The Impact of Chinese Energy OFDI on Energy Imports Trade

Xiaomei Han

*

and Yu Deng

Industrial economics and regional development research, China University of Petroleum (East China) School of Economics

and Management, 266580, China

Keywords: Energy, Outward foreign direct investment, Import trade, Static panel model.

Abstract: This paper selects the fixed effect and random effect methods. It uses the data of Chinese energy OFDI

(outward foreign direct investment) and energy imports to build a static panel, and empirically tests the import

trade effect of Chinese energy OFDI. The results show that the impact of Chinese energy OFDI on energy

import trade is positive. The specific influencing factors are embodied in the amount of foreign direct

investment in energy and the GDP of the host country. For high-income countries, energy investment from

China and the distance between the two nations play a significant role in promoting Chinese energy import.

For non-high-income countries, energy investment from China and GDP pushes forward an immense

influence on energy import. Therefore, in terms of foreign direct investment in energy, China should continue

to increase investment; in terms of investment location selection, enterprises in related fields should first

consider the GDP of the host country and the distance between nations.

1 INTRODUCTION

The sustainable growth of the national economy and

the guarantee of political and military security depend

on the stable energy supply. (

Liu & Li, 2018) In the

past decade, Chinese energy consumption has grown

at an average rate of 3.9%, ranking first in energy

consumption. However, with the increase of use, the

gap between domestic production and imports is

becoming more and more significant, the energy

dependence on foreign countries is increasing, and

the stability of energy supply has been improving in

recent years. (

Cheng & Yuan, 2015) In terms of

external energy dependence, according to China

Statistical Yearbook 2018, the ratio of Chinese energy

import to primary energy production in 1990 was only

1.26%. But in 2015 and 2016, the rate reached

21.42% and 25.93%, respectively. In 2018, Chinese

energy dependence on foreign countries was 21%, up

1% year on year. According to the BP World

Statistical Yearbook, Chinese energy dependence will

reach 23% in 2035. In such a domestic environment,

Chinese enterprises' foreign direct investment in

energy has become an important measure to improve

the national energy security pattern and open up

international markets.

In the past decade, with more and more

enterprises "going global", China has achieved

extensive expansion of OFDI stock and scope while

profoundly participating in the international energy

market. According to the national data of the National

Bureau of statistics from 2009 to 2017, the stock of

OFDI in Chinese energy production and supply

industry and manufacturing industry was only about

US $2.256 billion and the US $40.58 billion in 2009,

respectively, reaching US $24.99 billion and the US

$157.67 billion in 2017. With the steady growth of

Chinese energy OFDI, the promotion of the "one belt

and one way" initiative has become a new opportunity

for Chinese enterprises to take an in-depth part in the

energy market, (Yang & Wang, 2018) and its growth

will not change. (Gusarova , 2019) In terms of

energy production, Central Asia, West Asia, and

North Africa are rich in energy resources. In terms of

energy consumption, East Asia and Europe connected

by the "one belt and one-way initiative" are important

energy consumption areas in the world. Under the

international background of a good cooperation

situation, the integration of Chinese enterprises into

the world energy pattern has become a meaningful

way to realize the upgrading of the global value chain

and industrial chain.

Combined with various indicators such as

bilateral geographic distance, host country's

economic level, and energy factors, Chinese energy

OFDI investment has diversified in location selection,

Han, X. and Deng, Y.

The Impact of Chinese Energy OFDI on Energy Imports Trade.

DOI: 10.5220/0011358300003355

In Proceedings of the 1st International Joint Conference on Energy and Environmental Engineering (CoEEE 2021), pages 77-81

ISBN: 978-989-758-599-9

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

77

mainly including Australia, Brazil, Britain, Canada,

Ethiopia, India, Indonesia, Iraq, Kazakhstan, Laos,

Malaysia, and other countries. Through the analysis

of investment motivation, the location choice of

Chinese overseas energy investment has the obvious

motivation of resource seeking, and economic

development level seeking, the institutional distance

between the host country and China harms investment

location. (

Yang & Wang, 2018) Has OFDI in energy

in the past decade promoted Chinese energy import?

At the same time, considering the heterogeneity of the

host country's development level, does Chinese

energy OFDI also have heterogeneity in the impact of

bilateral energy trade?

2 LITERATURE REVIEW

There are two kinds of theoretical views on OFDI and

trade effect. That is, some scholars think that OFDI

and business are naturally complementary, while

others believe that complex dynamic interaction is the

real connection between them. According to the

above point of view, Mundell (1957) thinks that the

relationship between investment and export trade

takes the form of mutual substitution. Chiappini

(2012) tested the data of 11 European countries and

concluded that OFDI is complementary to exports.

