Marketing, Manufacturing and Economics: The Foundation

for the Competitiveness of a Modern Enterprise

Hanna Andrushchenko

a

, Evhen Chuprinov

b

, Victoria Hryhorieva

c

, Victor Batareyev

d

and Iryna Lyakhova

e

State University of Economics and Technology, 5, Stepana Til`gi str., Kryvyi Rih, 50006, Ukraine

Keywords: Steel Production, Technology, Competitiveness, Marketing, Economic Efficiency.

Abstract: The world market of rolled metal products has been analyzed, the competitiveness of PJSC "ArcelorMittal

Kryvyi Rih" has been studied on it. It is concluded that entering new sales markets and stable development of

an enterprise in a changing market environment is possible through the introduction of new technologies with

minimal costs. A new parameter of the oxygen-converter process is proposed - the radiation temperature of

the surface of the reaction zone. The use of this parameter will reduce the number of blows during steel

smelting. The economic efficiency of the steelmaking process at a metallurgical enterprise is calculated. A

logical relationship has been built between the defining links of modern metallurgical production - from

marketing to economic feasibility, using the example of new methods of controlling the steelmaking process.

A new mechanism for the efficient operation of a metallurgical enterprise has been developed, which is based

not only on production elements, but also on the active involvement of marketing and economic solutions.

1 INTRODUCTION

In today's market conditions, metallurgical

enterprises are very important for their successful

operation not only to develop and implement new

production technologies, but also to be able to present

their developments, visualizing them on social

networks, booklets and other media to increase

potential consumer interest in their products.

Demand for steel is currently deteriorating

sharply, particularly in China as a world leader in the

metallurgical market, and prices for raw materials and

finished products are falling. At the same time, China

in 2022 intends to limit steel production to last year's

level. It seems that the center of influence on the

market has moved from the Asian region.

Protectionism is strengthening and taking on new

forms with the EU-US agreement. Large restrictions

are to be expected, including on higher processed

products.

a

https://orcid.org/0000-0002-7778-5622

b

https://orcid.org/0000-0001-8605-3434

c

https://orcid.org/0000-0002-1397-0546

d

https://orcid.org/0000-0002-2991-9892

e

https://orcid.org/0000-0001-7589-8351

REPAS's forecast for the situation in the last

quarter of 2021 turned out to be true in terms of

stability. There were many downtime in November

and December. In 2022, new production facilities will

appear on the market. It will be interesting to see how

they find consumers in the face of increasing trade

restrictions.

Given this, the purpose of this article is to study

and analyze global trends in the ferrous metallurgy

market, as well as to develop new integrated methods

and marketing activities for the interaction of various

departments of one enterprise.

The purpose of the article is revealed in the

following tasks:

- to analyze the world market of rolled metal and

determine the level of competitiveness of PJSC

"ArcelorMittal Kryvyi Rih" on it;

- find new ways to implement the latest

metallurgical technologies with minimal production

and non-production costs;

Andrushchenko, H., Chuprinov, E., Hryhorieva, V., Batareyev, V. and Lyakhova, I.

Marketing, Manufacturing and Economics: The Foundation for the Competitiveness of a Moder n Enterprise.

DOI: 10.5220/0011345600003350

In Proceedings of the 5th International Scientific Congress Society of Ambient Intelligence (ISC SAI 2022) - Sustainable Development and Global Climate Change, pages 145-154

ISBN: 978-989-758-600-2

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

145

- calculate the economic efficiency of the steel

production process at the metallurgical enterprise;

- on the basis of research results to build a logical

connection between the defining links of modern

metallurgical production – from marketing to

economic feasibility;

- to develop a new mechanism for the effective

operation of the metallurgical enterprise, which is

based not only on production elements, but also on

the active involvement of marketing and economic

solutions.

The solution of the above tasks will allow to

develop new mechanisms for the operation of a

metallurgical enterprise, including the synergy of

marketing and economics, in today's highly

competitive environment can become an important

element of effective interaction between the

manufacturer and the end consumer.

2 MARKETING RESEARCH

We will conduct a brief marketing analysis of the

modern world metallurgical market. Recent trends in

global change (in particular, the events of 8-12

November 2021 and as a result – the agreement

between the EU and the US on import quotas, the

exclusion of European steel products and aluminum

from the 25 % duty under section 232 of 1 January

2022) (Holappa, 2021) in the metal market have had

a significant impact on the state of the global mining

and metallurgical complex.

Interestingly, it was the United States that took the

initiative in this agreement, as from December 2021

the EU planned to introduce a second package of

measures in response to a total of 3.6 billion euros per

year to compensate for losses from US customs tariffs

in 2018. The first package worth a total of 3.6 billion

euros a year was introduced in 2018, and the second

was waiting for its time. And now, instead of a 25%

duty, European plants will be able to supply products

to the United States duty-free, but within quotas.

Among the points of the high-profile deal, it is

important that Europeans offer Americans:

- refusal to introduce compensatory measures;

- refusal to appeal against tariffs in the WTO,

including issues between Boeing and Airbus;

- long-term agreements on joint counteraction to

surplus capacities in the world steel industry, as well

as on promotion of decarbonization.

Such events, in turn, contribute to the desire of

full-cycle enterprises to take appropriate measures,

such as reducing emissions and expanding the

production of electric steel, which is made possible

by keeping scrap within their country, creating a scrap

procurement business. Increasing the use of scrap and

stimulating such a production path is the most

affordable way for steel companies seeking to ensure

vertical integration and occupy their niche in the

scrap market.

