

Note: ***, **, * indicate significant at the level of 1%, 5%, and 10%, respectively. The t value is in parentheses.

3.4 Robustness Test

In order to test the robustness of the empirical results,

this paper uses the practice of Wu XB et al. (Wu, et

al, 2017) and adopts "debt financing cost * asset

liability ratio + equity financing cost * (1-asset

liability ratio)" (ACOC) as an alternative variable of

financing cost (WACC). After testing, the empirical

results are basically consistent with the previous text,

indicating that it is robust.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

792

Table 6: Robustness test.

𝑉𝑎𝑟𝑖𝑎𝑏𝑙𝑒

Model (1)

ACOC

Model (2)

CR

Model (3)

ACOC

𝐶𝐼𝐷𝐿

-0.050*** 1.167*** -0.048***

(-2.895) (3.585) (-2.749)

CR

-0.002**

(-2.243)

𝑆𝐼𝑍𝐸

0.001 1.746*** 0.005**

(0.816) (63.554) (2.220)

𝐴𝐺𝐸

0.001*** -0.046*** 0.001***

(4.056) (-9.687) (3.621)

𝐿𝐸𝑉

-0.033*** 0.451** -0.032***

(-2.872) (2.123) (-2.788)

𝐶𝐹𝑂

0.062** 1.031** 0.064**

(2.436) (2.168) (2.522)

𝑅𝑂𝐴

0.129*** 20.205*** 0.171***

(3.189) (26.721) (3.844)

𝑂𝐼𝐺𝑅

-0.003 -0.287*** -0.004

(-0.665) (-2.998) (-0.783)

𝐶𝑜𝑛𝑠𝑡𝑎𝑛𝑡

0.018 -36.400*** -0.059

(0.478) (-51.406) (-1.157)

IND Yes Yes Yes

YEAR Yes Yes Yes

𝑁 3270 3270 3270

2

R

0.059 0.742 0.060

Note: ***, **, * indicate significant at the level of 1%, 5%, and 10%, respectively. The t value is in parentheses.

4 CONCLUSIONS

In order to explore whether corporate carbon

disclosure can reduce financing costs, this paper

analyzes the mechanism based on stakeholder theory,

information asymmetry theory, signal transmission

theory and reputation theory, excavates domestic and

international carbon information from the four

dimensions of low-carbon awareness, emission

reduction management, emission reduction

performance and carbon emission assurance, and

constructs the evaluation system of carbon

information disclosure level, Taking the listed

companies that issued social responsibility reports

from 2010 to 2019 as a sample, this paper discusses

the impact of carbon disclosure level on corporate

financing cost, and studies the intermediary role of

organizational reputation in the relationship between

carbon information disclosure level and financing

cost. Research findings:(1) The level of carbon

information disclosure of listed companies needs to

be improved. The disclosure content is not perfect.

Most companies tend to disclose domestic carbon

information and lack international carbon

information; The disclosure methods are not unified,

the disclosure process is not standardized, and the

comparability of carbon information is poor. (2)

Improving the level of carbon information disclosure

is conducive to improving the reputation of the

organization, so as to reduce the financing cost. A

The Impact of Carbon Information Disclosure Level on Enterprise Financing Cost in the New Economy: Research on the Mediating Effect

of Organizational Reputation

793

high level of carbon information disclosure can

reflect the environmental responsibility

consciousness and environmental risk management

level of listed companies, establish a good image,

improve corporate social reputation and reduce

corporate financing costs.

In order to improve the carbon information

disclosure level of Chinese enterprises, we should

pay attention to the following points:(1) The

government should speed up the construction of

carbon information disclosure regulations and

enhance the level of carbon information disclosure of

enterprises. Refine carbon information disclosure

requirements or separately issue carbon information

disclosure standards to clearly specify the content of

carbon information disclosure; Establish an official

platform for carbon information disclosure, conduct

disclosure at a unified time and place, and standardize

the disclosure process. (2) Listed companies should

improve the level of carbon information disclosure

and give full play to the financing cost advantage it

brings to enterprises. In terms of disclosure content,

we should seriously follow the relevant guidelines at

home and abroad to achieve domestic and

international standards; In terms of disclosure

methods, a separate social responsibility report is

published on the enterprise's official website to

establish a good corporate image and enhance the

organization's reputation, so as to reduce the

financing cost.

ACKNOWLEDGEMENTS

This work was financially supported by The National

Natural Science Foundation of China (71971071).

REFERENCES

Guan KL., Zhang R., (2019) Corporate reputation and

earnings management: effective contract view or rent-

seeking view [J] Accounting research, (01): 59-64.

Lee S Y., Park Y S., Klassen R D . (2015) Market responses

to firms' voluntary climate change information

disclosure and carbon communication[J]. Corporate

Social Responsibility & Environmental Management,

22(1):1-12.

Li XD., Tong X., et al., (2020) Reputation mechanism,

social trust and shared economic development -- an

analysis based on the sample data of 70 cities in China

[J] Business research, (11): 35-42.

Liu ZB. (2020) Seeking the new logic of reshaping chinese

economic cycle in domestic and foreign [J].

Exploration and Free Views, (07):42-49+157-158.

Lu JY. (2020) Analyzing the “DualCirculation”

development pattern from the perspective of value

creation [J]. Contemporary Economic Management,

42(12): 8-15.

Ma W., Gai YX. (2019) Corporate life cycle, carbon

information. disclosure and financing constraints:

empirical evidence based on heavy pollution

industries[J]. Journal of Industrial Technological

Economics, 303(01):109-116.

Mei XH., Ge Y., et al., (2020) Research on the impact

mechanism of environmental legitimacy pressure on

enterprise carbon information disclosure [J] Soft

science ,34 (08): 78-83.

Wen SB., Zhou LL. (2017) The influencing mechanism of

carbon disclosure on financial performance--“inverted

u-shaped” moderating role of media governance [J].

Management Review, 29(11): 183-195.

Yang J., Zhang M., et al. (2020) Carbon information

disclosure, environmental regulatory pressure and debt

financing costs——empirical data from chinese a-share

listed companies in the high carbon industry[J]. Journal

of Nanjing University of Technology (Social Science

Edition), 19 (06):86-98+112.

Zhou B., Han L. (2020) Land Finance, endogenous money

and corporate financing cost--evidence from the data of

chinese listed companies[J] Journal of Shanxi

University of Finance and Economics, 42(12):53-67.

Zhou, ZF., Zhou, H., et al., (2018) Carbon disclosure,

financial transparency, and agency cost: Evidence from

Chinese manufacturing listed companies. [J]Emerging

Markets Finance & Trade, 54(12):2669-2686.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

794