An Overall Analysis of Tecent's Business Model

Jichen Huang

1,† a

, Lelin Li

2,† b

, Yuxing Lu

3,† c

and Luyao Zhang

4,† d

1

Macau University of Science and Technology, Macau, China

2

Xinhua College of Sun Yat-sen University, Dongguan, China

1109377090@qq.com

3

University of Dalian, Dalian, China

3097840778@qq.com

4

Xi’an University of Finance and Economics, Xi’an, China

2214988341@qq.com

†

These authors contributed equally

Keywords: Internet Company, PEST, 3C, Product Analysis, Profit Model, Ratio Analysis.

Abstract: In the past thirty years, our economy has developed at an unprecedented speed. At the same time, China’s

consumption concept and consumption structure has also undergone profound changes. With the

development of electronic technology and application of electronic products, a large number of people have

been exposed to Internet. Taking Tencent as an example, this paper summarizes Tencent's current macro

environment, business strategy, product system and profitability status from the perspectives of PEST, 3C,

product features, profit model and financial ratio through the literature research method and case analysis

method, and summarizes its financial and operating conditions according to the data of Tencent's financial

statements in recent years, and looks forward to the future development of Tencent. At the same time, using

this paper as a reference, it provides a certain degree of practical experience and reference significance for

the selection and innovation of other Internet companies.

1 INTRODUCTION

1

Tencent Holdings Limited is a Chinese multinational

investment holding conglomerate, founded in

November 1998 and is headquartered in Shenzhen,

China. It is one of the largest internet integrated

service providers and one of the internet companies

with the most service users in China. Tencent

specializes in various internet-related services and

products, entertainment, and technology both in

China and globally. Tencent also invests in AI by

jointly establishing an innovation lab with MediaTek.

Its many services include social network, music, e-

commerce, smartphones, mobile games, and it started

to buy large video game companies, making it also

become the largest and most valuable gaming and

social media company in the world. Tencent went

public on the Stock Exchange of Hong Kong in 2004.

Tencent became Asia’s largest company and one

a

https://orcid.org/0000-0002-8952-1130

b

https://orcid.org/0000-0002-3451-3934

c

https://orcid.org/0000-0002-4465-3287

d

https://orcid.org/0000-0002-5407-4713

of the world’s top five firms. It growing so fast, with

a market cap of more than $720 billion, Tencent

briefly overtook one of the world’s largest listed

company.

The research objective is the operating condition

of Tencent’s product industry and give Tencent some

suggestions on future development.

2 PEST ANALYSIS

This paper selects the PEST analysis model to

summarize the macro and external environment in

which Tencent is surrounded.

2.1 Political Factors

The Chinese government has issued series of policies

to improve livelihood of people and promote

environmental protection through the Internet in

recent years. In November 2020, the State Council

issued a notice on the ‘Plan for Solving the

Difficulties of the Elderly in Using IT’, proposing to

Huang, J., Li, L., Lu, Y. and Zhang, L.

An Overall Analysis of Tecent’s Business Model.

DOI: 10.5220/0011189400003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 521-531

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

521

effectively solve the difficulties encountered by the

elderly in terms of using intelligent technology, so

that the majority of the elderly can better adapt to and

integrate into this smart society. Internet information

enterprises took the lead in carrying out age-

appropriate transformation to help ‘silver hair touch

the net’. On July 15, 2021, 13 political departments

jointly issued ‘Opinions on Supporting the

Development of New Models and Activating the

Consumer Market to Drive Employment Expansion’,

innovating the supply mode of production factors,

activating new consumer markets and developing

new employment forms.

However, for domestic Internet giants, there is a

trend of abolishing preferential tax rates in national

policies. In Chinese Taxation, enterprises that have

obtained the qualification of national key software

enterprises enjoy a preferential corporate income tax

rate of 10%. When large Internet companies have

less operating pressure that is smaller than that of

enterprises in other industries, the corporate income

tax rate of them has returned from tax incentives to

normal tax rate. According to Morgan Stanley's stock

analyst Gary Yu, if Tencent's corporate income tax

rate rises from 10% to 15%, Tencent's share price

will be negatively impacted by 6%.

