The Methodology for Using a Business Simulator with Elements of

Machine Learning to Develop Personal Finance Management Skills

Dmytro S. Antoniuk

1 a

, Tetiana A. Vakaliuk

1,2,3 b

, Vladyslav V. Didkivskyi

1 c

,

Oleksandr Yu. Vizghalov

1 d

, Oksana V. Oliinyk

1 e

and Valentyn M. Yanchuk

1 f

1

Zhytomyr Polytechnic State University, 103 Chudnivsyka Str., Zhytomyr, 10005, Ukraine

2

Institute for Digitalisation of Education of the NAES of Ukraine, 9 M. Berlynskoho Str., Kyiv, 04060, Ukraine

3

Kryvyi Rih State Pedagogical University, 54 Gagarin Ave., Kryvyi Rih, 50086, Ukraine

oov76@ukr.net, v.yanchuk@gmail.com

Keywords:

Business Simulator, Machine Learning, Personal Finance, Personal Finance Management Skills.

Abstract:

Any person, not even a financier, should be knowledgeable in the field of personal finance management. As

a result of the survey, it was concluded that schoolchildren and students should be interested in the study of

personal finance, even within other disciplines in the form of separate sections. Successful personal experience

and knowledge of the teacher in the field of personal finance is an important component of the effectiveness

of the formation of competence of pupils, students, and adults in the field of personal finance. Business

simulators come in handy here. That is why the authors developed a business simulator for the development of

personal finance management skills, which was developed in the form of a web service. The article presents a

methodology for using the use of a business simulator with elements of machine learning to develop personal

finance management skills, its main components are given: content, purpose, forms, methods and means. The

main features of this simulator, which are presented in different sections of the simulator, are considered.

It is shown what skills of personal finance management are developed using this business simulator. Since

this simulator was designed to develop personal finance management skills, an attempt was made to apply

machine-learning elements to make this business simulator work even better. The proposed simulator can be

used in the future to teach the elements of personal finance management to people who are not sufficiently

knowledgeable in the field of such finance. Moreover, the web application can be useful even for school-age

children, so the simulator can complement the educational process within the economic courses not only in

higher education institutions but also in secondary education institutions of Ukraine.

1 INTRODUCTION

Almost every day, each person spends money on

housekeeping, utility bills, payment for services and

purchases. It also includes debts on loans, or just bor-

rowed money from friends. Personal finance includes

all the funds available to us and the ability to man-

age them, so the topic of personal finance is relevant

and worthy of attention for everyone who cares about

their financial well-being. That is why any person,

a

https://orcid.org/0000-0001-7496-3553

b

https://orcid.org/0000-0001-6825-4697

c

https://orcid.org/0000-0002-4615-7578

d

https://orcid.org/0000-0003-0985-4929

e

https://orcid.org/0000-0003-2188-9219

f

https://orcid.org/0000-0002-6715-4667

not even a financier, should be knowledgeable in the

field of personal finance management. As a result, a

survey was conducted to find out certain aspects of

the financial literacy of first-year students as individ-

uals who have their financial resources. In 2019, 167

respondents took part in the survey, in 2020 – 214 re-

spondents (first-year students of the Faculty of Infor-

mation and Computer Technologies of the Zhytomyr

Polytechnic State University).

As a result, it was found that in 2019, 70.7%

of respondents consider themselves financially liter-

ate, ready to consciously and effectively manage their

own and family financial resources; in 2020 – 74.3%.

At the same time, 29.3% of respondents in 2019 do

not consider themselves sufficiently aware in this re-

gard; in 2020 – 25.7% (see figure 1, a).

It was also found that in 2019 45.5% of respon-

92

Antoniuk, D., Vakaliuk, T., Didkivskyi, V., Vizghalov, O., Oliinyk, O. and Yanchuk, V.

The Methodology for Using a Business Simulator with Elements of Machine Learning to Develop Personal Finance Management Skills.

DOI: 10.5220/0012061800003431

In Proceedings of the 2nd Myroslav I. Zhaldak Symposium on Advances in Educational Technology (AET 2021), pages 92-102

ISBN: 978-989-758-662-0

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

Figure 1: Financial literacy education results.

dents studied the basics of financial literacy in at least

one form, in 2020 – this figure dropped to 19.6%, in

2019 54.5% – did not study in any form, in 2020 –

this figure is 80.4% (see figure 1, b).

In addition, by the results of the survey, it was

found that in 2019 14.4% of respondents at the high-

est level assess their level of readiness for conscious

and effective management of own and family finan-

cial resources, in 2020 – 10.7%, 38.3% of respon-

dents in 2019 – indicated the level of readiness “good”

and “satisfactory”, while in 2020 46.7% indicated the

level of readiness “good”, 35% - “satisfactory”. All

others either rated the level at the lowest level or an

unsatisfactory level.

As a result of the survey, it was concluded that

schoolchildren and students should be interested in

the study of personal finance, even within other dis-

ciplines in the form of separate sections. Successful

personal experience and knowledge of the teacher in

the field of personal finance is an important compo-

nent of the effectiveness of the formation of compe-

tence of pupils, students, and adults in the field of

personal finance. Business simulators come in handy

here.

1.1 Theoretical Background

The need for personal finance competency develop-

ment was analyzed in the research internationally.

