Sustainable Development of Methods for Assessing the Economic

Efficiency of Enterprises under the Conditions of Business

Intellectualization

Denys Vasylychev

a

, Sergiy Tsviliy

b

, Darya Gurova

c

and Olena Halan

d

National University «Zaporizhzhia Polytechnic», Zaporizhzhia, Ukraine

Keywords: Efficiency, Business, Results, Costs, Profit.

Abstract: The content and stages of business efficiency analysis were determined. It is established that for the purpose

of assessing the business management of the enterprise, science and practice have developed economic

indicators that model economic phenomena and are designed to assess the economic performance of an

enterprise or its business activity under the conditions of business intellectualization. It is proved that business

efficiency is measured in one of two ways, reflecting the performance of the enterprise in relation to either

the amount of resources advanced or the amount of their consumption (costs). To assess the efficiency of a

business, a system of indicators is used, it includes both private and generalized indicators of efficiency. The

proposals on the formation of generalizing indicators of economic efficiency at the macro- and micro-level

are considered. When building a model of economic efficiency of business using the resource approach, the

concepts of advanced variable capital and applied variable capital are used. To calculate the economic

efficiency of business using the resource approach, it is necessary to take the ratio of the result, which is

commodity capital in monetary form, and the cost of resources of human and social labor.

1 INTRODUCTION

Assessment of business efficiency of an enterprise is

the final stage of financial and managerial analysis.

Analysis of overall business efficiency is the

prerogative of the highest level of enterprise

management. Efficiency (success) of private

management decisions should be evaluated from the

point of view of overall success of the enterprise, its

long-term survival in the context of the

intellectualization of business.

In modern conditions, in the period of high

competition, the goal of enterprises is to maximize

profits with minimal costs (Rzaev, 2011).

For the purpose of assessing the business

management of an enterprise, science and practice

have developed special tools, which are called

economic indicators. Economic indicators model

economic phenomena. They are designed to measure

a

https://orcid.org/0000-0002-5057-7575

b

https://orcid.org/0000-0002-1720-6238

c

https://orcid.org/0000-0002-3180-0348

d

https://orcid.org/0000-0001-6061-5224

and evaluate the essence of economic characteristics,

economic efficiency of an enterprise's business or its

business activity.

Also, scientific research needs methodological

approaches to the selection of components and

criteria for assessing the economic performance of

enterprises, identifying reserves and opportunities

for their functioning, as well as the use of economic

and mathematical methods for forecasting their

further development.

Thus, the purpose of the article is to investigate

the methods for assessing the economic efficiency of

enterprises under the conditions of business

intellectualization and growth of their profitability.

208

Vasylychev, D., Tsviliy, S., Gurova, D. and Halan, O.

Sustainable Development of Methods for Assessing the Economic Efficiency of Enterprises under the Conditions of Business Intellectualization.

DOI: 10.5220/0011348300003350

In Proceedings of the 5th International Scientific Congress Society of Ambient Intelligence (ISC SAI 2022) - Sustainable Development and Global Climate Change, pages 208-218

ISBN: 978-989-758-600-2

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

2 THEORETICAL BASIS OF

RESEARCH

Intellectualization of economy and business is a

complex system economic category, the methodology

and evaluation of which require both a systematic

approach and a comprehensive approach because of

the need to justify management decisions in the

context of limited resources.

This situation is characterized, first, by the need

for its characterization at different levels of

management − individual, enterprise, sectoral,

regional and national. Secondly, the need for

monitoring and diagnostics not only in statics, but

also in dynamics, in the structural aspect. Thirdly, the

expediency of determining the measure of

effectiveness of the use of unpopular capital as a

realization of intellectual potential. Fourthly, the need

to provide feedback on the effectiveness of public

policy in the business environment. Fifth, the

formation of conclusions about the role of

intellectualization in the process of economic and

business development.

2.1 Stages of Business Efficiency

Analysis

Finding a solution to the problem of improving the

performance of enterprises in the process of

intellectualization of business can be achieved

through the development of methods for analyzing

the effectiveness of enterprise business processes.

Therefore, this actualizes the research in the field of

management of enterprise business intellectualization

on the basis of the development of models for

assessing the economic efficiency of enterprises.