2.2 Economic Factors

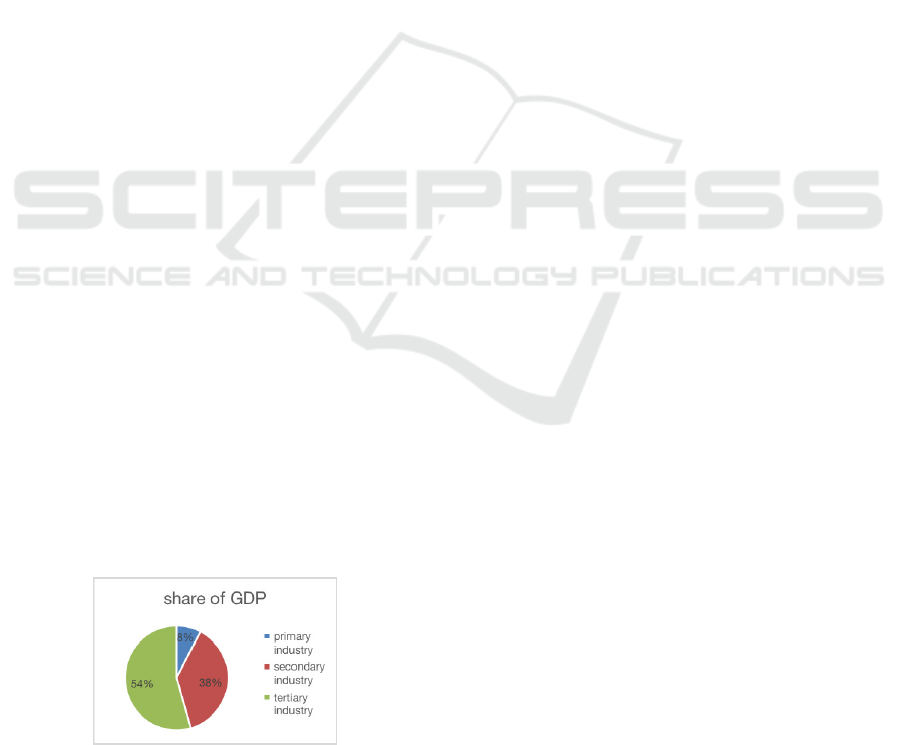

In China, the GDP of the tertiary industry has grown

rapidly in recent years. Data collected from Statistics

of China-Announcement by the National Bureau of

Statistics on the final verification of GDP in 2020 is

shown in Figure 1, tertiary industry accounted for

54% of GDP, the total current price was 551974

billion RMB, and the constant price growth rate was

1.9% in 2020. The increasing trend in tertiary

industry was partly contributed to the spread of

Internet and digitalization. Chinese economy has

shifted from a stage of high-speed growth to a stage

of high-quality development. According to the

analysis, for every 10% increase in digitalization,

GDP per capita increases by 0.5% to 0.62%.

Figure 1: Proportion of GDP in three forms of industry in

China in 2020.

The economic situation prompts Internet

companies to differentiate their marketing of

products, bringing greater opportunities and

challenges to Tencent. The analysis covers the most

typical and successful strategies, which distinguished

Tencent Games from its competitors' product (Shen,

2021).

However, the advertising economy is sluggish.

According to the three quarterly reports of various

Internet companies, online giants such as Tencent

and Baidu have been deeply affected by the big

environment and their growth has been sluggish. In

the current period, Tencent's Non-IFRS net profit of

$31,751 million decreased 2% year-over-year for the

first time in 10 years (He, 2021).

2.3 Socialcultural Factors

Tencent occupies most of the domestic game market

in China. Recently, the ‘Economic Information

Daily’ sponsored by the head of the Xinhua News

Agency published an article which directly pointed to

the harm of online games to adolescents, such as

more than half of children's myopia, addicted to

games, delayed schooling, personality alienation,

physical weakness, etc. Under series of control

measures, Tencent Games finally limited the daily

game time to 1.5 hours, shortening the game time

again, which means that its revenue from games will

be affected to some extent.

The development of the fan economy drives the

development of Internet companies, especially those

that focus on the film and television domain. In the

era of pan-entertainment, Chinese consumers have

ultimate experiences related to entertainment, and IP

dramas are the core content of fan consumption.

Since 2012, Tencent has proposed ‘pan-

entertainment’, linking online and offline, and

transformed IP such as games, animation and

literature to create industrial chains.

2.4 Technological Factors

Big data technology has become the main application

mean of Internet enterprise user analysis. In the

modern society, data presents the characteristics of

value and diversification. The user information

database established through cloud computing is a

key project of Internet companies. Based on big data

and cloud technology, Tencent Video conducts data

processing and comprehensive analysis of users' age,

gender, region, Internet access scenarios, time,

content preferences and so on, ultimately providing

users with diversified services.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

522

Tencent makes good use of the social software

‘strong link’ technology. WeChat, QQ and other

social platforms have a "strong link" relationship,

which is mainly based on the trust relationship. Users

can watch their favorite content in Tencent Video,

share it with one click to WeChat friends circle, QQ

space and other platforms, achieving the effect of

‘secondary dissemination’ (Wei, 2019).

The Mini Program is a product developed by the

WeChat of Tencent, which is on average more than

20% faster than H5. As the Mini Program technology

develops, functions of Mini Programs have been

more and more completed. The biggest advantage of

the Mini Program is to implement the function of

linking to third parties, and finally achieve seamless

docking with users with high quality, high speed and

great convenience.

3 3C ANALYSIS

This paper selects the three c analysis business model

to summarize the operational strategy of Tencent.

3.1 The Customers

Tencent's clients are mostly on the Internet,

regardless of their age or educational background, as

long as they are netizens. Initially, Tencent focused

on instant messaging and social networking

platforms, as China's economy was developing at an

unprecedented speed and customers were looking for

a new way to communicate. Then QQ came along

and became the most famous platform since 2000.

The number of QQ's customers increased

dramatically during this period, which was the base

of Tencent's customers (Liu, 2015). Tencent caught

up with the rise and popularity of smart phones,

which rapidly boosted the number of users.

Furthermore, at this time, national policy is very

favorable to the development of Internet enterprises,

the Internet economy is accelerating its penetration

into the traditional economy, the development is

gradually undergoing in-depth transformation, and

the life of Internet users is being promoted towards a

comprehensive network (Liu, 2015). After

accumulating a huge number of users on QQ,

Tencent launched WeChat in 2011. A new

application that helps users to perform a variety of

tasks that touch every part of their lives such as

WeChat Pay and We Chat Health. WeChat's user

base had grown to 1.225 billion by 2020.

