Arbitrage on European Energy Markets

Pavel Sedláček

Masaryk University, Faculty of Economics and Administration, Brno, Czech Republic

Keywords: Electricity, Arbitrage, Commodity Markets.

Abstract

: Aim of this paper is to present arbitrage opportunities within chosen European energy commodities,

specifically electricity sold on German, Polish, French, Slovak, Czech, Italian, Hungarian markets. As the

main product was chosen BL CAL+1 – electricity future of next year delivery. Energy exchange market

correlations and differentials are calculated and compared with the costs related to transfer of the commodity.

Final possible profit as well as risks (and related possible loses) are expressed. All possible arbitrage options,

country law, tax and market specifics are considered. Final conclusion whether the arbitrage is possible, how

difficult it is to find such situations is stated, as well as the formula, which variables are necessary to focus on

for time arbitrage calculation based on various data inputs.

1 INTRODUCTION

Recent situation in energetics correspond with

globalization trend in other sectors. Energy futures

are sold in centralized commodity exchanges across

European countries, for example commodity

exchange EEX (European Energy Exchange) covers

electricity futures from most European countries

(Austria, Belgium, Bulgaria, Czech Republic, the

Netherlands, France, Great Britain, Germany,

Greece, Hungary, Italy, Scandinavia (Denmark,

Finland, Norway, Sweden), Poland, Romania, Serbia,

Slovakia, Slovenia, Spain and Switzerland and most

recently Japan). Nevertheless those products are with

financial settlement only, so that the traders use them

for hedging their products to avoid risks and then

when financial settlement is over, they buy the

electricity on spot market (in case of Czech Republic

it is traded on OTE (the Czech electricity and gas

market operator) operating daily electricity market).

This market runs as a blind auction, and if the subject

is not successful in this auction, there is possibility to

furthermore adjust volumes on intraday market (with

higher spread and lower liquidity) or to be charged

the missing purchase volume with final imbalance

price. This final imbalance price depends on final

situation of system imbalance, whether the subject

imbalance is the same sign of number as system

imbalance, regarding this is the subject charged with

imbalance price or receives the counter-imbalance

price.

What this information means in praxis?

Commodity exchange products are only tool to avoid

bigger losses and make hedging, but it is not a place

providing the traders opportunity to get real future

deliveries. This tool is to be used only avoiding risk,

that the price of current fixed contracts multiplies

within the period before delivery. After purchase of

this future, current price is financially cleared with the

purchased price, so if the price doubles at the end,

price difference between final price and purchase

price is paid buyer, but they still need to buy the real

delivery products at producers, or indirectly at OTE

daily market. Price of next year future at the yearend

has different price as price on daily market for next

days, so this cover price risks, but in previous 3 years

the spot price was more convenient than the future

price.

Also, this system brings opportunity for price

speculations, prediction usage for time arbitrages and

also but less likely arbitrages within countries. As the

price volatility increased in recent years, this is

current concern of more and more people working in

field of energetics.

2 METHODOLOGY

Is it possible to predict based on today market

changes tomorrow prices (price speculation)? Is it

possible to find arbitrage opportunities, when it is

profitable to transfer electricity across borders

Sedlá

ˇ

cek, P.

Arbitrage on European Energy Markets.

DOI: 10.5220/0011357900003355

In Proceedings of the 1st International Joint Conference on Energy and Environmental Engineering (CoEEE 2021), pages 57-61

ISBN: 978-989-758-599-9

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

57

(location arbitrage)? To answer first question,

econometric modelling above historical data is used,

to answer second, historical opportunities were

searched.

When looking for price speculation, econometric

predictions were used for determining near future and

receiving some profits from this and further assessed.

If the difference of prices today and tomorrow is

higher than the spread, the deal is profitable.

Table 1. Methods used in this model.

Purpose Method

Complexity

criterion

Predictor

engineering

PCA Variance

Predictor

preselection

Lasso

5-fold CV

error

Ridge

5-fold CV

error

RF

5-fold CV

error

Lag

determination

ARIMAX

AIC

Model

specification

ARIMAX

AIC

There were selected data time series from January

2015 to December 2019, such as electricity market

prices (BL cal+1) in Germany, Poland, France,

Slovakia, Czech Republic, Italy, Hungary, contracted

quantities per day in Czech Republic, gas prices

(NCG cal+1 and cal+2), LGO (light gas oil), oil, coal

and uranium, prices of emission allowances,

information about daily electricity production by

source and prices on spot electricity market of that

day, exchange rates of CZK/EUR and EUR/USD,

weather data (temperature, sunshine and wind), day

of week, stock exchange indexes (PX and DAX),

stocks of ČEZ and EON (Czech and German

electricity trading and distributing companies).