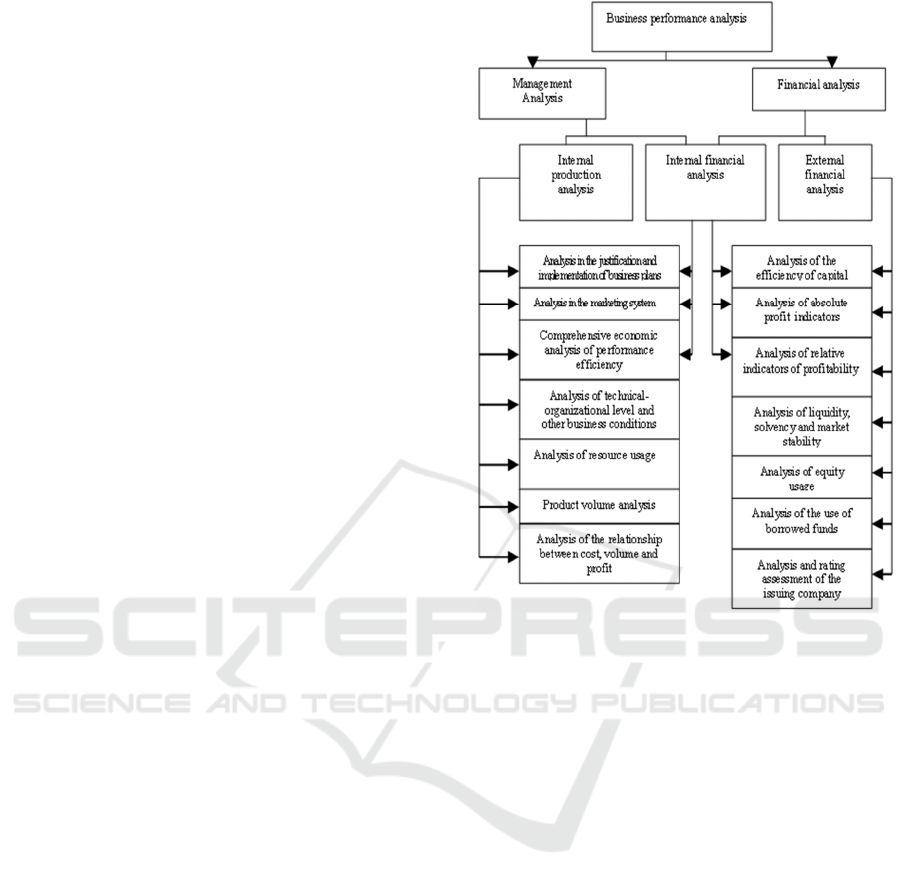

Schematic content of business efficiency analysis is

shown in Figure 1.

As can be seen from the scheme, which is

presented by A.D. Sheremet, a comprehensive

assessment of the economic efficiency of business is

an integral part of the managerial and financial

analysis (Sheremet, 2011). The article will focus on

the analysis and management of economic efficiency

of enterprise business.

The modern economy is distinguished by two

features:

– complete economic isolation, independence and

responsibility of enterprises as subjects of the market;

– uncertainty of market conditions, as a

consequence of free establishment by the enterprise

of business relations with partners, and free prices and

tariffs for products.

Figure 1: Scheme of the content of business efficiency

analysis (Sheremet, 2011).

Under these conditions, the central task of

management is to minimize business risks on the

basis of the assessment of each decision in terms of

the possibility of extracting economic benefits. This

creates objective prerequisites for increasing the role

of methods for analyzing the economic efficiency of

an enterprise's business. This requires modernization

of the methodology of this analysis, improvement of

methods of enterprise business economic efficiency

management.

For the purpose of assessing the business

management of an enterprise, science and practice

have developed special tools that are called economic

indicators. Economic indicators model economic

phenomena. They are designed to measure and

evaluate the essence of economic characteristics,

economic efficiency of an enterprise's business or its

business activity.

Further we will consider indicators of business

efficiency used in the enterprises of Ukraine.

Economic efficiency penetrates all spheres of

practical human activity, all stages of social

production, is the basis for construction of

quantitative criteria and value of decisions made.

Sustainable Development of Methods for Assessing the Economic Efficiency of Enterprises under the Conditions of Business

Intellectualization

209

2.2 Theory and Methodology of

Performance Evaluation

Currently, the most complete and consistent study of

economic efficiency of business (disclosure of the

subject of analysis) is given in the theory of

comprehensive economic analysis. All sections of

current, prospective and operative analysis are

devoted to efficiency analysis. It evaluates achieved

business efficiency, reveals factors of its change,

unused possibilities and reserves for increase

(Mykytiuk, 2018).

Business efficiency is measured in one of two

ways, reflecting the performance of the enterprise in

relation to either the amount of resources advanced,

or the amount of their consumption (costs) in business

processes.

In the system of economic indicators, some

characterize the effectiveness of a single type of

product (vertical feature of management), others − all

types of products or services (horizontal feature of

management). There are generalized and private

indicators of business efficiency. The first ones

characterize the effectiveness of the use of total labor

costs; the second ones characterize the effectiveness

of the use of individual types of labor costs.

The ratio of the results of labor to the inputs of

live labor reflects a subsystem of indicators of

productivity or output of live labor. The ratio of labor

results to past labor costs (production costs, equity

capital, cost of production funds), which includes the

overwhelming part of total labor costs, represents a

subsystem of indicators characterizing efficiency of

past labor (productivity of funds, productivity of

materials, turnover of current assets). Finally, the

ratio of the results of labor to the total expenditures of

the enterprise is a subsystem of indices characterizing

the efficiency of production of concrete products.

Advantages and disadvantages of methods of

measurement of each of efficiency indicators are

caused by contradictory sides of indicators, which

express the results of business (Babenko, 2010).

