Board Political Connection Effect on Downward Earnings

Management

Arniati

1

, AnAn Chiu

2

and Shaio Yan Huang

3

1

Department of Management Business, Politeknik Negeri Batam,

Ahmad Yani Street, Kota Batam, Kepulauan Riau, 29461, Indonesia

2

Department of International Business, Feng Chia University,

100, Wenhua Road, Xitun District, Taichung City, 40724 Taiwan

3

Department of Accounting & Information Technology, National Chung Cheng University,

168, Section 1, Daxue Road, Minxiong Township, Chiayi County, 62102 Taiwan

Keywords: board political connection, downward earning management, investor protection

Abstract: This study examined whether political connections effect on earnings management, in a new investigation of

political connection Indonesia's companies on downward real earnings management. Using data in two

periods President of Indonesia, this study provided empirical support that the connected firms tend to

underperform earning, using downward earnings management. This study also exhibits that the level of

earnings management for the connected firms before or after the President change in 2014 is different because

there have been changes in the minority investor protection policy.

1 INTRODUCTION

This study investigates the impacts of political

connection on earnings management strategy in

Indonesia. Political connections have more benefits to

the firm, especially to achieve outcomes that serve the

firm's perceived interests (Song, Nahm, & Zhang,

2017). One of the advantages is to manage profit,

which was identified by the lower quality of earnings

information on companies that have political

connections for countries with higher political

connection and corruption (Chaney, Faccio, &

Parsley, 2011). Agency conflicts in a politically

connected firm affect the reporting of poor-quality

accounting information (Chaney et al., 2011; Faccio,

2010; Ramanna & Roychowdhury, 2010). They

suggested that the firms perform earning management

activities to managing political cost, such as a

donation for an election and cost of debt if the firm

lender is a government-owned bank. Riahi Belkaoui

(2004) also suggested that firms dominated by

political influences tend to report lower quality

financial information to avoid intervention. The

protection from politicians leads to connected

1

Global Intelligence Alliance (GIA) is the partner for

organizations seeking to understand, compete and grow in

international markets.

companies to deliberately hide and obscure financial

information to benefit them at the expense of

investors (Leuz, Nanda, & Wysocki, 2003).

Utilize accrual, or real earnings management

would be maximized through coordinate the use of

both (Darrough & Rangan, 2005), especially if

managers of firms are aware of the rewards by

meeting the targets of earnings (Bartov, Givoly, &

Hayn, 2002). Variation in earnings management to

achieving the goals is not only for accrual-based

earnings management, but also for real earning

management (Kothari, Mizik, & Roychowdhury,

2016; Zang, 2012). However, there is a uniform

impact of political connection with earnings

management, while political and economic

conditions in each country are different.

Indonesia provides a particularly suitable setting

for examining the role of political connection for

earning management strategy. Indonesia is one of the

top five emerging market countries from 2012 to

2017 from Global Intelligence Alliance

(https://www.m-brain.com)

1

.

Political connections are commonplace in

Indonesia, and politicians tend to have a significant

Arniati, ., Chiu, A. and Huang, S.

Board Political Connection Effect on Downward Earnings Management.

DOI: 10.5220/0011312500003255

In Proceedings of the 3rd International Conference on Applied Economics and Social Science (ICAESS 2021), pages 155-165

ISBN: 978-989-758-605-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

155

influence on the firms (Faccio, 2010; Fisman, 2001).

Fisman (2001) proves that well-connected firms will

suffer more, relative to less-connected firms, in

reaction to a Suharto health rumor. It suggested that

more political connections in Indonesia with Suharto

in the Suharto era and after the fall of Suharto.

The relation between political officers and

business elites provides opportunities for businesses

to use political connections to extract economic rents.

Indeed expropriation of investor rights is carried out

by connected firms (Leuz et al., 2003). Previous

research discussing the political connection in

Indonesia uses the degree of political dependence on

the Soeharto family (e.g., Leuz and Oberholzer-Gee

(2006); Nys, Tarazi, and Trinugroho (2015)).

Political dynamics after Soeharto's era were changed

dramatically, become decentralized systems, multi-

party, and lost composition of parliament from the

military faction (Marcus Mietzner, 2013; Ruland &

Manea, 2013; Ziegenhain, 2016). It's exciting to study

political connection in Indonesia after Suharto's era,

especially since Yudhoyono's era because ideally,

civilian-military relation in national politics has been

since President Yudhoyono (Sebastian, 2013).

However, limited researches discuss the effect of

political connection on earning management in

Indonesia with a focus on earnings management.

Although Habib, Muhammadi, and Jiang (2017a)

investigated about political connections on earnings

management in Indonesia. However, they examined

the impact of the connections only on accrual

earnings management. Therefore, we will investigate

more detail using real earning management.

This study contributes to the political connections

literature. It extends previous researches to discuss

the effect of political connections on downward

earnings management in Indonesia in two presidential

periods, using real earning management. Downward

earning management is possible because companies

expect benefits from the government, such as subsidy

or tax incentives, form the government (Jiang, Hu,

Zhang, & Zhou, 2018).

This paper collects data of the Indonesia listed

firm through the Osiris database and Indonesia Stock

Exchange website from 2007 to 2017, where there are

different political and social environments through

two elections and one presidential change, i.e.,

Yudhoyono and Joko Widodo era. This research

suggests that firms with another kind of political

connections in Indonesia have a different impact on

accrual and real earnings management. The results

show that firms with political connections are more

likely to downward real earnings management.

The remainder of this paper was organized into

four following sections. In the second section, the

researchers describe the institutional background and

develop a hypothesis. The third section discusses the

sample and methodology. The fourth section presents

an empirical analysis results. The fifth section

presents the conclusion.

2 INSTITUTIONAL

BACKGROUND AND

HYPOTHESIS DEVELOPMENT

2.1 Political Connections in Indonesia

There is a famous and long political turmoil in

Indonesia starts from Suharto's time (1966-1998).

After that, there are short tenures of President

Habibie, President Abdurrahman Wahid, and

President Megawati that ended in 2004 (Indonesia-

Investments, 2017). Suharto constructed a secure

government, centralized, and military-dominated

government and Indonesia experienced significant

economic growth. Hence, the political condition in

Indonesia was strongly influenced by the President

Suharto era (Ruland & Manea, 2013). However,

Suharto is the most corrupt leader in modern history

(Transparency_International, 2004). Which caused

the economy and politics in Indonesia after Suharto

entered the reform era. Starting from Abdurrahman,

after that replaced by Megawati (Honna, 2003).

Political stability then appears to emerge under

President Yudhoyono from 2004 to 2014. To achieve

political stability, President Yudhoyono appointed

members of other parties to his cabinet. The new

political era after President Yudhoyono is President

Joko Widodo from 2014 to 2019. As a president in

the freedom of information era, President Joko

Widodo has implemented more corporate governance

issues, such as budget transparency, law enforcement,

and eradicating corruption (Indonesia-Investments,

2017).

