Stock Market Analysis and Stock Prices Prediction with Long

Short-term Model

Hang Yu

a

Queen’s University Belfast, BT7 1NN, Belfast, U.K.

Keywords: Stock Market, Finance, Pandas, Data Visualization, Long Short-Term Memory.

Abstract: The Stock Market Analysis and Prediction project uses Yahoo Finance data to investigate and anticipate stock

market volatility using technical analysis, visualization, and forecasting. Analyzed a stock's risk based on its

prior performance history by using pandas to gather stock information and then visualizing it in a variety of

ways. With the use of data visualization, we want to get a deeper knowledge of the stock market data in order

to create predictions about future stock performance and risk value for specific stocks as part of this project.

Statistical analysis and data mining are part of the project. NumPy, Pandas, and Data Visualization Libraries

are all heavily used in this project. Long short-term memory was used to make predictions about future stock

values. With historical data, the long short-term memory approach was able to forecast properly, with a mean

square error of roughly 3. Pre-training models of long-term memory were used to predict the validation data.

1 INTRODUCTION

Millions of dollars are exchanged every day, and

behind each dollar is an investor seeking to make a

profit (Ince, 2000). Corporate fortunes fluctuate on a

daily basis depending on market conditions and

sentiment. There is a tempting promise of money and

power if an investor can precisely forecast market

moves. When the stock market goes haywire, it is no

surprise that the public's attention is drawn to the

market's problems. A greater grasp of stock market

forecasting might be useful in the event of similar

occurrences in the future (Gers, et al, 2002).

Exchanging the stocks on money markets is one

of the significant speculation exercises. Already,

scientists developed different stock examination

system that could empower them to envision the

bearings of stock esteem development. Predicting and

foreseeing of significant worth future cost, in

perspective of the present cash related information

and news, is of colossal use to the financial pros

(Akita, et al, 2016). Financial masters need to know

whether some stock will get higher or lower over

particular time-period. To obtain the accurate output,

the approach used is to implemented is machine

learning along with supervised learning algorithms.

a

https://orcid.org/0000-0002-0679-7239

Results are tested using different types of supervised

learning algorithms with a different set of a features

(Siew, et al, 2012).

This paper is mainly about the analysis of short-

term stock prices, seeking stock market data,

especially some technology stocks. In this article,

four technology stocks are selected for analysis,

including Amazon, Apple, Microsoft and Google. On

the premise of solving the changes in stock prices

over time and the moving averages of various stocks,

we then use python Use machine learning models to

predict short-term stocks on historical data. We will

learn how to use Pandas to obtain stock information

and visualize different aspects of it. Finally, this

article will use the long and short-term memory

(LSTM) method to predict future stock prices by

studying the previous performance history of stocks.

2 METHODOLOGY

2.1 LSTM Introduction

The output of a Long short-term memory (LSTM)

variant of Recurrent Neural Network (RNN) does not

fade or burst as it cycles through the feedback loops

466

Yu, H.

Stock Market Analysis and Stock Prices Prediction with Long Short-term Model.

DOI: 10.5220/0011186200003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 466-470

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

(Sak, et al, 2014). As a result, recurrent neural

networks are better at identifying patterns. Because

they do not suffer from the vanishing gradient

problem, long short-term memory networks are more

suited to sequence learning tasks than other RNN

architectures (Mali, et al, 2017).

2.2 Data Selection

This section will go over how to handle requesting

stock information with pandas, and how to analyze

basic attributes of a stock. For reading stock data from

yahoo, this research uses DataReader to get the yahoo

finance data. In order to better understand the

situation of these four stocks and build a better model,

we calculated the moving average values of various

stocks on the basis of these data, paving the way for

our following calculation.

2.2.1 What Was the Moving Average of the

Various Stocks?

