Linking Government R&D Subsidies and Innovation Performance:

A Chain-mediating Role of R&D Investment and Technological

Collaboration

Xingxiu Wang

a

and Huiying Jiao

School of Management, Changchun University, Changchun, China

Keywords: Innovation Performance, Government R&D Subsidies, Technological Collaboration, R&D Investment,

Chain-Mediating Role.

Abstract: This paper aims to probe how government R&D subsidies relate to innovation performance. The authors

examined R&D investment and technological collaboration as mediators of relationship between government

R&D subsidies and innovation performance. The paper opted for a time-lagged research design to test

hypotheses with data covering 483 high-tech listed firms’ data in China from 2007 to 2019. STATA and the

PROCESS macro in SPSS are used in regression analysis. The results show that R&D subsidies are positively

related to firms’ innovation performance. The relationship is mediated by R&D investment and technological

collaboration. Furthermore, R&D investment is positively related to technological collaboration, there is a

chain-mediating relationship among R&D subsidies, R&D investment, technological collaboration and

innovation performance. This paper constructs a theoretical framework to specifies the process through which

R&D subsidies affects firms’ innovation performance to expand understandings of R&D subsidies, which

further provides practical value to administrative staffs and policymakers for formulating innovation strategies

and R&D subsidies decisions more effectively.

1 INTRODUCTION

The fast growth model of China’s economy has been

replaced by a high-quality development one recently.

It has been generally acknowledged that

technological innovation exerts a major function on

keeping firms’ sustainable development and is the

engine of high-quality economic development. In

order to raise firms’ enthusiasm for technological

innovation, China’s government subsidizes their

research and development (R&D) programs by

increasing its intensity of funding continuously (Liu,

et al., 2021).

A considerable number of studies tested the

associations between R&D subsidies and firms’

innovation performance (Yi, et al., 2021; Gao, et al.,

2021). Some studies found evidence indicating

positive innovation performance effects linked to

government R&D subsidies (Wu, et al., 2020, Xu, et

al., 2021). Other studies reported that government

R&D subsidies distorted factors’ price in the process

a

https://orcid.org/0000-0003-3319-7850

of innovation, resulting in rent-seeking (Gao, et al.,

2021, Zhang 2019). In order to obtain public

subsidies, some companies may ignore the actual and

emerging needs of innovation, which has a crowding

out effect on private R&D capital contribution

(Zhang, 2019, Yu, et al., 2016). In recent studies,

from a perspective of contingency, researchers found

the underlying value to discover the factors

influencing the link between R&D funding and firms’

innovation performance (Gao, et al., 2021). The local

R&D financial assistance and specialized industrial

agglomeration have been regarded as potentially

crucial elements in mitigating the influence of R&D

subsidies for innovation performance (Gao, et al.,

2021).

Previous literature postulated that a direct link

exists between government R&D subsidies and

innovation performance. However, few studies have

explored how government R&D subsidies relate to

innovation performance. In general, R&D investment

can be stimulated by government R&D grants, which

Wang, X. and Jiao, H.

Linking Government RD Subsidies and Innovation Performance: A Chain-mediating Role of RD Investment and Technological Collaboration.

DOI: 10.5220/0011287600003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 749-756

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

749

also positively influence innovation performance,

thus some empirical studies found that R&D

investment is the link between R&D funding and

innovation performance (Liu, et al., 2021, Xu, et al.,

2021, Cerulli, et al., 2015). But existing researches

chiefly direct attention to the incentive mechanism of

R&D financial support. In fact, R&D subsidies can

be regarded as dual signals during the innovation

process (Bianchi, et al., 2019). Therefore, numerous

investigations and studies are needed to reveal the

mechanism of how government R&D subsidies affect

firms’ innovation performance.

We expand the work on the inner influencing

mechanism of R&D subsidies on innovation

performance in this article. We suggest that R&D

subsidies have a positive effect on innovation

performance. Furthermore, we expect that R&D

investment and technological collaboration are

potential mechanisms for explaining the association

between government R&D subsidies and innovation

performance. R&D investment is more likely to

improve technological collaboration of firms, thereby

R&D financial allowances will relate indirectly and

effectively to innovation performance via the chain-

mediating role of R&D investment and technological

collaboration. Using panel data on China’s 483 high-

tech listed firms from 2007 to 2019, we demonstrate

the influencing mechanism of R&D subsidies on

innovation performance.

Our research extends the previous literature in

two aspects. Based on what we have learned, this is

the first research that combines R&D investment and

technological collaboration to explain how

government R&D subsidies create value for firms’

innovation. Compared to other studies on government

R&D subsidies (Gao, et al., 2021, Wu, et al., 2020,

Yu, et al., 2016), our research demonstrates that R&D

investment and technological collaboration are

essential factors in enabling companies to reap the

benefits of R&D subsidies. Several researches have

started to take the mediating role of R&D investment

into account (Xu, et al., 2021). Nevertheless, they

ignore the signalling of R&D subsidies will

encourage technological collaboration (Chapman, et

al., 2018, Kim, et al., 2021), which may play the

potential mediating role. In addition, new evidence

has been provided to indicate that the effects of R&D

subsidies on corporate innovation performance are

positive in this paper. The main framework of our

study is arranged as follows. The very next part

shows the theoretical foundation for probing the

connections among R&D subsidies, R&D

investment, technological collaboration and

innovation performance. Then, data, methods,

consequences of the study are described in detail. At

last, the conclusion part is given.