Thus, according to (Kim, 2022) in the fall of 2021

in the US, manufacturers bought their own scrap

companies in order to provide themselves with scrap,

for example, BlueScope bought MelalX for $ 240

million, Cleveland Cliffs bought for $ 775 million

Ferrous Processing and Trading Company (FPT) to

continuously provide scrap resources for the

operation of its planned expansion facility.

By collecting and processing 3 million tons of

scrap per year, FPT earns $ 100 million. EBITDA per

year. That is, the multipliers to EBITDA at the level

of more than 7.0 in scrap harvesters are much higher

than the average multiplier in steelmakers - 5.0. In

addition, the case with MelalX is also interesting in

that the sellers are the family of American

businessmen Rifkin. They founded MelalX from

scratch in 2012 with $ 1 billion in proceeds from the

sale of the same OmniSource Corp scrap business to

OmniSource Corp. Also, in the United States, the

scrap procurement business is in high demand.

Steelmakers are actively entering the upstream to

provide themselves with raw materials, and

entrepreneurs are operating on a business model

suitable for replication and scaling.

According to the American media, in the United

States, along with plans to reduce emissions and

expand production of electric steel, there is an

increased demand for scrap assets. In mid-2020, Steel

Dynamics signed another agreement to buy a waste

scrap company in Mexico - Zimmer, which processes

500 thousand tons of scrap per year. Active M&A

processes take place within the procurement industry

between operators. In general, it is natural that the

most affordable way to reduce emissions now is to

increase the use of scrap, as stimulating such a

production path leads to vertical integration and

participation in the scrap market, as discussed above.

Concerns about steel producers in the United

States about providing their assets with scrap are due

to the fact that they see for themselves the risks

associated with possible increases in scrap prices, its

deficit. For example, in China in the first half of 2021,

scrap consumption increased by 47%. That is, in the

United States, a region that is one of the largest

exporters of scrap, steel producers fear possible

difficulties with raw materials. The activity is not

aimed at purchasing by iron ore raw materials assets

ISC SAI 2022 - V International Scientific Congress SOCIETY OF AMBIENT INTELLIGENCE

146

or coal assets. Scrap becomes the central object of

mergers and acquisitions.

A fateful decision to ban scrap exports may also

be made in the EU in the near future. Demand for steel

is weakening in these countries, so, for example,

traders are trying to export g/k roll to Egypt to unload

their warehouses.

Turkish producers fear that because of the

agreement they will lose in competitiveness to

European exporters, who have received a significant

advantage in the form of the absence of a 25 % duty.

Turkey buys scrap in the EU, ie loses in the cost of

raw materials. Therefore, the Turks may lose their

small exports to the United States.

By the way, Ukraine can lose in the segment of

pipes on the American market, for which seamless

pipes were the main export item to the United States.

The issue of negotiations on Ukraine's exclusion from

Section 232 was periodically raised, but this remained

at the level of initiatives. It is advisable to intensify

this direction, because the more countries conclude

such agreements (Canada, Mexico, Brazil, Argentina,

and now the EU), the greater the volume of exports

will be lost by domestic producers.

At the same time, financial analysts trace the

probable consequences of this trend of increasing

demand for scrap assets, the most important of which

is the inverse relationship between the role of steel

companies in the scrap market and the supply of scrap

to foreign markets. After all, producers have become

interested primarily in providing themselves with

their own raw materials, and only then - in sales to the

free market and for export. At the same time,

increasing the concentration and entry of steel

companies into the scrap market in the long run will

lead to a reduction in world trade in scrap. Now this

trend is typical for the United States, but its

occurrence is predicted in other regions (Kim, 2022).

According to (Holappa, 2021), in 2020 Europeans

exported 2.4 million tons of steel products to the

United States. The main export items were flat rolled

products with coated and special alloys (about 1

million tons), as well as pipes (about 0.4 million

tons). EU producers have previously received

exemptions from Section 232. According to

EUROFER, last year about 1 million tonnes of these

2.4 million tonnes fell under these exemptions.

Therefore, quotas and exemptions together give the

potential for exports of 4.3 million tons, which is 2

million tons higher than exports in 2020.

However, such trends are more theoretical than

practical, because it is fundamental and strategically

important to identify products that have the greatest

potential for export. Thus, in 2017, European exports

to the United States amounted to 4.5 million tons.

As a result of the introduction of section 232,

exports from the EU to the US of long-term rolled

products decreased the most - by 700 thousand tons.

But these are less marginal products, European

producers do not have special advantages over

American ones. Therefore, opportunities to increase

long-term rental exports to the United States are

limited. While the export of flat rolled products with

coating and special steel fell by 500 thousand tons,

and the export of pipes - by 600 thousand tons. These

segments have the greatest potential. However, there

was a shortage of capacity in the flat-rolled segment

in the EU this year. Therefore, the expected supply

potential may remain open.

There are significant opportunities in the pipe

segment, where investment in the oil and gas segment

is expected to increase in the United States next year.

That is, Europeans can increase their exports to the

United States next year from 0.5 million tons to 1

million tons, which, in principle, a lot, but not critical

for the American market. Americans do not agree to

trade concessions for the sake of hype or PR - they

clearly understand that such agreements will not harm

their industry.

Returning to China, it should be noted a sharp

decline:

- the cost of futures for iron ore on the Dalian

Exchange, just for one week in mid-November - by $

85.6 per ton, or 2.6 %;

- value of coking coal futures - up to $ 345, or

8.7 %;

- prices for finished steel products, namely,

fittings - by 17 %, hot-rolled coil - by 14 %.

According to the forecasts of (Kim, 2022), the

current negative trend will continue until the end of

2021, and steel production in China may show a

further decline in the first quarter of 2022.