The most important indicator of efficiency is the

productivity of live labor. The most obvious

characteristic of productivity of live labor is an

indicator equal to the ratio of the volume of output in

kind, taking into account quality indicators, to the

cost of live labor. Prices have a great influence on the

indicator of the output of live labor, calculated in

value terms by net or net output (Babenko, 2010).

Indicators of return on assets (cost of goods),

material output (cost of materials), the level of

profitability should be distinguished depending on

whether they refer to the output of one type of product

or its entire range. Thus, fixed assets, in some cases,

it is difficult to attribute to the production of a

particular type of product. Among them there are

general-purpose fixed assets. Circulating capital is

not subject to such a division at all. Therefore,

turnover of current assets is determined in relation to

all products.

In the indicators "productivity", "yield of funds",

"productivity of materials", "turnover ratio" the

overall result − the volume of output − is correlated

with a business factor. The listed indicators can be

multidirectional. Each of them characterizes the

efficiency of inputs of live or past labor (Salyha,

2001).

The correlation between the dynamics of output

and the dynamics of results (costs) determines the

nature of economic growth. Business economic

growth can be achieved both extensively and

intensively. The excess of the growth rate of output

over the growth rate of resources or costs indicates

predominantly intensive economic growth.

To assess the efficiency of a business, a system of

indicators is used – profitability of capital, resources

or products. Business activity of an enterprise, in the

financial aspect, manifests itself, first of all, in the rate

of turnover of its funds. The profitability of an

enterprise reflects the degree of profitability of its

business. The analysis of business activity and

profitability lies in the study of levels and dynamics

of various financial ratios of turnover and

profitability, which are relative indicators of

enterprise financial results (Horodynska, 2008).

Thus a system of indicators is used to evaluate

business efficiency. This system should include both

private and generalizing performance indicators. A

generalizing indicator should give an integral

estimation, characterizing efficiency of usage of all

kinds of resources (costs) of enterprise.

None of these economic indicators can be

generalizing, because the result of activity does not

meet the costs. The generalizing indicator should, by

construction, meet the principles of business

efficiency management.

Next, let us consider the proposals available in the

economic literature on the formation of generalized

indicators of economic efficiency at the macro- and

microlevel.

2.3 The Theory of Formation of

Economic Efficiency Indicators at

the Macro Level

The foundations of the formation of the theory of

production efficiency, which characterizes the ratio of

ISC SAI 2022 - V International Scientific Congress SOCIETY OF AMBIENT INTELLIGENCE

210

results and costs, should be attributed to the moment

of analysis of the two factors of goods: consumer

value and value, disclosed by K. Marx (Marx, 1983).

Forming economic laws of time saving and growth of

labor productivity per unit of consumer value K.

Marx notes: "In general, the greater the productive

power of labor, the less labor time required for

production, the less labor mass crystallized in it, the

less its value (Marx, 1983).

The mathematical interpretation of the law of

economy of time, according to K. Marx's theory, can

be represented by expressions:

2

2

1

1

nn

Q

t

Q

t

>

(1)

2

222

1

111

nn

Q

mVc

Q

mVc ++

>

++

(2)

where t

1

/Qn

1

; t

2

/Qn

2

– the time required to

produce a unit of use value Qn

1

, Qn

2

, in the base

period and the new period; с

1

, с

2

– permanent capital

in the base period and the new period;

V

1

, V

2

– variable capital in the base period and the

new period;

m

1

, m

2

– surplus value in the base period and the

new period.

The law of the growth of the productive power of

labor, in fact, is interrelated with the law of economy

of time and can be represented by the expressions:

2

2

1

1

t

Q

t

Q

nn

<

(3)

222

2

1

11

1

mVc

Q

mVc

Q

nn

++

<

++

(4)

The mathematical representation of the laws of

saving time, and the growth of the productive force of

labor makes it possible to determine what constitutes

an indicator of general and comparative economic

efficiency (Marx, 1983).

The theory of efficiency was developed in the 20s

of the twentieth century. It was conditioned by the

solution of the problem of rational use of capital

investments, comparison of options in the

development of projects for the construction of power

plants, railroads, land reclamation facilities. In the

mid-20s of the twentieth century, the problem of

efficiency began to be posed as a problem of

determining the efficiency of capital investments for

individual industries and industry as a whole. Over

time, the problem of efficiency becomes a broader

one, and finally, the debate about it develops into a

dispute about economic efficiency (Salyha, 2001).

The subject of the discussions was the key issues

– the content of the category of efficiency of social

production, criteria and indicators of efficiency at the

level of society and enterprise, ways to measure it,

etc. H. Abezhauz, V. Akulenko, M. Barun, H.

Burshtein, F. Vinnik, R. Holdberg, A. Kalmanovsky,

V. Krasovsky, L. Litoshenko, Yu. Mitlyansky, P.

Maslov, S. Rosentul, J. Rosenfeld, A. Segal, M.

Smith-Falkner, S. Strumilin, Sh. Turetsky, H.

Feldman, N. Shaposhnikov, L. Yushkov, etc. took an

active part in the discussion. However, at that time

economists failed to come to a common position.

Many of their valuable thoughts were not understood

by their contemporaries (Salyha, 2001).