The political connection may be changed in the

new president era because new policy from the

government will increase protection to investment in

Indonesia. The lower protection of investors

associated with lower quality of earning, indicated by

an increase of earnings management (Boonlert-U-

Thai, Meek, & Nabar, 2006; Houqe, van Zijl,

Dunstan, & Karim, 2012; Leuz et al., 2003).

Moreover, Enomoto, Kimura, and Yamaguchi (2015)

suggested that managers in countries with stronger

investor protections tend to engage in real earnings

ICAESS 2021 - The International Conference on Applied Economics and Social Science

156

management instead of accrual earnings

management. Habib et al. (2017a), by using a more

specific type of political connection in Indonesia,

their study provided that connected companies in

Indonesia more likely to engage accrual earning

management through related party transactions.

2.2 Political Connections and Earnings

Management

Accrual earnings management occurs when managers

choose accounting policies to achieve earnings

objectives (Dechow, Sloan, & Sweeney, 1995; Jones,

1991). Real earnings management occurs when

managers perform actions that change the timing or

structuring of operation and diverge from regular

business activity, such as manipulating sales,

reducing discretionary expenditures, and

overproducing inventory to obtain certain earnings

(Roychowdhury, 2006). Earning management

strategy, i.e., accrual-based and real earnings

management can be implemented with various

conditions, such as investor protections in a country

(Boonlert-U-Thai et al., 2006; Degeorge, Ding,

Jeanjean, & Stolowy, 2013; Enomoto et al., 2015;

Irani & Oesch, 2016).

Real earnings management is considered to be

more expensive than accrual-based earnings

management (Graham, Harvey, & Rajgopal, 2005;

Kim & Sohn, 2013), and it has an impact on cash

flow (Gunny, 2010). Moreover, real earnings

management is more difficult to detect than accrual

earnings management because it affects cash flows,

not under an existing auditing system, and not subject

to extensive controls and external monitoring by

society (Kim & Sohn, 2013; Wongsunwai, 2013).

Therefore, the firms with lower investor protection

tend to engage accrual earning management because

less costly (Enomoto et al., 2015; Irani & Oesch,

2016). On the contrary, firms with high pressure from

internal and external factors are more likely to

employ real earning management because of more

confidentiality (Kim & Sohn, 2013).

Agency conflicts in a politically connected firm

affect the reporting of poor-quality accounting

information (Chaney et al., 2011; Faccio, 2010;

Ramanna & Roychowdhury, 2010). They suggested

that the firms perform earning management activities

to managing political costs, such as a donation for an

election and the cost of debt if the firm lender is a

government-owned bank. Riahi Belkaoui (2004) also

2

The Indonesia Stock Exchange is Indonesian capital

market located in Jakarta. Before 2007, Indonesia has two

suggested that firms dominated by political

influences tend to report lower quality financial

information to avoid intervention. Moreover,

utilization of accrual-based and real earnings

management would be maximized through the

coordinated use of both (Darrough & Rangan, 2005),

especially if managers of firms are aware of the

rewards by meeting the targets of earnings (Bartov,

Givoly, & Hayn, 2002). Variation in earnings

management to achieving the goals is not only for

accrual-based earnings management but also for real

earning management (Kothari et al., 2016; Zang,

2012).

Political connection in Indonesia is increasing

from the Soeharto era to Joko Widodo era, although

with different patterns. The increasing of

entrepreneurs involved in politics and the decline in

military function in politics in Indonesia in recent

years has caused different patterns and impact of

political connection in Indonesia firms (Fukuoka,

2013). This difference is expected to have a different

impact on earnings management in Indonesia. The

politically connected firm in Indonesia also provides

more benefit to the company, such as easy to get a

loan from a bank, tax rate treatments (Faccio, 2010;

Habib et al., 2017a; Leuz & Oberholzer-Gee, 2006;

Nys et al., 2015). Hence, this has an impact on lower

investor protection in Indonesia and no regulation

regarding the involvement of politicians in the

company business, and also there is no rule for

punishing earnings management. It is possible for the

firm decrease earning using downward earnings

management. Therefore, firms with political

connections more likely to underperform earnings

management compared to firms without political

connections. Therefore, the hypothesis that:

Ha: Firms with political connections are more likely

to downward earnings management than with non-

connected firms.

3 RESEARCH METHODOLOGY

3.1 Data and Sample

This study collects data of the Indonesian listed

companies from Osiris database and the firm's

financial reports downloaded from the Indonesia

Stock Exchange (http://www.idx.co.id/index-

En.html)

2

. We hand-collect the names and the number

of the board of commissioners, the board of director

capital market, i.e. Jakarta Stock Exchange and Surabaya

Stock Exchange. These capital market merge in 2007.

Board Political Connection Effect on Downward Earnings Management

157

from the profile of commissioners and directors

section on annual reports and financial statements.

We check the name of board members with political

connections to ensure the information of political

connections through other resources such as

government websites. For unavailable data, We

searching for news from online websites. This paper

obtains 3.625 firm-year observations or 427 firms

from 2007 to 2017, which the political connection

data and financial report data available complete in

published annual reports, with board profile and

database. The data exclude financial industry due to

the different operating system between financial and

nonfinancial industry. The data period includes Table

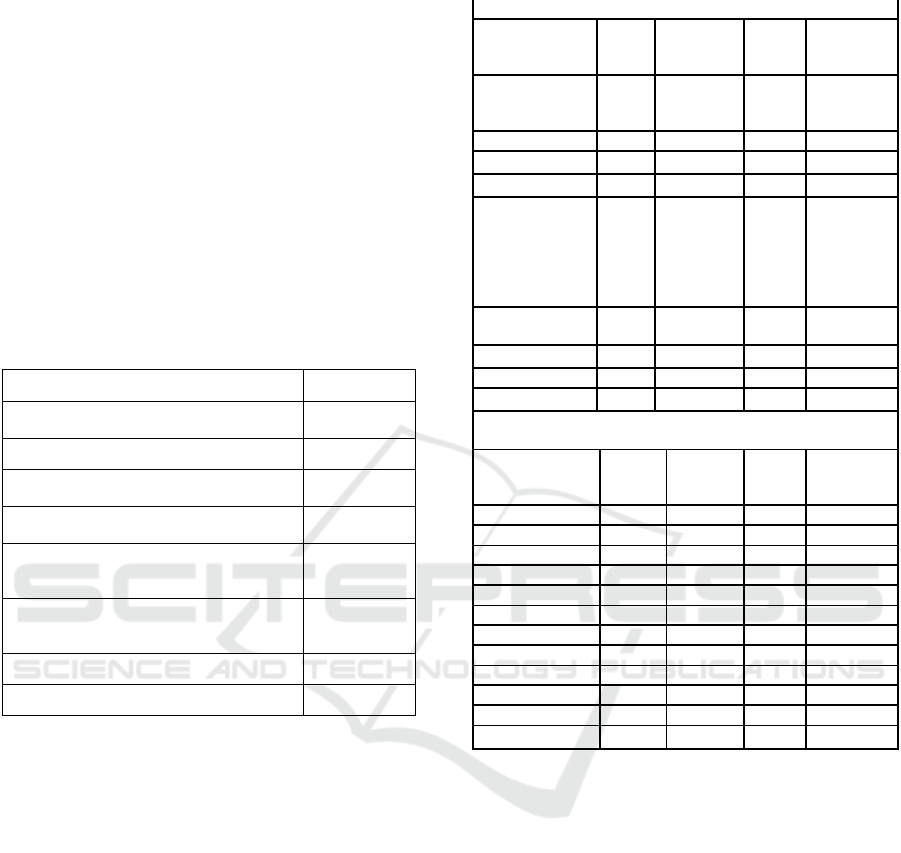

1 illustrates the sample collection process.