2 THEORY AND HYPOTHESES

2.1 Government R&D Subsidies and

Innovation Performance

As competition between countries becomes fiercer,

the importance of technological innovation becomes

more and more prominent. Technological innovation

behaviours have been strongly supported by

governments in most countries, and the relevant

policies are tilted towards innovative firms, and the

most important is the subsidy of R&D activities.

Government R&D assistance exerts the following

multiple influences on firms’ technological

innovation. One is to provide direct financial support

to reduce R&D costs. Public R&D funding can be

regarded as an incentive policy, which gives free

financial support to firms’ technological innovation

activities (Chapman, et al., 2018). Bérubé and

Mohnen (2009) showed that R&D subsidies motivate

corporations to introduce more new products. The

second is to transmit signals and improve innovation

success rates. Acting as a “stamp of approval”, the

award of Government R&D subsidies is a signal to

distinguish firms from their competitors (Bianchi, et

al., 2019). R&D financial support will enhance the

attractiveness of enterprises’ innovation projects,

appeal outstanding technical talents to join in and

provide access to other innovative factors, so as to

improve the success probability of innovation. Third,

it will ease the financing constraints. Yang et al.

(2021) pointed out that if engaging in R&D activities

actively, firms face lower financing costs in the bond

market. Government R&D subsidies provide

important signals to financial institutions to identify

firms’ technological innovation ability, thus reducing

firms’ financing cost via financial support for

technological innovation. In addition, R&D subsidies

are also one of the signals for consumers to measure

product quality in product markets, improving the

competitiveness of firms in the market and forming a

virtuous circle. There is no denying that R&D

subsidies may lead to adverse selection effect due to

rent-seeking, encroachment and other issues.

However, in general, the government R&D subsidies

have clear categories of subsidies and higher

application thresholds, so the probability of reverse

selection effect is low on the whole. Therefore, the

public R&D funding can promote the efficiency of

corporate innovation programs. Using data from

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

750

Germany, Plank and Dubliner (2018) found public

R&D subsidies enhance firms’ innovation. Thereby

we put forward the following hypothesis: H1.

Government R&D subsidies have a positive impact

on innovation performance.

2.2 The Mediating Role of R&D

Investment

As special assets accumulate, firms’ private

investment in R&D is conducive to the creation of

knowledge, thus improving their competitive

advantage in the market. Firms’ R&D investment is

influenced by government R&D subsidies through

the following means. First, it has competitive effects

on firms’ innovation activities. To apply for

government R&D subsidies, enterprises must meet

the threshold, so they need to improve their

competitiveness, and the simple and direct way is to

raise the amount of R&D capital. In addition, the

awarding of public R&D grants ought to be more

observable to outsiders, so as to avoid information

asymmetry. Public R&D subsidies draw the

government’s attention to key industries and

technical areas, which will induce firms to increase

investment in R&D projects and make the market

participants to form a positive expectation, changing

the expected return of firms in related fields. Third,

R&D subsidies are also an important way to help

firms share the risk of technological innovation, thus

increasing firms’ enthusiasm to provide capital to

R&D projects (Cerulli, et al., 2015). The

improvement of R&D investment gives fiscal

guarantee to technological innovation. Chen (2021)

also confirmed that firms’ R&D investment is a

crucial factor to improve the performance of

technological innovation. Some previous studies

have indicated that firms’ R&D investment is a

critical pathway of public R&D funding on

innovation performance (Xu, et al., 2021, Cerulli, et

al., 2015). For the above reasons, we come to the next

hypothesis: H2. Firms’ R&D investment mediates the

relationship between government R&D subsidies and

innovation performance.

2.3 The Mediating Role of

Technological Collaboration

As far as the firm itself is concerned, the

organizational boundary is becoming more and more

blurred, the knowledge flow is more frequent, and it

becomes a common phenomenon to establish

technological collaboration with partners and

enhance innovation capacity using external

intellectual capital due to increasing technical

complexity. In addition to R&D investment, public

R&D funds will also affect technological innovation

by promoting technical collaboration. On the one

hand, public R&D funds often favour unconventional

or challenging innovation projects, which will urge

firms to search and acquire knowledge in multiple

technology areas and increase the diversity of

technical knowledge (Chapman, et al., 2018). In order

to improve the probability of success, firms not only

need to cooperate with different types of partners, but

also should communicate effectively to reduce the

costs of collaboration. On the other hand, R&D

subsidies provide funding and other potential

resources to support various technological

collaboration activities. Bianchi et al. (2019)

proposed the twofold signalling effect of public R&D

funds, which provides correlative personal

information about firms’ quality and innovation

potentiality. Therefore, public R&D funding provides

more opportunities for enterprises to obtain external

financing and work with high-quality partners

(Chapman et al. 2018, Mo et al. 2020). In addition,

the greater the intensity of R&D subsidies, the greater

the importance or quantity of projects financed. This

will facilitate the identification, absorption and

application of external knowledge in related technical

fields and enhance the intensity of technological

collaboration. The rise in the intensity of

technological collaboration will further improve

firms’ innovation performance (Kim, et al., 2021).

Accordingly, we put forward the third hypothesis:

H3. Technological collaboration mediates the

relationship between government R&D subsidies and

innovation performance.

