The Trade Potential and Trade Efficiency of the “One Belt, One

Road” Countries along the Border and Their Impact on China's

Foreign Direct Investment: Based on the Stochastic Frontier Gravity

Model

Yulanxin Wang

1

, Xinran Wang

2

, Junkai Guo

3

, Yiwen Jiang

4

and Qifei Ma

5

1

Department of Quantitative Economics, Jilin University, Jilin, China

2

Department of Finance, Jilin University, Jilin, China

3

Department of Economics, Jilin University, Jilin, China

4

Department of International Trading, Jilin University, Jilin, China

5

Department of Human Resource Management, Jilin University, Jilin, China

Keywords: Stochastic Frontier Gravity Model, OFDI, Trade Potential And Trade Efficiency.

Abstract: With the rapid development of big data economy, economic and trade cooperation between countries has been

better studied for better development. This paper uses the "one belt, one road" countries data from the

database, such as the world bank and other databases. And the paper is also to test the applicability of the

model and to prove that the stochastic frontier gravity model should be used for the study. “One belt, one

road” countries’ GDP and the degree of integrity have significant impact on China's OFDI.

1 INTRODUCTION

After the outbreak of the financial crisis, the

economies of various countries are gradually brewing

recovery, the international situation is still in a state

of instability, the phenomenon of development and

differentiation between countries due to the existence

of economic circles, the economic gap between

countries is gradually widening, and the more

backward countries are facing great challenges. Since

2019, the world has seen a new dilemma - the new

crown pneumonia epidemic. The world economic

growth rate has been at the lowest level since the 2008

financial crisis, trade between countries has slowed

down significantly due to the epidemic restrictions

and the economy has suffered a huge impact, but the

outflow of outward direct investment has increased

by 33.2% year-on-year after three consecutive years

of decline. The pace of China's opening up to the

outside world is still stable. And Chinese enterprises

are also constantly "going out". In 2019, China's

outward direct investment was US$1369.1, second

only to Japan's, and China's outbound investment

stock reached US$2.2 trillion, ranking third in the

world. Second only to the United States and the

Netherlands.

In today's context of both impetus and obstacles,

the joint construction of the "Belt and Road" can

conform to the current background of economic

globalization and uphold the spirit of China's

"opening up". In this context, the impact of the trade

potential and trade efficiency of countries along the

"Belt and Road" on China's outward direct

investment is studied, and then the policy

recommendations of China's outward direct

investment under the background of the "Belt and

Road" economic cooperation are given, which has a

significant impact on the development of China's

economy and trade. In the process of reading the

literature, I found that many scholars have research

directions related to the "Belt and Road", and some

scholars have carried out the research direction of

trade potential and trade efficiency on a certain

industry, based on the importance of trade and OFDI,

which has gradually been put on the agenda, coupled

with the inseparable link between trade and OFDI, so

this article discusses the literature on trade efficiency

and trade potential for OFDI.

In recent years, due to the continuous

advancement of the wave of economic globalization,

218

Wang, Y., Wang, X., Guo, J., Jiang, Y. and Ma, Q.

The Trade Potential and Trade Efficiency of the â

˘

AIJOne Belt, One Roadâ

˘

A

˙

I Countries along the Border and Their Impact on Chinaâ

˘

A

´

Zs Foreign Direct Investment: Based on the Stochastic

Frontier Gravity Model.

DOI: 10.5220/0011172100003440

In Proceedings of the International Conference on Big Data Economy and Digital Management (BDEDM 2022), pages 218-226

ISBN: 978-989-758-593-7

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

many scholars have conducted research on the trade

potential and trade efficiency of the "Belt and Road"

countries. First of all, in the development trend of

trade efficiency and trade potential, scholars have

reached inconsistent conclusions. Through the study

of bilateral trade, he (Zhang, 2017) concluded that

trade efficiency is now low, and gave suggestions on

how to increase outward direct investment and sign

free trade zones; The paper was used (Li, 2018) by a

stochastic frontier model in the analysis and

calculation of trade efficiency and trade potential of

countries along the "Belt and Road" to conclude that

although trade efficiency is declining, there is an

overall upward trend; When calculating the trade

potential of countries along the "Belt and Road"

based on the stochastic frontier gravitational model,

it is believed (Quan, 2019, Gao, 2019) that neither

trade potential nor trade efficiency has reached a very

high level, and there is still a high room for

improvement. In the study on the development scope

of trade efficiency and trade potential, the paper was

used (Li, 2020, Ni, 2020) by the HT model to measure

the countries along the "Belt and Road", and

concluded that China's trade potential for Asian

countries is small, while its trade potential for Central

and Eastern European countries is large.

In terms of the selection of explanatory variables,

it is believed (Feng, 2019, CHEN, 2019) that some

economic indices, the total number of countries,

political systems, and preferential trade agreements

are important factors when influencing trade

efficiency and potential; Based on the study of

stochastic frontier gravitational models and trade

inefficiency models, it is concluded (Li, 2019, Lü,

2019) that signing free trade agreements and opening

Confucius Institutes is conducive to China and the

"Belt and Road" in improving financial freedom,

infrastructure construction, cultural exchanges, etc.

