SVAR Metrics Analysis for the Impact of Fintech on Rural

Economy Growth

Yu Duan

a

, Yuxin Liu

b

and Jinchuan Ke

c

School of Economics & Management, Beijing Jiaotong University, 100044, Beijing, China

Keywords: Fintech, SVAR, Impulse Function.

Abstract: The Fintech (financial technology) has the characteristics of low transaction costs, high transaction efficiency

and strong assistance. In the past decade, it has gradually become one of the main forms of Fintech. Based on

the background of the rapid development of Fintech, this article discusses the impact mechanism of Fintech

on rural economic development from the perspective of the development scale of internet third-party payment

and P2P network loans. The results of the research show that the impact of Fin-tech on the development of

the rural economy is weak in the short-term and strengthened in the long-term. The results of the impulse

response show that the positive changes in rural economic growth itself, third-party payments and P2P

network loans can significantly promote local economic development.

1 INTRODUCTION

Fintechs such as P2P and crowd funding platform

have injected new vitality into finance and related

industries from all aspects. It is not difficult to find

that the sudden emergence of Fintech (financial

technology) is significantly impacting the existing

profit model of traditional financial institutions. The

rural market is an indispensable part of the internet

economic system, and the development of Fintech

can greatly meet the innovation needs of its financial

service system. In addition, the innovative

characteristics of Fintech itself are compatible with

the ideas for the transformation and upgrading of my

country's rural economy, and can help the rural

economy move towards high efficiency and high

quality. Driven by innovation, the development mode

of "Internet + modern countryside" has become

commonplace. Financial institutions are actively

deploying rural areas. From the perspective of

econometrics, this article takes the entire rural

economic development as an explanatory variable,

and uses the SVAR model to empirically analyze the

relationship between Fintech and the rural economy.

a

https://orcid.org/0000-0001-7465-5323

b

https://orcid.org/0000-0003-0809-9685

c

https://orcid.org/0000-0001-6747-6968

2 LITERATURE REVIEW

In the context of global economic integration, the

economic ties between different regions and

industries are closer, and financial technology and its

service products are continuously integrated with the

real economy (Li 2015). Industry 4.0 is the fourth

industrial revolution, which is closely related to the

Internet of things (IOT), communication technology

(ICT) and enterprise architecture (EA). Therefore,

fintech has also developed rapidly with industry 4.0

(Lu 2017). In the era of industry 4.0, through fintech,

all forms of financial transactions not only make

faster, easier and more efficient, but also make a

positive contribution to improving public financial

services and help promote the economy in the digital

age (Mardiana 2020).

Many scholars have carried out detailed

interpretation and analysis of Fintech risk, and

successfully applied it to real economic development

research. For example, Ying (2016), Kai (2016) and

Xianyu (2018) believes that Fintech has developed

rapidly in recent years, but it needs to be strictly

regulated by the government. Ting (2017) believes

that the theory of rural finance still needs to be

Duan, Y., Liu, Y. and Ke, J.

SVAR Metrics Analysis for the Impact of Fintech on Rural Economy Growth.

DOI: 10.5220/0011188300003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 497-502

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

497

developed in depth, and that the government's timely

and appropriate intervention is particularly needed to

help traditional and new rural financial institutions

embark on the development path of inclusive finance.

The view point of Jianbing (2018) is that Fintech has

become a new vitality in rural economic development

from budding to vigorous development in just a few

years. Wenqi (2018) combed and summarized the

theory of rural finance, summarized and analyzed the

development process and current situation of rural

finance, constructed a panel model to study the

mechanism of rural financial development and

farmers’ income growth. Yongcang (2021) deeply

analyzed the evolution process and structural changes

of rural household income growth, the characteristic

facts and evolution trends of digital finance, and

constructed a theoretical framework for the influence

of digital finance on household income growth.

3 SVAR MODEL

The Vector Auto Regressive Model to study the

interaction between two or more variables is referred

to as VAR model. The VAR model is essentially a

multivariate data analysis method, which takes each

endogenous variable in the system as a function of the

lag value of all endogenous variables in the system.