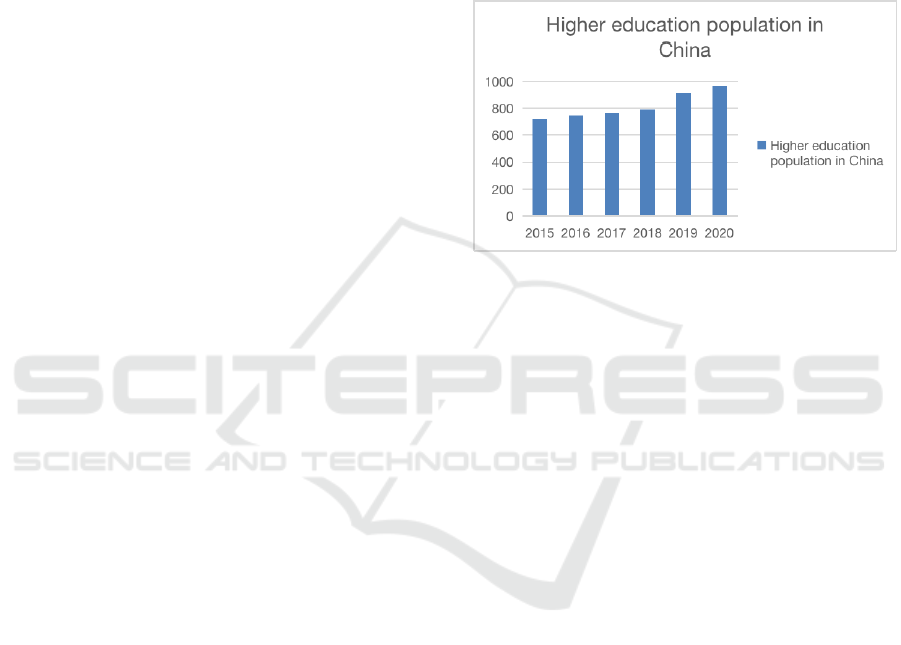

With the growth of electronic technology and the

application of electronic products, an increasing

number of people now have access to online games,

and Tencent's refinement of QQ games has attracted

users of all ages to the platform. Chess, cards, and

mahjong are popular among not only young but even

middle-aged and elderly people. Users between the

ages of 18 and 35 are drawn to competitive mobile

games like "King of Glory" and "PUBG." The

majority of well-educated young people shown in

Figure 2 are willing to try new things and have the

financial ability to support their hobbies.

a. Reference: The Ministry of Education

Figure 2: Higher education population in China.

However, Tencent unconcerned about the

prospective elderly clients. Tencent's customer base

is currently dominated by teenagers and young

people, as the majority of the middle-aged and

elderly are unable to use many of the company's

technology goods. Tencent should improve this

element and create goods that are useful to middle-

aged and senior people.

3.2 The Competitors

NetEase, as one of the competitors is valued at

us$700 billion. Both Tencent and NetEase have

significant gaming operation and research and

development skills. NetEase's competitive advantage

stems from its developed business model and

extensive agency expertise. NetEase is very good at

extending the life cycle of their games, and its classic

works are "A Chinese Odyssey to the West" and

"Dream Westward Journey" created since 2005.

However, in the era of mobile games, Tencent

occupies the market share earlier. With the help of

social platforms and other businesses, such as QQ,

WeChat and QQ browser, Tencent games are more

easily known by the public. Moreover, the user

stickiness of social platforms makes it easier to

spread games with multiple participants. Tencent's

position in the business is hard to overcome in a short

term, and it possesses a significant number of

An Overall Analysis of Tecent’s Business Model

523

valuable resources. Tencent was one of the first

companies in the game industry to create a large-

scale layout, and thanks to the high stickiness of QQ,

it was able to precisely divide the market and target

the audience, putting its operational revenue in first

position (Feng, 2019).

Tencent and NetEase's market share is expected

to grow by ten percent to twenty percent.

Considering Tencent's great competitiveness, trying

to catch up to Tencent will be extremely tough for

NetEase. However, since NetEase and Tencent have

different relative advantages in different fields,

NetEase can catch up with Tencent by developing

online and mobile games. And since Tencent lacks

the competence and experience to develop into new

markets outside of China, it is not appropriate to

implement an overseas internationalization strategy

blindly (Li, 2014).

3.3 The Corporation

Tencent's roots are in the social media industry, but

the game industry accounts for half of its revenue,

and advertising finance is the company's future

growth direction. Up to now, Tencent game

development has established a solid competitive

advantage in the business. First of all, Tencent has a

large channel distribution capacity. Through its QQ,

WeChat, and QQ browser apps, as well as its tight

cooperation with Apple Inc., Tencent has become

China's leading mobile game distribution provider.

Tencent, on the other hand, is distinct from all other

game companies. Tencent has introduced a huge

number of initial consumers to its newly launched

game products by building up exposure portals on

social networks. Tencent's competitors have opted to

collaborate with Tencent to jointly create and release

classic terminal game IP in the era of terminal games.

Second, Tencent has a rich product lines which

reduce the risk of relying too much on one single

game. And stable revenue gain from its game

business. Client games, mobile games, web games,

and other fields are all covered by Tencent games.

The game category is also quite diverse, with role

playing games, competitive games, casual games,

and chess and card games. In addition to its own

research and development and agency games,

acquisitions are also an important way for Tencent to

expand its game territory. It acquired developer Riot

Games in 2011 and made $1.6 billion in 2015 with

“League of Legends”, making it the highest-grossing

game in the world that year. And "clash Royale" has

long been one of the top three smart phone games,

with Tencent owning 84.3% of Finnish developer

Spuercell for $8.6 billion.

Third, the research and development capabilities

has improved. "Honor of Kings", which was released

in 2015, has dominated the global mobile gaming

rankings for three years in a row. It can only keep its

leadership by constantly expanding its own research

and development capabilities.

