Competency and Religiosity of Internal Auditor on the Fraud

Mitigation in Indonesian and Malaysian Islamic Bank

Mohamad Heykal, Ismi Fathia Rachmi and Meiryani

Accounting Department, Faculty of Economics and Communication, Bina Nusantara University, Jakarta, 11480, Indonesia

Keywords: Competency, Religiosity, Internal Auditor, Fraud Mitigation, Malaysian Islamic Bank.

Abstract: In recent years, the occurrence of financial crimes have raised regulators’ concern for the need to manage the

consequences of these crimes. Particularly, in the context of the financial institution prior studies examining

the relation between risk management, management support, religiosity and also internal auditor competence

for fraud mitigation . This study is, therefore, made for mitigating fraud occurrence and mitigation in the

Islamic banking that located in Malaysian and also Indonesia. From this research it can be concluded that risk

management has a positive and significant effect on fraud mitigation. management support has a positive and

significant impact on fraud mitigation at banks in Indonesia and Malaysia. Religiosity has a negative and

insignificant effect on fraud mitigation in Islamic banks in Indonesia and Malaysia. Internal Auditor

Competence has a positive effect on fraud mitigation but not significant, meaning that internal auditor

competence does not always have a positive effect on fraud prevention in Islamic banking companies in

Indonesia and Malaysia.

1 INTRODUCTION

Employees’ fraudulent cases in such big corporations

as Société Générale in 2008, UBS in 2011, Wells

Fargo in 2016, and Punjab National Bank (PNB) in

2018 caused a loss of almost $6.3 billion, $2.3 billion,

and $189 million and $1.7 billion worth of heavy

fines, respectively. The Association of Certified

Fraud Examiners (ACFE), the largest anti fraud

institution in the world, reports fraud leave

organizations in losses of almost 5 percent of their

annual revenues. Computing the percentage into the

2009 Gross World Product (GWP) assessed results in

a loss of more than $2.9 trillion. Fraud cases burdened

the 2012 global economy by the increasing loss to

$3.5 trillion, and the loss reached $4 trillion in 2017.

Fraud afflict not only conventional financial

institutions but also Islamic financial institutions;

Mandiri Syariah’s 2012 fraud case, was an example.

Mandiri Syariah is one of the largest Islamic banks in

Indonesia, and it was the 2012 internal audit finding

that its four officials working in Bogor branch were

committed to criminal acts of disbursing fictitious

financing. Such financial crime was ironic, for it was

recorded by an Islamic banks whose sharia principles

and religiosity are the foundation.

The fraud committed by officials of Islamic banks

contradicts words of Allah SWT as stated in QS Al

Baqarah verse 188: "And do not bring the affairs of

your property (to) the judge by sipping it so that you

can eat the property of others in a vanity even though

you know". Indeed, QS Al Qasas verse 77 affirms

fraud is an act to cause damages. Gold pawning fraud

afflicting BRI Syariah and Mega Syariah were to

name a few of flaws recorded by Islamic banks. Non-

bank Islamic financial institutions were also in the

grip of fraud as during 2014-2015, Jakarta and Kediri-

based Islamic cooperative institutions were in the

plight of fraudulent acts. Apart from Indonesia, Ihlas

Finance House, a Turkey-based Special Finance

House filed for bankruptcy in 2001 due to violation

to prudent ethics. From 2007 to 2010, the Dubai Debt

Crisis to involve financial malfeasance worth USD1

million whose USD500 million was incurred at Dubai

Islamic Bank within one year was, and it is another

example of Islamic bank’s susceptibility to fraud.

Islamic Bank of South Africa filed for bankruptcy in

1997 with debts worth of R50-R70 million. The

lenient GCG made its officials in authority prone to

fraud and ignored poor accounting system, thereby

legitimizing the failure of sharia principles as the

strong footing for Islamic bank.

264

Heykal, M., Fathia Rachmi, I. and Meiryani, .

Competency and Religiosity of Internal Auditor on the Fraud Mitigation in Indonesian and Malaysian Islamic Bank.