2.4 The Chain-Mediating Role of R&D

Investment and Technological

Collaboration

Literature on technological collaboration

demonstrated that firms’ R&D investment improves

technological collaboration from many aspects

(Cerulli, et al., 2015). First, it avoids information

asymmetry. There is a widespread problem of

information asymmetry during the process of

technological collaboration, because firms know

more about their own resources, information, and

capabilities than their partners. At this point, firms

with higher quality can signal that they are better than

their competitors by increasing R&D investment. By

observing firms’ innovation capabilities, partners can

identify firms’ quality and increase the possibility of

collaboration. Second, it enhances the confidence in

Linking Government RD Subsidies and Innovation Performance: A Chain-mediating Role of RD Investment and Technological

Collaboration

751

successful technological collaboration and boosts

firms’ attractiveness. Innovation is the source of

firms’ sustainable development, big R&D

investments show their confidence to promote

innovation vigorously, thereby enhancing partners’

enthusiasm in technical collaboration. Third, it

improves firms’ absorption capacity. The intensity of

technical collaboration depends on the individual

absorption capacity of the members of the firm

(Laursen, Salter, 2014). Absorption capacity is a by-

product of previous innovation activities and problem

solving; stronger innovation input means that

enterprise innovation activities are more active and

experienced. This helps to recognize and acquire

external knowledge that is valuable to technological

innovation as well as further improve firms’ practices

and processes to analyse and interpret external

information, which will exert positive impact on

technical collaboration and improve innovation

performance. Accordingly, we come up with the

subsequent hypothesis: H4. R&D investment and

technological collaboration will play a chain-

mediating role in the relationship between

government R&D subsidies and innovation

performance.

3 DATA AND MEASURES

3.1 Data

High-tech firms have strong willingness to innovate

and participate in innovation activities frequently,

which is the focus of public R&D funds in China, so

we collect the firm-level data set of the study of listed

high-tech companies on the Shanghai and Shenzhen

stock exchanges. Among all listed firms, a total of

3,083 firms were identified as high-tech enterprises

covering the period of 2001-2019. In order to avoid

common research bias, we clean the data by

following steps. First, the study excludes high-tech

firms whose information disclosure is incomplete.

Second, we rule out firms that are treated by ST and

*ST. Third, listed firms in the financial insurance

category are precluded. Finally, we also exclude

firms with a large number of missing observations

and outliers, i.e. firms with an asset-liability ratio

greater than or equal to 1. After data cleaning, the data

of 483 high-tech listed firms are obtained between

2007 and 2019. These firms are distributed in 16

industries, including the computer and electronic

product manufacturing industry, electrical equipment

manufacturing industry, etc. Research data consist of

firms’ basic data and technological collaboration

data. Basic data are related to R&D expenses, R&D

subsidies, asset-liability ratio, etc. over the years,

which is collected and organized through the

CSMAR database. Government R&D subsidies come

from details of government subsidies in financial

statements and are collected manually. According to

the research of Gong and Zhu (2021), if the title of a

subsidies project contains any of the following words,

namely, “research and development”, “patents”,

“technological innovation”, “technological

transformation”, “independent innovation”,

“copyright”, “research”, “new products”, “science

and technology”, “industrial innovation”, “industrial

upgrading”, “knowledge copyright”, “technical

standards”, “design specifications”, “development”,

“high-tech”, “gazelle”, “Ph.D”, the project is

considered to be awarded government R&D

subsidies. Technological collaboration data relevant

to the intensity of technological collaboration are

collected and calculated manually, mainly through

the patent search and analysis system, which belongs

to the State Intellectual Property Office in China

(CNIPA). First, the sample firms’ patent application

data are retrieved by regular means from 1 January

2001 to 31 December 2020, of which a total of 33764

co-patent applications are collected, and the number

of firms’ partners is counted to calculate the intensity

of technological collaboration. In addition,

continuous variables are winsorized at quantiles of

1% and 99% to avoid the effects of extreme values.

3.2 Measures

Dependent variable: innovation performance (Inno).

Patents are the main objective index of technological

innovation output. They are classified into

three kinds,

i.e. design, utility model and invention in China. The

application time of invention is long due to the stage

of substantive examination; thus its protection time is

longer than that of others. Correspondingly, the

annual fee and agency cost are high. Therefore,

consistent with the existing research (Zhang 2019),

the study treats the number of invention patent

applications as the variable representing innovation

performance.

Independent variable: Government R&D

subsidies (RD_G). According to Bianchi et al.

(2019), it can be measured by two methods. One is a

dummy variable; if a firm is awarded government

R&D financial assistance, the dummy variable equals

1, otherwise 0. The other one is the logarithms of one

plus total amount increased through R&D funds; the

greater the value, the more R&D subsidies firms

receive. The study mainly adopts the second method.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

752

Mediator variables: R&D investment (RD_F) and

technological collaboration (Depth). Following the

practice of existing research (Xu, et al., 2021), R&D

investment is evaluated by the logarithms of one plus

total amount of enterprise’s R&D expenses, which is

R&D intensity essentially. Following Yang et al.

(2019), we adopt technological collaboration depth as

a proxy for technological collaboration, which is

evaluated by the average number of co-patent

applications.

Consistent with previous literature (Liu, et al.,

2021, Xu, et al., 2021, Bianchi, et al., 2019, Yang et

al. 2019), this study chooses 11 control variables, i.e.

firm age (Age), firm size (Size), etc., which are

demonstrated in Table 1.