Several drawbacks like multicollinearity,

autocorrelation, missing values, necessity to detect

high number of irrelevant variables and debatable

stationarity, are to be expected. Regarding satisfying

satisfy stationarity assumption, one day differences

was used. As notable from Table 1, Lasso and Ridge

are maintaining linear structure shared with

ARIMAX models. Last method - Random Forests –

was chosen for endurance against different scales,

multicollinearity and autocorrelation thanks to

random sampling from data common to all bagging

algorithms. (Pedregosa, 2011) Also, as a CART

based method, RF are able to deal with missing

observations by surrogate splits. (Greene, 2000)

Multicollinearity would be expected in financial

markets setting, Principal Components Analysis

(PCA) was used to orthogonalize some of the

predictors exhibiting high correlation as well as to

engineer new predictors with potentially higher

prediction power (

Hastie, 2003). Reducing our

feature space by mentioned methods, ARIMAX

assess variable relevance better (Hyndman,2019). It

is suitable for ability to take full advantage of non-

trivial link between past and present values and for

interpretability and transparency common to all linear

models. Prediction on strictly independent test sample

was developed, accurately assessing model’s

prediction abilities.

When searching for location arbitrage

possibilities, analytical methods and comparison are

used.

3 RESULTS

3.1 Time Electricity Arbitrage

(Statistical)

When looking for time arbitrage, time series that

might affect electricity future were chosen from

various fields and as well as their possible delay, so

that it would be possible to predict on their behalf and

thus gain profit.

Table 2. Econometric modelling output.

Coal spot

price

Germany

DAX

index

NCG

Germany

cal+2

Weather -

temperature

Coal

index

(NL)

-0.0052 4e-04 0.2178 0.0148 0.0679

s.e.

0.0016

1e-04 0.0766 0.0050 0.0144

sigma^2 estimated as 0.1672: log likelihood=-423.4

Table 3. Confusion matrix.

Obs.

Pred.

0 1

0 107 75

1 62 104

CoEEE 2021 - International Joint Conference on Energy and Environmental Engineering