DOI: 10.5220/0011246400003376

In Proceedings of the 2nd International Conference on Recent Innovations (ICRI 2021), pages 264-269

ISBN: 978-989-758-602-6

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Violations to sharia principles within Islamic

financial institutions implies that similar to their

conventional peers, they are not immune to fraud. The

lowest to the highest officials in authority abuse

prudent ethics and leave fraud mitigation

unimplemented. The fraud mitigation strengthens

best practices of sharia principles, including to

regulate the code of conduct of accountants working

in Islamic financial institutions. Under sharia

principles, Islamic financial institutions are well

aware that they hold responsibility of their actions to

the management, shareholders, and Allah Subhanahu

Wa Ta’ala. Likewise, their accountants’ awareness of

sharia principles mitigate fraud. The obedience to

sharia principles proves ones’ religiosity as the

professionals’ religiosity is significant to the success

of companies in taking fraud mitigation into

practices. The research by Arwani claims within

Islamic institutions, accountants’ religiosity

determine their self-consciousness about the

importance of holding their jobs’ responsibility to

God. Thus, albeit the physical and metal pressures to

perform internal auditing, they can thrive in

demonstrating prudent ethics. The research by

Pamungkas (Abdullah and Said, 2019) is one among

other studies discussing religions and efforts to

prevent fraud. Pamungkas elaborates the roles of

religiosity and rationalization efforts in preventing

accountants from committing to fraud. Likewise,

whose research is relevant to Islamic banking and

examines the significance of religiosity reasons

characters and profiles of employees imply their

potential for committing to fraud. Also, Pupung

Purnamasari and Ima Amaliah (2019) argue

religiosity is significant to fraud prevention.

2 LITERATURE REVIEW

2.1 Fraud Concept

Generally, the concept of fraud stems from Greek

mythology narrating the personification of deceit,

treachery, trickery and dishonesty embodying in one

of the evils contained in Pandora’s Box. The study of

fraud involves auditing, accounting, criminology,

management, and psychology. Because fraud is not a

pure accounting notion, auditors and accountants

consider fraud as a legal concept typically involving

a criminal offense. For several decades, professionals

and academicians have tried to better understanding

on the causes of deviance behavior and find

prevention and detection methods for curbing such

behavior. These decades of research underline the

popularity of “fraud examination” which combines

two distinctive disciplines: accounting and

criminology. Based on the definition from the

Association of Certified Fraud Examiners (ACFE)

cited in a book written by Tuanakotta, fraud is any of

acts against the prevailing law and intentionally

committed to specific purposes. Such acts are best

define in any commitment to manipulation and

providing inaccurate reports. Internal or external

parties of an organization may benefit from such acts

and harm others.

Islamic law states fraud as acts of cheating

conducted intentionally, thereby causing

misunderstanding (ghaban fahisy), imbalance or

(gharar), and trickery. Islamic sharia prohibits such

acts as mentioned in QS Al Baqarah verse 188 and

QS Al Mutaffifin verses 1-6. Faith and belief are

rarely considered when it comes to the discussion on

cheating. Faith is hardwired consciousness

determining humans’ deeds and has profound

impacts; humans’ deeds of avoiding any fraud

explains ones’ adherence to the faith they hold.

Islamic law emphasizes that one holds

responsibility of his job to himself and God, and the

adherence to such principle is faith bound in religion

and belief. Faith matters and may change over time as

Abu al-Hasan al-Asy'ari, one of well-known scholars

and the founder of the Ahlussunnah wal Jama'ah

aqidah states one’s faith experiences ups and down.

Faith bears good deeds and keeps one from evil

conducts, likewise good deeds strengthen one’s faith.

Surah Al-Qur'an Surah Al-Anfal verse 2 explains

"Surely believers are only those who are thrilled when

the name of Allah is called and increase their faith if

the verses are recited, and to their Lord they are trust”.

The verse proves that one’s activities may strengthen

or weaken his faith.

2.2 Risk Management

The concept of risk management remains vague in

light of its emphasis on how to manage uncertainty.