The challenge is relevant for both developed and de-

veloping countries. Influence of the financial literacy

on the well-being of people worldwide and the need

to recognize it as the fundamental right and universal

need was discussed by Lusardi (Lusardi, 2019). An-

other research by Lusardi et al. (Lusardi et al., 2017)

shows that in the USA 30–40% of retirement wealth

inequality is associated with the level of financial lit-

eracy alone. As for the initial personal finance man-

agement, knowledge, and skills formation, the study

concludes significant influence of the high school fi-

nancial literacy courses on the lower default rates and

better credit scores (Urban et al., 2020).

Using business simulations in education is a

shared practice now. Simulations are being used in

practical training, such as flight or combat simula-

tions as well as in economic, managerial, and finan-

cial areas. Researchers study the pedagogical sig-

nificance of this type of technology-enhanced educa-

tional method. Hern

´

andez-Lara et al. (Hern

´

andez-

Lara et al., 2019) concluded the positive impact

of business simulations on the generic competen-

cies. Farashahi and Tajeddin (Farashahi and Tajed-

din, 2018) conclude the effectiveness of business sim-

ulations in their comparative study. The study of

business simulations in economic or finance evolves

with the evolution of technologies available to de-

velop immersive, attractive, and highly functional ex-

periences. The range of use-cases differs from ele-

mentary schools to life-long learning establishments.

Korgin (Korgin, 2015) provides evidence of the effec-

tiveness of the simulation games for kids with basic

arithmetical operations literacy. Palan (Palan, 2015)

studied the criterion and approaches to select business

simulation software for asset market experiments to

use in the higher education establishments.

The analysis provides evidence of the effective-

ness of business simulation usage in education in gen-

eral and the need to further development of business

simulation for the economy and finance literacy de-

velopment, assessment, and study of its behavioral as-

pects.

The purpose of the article is to describe the

methodology for using the business simulator with

elements of machine learning to develop personal fi-

The Methodology for Using a Business Simulator with Elements of Machine Learning to Develop Personal Finance Management Skills

93

nance management skills.

2 RESULTS

The analysis of the analogues (Antoniuk et al., 2019,

2020) revealed that most part of the simulation soft-

ware is appropriate for a specific area of the finance in

the countries with developed financial markets. Based

on the conclusions above this work represents the ex-

periment in developing more generalized simulator

for the countries with less developed market of finan-

cial instruments.

That is why the authors developed a business sim-

ulator for the development of personal finance man-

agement skills (Antoniuk et al., 2022a,b), which was

developed in the form of a web service (10, 2020).

The methodology for using a business simulator

with elements of machine learning to develop per-

sonal finance management skills is presented in the

next part of this work.

The methodology for using a business simula-

tor with elements of machine learning to develop

personal finance management skills, like any other

methodology, includes the purpose and content of the

application, forms, methods, and tools.

It is focused on the expected result – the improved

personal finance management skills because of using

a business simulator with elements of machine learn-

ing.

The purpose of using a business simulator with el-

ements of machine learning is to develop personal fi-

nance management skills.

The content of using is the improvement of the

process of teaching normative disciplines using a

business simulator with elements of machine learn-

ing.

The proposed methodology includes the following

methods for using a business simulator with elements

of machine learning:

1. Adaptive learning. In the simulator, a process is

created in a game form, which in the literature is

called the examination cycle. At each stage of the

simulator, the user is faced with a list of prob-

lems corresponding to the current level of com-

petence. In the process of passing the simula-

tion, the user is allowed to use new tools avail-

able in the field of personal finance management,

which could not be effectively used at previous

levels of the formation of the relevant compe-

tence. This approach requires the user to itera-

tively master new knowledge, skills, and abilities

that are more complex from a theoretical and psy-

chological point of view, and the ability to use

them in situations close to real ones. In the pro-

cess of passing the simulation and the correspond-

ing stages of the formation of competence, the

user gets the opportunity to work out tools and

situations that were previously unfamiliar to him

or are of additional interest to him, taking into ac-

count the stage of the life cycle, the field of activ-

ity or current problems and interests.

2. Situational modeling. The simulator proposed for

use in this work is based on a realistic simula-

tion of common and more specific situations in

the process of managing personal or family fi-

nances. The initial stage is modeling the creation

of a diversified currency and forms of storing the

user’s financial basket. In the future, to move

to more complex personal finance management

tools, credit and deposit operations with a dif-

ferent set of time parameters, payment schedules,

and forms of provision are added to the simulated

situations. The realism of the simulation is en-

sured by the presence of probabilistic events with

a positive or negative impact of different mone-

tary values on the user’s personal finances. Non-

financial investment transactions are the next step

in familiarizing and developing the user’s compe-

tence in the field of personal finance management.

Here are the main forms of conducting training

sessions using a business simulator with elements

of machine learning within the framework of this

methodology:

• Introductory classes for teachers and facilitators

on the functionality, modes, and features of us-

ing the simulator, the analytical capabilities of the

platform, and the means of scientific research on

the effectiveness and adaptability of the process of

developing user competence;

• autonomous and group independent work with the

simulator, aimed both at independent in-depth or

a convenient pace through the training and game

plot of the simulator and at the joint learning

activities of user groups and facilitators of such

classes either with elements of the competition or

without such elements;

• an in-depth analysis of the situations of the sim-

ulator can take place in face-to-face or remote

format with individual students or groups. This

form of interaction is aimed at additional elab-

oration of situations, behavioral and psychologi-

cal aspects or financial instruments, the work with

which causes difficulties, misunderstanding, or at-

tracting additional interest of users.

