Comparative Study on the Economic Environment of Oil and Gas

Resource Countries based on Entropy Weight-TOPSIS Method

Mingyan Ding

Beijing Jiaotong University, Beijing, China

Keywords: Economic Environment, Entropy Weight-Topsis Method, Research and Prediction, Oil and Gas Resources

Cooperation Countries.

Abstract: This paper evaluates the economic environment of oil and gas resource cooperation countries of China through

data evaluation. This paper selects 9 evaluation indicator variables, constructs the evaluation system, and uses

the entropy weight and TOPSIS method to calculate the economic environment of these countries. According

to the assessment results, population, per capita GDP and total GDP have the greatest impact on the economic

environment. India, Qatar, UAE, Indonesia and Russia have the best economic environment and have good

investment prospects for Chinese companies; Uzbekistan, Iran and Azerbaijan have relatively backward

economic environment and high investment risk, so a risk response system should be established before

business corporation.

1 INTRODUCTION

Since the "one belt, one road" initiative was proposed,

China's cooperation with oil and gas resources

countries along the route has become increasingly

close. However, most countries along the line belong

to developing countries, and there are great

differences in soft environment such as economic

development, political situation, legal environment

and social environment. These factors may be

potential investment risks. Economic environment is

one of the most important components of soft

environment. At present, the backward economic

development of some countries increases the risk of

Chinese enterprises investing abroad. In order to

promote cooperation with countries rich in oil and gas

resources and reduce investment risks, China must

study and predict the economic environment of

countries along the line. By understanding the

economic development of various countries,

enterprises choose appropriate investment

cooperation countries.

Economic environment is a non-material

condition and an important benchmark to measure the

investment environment of a country or region.

Investment in various countries, regions or industries

is increasingly inseparable from economic soft

environment evaluation. The development of big data

economy provides scholars from all walks of life with

a new method to study the economic environment.

Since the one belt and road initiative, many scholars

have evaluated and analyzed the economic

environment of different countries based on different

data methods to guide China’s enterprises to invest

overseas.

Most domestic scholars generally start with the

hard environment and soft environment when

studying the investment environment of China’s oil

and gas resources cooperation countries. There is

little literature devoted to the economic

environmental conditions of countries along the line.

Moreover, the index system and research methods

constructed by domestic scholars are not exactly the

same. Therefore, combined with relevant data, this

paper studies the economic environment of China’s

oil and gas resources cooperation countries,

constructs an evaluation system and makes

mathematical analysis, so as to deeply understand and

predict the economic environment of countries along

the line.

The investment environment can reflect a

country’s ability to attract investment. The theory of

"investment environment" appeared only around

1970. With the development of mathematical model

and information technology, foreign scholars began

to carry out quantitative research, and the research

results are more objective. Globerman (2002) studies

Ding, M.

Comparative Study on the Economic Environment of Oil and Gas Resource Countries based on Entropy Weight-TOPSIS Method.

DOI: 10.5220/0011178800003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 361-365

ISBN: 978-989-758-593-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

361

the impact of national governance capacity on foreign

capital inflow and outflow, which is divided into

three aspects: economy, politics, system and legal

environment (Globerman, 2002) Raj (2016)

established a comprehensive evaluation system to

study supply chain management decisions, analyzed

and ranked multiple decision-making processes with

entropy weight method and TOPSIS ranking method,

and selected the optimal decision (Raj, 2016, Kumar,

2016, Sharma, 2016). Hussain Jamal (2020)

conducted a comprehensive assessment of the

investment risks and natural resources of countries

along the “Belt and Road” through entropy weight-

TOPSIS ranking, and provided the minimum risk

recommendations for Chinese enterprises to invest

abroad. The results showed that Singapore, Malaysia,

Nepal, Bhutan, Russia, Armenia and the UAE are the

most suitable for Chinese companies to invest in

(Jamal, 2020, Zhou, 2020., Guo, 2020, Anwar, 2020).

This paper aims to be based on the economic

environment of some oil and gas countries, so the

selected indicators are the economic and

environmental indicators of countries rich in oil and

gas resources. Many scholars have also studied the

economic environment assessment of oil and gas

countries, but there is no unified evaluation system.