It is not the purpose of this article to review the

development of the theory of economic efficiency.

These issues have already been addressed by some

authors. The task is to identify when for the first time

the authors put forward the idea of determining the

relationship of private indicators of economic

efficiency in a single integral or synthetic indicator.

At the macro level, as a generalizing indicator of

economic efficiency, scientists suggest using the ratio

(Vorst, 1994):

FML

V

Е

in

γ

++

=

(5)

where V – pure product with regard to its

composition and quality;

L

in

– labour input;

М – current costs of material labor;

F – one-time investments in production assets;

γ – the coefficient of reduction to a single

dimension, which allows to sum up the costs and

investments.

This formula conceptually reflects the essence of

the construction of the indicator. But it is impossible

to use it in practice, because it is not clear how to

express the coefficient of conversion. It is not clear

what is the cost-of-living labor is. The formula differs

in its construction from the mathematical expression

of the law of productive labor force. There is no

criterion (threshold standard) of judgment about

efficiency.

The study of the efficiency of social production

would be incomplete without considering production

functions that characterize the dependence of output

on production factors (Vasyl’yva, 2021). The first

version of such functions is the Cobb-Douglas

production function, which considers the dependence

of output on only two factors − capital and labor:

Sustainable Development of Methods for Assessing the Economic Efficiency of Enterprises under the Conditions of Business

Intellectualization

211

,

βα

LKAV ⋅⋅=

(6)

where V – production volume;

К – production funds;

L – labor force;

А,

α

,

β

– parameters of the function;

А – coefficient of proportionality or scale;

α

,

β

– coefficients of output elasticity by capital and

labor, which characterize the increase in output per

1% increase in the corresponding factor of

production.

This expression was improved by a number of

researchers, including economists A. Solow, E.

Denison, A.I. Anchishkin, S.M. Veshnev, P.F.

Pochkin, Y.L. Shtern, O.O. Vasyl’yva who proposed

to consider in the form of special coefficients such

factors as qualification of workers, technical level of

production, etc. As a result, the Cobb-Douglas

function acquired the following generalized form

(Holovenko, 2016):

,

Rt

eLKAV ⋅⋅⋅=

βα

(7)

where: e

Rt

– a factor that denies the impact of

qualitative changes in production, including

technological progress.

Expressed in terms of the average annual growth

rate, the function is transformed and has the following

form:

I

о

=

α

I

к

+

β

I

ch

+ R

(8)

where: I

о

, I

к

, I

ch

– the growth rates of production,

production funds and labor force, respectively;

R – a complex index of growth of the total

economic efficiency of all production factors

(Holovenko, 2016).

According to the authors of this article, if we use

the Cobb-Douglas production function, business

efficiency can be expressed by the ratio of output (in

value terms) to costs:

1==

βα

L

AK

V

E

(9)

The above considered mathematical models of the

formation of economic efficiency indicator at the

macro level.

2.4 The Theory of Economic Efficiency

Indicators at the Micro Level

In theory and practice, the level of profitability of

business processes is preferred as a generalizing one

(Kudrenko, 2014). This statement is controversial for

a variety of reasons. Firstly, profit is not the result

only of the turnover of production assets. Secondly,

this indicator (numerator) can increase due to the

growth of prices, while other efficiency indicators can

worsen. As a consequence, productivity of funds,

material productivity, and productivity of live labor

will decrease. Thirdly, during the period during which

profits will be made, current assets will make many

turns, and fixed assets will serve only a part of their

service life. Fourth, the authors of this article believe

that for purposes of measuring the business

performance of an enterprise, fixed assets and current

assets cannot be added up, despite the fact that these

components are measured in cost units.

Thus, in order to evaluate the performance of an

enterprise, Ohon C.H. proposes to introduce the

coefficient of active costs, defined as the ratio of

active costs to the cost of production (Ohon, 1996). In

this case, active costs are understood as labor costs,

the cost of introducing new technologies. Such an

indicator has the right to exist. However, it cannot be

classified as a generalizing indicator. It does not

reflect the overall performance of the enterprise and

the resources (costs) to obtain them.

Of scientific interest is the proposal of some authors

to use the following ratio as a generalizing one

(Salyha, 2007:

ОСОf

zpА

СС

PII

Е

+

++

=

(10)

where I

А

– amortization charges;

I

ZP

– labor costs;

P – balance sheet profit of the enterprise;

С

Оf

– average annual value of fixed assets,

С

ОС

– average annual value of current assets of the

enterprise.

As a justification of this indicator the authors note

that in this formula "depreciation charges represent

the degree of use of fixed assets, while wages and

profits represent the degree of use of current assets"

(Salyha, 2007).

It is difficult to fully agree with the proposals of

some authors for various reasons, namely:

having taken the economic efficiency

indicator as a ratio of results to costs as the basis for

formation, the authors substituted results for costs,

ISC SAI 2022 - V International Scientific Congress SOCIETY OF AMBIENT INTELLIGENCE

212

including depreciation, labor costs and profits. For

example, the ratio of depreciation to the cost of fixed

assets is an indicator that characterizes the rate of

depreciation, i. e. the number of turns of fixed assets

per year;

the authors' notion that wages and profits

characterize the degree of use of current assets is

controversial. After all, current assets are designed to

ensure the circulation of material costs, remuneration

of labor, and participate in the formation of profits.