Table 1: Sample selection

Information Observations

All firm-year observation from 2007 to

2017

(

471 firms

)

4.721

Less:

Number of firms-year observations

financial secto

r

621

Number of firms-year observations

with a ne

g

ative book value

186

Number of firms-year observations

with missing data of dependent

variables

190

Number of firms-year observations

with missing data of other control

variables

97

Final Sample (firms-year) 3.625

Final Sample (firms) 427

Table 2 Panel A provides industry distribution of

the firm-year samples, revealing that manufacturing

industry accounts for 42.26 percent of the total firm-

year samples. SIC codes are used to classify industry.

Table 2 Panel A also reports the percentage of

political connection of the sample observations by

industry. The highest percentage is the construction

industry for 51.12 percent of total sample

observations. Table 2 Panel B shows the sample

distributions by year. Interestingly, the percentage of

political connections increase over time, from 32.62

percent in 2007 to be 42.67 percent in 2017, and

decline to be 41.87 percent in 2017 with average 39.7

percent firms-years have political connections.

Table 2: Sample distribution

Panel A: Sam

p

le Distribution b

y

Industr

y

Industry

Firm-

year

% of firm-

year/Total

fir

m

PC

Firm-

y

ea

r

% of firm-

year/indust

r

y

Agriculture,

Forestry, And

Fishin

g

128 3.53 54 42.19

Minin

g

311 8.58 156 50.16

Construction 178 4.91 91 51.12

Manufacturing 1532 42.26 460 30.03

Transportation,

Communicatio

ns, Electric,

Gas, and

Sanitary

Services

480 13.24 223 46.46

Wholesale

Trade

321 8.86 136 42.37

Retail Trade 359 9.9 179 49.86

Services 316 8.72 140 44.3

Total/Average 3625 100 1439 39.7

Panel B: Sam

p

le Distribution b

y

Yea

r

Years Firm

% of

firms/To

tal fir

m

PC

Firm

% of PC

firms/year

2007 233 6.43 76 32.62

2008 265 7.31 96 36.23

2009 281 7.75 105 37.37

2010 294 8.11 114 38.78

2011 328 9.05 131 39.94

2012 348 9.6 139 39.94

2013 367 10.12 148 40.33

2014 376 10.37 154 40.96

2015 382 10.54 163 42.67

2016 376 10.37 156 41.49

2017 375 10.34 157 41.87

Total/Average 3625 100 1439 39.7

3.2 Measuring of Political Connections

This paper measures the political conditions of

Indonesia following Faccio (2006), Fan, Wong, and

Zhang (2007) and (Cheng, 2013). The firm is defined

as politically connected (POLCON) if at least one

board of commissioner or board of director: (a) is a

current or former member of parliament or the party,

(b) is a former minister or directorate general (under

minister) or local government, and (c) is a former

army or police. This study use minister or directorate

general, because of this position has a durable power

of government. Moreover, this study uses the former

army and police as a military connection, because of

the base on history for police and army in Indonesia

came from the same institution (Marcus Mietzner,

2006; M. Mietzner, 2008).

ICAESS 2021 - The International Conference on Applied Economics and Social Science

158

3.3 Measuring of Earnings

Management

This study use real earning management as a

dependent variable. The characteristics of real

earning management are abnormally low cash flows

from operations, abnormally high production costs,

and abnormally low discretionary expenses. This

study follows Roychowdhury (2006) to estimate

abnormal levels of operating cash flows,

discretionary expenditures, and production in

equations (1), (2) and (3) as follows:

𝐶𝐹𝑂

𝐴

=𝑘

1

𝐴

+𝑘

𝑅𝐸𝑉

𝐴

+𝑘

∆𝑅𝐸𝑉

𝐴

+𝜀

.....(1)

𝐷𝐼𝑆𝑋

𝐴

=𝑘

1

𝐴

+𝑘

𝑅𝐸𝑉

𝐴

+𝜀

…………………………..(2)

𝑃𝑅𝑂𝐷

𝐴

=𝑘

1

𝐴

+ 𝑘

𝑅𝐸𝑉

𝐴

+ 𝑘

∆𝑅𝐸𝑉

𝐴

+𝑘

∆𝑅𝐸𝑉

𝐴

+𝜀

..(3)

The CFO is operating cash flows; A is total assets;

REV is net sales; ΔREV is the change in net sales;

DISX is the sum of research and development

expenses, sales expenses, general and administrative

expenses, and advertising expenses, and PROD is the

sum of the costs of goods sold and the change in

inventories. Equations (1) – (3) estimated for each

industry and year to be real earning management from

operating cash flow (REM_CFO), real earnings

management from the cost of production

(REM_PROD), and real earning management from

general discretionary (REM_DISX).

These studies follow Cohen, Dey, and Lys (2008),

Cohen and Zarowin (2010) and Braam, Nandy,

Weitzel, and Lodh (2015) to capture the aggregate

effects of real earnings management. This study

combined the three individual real earnings

management measures to create comprehensive

measures of real earnings management. The

aggregate real earning management is the amount of

the standardized variables of REM_CFO,

REM_DISX, and REM_PROD to make REM_CPD.

The higher the amount of REM_CPD exhibit that the

firm is engaged in real activities manipulation. To

investigate downward real earning managament, this

study use dummy variable. The value is 1 if a firm has

negative REM_CPD, with notation DEM.

3.4 Empirical Model

This research implements Heckman two-stage

procedure to avoid potential endogeneity of the

diversification decision. Heckman's self-selection

model without valid instrumental variables can

produce unreliable results. In the first stage of the

Heckman model, this study use the firm location

(HQ_Capital), a dummy variable coded 1 if the firm

located in the capital city Guedhami, Pittman, and

Saffar (2014). The following equation (4) is the

Heckman first-stage probit regression:

𝑃𝑂𝐿𝐶𝑂𝑁

,

=𝛼

+ 𝛽

𝐻𝑄_𝐶𝑎𝑝𝑖𝑡𝑎𝑙

,

+ 𝛽

𝑆𝑖𝑧𝑒

,

+𝛽

𝐿𝑒𝑣𝑒𝑟𝑎𝑔𝑒

,

+𝛽

𝐶𝑎𝑝𝑖𝑛𝑡

,

+𝛽

𝐺𝑟𝑜𝑤𝑡ℎ

,

+𝛽

𝑇𝑜𝑝𝑠ℎ𝑎𝑟𝑒

,

+𝛽

𝐹𝑜𝑟𝑜𝑤𝑛

,

+𝛽

𝐼𝑛𝑑𝑒𝑝𝑏𝑜𝑎𝑟𝑑

,

+𝛽

𝐵𝑖𝑔4

,

+ 𝑖𝑛𝑑𝑢𝑠𝑡𝑟𝑦 𝑎𝑛𝑑 𝑦𝑒𝑎𝑟 𝑑𝑢𝑚𝑚𝑖𝑒𝑠

+ 𝜀……………………………(4)