Wang Yue (2016) studied the investment

environment of oil and gas countries from nine

aspects such as economic environment (Wang, 2016).

He Bo et al. (2013) studied the integration of

economic environment and political environment

(He, 2013, An, 2013, Fang, 2013, Zhao, 2013, Ding,

2013). Liu Erhu (2018) divided it into four aspects:

political environment, economic environment,

infrastructure conditions and production factors (Liu,

2018, Chen, 2018).

Some scholars construct the evaluation index

system and select the evaluation model for

quantitative analysis, and the results are more

scientific. Wang Xinmin et al. (2015) used Theil

index to quantitatively study the investment

environment of major oil and gas countries (Wang,

2015, Liu, 2015, Sun, 2015). Li Yu et al. (2016)

constructed the index system through the Delphi

method, evaluated the investment environment from

six aspects, and divided the countries along the line

into four strategic countries: priority investment area,

key investment area, potential investment area and

risk area (Li, 2016, Zheng, 2016, Jin, 2016, Wang,

2016, Li, 2016, Zhao, 2016, Huang, 2016, Dong,

2016). Wang Yue (2016) one of the 9 level one

indicators and 58 two one indicators, one belt, one

road, the main oil and gas cooperation countries, and

the distribution of investment indicators (Wang,

2016). Wang Yaoqing and others (one) compare the

advantages one of the "one belt, one road" main

product from the perspective of the global industrial

chain (Wang, 2017, Tun, 2017, Sun, 2017). Liu Erhu

and Chen Ying (2018) used entropy weight method

to measure the impact of economy on the investment

environment of the five Central Asian countries (Liu,

2018, Chen, 2018). Li Youshu et al. (2019) used

entropy weight method to evaluate investment in

some energy countries, and used SE-DEA model and

Malmquist index method to evaluate investment

performance (Li, 2019, Li, 2019, Luo, 2019).

In the domestic research literature, scholars

mostly build the investment environment evaluation

indicators system to quantitatively evaluate the

investment environment of various countries, so as to

put forward corresponding investment suggestions.

Although the research method of constructing the

evaluation system is more scientific than the simple

qualitative research. However, the comprehensive

evaluation system is easy to be incomplete and omit

indicators, resulting in inconsistent evaluation system

and inconsistent research results. Therefore, this

paper only evaluates and forecasts the economic

environment to ensure the comprehensiveness of the

indicators. In order to ensure the objectivity of data

and results, the most objective research method

entropy weight TOPSIS method is selected.

The structure of this paper is as follows, the

second part is the Materials and Methods, the third

part is the results and discussion, and the fourth part

is the conclusions.

2 MATERIALS AND METHODS

2.1 Materials

According to the richness of oil and gas resources and

the availability of data, this paper finally selects 18

countries as the research objects. According to the

country guidelines of the Ministry of Commerce,

Kazakhstan, Turkmenistan and Uzbekistan belong to

Central Asia; Iran, Saudi Arabia, Kuwait, Qatar,

UAE, Oman and Egypt belong to West Asia and

North Africa; Indonesia, Malaysia, Thailand and

Vietnam belong to Southeast Asian countries; There

are also India, Russia, Pakistan and Azerbaijan, a

total of 18 countries.

The data used in this paper are from the foreign

guide of the world bank, the Ministry of Commerce

of China and the Wall Street Journal. The economic

environment is an important aspect that constitutes

the soft environment. The quality of a country's

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

362

economic environment directly affects investor

confidence. Generally speaking, a country with a

better economic environment has a better

environment in terms of education, infrastructure,

roads, etc., and the investment risk is lower, and it is

more favored by investors. Therefore, this paper

constructs the following index system to evaluate the

economic environment of various countries.

Based on the evaluation system in the reference

literature of quantitative research, this paper screened

out 5 first-level indicators and 9 secondary indicators

of economic environment. Therefore, the economic

environment evaluation system of my country's oil

and gas resource cooperation countries is constructed.