Risk management received slight attention after the

end of World War II in 1950, and it was applied for

the purpose of protecting organizations against

unexpected outcome. Although banks and other

organizations fix achievable objectives, business

environment undergoes continuous changes and faces

various risks that might threaten the achievement of

certain objectives. The high-profile scandals in the

US of 2000 coupled with the financial crisis in 2008-

2009 raised more concerns on how risk management

can improve corporate governance. Risk management

has become the agenda of both public and private

Competency and Religiosity of Internal Auditor on the Fraud Mitigation in Indonesian and Malaysian Islamic Bank

265

sectors and developed into an area of interest among

policy makers, academicians, managers, and

professionals since then. Mainly, it explains about

managing systematic and unsystematic risks.

2.3 Management Support

The top management in certain organizations,

unfortunately, hold responsibility for employees’

fraud regardless of its awareness of such

misconducts. Indeed, organizations might

unintentionally provide opportunities to such

misconducts e.g., poor internal control giving rooms

for internal or external parties who have motive to

involve in opportunistic conducts. Thus, the crooks

gains private benefit while leaving top management

and certain organizations unaccountable and

susceptible to risks. The rising bankruptcy caused by

financial scandals, management has to cope with

increasing pressures and take necessary procedures

for managing stakeholders’ interests. Furthermore,

regulators have top management take more

responsibilities for internal arrangements. For

instance, Section 404 of Sarbanes-Oxley requires

managers to monitor ICs and provide periodic reports

containing assessments of the effective practices of

IC structure.

2.4 Religiosity

Religiosity significantly influences attitudes and

values as Abiola (2009) writes religion is a greater

concept giving human a personal identity, and

therefore humans must respond to religious dogmas

established by the religion they embrace regardless of

the consequences. Alleyne and Howard (2005) states

religion, which is taken from the word religio, means

something to regulate people’s deeds, demand

obedience from its believers, and bind its believers

into certain community. Also, religiosity is a path and

goal to achieve a sacred thing. One with strong

religiosity as shown in his personal identity certainly

has significant impacts on his surrounding

environments. Al-Sawalqa (2012) explains people

who excel in religious matters including their active

engagement in religious gatherings build strong

connection with others as well. Religiosity is sacred

value to certain believers and powerfully shapes

thought, emotion and characters of the believers. The

studies of psychology and sociology acknowledges

inextricable connection among religions, religiosity,

and behavior of their believers. The study of

psychology reasons that one’s personality determines

his religiosity and abilities.

2.5 Internal Auditor Competency

Competence is defined differently, but it basically

takes in forms of skills fit with certain requirements.

Competence is significant to one’s performance and

determines one’s capability for achieving certain

goals set by the organization. Both internal and

external auditors are expected to master theory and

excel the application whenever they carry out

auditing duties with set guideline and standard. Based

on the etymological definition, competency is defined

as a set of skills, abilities, and authority. Meanwhile,

English dictionary defines competence as skills

shown by people having certain expertise or high

knowledge in a particular subject, and therefore skills

are obtained from learned knowledge and

experiences. In the accounting discipline, Akra

(2016) state that competence is an expertise

sufficiently exploitable and applicable for performing

audit process objectively. Meanwhile, Spencer

defines competence as basic characteristics possessed

by individuals, and such characteristics are needed by

individual to meet certain criteria required by a

position. Furthermore, Spencer argues competence

basically consists of 5 characteristics: existence of

motives, factors, self-concept, knowledge in a

particular field, and skills in performing tasks.

3 RESEARCH METHODOLOGY

The study techniques employed in quantitative

research include randomization, protocols, and highly

structured and administrated survey with a limited

range of predetermined responses to the sample of the

study. Having learned other research using

quantitative approach for studying Libya-based

banks’ governance on mitigating fraud, this research

also applies quantitative approach for collecting data,

analysis, accomplishing research’s objectives, and

formulating hypotheses. In addition, the quantitative

approach has higher degrees of external validity than

the qualitative approach. It means the result derived

from quantitative approach is applicable to generalize

other circumstance. Since this research applies

quantitative approach, the design of its structured

questionnaire is suitable for gathering information

given by large number of participants. This research

uses questionnaire survey to collect data, and

therefore the data can be analyzed using such

advanced and complex statistical software as SPSS or

PLS.