The Chinese Federation of Logistics and

Procurement predicted that in November 2021 the

steel market will continue to shrink. Production was

constrained by environmental restrictions, which are

traditionally introduced in the autumn-winter period

to reduce air pollution. In conditions of lower

temperatures, there was a seasonal decrease in

demand for steel for construction work. At the same

time, enterprises are very cautious about the prospects

for economic development: the index of productive

business activity fell by 10.3 percentage points.

relative to the previous month (up to 46.1%). That is,

we see a tendency to slow down.

The federation expects raw material prices to fall:

with the resumption of supply, coal prices have

Marketing, Manufacturing and Economics: The Foundation for the Competitiveness of a Modern Enterprise

147

returned to a reasonable level, and iron ore prices may

re-enter the downward trend amid declining domestic

demand. Under the influence of demand in the

southern regions of China, steel prices may rise in the

first half of January 2022, but with worsening weather

conditions, demand will weaken, and in the second

half of the month prices will fall.

In addition, China is an important source of

demand for semi-finished products, due to increased

control over the dynamics of steel production, even

using the method of re-exporting previously imported

semi-finished products to Southeast Asia.

At the same time, we observe a reduction in

demand for iron ore, which caused it to fall in price

from mid-October to mid-November 2021 by 21 %

(Kim, 2022).

Instead, the price of coal was constant due to the

shortage of its supply on the market. However,

experts predict a rapid fall in prices in the future due

to the collapse of steel production in China and

abroad. At the same time, along with coal, there will

be a new wave of falling steel prices around the

world.

With regard to fittings, it should be noted that the

International Association of Manufacturers and

Exporters of Fittings (IREPAS) (Kim, 2022) notes the

balance of supply and demand in the global long-term

rental market, as well as the willingness of

manufacturers to ensure timely delivery. Demand in

Europe and North America is strong, stocks are

actively replenished after depletion. It is expected that

active demand will continue in 2022 due to steady

growth in investment.

However, one should also take into account such

a deterrent to the development of international trade

as high freight rates. Every contract signed in the

second quarter now has high transportation costs,

which nullify profits. Given this fact and rising scrap

prices, long-term rental prices in the US market can

be expected to remain high in the first quarter of next

year.

The intensification of the process of introduction

of decarbonization of metallurgical production

testifies to the awareness of the fact that a

"revolution" of technologies is imminent in the world

metallurgy.

According to the British center "Agora", by 2030

71 % of blast furnaces in the world will be

decommissioned or will need to replace the lining.

This creates opportunities for large-scale

transformation of the industry during this period and

the replacement of blast furnace production with

other technologies, in particular the production of

direct reduction iron (DRI) (Holappa, 2021). Agora

estimates that 40 million tons of green DRI

(hydrogen-assisted) capacity will be built by 2030,

while companies are barely investing in industrial-

scale CO2 capture and disposal technologies (there

are only pilot plants, such as within the project

"Hisarna on Tata Steel").

The prioritization of hydrogen technologies is due

to the fact that they completely prevent CO2

emissions at the stage of production, while capture

projects are already struggling with the consequences

and, in addition, there are several complex problems

with the capture of captured CO2:

- incomplete availability of natural reservoirs

suitable for CO2 storage;

- the need to take into account which products are

made from captured carbon dioxide. If in the process

of using these products CO2 is released into the

atmosphere again, the feasibility of such utilization of

carbon dioxide is questionable.

We are even aware of the fact that in the future

there will be a gap in the pace of decarbonization of

metallurgy in developed and developing countries.

The majority of projects are being implemented or

will be implemented in the former as not only having

cheap sources of funding and technology

development centers, but also creating infrastructure

and implementing appropriate government policies to

promote decarbonisation.

ArcelorMittal, the world's largest steelmaker,

recorded a net profit of $ 4.6 billion in its financial

report published on the company's website

(https://ukraine.arcelormittal.com/?lang=en) in the

third quarter of 2021. This is a record figure since

2008. In the third quarter of 2020, the company

received a net loss of UAH 261 million. Compared to

the second quarter of 2021, ArcelorMittal increased

its net profit by 15 % in the third quarter of 2021.

Management explains these results for the third

quarter by the successful maintenance of strong price

conditions, which led to the highest net profit and the

lowest net debt since 2008.

ArcelorMittal's revenue in July-September 2021

increased by almost half compared to the third quarter

of 2020 - to 20.2 billion dollars.

The company's EBITDA (net income before taxes

and depreciation) in the third quarter of 2021

amounted to 6.058 billion dollars. In July-September

2020, the figure was UAH 901 million.

Operating profit in the third quarter of 2021

amounted to 5.3 billion dollars, in the third quarter of

2020 - 718 million dollars.

As of the end of September 2021, ArcelorMittal's

net debt fell to $ 3.9 billion of $ 5 billion as of the end

of the second quarter of 2021.

ISC SAI 2022 - V International Scientific Congress SOCIETY OF AMBIENT INTELLIGENCE

148

Despite the corporation's financial success, we are

also seeing a reduction in steel volumes. Thus,

ArcelorMittal in the third quarter of 2021 reduced

steel shipments by 19.8 % compared to the third

quarter of 2020 - to 14.6 million tons. The

corporation-maintained steel production at last year's

level - 17.2 million tons. Iron ore production in three

months decreased by 13.8 % to 13 million tons.

As you know, ArcelorMittal is the world's leading

steel and mining company with a presence in 60

countries and production assets in 18 countries.

According to the results of 2020, the steel giant

reduced steel production by 20.3 % compared to 2019

- to 71.5 million tons (Lehenchuk, 2021).