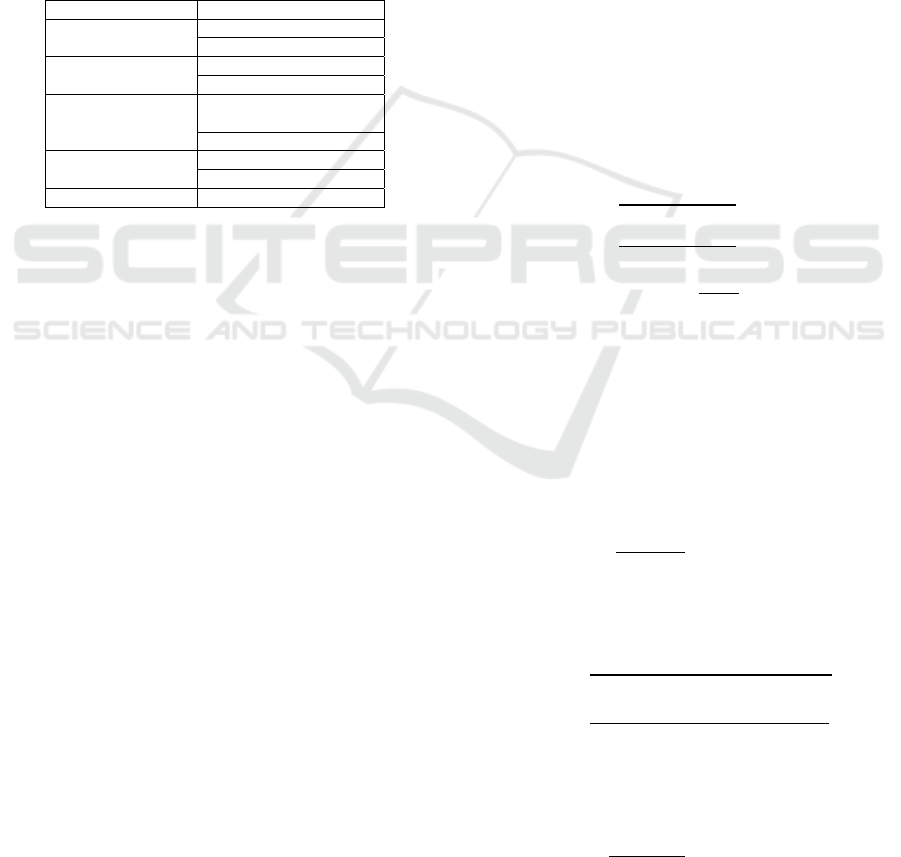

Table 1: Evaluation indicators.

Primary indicators Secondary indicators

Economic scale

Total GDP

population

Economic level

Per capita GDP

GDP growth rate

foreign trade

Proportion of total import

and export in GDP

Net FDI inflow

Economic stability

Inflation rate

unemployment rate

economic system Economic freedom

Explain the above evaluation system and

indicators: since the economic freedom index cannot

be measured by actual values, the reference to the

relevant literature here is replaced by the score of the

economic freedom of various countries in the report

published by the Wall Street Journal.

2.2 Entropy Weight – TOPSIS

2.2.1 The Meaning of Entropy Weight

Method and TOPSIS Method

Entropy was first introduced in thermodynamics to

measure the degree of disorder in microscopic matter

as it moves thermally. Later, Shannon proposed the

"information theory", which quantitatively analyzes

the problem with information entropy, so as to make

an objective evaluation. Because the entropy weight

method has the advantages of objectivity and strong

persuasion, the entropy weight method is now widely

used in the evaluation and analysis of economic,

social, engineering and other fields. In this paper, the

entropy weight method is also chosen because of its

objectivity. It is completely based on the analysis of

data to obtain results and is not easily affected by

subjective factors.

The entropy weight method determines the weight

of the indicator by measuring the disorder degree of

the data. That is to say, the more disordered the index,

the more information it provides, the smaller its

information entropy, and the greater its role in the

evaluation system, so the greater the weight is given.

TOPSIS is to sort the compared objects by

calculating the distance between the compared

objects and the positive and negative ideal solutions

when comparing multiple indicators or multiple

schemes. Combined with the entropy weight method,

on the one hand, the objective weight data calculated

by the entropy weight method can be used, and on the

other hand, TOPSIS can sort and compare multiple

objects.