But profit is not a consequence of turnover of current

assets only;

fixed assets and current assets are for all the

costs of living and public labor, necessary for the

production of products;

costs do not include intangible assets as an

element of resources;

according to L.N. Drahun the most

generalized assessment of production efficiency is

given by the coefficient of the marginal level of net

profit. It is determined by the ratio of net profit to the

volume of commodity production. To solve the

problems of intrafarm operational analysis offer the

indicator of the specific reduced costs, determined

from the ratio of the annual costs to the volume of

marketable products. Reduced annual costs are

calculated as the sum of production costs and the

amount of fixed assets, current assets and labor,

expressed with the coefficients of conversion. These

coefficients are determined by the ratio of the value

of taxes (VAT, profit tax, land tax, excise tax, etc.) to

the cost of fixed assets, current assets and payroll with

social charges, respectively (Drahun, 2000).

This proposal is controversial for the following

reasons. First, there is no criterion for judging the

effectiveness of the decision. Secondly, the

coefficient of the marginal level of net profit

(profitability of marketable output) is a private

indicator, if only for the reason that profit is not the

result (consequence) of marketable output (reason).

Third, the authors lose sight of the fact that the annual

cost should express the cost of labor and capital labor

on output. Fourthly, they overlook the fact that

circulating capital ensures the turnover of material

costs, sales of products and labor remuneration. In

other words, current assets contain part of the cost-of-

living labor. Therefore, there is double counting in the

assessment of labor resources.

R.M. Petukhov's proposal for assessing the

efficiency (Petukhov, 1987):

)(

bОСofn

BB

КССЕI

V

C

V

Е

++⋅+

==

(11)

where Е – coefficient of economic efficiency of

production;

V

B

– annual gross output, calculated in

comparable wholesale prices;

С – total reduced costs;

I – annual production costs of the given

production unit;

Е

n

– normative coefficient of economic efficiency

of capital investments;

С

Оf

– average annual cost of fixed production

assets;

С

ОС

– current assets;

К – economic evaluation of human resources.

Here К

b

is interpreted as the cost of professional

training, as investment in the training of personnel.

R.M. Petukhov believes that the proposed

indicator can be used to compare the economic

efficiency of businesses in different sectors of the

economy.

Let us give a critical assessment of this proposal.

Essentially, the indicator reflects the ratio of the

volume of gross output and the costs, which are

necessary for the output. Consequently, the criterion

for choosing the option should be the condition in

which the numerator exceeds the denominator, i.e. the

indicator is greater than or equal to one. But such a

condition should be observed at every enterprise

when business results exceed the present annual

costs. If this condition is not met, the enterprise is

operating at a loss. This conclusion leads to the

following conclusion: firstly, this indicator is not

suitable for comparing the economic efficiency of

businesses. Secondly, the normative indicator of

economic efficiency of investments is absent in the

statistical and financial statements of the enterprise.

Thirdly, the author overlooked the fact that the

product Еn(С

Оf

+ С

ОС

+ К

b

) is a normative profit,

expressed as a share of investment. Fourth,

investments in personnel are already accounted for

partly in current assets, so there is double counting in

the estimation of costs. Fifth, the author's attempt to

present the given annual costs as a resource-cost

approach to assessing the economic efficiency of a

business is inappropriate. This is a cost approach.

Only part of the cost of live labor in the form of

normative profit is expressed as a share of resources.

3 RESULTS AND DISCUSSIONS

Analysis of methods for measuring the economic

performance makes it possible to draw the following

conclusions:

Sustainable Development of Methods for Assessing the Economic Efficiency of Enterprises under the Conditions of Business

Intellectualization

213

1 In the economic literature, to assess economic

efficiency, a system of particular indicators is used,

which characterize the performance of the enterprise

either the amount of resources advanced, or the

amount of their consumption (costs).

2 In foreign sources there are general

suggestions for the calculation of the generalizing

indicator, reflecting the economy of the enterprise,

which is defined as the ratio of the volume of output

to the volume of consumed resources. For enterprises

in Ukraine economists recommend using the level of

profitability of products or sales as a generalizing

indicator.

3 Economic indicators have different names.

For example, the profitability of sales has names:

profitability of turnover, commercial margin,

profitability ratio. In this regard, the authors believe

that it is necessary to create a state standard on

economic terminology.

4 Employees, to ensure the long-term survival

of the enterprise, are interested in business efficiency

not only in terms of increasing income per unit cost

due to internal factors, but also the influence of

external factors. Thus, business efficiency is an

economic category that depends on internal and

external variables.

5 Since profit is the result of living labor with

the help of means of labor and objects of labor, the

question of determining the impact of each cost value

(each resource) on the amount of profit received is

considered relevant.

6 In assessing the business efficiency of an

enterprise, scientists have not considered all options.