The tools for developing personal finance man-

agement skills provided in the proposed methodology

AET 2021 - Myroslav I. Zhaldak Symposium on Advances in Educational Technology

94

using a business simulator with machine learning ele-

ments include computers, smartphones, tablets with

Internet access, a business simulator with machine

learning elements; teaching materials.

The result of the proposed methodology: the skills

of managing personal money are formed at a high

level; acquired skills to successfully apply a business

simulator with elements of machine learning to per-

form practical work.

Within the framework of this methodology, we of-

fer different forms and methods of using a business

simulator with machine learning elements to develop

personal finance management skills: organization and

development of a business simulator with machine

learning elements to develop personal finance man-

agement skills; sessions of using a business simulator

with elements of machine learning to simulate socio-

economic situations that correspond to the topic of

the lesson; organization of thematic economic train-

ing using a business simulator with elements of ma-

chine learning; visualization of economic and behav-

ioral concepts; using a business simulator with ele-

ments of machine learning as a means of targeted in-

depth problem-based learning; using a business sim-

ulator with elements of machine learning as a means

of organizing an assessment.

At the same time, the organization and develop-

ment process of a business simulator with elements

of machine learning for the development of personal

finance management skills ensures the use of knowl-

edge needed to complete a project in the field of pro-

fessional activity of students of IT specialties as an

incentive for obtaining new knowledge in the field of

economics. In the process of developing a business

simulator with elements of machine learning, the ac-

quisition of skills and abilities is ensured, as well as

the formation of a personal attitude to the problematic

issues of the economic industry.

Sessions of using a business simulator with

elements of machine learning to simulate socio-

economic situations that correspond to the subject of

the lesson material provide students with interest, pro-

vide the necessary theoretical information in the field

of the lesson, organize the possibility of obtaining

skills in this topic, and initiate the formation of stu-

dents’ personal attitude to the socio-economic situa-

tion, considered by focusing on a specific economic

law, principle or concept, which reduces the complex-

ity of understanding.

The organization of thematic economic training

using a business simulator with elements of machine

learning contributes to motivation and increased at-

tention to the knowledge of the lesson material. Ob-

taining the skills and abilities of rational behavior in

the problematic area of training is an integral part of

the training, providing one’s own experience, close to

practice and the formation of a stable personal atti-

tude, provoked by the experience of mastering prob-

lematic material and the active generation of relevant

conclusions.

Visualization of economic and behavioral con-

cepts allows students to be motivated to perceive the

lesson material. When using a business simulator

with elements of machine learning with dynamic pa-

rameters or dynamic content, provides students with

the skills and abilities to manage an object of a socio-

economic nature. Visualization and selection of top-

ics relevant to the audience contribute to the formation

of one’s own attitude towards the object of knowl-

edge. The use of a business simulator with elements

of machine learning as a means of targeted in-depth

problem-based learning basically contains the need

for independent work on organizing such a lesson.

This approach allows for the development of per-

sonal finance management skills, initiating the inde-

pendent study of the lesson material. Supplementing

this method with an assessment in the form of an es-

say, including questions on the relevance of the sub-

ject of the simulation conducted for the student who

conducts it, and the group as a whole, contributes to

the formation of a personal attitude to the problems of

the studied material.

A separate object of study in the process of using

such a simulator can be the results of comparing the

optimality of decisions made by a person and a model

using machine learning algorithms. Such a compar-

ison complements the learning process with visual

data on the causes and consequences of applying var-

ious approaches to managing personal finances.

Consider the main features of this simulator,

which are presented in different sections of the simu-

lator (figure 2):

1. Current account management options.

2. Savings management options.

3. Deposit management options.

4. Credit management options.

5. Non-financial investment management options.

6. Information on changes in current accounts that

have occurred in the last week.

7. Analytical information on the dynamics of

changes in current account funds, savings, and in-

vestments.

8. Information on current exchange rates.

9. List of recent transactions that have been made on

current accounts.

The Methodology for Using a Business Simulator with Elements of Machine Learning to Develop Personal Finance Management Skills

95

Figure 2: Business simulator.

Consider in more detail the section with current

account management options (figure 2, A). The “Cur-

rent account” section contains a list of current ac-

counts in the form: code and available amount.

The user has the opportunity to open a new ac-

count. To do this, click on the “Open account” button,

then a window will appear where you need to select

the currency in which you want to open a new account

(figure 3). Each user action in the simulator (for ex-

ample, opening a new account) is accompanied by a

message that appears in the lower right corner of the

page.

Figure 3: Example of opening a new account.

After opening a new account, the “Exchange” op-

tion will be available in the “Current account” sec-

tion, which allows you to exchange currencies at the

rate that can be viewed in another section “Exchange

rates” (figure 2, B).

To exchange currencies, the user can enter the

amount he wants to sell and the amount in the cur-

rency to be purchased will be filled in automatically.

The user can also enter the amount to purchase and

the amount required for the purchase will be filled in

automatically. The user can also change currencies

and the amounts will be automatically transferred.

In the process of performing all actions by the

user, a real-time section is available with information

about changes in current accounts that have occurred

in the last week (figure 2, D). The user can choose the

currency of the account for which he wants to see the

relevant data (figure 4).

Figure 4: Example of currency exchange.

In addition, in the simulator, there is a section with

analytical data on the dynamics of changes in current

account funds, savings, and investments since the be-

ginning of the simulation (figure 5). The user can se-

lect the currency of the account for which he wants to

AET 2021 - Myroslav I. Zhaldak Symposium on Advances in Educational Technology

96

see the information. By default, to visualize the dy-

namics of funds in all accounts, the option “Accounts

total amount in USD” is selected, which displays the

total amount of funds in all accounts converted into

USD.