4 PRODUCT SYSTEM

Tencent has a large number of products, covering

almost all areas of the Internet. The main high-

quality products are the profit sources of Tencent's

profit model, and Tencent mainly relies on these

products to improve quality and efficiency and create

value for enterprises.

4.1 Communication and Social

Networking

Starting from connecting people, Tencent provides a

feature-rich, easy-to-use instant messaging and social

networking platform that personalizes

communication, sharing and exchange and enriches

people's lives. Tencent's QQ, Qzone and WeChat are

among the top five social networks in the world.

4.1.1 WeChat

Since its launch in 2011, WeChat, the

communication and social platform with the largest

user base in China, not only supports sending voice,

video, pictures and text, but also combines real-time

communication with social information and lifestyle

services. WeChat applets provide functions such as

public platforms and message pushing to bring

merchants and users closer together; WeChat Pay

allows users to complete a fast, secure and efficient

payment process. As of March 2020, WeChat has

more than 1.2 billion monthly active accounts,

covering more than 90% of smartphones in China.

4.1.2 QQ

QQ is an Internet-based instant messaging software

developed by Tencent, which supports online

chatting, video calling, file sharing, network hard

disk, QQ mailbox and other functions, and continues

to introduce innovative features that meet the needs

of young users. Among them, QQ Mailbox has over

800 million registered users and 500 to 600 million

active users, making it the main free mailbox used in

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

524

China. As of March 2020, QQ had 768 million

monthly active users (including PC and mobile).

4.1.3 Qzone

Qzone is a social platform that supports users to

share and interact with friends and family, meeting

their needs for display, communication and

entertainment, and sharing their lives anytime,

anywhere, with the third highest number of monthly

active users in the world.

4.2 Entertainment

At present, Tencent's entertainment products mainly

include games, videos, live streaming, news, music,

literature and other contents.

4.2.1 Tencent Game

Founded in 2003, Tencent Game is a leading game

developer and operator in the world. Tencent Game

released its first game QQ Tang in 2004, and in

2015, TiMi Studio released the multiplayer online

battle game Glory of Kings, which by 2017 was both

the world's most popular game and the most

downloaded app in the world. In 2011, Tencent

Games started hosting online multiplayer games

such as Call of Duty Online, consisting of previous

Call of Duty titles with added content, as well as the

game League of Legends, which it now fully owns

("Arena of Valor Revenue Clears $140 Million

Outside China", 2019). At the same time, Tencent

Games also actively promotes the development of

the eSports industry and creates a high-quality

digital life experience for users.

4.2.2 Tencent Video

At present, Tencent Video aggregates a large

amount of content resources such as popular movies

and TV shows, sports events and news and

information, and has developed into China's largest

online video media platform in terms of average

daily active users through various forms such as PC

terminal, mobile terminal and living room products.

4.2.3 Wesee

Wesee is Tencent's short video creation and sharing

platform, and is the main competitor of TikTok.

Users can log in through their QQ and WeChat

accounts and share the videos they shoot to WeChat

friends, friends circle, Qzone and other platforms

simultaneously.

4.2.4 Tencent Music

Tencent Music Entertainment Group is a leader in

digital music services in China, with China's widely

popular music platforms: QQ Music, KuGou Music

and Nationwide K Song, with a total monthly active

user base of over 800 million. As of December 31,

2019, Tencent Music's music library exceeded 40

million tracks.

4.3 Financial Technology Services

Tencent Financial Technology is committed to

connecting people and finance based on two

platforms, WeChat Pay and QQ Wallet, and works

with partners to provide global users with financial

services such as mobile payment, wealth

management, credit services, securities investment,

etc.

4.3.1 WeChat Pay

Based on the binding of bank cards, users can

complete a secure and efficient payment process

through their cell phones. In China, WeChat Pay

has achieved full online and offline coverage,

providing users with a full range of services such as

retail, food and beverage, and travel. Overseas,

WeChat Pay has covered more than 60 overseas

markets and supports transactions in 17 currencies.

4.3.2 QQ Wallet

It is a mobile payment product based on Tencent

QQ, integrating different convenient payment

methods such as bank cards, QR codes and NFC,

etc. QQ Wallet's main customers are young people

under 21 years old, and it provides mobile QQ users

with various experiences such as life services,

financial management, public welfare and travel by

combining QQ products and merchants.

4.3.3 Tencent Wealth Management

As the official financial platform of Tencent, since

its launch in January 2014, Wealth Management has

cooperated with banks, insurance, funds and other

financial institutions to bring one-stop investment

and financial management experience to hundreds of

millions of users. At present, it has launched money

funds, insurance-type wealth management, bond

funds, hybrid funds and other financial products as

well as a variety of functions such as salary fixed

investment, index fixed investment, credit card

repayment financing and mortgage financing. Meet

An Overall Analysis of Tecent’s Business Model

525

the diversified wealth management and asset

allocation needs of users. By the end of 2019, the

total customer assets of Wealth Management

reached RMB 900 billion.

4.4 Tool

Tencent provides users with a variety of tools to help

them quickly solve specific needs such as network

security management, fast browsing, and location

travel.

4.4.1 QQ Browser

With X5 kernel, it supports different end-users to

access the Internet quickly. It is fast, traffic-saving

and industry-leading in terms of stability. QQ

Browser also provides a number of services such as

information, short videos, novels and cartoons. It

intelligently understands users' preferences and

provides them with better search services and

content browsing experience.