POLCON equals to 1 if the firm has a political

connection and 0 otherwise. The next equation is the

Original Least Squares regression. The following

model (5) is used to estimate political connections

and earning management:

𝐷𝐸𝑀

,

=𝛼

+ 𝛽

𝑃𝑂𝐿𝐶𝑂𝑁

,

+ 𝛽

𝑆𝑖𝑧𝑒

,

+𝛽

𝐿𝑒𝑣𝑒𝑟𝑎𝑔𝑒

,

+𝛽

𝐶𝑎𝑝𝑖𝑛𝑡

,

+𝛽

𝐺𝑟𝑜𝑤𝑡ℎ

,

+𝛽

𝑇𝑜𝑝𝑠ℎ𝑎𝑟𝑒

,

+𝛽

𝐹𝑜𝑟𝑜𝑤𝑛

,

+𝛽

𝐼𝑛𝑑𝑒𝑝𝑏𝑜𝑎𝑟𝑑

,

+𝛽

𝐵𝑖𝑔4

,

+ 𝑖𝑛𝑑𝑢𝑠𝑡𝑟𝑦 𝑎𝑛𝑑 𝑦𝑒𝑎𝑟 𝑑𝑢𝑚𝑚𝑖𝑒𝑠

+ 𝜀……….…………………(5)

The next equation is Heckman's second-stage

regression. This study use coefficient estimates from

the equation (6) to construct the Inverse Mills Ratio

of POLCON as a control variable in the equations (6).

The equation is:

𝐷𝐸𝑀

,

=𝛼

+ 𝛽

𝑃𝑂𝐿𝐶𝑂𝑁

,

+ 𝛽

𝑆𝑖𝑧𝑒

,

+𝛽

𝐿𝑒𝑣𝑒𝑟𝑎𝑔𝑒

,

+𝛽

𝐶𝑎𝑝𝑖𝑛𝑡

,

+𝛽

𝐺𝑟𝑜𝑤𝑡ℎ

,

+𝛽

𝑇𝑜𝑝𝑠ℎ𝑎𝑟𝑒

,

+𝛽

𝐹𝑜𝑟𝑜𝑤𝑛

,

+𝛽

𝐼𝑛𝑑𝑒𝑝𝑏𝑜𝑎𝑟𝑑

,

+𝛽

𝐵𝑖𝑔4

,

+ 𝛽

𝐼𝑀𝑅_𝑃𝑂𝐿𝐶𝑂𝑁

,

+ 𝑖𝑛𝑑𝑢𝑠𝑡𝑟𝑦 𝑎𝑛𝑑 𝑦𝑒𝑎𝑟 𝑑𝑢𝑚𝑚𝑖𝑒𝑠

+ 𝜀……….…………………(6)

Board Political Connection Effect on Downward Earnings Management

159

This research controls following variables: firm

size (Size), capital structure (Leverage), capital

intensity (Capint), and firm growth (Growth) (Chen,

Firth, & Xu, 2009; Muttakin, Monem, Khan, &

Subramaniam, 2015; Wu, Wu, Zhou, & Wu, 2012).

This study added ownership as a control variable,

such as a proportion of top shareholder (Topshare)

and foreign ownership (Forown). Topshare and

forown are essential roles in mitigating real earning

management (Guo, Huang, Zhang, & Zhou, 2015).

Researchers add a proportion of independent boards

(Indepr) and the number of the board (Board). The

Independent board provides active monitoring of

earning management and mitigated family-controlled

firms (Jaggi, Leung, & Gul, 2009). Xie, Davidson,

and DaDalt (2003) suggested that Board size related

to earnings management. We also control audit

quality using the big audit firm (Big4) because high

audit

quality reduces earning management

(Guedhami et al., 2014; Habib, Muhammadi, & Jiang,

2017b). This study also included industry dummies

and year dummies variable in the models to control

for the industry effect and year. The completion of a

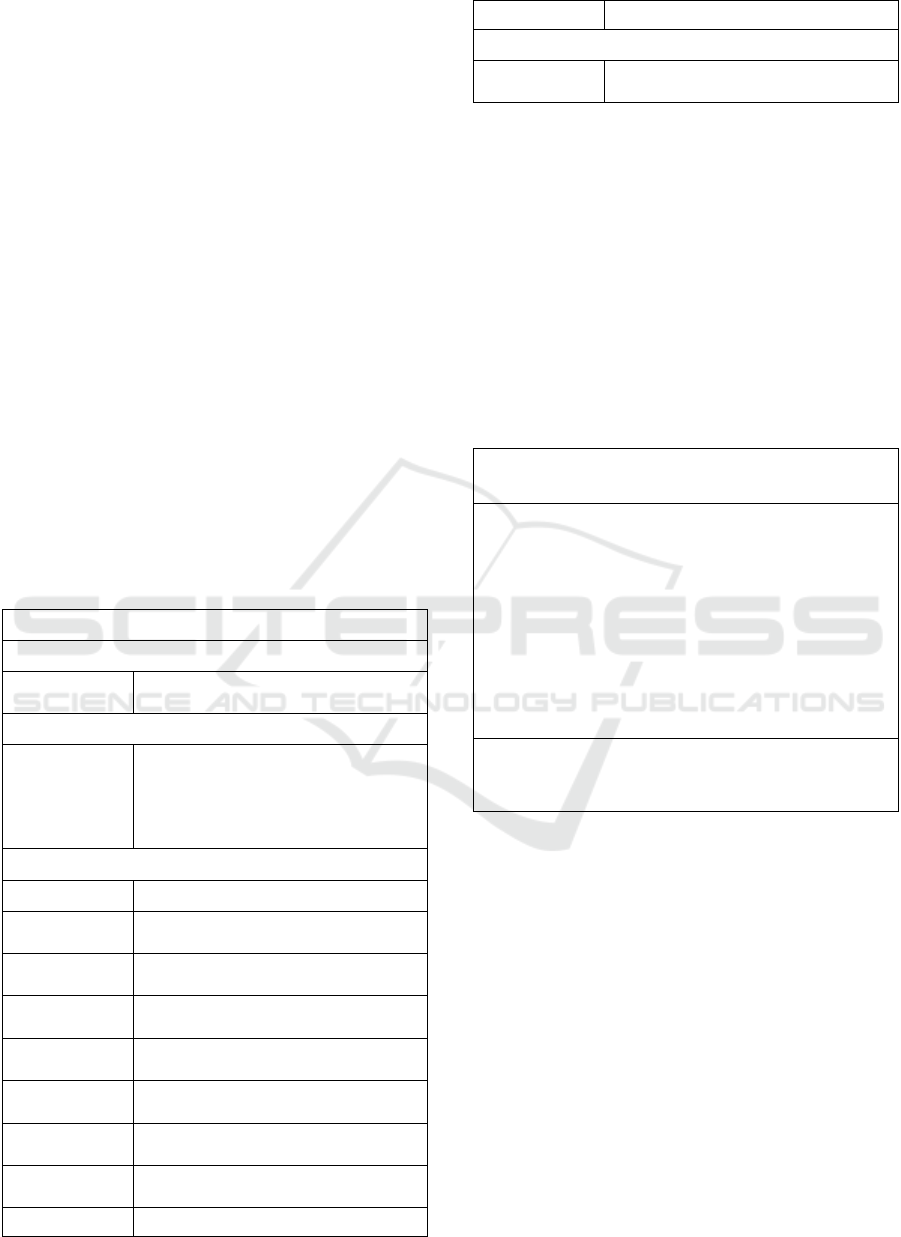

variable definition explained in Table 3.