Figure 5: Analytical information on the dynamics of

changes in current account funds, savings, and investments.

The user also can view transaction information on

all current accounts (figure 2, C). The corresponding

section contains a list of the last 5 transactions. In this

case, the user can view all transactions or filter them

by specific weeks in the details window (figure 6).

Figure 6: List of transactions with the filter by weeks.

At the beginning of the 4th week of the simula-

tion, a window with a test question appears, in which

the participant is asked what the amount is enough

to save for savings from a monthly salary per month.

This question is part of the assessment, and the user

is obliged to answer it.

To sometimes distract the user from financial in-

struments and bring more of the reality into the simu-

lation process, random events were added to the sys-

tem, including various diseases, repairs, the birth of a

child, and so on. Most random events last for some

time and additional costs for the entire period of va-

lidity. Some events are constant, so costs are made

every week, such as the birth of a child. You can’t

cancel any random event, you can just accept it and

close the window (figure 7).

Figure 7: An example of a random event.

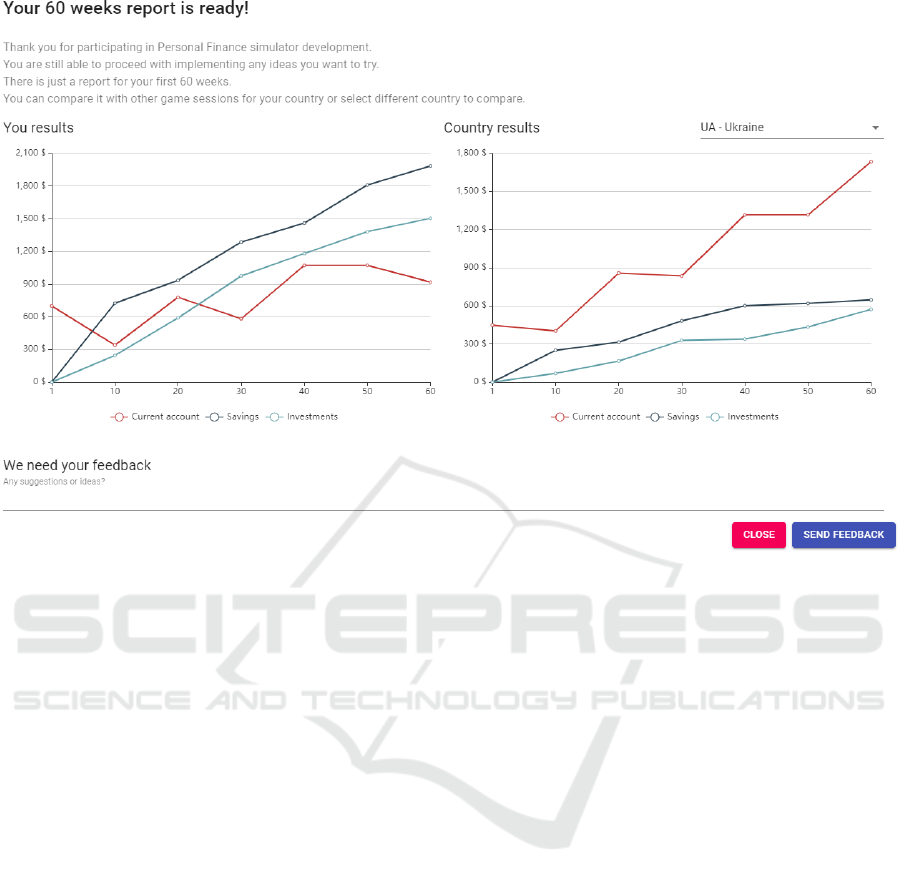

Upon reaching the 60th week of the simulation,

the user will be shown a page where the participant

can view analytical data on the dynamics of changes

in funds on all current accounts, savings, and invest-

ments since the beginning of the simulation (figure 8).

Funds on all accounts, savings, and investments are

converted into USD and shown in one chart. On this

page, the user can compare their results with the re-

sults of other participants in their country, as well as

from other countries, in addition, they can share their

thoughts or ideas about the simulator by filling in the

field at the bottom of the page.

The Methodology for Using a Business Simulator with Elements of Machine Learning to Develop Personal Finance Management Skills

97

Figure 8: Example of simulation results.

The use of the Simulator facilitates forming of

the following knowledge, skills, and competencies as

well as the personal attitude towards:

• Using the diversified list of currencies.

• Forming widely-acknowledged standard of emer-

gency savings and assessing readiness for longer-

term investment.

• Using basic saving and investment instruments

available in a wide range of countries such as de-

posits (deposit certificates), real estate, and busi-

ness investments. Experiencing different types of

instruments and understanding their specific.

• Debt-management and forming personal behav-

ioral attitude to using debt as constructive invest-

ment leverage.

Since this simulator was designed to develop per-

sonal finance management skills, an attempt was

made to apply machine-learning elements to make

this business simulator work even better. This re-

quires the creation of a system that could determine

for the user an effective strategy of action in the sim-

ulator because the amount of real data of simulation

participants is extremely small for analysis and iden-

tification of hidden dependencies using cluster analy-

sis. This task is suitable for those that are solved by

the latest approach in machine learning, namely rein-

forcement training.