4.4.2 Tencent Maps

It provides users with digital maps, intelligent route

planning, navigation and other travel-related

services. At present, Tencent Maps provides address

search and bus route search services in various cities

across China and has accessed more than 2,000 sets

of indoor maps, providing accurate navigation in

major airports, railway stations and shopping malls,

making users' travel life more efficient.

5 PRODUCT ANALYSIS

5.1 One-Stop Online Lifestyle Services

Tencent takes "providing users with one-stop online

lifestyle services" as its strategic goal, grasps

consumers' preferences and needs, and integrates and

develops similar products, making them show a

diversified development trend. In order to effectively

meet users' demand for information and knowledge,

Tencent has launched products such as QQ Browser

and QQ Mail; in order to enable users to share

resources with each other, it has launched QQ Space

and the Circle of Friends; in order to realize users'

demands for entertainment, Tencent has launched

QQ Show/pet/Game/music/Radio/TV and other

series of products. At the same time, it has invariably

increased customers' loyalty to Tencent's products

and made them recognize the brand more.

5.2 High Product Viscosity

Social platforms such as WeChat and QQ have

brought great success to Tencent. Through the

cultivation of users for nearly a decade, customers'

reliance on Tencent's products has been formed, and

Tencent has thus occupied the dominant position in

China's instant messaging market. At the same time,

by meeting users' new needs and guiding them to

new consumption behaviors, the combination of free

products and value-added products has made it

difficult for customers to switch to other instant

messengers, thus retaining users and ultimately

achieving a win-win situation among multiple

applications.

Relying on its huge user base and taking

advantage of people's strong demand for

communication in the Internet environment, Tencent

has developed its profit point from a single QQ to

multiple applications; its profit source has also

changed from smaller mobile QQ users in the past to

paid users of other applications; some users have

changed from students to workers, making

customers' ability and willingness to pay also greatly

enhanced, creating Tencent's current monopoly

position.

5.3 Adapt to Development and Rapid

Innovation

Tencent's financial results in 2020 showed that the

growth of Tencent's Internet community value-added

services revenue slowed, but in mobile and telecom

value-added services, revenue achieved solid

growth, and the popularity of social software and

mobile games continued to grow. Tencent adapted to

this change in a timely manner by vigorously

developing its mobile Internet business, increasing

its wireless Internet business products and enhancing

the functionality and social aspects of its products.

In addition, Tencent advocates digging into

customer needs and making timely adjustments and

modifications based on users' feedback on the

platform, constantly iterating and updating products

to improve user experience. During the development

of its own products, Tencent is the first to

investigate and study new products and technologies

in the industry. Based on the ideas and behaviors of

innovators, Tencent absorbs the innovative

technologies used by other brands by introducing

and purchasing them, and makes appropriate

adjustments and improvements in combination with

its own basic situation and profit model development

needs, so as to formulate more scientific competitive

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

526

solutions to enter the market and effectively improve

the core competitiveness of the company.

6 ANALYSIS OF TENCENT'S

PROFIT MODEL

The attention to the profit model stems from the rapid

development of the Internet. Tencent, as a famous

Internet enterprise giant in China, and its

achievements are full of praise for all the Internet

companies. Tencent's initial free social networking

software totaled 482.064 billion RMB in 2020.

Tencent made such huge profits, inseparable from the

following two profit models: Tencent's QQ and

WeChat profit model and Tencent's game industry

profit model.

6.1 Tencent QQ and WeChat Profit

Model Classification and Analysis

In the past 23 years, Tencent has formed effective

profit models in QQ and WeChat social media, has

experienced the test of practice, and has been widely

adopted. Therefore, according to different business

structures, the relatively mature profit model of QQ

and WeChat can be divided into the following

categories.

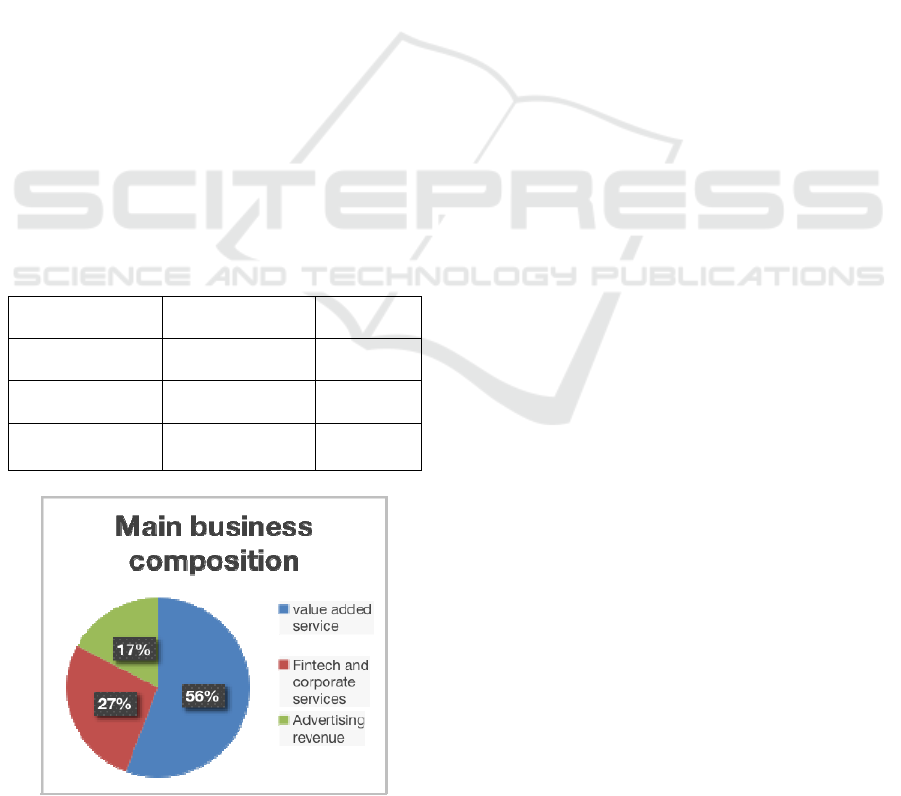

Table 1: The percentage of main sources of profit.