58

Results of this econometric modelling in table 2

and table 3 is possibility to predict tomorrow price

increase (based on today data) with 62 % chance,

decrease with 59 %. This percentage seems a bit low,

nevertheless using this strategy should be profitable

in long term period. Final significant predicators for

tomorrow electricity future price are today change in

coal prices (reflecting that highest volume of

electricity in Czech republic is produced in coal

power plants, DAX (German stock index reflecting

German economy), weather forecast for tomorrow

(°C) and long-term gas contract price. We must

consider not only the spread “gap”, but also the fact,

that this tool is only 10 % better then coincidence. R

squared value would be around 0,1 explaining that 90

% is coincidence and we predict remaining 10 %., so

therefore the model is very unstable, the key

indicators and number can change within time, so

they would have to be updated very often for

commercial use. Even this might produce profits due

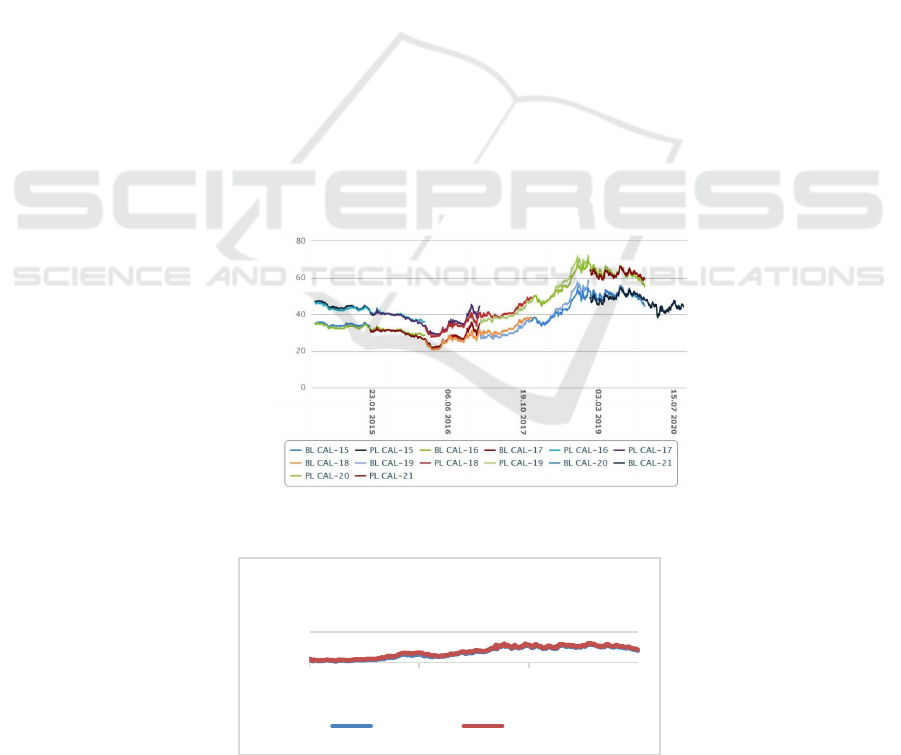

to high volatility as presented below on Figure 1.

3.2 Location Electricity Arbitrage

Every country in Europe has different electricity

price. There is possibility to buy product at different

country and buy border transfer (transferring real

commodity, so real delivery contract only, no

financial settlement products). This service is

operated by JAO company (jao.eu), running as an

auction. On this auction there are used mostly daily,

monthly and yearly products. If the bidder is

successful (demand meets supply), there is allocated

volume to be transferred. The winner does not have

to use the whole volume (it is right to transfer, not

obligation).

When looking on historical final data to answer,

whether the transfer option is convenient and it is

possible to gain better price using foreign future price

and transfer option than domestic future, historical

data from JAO were used. There is only one auction

for yearly product for following year.

For example:

CZ->SK 26.11.2019 for 2020 at 1,36 EUR/MWh,

price differential of this day at EEX: 48,56 –> 44,8 =

-3,76

SK->CZ 26.11.2019 for 2020 at 0,03 EUR/MWh,

price differential of this day at EEX: 44,8 –> 48,56 =

3,76

DE->FR 14.12.2018 for 2019 at 6,34 EUR/MWh,

price differential of this day at EEX: 50,93 –> 63,65

= 12,72

FR->DE 14.12.2019 for 2019 at 0,71 EUR/MWh,

price differential of this day at EEX: 63,65 –> 50,93

= -12,72

Price [EUR/MWh]

Figure 1. Electricity price historical data (CZ cal+1) (PRE, 2020)

Figure 2. CZ and SK market price historical differences for CAL20.

25,00

75,00

2016/12/29 2017/12/29 2018/12/29

CAL20 CZ and SK market

CAL20 CZ CAL20 SK

Arbitrage on European Energy Markets

59

From data in figure 2 is obvious, that some

transfers are more convenient than other, nevertheless

to make this deal and gain profit from it, there have to

by some conditions fulfilled. The company must have

status of electricity trader in both countries (necessary

license in both countries), excessive volumes of

electricity, that the company really needs to transfer

and consume in different country, or to have a buyer

of real commodity in this country. Only transferring

to other country because of low transfer price and

then selling the volumes on daily markets would be

extremely risky. There is current trend, that spot

prices are lower than future prices (but this can of

course change).

To get real settlement future the first step would

be contract with an electricity producer willing to sell,

which would be further used for transfer. This real

product is not hard to get, but it comes with

guarantees and prepayments from the side of

powerplant owner. Guarantees and prepayments are

inevitable, as if the company buying the contract for

next year goes into insolvency, there would be a not

hedged delivery and loss would be on side of supplier

(difference of settled and current price).

This means it would be more convenient if the

delivery in other country is really needed in another

branch of same company, then just buying the product

for speculation on price difference. But even this

scenario is possible – after calculating price

difference in countries, nominating willingness to

transfer between those countries for price lower than

this difference, and if bid is successful, buying

product in one country and look for buyer in another.

To sum up, As the products on EEX or PXE

(Power Exchange Central Europe) are financial only,

but border transfer rights are real deliveries, so it is

not possible to think about buying financial product,

buying border transfer (real) and sell it on another

market as financial product. Nevertheless attendance

of the auction is important for companies selling real

product on several markets, so they can take

advantage and transfer their own volumes (produced

at their powerplants or bought from partner

powerplants via bilateral contracts) to other countries

and avoid higher price differences than transfer fee.

Taxes are another thing to be mentioned. As the

condition is that the company must have branches and

license in both countries, this trade is basically selling

the volumes (revenues) at price raised by transfer

costs (costs –> revenues) from one company (from

one branch) to another (costs). There is no VAT

between electricity traders. This trade seems

straightforward, but we can imagine situation, when

in the portfolio of Czech company are several

purchases with different price. Company decides to

transfer part of it to branch in Slovakia, choses some

exact deal that transfers (with additional costs)

abroad. As the company has chosen some cheap

purchase, potential profit was thus transferred from

Czech Republic to Slovakia. In Czech Republic is

corporate profit tax 19 %, meanwhile in Slovakia is

15 % (for smaller entities). Profit was realized in

Slovakia when the electricity was sold to Slovak

households and 4 % were saved on taxes.