The indicators proposed in the economic literature are

private. In them, the entire result is transferred to one

of the factors of production or not all costs are taken

into account. The result is not the consequence, and

the costs are the cause.

7 There are no or insufficiently substantiated

threshold values of the considered indicators. The

dynamics of changes in the calculated indicators

indicates the improvement (deterioration) of the

indicator. In the absence of a standard,

recommendations to improve the efficiency of the

business of the enterprise can be developed with the

help of expert evaluations.

8 A certain difficulty for practice is a set of

private indicators, to a certain extent duplicating

information. In our opinion, it is necessary to allocate:

a generalizing indicator; the main private indicators;

additional private indicators of economic efficiency

of business enterprise.

9 One of the disadvantages, which does not

allow to comprehensively and accurately measure the

effectiveness of the business of the enterprise is the

lack of a generalizing or integral indicator. It would

make it possible to measure the level or increase in

efficiency at the macro- and micro-level. A wide set

of individual indicators, because of their different

orientation, allows to give an unambiguous

assessment of the level or increase in business

efficiency.

10 In a set of indicators there is no logical

consistency, unity, interrelation, interdependence,

consistency.

11 In the economic literature there is no

distinction between the categories of "economic

efficiency" and "economic efficiency of business".

To build a model of economic efficiency of

business through the resource approach, the authors

of the article use the concepts - advanced variable

capital and applied variable capital. The advanced

variable capital (capitalized wages) is understood as

a part of current assets, which is in circulation and is

spent on wages and unified social tax (UST). In

essence it is a salary for one its turnover. Under the

applied variable capital we understand annual

expenses on a labor payment with UST.

There is a relationship between the categories in

question. Annual labor costs with UST are equal to

the product of variable capital (capitalized wages and

salaries) by the number of turns it will make during

the year. Consequently, the amount of variable capital

(capitalized wages) can be found from the ratio:

,

п

I

С

zp

zp

=

(12)

where С

zp

– variable capital (capitalized wages

and salaries), UAH;

I

zp

– annual labor costs with UST, UAH/year;

n – the number of revolutions of variable capital

per year.

The sum of labor costs and profits is the newly

created value due to live labor. Live labor, as noted

above, can be expressed in terms of the number of

workers or in monetary terms (in resource terms as

the sum of variable capital and capitalized profit, or

in cost terms as the sum of annual labor costs and

annual profit).

The relationship of live labor in the resource

approach is supposed to be expressed as:

ISC SAI 2022 - V International Scientific Congress SOCIETY OF AMBIENT INTELLIGENCE

214

.

;

;

пCh

PI

К

ChК

п

P

п

I

ChКСС

zp

ch

ch

zp

chпzp

⋅

+

=

⋅=+

⋅=+

(13)

(14)

(15)

Consequently, the coefficient of the living labor

inputs Kch is equal to the sum of types of created

value per one worker and per one turn of capitalized

wages (variable capital) and profits.

For clarity, let us present the relationship of living

labor costs in the resource and cost form,

understanding that the cost-of-living labor is a newly

created value, i.e.:

,ChКPI

chzp

⋅

′

=+

(16)

where I

zp

, P – respectively, annual labor costs and

profits, UAH;

К

ch

′

– the coefficient of resource and current costs

of live labor, UAH/year person;

Ch – number of employees, pers.

From here we find:

.

Ch

PI

К

zp

ch

+

=

′

(17)

There is a correlation between the coefficient of

the input of live labor in the resource and cost form:

.

;

;

ch

ch

ch

ch

chch

К

К

п

п

К

К

пКК

′

=

′

=

⋅=

′

(18)

(19)

(20)

Next, we determine the capitalized material costs.

Capitalized tangible costs are the advanced part of

current assets, which is in a turnover and is spent on

material and other costs. The annual sum of material

and other costs in business costs is the applied

capitalized material costs. The applied costs are equal

to the product of the advanced part by the number of

turnovers for the year, i.e.:

,

п

I

С

m

m

=

(21)

where С

m

– capitalized material costs, UAH;

I

m

– annual material and other costs, UAH/year;

n – number of turnovers of capitalized material costs

per year.

The relationship between capitalized material

costs and wages (variable capital) is due to three

circumstances. First, the amount constitutes

circulating capital. Second, the ratio of capitalized

tangible costs to variable capital is equal to the ratio

of tangible costs to labor costs. Third, the number of

revolutions that advance material costs and labor

costs are the same. This is due to the fact that the

circulation of all elements of current assets occurs

simultaneously.

In mathematical interpretation it is offered to

represent these dependences as:

,

;

.

.

п

I

п

I

С

ССС

zp

m

ко

zpmко

+=

+=

(22)

(23)

where С

о.к

– circulating assets.

It is necessary to draw a distinction between the

categories of " circulating capital " and "current

assets". It is necessary to define these theoretical

concepts more clearly. circulating capital, according

to K. Marx, is a part of fixed capital spent on the

objects of labor (capitalized material costs) and

variable capital spent to pay the labor force

(capitalized wages) (Marx, 1983).