The improvement of trade efficiency in countries

along the Belt and Road; Based on the study of trade

potential based on the stochastic frontier gravitational

model, it is concluded (Zhang, 2020, Zhang, 2020,

Chen, 2020) that common language, trade freedom,

political stability, trade facilitation degree, and the

signing of free trade agreements can have a positive

impact on trade efficiency and potential; Based on the

stochastic frontier gravitational model, the study of

global trade efficiency and trade potential was carried

out (Chen, 2016, XIE, 2016, LIN, 2016), and the

study showed that trade input, trade concentration,

trade complementarity index positively correlated

trade efficiency and trade potential, and the degree of

trade diversification had a negative correlation with

it, but the impact of trade diversification, trade

concentration and trade complementarity index on

trade was not obvious; Based on the stochastic

frontier gravitational model and trade non-efficiency

model, it is concluded (Li, 2020, Zhang, 2020, Chen,

2020) that the scale of economic development of

countries and the import of final consumer goods by

participating countries have a positive effect on trade,

while differences in political systems and

geographical distance have a restraining effect on

trade; The paper was used (Li, 2021) by the stochastic

frontier gravitational model draw the conclusion that

the income level of countries along the "Belt and

Road" has a very obvious role in promoting trade

efficiency, and has a more obvious impact on trade

efficiency in terms of geographical location at the

same time. Trade freedom and tariff levels have a

positive effect on trade efficiency.

In the study (Yang, 2019) of influencing factors,

based on the stochastic frontier gravitational model

and trade inefficiency model, the income level,

population size, geographical distance and

landlocked countries restrictions between China and

the belt and road have a significant impact on trade

potential, trade inefficiency is the main reason for the

gap between the actual trade level and trade potential,

and helps to improve trade efficiency by narrowing

the gap between the democratic degree of

government, improving trade freedom and signing

regional trade agreements. The paper was used

(Zhang, 2017) by the study of stochastic frontier

gravitational model. It is concluded that there are still

major problems in trade facilitation and government

governance capacity of countries along the "Belt and

Road" that inhibit trade efficiency between countries.

In addition to enhancing the degree of convenience

and government capacity, China can promote the

negotiation of inter-state trade agreements and

increase of outward direct investment to improve

trade efficiency and trade potential; The paper (Li,

2021) was used by the stochastic frontier

gravitational model. It is concluded that the per capita

GDP, geographical distance, common border, WTO

organization, trade freedom and other factors of the

countries along the route have a greater impact on

trade potential and trade efficiency, while the

government integrity index, trade freedom, labor

scale, final consumption expenditure, and exchange

rate estimates have a significant effect on trade. The

innovation of its research is to conclude that tariff

levels are negatively correlated with trade and that the

role of financial freedom and OFDI in trade

efficiency is not a simple promotion, and this

indicator does not play a large role in China's trade

with countries along the route.

The Trade Potential and Trade Efficiency of the â

˘

AIJOne Belt, One Roadâ

˘

A

˙

I Countries along the Border and Their Impact on Chinaâ

˘

A

´

Zs

Foreign Direct Investment: Based on the Stochastic Frontier Gravity Model

219

Due to the increasingly close ties between

countries and the smooth operation of the strategy of

"Belt and Road" proposed by China today, the topic

of trade potential and trade efficiency has become

more and more hot, and many scholars have done

research in this regard. The study found (Tan, 2015,

Zhou, 2015) that the trade efficiency of countries

along the "Belt and Road" is improving, and there is

still a wide range of improvements in trade potential;

It is believed (Wang, 2016) that China's trade

efficiency with Iran, Kyrgyzstan, Ukraine, Russia and

other countries along the "Belt and Road" is relatively

high, and it is also at a high level in terms of trade

potential.

At the same time, it can also be found that

scholars' research on trade efficiency and trade

potential involves many different fields, including

agricultural products, manufacturing, cultural

products, and foreign exports. For example, the paper

was measured (Chen, 2018, Xie, 2018, Liu, 2018) by

the efficiency of cultural trade, etc., and used (Wang,

2019, CHEN, 2019, GAO, 2019) by complex

network analysis method and combined with

stochastic frontier models to study the topological

characteristics of the "Belt and Road" trade network

and its impact on China's import and export trade

efficiency.

In a study of OFDI related to the research topic of

this paper, it was argued (Zhang, 2017) that China's

OUTWARD direct investment with countries along

the "Belt and Road" will increase the volatility of the

inefficient value of trade due to the strong volatility

between China and the region itself. It was argued

(Li, 2021) that foreign investment in inter-country

trade dilutes the demand for import trade.