2.2.2 Entropy Weight Method and TOPSIS

Sorting Calculation Process

We assume that there are m countries, and each

country has a total of n last-level evaluation

indicators. 𝑥

represents the j

th

indicator of the i

th

country. 𝑌

represents the j

th

indicator of the i

th

country. (i=1, 2……m;j=1, 2……n)

a) Standardize processing and calculate

information entropy

𝑋

=

(1)

𝑋

=

(2)

𝑌

=

∑

(3)

The information entropy is E, and the information

entropy of the j

th

index is E

j

; constant K=−1/ln𝑚,

calculate information entropy:

𝐸

=K

∑

𝑌

ln𝑌

(4)

If 𝑌

=0, then ln𝑌

The formula has no

meaning, so it is defined at this time𝑌

ln𝑌

=0.

b) Determine index weight

Let the weight be w and the weight of the j

th

indicator be𝑊

.

𝑊

=

∑

(

)

(5)

c) Calculate Euclidean distance

Let the positive distance be 𝑑

, the negative

distance is 𝑑

, the European distance of the i

th

country is 𝑑

or 𝑑

. calculation:

𝑑

=

∑

(Y ∗ 𝑊

−maxY∗ 𝑊

)

( 6 )

𝑑

=

∑

(Y ∗ 𝑊

−minY∗ 𝑊

)

(7)

d) Calculate TOPSIS proximity and sort

The calculated proximity is used as the score of

TOPSIS method in various countries.

𝑐

=

(

)

(8)

Comparative Study on the Economic Environment of Oil and Gas Resource Countries based on Entropy Weight-TOPSIS Method

363

According to the definitions of the entropy weight

method and the TOPSIS method, the proximity is

between 0 and 1, and the closer to 1, the better the soft

environment of the country. Therefore, in this paper,

the calculated Entropy Weight-TOPSIS proximity is

ranked according to the economic environment of

various countries.