Therefore, this model successfully extended the

univariate autoregressive model to the vector

autoregressive model composed of multiple time

series variables. If the VAR model is not based on

strict economic theory, the explanatory variables are

all lagged terms, and no parameter constraints are

imposed, then it can avoid identification problems

and endogenous explanatory variable problems, so it

is structural and non-restrictive, and is recorded as

SVAR. The important premise of the realization of

the VAR model is that the time series corresponding

to all variables are stable. Therefore, this paper uses

the ADF unit root test method to test the stationarity

of the selected time series and their difference terms.

Its basic form is as follows:

∆Y

=β

+γt+∅Y

+

∑

β

∆Y

+δ

(1)

Where, ∅=0, the original series is a non-

stationary series, and ∅<0, the original series is a

stationary series. The general mathematical formula

of the SVAR model is shown as follows, setting the

number of variables as N and the lag order as p, where

c is the n-dimensional constant column term, 𝜀

is

the n-dimensional error column vector, the

coefficient α is a matrix of N×N:

Y

=c+

α

Y

+

α

Y

+

α

Y

+⋯+

α

Y

+

ε

(2)

Where, Y

=(y

,

,y

,

,y

,

,⋯,y

,

) , c=

(c

,c

,c

,⋯,c

),

ε

~ΠN(0,Ω)

,

ε

=(ε

,

,ε

,

,ε

,

,⋯,ε

,

)

.

Π

=

π

,

⋯

π

,

⋮⋱⋮

π

,

…

π

,

, j=1,2,3,⋯,p

(3)

If the model meets the conditions: (1) The n*n-

dimensional matrix formed by the coefficient is not 0

and p>0; (2) The roots of the characteristic

equation fall outside the unit circle; (3) ε

are

independent of each other. At this time, ε

is an n-

dimensional white noise vector sequence, also called

an impact vector. Cov(ε

x

)=E(ε

x

)=0, (

j=1,2,3,⋯), that is, the lag period of x

, x

and ε

is not correlated.

In order to solve the problem of correlation

between the random error terms corresponding to

different equations, we usually use Cholesky

decomposition to attribute the relevant part to the

random disturbance term of the first variable in the

SVAR system. Processing in this way can make the

random error terms corresponding to different

equations irrelevant.

The SVAR model estimation method used in this

paper is OLS estimation, and the model parameter

matrix is:

A

=

a

,

⋯a

,

⋮⋱⋮

a

,

…a

,

,i=1,2,3,⋯,p (4)

Then find the OLS estimate of the model

parameter matrix A

,A

,⋯,A

, that is, find the

(A

,

A

,

⋯,A

) that makes the following formula

obtain the minimum value:

Q=

∑

y

−

∑

A

y

y

−

∑

A

y

(5)

For the order determination, this article uses the

AIC and SC information criteria, also called the

minimum information criterion, to determine the lag

order of the SVAR model:

AIC=−2l/T+2n/T,SC=−2l/T+nlnT/T

(6)

Where, l=−

(1 + ln2π) −

lnΣ

, n is the

number of parameters that the model needs

to estimate,

n=pN

. The minimum information criterion is to

take p=1,2,3... for AIC or SC respectively. When AIC

or SC=min, the corresponding p is the appropriate

order of the model, and the corresponding

A

1

,

A

2

,

⋯,A

P

is the best model parameter estimation.

After establishing the SVAR model, we need to

make a judgment on the stability of the SVAR model,

based on the value of the characteristic root. Calculate

the value of the characteristic root and compare the

absolute value of its reciprocal with 1. If the absolute

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

498

value of all the reciprocal of the characteristic root is

less than 1, it means that the SVAR model is stable.

If the absolute value of the reciprocal of the

characteristic root is greater than 1, it means that the

SVAR model is unstable. The stationary SVAR

model can be written as a vector moving average

model, denoted as VMA:

y

=μ+

∑

A

ε

(7)

Where, μ is the p×1 dimensional vector of the

mean value of y

t

, and A

i

represents the impulse

response matrix, which shows the response of the

variable to short-term impacts of other variables, and

can reflect the dynamic interaction characteristics

between the variables. For the impulse response, the

cumulative response function caused by the pulse of

y

j

is

∑

d

ij

(q)

∞

q=0

, among them, d

ij

(q)

is the element in

the i-th and j-th columns of A

q

(

q=0,1,2,3, ⋯

)

.