As we can see, the autumn of 2021 turned out to

be difficult for metallurgists: the world industry is

reducing production and Ukraine is no exception.

In September 2021, the volume of steel smelting

by domestic enterprises decreased by 8.4 % compared

to August 2021. The same trend was observed in

October. According to (Holappa, 2021), steel

production in October fell by another 5.8 % m/m.

That is, the negative dynamics relative to August is

minus 13.6 %.

Among the main reasons is the 45-day suspension

for the repair of the largest blast furnace №9 at PJSC

ArcelorMittal Kryvyi Rih. There is also a shortage of

coke due to problems with coal supplies, especially

local. According to the Ukrkoks association,

production restrictions related to coal and coke

shortages persisted in November-December 2021.

In November 2021, the situation did not improve

significantly. The №9 blast furnace was still under

repair. The problem with coke did not go away. Some

improvements did not appear until December 2021.

At the end of September 2021, there was a certain

rebound in prices and, consequently, an increase in

demand in December. But in the new 2022, the

market will face a new challenge - a shock to demand

under the influence of high energy prices and a

gradual strengthening of monetary policy of central

banks.

PJSC "ArcelorMittal Kryvyi Rih" is a full-cycle

metallurgical enterprise, part of the ArcelorMittal

group. The plant covers the entire production cycle -

from iron ore mining and coke production to the

manufacture of finished metal products. The

company produces semi-finished products, as well as

high-quality and shaped products.

Examining the features and results of PJSC

"ArcelorMittal Kryvyi Rih" for 2019-2021, it should

be noted that PJSC "ArcelorMittal Kryvyi Rih" in

January-October 2021 increased iron production by

13.9 % compared to the same period last year - up to

4.57 million tons (Chaika, 2021).

During this period, rolled production increased by

5.4 % compared to January-October 2020 - up to 3.9

million tons, steel smelting - by 8.9 %, to 4.17 million

tons. In October, the plant produced 400 thousand

tons of rolled products, 410 thousand tons of steel and

405 thousand tons of pig iron.

However, in 2020 PJSC "ArcelorMittal Kryvyi

Rih" reduced the production of rolled products by 7.6

% compared to 2019 - to 4.3 million tons. Steel

production for the year fell by 12.1% to 4.7 million.

tons, and cast iron - by 6.9% to 4.9 million tons.

Negative dynamics in the sphere of production is

also connected with the growth of energy prices and

the state's attempts to control energy consumption

(these factors affected both producers and

consumers). The decline in exports was influenced by

the decline in domestic steel production, as well as the

resumption of production abroad.

3 ANALYSES OF PREVIOUS

STUDIES

Currently, specialists of the State University of

Economics and Technology with scientists from other

educational institutions of Ukraine are working on a

comprehensive improvement of metallurgical

processes, ranging from technologies for coke

(Kormer, 2021) and metallurgical raw materials

(Zhuravlev, 2021) to environmental issues

(Radovenchyk, 2021). However, a special role in

improving the work of metallurgical production are

the processes of steel smelting.

Currently, the technological process of converter

melting is corrected by the total oxygen consumption,

as well as the data obtained during the "rolling" of the

converter in order to take a sample of metal for carbon

content and measure its temperature (Tanzer, 2021).

The number of such "rolls" of the converter can reach

two, three or more times, which negatively affects the

performance of the converter, temperature losses of

metal and slag, slag thickening and other disorders of

converter melting (Rout, 2018; Li, 2021). The

experience of industrialized countries, in particular

Japan, shows that the melting in the required chemical

analysis and temperature is 99.8% without the

implementation of "rolling" the converter and

corrective "additional" (Brämming, 2016).

It is possible to predict the time of completion of

the oxygen purge of the converter smelting and to

monitor the course of its main processes on the basis

Marketing, Manufacturing and Economics: The Foundation for the Competitiveness of a Modern Enterprise

149

of real-time calculation (during melting) of the melt

temperature (reaction zone) (Mason, 2020; Kumar,

2016). The temperature of the melt (reaction zone) is

easy to determine from the equations of the balance

of heat (Liu, 2019; Arnu, 2017; Zhou, 2017; Sohn,

2019; Rieger, 2020; Zhu, 2020; Florén, 2019;

Manabe, 2019; Madhavan, 2021) radiated by the

hemisphere of the reaction zone to the water-cooled

oxygen lance and the heat removed from the oxygen

lance by water.

4 RESULTS OF THE STUDY

To calculate the temperature of the melt, input

information is required: about the water temperature,

its flow rate and pressure at the inlet and outlet of the

oxygen lance; temperature, flow rate and pressure of

injected oxygen. The mathematical model for

calculating the melt temperature introduces

information about the position of the oxygen lance,

raw materials, molten steel grade, as well as chemical

analysis of metal samples and direct temperature

measurement during the "rolling" of the converter.

Using a mathematical model, the current

temperature (during melting) of the reaction zone

(Trz) of the metal is calculated and the dependence

Tr.z. of time. Changes in the temperature of the

reaction zone during melting characterize the

processes occurring in the bath of the converter.

Analysis of the obtained dependence in real time

allows us to quickly predict the end of oxidation [Si]

and [Mn], the content of [C] in the melt. In addition,

the thermal energy of radiation in different periods of

melting is predicted to adjust the flow of injected

oxygen during melting, the need to adjust the position

of the oxygen lance relative to the metal, and most

importantly, you can predict with high reliability the

end of purge.

The technological means of the automation

system implementing the developed model include

sensors of temperature, flow, water and oxygen

pressure, lance position, means of communication

with ACS TP converter smelting, control and

workstation control, as well as a set of algorithms and

programs.