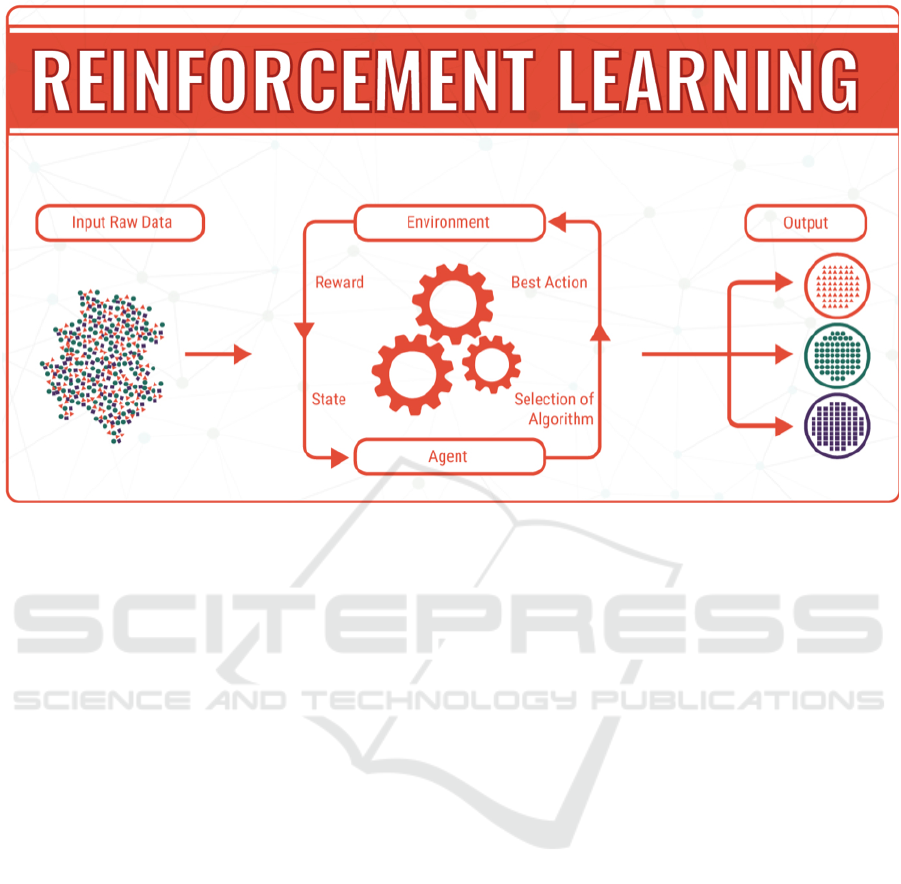

Reinforcement learning (RL) is a type of machine

learning in which the agent directly examines envi-

ronmental data, receives rewards, and sets policies for

optimal action. The goal of RL is to find the optimal

policy that maximizes the expected amount of future

rewards (Sutton and Barto, 2015).

Reinforcement learning focuses primarily on how

to obtain the optimal strategy (Sutton and Barto,

2015) (figure 9). Ideally, the system should determine

what will be financially optimal, as well as understand

what is inherent in man, given its characteristics. For

example, if a person has never used investment instru-

ments, it is not worth building a strategy for him with

too aggressive investment behavior, because it is un-

likely that a person will follow it.

Reinforcement learning includes an agent, a set of

states S, and a set of actions by states A. By acting

a ∈ A , the agent moves from state to state. Acting

in a certain state provides the agent with a reward.

The agent’s goal is to maximize his overall (future)

reward. He does this by adding the maximum reward

that can be achieved from future states to the reward

for reaching his current state, thus influencing the cur-

rent action with a potential future reward. This poten-

tial reward is the sum of the rewards of all subsequent

steps, starting from the current state.

Formally, reinforcement learning is modeled as a

Markov decision-making process (MDP). MDP pro-

AET 2021 - Myroslav I. Zhaldak Symposium on Advances in Educational Technology

98

Figure 9: The principle of operation of the model of training with reinforcement (Sutton and Barto, 2015).

vides a mathematical basis for modeling decision-

making in situations where the results are partly ran-

dom and partly controlled by the decision-maker (Put-

erman, 2008).