Business

Operating

income

Percentage

Value-added

services

$2642.12billion 54.81%

Enterprise

services

$1280.86 billion 26.57%

Online

advertising

$82.271 billion 17.07%

Figure 1. Main business composition of Tencent.

6.1.1 Member Profit Model (Value-added

Service)

The membership profit model is mainly to establish

an organizational form of a member club to make

profits by providing products and services.

According to data from table 1 and figure 3,

Tencent's value-added services accounted for 54.81%

in 2020, as one of the main sources of revenue. In

addition, Tencent QQ mainly focuses on QQ

members, QQ exhibitions and other representative

Internet value-added businesses. At first, Tencent

first offered free instant chat tools, so it mastered a

large number of users. But if this free strategy, it will

not bring any effective benefits to Tencent. So far,

Tencent has been focused on how to convert market

share into profits. Tencent has also added value-

added services for charging services, and continues

to provide customers with free instant chat tools. For

example, instant chat software with a free strategy

occupies an important market share, coupled with

QQ membership and QQ display clothing to make a

profit. The value of the content pushed by the

WeChat public platform is to push the original

content with its own platform characteristics, so as to

attract potential users with the content, retain fans,

enhance the interaction with fans and cultivate fans'

dependence on the platform. At present, WeChat has

entered every corner of people's life. WeChat public

platform was officially launched on August 23, 2012,

which is a new functional module added by Tencent

on the basis of WeChat. Tencent has a clear

positioning for the public platform (Han 2022).

6.1.2 Mobile Value-added Profit Model

(Enterprise Mobile Value-added

Services)

Mobile value-added profit is mainly through

cooperation with operators to provide QQ voice calls,

SMS and so on to obtain profits. In 2020, Tencent's

Fichte and enterprise services accounted for 26.57%

of the company, and its operating revenue reached

128.086 billion yuan, which specifically refers to the

combination of smart-phone and computer social

software to form mobile social software and increase

the value-added income of SP business. For example,

with the popularity of smart phones, QQ also began

to bind to mobile phones and become a mobile QQ,

transforming from a PC terminal to a mobile

terminal, and also supporting PC to mobile phones.

Thus, the interaction between the two increased, and

thus the amount of information transmitted increased

An Overall Analysis of Tecent’s Business Model

527

substantially. Earnings by sharing revenue with

telecommute operators.

6.1.3 Advertising Profit Model

There is no doubt that advertising is one of the

earliest profit models. Online advertising accounted

for 17.07% in 2020 in Tencent, so the investment of

online advertising should be strengthened in the

future. The establishment of official chat account

mainly depends on the number of fans, the quality of

the article content of the account, and the degree of

activity of the public account. First, content of

articles in public accounts supports the original

design, which improves the popularity of public

accounts and improves stream, and the greater the

click power of revenue will be. Public accounts have

the original foundation, which also have the certain

popularity, no longer need to rely on traffic owners,

commercial advertising can become the main source

of personal official account of WeChat profits.

Advertising profit model also includes advertising

platform fees, for instance, for writers who write

advertising articles in WeChat, revenue is expected

to reach hundreds of thousands or tens of thousands

of dollars if fans and views continue to rise. It is also

mainly through stream.

6.2 Tencent Game Industry Profit

Model Analysis

Tencent has a lot of profit returns in addition to the

news agency delivery app, the game industry has

brought huge profits. In the mobile game market in

2020, Tencent generated a huge marketing revenue

with 20.967.6 billion RMB, which was increased by

4.84%, compared to 2019. Therefore, Tencent, as a

leader in the game industry, its profit model makes

huge contribution.

6.2.1 The Components of Tencent Game

Profit Model

Firstly, relying on social media article content, such

as personal WeChat official account, WeChat and

other push content, Tencent obtains support of stream

for its profitability from games.

Secondly, from the perspective of the profit

object. The object of profit is the object of the

income of the enterprise, that is, the customer of the

enterprise. The size and purchasing power of the

profit target group can directly determine the

business profit of the enterprise. Tencent Games'

profit targets are gamers. The more gamers, the better

the profitability of Tencent Games. Tencent quickly

grabbed market share in mobile games while

maintaining its messaging business. The constituent

elements of profit patterns were based on virtual

currency and network advertising profit point as the

core, with individual consumers as the main target of

profit, to pay for value-added services and

advertising revenue as the main source of profits, in

cooperation with other manufacturers to expand

overseas, the development game live platform for

profit leverage, vertical integration to strengthen

innovation to enhance technical barriers and value

chain for profit barrier.

6.2.2 Main Profit Model of Tencent Game

Table 2: Profit data of Tencent.