The algorithm for calculating the current

temperature of the reaction zone (Tr.z.) during

melting is based on the consideration of the melt as

an energy emitter. Thus, when purging the melt in the

converter with technical oxygen through a multi-

nozzle lance, the surface of the steel melt is a sphere

of radiation with a high temperature, the temperature

of the reaction zone (Tr. z.). This temperature is

analytically related to the metal temperature (Tm).

The flow of electromagnetic radiation from the

sphere of the reaction zone through the space of hot

gases (blackness coefficient 0.8-0.9) falls on the

surface of the water-cooled lance (technical oxygen is

injected through the lance), and consumption,

pressure, temperature and O2 content may vary. as

well as changes the position of the lance in different

periods of melting).

The energy of radiation from the surface of the

reaction zone obeys the Stefan-Boltzmann law:

Е = ε·С·(Т/100)

4

, W/cm

2

,

(1)

where ε - is the blackness coefficient (0.8-0.9), C

is the radiation coefficient of the absolute body 5.68

W/cm2·K4, T is the temperature of the radiating

surface, K.

The power (P) of radiation incident on an oxygen

lance with a surface area (Sf) will be:

Р = Е·S

f

= S

f

·ε·С·(Т/100)

4

, W

(2)

The power of the energy obtained by water (Pw)

cooling the lance from the flow of energy radiated by

the surface of the reaction zone can be estimated by

the formula:

Рw = V·(ρ2·h2 - 1·h1), kW, (3)

where V is the volume of water cooling the lance

per unit time, m3; ρ2 - density of water, kg/m3 at a

temperature of T2 at the outlet of the lance; ρ1 -

density of water, kg/m3 at a temperature of T1 at the

entrance to the lance; h1 - specific heat of water,

J/(kg·°K), at a temperature of T1 at the entrance to the

lance; h2 - specific heat of water, J/(kg·°K), at a

temperature of T2 at the outlet of the lance.

The given values of water parameters are

calculated from measurements of temperatures T1

and T2, pressure and water flow.

The cooling effect of oxygen blown through the

lance is taken into account by a factor of k1, and the

effect of the distance from the lance to the surface of

the reaction zone by a factor of k2, (lance position).

As a result, the energy power obtained by cooling

water, taking into account the effect of oxygen purge

through the lance and its position relative to the

surface of the reaction zone (measured oxygen flow,

pressure and temperature, and the lance distance to

the melt surface) will be:

Рw = k1·k2·V·(ρ2·h2-ρ1·h1)·103 , W, (4)

ISC SAI 2022 - V International Scientific Congress SOCIETY OF AMBIENT INTELLIGENCE

150

The power of the flow falling on the surface of the

lance is compared with the power obtained by cooling

the lance with water:

Р = Р

w

= S

f

·ε·С·(Т/100)

4

= k

1

·k

2

·V·

·(ρ

2

·h

2

-ρ

1

·h

1

)·10

3

, W,

(5)

where from

(Т

rz

/100)

4

= (k

1

·k

2

·V·(ρ

2

·h

2

-

-ρ

1

·h

1

)·10

3

)/S

f

·ε·С,

(6)

Т

rz

4

= (10

3

·10

8

·k

1

·k

2

⋅V·(ρ

2

·h

2

-

ρ

1

·h

1

))/S

f

·ε·С,

(7)

then the temperature of the reaction zone will be:

Thus, by measuring the heat flux obtained by

cooling water and introducing correction factors for

oxygen consumption and lance position, it is possible

to calculate the current temperature of the radiating

surface of the reaction zone using a computational

algorithm, which allows to have a new process

parameter throughout the melting time.

Connections Tr.z. with technological parameters

of converter smelting installed in the oxygen-

converter shop "ArcelorMittal Krivoy Rog".

It was found that the temperature of the reaction

zone Tr.z. reflects its changes in different periods of

melting technological processes in the converter (Fig.

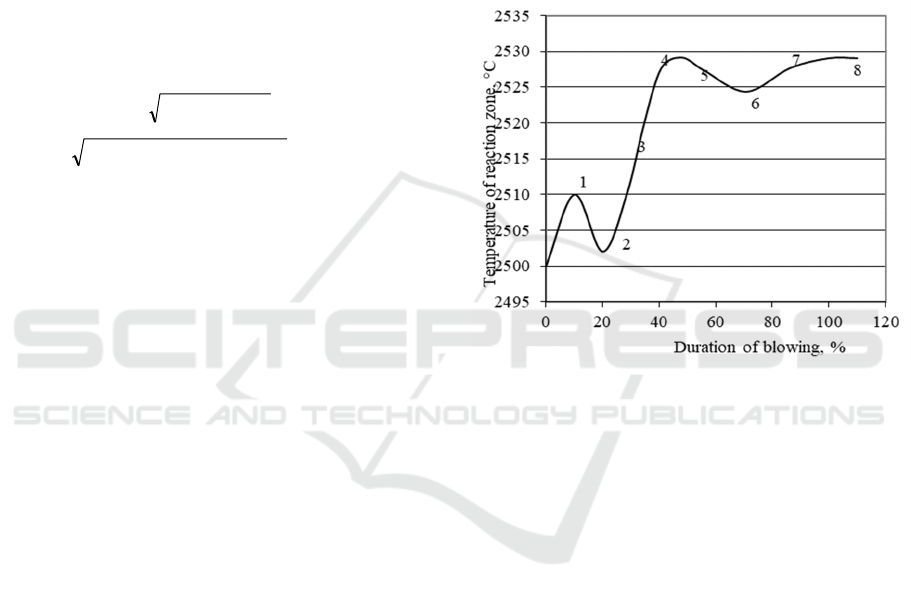

1):