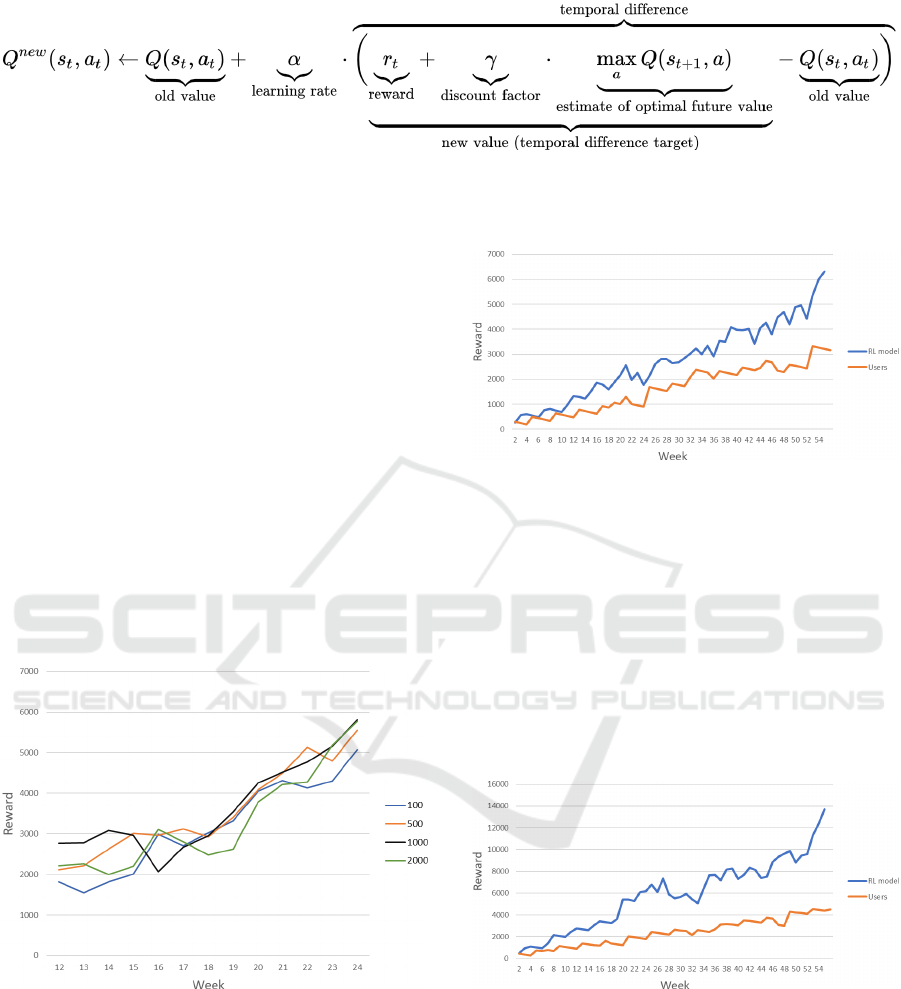

One of the algorithms of reinforcement training is

Q-learning. The purpose of Q-learning is to learn a

strategy that gives the agent information about which

step is best to perform in a particular state S.

The algorithm contains the following elements:

• r

t

the reward received in the transition from state

s

t

to state s

t+1

;

• α – the pace of learning, which determines the ex-

tent to which new information will override old

information;

• γ – depreciation ratio, which gives the effect of

valuing rewards received earlier, higher than those

received later (figure 10).

Before training, Q is initialized with an arbitrary

fixed value (selected by the programmer), for exam-

ple, 0. Then, at each point in time t, the agent selects

an action a

t

, receives a reward r

t

, moves to a new

state s

t+1

(which may depend on both the previous

state s

t

and the selected action), and table Q is speci-

fied. The core of the algorithm is the Bellman equa-

tion as a simple update of values by iteration, using

the weighted average old value and new information

(Watkins and Dayan, 1992).

As a result, the open-source library SharpRL was

chosen (Jansson, 2015). This library provides ba-

sic functionality for developing a learning environ-

ment with reinforcement based on the Q-learning al-

gorithm. The program for defining personal financial

strategies is a console application. Running this pro-

gram involves setting certain parameters, including:

• number of simulation passes in training mode;

• the number of simulations in the mode of compli-

ance with the model policy after training;

• duration of the simulation in weeks;

• monthly income and expenses of the user in a

certain currency, which will be determined as the

main currency of this user.

At the end of the training process, the screen will

display the maximum reward that was achieved dur-

ing the program; data on the user in the last week,

which include: funds in current accounts, amounts

invested in deposits and savings of the user; the best

way that was found during the operation of the sys-

tem. Each step of the path is an action that is recom-

mended for the user to perform in a particular week.

For more information, user data is displayed next to

each step after performing the specified operation.

To have more opportunities to analyze the results,

the program saves them in a CSV file, which can

be used to compare the data with data from other

launches of the program.

The generated file has only two columns: the

first – indicates the week of the simulation, the sec-

ond – the reward received by the user this week.

The Methodology for Using a Business Simulator with Elements of Machine Learning to Develop Personal Finance Management Skills

99

Figure 10: Q-learning algorithm.

As a result, the operation of the system with differ-

ent initial parameters was analyzed and it was found

that a small number of iterations is the cause of an un-

trained model, which results in unstable results. Ex-

periments were conducted and it was hypothesized

that the optimal ratio of initial parameters, namely:

the number of simulation passes in the training mode

and the number of simulation passes in the mode of

adherence to the model policy after training, is close

to 1000. It was found that best results. After attempts

to increase these figures, the results remained within

the statistical error. For example, figure 11 shows the

result of increasing the number of training epochs to

2000, which, compared to the results of 1000 epochs,

remained almost unchanged. As a result of the study,

it was concluded that with the current set of possi-

ble actions in the system (for example, to open a de-

posit of 10% of profits, etc.), increasing the number

of training epochs does not improve the result.

Figure 11: Results with different number of epochs of train-

ing in the mode of adherence to the trained model.

To test the trained model, a method of comparing

the results of the system with the average values of

the results of the passage of real users in the devel-

oped simulator was chosen. Thus, it was decided to

take a certain period, for example, 54 weeks, and col-

lect user data using the available functionality of the

simulator. Based on the collected user data and the re-

sults of the trained model, several comparative graphs

with different indicators of income and expenses were

constructed.