3 RESULTS AND DISCUSSIONS

3.1 Weighting Results and Discussion

The weights of secondary indicators and tertiary

indicators are calculated by entropy weight method,

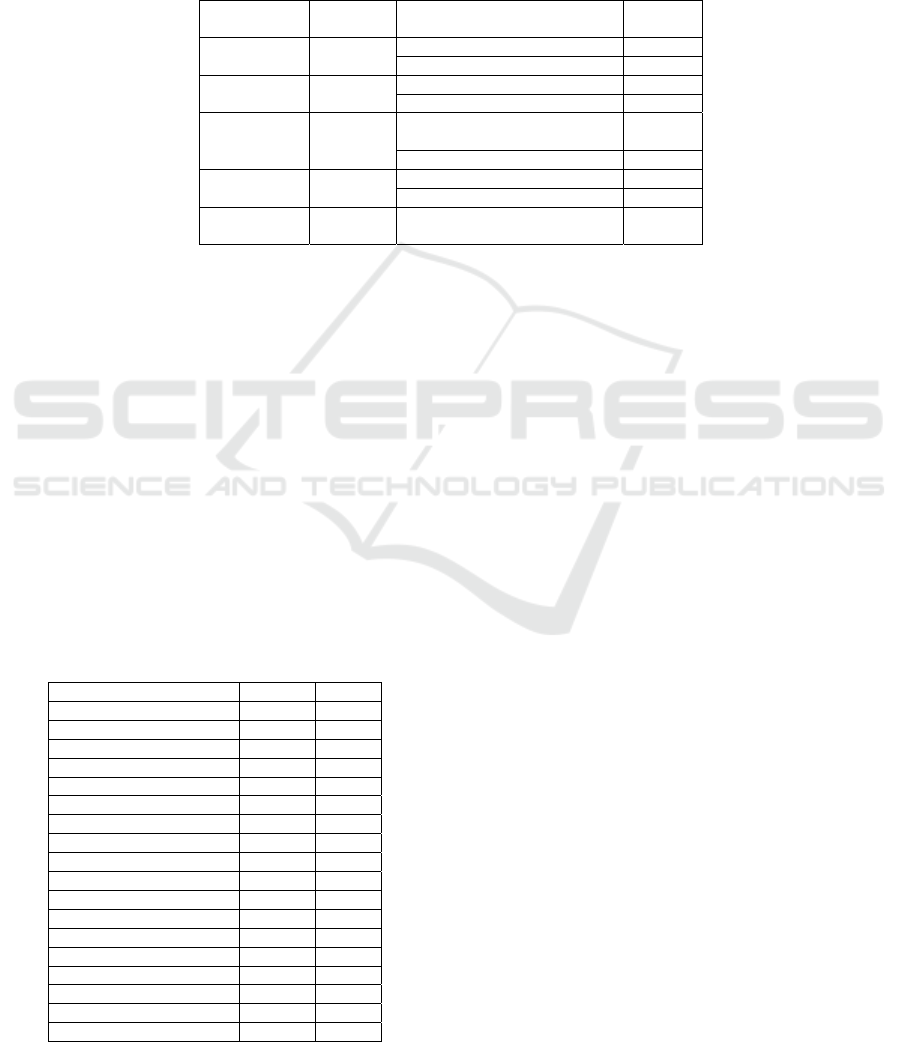

as shown in Table 2.

Table 2: Weight of evaluation indicators.

Primary

indicators

weight

Secondary

indicators

weight

Economic

scale

0.45

Total GDP 0.16

Population 0.29

Economic

level

0.25

GDP per capita 0.17

GDP growth rate 0.07

foreign trade 0.17

Proportion of total import and

export to GDP

0.08

Net FDI inflow 0.09

Economic

stability

0.07

Inflation rate 0.03

Unemployment rate 0.04

economic

system

0.05 Economic freedom 0.05

The weights of the three indicators of population,

GDP per capita and total GDP are relatively high,

indicating that these three indicators are the most

important in evaluating the economic environment

and have the greatest impact on the economic

environment. Countries with large populations may

have greater market potential and have a better

investment climate. Economic stability and economic

system indicators have less weight, indicating less

impact on the economic environment.

3.2 Evaluation Results and Discussion

Table3 calculates the TOPSIS proximity as scores

and sorts all countries according to the results.

Table 3: Economic environment ranking of countries.

country ranking score

India 1 0.6509

Qata

r

2 0.3407

The United Arab Emirates 3 0.2908

Indonesia 4 0.2665

Russia 5 0.2581

Vietnam 6 0.2557

Kuwai

t

7 0.2111

Malaysia 8 0.2063

Thailand 9 0.2017

Saudi Arabia 10 0.1928

Pakistan 11 0.1870

Turkmenistan 12 0.1542

Oman 13 0.1504

Egyp

t

14 0.1422

Kazakhstan 15 0.1341

Uzbekistan 16 0.1297

Iran 17 0.1159

Azerbaijan 18 0.1157

India scored the highest, indicating that India's

economic environment is the best, mainly due to the

country's large population and large economic

aggregate. The economic development of India is

similar to that of China. With large economic scale

and rapid development, India is one of the most

influential developing countries in the world.

Followed by Qatar, the United Arab Emirates,

Indonesia and Russia, these countries are favored by

investors because of their large economic aggregate

or high per capita GDP, stable economic policies and

stable markets. Qatar and the United Arab Emirates

have rich oil and gas resources and good economic

environment. Although the population is small, the

per capita GDP is relatively high. The economic

system is very flexible, the tax burden on enterprises

is minimal, and the restrictions on foreign investment

are small. When Chinese companies choose countries

to cooperate with, they can give priority to these

countries with higher scores. They have a good

economic environment.

Vietnam scored 6th, with a better economic

environment. Vietnam's economy is developing at the

fastest speed and has great potential for development.

Moreover, the Communist Party of Vietnam is in

power, and the government has high work efficiency

and continuous policies, which is conducive to

domestic political stability, economic development

and regulation.