Circulating capital of enterprises, in principle, is

also spent to finance material costs and labor

remuneration, but its composition is designated by a

different principle. Circulating capital includes:

current assets (production inventories, work in

progress) and circulation funds (inventories of

finished goods, shipped products, cash on settlement

accounts and in cash of the enterprise, accounts

receivable).

Economic efficiency of monetary capital turnover

Ек is proposed to be determined by the ratio of capital

received with the newly created value to the cost of

capital spent on the purchase of means of production

and labor:

(

)

()

.1

1

.

.

п

сооf

псооf

к

СС

СС

Е

ρ

ρ

+=

+

+⋅+

=

(24)

where

ρ

п

– profitability of products, fractions of

units.

Thus, the economic efficiency of the circulation

of monetary capital is a value proportional to the ratio

of the volume of products sold to the business costs.

Capitalized profit, which is the amount of money in

Sustainable Development of Methods for Assessing the Economic Efficiency of Enterprises under the Conditions of Business

Intellectualization

215

circulation, is the source of payments at the expense

of business profits.

The criterion for choosing the best business

solution should be the condition that ensures a profit

not lower than the norm, i.e.:

,1

.inк

Е

ρ

+≥

(25)

where ρ

n.i

– normative product profitability,

which is the ratio of normative profit to business

costs, fractions of units.

To calculate the economic efficiency of business

using the resource approach, it is necessary to take the

ratio of the result, which is commodity capital in

monetary form, and the cost of resources of living and

public labor. In other words, both the numerator and

the denominator of the formula are proposed to be

expressed in resource form.

A number of questions arise here:

1. Can commodity capital be expressed in natural

form?

2 How can it be represented in monetary form?

3 When can commodity capital be represented in

kind?

4 Are we making a methodological mistake by

representing commodity capital received in a year,

but expressing expenditures as resources? What does

this mistake lead to?

5 What is the criterion for choosing the best

business solution?

To answer these questions, let us again turn to the

turnover of monetary capital. At the second stage of

monetary capital turnover there is a connection of

means of labor, objects of labor and labor force

(living labor), productive capital turns into

commodity capital, into production, which includes

added value. Newly produced commodity capital, by

its properties and external form, differs from the

goods purchased for the production of products, with

greater value.

Consequently, commodity capital can be

represented both in kind (if one type of product is

produced) and in money terms. Since in practice the

volume of output is measured only for a certain

period, let us represent commodity capital by the ratio

of the annual volume of output to the number of turns

of commodity (monetary) capital for the year.

This means that commodity capital is the volume

of output (in kind or in money terms) for one turn of

monetary capital.

In other words, the annual volume of output is

equal to the product of commodity capital and the

number of turns of commodity capital per year. Here

we assume that all output (commodity capital) will be

sold.

Thus, commodity capital can be represented both

in physical and monetary terms. It should be

presented in physical terms when we are talking about

the economic efficiency of the production of one type

of product. If we are talking about the economic

efficiency of the business of an enterprise which

produces a nomenclature of products, only a

monetary representation of the result is appropriate.

Based on the above, the indicator of economic

efficiency of business using the resource approach is

proposed to be expressed by the ratio:

,1=

⋅++

=

ChКСС

Т

Е

chmоf

(26)

where Е – indicator of the economic efficiency of

the enterprise;

Т – commodity capital, UAH;

С

оf

– average annual value of fixed assets and

intangible assets, UAH;

С

m

– capitalized material and other costs, UAH;

К

ch

– the coefficient of resource and current costs

of live labor, UAH/year person;

Ch – average annual number of personnel, person.

The criterion of choice is the condition Е=1,

assuming that the commodity capital is equal in value

to the resources spent.

Let us represent this dependence using economic

indicators, reflected in statistical reporting and used

in practice, assuming that one type of product is

produced:

.1

0

..

0

≥

++

⋅

=

п

P

СC

n

Q

v

Е

n

соfо

(27)

where v – unit price, UAH/unit;

Q – the annual volume of marketable products

(commodity capital), units/year;

п

0

– number of revolutions performed by cash

capital per year;

С

о.с

– annual average balance of current assets,

UAH;

P

n

– annual volume of profit (normative profit),

UAH/year.

By performing conversions in the formula, we

obtain:

ISC SAI 2022 - V International Scientific Congress SOCIETY OF AMBIENT INTELLIGENCE

216

()

;1

0

≥

+

−⋅

=

осоf

n

СС

п

PQv

Е

(28)

.

0

п

СС

PQv

Е

осоf

n

≥

+

−⋅

=

(29)

The proposed mathematical models make it

possible to:

– identify the relationship between private

economic indicators of the use of certain types of

resources;

– to calculate the amount of money (money

supply) that is in circulation of the enterprise;

– to calculate the turnover rate of financial

resources for the year.

Thus, if the annual volume of sales or other

measures (net production, profit) is used as a result,

and as costs the resources being advanced, one of the

basic principles of construction of a generalizing

indicator of economic efficiency of enterprise

business is violated – matching costs and results

(costs cause, results – consequence).