3.3 Other Arbitrage Options in

Energetics

There is time to time another possibility of arbitrage

in energy sector such as Euro-Asian LNG (liquefied

natural gas) arbitrage in 2019. In this case it was

convenient to transfer LNG on tankers, but this

window usually closes quickly, as the market reacts

on the arbitrage possibility with price reduction the or

the arbitrager fills the gap. (Zawadzki, 2019)

When looking for arbitrage opportunities, Balkan

countries are in the field of energies said to be last

haven, but also this gap is closing. (Flášar, 2016)

Considering time arbitrage via real instrument,

accumulator and pumped-storage power plants can be

mentioned. The principle of consuming electricity at

off-peak hours and delivering at peak hours is more

and more popular, in case of accumulators, the

investment return rate is getting under 10 years,

resulting in future wider usage and production.

(technickytydenik.cz, 2020)

4 CONCLUSIONS

The time arbitrage is possible and easiest way is

purchasing futures (EEX – financial settlement) and

sell it later, but the chance of success of prediction

tool is 62:38, the price difference must exceed

buy-sell spread, the model is very unstable and also it

is connected with fees paid to the commodity

exchange. If the company needs to buy some volumes

anyway to final customers portfolio, they can make

purchases regarding to this model prediction, if they

are successful, they can sell some volumes with

immediate profit, if not, they can hold those volumes

as final real delivery prices (thus receive smaller

profits in next year).

Location arbitrage is only reachable for product

with real settlement and is convenient only if the

volumes transferred via borders are consumed by the

company branch or if there is a buyer willing to buy

straight ahead, otherwise it would be too risky to wait

CoEEE 2021 - International Joint Conference on Energy and Environmental Engineering

60

on final prices on daily market. The transfers are with

restricted capacities, which should be beard in mind

when purchasing the remaining volumes. If

successful, companies can gain here the profits from

arbitrage as well as tax benefits.

Main contribution of this paper is advice for

companies considering possibility to enter another

market as well as all people working on research on

factors having impact on electricity prices and market

behaviour. Main conclusion is knowledge, that we

can partially predict tomorrow electricity prices, what

factors have impact, that the model is keen for

frequent changes and that having branches abroad can

gain profits to companies trading electricity.

ACKNOWLEDGEMENTS

The support of the Masaryk University internal grant

No. 2182 is gratefully acknowledged.

REFERENCES

Akumulátory by potřebovaly nový zákon (2020)

(accumulators would need new law) [online]. 29.6.2020

[cit. 2020-08-20]. Available at:

https://www.technickytydenik.cz/rubriky/energetika-

teplo/akumulatory-by-potrebovaly-novy-

zakon_50639.html

Flášar, P., Fousek, J., Jícha, T., Kabele, R., Kanta, J. et al.

(2016). Trh s elektřinou: úvod do liberalizované

energetiky, (The electricity market: introduction in

liberalized energetics) Asociace energetických

manažerů.

Greene, W. H. (2000). Econometric Analysis. Prentice Hall

Inc.

Hastie, T. R., Tibshirani, R., Friedman, J. H. (2003). The

elements of statistical learning: data mining, inference,

and prediction. Corrected ed. New York: Springer.

Hyndman, R., Athanasopoulos, G., Bergmeir, C., Caceres,

G., Chhay, L., O'Hara-Wild, M., Petropoulos, F.,

Razbash, S., Wang, E., Yasmeen, F. (2019). forecast:

Forecasting functions for time series and linear models.

Software, R package.

Pedregosa, F., Varoquaux, G., Gramfort, A., Michel, V.,

Thirion, B. et al. (2011). Scikitlearn: Machine Learning

in Python. JMLR 12.

PRE [online]. 2020 [cit. 2020-09-10]. Dostupné z:

https://www.pre.cz/cs/velkoodberatele/vyvoj-cen/

Zawadzki, S. (2019). European gas prices exceed Asian

spot LNG, shuts arbitrage. Reuters [online]. 15.7.2019

[cit. 2020-06-28]. Available at:

https://www.reuters.com/article/us-global-lng-

europe/european-gas-prices-exceed-asian-spot-lng-

shuts-arbitrage-idUSKCN1UA1L6

Arbitrage on European Energy Markets

61