It is equally important to study the relationship

betwee trade and OFDI abroad. It was examined

(Amour, 2017, WU, 2017) by the implementation of

China's OFDI, surveying some theoretical and

empirical literature on the motivations and

determinants of CHINA's OFDI. In the past, most

scholars have argued that strategic behavior and

economic considerations seem to be the basic

motivations for China's OFDI, but in fact, the main

factors that determine the amount of Chinese FDI

include market size variables, labor market

conditions, institutional variables, macroeconomic

policy variables, and the global supply of FDI, as well

as GDP, market size, and trade freedom. The study

also points out that China's offline foreign direct

investment in the world is seeking markets and

resources. It was concluded (Suresh, 2014, Bulbul,

2014, Vivek, 2014) that over the past decade, outward

direct investment and economic growth have been

inextricably linked, but the causality has been

controversial. The article examines the multiple

causal relationships between China's outward direct

investment, economic growth, and foreign trade

between China and India. The article found that the

two countries presented opposite results in terms of

the causal relationship between FDI and GDP.

Foreign scholars not only study trade and OFDI on

the current situation, but also give corresponding

policy recommendations. The studies (Zhang, 2006)

show that OFDI can reduce poverty by promoting

economicgrowth and spreading growth. And OFDI is

also an important source of China's economic growth.

By leading programs and policies to improve the

investment environment in poor provinces,

government can reduce more poverty and attract

more OFDI; The study (Li, 2011, Jin, 2011) points

out that China is South Korea's largest exporter and

largest importer. In terms of economic dependence

and geographical location, South Korea cannot ignore

the importance of China, which should take into

account both countries, namely trade and investors,

while increasing the volume of outward direct

investment. By changing the way the economy

depends on, South Korea should also increase its

outward direct investment from China to keep trade

and investment balanced between the two countries.

The study notes (Makaranga, 2019) that the

relationship between OFDI and trade growth has long

been an area of concern for many policymakers,

economists and academics. This is because OFDI can

affect many macroeconomic factors in recipient

countries. OFDI is a resource bundle for economic

growth in developing countries, particularly in

Africa. As a result, most African countries have

expressed support by providing incentive policies to

foreign companies related to OFDI. The article also

draws false conclusions: the impact of FDI inflows on

economic growth will certainly increase, thus

achieving sustainable economic growth and

development.

In summary, there have been in-depth studies on

trade potential, trade efficiency and China's outward

foreign direct investment, but there are few studies on

China's outward direct investment from the

perspective of common trade potential and trade

efficiency, and there are few studies that combine

trade potential, trade efficiency and China's outward

direct investment in the context of the Belt and Road

Initiative. Based on this, on the basis of China's

analysis of the current situation of outward direct

investment in the "Belt and Road" countries, the

study empirically analyzes the trade potential of

countries along the "Belt and Road" from the

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

220

perspectives of GDP, population size, distance from

China, whether there is a common border,

government integrity, trade freedom, monetary

freedom, financial freedom, whether to sign a free

trade agreement, whether to join the WTO, etc.,

through the establishment of a random frontier

gravitational model.

2 ANALYSIS OF THE SITUATION

2.1 The Size of China's Outbound

Direct Investment

Current between countries are closely linked, is

undergoing dramatic changes, after the outbreak of

the financial crisis, the economy is gradually making

recovery, the international situation is still in a state

of flux, between countries due to the existence of the

economic circle, the phenomenon of the development

of differentiation, gradually widening economic gap

between countries, relatively backward countries

facing a great challenge. Since 2019, the world and a

new dilemma - COVID - 19 outbreak, the world's

economic growth to its lowest level since the

financial crisis in 2008, trade between countries

restricted by epidemic appeared significantly

slower.Economy suffered a huge impact.However,

foreign direct investment flow after falling for three

years rose 33.2%, China is still opening up steadily,

and Chinese companies are also going global. In

2019, China's outbound direct investment reached us

$1,369.1, second only to That of Japan. China's

outbound investment stock reached $2.2 trillion,

ranking third in the world. Only the United States and

the Netherlands.

