Role of Good Corporate Governance in Minimizing Bankruptcy by

Moderating Pandemic Covid-19

Anita Juwita

1

, Hugo Prasetyo

1

and Meiryani

2

1

Accounting Department, Faculty of Economic and Communication, Bina Nusantara University, Jakarta, 11480, Indonesia

2

Finance Department, Faculty of Economic and Communication, Bina Nusantara University, Jakarta, 11480, Indonesia

Keywords: Independent Board Commissioner, Institutional Ownership, Board Directors Size, Financial Distress,

Pandemic Covid-19.

Abstract: This research has main object to determine role Good Corporate Governance in minimizing potential of

bankruptcy with pandemic covid 19 as moderating variables. This study uses causal method, which aims to

explain the causal relationship between one variable that affects other variables. The sample using automotive

companies listed on the Indonesia Stock Exchange during the period 2016-Q1 until 2020-Q3 and analysis

data techniques using linear regression with panel data using E views program version 8.0. The type of data

using secondary data as financial statement. This study uses independent board commissioner, institutional

ownership and board size of director as the independent variable, financial distress as the dependent variable,

the Covid-19 pandemic as moderating variable and applying panel data regression with random effect testing.

Result of this research are Independent commissioners, institutional ownership and Covid 19 have impact on

financial distress but board directors size doesn’t impact on financial distress. Independent board

commissioners which moderated by the Covid-19 has impact on financial distress but institutional ownership

and size board of directors which are moderated by the Covid-19 don’t impact on financial distress9.

1 INTRODUCTION

The Covid pandemic significantly impact on reducing

Indonesia's economic growth. Stated by the Head of

the Central Statistics Agency (BPS) Suharyanto, this

pandemic reducing economic growth within second

quarter of 2020 for 5.32%. It is also estimated that

economic growth will remain minus in the third

quarter of 2020. If this condition occurs, Indonesia

entering the stage of an economic recession. The

effects of an economic recession is the potential for

the possibility of company bankruptcy, due to the

company's inability to make sales, resulting in

negative company profits and the cessation of

company operations (Svobodová 2013; Achim et al.

2012; Smrcka et al. 2013).

This pandemic having an impact on Indonesia

macro economy and directly affected the company's

performance. Covid 19 has significantly impact on

China’s financial performance, studied by Shen et al

(2020). The initial symptom of bankruptcy is

financial distress and indicated with uncertainty of the

company's profitability in the future. The company

declared bankrupt while debt is greater than the assets

and unable to covering its obligations to creditors at

maturity (Hanafi, 2013). Financial distress is a stage

of degenerating financial conditions prior to

bankruptcy or liquidation Platt and Platt (2002).

Companies need to anticipate financial distress

condition that can affect to bankruptcy or delisting.

Delisting is condition while issuer's securities no

longer trading on stock exchange. One system that

can minimize the risk of bankruptcy during the

COVID-19 pandemic is implementation of Good

Corporate Governance (GCG). GCG has important

role in minimizing conflicts of interest between

managers and shareholders Shahwan (2015). In Spain

found that the implementation of GCG has an impact

on financial distress research by Manzaneque et al.

(2015). Miglani et al. (2014) in Australia and

Manzaneque et al. (2016) in Spain studied

institutional ownership significantly impact to

financial distress. Manzaneque et al. (2016) analysed

the influence institutional ownership for company’s

continuity, his research mentioned the effectiveness

corporate governance in monitoring management

long-term performance. Institutional ownership play

significant role in controlling management.

256

Juwita, A., Prasetyo, H. and Meiryani, .

Role of Good Corporate Governance in Minimizing Bankruptcy by Moderating Pandemic Covid-19.

DOI: 10.5220/0011245700003376

In Proceedings of the 2nd International Conference on Recent Innovations (ICRI 2021), pages 256-263

ISBN: 978-989-758-602-6

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Therefore, the higher institutional ownership, the

more company in financial distress condition.

Shahwan (2015) in Egypt and Li et al (2008) in China

didn’t show a significant impact of managerial

ownership on financial distress. Suntaruk's studied

(2009) in Thailand showed GCG didn’t impact to

financial distress. Miglani et al. (2014) studied the

independent director variable was negatively related

to financial distress, while Manzaneque et al. (2016)

showed a negative relationship between independent

directors and financial distress.