ICRI 2021 - International Conference on Recent Innovations

266

H1: Risk Management has significant effects on

fraud mitigation in Indonesian and Malaysian

Islamic Banks.

H2: Management Support has significant effects

on fraud mitigation in Indonesian and

Malaysian Islamic banks.

H3: Religiosity has significant effects on fraud

mitigation in Indonesian and Malaysian

Islamic banks.

H4: Internal auditor competency has significant

effects on fraud mitigation in Indonesian and

Malaysian by Islamic banks.

4 DISCUSSION AND RESULT

This research applies qualitative approach to examine

the relationship between different organizational

governance and fraud mitigation. The objects of this

research are the analysis of Indonesian and Malaysian

Islamic banks. The primary data of this research is

obtained through a survey where questionnaires are

distributed to several Islamic banks in Indonesia and

Malaysia.

The survey to involve 65 respondents results a

sample consisting of 34 Indonesian respondents and

31 Malaysian respondents. Most of the respondents to

constitute 31% of the total number are employees in

private-owned banks, 23% of employees in state-

owned banks (SOE), 20% of employees in joint-

venture banks, 18% of employees in state-owned

subsidiaries banks, and the remaining 8% of

employees in foreign banks. Of note, this survey

involves foreign banks whose 87% of the total

number are banks with more than 500 employees and

the remaining 13% to have less than 500 employees.

Furthermore, 54% of the respondents are male

employees in varied age ranges. Most of them or

equal to 37% are in the 25-30 age range, 25% of the

31-40 age range, 23% of the 41-50 age range, and the

remaining 16% male respondents categorized into

different age ranges: those who are less than 25 years

old and those who are more than 50 years old. The

respondents are professionals with varied level of

formal education. Most of the respondents earn their

bachelor degree (S1) and master degree (S2). Of note,

86% of them have more than 5-year working

experience in the banking sector; 62% of them are in

the supervisory level; and 72% of them are in the

executive level. The respondents’ education, working

experience, and official level prove their competency

in succeeding the assessments and providing inputs

related to the research’s topic.