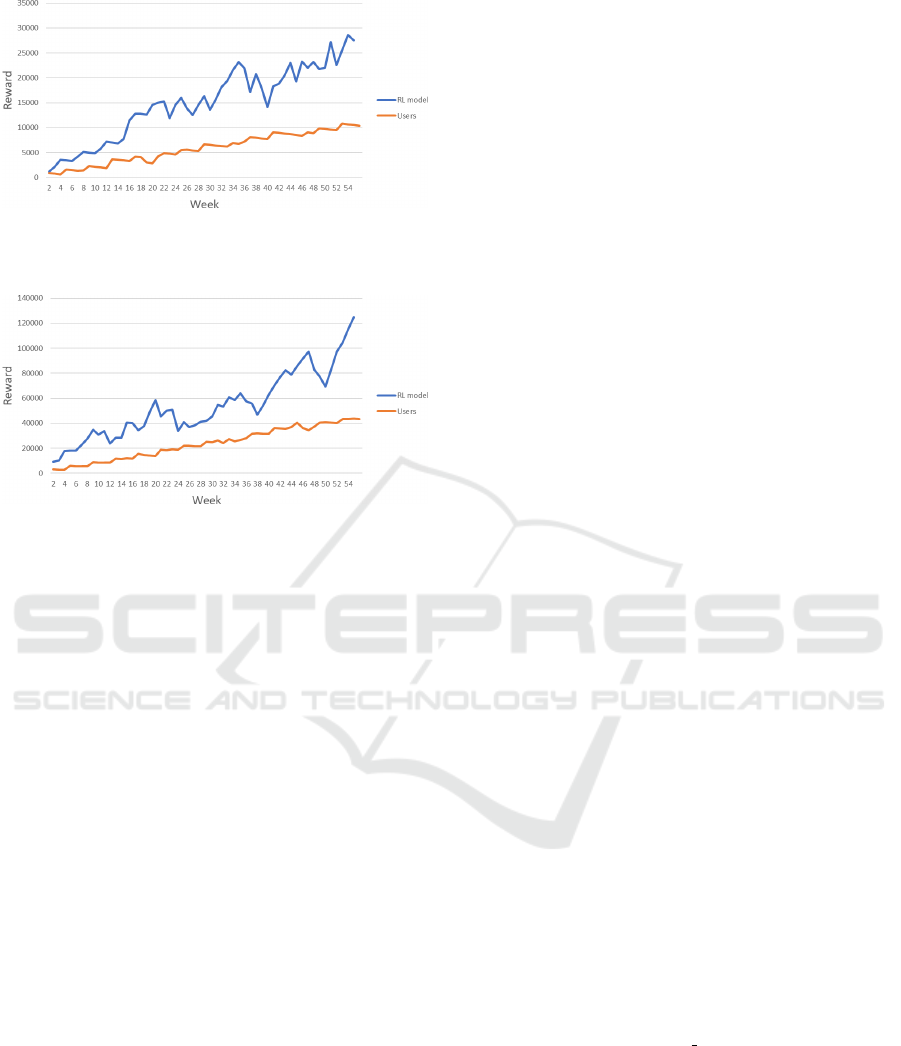

Figure 12: Comparison of model and user results with pa-

rameters of UAH 10,000. income and 6,000 UAH costs.

It was found that for 54 weeks, the system shows

consistently better results than the average results of

users who underwent the simulation. From the graph,

you can see that the performance of the model is

growing from week to week, which means that the

system adapts to the environment.

After increasing the parameters of profit and ex-

penses, the difference in the graphs becomes more

significant in favor of the trained model. This is

shown in figure 13, 14, 15.

Figure 13: Comparison of model and user results with pa-

rameters of UAH 15,000 income and UAH 9,000 costs.

Jumps can be seen in the graph showing the re-

sults of the reinforcement learning model. They can

be seen more often on charts where higher incomes

and a large difference between income and expenses.

This is the effect of specific rules that are described

to train the model so that the virtual agent system

follows the best path. For example, if an agent has

opened a deposit for 3 months, after this period the

deposit will be closed automatically and this closing

AET 2021 - Myroslav I. Zhaldak Symposium on Advances in Educational Technology

100

Figure 14: Comparison of the results of the model and

users with the parameters of UAH 30,000 income and UAH

15,000 costs.

Figure 15: Comparison of the results of the model and users

with the parameters of UAH 100,000 income and 30,000

UAH costs.

of the deposit will significantly affect the user’s re-

ward for this week. However, the system learns and

“understands” where to invest or save. As a result,

this leads to sharp increases in performance, as seen

in the graphs. In the graphs responsible for the results

of real users, such behavior is not observed, which in-

dicates the ignorance of users with effective ways to

manage personal finances within the developed simu-

lator.

3 CONCLUSIONS

Currently, economic processes are a new topic for re-

search into the possibilities of applying the full po-

tential of machine learning. Scientists from around

the world are just making the first attempts to repro-

duce such processes programmatically to use artificial

intelligence to find solutions and answer various eco-

nomic questions of humanity.

The proposed developed software package con-

sists of two parts: a personal finance management

simulator and a system for determining effective fi-

nancial strategies, which uses reinforcement learning

opportunities.

The proposed simulator can be used in the future

to teach the elements of personal finance management

to people who are not sufficiently knowledgeable in

the field of such finance. Moreover, the web appli-

cation can be useful even for school-age children, so

the simulator can complement the educational process

within the economic courses not only in higher edu-

cation institutions but also in secondary education in-

stitutions of Ukraine.

The prospects for further research include testing

the effectiveness of the proposed simulator of per-

sonal finance as a learning tool.

When constructing a methodology for using a

business simulator with elements of machine learning

to develop personal finance management skills, it is

advisable to take into account: various types, scopes,

methods of placement, and purposes of using busi-

ness simulators. The use of a business simulator with

elements of machine learning is expedient and con-

tributes to an increase in the efficiency of the educa-

tional process, the formation of personal finance man-

agement skills, and also forms a steady cognitive in-

terest in students in educational activities. The appli-

cation of the author’s methodology will improve and

supplement the educational process in higher educa-

tion by including a business simulator with elements

of machine learning.