The economies of Uzbekistan, Iran and

Azerbaijan are relatively backward. Uzbekistan is a

small country with insufficient market potential and

a small economy. Iran is affected by U.S. sanctions,

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

364

political instability, hampered oil exports and

stagnant economic development. Unemployment and

inflation are at high levels, people's living standards

are declining, and foreign capital has less

expectations. The disintegration of the Soviet Union

has had a huge impact on Azerbaijan, and

Azerbaijan's economy is constrained by the current

oil and gas downturn. The economic environment of

these countries is backward, and the risks of

economic cooperation are relatively high. Therefore,

investors should guard against economic risks in

international cooperation.

4 CONCLUSIONS

This paper conducts a comparative study on the

economic environment of 18 oil and gas resource

cooperation countries. Nine measurement indicators

are selected to construct an evaluation system, and

entropy weight method and TOPSIS ranking method

are used to evaluate the research objectives. The

results show that population and per capita GDP have

the highest weights and have the greatest impact on

the economic environment. The ranking results of

TOPSIS show that India, Qatar, and the United Arab

Emirates are the three countries with the best

economic environment. Although the economic

environment of these three countries ranks high, there

are still investment risks in each country. Before

cooperation, enterprises must do a good job of

investigation, consultation and planning, and fully

understand the political, legal system, social customs

and other conditions of the host country. Uzbekistan,

Iran, and Azerbaijan are the three countries with the

worst economic environment. Prioritizing

cooperation with countries with a better economic

environment can effectively expand the market and

avoid risks; cooperation with countries with unstable

economies may bring losses. However, these

countries have abundant energy resources and they

are potential resource cooperation countries.

Carrying out oil and gas cooperation with these

countries is conducive to ensuring the diversification

of sources of China's oil and gas resources. It is

necessary to be vigilant against risks in the economic

environment. Chinese companies should establish an

effective risk response system and not fight

unprepared battles.

There are still research limitations in this paper,

and the selected indicators are biased towards the

macroscopic aspect. In the future research, the

economic environment needs to be studied from the

microscopic level. The factors affecting the economy

are complex, and it is hard to quantify all the

influencing factors, so the established indicator

system is not perfect.

REFERENCES

Globerman, S. (2002) Global Foreign Direct Investment

Flows: The Role of Governance Infrastructure. World

Development, 30.

He, B., An, H.Z., Fang, W., Zhao, H.Y., Ding, Y.H. (2013)

Evaluation and optimization of global oil and gas

resources investment environment. Resources and

industry, 15: 114-118.

Jamal, H., Zhou, K., Guo, S.L., Anwar, K. (2020)

Investment risk and natural resource potential in “Belt

& Road Initiative” countries: A multi-criteria decision-

making approach. Science of The Total Environment.

Li, Y., Zheng, J., Jin, X.T., Wang, Z., Li, Z.H., Zhao, M.Y.,

Huang, Y.B., Dong, S.C. (2016) "One belt, one road"

investment environment comprehensive evaluation and

Countermeasures. Journal of the Chinese Academy of

Sciences, 31: 671-677.

Li, Y.S., Li, L., Luo, Y.L. (2019) China’s location choice

one belt, one road and other countries: Based on

investment environment and investment performance.

Economic issues, 7: 115-122.

Liu, E.H., Chen, Y. (2018) Comparative study on

investment environment of five Central Asian countries

under the background of Silk Road Economic Belt.

World geographic research, 27: 100-107.

Raj, A., Kumar, J., Sharma, H. (2016) Analysis of Rural E-

commerce Evaluation in Heilongjiang Province Based

on Entropy Weight Method. Indian Journal of Public

Health Research & Development, 1.

Wang, X.M., Liu, B.Q., Sun, J.F. (2015) Study on potential

evolution and differential change trend of international

oil and gas investment environment. World economic

research, 2: 105-114 + 129.

Wang, Y. (2016) Analysis and evaluation of one belt, one

road main oil and gas investment environment.

Industrial technology and economy, 35: 118-127.

Wang, Y.Q., Tun, F.H., Sun, Z.H. (2017) "One belt, one

road" oil and gas trade competitiveness measurement

and cooperation potential evaluation: A Perspective of

the whole industry chain. Journal of the Pacific, 25: 68-

83.

Comparative Study on the Economic Environment of Oil and Gas Resource Countries based on Entropy Weight-TOPSIS Method

365