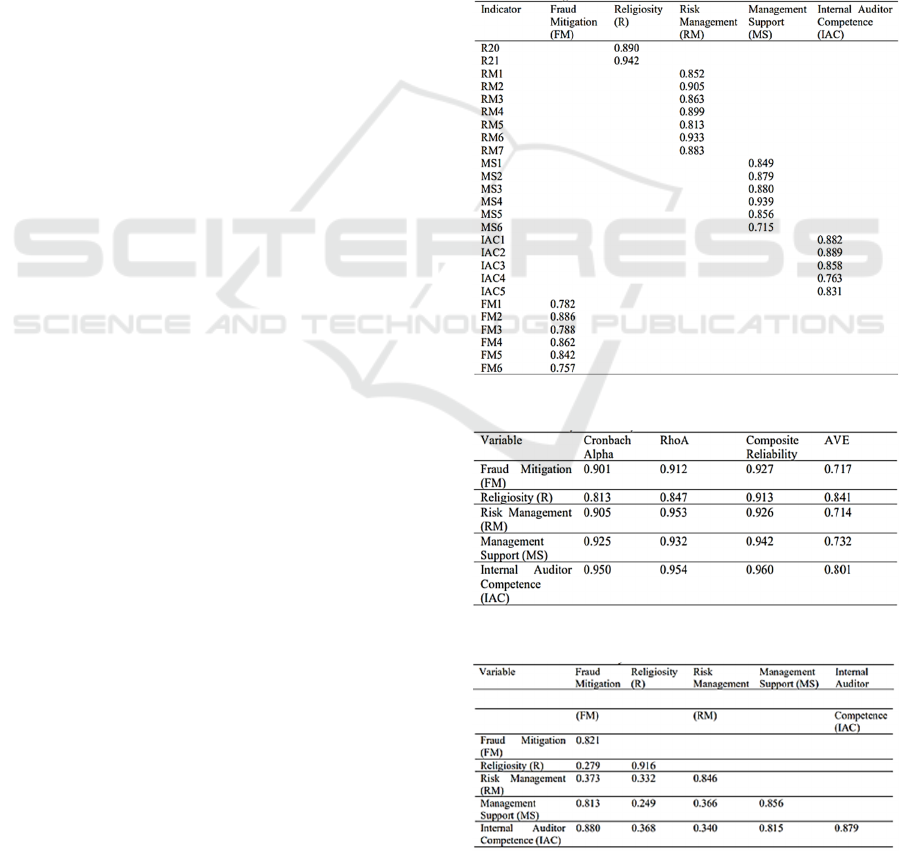

Analysis of the outer model is carried out to

ensure that the measurement used is valid and

reliable. This research uses three indicators namely

convergent validity, Discriminant validity and

unidimensionality to test the outer model. The data

processed using smart PLS results in indicators as

following R11, R12, R13, R14, R15, R16, R17, R18,

R19, R110, R11, R12, R13, R14, R15, R16, R17,

R18, R19, R22, IAC6, and FM7 with a factor loading

value below 0.7. Thus, the 22 indicators should be

removed from the model. Here are 26 indicators with

a factor loading value higher than 0.7.

Table 1: Factor Loading Indicator.

Table 2: Construct Reliability and Validity.

Table 3: Discriminant Validity.

Competency and Religiosity of Internal Auditor on the Fraud Mitigation in Indonesian and Malaysian Islamic Bank

267

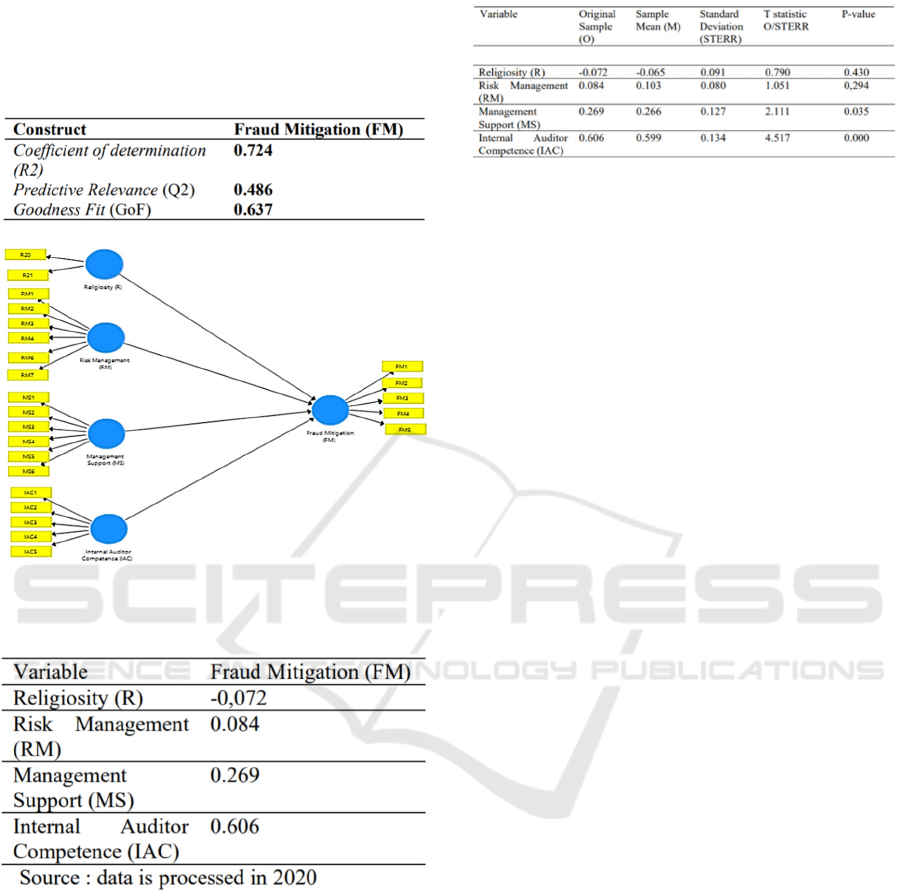

Inner model evaluation can be done by looking at

the value of the coefficient of determination (R2),

Predictive Relevance (Q2) and Goodness of Fit Index

(GoF).