2021,

June

30th

2020,

June

30th

(One million RMB)

Income 138.259 114.883

Gross profit 62,745 53.210

Operating profit 52,487 39,311

Profit during the period 43.022 32.454

The equity holders of

the Company shall

make a profit

42,587 33,107

Non-international

financial reports into

the Compan

y

Equity holders shall

account for a profit

34.039 30.153

Earnings per share (RMB per share)

Basic EPS 4.472 3.491

Diluted EPS 4.387 3.437

Non-FIRS earnings per

share

(RMB per share)

Basic EPS 3.574 3.180

Diluted EPS 3.504 3.130

According to data from table 2, Tencent Game's

value-added business revenue in 2021 was

significantly higher than that in 2020, mainly driven

by revenue growth from games such as King of

Glory and PUBG Mobile. There are two main profit

models:

Online advertising business. Internet companies

such as Google, Facebook and Alibaba have already

invested heavily in advertising and generated huge

revenue. Tencent's revenue in the first quarter of

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

528

2020 was 114.883 billion RMB, increased 26%

compared to the previous year, with advertising

revenue of 17.713 billion RMB, accounting for 32%.

Value-added service business. Tencent game is a

recharge and charging mode, with "business

diversified profit" as the center, "King of Glory" is a

typical example, all kinds of skins and heroes can be

bought on mobile phones, and surroundings (dolls

and hands) can be purchased through prepaid mobile

phone virtual currency, Tencent users have exceeded

hundreds of millions, so the economic benefits are

very huge (Yang 2021).

7 ACCOUNTING ANALYSIS

According to the data of Tencent's 2020 financial

statements, table 3, table 4 and table 5 are calculation

results of Tencent's liquidity ratios, profitability

ratios and solvency ratios.

Table 3: Liquidity ratios of Tencent in 2020.

Ratios TENCENT

Year 2019 2020

Current ratio 1.06 1.18

Aci

d

-test

(q

uick

)

r

atio 1.05 1.18

Accounts receivable

turnove

r

11.6times

31.5days

12.3times

29.7days

Inventory turnover

400times

0.9days

350.2times

1.0days

• Current ratio: It means Tencent had a better

capacity to repay short-term loans that were

due within the next year than 2019. The

increase shown in both current assets and

current liabilities caused the increase of the

current ratio in 2020.

• Acid-test(quick) ratio: The calculation result

shows an increase in acid-test ratio which

indicates that Tencent had strong growth,

quickly able to convert receivables into cash

and comfortable in its financial obligation

coverage. Due to the fact that Tencent had a

increased figure on cash (40%) and accounts

receivable (25.5%).

• Accounts receivable turnover: In 2020,

Tencent had a better account receivable

turnover, and it showed a short time between

credit sales and cash receipts. The figure

slightly decline due to the fact that Tencent

had a better figure on accounts receivables.

Tencent had a low accounts receivables

turnover days due to the fact that the

company have a longer payment contract

period.

• Inventory turnover: In 2020, the inventory

turnover days of Tencent had a slightly

increased, which indicates that the company

had a better ability to make profits.

Table 4: Profitability ratios of Tencent in 2020.

Ratios TENCENT

Year 2019 2020

Profit mar

g

in 25.42% 33.22%

Asset turnove

r

0.45 0.42

Return on assets 11.43% 14.00%

Return on common

stockholders' e

q

uit

y

20.73% 23.63%

Earnin

g

s

p

er share 9.86 16.84

Price-earnings ratio 33.78 41.21

Payout ratio 10.54% 10.90%

• Profit margin: Revenues from Value-added

Services, Online Advertising as well as Fin

Tech and Business Services were all

increased in 2020. The cost of revenue

reasonably increased, proves that Tencent did

well in maintaining revenue growth in the

main business, at the same time, paid

attention to the cost control.

• Asset turnover: Tencent used assets less

efficient than 2019. The main reason why

there was a downward trend is that the

company increased its investment in assets

by 2020, especially the investment in Non-

current assets.

• Return on assets: The increase in return on

assets shows that Tencent uses assets more

efficient than 2019. Tencent did a good job

in cost control, only showing a slight

increase in Selling and marketing expenses

and General and administrative expenses.

• Return on common stockholders' equity: It is

a profit indicator that shareholders are

concerned about. It shows that for every

dollar a shareholder invests in Tencent, they

can create about $0.24 in value, in addition to

dividends.

• Earnings per share: On the whole, Tencent's

EPS is showing a growth state. Earnings per

share of the Company's common

shareholders rose to 16.84 from 9.86. Both

show an upward trend in Tencent’s annual

report. Net income increased from RMB

93310 million in 2019 to RMB 159847

million, a significant increase, reflecting not

only Tencent's good operating performance

An Overall Analysis of Tecent’s Business Model

529

and increased revenue from its main

business, but also Tencent's good cost

control. The number of common shares

increased slightly. This is also a good

phenomenon, during this period, Tencent's

visibility has increased, and the enterprise

has a great reputation.

• Price-earnings ratio: Compared with 2019,

Tencent's the price-to-earnings ratio for 2020

has improved significantly, indicating that

investors' confidence in Tencent, an internet

company, has improved under the epidemic.

Tencent's annual net profit growth is very

large, and the return on investment in

Tencent is relatively faster, so Tencent

should get a trading premium at a higher

valuation. Tencent's market share is large,

and its main business has unique selling

points, which are more extensive than the

other companies, thus strengthening

Tencent's pricing power. As far as managers

are concerned, Tencent's managers are

trusted by many people and may lead to a

rush of investors. Finally, Tencent's profit

quality is high. The earning cash ratio is a

good measure of it. It has been calculated

that Tencent's net cash from operating

activities to net income ratio is greater than

one, showing a volatile but relatively stable

state, indicating that Tencent has more cash

that can be allocated according to its own

wishes, the corresponding repayment ability

and the ability to pay cash increased,

resulting in an increase in Tencent's P-E

ratio.