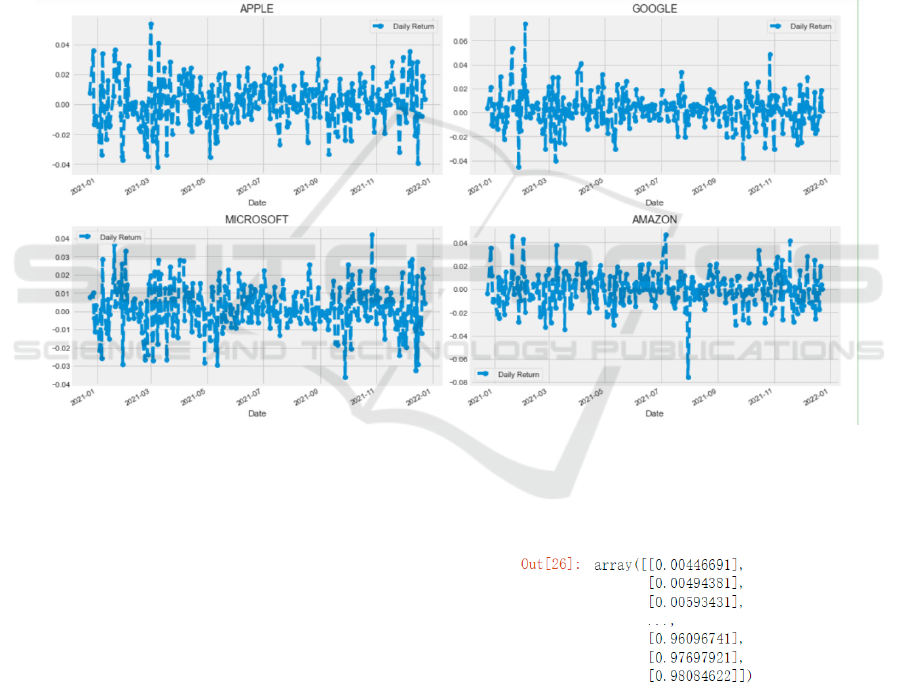

This section is now going to analyze the risk of the

stock. In order to do so, it needs to take a closer look

at the daily changes of the stock, and not just its

absolute value. This paper will use pandas to retrieve

the daily returns for the Apple stock, and use

pct_change to find the percent change for each day

(Li, et al, 2016).

Figure 1: Change curve of the stock difference of each company.

Figure 1 shows the change curve of the stock

difference of each company. It can be seen from the

graph that the daily difference of APPLE, GOOGLE,

MICROSOFT companies have obvious positive and

negative fluctuations, while the stock fluctuations of

AMAZON are all positive. Value fluctuates. From the

analysis in 2.2.1 section, although AMAZON’s stock

fluctuates throughout the year and has no obvious

upward trend, its daily spread is greater than 0.

Therefore, AMAZON’s stock returns will be the best

among the four companies.

2.3 Clean Data

This paper uses 95% of the data as the training set and

the rest as the test set. According to the above code,

the number of lines of the training model is 2387.

Through the MinMaxScaler method in the sklearn

module, the features are normalized, and the

processing results are as follows:

2.4 Exploratory Data Analysis

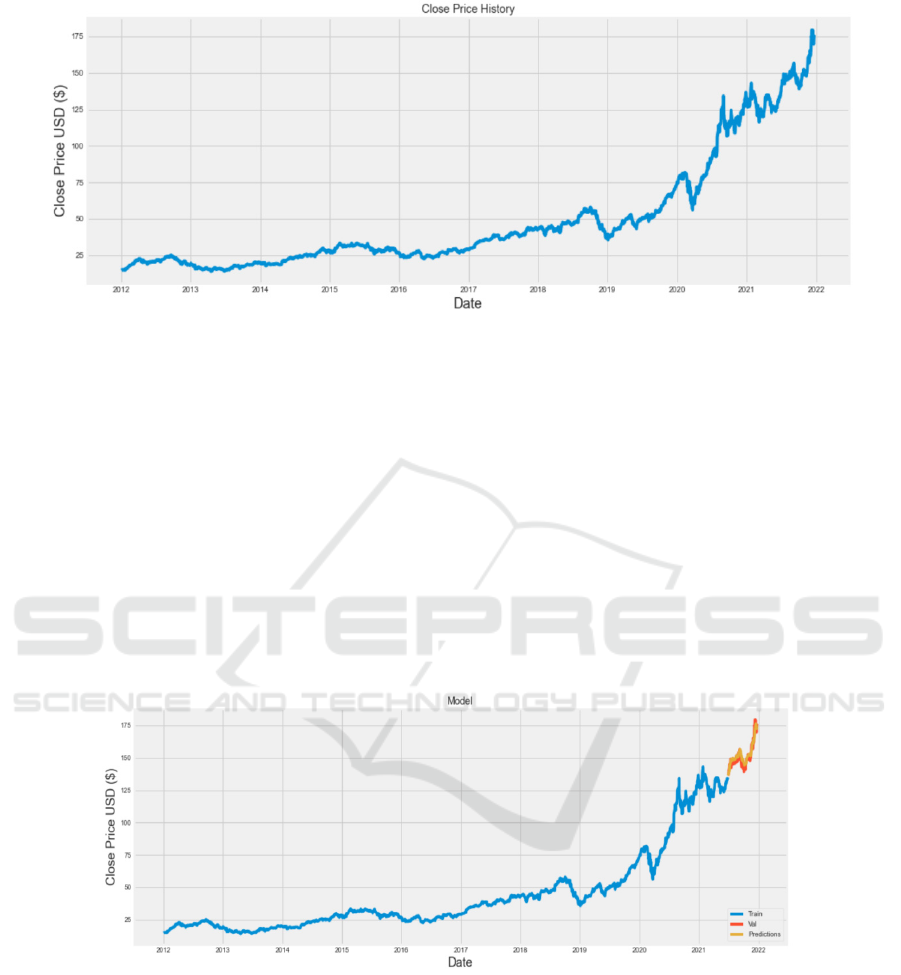

The Figure 2 shows the trend of AAPL’s stock price

change. The time is from 2021 to 2022. It can be seen

from the figure that APPLE’s stock price is on the

rise.

The rise in 2012-2019 is relatively slow. After

Stock Market Analysis and Stock Prices Prediction with Long Short-term Model

467

Figure 2: The trend of AAPL’s stock price change.

2019, the price rise is very high. Quickly, with small

fluctuations.

2.5 Model Building

A two-layer LSTM with a network structure of fully

connected layers on both sides will be used. Among

them, the number of neurons in the first layer of

LSTM is 128, the number of neurons in the second

layer of LSTM is 64, the number of neurons in the

first fully connected layer is 25, and the number of

neurons in the second fully connected layer is 25. The

number of neurons is one. The gradient descent

optimizer uses the adam algorithm, and the loss is

represented by the mean square error. The number of

iteration steps is 1. After the above code calculation

that after one round of iteration, the model has

converged very well, with a loss of 0.0013.

2.6 Evaluate Model

The error results of the LSTM model obtained

through 3.5 training on the test. According to the

calculation of the code program, the error of the

trained model on the test set is about 3.3.

Figure 3: The distribution of the true value and the predicted value.

It can be seen from the figure 3 that the predicted

value of the model is basically consistent with the true

value, indicating that the training effect of the model

is better.

3 DISCUSSION

In most cases, investments are made on the basis of

forecasts derived from previous stock price data after

taking into account all relevant variables. The Long

short-term memory (LSTM) can properly forecast

whether stocks rise or fall, and the findings suggest

that the LSTM can predict future states better than

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

468

current ones. For example, the classifier may be

trained on a wider range of organizations rather than

just one. An improved classifier that can be used to

categorize equities from a variety of different firms

will be created as a consequence. A news headline's

certainty of feeling may also be improved. As a

consequence, the classifier will be able to provide

even better results.

An LSTM model's fundamental weakness is that

it relies largely on stepwise forecasts to anticipate a

time series. We showed in our example that we could

forecast the number of passengers flying at time t by

using the five prior data that we had. With an LSTM,

long-term forecasting may not work. The amount of

the data is also a concern. Like any other neural

network, an LSTM has to be trained on a huge

quantity of data (Lu, et al, 2019). In spite of this, the

RMSE as calculated throughout the test data was still

not too high.

In the next few years, ResNet appeared. ResNet is

a residual network, which means to train a deeper

model. In 2016, a team of researchers from Microsoft

Asia Research Institute used an amazing 152-layer

deep residual networks in the ImageNet Image

Recognition Challenge to obtain all three major

projects of image classification, image positioning,

and image detection with absolute advantage (Liu, et

al, 2018). After that, the Attention model appeared.