Ouyang, Zhou, and Guan (2019) from the theoretical

point of view, taking Chinese enterprises as the

analysis object, studies that OFDI has trade

complementary effect. Liu et al. (2016) believe that

the trade effect of OFDI varies with its development

stage. Some scholars think that the trade effect of

OFDI varies with the host country. Wang, Tian, and

Xie (2014) believed that in terms of export trade,

OFDI to emerging economies showed a significant

role in promoting; OFDI to resource-rich countries

showed a positive correlation with imports and

exports. Li and Che (2019) believed that Chinese

OFDI exerts an enormous function on the export of

capital goods and technology goods. Zhang (2012)

found that for host countries with abundant resources,

Chinese OFDI has significant effects on promoting

import and export trade, followed by Chinese OFDI

for developed countries.

In the middle of the 20th century, the research of

OFDI began to involve energy. Venables (1999) and

others analyzed Chinese participation in Central

Asia's oil resources. They believed that China would

make a large amount of energy investment in the

region in consideration of future economic growth

and geopolitical issues. Ramasamy, Yeung, and

Laforet (2010) consider that Chinese energy OFDI is

more diversified in terms of investment location

selection by considering the host country and

enterprise factors.

To sum up, the current academic research on

OFDI mainly focuses on the trade effect of overall

investment, while the research on the home country's

import effect of different industries is less. In terms of

energy supply, Chinese energy security is becoming

increasingly severe. Based on the above

considerations, this paper takes 2009-2018 energy

OFDI related data as the starting point. It uses the

static panel model to evaluate the impact of the

Chinese energy industry OFDI on the energy import

of the home country.

3 MEASUREMENT MODEL AND

DATA

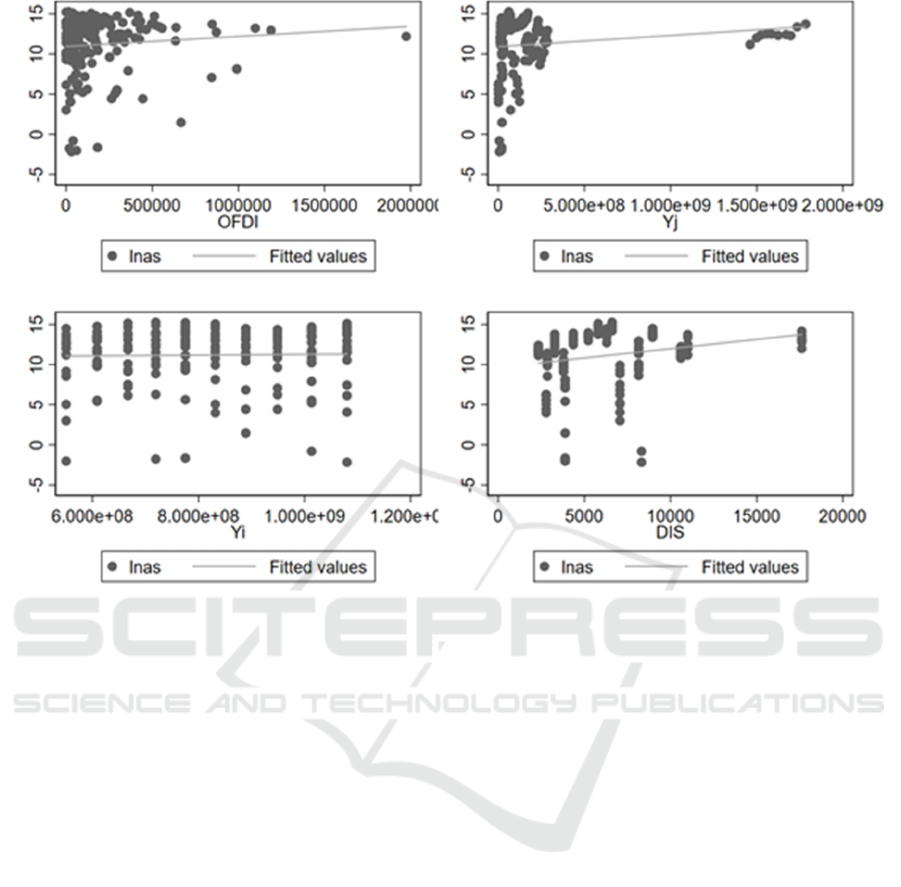

Firstly, this paper analyzes the correlation between

Chinese total energy import and its influencing

factors by using stata15.0 and draws a quadratic fit

between independent variables and dependent

variables (see Figure 1). Besides

i

Y

, the other

variables show a positive slope of the quadratic fitting

line, indicating a positive correlation between

Chinese OFDI and Chinese total energy import.