The board of directors is the executor, decision

maker and manager of a company. The bigger size of

Board of Directors according to agency theory will

bring superiority in decision making. Making the

right decisions, the possibility of financial distress

conditions can be avoided. Bigger size Board of

Directors the possibility of financial distress will be

smaller. Research by (Widyasaputri, 2012), founded

a positive impact of size of the Board of Directors on

the possibility of financial distress, means the greater

the size of the Board of Directors, the greater the

possibility of financial distress. The size of the Board

of Directors has a negative effect on the possibility of

financial distress (Hanifah and Purwanto, 2013).

Research conducted by (Manzaneque et al., 2016)

found that board size has a negative effect on the

likelihood of financial distress

Based on the results of previous empirical studies,

it is known that there are still inconsistent results

regarding the relationship between GCG and

financial difficulties. There are still very few studies

that test the Covid Pandemic 19 factor as a

moderating variable that affects the relationship

between GCG and financial difficulties. The

automotive industry chosen as the sample because the

it’s quite affected by the Covid-19 pandemic in

Indonesia. This study purpose to analyze the effect of

the implementation of Good Corporate Governance

on financial difficulties, analyze the effect of the

Covid 19 pandemic on financial difficulties, and

analyze whether the Covid-19 pandemic moderates

the effect of Good Corporate Governance on financial

difficulties.

2 LITERATURE REVIEW

2.1 Bankruptcy Theory

Emerling (2015) stated bankruptcy as the last phase

of a company’s life due to insolvency. Ben et al.,

(2015) stated bankruptcy was the company's failure

in generating profits. Bankruptcy is the situation

while debtor unable in covering debts and inability to

survive in market competition, asset’s destruction and

low productivity (Aleksanyan and Huiban 2016). The

company is declared bankrupt if the company's debt

is greater than the assets owned by the company, and

the company is unable to fulfil its obligations to

creditors at maturity (Hanafi, 2013).

2.2 Financial Distress

Platt and Platt (2002) stated Financial distress as

decline condition in financial conditions that occurs

before bankruptcy or liquidation occurs. Financial

distress can be detected when a company is

experiencing financial difficulties or has

experienced a continuous decline in profit and is

unable to meet its obligations when they fall due.

Companies that are in a “decline" cycle must be able

to make strategic choices whether to reduce

dividends, reduce investment or change the capital

structure to avoid financial distress (Koh, Durand,

Dai, & Chang, 2015). Edi and May Tania (2018)

stated that financial distress means a condition in

which a company is categorized as facing a financial

crisis that decreases in fulfilling its responsibilities

to creditors.

2.3 Financial Distress Measurement

The measurement of financial difficulties in this

study refers to Altman (1968), Altman (1968)

developed a model for bankruptcy prediction as

Altman Z score model and defined as Multiple

Discriminant Analysis (MDA). The MDA technique

has been applied in several financial distress and

bankruptcy studies with satisfactory results (Aziz

and Dar 2006; Bellovary, Giacomino and Akers

2007; Platt and Platt 2006; Zmijewski, 1984). The

discriminant function estimated by Altman (1968) is

Z = 1,2X1 + 1,4X2 + 3,3X3 + 0,6X4 + 0,999X5

Where X1 = Working Capital/Total Assets; X2 =

Retained Earnings/ Total Assets; X3 = Earnings

before Interest and Taxes/Total Assets; X4 = Market

Value of Equity/Book Value of Total Liabilities; X5

= Sales/Total Assets; Z = Overall Index. On

Altman's formula, the firms classified according to

the company's sustainability. Z < 1.80→Distress

Zone. Z > 2.99 →Safe Zone. 1.8 < Z < 2.99→Grey

Zone.