- the temperature of the steel melt Tsm and the

temperature difference ΔT = Tr.z. – Tsm;

- the first maximum ΔT reflects the intense course

of the oxidation reaction Fe in the reaction zone with

weak heat dissipation due to poor mixing of the bath

and low rate of carbon oxidation - VC;

- the next rise in ΔT is associated with the active

oxidation of [Si] and [Mn], which oxidize more

actively than [C], and as their content decreases, the

bath overheats weakens;

- the completion of the oxidation of [Si] and [Mn]

creates the preconditions for less active [C] to

combine with O2 under favorable external conditions

(high temperature), to stir the bath more intensively

and remove heat, reducing ΔТ;

- after the intensification of endothermic processes

due to Fe oxides in the slag there is a new rise ΔT;

- after decreasing the concentration [C], its

oxidation rate VC decreases, the mixing of the bath

with the formed CO decreases and the growth of Tr.z.

with a rate (2-3 °C) per minute with its final

stabilization; then Tsm increases, and ΔT decreases

with constancy Tr.z.;

- temperature difference ΔT = Tr.z.-Tsm allows

you to predict the change in the content of [C] in the

melt from its second maximum (there are

experimental dependencies that need to be adapted to

the conditions of the shop and empirical

dependencies, for example:

(ΔТ/100)

2

= 10(5 + 4[С] - [С]

2

). (9)

1 - intense oxidation of Fe with weak stirring, 2 - the

beginning of active oxidation of [Mn] and [Si],

3 - endothermic processes of Fe oxides in the slag, 4 -

growth retardation due to active stirring of the bath, 5 - fall

due to reduction [C], 6 - deterioration of mixing, 7 -

temperature increase by 2-3 ° C, 8 - temperature

stabilization

Figure 1: Change in the temperature of the reaction zone

during different melting periods in the converter.

It should be noted that after the second maximum

ΔT there is an accumulation of O2 in the melt and

oxidation [C] there are periods when the amount of

carbon monoxide formed exceeds stoichiometrically

possible, based on oxygen consumption in the melt

bath (these ratios can be calculated), due to excess

oxidation melt.

This situation can be calculated and influenced by

the gas-blowing mode to reduce the supply of oxygen

to the melt to reduce the oxidation of steel and reduce

deoxidizer consumption when casting steel or provide

for the replacement of oxygen with air without

compromising bath mixing.

The efficiency of control over the steel smelting

process will be higher with the use of additional

compensatory measures to reduce the likelihood of

Т

rz

=

4

21

11

Vkk10 ⋅⋅⋅

⋅

⋅

4

f1122

СS/)hh( ⋅ε⋅⋅ρ−⋅ρ

, К.

(8)

Marketing, Manufacturing and Economics: The Foundation for the Competitiveness of a Modern Enterprise

151

overfilling (Chuprinov, 2021) - the use of limestone

in the amount of 130-140 kg/t of pig iron in the case

of the latter, the addition of coolant in the form of

ground coke in the amount of 120 kg/t scrap when

using it, as well as overheating of the metal by 20-30

°C in the case of an oxygen converter on the "goat"

scrap.

5 ECONOMIC JUSTIFICATIONS

An important stage of any research process, including

the process of improving metallurgical technologies,

is to understand, formulate and justify the factors that

determine the economic efficiency of decisions.

In particular, one of the determining factors that led

to the expediency of eliminating the addition of steel

is a significant saving of time spent on one smelting

of steel. Thus, if the duration of one melting is

considered to be 53-54 minutes, then due to the

elimination of the last stage of melting -

supplementation, the duration of which is 3-4

minutes, it becomes possible to achieve one melting

lasting 50 minutes.

In metallurgical practice it is known that in the

conditions of standard smelting of steel (with the

stage of supplementation) with an approximate

duration of 54 minutes for one smelting one converter

is capable to smelt 140 tons of steel. Accordingly, for

the day under this scheme is 26.6 smelts and can be

obtained 3724 tons of steel.

If you consider the option of smelting without

supercharging (lasting 50 minutes), then in a day it is

possible to carry out 28.8 smelting of steel under this

scheme, ie to smelt 4032 tons of steel.

Determining the volume of steel smelting

with/without taking into account the finishing process

makes it possible to estimate the change in the daily

volume of steel smelting by one converter by

reducing the time spent on additional welding. This

can be calculated by the following formula:

1

2

sp

V

V

К =

,

(10)

where K

sp

- growth rate of steel smelting one

converter per day;

V

1

- daily volume of steel smelting by one

converter (3724 t),

V

2

- daily volume of steel smelting as one

converter as a result of technological change, in

particular, avoidance of the additional process (4032

tons).

Also, the growth rate of steel smelting per

converter per day will be:

0827,1

3724

4032

К

sр

==

If we talk about the absolute changes in achieving

economic efficiency of our proposed measures, it is

advisable to calculate the amount of additional

steelmaking. Thus, in one day, provided that the

additional process is avoided, one converter will

make it possible to obtain the following increase in

the volume of steel:

∆V = V

2

- V

1

,

(11)

where ∆V is the daily increase in steel volume.

That is:

∆V = 4032 - 3724 = 308 (t).

Given that the use of specially adapted to the

described process of steel smelting mathematical

models, we managed at the stage of chemical analysis

of the sample to obtain a 50 percent quality result of

the chemical composition of steel, for greater

accuracy of further calculation of additional profits.

twice less than expected, ie 154 tons.