Although the scatter diagram cannot fully explain the

specific relationship between dependent variables

and independent variables, the chart still shows that

there is a clear correlation between the selected

relevant variables and Chinese total energy import.

The specific situation also needs to be discussed in

the next step through the measurement model.

CoEEE 2021 - International Joint Conference on Energy and Environmental Engineering

78

Figure 1. Correlation between total energy import of China and its influencing factors.

3.1 Model Construction

ln𝐴𝑆

,

𝛽

,

𝛽

ln𝑌

,

𝛽

ln𝑌

,

𝛽

ln𝐷𝐼𝑆

𝛽

ln𝑂𝐹𝐷𝐼

,

𝑢

(1)

3.2 Measurement Method

Given the time correlation and cross-section

correlation of the data, this paper selects panel data to

study the relationship between Chinese energy OFDI

and energy import. Because there are differences in

the level of economic development of different

countries and restrictions on the number of samples,

this paper adopts the static panel model. At present,

the academic circles mainly take fixed effect and

random effect models for panel data processing. For

careful consideration, this model uses both fixed

force and random effect to make an econometric

estimation.

According to the difference in income, this paper

divides the data into three groups of samples: All

countries, High-income country and Non-high-

income countries. The results are presented in table 1.

The p-value of the Hausman test is higher than 0.05,

which shows that the estimation of random effect is

appropriate, whether it is a population sample, a high-

income sample, or a non-high-income sample.

3.3 Selection of Variables and Data

Sources

Taking ten years (2009-2018) as the time scale and

considering the continuity of investment, 18 countries

are selected as the research objects. The specific

countries are Australia, Brazil, the United Kingdom,

Canada, India, Indonesia, Iraq, Laos, Malaysia,

Vietnam, Pakistan, the Philippines, the Russian

Federation, Saudi Arabia, Ethiopia, Turkey,

Kazakhstan, and the United States. According to the

world bank classification standard, this paper divides

the national data into high-income samples and non-

high-income samples. Besides, the sources of

relevant indicators are as follows:

(1) Chinese total energy import data comes from

the United Nations COMTRADE database, in which

Chapter 32, chapter 33, chapter 34, and chapter 35 of

sitrev. 3 are used for energy import, with a unit of

USD 10000. Considering the inflation, this paper

deals with the import data in constant US dollars

(2010 = 100).

The Impact of Chinese Energy OFDI on Energy Imports Trade

79

(2) The size of the country and represent the size

of the home country and the size of the host country,

respectively, which is expressed in terms of real GDP

(2010 = 100) obtained through constant price

processing. Its data source is the WDI database, and

the unit is USD 10000.

(3) Distance (DIS), the GeoDist DataBase is

selected as the primary source of data, and the

kilometer is the unified unit.

(4) Chinese outward foreign direct investment

(OFDI) selects the stock data of energy OFDI in

"China Global Investment Tracker" (Only consider

problem-free transactions). The data is processed at a

constant price in 10000 US dollars (2010 = 100).

4 EMPIRICAL TEST AND

RESULT A NALYSIS

Six groups of regression results can be obtained by

estimating the random and fixed effects of the total

samples and two groups of subsamples. Among them,

all countries are models 1 and 2, high-income

countries are models 3 and 4, and non-high-income

countries are models 5 and 6. See table 1 for the

specific results.

Note: Standard errors in parentheses * p < 0.05, ** p

< 0.01, *** p < 0.001. The value in brackets below

the coefficient is the standard error; FE and RE

represent fixed effect model and random effect model

respectively.

Based on the data of Chinese energy OFDI and

host countries from 2009 to 2018, this paper uses a

static panel as the research model to conduct

empirical analysis. The results verify that its energy

OFDI drives Chinese energy import trade.

Specifically, first of all, compared with Chinese GDP

and the geographical distance between two nations,

energy OFDI and the host country's GDP have a more

significant energy import effect. Secondly, the sub-

sample analysis results show that for high-income

countries, compared with Chinese GDP, energy

investment from China, and the gap between the two

nations have a significant role in increasing Chinese

energy import. For non-high-income countries,

compared with the distance between two nations and

Chinese GDP, energy investment from China and its

GDP have significant effects on promoting Chinese

energy import.