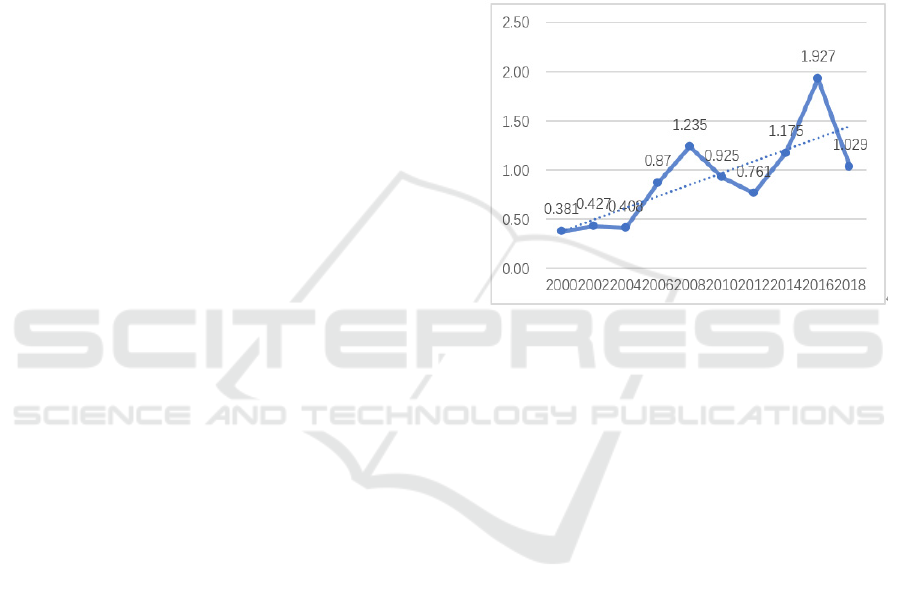

According to Figure 1, the proportion of net

outflow of OFDI in GDP was 0.381% at the

beginning of this century in 2000, and increased to

0.925% ten years later in 2010. Due to the impact of

Covid19 at the end of 2019, import and export trade

at home and abroad will have strong fluctuations, and

the scale of OFDI will also be greatly impacted.

However, before that, the data in 2018 had increased

to 1.029%. As can be seen from the trend line shown

in the figure, the proportion of China's net outflow of

OFDI in GDP showed an overall upward trend.

If only consider the relevant data of foreign direct

investment, although it can be seen that the

development trend, It can be easily affected by other

aspects. When GDP also maintains rapid rising trend,

the economic environment is optimistic and the

economy of every composition lead toward the

development of the whole .And we are through the

foreign direct investment outflows as a share of

GDP,Then we can know the relative changes of

foreign direct investment. If OFDI is compared to a

boat in the downstream, then the proportion data is

equivalent to the relative speed of the boat and the

current. Thus, it can be concluded that the importance

of OFDI for China's economy has been growing,

which is also the root of our research. Under the

current background of both driving forces and

obstacles, the Belt and Road Initiative can adapt to

the current background of economic globalization

and uphold the spirit of China's "opening-up".

Figure 1: Net outward direct investment outflow (share of

GDP).

2.2 OFDI between China and Other

Belt and Road Countries

In recent years, many developing and emerging

countries have undergone dramatic changes from

isolationist, import-substitution policies to open

market policies aimed at increasing outward direct

investment. Foreign investment plays an increasingly

important role in a country's economic growth, and

all countries begin to attach importance to foreign

investment and increase foreign investment, while

encouraging foreign investment in their own country.

The study of foreign direct investment is of great

significance and guiding role in the development of

economic globalization.