• Payout ratio: Tencent's dividend payout ratio

in the past two years was relatively stable

between ten and eleven percent. Dividends

distributed in 2020 were relatively higher.

Tencent pays out a smaller percentage of its

earnings to shareholders as dividends, giving

it a more sustainable than others. A smaller

payout ratio point to Tencent's reinvestment

strategy. It reinvests the bulk of its earnings

for new facilities and other operating needs,

to expand operations and promote the

development of the company.

Table 5: Solvency ratios of Tencent in 2020.

Ratios TENCENT

Year 2019 2020

Debt to assets ratio 48.8% 41.7%

Time Interest Earned 24 times 6.9 times

• Debt to assets ratio: was 48.8% in 2019 and

41.7% in 2020, this ratio was better than the

previous year, which means that the

improvement of solvency.

• Time Interest Earned: The higher the interest

expense multiple, the higher the ability to

pay interest. As Tencent's long-term

solvency decreased, its security and stability

declined either. Therefore, Tencent should

take measures such as reducing debt to

increase the interest coverage ratio, and not

keep it low until it is lower than 1 at last.

8 CONCLUSIONS

Through an in-depth analysis of Tencent's business

status, this paper puts forward the following

suggestions for Tencent: improve its ability to cope

with adverse changes in policies to better cope with

risks in the future; strengthen the attention to middle-

aged and elderly users; and put forward suggestions

for improving the independent research and

development capabilities and web games in games in

view of the serious homogenization of Tencent's

game products and the lack of core technologies and

high-end talents. It also summarizes the common

problems existing in Internet enterprises, and puts

forward suggestions for other Internet companies to

seize the opportunities of the times, conform to the

economic development situation, accurately locate

the market and target users, and accelerate the pace

of innovation, so as to provide reference for the

future development of Internet enterprises.

8.1 Our Advice

Tencent company is a leading enterprise in the game,

should strengthen the overall layout of the game.

Representative end games similar to NetEase games

are Fantasy Westward Journey Computer Version,

World 3, Against the Cold Water, etc. Representative

mobile games of NetEase games are Fantasy

Westward Journey mobile game, A Chinese Ghost

Mobile game, Onmyoji and so on. On the whole,

NetEase games have more kinds of game products

and richer layout. This is Tencent to strengthen the

area.

Research significance: The significance of this

study is not only to analyze Tencent's financial status

and business status from 2019 to 2020 and the

comparison with netease, but also to analyze the

future development direction of Tencent that should

focus on the game industry.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

530

Because of the booming development of the

game industry, Tencent not only brought huge

economic benefits, and even surpassed its competitor

NetEase for a time.

8.2 Future Studies

Tencent's future development direction should focus

on the development of the game industry and

innovative development of new games. Not only in

the development and construction of online social

apps.

8.3 Limitations

8.3.1 The Lack of Innovation and Serious

Homogenization of Developers

Compared with foreign countries, domestic game

companies lack core technology to establish game

differentiation and independent innovation ability in

game development, so they are more inclined to

increase capital investment to buy game copyright.

Such as mobile game developed by foreign

companies "after tomorrow", netease directly to buy

its copyright, obtains the good market response, lead

to directly purchase foreign copyright as a shortcut to

research and development of the domestic game, and

even some companies didn't get the original

authorization, direct copying foreign game, so

appeared in recent years several disputes about

mobile game works.

8.3.2 Lack of Core Technology and High-

end Talents

In addition to the lack of innovation, China's mobile

game production quality is low, the lack of quality of

the mobile game industry is also limited to further

development. For example, some domestic mobile

game engines, such as CoCOS2D-X and WiEngine,

are developed by foreign companies, and these patent

royalties also increase the cost of domestic

companies. In addition, some game rendering and

other later technologies are not mature enough

compared with foreign countries. In terms of

technology, this paper still has certain dependence on

foreign companies, which makes Chinese games

unable to compete with foreign countries in terms of

picture quality and fluency.

REFERENCES

"Arena of Valor Revenue Clears $140 Million Outside

China". sensortower.com. Archived from the original

on 11 April 2019. Retrieved 28 February 2019.

B. X. Han. Profit model of wechat public platform [J].

Enterprise Management, 2020(05):95-97.

D. T. Shen. Analysis on Marketing Strategies of Tencent

Games—Take Honor of Kings as an Example[J]. E3S

Web of Conferences, 2021, 235: 03028-.

"Eight O 'clock Financial Club" Financial Earnings of

Tencent Game Industry (2021-12-22)

F. Liu. Research on The Development Strategy of Tencent

[D]. Shihezi University,2015.

H. Y. He. Internet under the downturn of advertising:

Tencent Buddhism B station enterprising[N]. 21st

Century Business Herald, 2021-11-22(008).

DOI:10.28723/n.cnki.nsjbd.2021.004812.

J. Y. Feng. Research on Tencent's Profit Model [D].

Jiangsu University of Science and Technology.

2019(03)

Li. Research on Tencent's Development Strategy[D].

Ocean University of China, 2014.

Y. S. Wei. Analysis of Tencent Video Development

Environment under the Digital Revolution: Based on

PEST Analysis Method[J]. New Media. Research,

2019,5(06):99-101.DOI:10.16604/j.cnki.issn2096-

0360.2019.06.039.

Y. Yang. Tencent mobile game business profit model

research [D]. Xi 'an petroleum university, 2021. The

DOI: 10.27400 /, dc nki. Gxasc. 2021.000360.

An Overall Analysis of Tecent’s Business Model

531