Table 3: Variable definition

Variable

Definition

Dependent Variable (earning management proxies):

DEM 1 if the firm has a negative real earning

mana

g

ement and 0 otherwise;

Independent Variable:

POLCON 1 if board formerly or currently from

the army or police, minister, deputy,

director, or head of the division,

parliament (central or local

g

overnment

)

, and 0 otherwise;

Control Variables:

Size market capital value, log-transformed;

Leverage long-term debt divided by total assets in

y

ear t-1;

Capint Property and equipment divided by

total assets in year t-1;

Growth total sales divided by total sales in year

t-1;

Topshare percentages of the top shareholder in

the com

p

an

y

;

Forown percentages of foreign ownership in the

company;

Indepboard percentages of independent boards in

the company;

Big4 1 if the firm uses the big four public

accountants, 0 otherwise;

Year 1 if firm i is a member of year j;

Industry 1 if firm i is a member of industry j;

Selection Model Variable:

HQ_Capital 1 if the firm located in the capital city,

0 otherwise;

4 EMPIRICAL ANALYSIS

4.1 Descriptive Analysis

Table 4 presents the results of descriptive statistics.

The mean value of downward real earning

management (DEM) is 0.551. Averagely, political

connection (POLCON) is 39,7 percent of total

observations. The mean of POLCON almost the same

with corresponding data of Habib et al. (2017a).

Table 4: Descriptive statistics

Variable N

Mea

n

Media

n

Std

De

v

Min

Ma

x

DEM 3625 0.551 1 0.497 0 1

POLCON 3625 0.397 0 0.489 0 1

Size 3625 21.237 21.237 1.657 17.091 25.05

9

Growth 3625 0.232 0.106 0.795 -0.792 6.195

Leverage 3625 0.584 0.558 0.327 0.045 2.11

0

Capin

t

3625 0.406 0.358 0.303 0.002 1.59

0

MTB 3625 3.814 1.511 8.2562 0.125 62.69

6

Topshare 3625 0.515 0.510 0.221 0 1

Forown 3625 0.236 0.100 0.287 0 0.990

0

Indepboa

rd

3625 0.217 0.200 0.109 0 0.625

0

Big4 3625 0.3630 0 0.480 0 1

Notes: This table contains summary statistics for the raw

variables in our analysis. All the continuous independent

variables and control variables are winsorized at the 1

p

ercent level.

Source: SAS Output – SAS 9.4

4.2 Political Connections and

Downward Earnings

Management

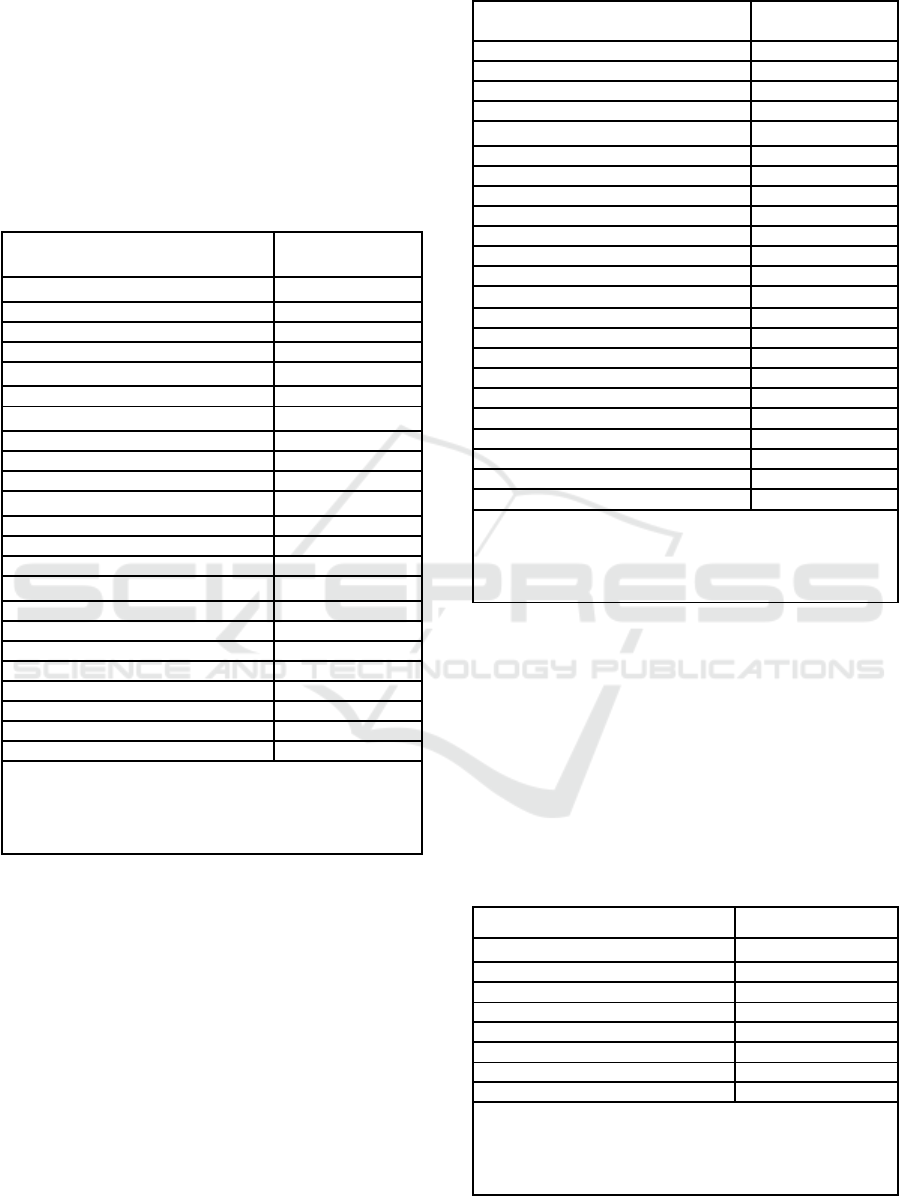

Table 5 exhibits the results of equation (5) that

political connections (POLCON) have significant

positive impacts on downward real earning

management (coefficient 0.084, t-statistic 2.29, 0.05

significant). This results support the hypothesis (Ha).