The matrix can be expressed as: A

=

∂y

∂v

⁄

, that is, the element in the i-th row and j-

th column of A

is equal to the j-th variable

perturbation term in the period t plus one unit. When

the disturbance term in other periods is constant, the

influence on the value of the i-th variable in the period

t+q.

In addition, based on the estimation of the SVAR

model, this paper further introduces Granger

causality test to clarify whether the correlation

between the variables we obtained is meaningful. The

Granger causality test is aimed at estimating the

following regressions in the time series:

y

t

=

∑

a

i

x

t−i

q

i=1

+

∑

b

j

y

t−j

q

j=1

+u

1t

(8)

x

=

∑

φ

x

+

∑

ω

y

+u

(9)

Among them, u

and u

are white noise. It is

assumed that y is related to itself and the past value

of x, and x is related to itself and the past value of y.

4 EMPERICAL ANALYSIS

4.1 Data Processing

This paper selects rural GDP as an indicator to

measure rural economic development and analyzes it

as an explanatory variable. In terms of Fintech, this

paper selects representative third-party payment scale

and P2P network loan transaction volume as

independent variables. This article selects the 2012-

2020 quarterly data for analysis. Due to the

exponential trend and heteroscedasticity that may

exist in the data, logarithmic processing is adopted for

the transformed data. After processing, the

corresponding symbols of the variables are:

LNGDP (Rural economic growth), LNPAY (Third-

party payment LNPAY), LNP2P (P2P network loan

LNP2P).

4.2 Staionarity Test of Variables

The stationarity of the time series can effectively

prevent the emergence of pseudo-regression models.

In this paper, the ADF unit root test method is used to

test the stationarity of the selected variables after

logarithmization of the time series data. The results

show that LNGDP, LNPAY, and LNP2P are all first-

order single integers at the 5% confidence level,

which meets the conditions for establishing the VAR

model. The stationarity test results are shown in Table

1.

Table 1: Unit root test results.

Variable t-Statistic Prob

LNGDP -26.5 0.0001

LNPAY -4.47 0.0004

LNP2P -3.37 0.0346

4.3 Lag Order Selection

The degree of freedom of the variables in the SVAR

model depends on the choice of the variable lag order.

The larger the lag order, the more complete the

dynamic relationship between the variables shown by

the model, but the increase in the variable lag order

will also cause the overall degree of freedom of the

model to decrease. Next, this article selects a more

appropriate lag order based on the model design and

selection of AIC and SC information criteria.

Through software analysis, it is found in Table 2

that the AIC value and SC value are the smallest when

the lag order is 5, so the optimal lag order is 5.

Table 2: Lag order performance.