Since, as mentioned above, according to the

standard scheme of smelting, the size of the daily

volume of steel smelting is 140 tons, it turns out that

in the conditions of smelting without refueling for

each subsequent smelting is an additional 14 tons of

steel.

As a rule, 5 converters work in the converter shop

of PJSC "ArcelorMittal Kryvyi Rih" at the same time,

so the daily increase in steel smelting in the whole

shop (∆V

c

) due to our proposals will be:

∆V

c

= 154 ∙ 5 = 770 (t).

Knowing the value of the average market value of

steel (Bm = 7000 UAH.), It is easy to determine the

amount of additional profit of the shop per day (GP)

as a result of the implementation of measures:

ΔП = В

m

∙ ∆V

c

,

(12)

or

ΔP = UAH 7,000 ∙ 770 = 5,390,000 (UAH).

Thus, due to the elimination of the additional

stage of the steel smelting process, which, in turn,

ISC SAI 2022 - V International Scientific Congress SOCIETY OF AMBIENT INTELLIGENCE

152

reduces the time of one smelting, it becomes possible

to achieve economic efficiency of our proposed

measures, as the daily profit increase of converter

shop PJSC "ArcelorMittal Kryvyi Rih" will be 5.39

million. UAH.

6 CONCLUSIONS

1. The results of marketing research show that against

the background of the extremely difficult situation on

the world metallurgical market and its unstable

situation, PJSC "ArcelorMittal Kryvyi Rih" needs to

apply the latest approaches to increase its

competitiveness, one of which should be a

comprehensive approach. combining efforts and

results from marketing and production activities of

the enterprise.

2. Application of mathematical model and system

of automatic control of melting on the basis of

operative control of change of temperature of reaction

zone will allow to reduce time on "rolls" of the

oxygen converter at reception of steel with the set

characteristics, and also to reduce melting duration by

2-3 minutes (to 4%). In addition, the use of additional

compensating mechanisms developed earlier (Mason,

2020) will significantly increase the economic

efficiency of the steelmaking process in the converter

shop

3. Coefficient analysis and economic assessment

of changes in the daily volume of steel smelting by

one converter by reducing the cost of additional time,

as well as the use of specially adapted to the described

process of steel smelting mathematical models

allowed to obtain 154 tons of steel as a daily increase

in steel t more than in the standard scheme of melting.

This, in turn, in the scale of the converter shop of

PJSC "ArcelorMittal Kryvyi Rih" with five

converters allowed us to achieve economic efficiency

from the measures proposed to us, namely, to receive

UAH 5.39 million. additional profit of the shop.

4. It should be noted that in the article the authors

managed to fulfill all the tasks set at the beginning

from the standpoint of innovation. So, for the first

time, an innovative approach to organizing the work

of a metallurgical enterprise is proposed, which is

based on close cooperation of important processes -

marketing, production and sales. This approach is

based on the invention of new ways of implementing

the latest metallurgical technologies with minimal

production and non-production costs, which allowed

to increase the level of economic efficiency of the

steel production process at the metallurgical

enterprise. Also, the newly developed production,

economic and marketing mechanism of efficient

operation of the metallurgical enterprise allowed to

build a logical connection between the defining links

of modern metallurgical production - from marketing

to economic efficiency.

5. The solutions developed in the technological

part were included in the automation equipment for

the oxygen-converter shop of AMKR. Models based

on 500 heats of various steel grades have allowed

technologists to introduce new methods of process

control, thereby increasing the efficiency of the steel

shop. To date, the elements of the presented study

have already been introduced into the production

process control scheme of the steelmaking

department.

REFERENCES

Holappa, L., Kekkonen, M., Jokilaakso, A. et al. A Review

of Circular Economy Prospects for Stainless

Steelmaking Slags. J. Sustain. Metall. 7, 806–817

(2021). https://doi.org/10.1007/s40831-021-00392-w

Kim, Y., Ghosh, A., Topal, E. et al. Relationship of iron ore

price with other major commodity prices. Miner Econ

(2022). https://doi.org/10.1007/s13563-022-00301-x

https://ukraine.arcelormittal.com/?lang=en

Lehenchuk, S., Mostenska, T., Tarasiuk, H., Polishchuk, I.,

Gorodysky, M. (2021) Financial Statement Fraud

Detection of Ukrainian Corporations on the Basis of

Beneish Model. In: Alareeni B., Hamdan A., Elgedawy

I. (eds) The Importance of New Technologies and

Entrepreneurship in Business Development: In The

Context of Economic Diversity in Developing

Countries. ICBT 2020. Lecture Notes in Networks and

Systems, vol 194. Springer, Cham.

https://doi.org/10.1007/978-3-030-69221-6_100

Chaika, A.L., Lebed, V.V., Kornilov, B.V. et al.

Implementation of a Set of Long-Term and Energy-

Saving Cast Iron Production Models in Blast Furnaces

in Ukraine. Steel Transl. 51, 201–204 (2021).

https://doi.org/10.3103/S0967091221030025

Kormer, M.V., Shmeltser, E.O., Lyalyuk, V.P., Lyakhova,

I.A., Chuprinov, E.V. (2021). Investigation Methods of

Preparation and Aspects of Introduction in Coal

Concentrates Chemical Reagents for Addressing the

Problem of Coal Raw Materials Freezing Message 2.

Prevention of Coal Freezing by Means of Acetates and

Silicone Polymer. Petroleum and Coal, Vol. 63, Issue

2, pp. 340-345.

Zhuravlev, F.M., Lyaluk, V.P., Chuprinov, E.V. et al.