The conclusion of this paper points out the direction

for China to better integrate into the world energy

market in the next step. First, we will continue to

increase investment in OFDI. This study shows that

OFDI in energy plays a decisive role in promoting

Chinese trade and import. The current international

background is the anti-globalization of trade and the

increasing dependence of Chinese energy on foreign

countries. Increasing Chinese OFDI in energy is

conducive to promoting energy trade cooperation

between China and other countries, eliminating trade

barriers, and providing more policy options for

Chinese stable energy supply. Second, in the selection

of

investment locations, relevant enterprises should

Table 1. Regression results of static panel model of Chinese energy OFDI.

Explanatory

variable

All countries High-income country Non-high-income countries

RE(1) FE(2) RE(3) FE(4) RE(5) FE(6)

lnofdi 0.2599

**

0.2513

***

0.3754

**

0.1473 0.3286

**

0. 2988

**

(0.1115) (0.1085) (0.1883) (0.1030) (0.1526) (0. 1504)

ln𝑌

0.4134

**

-2.1456

***

-0.0417 -7.5951

*

1.7667

**

-1.4310

(0.5619) (1.8272) (0.2705) (4.2659) (0.7356) (2.531)

ln

𝑌

0.4606 02.5110

***

1.8120

**

4.4086

***

-0.2086 1.9600

(0.6162) (1.1537) (0.9520) (1.5507) (0.8656) (1.8152)

lndis -1.71609 -4.5167

***

-2.4273

(1.800) (1.5732) (2.1896)

_cons -12.1323 -4.7515

***

13.0904 66.5801 0.4370 -8.2592

sigma_u 3.1103 7.0028 0 8.6036 3.5965 6.3238

sigma_e 1.3276 1.3276 0.6711 0.6711 1.5310 1.5310

rho 0.8459 0.9653 0 0.9940 0.8466 0.9446

Hausman 0.3154 0.8358 0.8412

CoEEE 2021 - International Joint Conference on Energy and Environmental Engineering

80

focus on the factors of GDP of the host country and

distance between two nations. For high-income

countries, we should focus on the bilateral

geographical distance between the host country and

China, while for non-high-income countries, the GDP

of the host country should be the primary

consideration.

REFERENCES

Cheng, Z., & Yuan, Z. (2015). The duration of china's

energy imports based on survival analysis. Import trade

effect and type discrimination of energy OFDI: a

systematic GMM Estimation Based on structural

gravity model. World economic research, (11), 11.

Chiappini, R. (2012). Offshoring and export performance in

the european automotive industry. Larefi Working

Papers, 16(4), 322-341.

Gusarova, S. (2019). Role of china in the development of

trade and fdi cooperation with brics countries. China

Economic Review.

Liu, H., & Li, X. (2018). The duration of china's energy

imports based on survival analysis. Resources

Science,40 (07),1438-49.

Liu, Z., Xu, Y., Wang, P., & Akamavi, R. (2016). A

pendulum gravity model of outward fdi and export.

International Business Review,25(6), 1356-1371.

Li Y., & Che L. (2019). The structural effect of trade

products of Chinese OFDI: an analysis based on

national heterogeneity. Journal of Hubei University

(Philosophy and social sciences edition), 46(04), 8.

Mundell, R. A. (1957). International trade and factor

mobility. The American Economic Review, 47(3), 321-

335.

Ouyang Y., Zhou D., & Guan H. (2019). Analysis of the

impact and mechanism of bilateral trade on Chinese

enterprises OFDI based on the microdata of Chinese

Listed Companies. International economic and trade

exploration, 35(2), 13.

Ramasamy, B., Yeung, M., & Laforet, S. (2010). China's

outward foreign direct investment: location choice and

firm ownership. Journal of World Business, 47(1), 17-

25.

Venables, A. J. (1999). Fragmentation and multinational

production. European Economic Review, 43(4-6), 935-

945.

Wang, S., Tian, T., & Xie, D. (2014). Study on the trade

effect of China's foreign Direct investment. World

Economic Studies, (10), 80-86+89.

Yang X, & Wang, Q. (2018). Location orientation of

overseas energy investment of Chinese Enterprises:

resource endowment, development level or institutional

distance. Economic and management research, 39

(06),122-34.

Zhang L. (2012). The influence of China's foreign direct

investment on import and export trade. Academic

communication, (7), 4.

The Impact of Chinese Energy OFDI on Energy Imports Trade

81