Lag order AIC value SC value

Level 2 -2.94 -2.66

Level 3 -2.62 -2.37

Level 4 -3.67 -3.46

Level 5 -6.03 -5.88

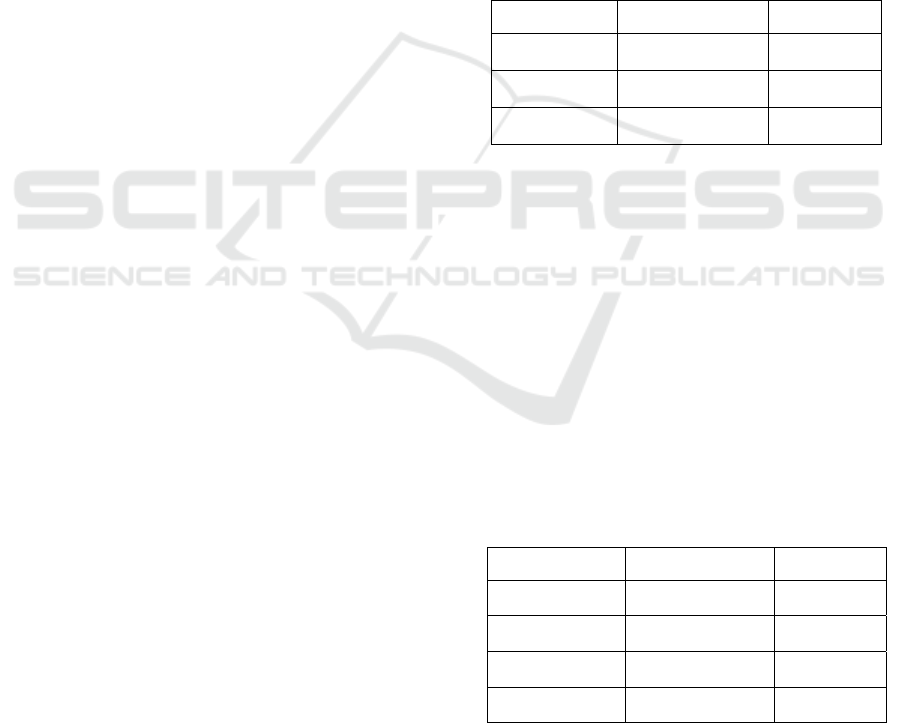

However, when the lag order is 4 or 5 in the

characteristic root test result, there are points outside

the unit circle, and when the lag order is 3, as shown

in Figure 1, all points fall within the unit circle.

SVAR Metrics Analysis for the Impact of Fintech on Rural Economy Growth

499

Therefore, the final reasonable lag order selected is 3,

and the VAR model we build is stable at this time.

-1.5

-1.0

-0.5

0.0

0.5

1.0

1.5

-1.5 -1.0 -0.5 0.0 0.5 1.0 1.5

Figure 1: Roots of AR characteristic polynomials.

4.4 Granger Causality Test

After determining the lag order, the SVAR (3) model

parameter estimation results are as follows.

LNGDP=0.9168∗LNGDP

(

−1

)

+0.936∗LNGDP

(

−2

)

+0.6046∗LNGDP

(

−3

)

+0.0204∗LNP2P

(

−1

)

+0.006∗LNP2P

(

−2

)

+0.0638∗LNP2P

(

−3

)

+0.01259∗LNPAY

(

−1

)

+0.0018∗LNPAY

(

−2

)

+ 0.0291∗LNPAY(−3)+8.579

From the estimation results, rural economic

growth is greatly affected by its own lagging items,

but the lagging coefficients of third-party payment

and P2P network loans are still positive. Therefore,

the lagging items of third-party payment and P2P

network loans are still affected by the level of

economic growth has a positive impact. The

development of Fintech has a positive impact on rural

economic growth. In addition, from the perspective

of the change trend of the coefficient of the lagging

term, the coefficients of third-party payment and P2P

network loans in the lagging three phases are slightly

higher than those of the lagging phases one and two.

The impact of growth has a time lag, and its positive

effects will gradually appear and increase over time.

Aiming at the established SVAR model, this paper

uses Granger Causality/Block Exogeneity Wald Tests

to test the causality between variables to clarify

whether the correlation between variables is

meaningful, and analyze third-party payment, P2P

network loans and rural economy.

Table 3 shows the results of the Granger causality

test, at a significance level of 10%, "third-party

payment is not the Granger reason for rural economic

development" and "P2P network loans are not the

Granger reason for rural economic development"

hypothesis rejected, that is to say, the development of

Fintech has a significant role in promoting the

transformation and upgrading of the rural economy,

while the back-feeding effect of rural economic

development on Fintech is not significant.