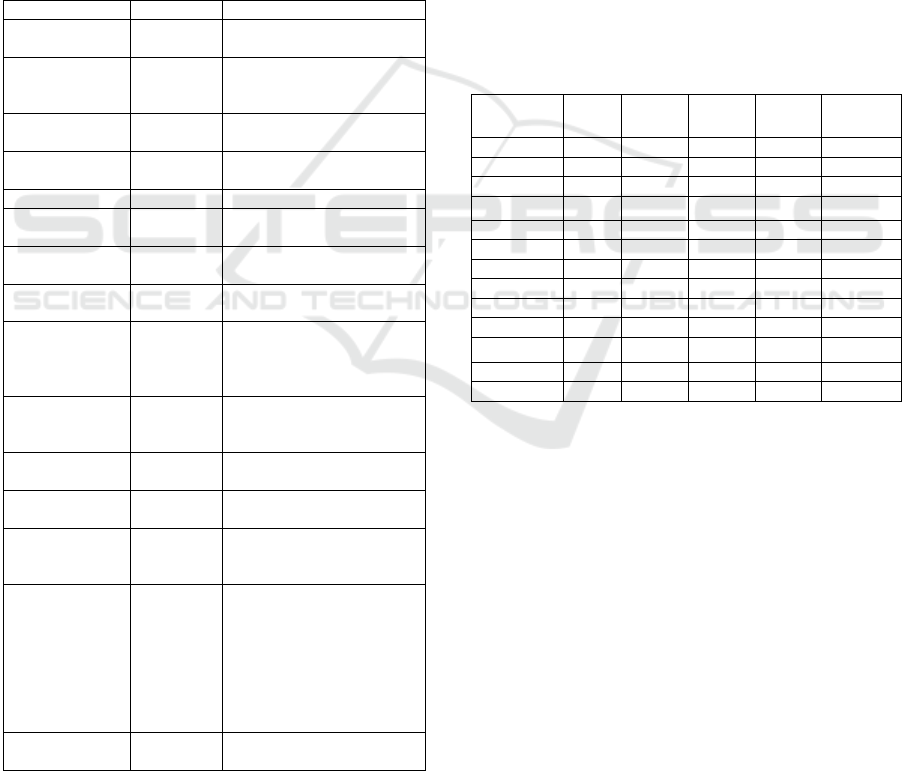

Table 1: Variables and Their Measurements

Variable Name Symbol Measurable Indicato

r

Innovation

performance

Inno Number of patent

applications for inventions

Government

R&D subsidies

RD_G Log of ( 1+ total amount

raised through R&D

subsidies)

R&D

investmen

t

RD_F Log of ( 1+ total R&D

expenses)

Technological

collaboration

Depth Average number of co-

patent applications

Firm size SIZE Log of the total asse

t

Firm age AGE Years since a firm was

funde

d

Leverage LEV Ratio of total debt to total

assets

Return on total

assets

ROA Ratio of net profit to total

average assets

Export Export The dummy variable equals

1 if the product of firm is

exported abroad, otherwise

0

Firm group Group The dummy variable equals

1 if the company belongs to

a firm group, otherwise 0

Institutional

environmen

t

Institution Market-oriented total index

score (Fan et al., 2018)

Market

concentration

HHI Heffendahl Hirschman

index

State-owned

enterprises

SOE The dummy variable equals

1 if the company is state-

owned, otherwise 0

Industry Industry According to the

technology intensity classes

of OECD, there are six

industry dummies, i.e. high-

tech manufacturing, high

medium-tech

manufacturing, etc.

(Herstad et al., 2015)

Year Year Dummy variables for the

years 2008

–

2019

3.3 Empirical Results

The descriptive statistics of all variables are shown in

Table 2. The mean value of innovation performance

is 21.547, its standard deviation value is 86.622,

demonstrating that the innovation output of Chinese

high-tech firms is in its infancy with a big gap

between high and low. The mean value of R&D

subsidies is 10.382 with a maximum of 18.390 and a

minimum of 0, which suggests that government R&D

subsidies is at a relatively top-level stage, but there is

also a big gap among firms. The average R&D

investment is 18.037 with a minimum of 15.251 and

a maximum of 21.512, displaying that the intensity of

R&D is comparatively balanced. The mean value of

technological collaboration is 1.329 with a maximum

of 26.125 and a minimum of 0, indicating that

technological collaboration depth is at a low level

with a big gap between high and low.