China has high hopes for trade with countries

along the belt and Road, and has set ambitious trade

growth targets with ASEAN, India and other

countries, and actively removed barriers to trade

development. On this basis, the paper studies the

trade potential and trade efficiency of countries along

the "Belt and Road", the factors influencing trade

potential and trade efficiency, and the actual impact

of trade potential and trade efficiency on China's

foreign investment. The study of these problems has

The Trade Potential and Trade Efficiency of the â

˘

AIJOne Belt, One Roadâ

˘

A

˙

I Countries along the Border and Their Impact on Chinaâ

˘

A

´

Zs

Foreign Direct Investment: Based on the Stochastic Frontier Gravity Model

221

important theoretical value and practical significance

for enriching and improving China's OFDI.As the

spread of COVID-19 has brought great uncertainties

to the economy, OFDI has changed greatly under the

influence of policies of various countries, so our data

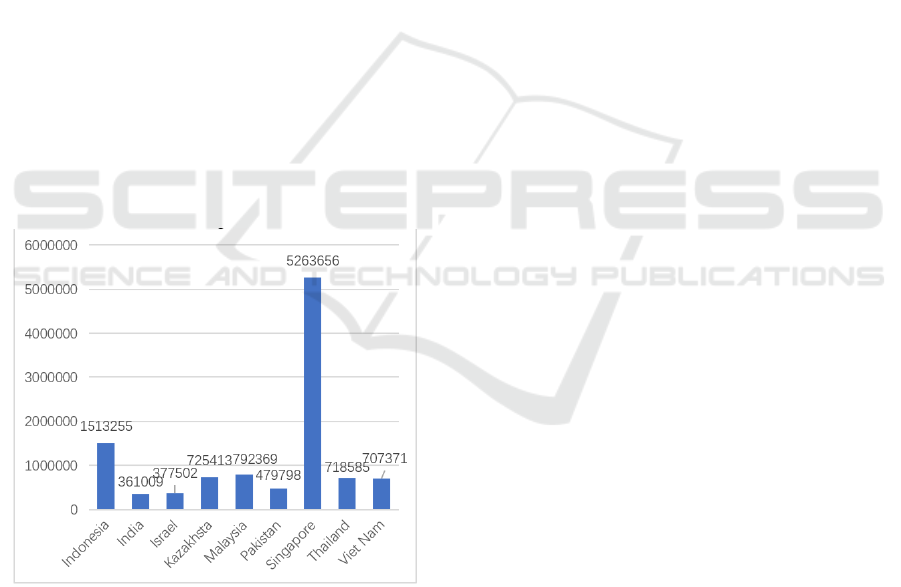

are mainly analyzed based on 2019. According to

figure 2 can see, in the year 2019, China's

"neighbourhood" net foreign investment up to

Singapore and other countries as much as $52.63656

billion, the second contact in foreign direct

investment in China is closely followed by Indonesia,

Malaysia, Thailand, Vietnam, kazakhstan, Pakistan,

Israel, India, etc., However, these countries are far

behind Singapore, but they have great potential for

future development. Therefore, China can provide

appropriate policy support to these countries in the

future construction of the "Belt and Road", so as to

facilitate the steady and efficient development of

regional economy.

While some countries are opposite bigger and the

Chineseon the net foreign investment is not high, the

reason may be that some political factors. In order to

better economic regional exchange in the future,

China also need to maintain good diplomatic image,

with other countries to establish friendly and close

relationship between foreign trade, promote the

development of health, coordination between

economy and effectively.

Figure2 China's Net Outbound Investment to Other

Countries (2019).

2.3 The Influence of Trade

Potential and Trade Efficiency on China's Foreign

Direct Investment

In the study of trade efficiency and trade potential,

it can be found that although they contain two

different aspects, there are still many similarities. The

total population, GDP, infrastructure construction,

logistics and transportation among countries will all

have an impact on trade efficiency. For trade

potential, in addition to some hard indicators,

"software", such as technology and experience, these

can also have a great impact. In general, some

countries that do not have hard indicators tend to have

the advantage of being a late mover. Therefore, in the

context of "One Belt and One Road", there are many

factors that need to be considered when studying

trade efficiency and trade potential. They are not only

the superficial positive correlation, but also some

other interfering factors.

Some of China's traditional industries have a

comparative advantage in the international market is

close to saturation. But with the incoming of the

economic globalization, the financial crisis is

emerging, which makes China's export growth have a

downward trend. The research of foreign direct

investment can effectively avoid the country setting

up for China of tariff and non-tariff barriers to

facilitate the export of China's domestic advantage

products, And in the information can be more

transparent and reduce the export process of trial and

error and blindness.

3 MODEL CONSTUCTION AND

DATA SOURCE

3.1 Theoretical Analysis

The purpose of the stochastic frontier gravity model

is to combine the stochastic frontier theory with the

gravity model to analyze the technical efficiency in

the production function. The model decomposes the

stochastic disturbance term into two parts: Trade non

efficiency and random error term.

The model form can be expressed as

( ) exp( ) exp( ), 0

it it it it it

Yfx

β

θ

μμ

=−≥,

(1)

or

Take logarithms on both sides and get

ln ln ( ) , 0

it it it it it

Yfx

β

θ

μμ

=+−≥,

(2)

In formula (2): 𝑌

refers to the investment

amount of China to country i in period t. 𝑥

is the

main factor affecting the actual investment amount,

generally natural factors, such as economic scale,

population, distance, etc; 𝛽 is the parameter to be

estimated of the explanatory variable; 𝜃

is a

random disturbance term and follows a normal

distribution with a mean value of 0; 𝑢

is a trade

non efficiency term, which refers to the factors

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

222

affecting the efficiency of bilateral trade. Generally,

it is human factors that cause the variables in the trade

group, such as government integrity, trade freedom,

financial freedom, etc., which are independent of 𝜃

.

It is usually assumed that they obey normal

distribution or tail normal distribution; The

expression of the model is as follows:

(,)

it it it

hZ a

μ

ε

=+

(3)

In formula (3): 𝑍

is the influencing factor of

trade non efficiency term, 𝛾 is the parameter to be

estimated and 𝜀

is the random disturbance term. In

this study, battese and coelli (1995) proposed to

substitute the trade inefficiency model into the

stochastic frontier gravity model. It means to

substitute equation (3) into equation (2), and

obtained:

[

]

ln ln ( ) ( , )

it it it it it

Yfx hZa

β

θε

=+−+,

(4)

If equation (4) is regressed, the stochastic frontier

gravity model and trade inefficiency model can be

estimated at the same time.

3.2 Empirical Model

3.2.1 Stochastic Frontier Gravity Model

Combined with the analysis of previous scholars,

generally, important objective factors that will not

occur significantly in the short term, such as total

GDP, population, geographical distance, whether it is

China's border country and other variables, are placed

in the stochastic frontier gravity model. The variables

such as government integrity, currency freedom,

trade freedom, financial freedom, whether there is a

trade agreement or whether to join the trade

organization are uniformly placed in the trade non

efficiency item. Build a specific stochastic frontier

gravity model.

it 0 1 2 3 4

ln ln ln ln ln , 0

it it it i it it it

OFDI GDP CAP DIS BO

ββ β β β θμμ

=+ + + + +− ≥

(5)

In (5): 𝑂𝐹𝐷𝐼

it

represents the total stock of China's

direct investment in country i in period t; 𝐺𝐷𝑃

、

𝐶𝐴𝑃

respectively represent the economic scale and

population of country i in period t; 𝐷𝐼𝑆

indicates

the geographical distance from Beijing, China to the

capital of country i ; 𝐵𝑂

indicates whether country

I and China have a common border. A dummy

variable is used here. If two countries have a border

for child labor, the variable is set to 1, otherwise it is

0. 𝜃

is a random disturbance term and 𝑢

is a

trade non efficiency term.