Table 3: Granger causality test results

Null H

yp

othesis F-Statist. Prob

LNPAY does not Granger

cause LNGDP

23.894 0.0007

LNGDP does not Granger

cause LNPAY

0.6944 0.5308

LNP2P does not Granger

cause LNGDP

3.8763 0.0736

LNGDP does not Granger

cause LNP2P

0.3628 0.7081

LNP2P does not Granger

cause LNPAY

0.8465 0.4686

LNPAY does not Granger

cause LNP2P

1.8084 0.2327

4.5 Impulse Response Analysis

Through the impulse response function of the SVAR

model, the time path of the response function of each

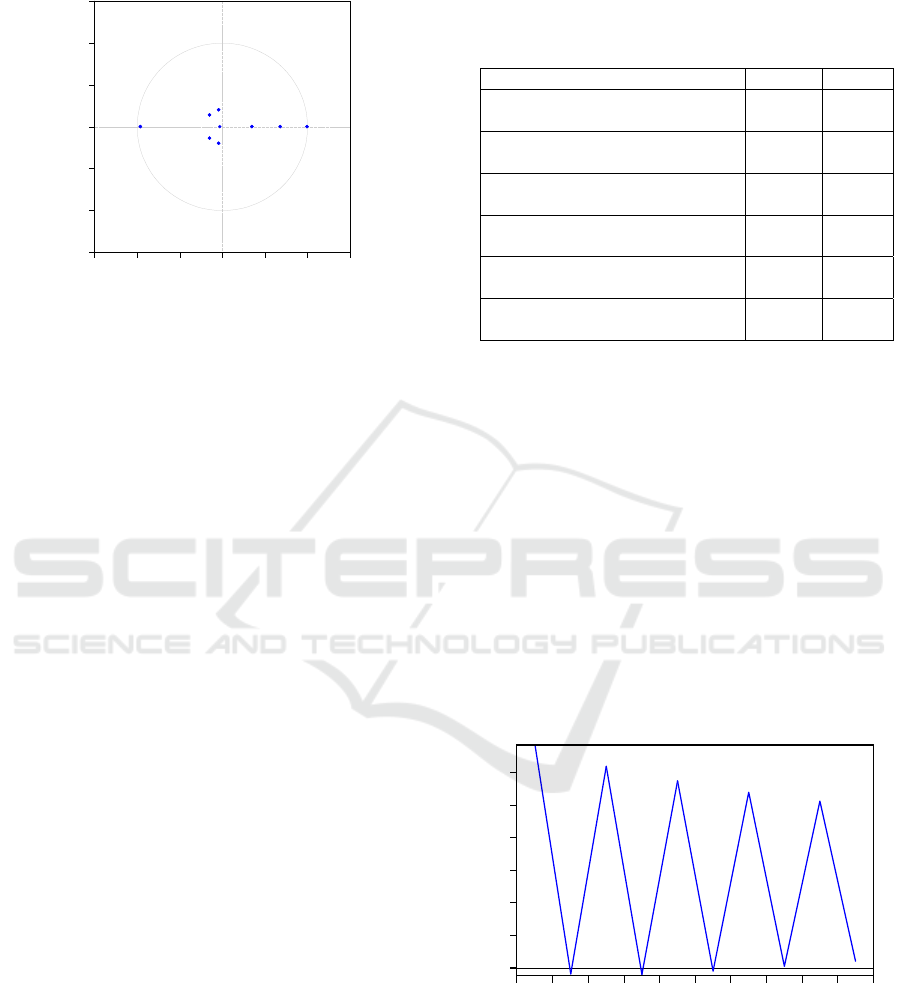

variable in the model can be analyzed. Figure 2 shows

the economic growth impulse response function.

Figure 3 shows the impact of P2P network loans on

rural economic growth.

From the impulse response results in Figure 2,

Figure 3, and Figure 4, it can be seen that rural

economic growth responds to its own disturbances or

shocks to a greater extent, while third-party payment

and P2P network loans have less impact on the

changes in rural economic growth. But from the result

point of view, the solid line is above the axis, so the

effects of the variables are in the same direction.

.00

.01

.02

.03

.04

.05

.06

1 2 3 4 5 6 7 8 9 10

Figure 2: Economic growth impulse response function.

(LNGDP to LNGDP)

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

500

.00

.01

.02

.03

.04

.05

.06

1 2 3 4 5 6 7 8 9 10

Figure 3: Economic growth impulse response function.

(LNGDP to LNP2P)

The impact of third-party payment on the growth

rate of the rural economy is shown in Figure 4.