All large technology companies have replaced LSTM

and its variants with attention-based models. Because

LSTM requires more resources to train and run than

attention-based models (Zhu, et al, 2019).

4 CONCLUSIONS

In today's world, stock market forecasting has

become a major concern. In most cases, investments

are made on the basis of forecasts derived from

previous stock price data after taking into account all

relevant variables. This study's findings demonstrate

that the LSTM is superior to current models in

predicting future state variables. There's still a lot of

room for experimentation. For example, the classifier

may be trained on a wider range of organizations

rather than just one. An improved classifier that can

be used to categorize equities from a variety of

different firms will be created as a consequence. This

might aid in further refining the classifier to get more

precise results. With the use of data visualization, we

want to get a deeper understanding of this data so that

we can generate more accurate forecasts regarding

stock performance and risk value for specific stocks

as part of this project. This project makes extensive

use of the NumPy, Pandas, and Data Visualization

libraries. Long short-term memory was used to make

predictions about future stock values. It is feasible to

forecast stock market movements using

previous data,

as shown by the findings, where the Long short-term

memory approach was able to properly predict using

the historical data and the mean square error on the

test data is about 3. As seen in the picture, the model's

projected value is almost exactly in line with the real

value, demonstrating that it has a better training

impact than previously thought.

ACKNOWLEDGEMENTS

First of all, I am honored to participate in this research

project of Financial Analysis & The Capital Asset

Pricing Model. I also like professor Honigsber's

teaching style. Thank you very much for your patient

explanation and help during this period. After that, I

am very grateful to my teacher Alan in university for

teaching me to write models in Python language.

REFERENCES

Akita, Ryo, et al. (2016). Deep learning for stock prediction

using numerical and textual information. IEEE/ACIS

15th International Conference on Computer and

Information Science (ICIS).

Gers, Felix A., Nicol N. Schraudolph, and Jürgen

Schmidhuber. (2002). Learning precise timing with

LSTM recurrent networks. Journal of Machine

Learning Research 3, August, pp. 115-143.

Ince, H. (2000). Support Vector Machine for Regression

and Applications to Financial Forecasting, Ieee-Inns-

Enns International Joint Conference on Neural

Networks IEEE Computer Society, vol6, pp. 348-353.

Li, P. C. Jing, Liang, T. Liu, M. Chen, Z. and Guo, L.

(2016). Autoregressive moving average modeling in the

financial sector, ICITACEE 2015 - 2nd Int. Conf. Inf.

Technol. Comput. Electr. Eng. Green Technol.

Strength. Inf. Technol. Electr. Comput. Eng.

Implementation, Proc., no. 4, pp. 68-71.

Liu, P., Hong, Y. and Liu, Y. (2018). Multi-Branch Deep

Residual Network for Single Image Super-

Resolution. Algorithms, 11(10), p.144.

Lu, N., Wu, Y., Feng, L. and Song, J. (2019). Deep

Learning for Fall Detection: Three-Dimensional CNN

Combined with LSTM on Video Kinematic Data. IEEE

Journal of Biomedical and Health Informatics, 23(1),

pp.314-323.

Mali, M. P. Karchalkar, Jain, H. A. A. Singh, and V.

Kumar. (2017). Open Price Prediction of Stock Market

using Regression Analysis, Ijarcce, vol. 6, no. 5, pp.

418-421.

Stock Market Analysis and Stock Prices Prediction with Long Short-term Model

469

Sak, Ha, sim, Andrew Senior, and Françoise Beaufays.

(2014). Long short-term memory recurrent neural

network architectures for large scale acoustic modeling.

Fifteenth annual conference of the international speech

communication association.

Siew H. L. and Nordin, M. J. (2012). Regression techniques

for the prediction of stock price trend, ICSSBE 2012 -

Proceedings, 2012 Int. Conf. Stat. Sci. Bus. Eng.

Empowering Decis. Mak. with Stat. Sci., pp. 99-103.

Zhu, Y., Zhang, W., Chen, Y. and Gao, H. (2019). A novel

approach to workload prediction using attention-based

LSTM encoder-decoder network in cloud

environment. EURASIP Journal on Wireless

Communications & Networking, (1), pp.1-18.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

470