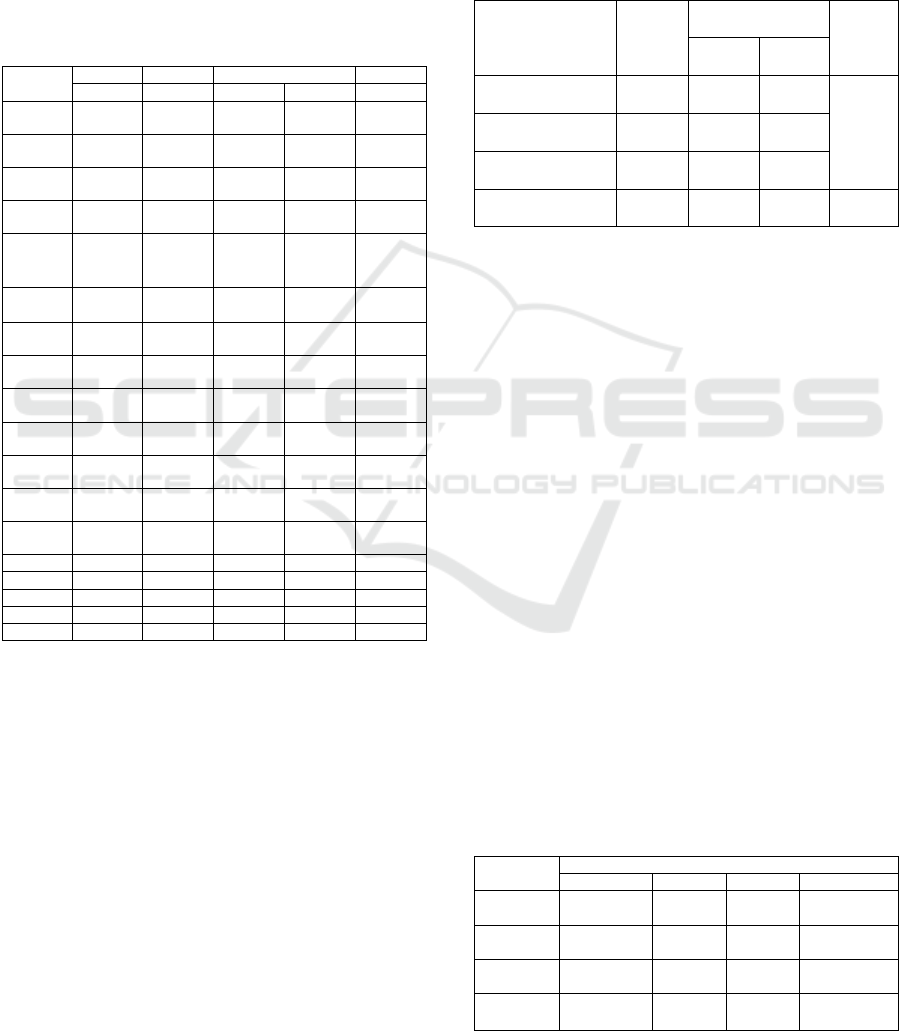

Table 2: Descriptive Statistics.

Variable Obs. Mean SD Min Max

Inno 5 205 21.547 86.622 0.000 1 919.00

RD_G 4 757 10.382 6.742 0.000 18.390

RD_F 3 722 18.037 1.253 15.251 21.512

Depth

5 206 1.329 3.689 0.000 26.125

SIZE 4 722 21.973 1.106 19.902 25.093

AGE 5 206 17.269 5.468 7.000 32.000

LEV

4 722 40.731 18.997 4.587 81.856

ROA 4 724 0.046 0.047 -0.114 0.194

Expor

t

4 136 0.582 0.493 0.000 1.000

Group 4 721 0.962 0.191 0.000 1.000

Institution

4 724 7.133 3.014 0.000 10.780

HHI 4 723 0.099 0.100 0.015 0.651

SOE 4 724 0.365 0.481 0.000 1.000

Note: Obs. denotes number of countries in the baseline model. SD denotes standard

deviation.

Table 3 reports the regression analysis results

through the causal-step method (Model 1 to 5). The

coefficient of RD_G shows that R&D subsidies can

improve firms’ innovation performance in Model 1

(b=0.009, p<0.01), which provides support for

Hypotheses 1. Model 2 indicates that the R&D

subsidies increase the R&D investment (b=0.004,

p<0.05). Meanwhile, the coefficient of RD_F is 0.080

(p<0.5) in Model 5, indicating that R&D investment

promotes innovation performance. Thus, Hypotheses

2 is confirmed. Model 3 implicitly assumes that R&D

subsidies have a constructive effect on technological

collaboration (b=0.014, p<0.01). The coefficient of

Depth in Model 5 suggests that technological

collaboration benefits innovation performance

(b=0.059, p<0.01). Therefore, technological

collaboration is an important pathway for R&D

subsidies to influence innovation performance,

Linking Government RD Subsidies and Innovation Performance: A Chain-mediating Role of RD Investment and Technological

Collaboration

753

providing, Hypotheses 3 is confirmed. Model 4

demonstrates that R&D investment undoubtedly

promotes the depth of technological collaboration

(b=0.132, p<0.05). The above regression results

together display that R&D investment and

technological collaboration play a chain-mediating

role in the links between government R&D subsidies

and firm innovation performance. Therefore,

Hypotheses 4 is confirmed.