The result indicates that political connection effect on

earning management practices than those without

political connections.

The political connection is available to help the

firms in many business fields, in the form of policy or

access. The firms with political connections have

more access to financial funding, contracts with the

ICAESS 2021 - The International Conference on Applied Economics and Social Science

160

government, and preferential tax treatments

(Claessens, Feijen, & Laeven, 2008; Faccio, 2010;

Goldman, Rocholl, & So, 2013; Wu et al., 2012). The

marginal benefit for the connections is substantial to

the firm to engage in earning management (Zang,

2012). Hence, the connection is able to drive firm to

underperform their earnings. Therefore, firms with

political connections may do downward earnings

management than firms without political connections.

Table 5: Political connection and earnings management

Variable DEM

POLCON 0.084**

(

2.29

)

Size 0.067***

(

5.7

)

Growth 0.0234**

(

2.01

)

Leverage -0.379***

(

-8.25

)

Ca

p

int 0.327***

(

6.78

)

Topshare 0.100

(

1.23

)

Forown -0.026

(

-0.43

)

Indepboard -0.06

(

-0.42

)

Bi

g

4 0.024

(

0.57

)

Interce

p

t -0.853***

(

-3.33

)

Industr

y

& Year FE Y

R S

q

uare 0.1861

Num. of observation 3625

Notes: Values in parentheses are t-values clustered at

each industry year. *, **, and *** indicate significance

at the 0.10, 0.05, and 0.01 levels, respectively. All VIF

Less than 10, All continuous variables are winsorized

1 percent at each end of the distribution.

Source: SAS Output – SAS 9.4

4.3 Test of Endogeneity

This paper presents the results of Heckman first-stage

probit regression from the equation (4) and the

Heckman second-stage regression from the equation

(6) in Table 6 and 7. The results show that capital city

as headquarter (HQ_Capital) is positive with

politically connected (coefficient 0.149, t-statistic

2.24, 0.05 significant). Thus, the firm locations are

good predictors of the political connection.

Table 6: First-stage Heckman test

Variable POLCON

HQ

_

Ca

p

ital 0.149**

(

2.24

)

SIZE 0.193***

(

11.85

)

Growth -0.070***

(

-2.95

)

Levera

g

e 0.133*

(

1.88

)

Ca

p

int 0.091

(

1.14

)

To

p

share 0.589***

(

5.78

)

Forown -0.248***

(

-3.10

)

Inde

p

boar

d

0.939***

(

4.56

)

A

g

e 0.395***

-6.37

Interce

p

t -5.583***

(

-15.31

)

Industr

y

& Year FE Y

R S

q

uare 0.1058

Num. of observation 3625

Notes: Values in parentheses are t-values clustered at

each industry year. *, **, and *** indicate significance

at the 0.10, 0.05, and 0.01 levels, respectively. All VIF

Less than 10, All continuous variables are winsorized 1

p

ercent at each end of the distribution.

Source: SAS Output – SAS 9.4

After fixing the potential self-selection bias by

applying the Heckman test, the result remains the

same. Table 7 shows that political connections have

an impact on downward real earning management.

The results support (H. Fan, 2017) because the

politically connected firms have more advantages

from the connections, such as subsidy from the

government.

Table 7: The Second-stage Heckman test of Political

connection and earnings management

Variable DEM

POLCON 0.058*

(

1.79

)

IMR

_

POLCON -0.062***

(

-5.97

)

Control Variable Y

Industr

y

& Year FE Y

R S

q

uare 0.1867

Num. of observation 3625

Notes: Values in parentheses are t-values clustered at

each industry year. *, **, and *** indicate significance

at the 0.10, 0.05, and 0.01 levels, respectively. All VIF

Less than 10, All continuous variables are winsorized 1

p

ercent at each end of the distribution.

Source: SAS Output – SAS 9.4

Board Political Connection Effect on Downward Earnings Management

161

4.4 Additional Analysis

4.4.1 Political Connection and Earnings

Management in Different Political

Environment

This section splits the analysis to be two sub-periods

presidential, 2007 to 2014, as represented the

previous presidential era before the 2014 election,

and after 2014 as represented the new presidential era

after the 2014 election. It is to investigate whether the

differences in the political environment effect on

earnings management. Table 8 proves that there is a

significant impact political connection (POLCON) on

downward real earning management in Yudhoyono

era (2007-2014). However, there is no impact of

political connections in Joko Widodo era (2014-

2015).

This result suggested that the connected firms in

the new political environment are more likely to less

earning management activity because difficult to the

previous political connection to connect with the new

political era (new President and parliament) (Leuz &

Oberholzer-Gee, 2006), especially if there is a change

of President and the coalition party. Therefore,

managers with previous political connections do not

take advantage of their relation. Besides that, investor

protection in Indonesia after the 2014 election is

increasing, indicated by increasing ease of doing

business (EODB) Indonesia rank is very significant

from 120 to 72 levels from 190 countries. Therefore,

the connected firm might reduce the earning

management level after the change of investor

protection or the managers will the changes in earning

management type to accrual earning management

(Enomoto et al., 2015; Leuz et al., 2003).

Table 8: The Second-stage Heckman test of Political

connection and earnings management for two periods of

President

Variable

DEM (2007-

2014)

DEM (2015-

2017)

POLCON 0.063* 0.024

(1.68) (0.62)

IMR_POLCON -0.672*** -0.563***

(-5.847) (-4.57)

Control Variable Y Y

Industry & Year FE Y Y

R Square 0.1890 0.1728

Num. of observation 2509 1116

Notes: Values in parentheses are t-values clustered at

each industry year. *, **, and *** indicate significance at

the 0.10, 0.05, and 0.01 levels, respectively. All VIF

Less than 10, All continuous variables are winsorized 1

p

ercent at each end of the distribution.

Source: SAS Output – SAS 9.4

4.4.2 Political Connection and Real

Earnings Management

Table 9 proves that political connection significantly

impacts on negative real earning management. This

regression proves that the firm with the political

connection may engage negative real earning

management as an effort to shows lower accounting

performance.

Table 9: The Second-stage Heckman test of Political

connection and earnings management

Variable REM

POLCON -0.465***

(

-2.55

)

IMR

_

POLCON 1.593***

(

2.91

)

Control Variable Y

Industr

y

& Year FE Y

R S

q

uare 0.1977

Num. of observation 3625

Notes: Values in parentheses are t-values clustered at

each industry year. *, **, and *** indicate significance

at the 0.10, 0.05, and 0.01 levels, respectively. All VIF

Less than 10, All continuous variables are winsorized 1

p

ercent at each end of the distribution.

Source: SAS Output – SAS 9.4

5 CONCLUSIONS

This study investigates the impact of political

connections on earnings management in the

Indonesia context. The research proves that political

connections associated with earning information

quality in Indonesia. The connected firms have an

impact on downward real earning management. The

firm expects that the firm will obtain benefits from

lower-earning, i.e., tax incentives, and subsidy from

the government (Jiang et al., 2018).