The proposed models for calculating economic

efficiency under conditions of business

intensification make it possible to: identify the

relationship between private economic indicators of

the use of certain types of resources; calculate the

amount of money that is in circulation of the

enterprise; calculate the rate of capital turnover for

the year.

4 CONCLUSIONS

As a result of the research, it was found that for the

purpose of assessing the business management of the

enterprise, science and practice have developed

economic indicators that model economic

phenomena and are designed to assess economic

efficiency in terms of business enterprise or its

business activity.

It is proved that business efficiency is measured

in one of two ways, reflecting the performance of the

enterprise in relation to either the amount of resources

advanced, or the amount of their consumption (costs)

in business processes. To assess the efficiency of a

business, a system of indicators is used, which

includes both private and generalized indicators of

efficiency. The proposals available in the economic

literature on the formation of generalizing indicators

of economic efficiency at the macro- and micro-level

were considered. The task was to identify when the

authors first put forward the idea of determining the

relationship of private indicators of economic

efficiency in a single integral or synthetic indicator.

The ratio of the results of labor to the inputs of

live labor reflects a subsystem of indicators of

productivity or output of live labor. The ratio of labor

results to past labor costs (production costs, equity

capital, cost of production funds), which includes the

overwhelming part of total labor costs, represents a

subsystem of indicators characterizing efficiency of

past labor (productivity of funds, productivity of

materials, turnover of current assets). The ratio of

labor results to the total expenditures of the enterprise

serves as a subsystem of indicators characterizing the

efficiency of production of specific products.

When constructing a model of economic

efficiency of business with the use of the resource

approach, the concepts of advanced variable capital

and applied variable capital are used. The advanced

variable capital (capitalized wages and salaries) is

understood as a part of circulating assets, which is

spent on wages and unified social contribution (UST).

To calculate the economic efficiency of business

using the resource approach, it is necessary to take the

ratio of the result, which is commodity capital in

monetary form, and the cost of resources of living and

public labor.

The proposed models for calculating the

economic efficiency of business under the conditions

of business intellectualization make it possible to:

identify the relationship between private economic

indicators of the use of certain types of resources;

calculate the amount of money that is in circulation of

the enterprise; calculate the turnover rate of financial

resources for the year.

REFERENCES

Babenko, A.H., Vasylychev, D.V., Bolduyeva, O.V.,

Trifonov H.F., 2010. Productivity Management.

Zaporizhzhia: ZTSNTEL.

Chutis, A.V., 1999. Financial position of the enterprise

(assessment, analysis, planning). Sumy: Publishing

house "University book".

Drahun, L.N., Redina, N.I., Zayats, E.I., 2000. Project on

Production Efficiency Management System Creation:

Goal Formulation, Criteria Selection. In Ekonomics:

Problems of Theory and Practice. № 22.

Holovenko, I.P., 2016. Theoretical and methodological

approaches to the assessment of economic efficiency of

functioning of enterprises. In Global and National

Problems of Economics. № 11.

Sustainable Development of Methods for Assessing the Economic Efficiency of Enterprises under the Conditions of Business

Intellectualization

217

Horodynska, D., 2008. Economical stability of an

enterprise. In Actual problems of economics. № 10(42).

Kudrenko, N., 2014. Theoretical and methodological

approaches to the assessment of economic efficiency of

functioning of enterprises. In Ekonomics. № 24.

Marx, K., 1983. Capital. Vol. 1-3. Moscow: Politizdat.

Mykytiuk, V.M., Palamarchuk, T.M., Rusak, O.P., 2018.

Fundamentals of Economical Analysis. Zhytomyr:

Ruta.

Ohon, C.H. 1996. Financial Methods of Regulation of

Economy. In Finansy Ukrainy. № 1.

Petukhov, R.M., 1987. Economic results of intensification

of industrial production, methods and indicators of their

evaluation. In Proceedings of the Academy of Sciences

of the USSR. Ser. Economic. № 4

Polyak, H.B., Akodis, I.A., Kraeva, T.A., 1997. Financial

Management. Moscow: Finance, UNITI.

Rzaev, G., 2011. Economic growth and steel development:

signs and results of the level of competitiveness of

enterprises. In Bulletin of Khmelnitsky National

University. Series "Economical Sciences". № 3.

Salyha, S.Y., Kostanyan, G.A., Vasylychev, D.V., 2001.

Management of Efficiency of Economic Entities.

Zaporizhzhia: The private company "Pavel".

Salyha, S.Y., Nusinov, V.Y., Semenov, G.A., 2007.

Efficiency of use of current assets of enterprises. Krivoi

Roh: Publishing house.

Sheremet, A.D., 2011. Theory of economic analysis.

Moscow: INFRA-M.

Vasyl’yeva, O., 2021. Assessment of factors of sustainable

development of the agricultural sector using the Cobb-

Douglas production function. In Baltic Journal of

Economic Studies, Vol. 7.

Vorst, J., Reventlow, P., 1994. Economics of the firm.

Moscow: Vysshaya shkola.

ISC SAI 2022 - V International Scientific Congress SOCIETY OF AMBIENT INTELLIGENCE

218