.00

.01

.02

.03

.04

.05

.06

1 2 3 4 5 6 7 8 9 10

Figure 4: Economic growth impulse response function.

(LNGDP to LNPAY)

Third-party payment and P2P network loans can

promote rural economic development. In addition,

the first-phase response value of the impulse response

results of third-party payment, P2P network loans and

rural economic growth is 0, which shows that the

impact of third-party payment and P2P network loans

on rural economic development is lagging. This is

because Fintech to inject capital or provide financial

services for the development of rural related

industries does not have immediate effect. It needs to

go through production, market and other links to

gradually emerge. As time goes by, the response

value shows a gradual upward trend, which shows

that from a long-term perspective, The development

of rural Fintech has a significant positive effect. The

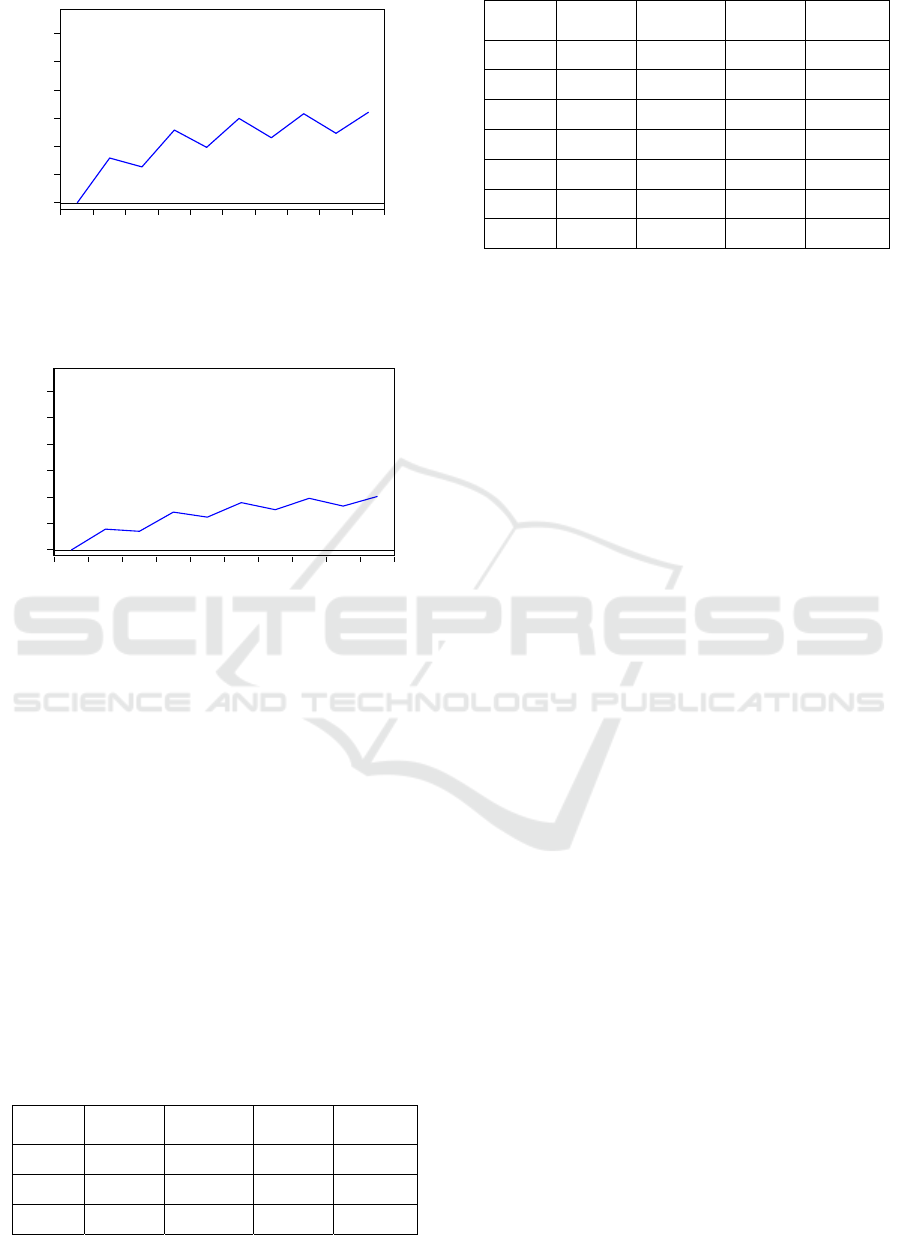

variance analysis can be seen in Table 4.