Table 3: The Mediating Role of R&D Investment and

Technological Collaboration

Variable Inno RD

_

F De

p

th Inno

Model 1 Model 2 Model 3 Model 4 Model 5

RD_G

0.009

***

(3.04)

0.004

**

(2.28)

0.014

***

(2.94)

0.006

(1.06)

0.004

(1.22)

RD

_

F

0.132

**

(

2.10

)

0.080

**

(

2.41

)

De

p

th

0.059

***

(

16.96

)

Constant -0.364

(-0.50)

4.715

***

(6.16)

-11.128

***

(-10.36)

-10.064

***

(-7.33)

-0.742

(-0.99)

SIZE

t-1

-0.035

(-1.05)

0.590

***

(19.95

)

0.400

***

(8.08)

0.274

***

(3.34)

-0.098

**

(-2.29)

AGE

t-1

-0.011

(-1.30)

-0.035

(-0.85)

0.008

(0.71)

-0.000

(-0.00)

-0.006

(-0.85)

LEV

t-1

0.002

(

1.19

)

0.003

**

(

2.23

)

0.002

(

0.67

)

0.002

(

0.54

)

0.004

**

(

1.99

)

ROA

t-1

3.075

***

(

6.53

)

3.284

***

(

11.56

)

4.207

***

(

5.00

)

3.721

***

(

3.62

)

2.067

***

(

4.08

)

Ex

p

ort

t-1

-0.086

(

-1.64

)

-0.087

**

(

-2.28

)

0.114

(

1.34

)

-0.026

(

-0.25

)

-0.085

(

-1.57

)

Grou

p

t-1

0.105

(

0.91

)

-0.021

(

-0.29

)

0.098

(

0.37

)

0.023

(

0.07

)

0.137

(

1.08

)

Institution

t-1

0.013

(0.57)

-0.021

(-0.78)

0.071

**

(2.22)

0.083

**

(1.98)

0.050

**

(2.33)

HHI

t-1

-0.486

(

-1.59

)

0.592

***

(

3.11

)

-0.591

(

-1.23

)

-0.207

(

-0.32

)

-0.301

(

-0.087

)

SOE

t-1

0.295

***

(

4.19

)

0.183

*

(

1.72

)

0.471

***

(

4.43

)

0.262

*

(

1.88

)

0.222

***

(

3.03

)

Yea

r

Yes Yes Yes Yes Yes

Industr

y

Yes Yes Yes Yes Yes

Obs. 3 584 2 985 3 693 2 077 2 985

F - 117.01

***

- - -

Wald 387.44

***

- 240.76

***

127.91

***

594.33

***

Note: (i) The values in parentheses are the p-values. ***, ** and * display significance at

the level of 1%, 5% and 10%, respectively, (ii) Model 2 was estimated by a regression

model for panel data, the other models were estimated by the negative binomial models

for panel data, whether to choose a fixed effect model or a random effect model were

determined by the Haussmann test.

Table 4 depicts the results from the bootstrap test

using Process (Hayes) for SPSS with 5000 samples

and a 95% confidence interval. The direct effects of

R&D subsidies fail to be statistically significant and

is reported in Table 4. R&D investment and

technological collaboration appears as valid

mediation mechanisms between R&D subsidies and

innovation performance, consistent with the

conclusion of the causal step method. These findings

strongly support that public R&D subsidies have

indirect influence on innovation performance through

increases in R&D investment and technological

collaboration. In addition, Table 4 confirms that R&D

subsidies promote R&D investment, R&D

investment has a progressive influence on

technological collaboration, thus increasing firms’

innovation performance. Consequently, we find

support for H4, which predicts the chain-mediating

role of R&D investment and technological

collaboration.

Table 4: Bootstrap Test Results.

The mediation

path

Indirect

effects

Confidence

interval (95%)

Direct

effect

Lower

limit

Upper

limit

RD_G—RD_F—

Inno

0.229 0.124 0.361

0.305

(1.24)

RD_G—RD_F—

Depth

—

Inno

0.046 0.022 0.085

RD_G—Depth—

Inno

0.165 0.007 0.373

Total mediation

effect

0.440 0.234 0.698

Note: The values in parentheses are the p-values.