Table 4: Inner Model.

Figure 1: Hypothesis testing.

Table 5: Path Coefficient.

From table 6 of the Path Coefficient, it is known

that religiosity (R) is in the range from 0 to -1,

meaning that Religiosity (R) has a negative effect

on Fraud Mitigation (FM). Meanwhile, Risk

Management (RM), Management Support (MS)

and Internal Auditor Competence (IAC) have

positive impacts on Fraud Mitigation (FM) because

the path coefficient value is in the range 0 to 1 or

positive.

Table 6: T Statistic.

The findings of this research explain that risk

management (RM) has positive and significant

effects on fraud mitigation, the findings support the

research conducted by Bento & White (2018) and

Bhasin (2015). Backed by other research’ findings,

this research strengthens the risk management (RM)

theorized by Bierstaker et al (2006), Cresswell

(2014); Gordon et al., (2009), and Hassan, (2009).

The findings of this research indicate that

management support (MS) has positive and

significant effects on fraud mitigation applied in

Indonesian and Malaysian Islamic banks. Also, the

findings imply the top management plays an

important role in mitigating fraud by means of

auditing and support the findings of research by

Holmes et al. (2002), Iffah et al. (2017),

Kanagaretnam et al. (2015); Kutluk (2017); Law

(2011); Rae et al. (2008).

The findings show that religiosity has negative

and insignificant effects on fraud mitigation in

Indonesian and Malaysian Islamic banks. In addition,

the findings opposing the research’s findings by Tack

and Kposowa (2019) explain internal auditor

competence (IAC) has positive effects on fraud

mitigation, but such effects are insignificant. It means

internal auditor competence does not necessarily have

positive effects on fraud mitigation in Indonesian and

Malaysian Islamic banks because such factor as risk

management (RM) and the role of management have

more significant effects on fraud mitigation.

REFERENCES

Abdullah, W. N., & Said, R. (2019). Audit and risk

committee in financial crime prevention. Journal of

Financial Crime, 26(1), 223-234.

Abdullatif, M., & Kawuq, S. (2015). The role of internal

auditing in risk management: evidence from banks in

Jordan. Journal of Economic and Administrative

Sciences, 31(1), 30-50.

Abiola, I. (2009). An assessment of fraud and its

management in Nigeria commerical banks. European

Journal of Social Sciences, 10(4), 628-640.

ICRI 2021 - International Conference on Recent Innovations

268

Alleyne, P., & Howard, M. (2005). An exploratory study of

auditors’ responsibility for fraud detection in Barbados.

Managerial Auditing Journal, 20(3), 284-303

Al Sawalqa, F. &. (2012). Internal Control and Audit

Program Effectiveness: Emprical Evidence from

Jordan. International Business Research, 5(9), 128.

Al-Akra, M. A.-Q. (2016). Internal auditing in the Middle

East and North Africa: A literature review. Journal of

International Accounting, Auditing, and Taxation,

26(C), 13-27.

Bento R.F. Mertins, L., & White, L. F. (2018). Risk

Management and Internal Control: A Study of

Management Accounting Practice. Advance in

Management Accounting, 30, 1-25.

Bhasin, M. L. (2015). Menace of Frauds in the Indian

Banking Industry: An Empirical Study. Australian

Journal of Business and Management Research, 4(12),

1-13.

Bierstaker, J. L., Brody, R. G., & Pacini, C. (2006).

Accountants' perceptions regarding fraud detection and

prevention methods. Managerial Auditing Journal,

21(5), 520-535.

Creswell, J. W. (2014). Research design: Qualitative,

quantitative, and mixed methods approaches: Sage

publications

El-Menouar, Y. (2014). The Five Dimensions of Muslim

Religiousity. Results of and Empirical Study. method,

data, analyses, 8(1), 53-78.

Gordon, L. A., Loeb, M. P., & Tseng, C. Y. (2009).