Fluxed Local Sinters—Agglomerated Iron Ore Mono

Raw Material for Blast-Furnace Smelting. Steel Transl.

51, 186–194 (2021).

https://doi.org/10.3103/S096709122-103013X

Radovenchyk, I., Trus, I., Halysh, V., Chuprinov, E.,

Ivanchenko, A. Evaluation of optimal conditions for the

application of capillary materials for the purpose of

Marketing, Manufacturing and Economics: The Foundation for the Competitiveness of a Modern Enterprise

153

water deironing. Ecological Engineering and

Environmental Technology, 2021, Vol. 22, Issue 2, pp.

1-7.

Tanzer, S.E., Blok, K. & Ramírez, A. Decarbonising

Industry via BECCS: Promising Sectors, Challenges,

and Techno-economic Limits of Negative Emissions.

Curr Sustainable Renewable Energy Rep 8, 253–262

(2021). https://doi.org/10.1007/s40518-021-00195-3

Rout, B.K., Brooks, G., Rhamdhani, M.A. et al. Dynamic

Model of Basic Oxygen Steelmaking Process Based on

Multi-zone Reaction Kinetics: Model Derivation and

Validation. Metall Mater Trans B 49, 537–557 (2018).

https://doi.org/10.1007/s11663-017-1166-7

Li, M., Shao, L., Li, Q. et al. A Numerical Study on

Blowing Characteristics of a Dynamic Free Oxygen

Lance Converter for Hot Metal Dephosphorization

Technology Using a Coupled VOF-SMM Method.

Metall Mater Trans B 52, 2026–2037 (2021).

https://doi.org/10.1007/s11663-021-02155-0

12. Brämming, M., Björkman, B. and Samuelsson C.

(2016). BOF Process Control and Slopping Prediction

Based on Multivariate Data Analysis. Steel Research

International, Vol. 87, Issue 3, pp. 301-310.

Mason P., Grundy A.N., Rettig R., Kjellqvist L., Jeppsson

J., Bratberg J. (2020) The Application of an Effective

Equilibrium Reaction Zone Model Based on

CALPHAD Thermodynamics to Steel Making. In:

Peng Z. et al. (eds) 11th International Symposium on

High-Temperature Metallurgical Processing. The

Minerals, Metals & Materials Series. Springer, Cham.

https://doi.org/10.1007/978-3-030-36540-0_10

Satish Kumar, D., Sah, R., Sekhar, V.R. et al. Development

of Blowing Process for High Manganese Hot Metal in

BOF Steelmaking. Trans Indian Inst Met 69, 775–782

(2016). https://doi.org/10.1007/s12666-015-0553-5

Liu L., Sun P., Gao Z., Wang Y. (2019) Integrated

Production Plan Scheduling for Steel Making-

Continuous Casting-Hot Strip Based on SCMA. In:

Wang K., Wang Y., Strandhagen J., Yu T. (eds)

Advanced Manufacturing and Automation VIII.

IWAMA 2018. Lecture Notes in Electrical

Engineering, vol 484. Springer, Singapore.

https://doi.org/10.1007/978-981-13-2375-1_53

Arnu D. et al. (2017) A Reference Architecture for Quality

Improvement in Steel Production. In: Haber P.,

Lampoltshammer T., Mayr M. (eds) Data Science –

Analytics and Applications. Springer Vieweg,

Wiesbaden. https://doi.org/10.1007/978-3-658-19287-

7_12

Zhou D., Cheng S. (2017) A New Method to Detect the

High Temperature Distribution in the Ironmaking and

Steelmaking Industry. In: Hwang JY. et al. (eds) 8th

International Symposium on High-Temperature

Metallurgical Processing. The Minerals, Metals &

Materials Series. Springer, Cham.

https://doi.org/10.1007/978-3-319-51340-9_49

Sohn, I., Ueda, S. Preface for Thematic Section:

Sustainable Iron and Steelmaking. J. Sustain. Metall. 5,

275 (2019). https://doi.org/10.1007/s40831-019-

00231-z

Rieger, J., Schenk, J. State-of-the-art Processing Solutions

of Steelmaking Residuals. Berg Huettenmaenn

Monatsh 165, 227–231 (2020).

https://doi.org/10.1007/s00501-020-00950-x

Zhu, R., Han, Bc., Dong, K. et al. A review of carbon

dioxide disposal technology in the converter

steelmaking process. Int J Miner Metall Mater 27,

1421–1429 (2020). https://doi.org/10.1007/s12613-

020-2065-5

Florén, H., Frishammar, J., Löf, A. et al. Raw materials

management in iron and steelmaking firms. Miner Econ

32, 39–47 (2019). https://doi.org/10.1007/s13563-018-

0158-7

Manabe, T., Miyata, M. & Ohnuki, K. Introduction of

Steelmaking Process with Resource Recycling. J.

Sustain. Metall. 5, 319–330 (2019).

https://doi.org/10.1007/s40831-019-00221-1

Madhavan, N., Brooks, G., Rhamdhani, M. et al. General

heat balance for oxygen steelmaking. J. Iron Steel Res.

Int. 28, 538–551 (2021).

https://doi.org/10.1007/s42243-020-00491-0

Chuprinov, E.V., Lyalyuk, V.P., Andrushchenko, H.I.,

Kassim, D.A., Rad'ko, N.G. (2021). Development of

supplements prevention system in oxygen converter

process in order to increase the economic efficiency of

steel melting. SHS Web of Conferences, Vol. 100, pp.

1-9.

ISC SAI 2022 - V International Scientific Congress SOCIETY OF AMBIENT INTELLIGENCE

154