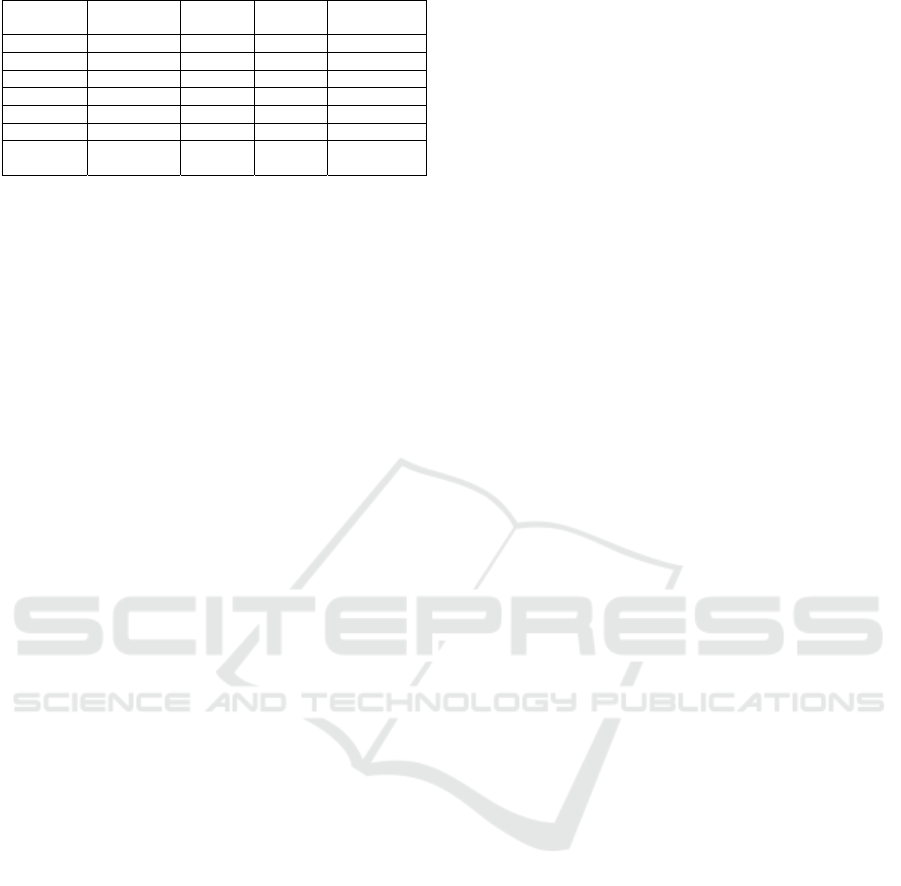

3.4 Robustness Checks

Three important robustness checks were conducted,

the results for which are shown in Table 5. First, we

tested the endogenous problems that may exist

between variables using system GMM estimation for

dynamic panel data. With leverage, ROA, R&D

investment at time t to t-2 as instrumental variables,

the coefficient of RD_G

t-1

is positive and significance

(b=1.118, p<0.05), passing the AR (2) test and

Hansen test in Model 6. Second, we checked the

sensitivity of key variables. With dummy variable as

a substitute measure of R&D subsidies, the

consequences show that the coefficient of RD_G is

positive in Model 7(b=0.131, p<0.01). With the count

of licensed patents instead of patent application

quantities for inventions in regression, Model 8

shows that the coefficient of RD_G is 0.009(p<0.05).

Finally, we replace the negative binomial models

with a panel Tobit model, which shows that the

coefficient of RD_G is 0.888 in Model 9(p<0.01). In

these settings, we obtain the same result of those

presented above.

Table 5: Robustness Checks Results.

Variable Inno

Model 6 Model 7 Model 8 Model 9

RD_G

t-1

1.118

**

(2.37)

0.009

**

(2.44)

RD_G

0.131

***

(2.96)

0.888

***

(3.35)

Inno

t-1

0.774

***

(

63.02

)

Constant 261.148

(0.91)

-0.460

(-0.63)

-1.179

***

(-1.25)

-490.000

***

(-7.26)

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

754

Control

Variables

Yes Yes Yes Yes

Year Yes Yes Yes Yes

Industry Yes Yes Yes Yes

Obs. 2 247 3 376 3 362 3 693

AR(2) 0.418 - - -

Sargan 0.000 - - -

Hansen 0.273 - - -

Wald 22 879.6

***

386.56

**

*

649.97

**

*

267.28

***

Note: The values in parentheses are the p-values. ***, ** and * indicate significance at

the level of 1%, 5% and 10% respectively. Due to limited layout, coefficients of control

variables are not listed here; if you’re interested, please contact the corresponding author.

4 CONCLUSIONS

Technological innovation is a fundamental factor to

boost the sustainable development of firms. As

important public policies, government R&D

subsidies support and stimulate firms to innovate

continuously, thus raise innovation performance. Our

intention in this paper has been to offer an explication

on how government R&D subsidies shape firms’

likelihood to implement technological innovation.

Using panel data from 483 Chinese high-tech listed

firms during the period 2007 and 2019, this research

estimates a chain-mediated model to investigate the

causal connection among R&D subsidies, R&D

investment, technological collaboration and

innovation performance.

Our findings provide strong support for the

assumption that R&D subsidies are conducive to

promoting innovation performance, proving the

effectiveness of public R&D funding in China. More

importantly, this research demonstrates that R&D

investment and technological collaboration illustrate

part of the process through which enterprises convert

the benefits of public R&D funds into enhanced

innovation performance. Particularly, the research

elaborates three substitute methods that allow

businesses to create value from government R&D

subsidies. For instance, consistent with previous

studies, our results demonstrate that R&D subsidies

enhance firms’ creativity by affecting their private

investment in R&D. Furthermore, technological

collaboration plays an important mediating role in the

association between government R&D subsidies and

innovation performance. In addition, our findings

also display that R&D investment and technological

collaboration play chain-mediating role through

which R&D subsidies have indirect influence on

innovation performance. Generally speaking, these

conclusions discover new methods through which

R&D subsidies drive innovation performance of

corporations, which further has implications for the

corporation innovation literature from the perspective

of signalling theory.

Our results have also implications for

practitioners. First, our results point out that public

R&D subsidies enhance innovation performance.

Therefore, the policy makers have an obligation to

keep on providing more R&D funding, firms should

actively apply for public R&D subsidies and enhance

their utilization efficiency, so as to jointly promote

innovation performance. What’s more, according to

the reported effects of R&D subsidies, it is obvious

that firms with reward of state R&D funds should

promote the intensity of R&D investment because it

not only boosts innovation performance directly, but

also plays an indirect role in strengthening

technology innovation by technological

collaboration. Third, firms should also establish open

innovation strategies, make good use of existing

R&D resources, increase the enthusiasm of partners,

and work together for more challenging technological

innovation activities. Finally, drawing on the findings

on multiple mediation roles of R&D investment

during technological innovation process, for one

thing, firms can choose different ways to achieve the

goal of improving innovation performance; for

another, policy-makers should take notice of the

signal transmitted by government R&D funds, and

manage them in a targeted manner, so as to increase

the effectiveness of public R&D funding.