In addition, the prospects for further study include

the selection of different simulators of this type, the

possibility of using simulators of this type to develop

the managerial and financial competencies of students

in various specialties, as well as the development of

an appropriate methodology and testing its effective-

ness. In the future, we plan to develop guidelines for

teachers on using a business simulator with elements

of machine learning to develop personal finance man-

agement skills in the educational process of higher ed-

ucation.

REFERENCES

(2020). Personal finance. https://financesimulator.

azurewebsites.net.

Antoniuk, D., Vakaliuk, T., Didkivskyi, V., and Vizghalov,

O. (2020). The need to develop a personal fi-

nance management simulator. Innovative peda-

gogy, 24(2):208–212. http://www.innovpedagogy.od.

ua/archives/2020/24/part 2/43.pdf.

Antoniuk, D., Vakaliuk, T., Yanchuk, V., and Yakobchuk,

A. (2019). Review of software tools for planning per-

sonal finances. In Collection of materials of the VII

All-Ukrainian Scientific and Practical Conference of

Young Scientists ”Scientific Youth-2019”, pages 105–

107. Comprint.

Antoniuk, D. S., Vakaliuk, T. A., Didkivskyi, V. V., and

Vizghalov, O. (2022a). Development of a simula-

tor to determine personal financial strategies using

machine learning. In Kiv, A. E., Semerikov, S. O.,

The Methodology for Using a Business Simulator with Elements of Machine Learning to Develop Personal Finance Management Skills

101

Soloviev, V. N., and Striuk, A. M., editors, Pro-

ceedings of the 4th Workshop for Young Scientists in

Computer Science & Software Engineering, volume

3077 of CS&SESW 2021, pages 12–26. CEUR Work-

shop Proceedings, CEUR-WS.org. https://ceur-ws.

org/Vol-3077/paper02.pdf.

Antoniuk, D. S., Vakaliuk, T. A., Didkivskyi, V. V.,

Vizghalov, O., Oliinyk, O. V., and Yanchuk, V. M.

(2022b). Using a business simulator with elements

of machine learning to develop personal finance man-

agement skills. In Ermolayev, V. A., Kiv, A. E., Se-

merikov, S. O., Soloviev, V. N., and Striuk, A. M., ed-

itors, Proceedings of the 9th Illia O. Teplytskyi Work-

shop on Computer Simulation in Education (CoSinE

2021) co-located with 17th International Conference

on ICT in Education, Research, and Industrial Appli-

cations: Integration, Harmonization, and Knowledge

Transfer, volume 3083 of CoSinE 2021, pages 59–

70. CEUR Workshop Proceedings, CEUR-WS.org.

https://ceur-ws.org/Vol-3083/paper131.pdf.

Farashahi, M. and Tajeddin, M. (2018). Effectiveness of

teaching methods in business education: A compari-

son study on the learning outcomes of lectures, case

studies and simulations. The International Journal of

Management Education, 16(1):131–142. https://doi.

org/10.1016/j.ijme.2018.01.003.

Hern

´

andez-Lara, A. B., Serradell-L

´

opez, E., and Fit

´

o-

Bertran,

`

A. (2019). Students’ perception of the im-

pact of competences on learning: An analysis with

business simulations. Computers in Human Behav-

ior, 101:311–319. https://doi.org/10.1016/j.chb.2019.

07.023.

Jansson, A. (2015). SharpRL: Reinforcement learning

library for .NET. https://github.com/svenslaggare/

SharpRL.

Korgin, N. A. (2015). Introduction to theory of control in

organizations for kids via interactive games. IFAC-

PapersOnLine, 48(29):289–294. https://doi.org/10.

1016/j.ifacol.2015.11.250.

Lusardi, A. (2019). Financial literacy and the need for fi-

nancial education: evidence and implications. Swiss

Journal of Economics and Statistics, 155(1):1. https:

//doi.org/10.1186/s41937-019-0027-5.

Lusardi, A., Michaud, P.-C., and Mitchell, O. S. (2017).

Optimal financial knowledge and wealth inequality.

Journal of Political Economy, 125(2):431–477. https:

//doi.org/10.1086/690950.

Palan, S. (2015). GIMS—Software for asset market exper-

iments. Journal of Behavioral and Experimental Fi-

nance, 5:1–14. https://doi.org/10.1016/j.jbef.2015.02.

001.

Puterman, M. L. (2008). Markov decision processes: Dis-

crete stochastic dynamic programming. John Wiley &

Sons, Inc. https://doi.org/10.1002/9780470316887.

Sutton, R. S. and Barto, A. G. (2015). Reinforcement learn-

ing: an introduction. The MIT Press, Cambridge,

2nd edition. https://web.stanford.edu/class/psych209/

Readings/SuttonBartoIPRLBook2ndEd.pdf.

Urban, C., Schmeiser, M., Collins, J. M., and Brown, A.

(2020). The effects of high school personal financial

education policies on financial behavior. Economics

of Education Review, 78:101786. https://doi.org/10.

1016/j.econedurev.2018.03.006.

Watkins, C. J. C. H. and Dayan, P. (1992). Technical Note:

Q-Learning. Machine Learning, 8(3):279–292. https:

//doi.org/10.1023/A:1022676722315.

AET 2021 - Myroslav I. Zhaldak Symposium on Advances in Educational Technology

102