Moreover, there are political environment effects

on the role of political connection with earning

management activity that is before or after the 2014

election. The political connections perform

downward earnings management in the Yudoyono

era. After 2014 election, Indonesia entered in a new

phase with new President from civilian, after 10-year

ICAESS 2021 - The International Conference on Applied Economics and Social Science

162

President from the military. The policy to increase

investor protection through law enforcement,

increasing pers freedom is able to reduce earning

management level. Hence, the manager connected

firm may reduce earning management. Other reasons

are including the cost of earning management

activities and benefit from the connection for

business.

This study implies that shareholders can consider

the advantages of having the board with good

government connections when they are selecting the

board members. Boards with good government

connections can benefit firms in several ways, such as

taxes, financing, cost strategy, or business strategy.

As for future research, researchers can further explore

different measures of political connections in

Indonesia, such as position in executive or military or

using the independent board connections. In addition,

researchers can also investigate interaction effects

that potentially influence the choices for different

earnings management strategies, such as public

monitoring, new regulation, board power, and board

ability.

REFERENCES

Boonlert-U-Thai, K., Meek, G. K., & Nabar, S. (2006).

Earnings attributes and investor-protection:

International evidence. The International Journal of

Accounting, 41(4), 327-357.

doi:https://doi.org/10.1016/j.intacc.2006.09.008

Braam, G., Nandy, M., Weitzel, U., & Lodh, S. (2015).

Accrual-based and real earnings management and

political connections. The International Journal of

Accounting, 50(2), 111-141.

doi:https://doi.org/10.1016/j.intacc.2013.10.009

Chaney, P. K., Faccio, M., & Parsley, D. (2011). The

quality of accounting information in politically

connected firms. Journal of accounting and economics,

51(1), 58-76.

doi:https://doi.org/10.1016/j.jacceco.2010.07.003

Chen, G., Firth, M., & Xu, L. (2009). Does the type of

ownership control matter? Evidence from China’s

listed companies. Journal of Banking & Finance, 33(1),

171-181.

doi:https://doi.org/10.1016/j.jbankfin.2007.12.023

Cheng, W. W. (2013). Political connections, directors'

status and auditor choice: Evidence from China. Paper

presented at the 2013 International Conference on

Management Science and Engineering 20th Annual

Conference Proceedings, Retrieve from

http://ieeexplore.ieee.org/document/6586479/.

Claessens, S., Feijen, E., & Laeven, L. (2008). Political

connections and preferential access to finance: The role

of campaign contributions. Journal of financial

economics, 88(3), 554-580.

doi:https://doi.org/10.1016/j.jfineco.2006.11.003

Cohen, D. A., Dey, A., & Lys, T. Z. (2008). Real and

Accrual-Based Earnings Management in the Pre- and

Post-Sarbanes-Oxley Periods. The Accounting Review,

83(3), 757-787.

Cohen, D. A., & Zarowin, P. (2010). Accrual-based and real

earnings management activities around seasoned equity

offerings. Journal of accounting and economics, 50(1),

2-19. doi:https://doi.org/10.1016/j.jacceco.2010.01.002

Darrough, M., & Rangan, S. (2005). Do insiders manipulate

earnings when they sell their shares in an initial public

offering? Journal of Accounting Research, 43(1), 1-33.

doi:10.1111/j.1475-679x.2004.00161.x

Dechow, P. M., Sloan, R. G., & Sweeney, A. P. (1995).

Detecting Earnings Management. The Accounting

Review, 70(2), 193-225.

Degeorge, F., Ding, Y., Jeanjean, T., & Stolowy, H. (2013).

Analyst coverage, earnings management and financial

development: An international study. Journal of

Accounting and Public Policy, 32(1), 1-25.

doi:https://doi.org/10.1016/j.jaccpubpol.2012.10.003

Enomoto, M., Kimura, F., & Yamaguchi, T. (2015).

Accrual-based and real earnings management: An

international comparison for investor protection.

Journal of Contemporary Accounting & Economics,

11(3), 183-198.

doi:https://doi.org/10.1016/j.jcae.2015.07.001

Faccio, M. (2006). Politically connected firms. The

American economic review, 96(1), 369-386. Retrieved

from http://www.jstor.org/stable/30034371.

Faccio, M. (2010). Differences between politically

connected and non-connected firms: A cross‐country

analysis. Financial management, 39(3), 905-928.

doi:https://doi.org/10.1111/j.1755-053X.2010.01099.x

Fan, Wong, T. J., & Zhang, T. (2007). Politically connected

CEOs, corporate governance, and Post-IPO

performance of China's newly partially privatized

firms. Journal of financial economics, 84(2), 330-357.

doi:https://doi.org/10.1016/j.jfineco.2006.03.008

Fan, H. (2017). Earnings Management, Politically

Connected CEOs, and Politically Connected

Independent Board Members: Evidence from China.

International Journal of Accounting and Financial

Reporting, 7(1), 291.

doi:https://doi.org/10.5296/ijafr.v7i1.11277

Fisman, R. (2001). Estimating the value of political

connections. The American economic review, 91(4),

1095-1102. Retrieved from

http://www.jstor.org/stable/2677829.

Fukuoka, Y. (2013). Indonesia's ‘democratic transition’

revisited: a clientelist model of political transition.

Democratization, 20(6), 991-1013.

doi:10.1080/13510347.2012.669894

Goldman, E., Rocholl, J., & So, J. (2013). Politically

Connected Boards of Directors and The Allocation of

Procurement Contracts. Review of Finance, 17(5),

1617-1648. doi:10.1093/rof/rfs039

Graham, J. R., Harvey, C. R., & Rajgopal, S. (2005). The

economic implications of corporate financial reporting.

Board Political Connection Effect on Downward Earnings Management

163

Journal of accounting and economics, 40(1), 3-73.

doi:https://doi.org/10.1016/j.jacceco.2005.01.002

Guedhami, O., Pittman, J. A., & Saffar, W. (2014). Auditor

choice in politically connected firms. Journal of

Accounting Research, 52(1), 107-162.

doi:https://doi.org/10.1111/1475-679X.12032

Gunny, K. A. (2010). The Relation Between Earnings

Management Using Real Activities Manipulation and

Future Performance: Evidence from Meeting Earnings

Benchmarks. Contemporary Accounting Research,

27(3), 855-+. doi:https://doi.org/10.1111/j.1911-

3846.2010.01029.x

Guo, J., Huang, P. S., Zhang, Y., & Zhou, N. (2015).

Foreign Ownership and Real Earnings Management:

Evidence from Japan. Journal of International

Accounting Research, 14(2), 185-213.

doi:https://doi.org/10.2308/jiar-51274

Habib, A., Muhammadi, A. H., & Jiang, H. (2017a).

Political Connections and Related Party Transactions:

Evidence from Indonesia. The International Journal of

Accounting, 52(1), 45-63.

doi:https://doi.org/10.1016/j.intacc.2017.01.004

Habib, A., Muhammadi, A. H., & Jiang, H. (2017b).