However, this investigation is not without

limitations, and future work may explore the

following issues. Firstly, because the data of R&D

subsidies are collected manually, the study only

selected the effect of the amount of R&D subsidies

on innovation performance, but did not classify the

specific content of subsidies or funding agencies to

explore its impact on innovation; more research is

needed in this field. Secondly, considering the

availability of data, the research selected high-tech

listed companies as research samples, not non-listed

enterprises, a deeper analysis with a wider sample is

needed too. In addition, this paper only tests the

impact of R&D subsidies, R&D investment,

technological collaboration on innovation

performance, it could be better to recognize other

factors with potential effects on how R&D subsidies

create value for firms, such as technical cooperation

governance, science cooperation and so on.

ACKNOWLEDGEMENTS

This study was funded by the Education Department

in Jilin Province and Jilin Provincial Key Laboratory

Linking Government RD Subsidies and Innovation Performance: A Chain-mediating Role of RD Investment and Technological

Collaboration

755

of Human Health Status Identification and Function

Enhancement, Grant Number are JJKH20200596SK

and 20200601004JC.We also gratefully

acknowledges the support of Xiaoli Zhong.

REFERENCES

Bérubé, C., Mohnen, P. (2009) Are firms that receive R&D

subsidies more innovative? Canadian Journal of

Economics, 42 (1),206–225.

Bianchi, M., Murtinu, S., Scalera, V. G. (2019) R&D

subsidies as dual signals in technological

collaborations, Research Policy, 48(09), 1-19.

Cerulli, G., Gabriele, R., Poti', B. (2015), The role of firm

R&D effort and collaboration as mediating drivers of

innovation policy effectiveness, Industry and

Innovation, 23(5), 1-22.

Chapman, G., Lucena, A., Afcha, S. (2018) R&D subsidies

& external collaborative breadth: differential gains and

the role of collaboration experience, Research Policy,

47(3), 623-636.

Chen, J. (2021) Research on the relationship among

government support, enterprise R&D investment and

technological innovation performance, Forecasting, 40

(02), 40-46.

Fan, G., Wang, X.L., Hu, L.P. (2018), Marketization index

of China's provinces: neri report 2018, Social Sciences

Academic Press, Beijing.

Gao, Y., Hu, Y., Liu, X., et al. (2021) Can public R&D

subsidy facilitate firms' exploratory innovation? The

heterogeneous effects between central and local

subsidy program, Research Policy, 50(04), 104-221.

Gong, H., Zhu, L.X. (2021) The ‘halo effect’ of

government R&D and Non- R&D subsidies on the

external financing of enterprises- based on the analysis

of the new energy enterprises, Science & Technology

Progress and Policy, 38(04),70-77.

Herstad, J., Sandven, T., Ebersberger, B., et al. (2015)

Recruitment, knowledge integration and modes of

innovation, Research Policy, 44(01), 138-153.

Kim, K, Sang, O. C., Lee, S. (2021) The effect of a financial

support on firm innovation collaboration and output:

Does policy work on the diverse nature of firm

innovation? Journal of the Knowledge Economy, 12

(2), 645-675.

Laursen, K., Salter, A.J. (2014) The paradox of openness:

appropriability, external search and collaboration,

Research Policy,43(05),867-878.

Liu, S., Du, J., Zhang, W. et al. (2021) Opening the box of

subsidies: which is more effective for innovation?

Eurasian Economic Review, Vol.11,pp. 421-449.

Mo,J., Lee, W., Mortara L . (2020), Do government R&D

subsidies stimulate collaboration initiatives in private

firms? Technological Forecasting and Social Change,

151, 1-14.

Plank, J., Doblinger, C. (2018) The firm-level innovation

impact of public R&D funding: evidence from the

German renewable energy sector, Energy Policy, 113,

430–438.

Wu, R. R., Liu, Z. Y, Ma, C. L., Chen, X. F. (2020) Effect

of government R&D subsidies on firms’ innovation in

China, Asian Journal of Technology Innovation,

28(01), 42–59.

Xu, J., Wang, X. H., Liu, F. (2021) Government subsidies,

R&D investment and innovation performance: analysis

from pharmaceutical sector in China, Technology

Analysis & Strategic Management, 33(5), 535-553.

Yang, L., Xu, C., Wan, G. (2019) Exploring the impact of

TMTs' overseas experiences on innovation

performance of Chinese enterprises: The mediating

effects of R&D strategic decision-making, Chinese

Management Studies, 13 (4),1044-1085.

Yang, Z.Q., Yuan, M., Zhang, Y. T. (2021) Enterprise

R&D Innovation and bond credit spreads: analysis

based on the signal transmission theory, Journal of

Shanghai University of Finance and Economics, 23

(01), 42-60.

Yi, J., Murphree, M., Meng, S. et al. (2021) The more the

merrier? Chinese government R&D subsidies,

dependence and firm innovation performance, Journal

of Product Innovation Management, 38 (2), 289-310.

Yu, F. F., Guo, Y., Le-Nguyen, K., Barnes, S. J., Zhang, W.

T. (2016), The impact of government subsidies and

enterprises’ R&D investment: a panel data study from

renewable energy in China, Energy Policy, 89, 106–

113.

Zhang, X. (2019) The impact of government R&D

subsidies on enterprise technology innovation—Based

on evidence from Chinese listed companies, American

Journal of Industrial and Business Management, 9, 720-

742.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

756