Table 4: Variance analysis results.

Period S.E. LNGDP LNP2P LNPAY

1 0.04799 100.0000 0.00000 0.00000

2 0.06098 74.0808 3.31968 22.5994

3 0.06558 71.2910 8.54267 20.1662

Period S.E. LNGDP LNP2P LNPAY

4 0.08073 51.2922 8.04840 40.6593

5 0.08526 55.2787 8.25947 36.4617

6 0.09907 41.3591 9.94682 48.6940

7 0.10433 47.0140 8.99896 43.9870

8 0.11634 37.8143 11.6640 50.5216

9 0.12204 43.3885 10.6797 45.9317

10 0.13145 37.5307 13.6003 48.8689

The results show that the third-party Internet

payment has the highest contribution rate to the rural

economic development. In the long-term

development process, the contribution to the rural

economy reaches 48.87%. Followed by P2P network

loans, in the long-term development process, the

contribution to rural economic development reached

13.6%. The influence of rural economic development

on itself has gradually weakened over time, while the

influence of third-party Internet payment and P2P

network loans on rural economic development has

gradually increased, which further proves that the

impact of Fintech on rural economic growth has a

time-lag conclusion.

5 CONCLUSIONS

In this study, the results that the scale of third-party

payment and whether P2P network loans have played

a positive role in rural economic development, and

the degree of this influence changes in a dynamic

environment. The results of Granger causality test

show that third-party payment and P2P network loans

have a significant role in promoting rural economic

development, while the back-feeding effect of rural

economic development on financial innovation is not

significant.

According to the results of impulse response, the

positive changes of rural economic growth itself,

third-party payment and P2P network loans can

obviously promote rural economic development, but

the promotion of rural economic growth by third-

party payment and P2P network loans has a time lag.

The results of variance decomposition also show that

third-party Internet payment has the highest

contribution rate to rural economic development.

We also find that financial innovation cannot play

a significant role in promoting in the short term, so it

is imperative to improve the construction of

information network in rural areas and service quality

of science such as e-commerce in the long term.

SVAR Metrics Analysis for the Impact of Fintech on Rural Economy Growth

501

REFERENCES

Jianbing, L. (2018). Research on rural economic

development under the background of financial

innovation. Natl Circu. Econ. 31, 84-86.

Kai, W. (2016). Research on the status quo, problems and

countermeasures of financial innovation in promoting

rural development in taizhou city. Times Financ. 30,

58-60.

Li, J. (2015). Thoughts on Internet Finance. Manag. World.

07, 1-7.

Lu, Y. (2017). Industry 4.0: A Survey on Technologies,

Applications and Open Research Issues. J. Ind. Inf.

Integrat. 6, 1-10.

Mardiana, S.L., 2020. Faridatul, T., Mardiyana, L.O. The

contribution of Financial Technology in Increasing

Society's Financial Inclusions in the Industrial Era 4.0.

Proc. 2nd Intl. Conf. Env. Geo. Edu. (ICEGE). IPO

Publishing Ltd.

Ting T., 2017. Research on the operation mechanism of

rural inclusive finance. Dissertation, nanjing forest.

univ.

Wenqi X., 2018. Development of rural finance in China.

Dissertation, Tianjin Univ. Financ. & Econ.

Xianyu X. (2018). Analysis of the impact of financial

innovation on economic development. Chin. Bus.

Forum. 28, 42-44.

Ying Z. (2016). The impact of the new round of financial

innovation reform on the rural economy. Econ. Res.

Ref. 64, 73-76.

Yongcang, W., 2021. Digital finance and farmers’ income

growth. Dissertation, S. Univ.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

502