3.2.2 Trade Inefficiency Model

By referring to the previous literature, this paper uses

the variables of government integrity, currency

freedom, trade freedom, financial freedom, whether

there is a trade agreement, whether to join the trade

organization and so on to construct the trade

inefficiency index system. The specific measurement

model is as follows:

01 2 3 4 5 6

ln ln ln ln ln ln

it it it it it it it it

GOV CUR GRA FIN AGR ORG

μγγ γ γ γ γ γ

ε

=+ + + + + + +

(6)

In equation (6): 𝐺𝑂𝑉

refers to the government

integrity of country i in period t. 𝐶𝑈𝑅

、𝐺𝑅𝐴

、

𝐹𝐼𝑁

represents the monetary freedom, trade

freedom and financial freedom of country i

respectively; 𝐴𝐺𝑅

indicates whether China has

signed a free trade agreement with country i; 𝑂𝑅𝐺

is whether country i is a member of WTO; 𝜀

is a

random perturbation term.

3.3 Sample Selection and Data Source

The strategy of “One belt, one road” was put forward

in 2013. Some countries were excluded because of a

serious lack of data. The data from the remaining

2013-2019 were selected from the year of 2013. The

data were analyzed by Frontier 4.1 soft. The

explanation of each variable, data source, expectation

and impact on dependent variables can be shown

from table 1.

3.4 Empirical Test and Result Analysis

3.4.1 Applicability Test of Model

In this study, the maximum likelihood ratio LR

statistic𝐿𝑅 = −2(𝑙𝑛 𝐻

−𝑙𝑛𝐻

) is used to judge the

effectiveness of the stochastic frontier gravity model

and the specific form of the model setting. Assuming

the original hypothesis𝐻

:𝛾 = 0, we could compare

the calculated LR statistics with the segment critical

value at the 1% significance level, so as to judge

whether to reject or accept the original hypothesis. 𝛾

can be expressed as𝛾=𝛿

/(𝛿

+𝛿

). Among them,

between 0 and 1, if the original hypothesis is

accepted, the model can be estimated directly by

ordinary least square method; If it approaches 1, it

indicates that the random frontier gravity model

should be used for estimation.

The Trade Potential and Trade Efficiency of the â

˘

AIJOne Belt, One Roadâ

˘

A

˙

I Countries along the Border and Their Impact on Chinaâ

˘

A

´

Zs

Foreign Direct Investment: Based on the Stochastic Frontier Gravity Model

223

Table 1: The explanation of each variable, data source, expectation and impact on dependent variables.

Variable Meaning Expecte

d

Symbol

Data Sources Theoretical Description

ln

it

GDP

GD

P

of countr

y

i

/

USD + Worl

d

Ban

k

Database

The large

r

the economic scale of the

invested country, the Greater China's

direct investment in the country

ln

it

CAP

Population of country i

/

p

erson + Worl

d

Ban

k

Database

The large

r

the

p

opulation of the investe

d

country, the Greater China's direct

investment in the country

ln

it

D

IS

Distance

b

etween China an

d

country i / km

- French CEPII

database

The close

r

China is to a country, the

Greater China's direct investment in that

country

ln

i

BO

Whethe

r

China an

d

country i

have a common border

+ French CEPII

database

If the investe

d

country has a common

border with China, China's direct

investment in the country will be greater

ln

it

GOV

government integrit

y

- American Heritage

Foundation

Database

The more honest the government of the

invested country is, the less resistance

China has to direct investment in the

country

ln

it

CUR

Degree of monetar

y

freedo

m

in

country i

-

American Heritage

Foundation

Database

The highe

r

the degree of monetary

freedom of the invested country, the

smaller the resistance of China's direct

investment in the country

ln

it

GRA

Degree of trade freedo

m

of

country i

- American Heritage

Foundation

Database

The highe

r

the degree of trade freedo

m

of

the invested country, the smaller the

resistance of China to direct investment in

the country

ln

it

F

IN

Degree of financial freedom in

country I

- American Heritage

Foundation

Database

The highe

r

the degree of financial freedo

m

of the invested country, the smaller the

resistance of China to direct investment in

the country

ln

it

A

GR

Whethe

r

China signe

d

a free trade

agreement with country i

- China Free Trade

Zone Service

Network

If a

b

ilateral free trade agreement is

signed, the less resistance China has to

direct investment in the country

ln

it

ORG

Whethe

r

countr

y

i is a membe

r

of

the world trade organization

- Official website of

the World Trade

Organization

If the investe

d

country is a membe

r

of the

world trade organization, the less

resistance China has to direct investment

in that country

3.4.2 Analysis of Model Regression Results

As can be shown from table 2, in the estimation of

trade potential and trade efficiency, the GDP of

countries along the line has a positive correlation and

significant effect on China's foreign investment,

which shows that the higher the economic

development level of countries along the line, the

more can promote China's foreign direct investment,

which is consistent with the expected theory.