Enterprise risk management and firm performance: A

contingency perspective. Journal of Accounting and

Public Policy, 28(4), 301-327

Hakim, A. (2012). The Implementation of Islamic

Leadership and Islamic Organizational Culture and Its

Influence on Islamic Working Motivation and Islamic

Performance PT Bank Mu'amalat Indonesia Tbk.

Employee in the Central Java. Asia Pacific

Management Review, 17(1), 77-90.

Hasan, Z. (2009). Corporate Governance: Western and

Islamic Perspective. International Review of Business

Research Papers, 5(1), 277-293.

Hayali, A. Sarili. S & Dinc, Y. (2011). Turkish Experience

in Bank Shareholders' Fraud and Bank Failure: Imar

Bank and Ihlas Finans Case. The Macrotheme Review

A Multidiciplinary Journal of Global Macro Trends.

Holmes, S. A., Langford, M., Welch, O. J., & Welch, S. T.

(2002). Associations between internal controls and

organizational citizenship behavior. Journal of

Managerial Issues, 85-99.

Iffah, N. W. F. M. W., Said, J., Ghani, K. E., & Puspitasari,

E. (2017). Potential Employee Fraud Scape in Islamic

Banks: The Fraud Triangle Perspective. Global Journal

Al-Thaqafah (GJAT), 7(2), 79-93.

Kanagaretnam, K., Lobo, J. G., & Wang, C. (2015).

Religiousity and Earnings Management: International

Evidence from the Banking Industry. Journal of

Business Ethics, 132, 277-296.

Kutluk, F. A. (2017). Behavioral Accounting and Its

Interactions. (I. S. Gokten, Ed.) Accounting and

Corporate Reporting - Today and Tomorrow, 191-207.

Law, P. (2011). Corporate governance and no fraud

occurrence in organizations: Hong Kong evidence.

Managerial Auditing Journal, 26(6), 501-518

Lewis, M. K. (2005). Islamic Corporate Governance.

Review of Islamic Economics, 9(1).

Lunenburg, F. C. (2012). Compliance Theory and

Organizational Effectiveness. International Journal of

Scholarly Academic Intellectual Diversity, 4(1).

Maltby, J ( 1999)," The Internal Structure Of A Derived,

Revised and Amended Measure Of The Religious

Orientation Scale The Age universal, Social Behaviour

and Personality, Vol 27 pp 407-412

Maziol, S. (2009). Risk management: Protect and maximize

stakeholder value. Oracle Governance, Risk, and

Compliance, White Paper.

Mujib, A. (2017). Sharia Fraud Model: The Fraud in the

Circle Faith. The 3rd International Conference on

Economics, Business and Accounting Studies

(ICEBAS). Jember.

Mukminin, K. (2018). How Close Islamic Banks Are to

Global Fraud: Learning from Dubai Islamic Bank in the

Time of Sub Prime Crisis. European Journal of Islamic

Finance.

Rae, K., & Subramaniam, N. (2008). Quality of internal

control procedures: Antecedents and moderating effect

on organizational justice and employee fraud.

Managerial Auditing Journal, 23(2), 104- 124.

Rae, K., Subramaniam, N., & Sands, J. (2008). Risk

management and ethical environment: Effects on

internal audit and accounting control procedures.

Journal of Applied Management Accounting Research,

6(1), 11

Rae, K., Subramaniam, N., & Sands, J. (2008). Risk

management and ethical environment: Effects on

internal audit and accounting control procedures.

Journal of Applied Management Accounting Research,

6(1), 11

Saunders, M, Lewis, P, & Thornhill, A. (2009).

Understanding research philosophies and approaches.

Research methods for business students, 4, 106-135

Siregar, S. V., & Tenoyo, B. (2015). Fraud awareness

survey of private sector in Indonesia. Journal of

Financial Crime, 22(3), 329-346.

Woods, M. (2009). A contingency theory perspective on the

risk management control system within Birmingham

City Council. Management Accounting Research,

20(1), 69-81

Competency and Religiosity of Internal Auditor on the Fraud Mitigation in Indonesian and Malaysian Islamic Bank

269