Political connections, related party transactions, and

auditor choice: Evidence from Indonesia. Journal of

Contemporary Accounting & Economics, 13(1), 1-19.

doi:https://doi.org/10.1016/j.jcae.2017.01.004

Honna, J. (2003). Military Politics and Democratization in

Indonesia. London/New York: Routledge.

Houqe, M. N., van Zijl, T., Dunstan, K., & Karim, A. K. M.

W. (2012). The Effect of IFRS Adoption and Investor

Protection on Earnings Quality Around the World. The

International Journal of Accounting, 47(3), 333-355.

doi:https://doi.org/10.1016/j.intacc.2012.07.003

Indonesia-Investments. (2017). Politik Indonesia.

Retrieved from https://www.indonesia-

investments.com/id/budaya/politik/item65

Irani, R. M., & Oesch, D. (2016). Analyst Coverage and

Real Earnings Management: Quasi-Experimental

Evidence. Journal of Financial and Quantitative

Analysis, 51(2), 589-627.

doi:https://doi.org/10.1017/S0022109016000156

Jaggi, B., Leung, S., & Gul, F. (2009). Family control,

board independence and earnings management:

Evidence based on Hong Kong firms. Journal of

Accounting and Public Policy, 28(4), 281-300.

doi:https://doi.org/10.1016/j.jaccpubpol.2009.06.002

Jiang, H. Y., Hu, Y. Y., Zhang, H. H., & Zhou, D. H.

(2018). Benefits of Downward Earnings Management

and Political Connection: Evidence from Government

Subsidy and Market Pricing. International Journal of

Accounting, 53(4), 255-273.

doi:10.1016/j.intacc.2018.11.001

Jones, J. J. (1991). Earnings Management During Import

Relief Investigations. Journal of Accounting Research,

29(2), 193-228. doi:10.2307/2491047

Kim, J.-B., & Sohn, B. C. (2013). Real earnings

management and cost of capital. Journal of Accounting

and Public Policy, 32(6), 518-543.

doi:https://doi.org/10.1016/j.jaccpubpol.2013.08.002

Kothari, S. P., Mizik, N., & Roychowdhury, S. (2016).

Managing for the Moment: The Role of Earnings

Management via Real Activities versus Accruals in

SEO Valuation. Accounting Review, 91(2), 559-586.

doi:https://doi.org/10.2308/accr-51153

Leuz, C., Nanda, D., & Wysocki, P. D. (2003). Earnings

management and investor protection: an international

comparison. Journal of financial economics, 69(3),

505-527. doi:https://doi.org/10.1016/S0304-

405X(03)00121-1

Leuz, C., & Oberholzer-Gee, F. (2006). Political

relationships, global financing, and corporate

transparency: Evidence from Indonesia. Journal of

financial economics, 81(2), 411-439.

doi:https://doi.org/10.1016/j.jfineco.2005.06.006

Mietzner, M. (2006). The politics of military reform in post-

Suharto Indonesia: Elite conflict, nationalism, and

institutional resistance.

scholarspace.manoa.hawaii.edu: East-West Center

Washington.

Mietzner, M. (2008). History in uniform; Military ideology

and the construction of Indonesia's past. Bijdragen Tot

De Taal- Land- En Volkenkunde, 164(4), 549-551.

Mietzner, M. (2013). Praetorian rule and redemocratisation

in South-East Asia and the Pacific Islands: the case of

Indonesia. Australian Journal of International Affairs,

67(3), 297-311. doi:10.1080/10357718.2013.788127

Muttakin, M. B., Monem, R. M., Khan, A., &

Subramaniam, N. (2015). Family firms, firm

performance and political connections: Evidence from

Bangladesh. Journal of Contemporary Accounting &

Economics, 11(3), 215-230.

doi:https://doi.org/10.1016/j.jcae.2015.09.001

Nys, E., Tarazi, A., & Trinugroho, I. (2015). Political

connections, bank deposits, and formal deposit

insurance. Journal of Financial Stability, 19, 83-104.

doi:https://doi.org/10.1016/j.jfs.2015.01.004

Ramanna, K., & Roychowdhury, S. (2010). Elections and

Discretionary Accruals: Evidence from 2004. Journal

of Accounting Research, 48(2), 445-475.

doi:10.1111/j.1475-679X.2010.00373.x

Riahi Belkaoui, A. (2004). Politically-Connected Firms:

Are They Connected to Earnings Opacity? Research in

Accounting Regulation, 17, 25-38. doi:10.1016/s1052-

0457(04)17002-1

Roychowdhury, S. (2006). Earnings management through

real activities manipulation. Journal of accounting and

economics, 42(3), 335-370.

doi:https://doi.org/10.1016/j.jacceco.2006.01.002

Ruland, J., & Manea, M.-G. (2013). The Legislature and

Military Reform in Indonesia In J Rüland, M-G

Manea & H Born (eds), The politics of military

reform: Experiences from Indonesia and Nigeria (pp.

123 - 145): Springer Heiderberg.

Sebastian, L. C. (2013). Taking Stock of Military Reform

in Indonesia The Politics of Military Reform (pp. 29-56

): Springer Springer Heiderberg

https://link.springer.com/chapter/10.1007%2F978-3-

642-29624-6_2.

ICAESS 2021 - The International Conference on Applied Economics and Social Science

164

Song, Z. J., Nahm, A. Y., & Zhang, Z. Y. (2017). Partial

State Ownership, Political Connection, and Financing:

Evidence from Chinese Publicly Listed Private Sector

Enterprises. Emerging Markets Finance and Trade,

53(3), 611-628. doi:10.1080/1540496x.2015.1097920

Transparency_International. (2004). Retrieved from

http://issuu.com/transparencyinternational/docs/2004_

gcr_politicalcorruption_en?mode=window&backgrou

ndColor=%23222222,

Wongsunwai, W. (2013). The Effect of External

Monitoring on Accrual-Based and Real Earnings

Management: Evidence from Venture-Backed Initial

Public Offerings. Contemporary Accounting Research,

30(1), 296-324. doi:https://doi.org/10.1111/j.1911-

3846.2011.01155.x

Wu, Wu, C., Zhou, C., & Wu, J. (2012). Political

connections, tax benefits and firm performance:

Evidence from China. Journal of Accounting and

Public Policy, 31(3), 277-300.

doi:https://doi.org/10.1016/j.jaccpubpol.2011.10.005

Xie, B., Davidson, W. N., & DaDalt, P. J. (2003). Earnings

management and corporate governance: the role of the

board and the audit committee. Journal of Corporate

Finance, 9(3), 295-316.

doi:https://doi.org/10.1016/S0929-1199(02)00006-8

Zang, A. Y. (2012). Evidence on the Trade-Off between

Real Activities Manipulation and Accrual-Based

Earnings Management. The Accounting Review, 87(2),

675-703 Retrieved from

http://www.jstor.org/stable/23245619.

Ziegenhain, P. (2016). Decentralisation and its impact on

the democratisation process. In M. Houg, M. Rossler,

& A.-T. Grumblies (Eds.), Rethinking Power Relations

in Indonesia: Transforming the Margins. London and

New York: Routledge.

Board Political Connection Effect on Downward Earnings Management

165