Population is also an influencing factor of trade

potential

and trade efficiency, which has a negative

inhibitory effect on China's foreign direct investment,

and the results are significant, which is obviously

inconsistent with the expected theory. China's “one

belt, one road”, is mostly a small country in

developing countries and a small country in

developed countries. This is also the reason why the

results are not consistent with the theoretical

expectations, according to the estimated results. The

leamer's non trade equilibrium interpretation applies

only to developed countries such as the United States.

The distance between the countries along the line and

China is negatively correlated, indicating that the

farther the countries along the line are from China,

the higher the cost, and the more unfavorable it is for

China's foreign direct investment. Whether there is a

common

border between the countries along the line

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

224

Table 2: Model regression results.

variable coefficient

t

-ratio

0.157

4.41096

ln

it

GDP

0.342

1.0809741

ln

it

CAP

-0.687

-1.0875752

ln

it

D

IS

-0.179

-4.0355547

ln

i

BO

-0.329

-1.2719382

ln

it

GOV

-0.423

ln

it

CUR

-0.108

ln

it

GRA

-0.107

ln

it

F

IN

-0.192

ln

it

A

GR

-0.892

ln

it

ORG

-0.805

gamma 0.53

and China has a significant impact, indicating that

bordering with China will promote foreign direct

investment. The trade potential and trade efficiency

measured by the level of government integrity are

significantly negatively correlated, indicating that the

more perfect the government system is, the greater

the amount of foreign direct investment is, which is

obviously consistent with the expectation. The

improvement of government system shows that the

political risk is small, which is conducive to China's

investment, which is also an important reason to

include it into the variables of trade potential and

trade efficiency. Different from previous studies, this

paper adds monetary freedom as a variable of trade

potential and trade efficiency. The results show that

this variable has a greater impact on trade potential

and trade efficiency, which means that the higher the

monetary freedom, the greater the amount of China's

foreign direct investment. A country's trade freedom

refers to the country's non-tariff barriers. It controls

the trade freedom by restricting imports directly and

indirectly. If the government reduces the trade

freedom, it will inevitably inhibit imports and affect

China's foreign direct investment. The degree of

financial freedom of a country includes the degree of

distribution of credit funds, the degree of government

service and regulation of financial institutions, and

the difficulty of financial services to the real

economy. If the degree of government regulation of

financial institutions is increased, it will inevitably

inhibit imports. Therefore, the improvement of

financial freedom will promote trade potential and

trade efficiency. Other variables, such as whether the

two sides have signed a free trade agreement and

whether the countries along the line have joined the

free trade organization, are consistent with the

theoretical expectation.

4 CONCLUSION AND ADVICE

Based on the above research conclusions, the paper

puts forward the following countermeasures and

suggestions: first, make full use of the Asian

infrastructure investment bank and the Silk Road

Fund, improve the overall trade facilitation level of

the region, and constantly explore the trade potential

and realize the common prosperity of the countries

along the line; Second, on the factors affecting trade

efficiency, targeted measures should be formulated to

improve China's export trade efficiency with

countries along the economic corridor of the new

Eurasian Continental Bridge. China's one belt, one

road, along with its economic development, will

enhance its efficiency in the export of trade, such as

strengthening bilateral and multi field cooperation,

improving customs clearance efficiency, improving

the quality of infrastructure, facilitating trade and

transport efficiency, and improving the quality of

logistics services. Third, upgrade green financial

services. As the saying goes, "economy is the body,

finance is the blood, and the two coexist and prosper".

China's “one belt, one road” and other countries will

be able to trade with the improved financial

supporting services. Mr. Chen Yulu, vice president of

the central bank, believes that the most important

thing in China's current financial reform is to

establish a world-class green financial evaluation

standard system. The development of green finance

is one of the biggest highlights of China's financial

reform in recent years and an important thrust for the

financial industry to better serve China's real

economy and help supply side structural reform. In

addition, Mr. Yi Gang, governor of the central bank,

believes that stable monetary policy and active fiscal

policy are the most important and best policies in the

short term, at most in the medium term, and also the

second best choice to make up for China's GDP

growth gap; Fourth, deepen China’s strategy of the

“one belt, one road”, the financial cooperation of the

countries along the border, enhance the degree of

The Trade Potential and Trade Efficiency of the â

˘

AIJOne Belt, One Roadâ

˘

A

˙

I Countries along the Border and Their Impact on Chinaâ

˘

A

´

Zs

Foreign Direct Investment: Based on the Stochastic Frontier Gravity Model

225

financial freedom, strengthen the government's

supervision over financial institutions, and increase

the scale of credit capital allocation.

REFERENCES

CHEN Chuang-Lian, XIE Xue-zhen, LIN Yu-Ting.

Analysis of global trade efficiency and trade potential

and its influencing factors[J]. International Trade

Issues, 2016(07):27-39.

Chen Lin, Xie Xuezhen, Liu Lin. Trade Efficiency and

Trade Potential of China's Exports: 1980-2015[J].

Feng Gen-yao, CHEN Xiao. Trade efficiency and export

potential of cultural products between China and the

fulcrum countries along the "Belt and Road"——

Estimation based on stochastic frontier gravitational

model[J]. Journal of Shaoxing University of Arts and

Sciences (Humanities and Social Sciences),

2019,39(06):64-72.

HABYARIMANA Jean D’Amour, WU Xiang Feng.

Motives and Determinants of China’s Foreign Direct

Investment in Rwanda[J]. International Journal of

Economic Behavior and Organization, 2017, 5 (2).

International Economic and Trade Exploration,2018,34 (1):

33-50.

International Trade Issues (2): 3-12.

Juma Makaranga. Foreign Direct Investment (FDI), Quality

of Institutions and Economic Growth: Evidence from

African Economies[D]. University of International

Business and Economics,2019.

Kevin Honglin Zhang. Does International Investment Help

Poverty Reduction in China? [J]. Chinese

Economy,2006,39(3).

Li Cuiping." Research on China's Foreign Trade Efficiency

under the Background of the Belt and Road Initiative:

Based on the Empirical Data of the New Eurasian Land

Bridge of 19 Countries[J]. Research on Technology

Economics and Management, 2021(02):112-117.

Li Haiwei, Ni Sha. Research on the Trade Environment and

Potential between China and Countries along the "Belt

and Road": An Empirical Test Based on HT Model[J].

Journal of Shanxi University: Philosophy and Social

Sciences Edition, 2020(3):73-85.

Li Helu, Jin Meizhen. FDI Environment and Promotion

Policy for China Money in Korea[J]. The Journal of

Korea Research Society for Customs,2011,12(4).

LI Ping. Trade potential and trade efficiency between China

and countries along the "Belt and Road" and its

determinants: An empirical study based on the

stochastic frontier gravitational model[J]. International

Business Research,2018,39(5):5-16.

Li Xiao, Zhang Yuxuan, Chen Xiaoxin. A Study on China's

Trade Potential with The Belt and Road Participating

Countries: A Case Study of Final Consumer Goods

Imports[J]. Nankai Economic Research, 2020(01):45-

69.

Li Xiaozhong, Lü Peipei. Research on the Export Trade

Potential and Trade Efficiency of China's Equipment

Manufacturing Products: An Empirical Study Based on

the "Belt and Road" Countries[J]. International Trade

Issues, 2019(01):80-92.

Liang Wang and Yuanyuan Wu, (2016), "The Trade

Potential of the Silk Road Economic Belt: An Analysis

Based on the 'Natural Trading Partner' Hypothesis and

the Stochastic Frontier Gravitational Model," The

Economist, Vol. 4, pp. 33-41.

Quan Yi, Gao Junxing." The Belt and Road Initiative and

the New Strategy for The Development of China's

Coastal Opening-up[J]. Fujian Forum (Humanities and

Social Sciences Edition), 2019(12):106-114.

Suresh K. Chadha, Bulbul Singh, Vivek S. Natarajan.

Interaction among foreign direct investment, economic

growth and foreign trade: evidence from India and

China[J]. Int. J. of Process Management and

Benchmarking,2014,4(2).

Tan Xiujie, Zhou Maorong. 2015. Trade Potential and

Influencing Factors of the Maritime Silk Road in the

21st Century: An Empirical Study Based on Stochastic

Frontier Gravitational Model[J].

WANG Yan-fang, CHEN Shu-mei, GAO Jia-hui." The

Impact of the Belt and Road Trade Network on China's

Trade Efficiency: A Comparison with TPP, TTIP, and

RCEP[J]. Asia-Pacific Economics, 2019(1):49-55.

Yang Yiting. An Empirical Analysis of China's Trade

Potential and Trade Efficiency with the Belt and Road

Countries[J]. Monthly Price, 2019(05):47-54.

Zhang Huiqing. Research on the trade potential between

China and regions along the "Belt and Road"[J].

International Trade Issues,2017(07):85-95.

Zhang Yuling, Zhang Xia, Chen Meng. Research on trade

potential, efficiency and influencing factors between

China and countries along the Maritime Silk Road: An

Empirical Analysis Based on Stochastic Frontier

Gravitational Model[J]. Journal of Yili Normal

University (Social Science Edition), 2020,38(02):56-

65.

BDEDM 2022 - The International Conference on Big Data Economy and Digital Management

226