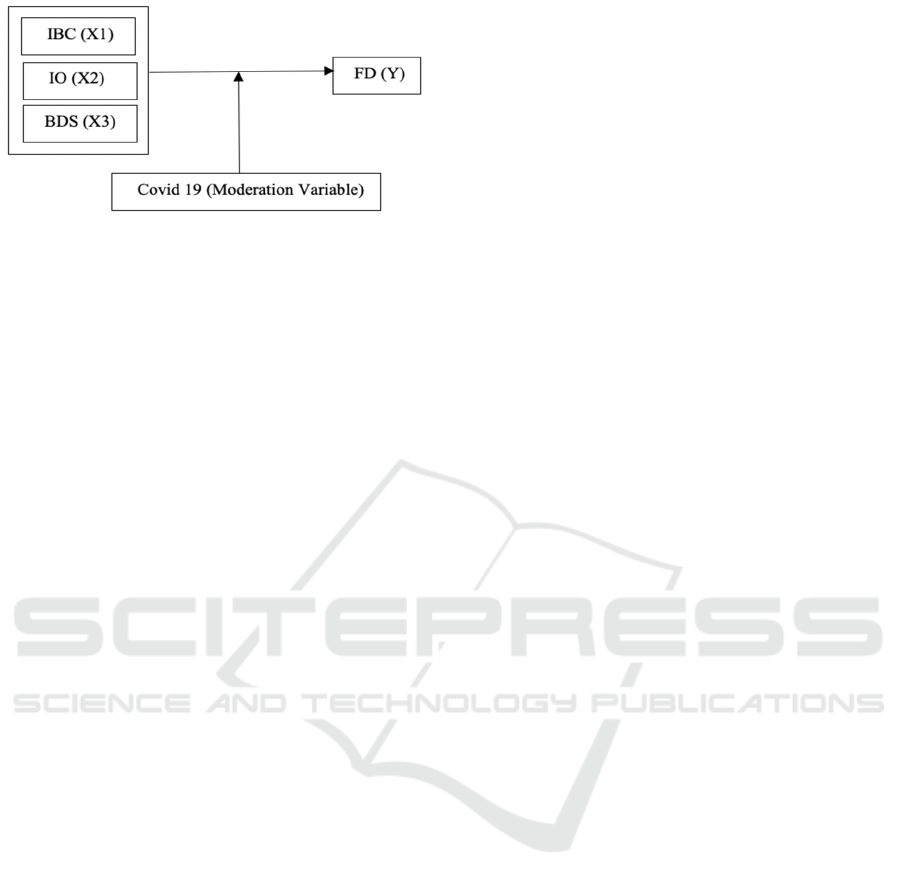

2.4 Research Model

The research model in this study showed below:

Role of Good Corporate Governance in Minimizing Bankruptcy by Moderating Pandemic Covid-19

257

Figure 1: Research model.

IBC (X1) : Independent Board Commissioner

IO (X2) : Institutional Ownership

BDS (X3) : Board Directors Size

FD (Y) : Financial Distress

COVID (M) : The Covid-19 pandemic.

The following will explain the concept and

operational definitions of each variable.

2.4.1 Independent Board of Commissioners

According to Marlinda et.al. (2020) the independent

board of commissioners as a person who is not

affiliated in all respects with the controlling

shareholder has no affiliation with the board of

directors or the board of commissioners and does not

serve as a Director in a company related to the owner

company

2.4.2 Institutional Ownership

Institutional ownership is ownership of company

shares owned by institutions or institutions such as

insurance companies, banks, investment companies,

and other institutional property. (Arianandini and

Ramantha, 2018).

2.4.3 Board Directors Size

The board of directors is the executor, decision maker

and manager of a company. The size of the Board of

Directors which is getting bigger according to agency

theory will bring advantages in making decisions

(Widyasaputri, 2012).

2.4.4 Financial Distress

Bankruptcy prediction in this study was carried out at

listed manufacturing companies in Indonesia, where

the measurement of bankruptcy prediction uses the

Altman's Z-score model. This is supported by Sajjan's

research (2016) that the measurement of z score

suitable for manufacturing companies is to use the

Original Altman’s Z-score model (1968).

2.5 Hypothesis

H1: Independent board commissioners effect on

financial distress.

H2: Institutional ownership has effect on financial

distress.

H3: Size board of directors has effect on financial

distress.

H4: The Covid-19 pandemic effect on financial

distress.

H5: Independent board commissioners effect on

financial distress which is moderating by the Covid

19 Pandemic.

H6: Institutional ownership effects financial distress

which is moderating by the Covid-19 Pandemic.

H7: The size of the board of directors affect financial

distress which is moderating by the Covid-19

Pandemic.

3 ANALYSIS METHOD

This research using quantitative approach and

population in this study are automotive companies

listed on the Indonesia Stock Exchange for the period

2016-Q1 to 2020-Q3. The sampling using non-

probability sampling method with purposive

sampling technique. The sample for automotive

companies for the 2016-q1 - 2020-q3 period with the

criteria: (1) IDX listed public company for the period

2016-2020; (2) Automotive companies that

consistently publish financial reports for the period

quarter (q) 1 of 2016 - quarter (q) 3 of 2020; (3)

Automotive companies that have the data or variables

needed in this study. The data analysis method is

panel data regression model (combination of time

series and cross section) using statistical application

program Eviews 8.0.

This research using 12 Automotive companies

with five years total research. The independent

variable are Independent Board Commissioner (X1),

Institutional Ownership (X2) and Board Directors

Size (X3). The dependent variable is Financial

Distress (Y) and Covid 19 as moderation variable.

ICRI 2021 - International Conference on Recent Innovations

258

Table 1: Variable Measurement.

Source: Data processed, 2020

4 RESULT AND DISCUSSION

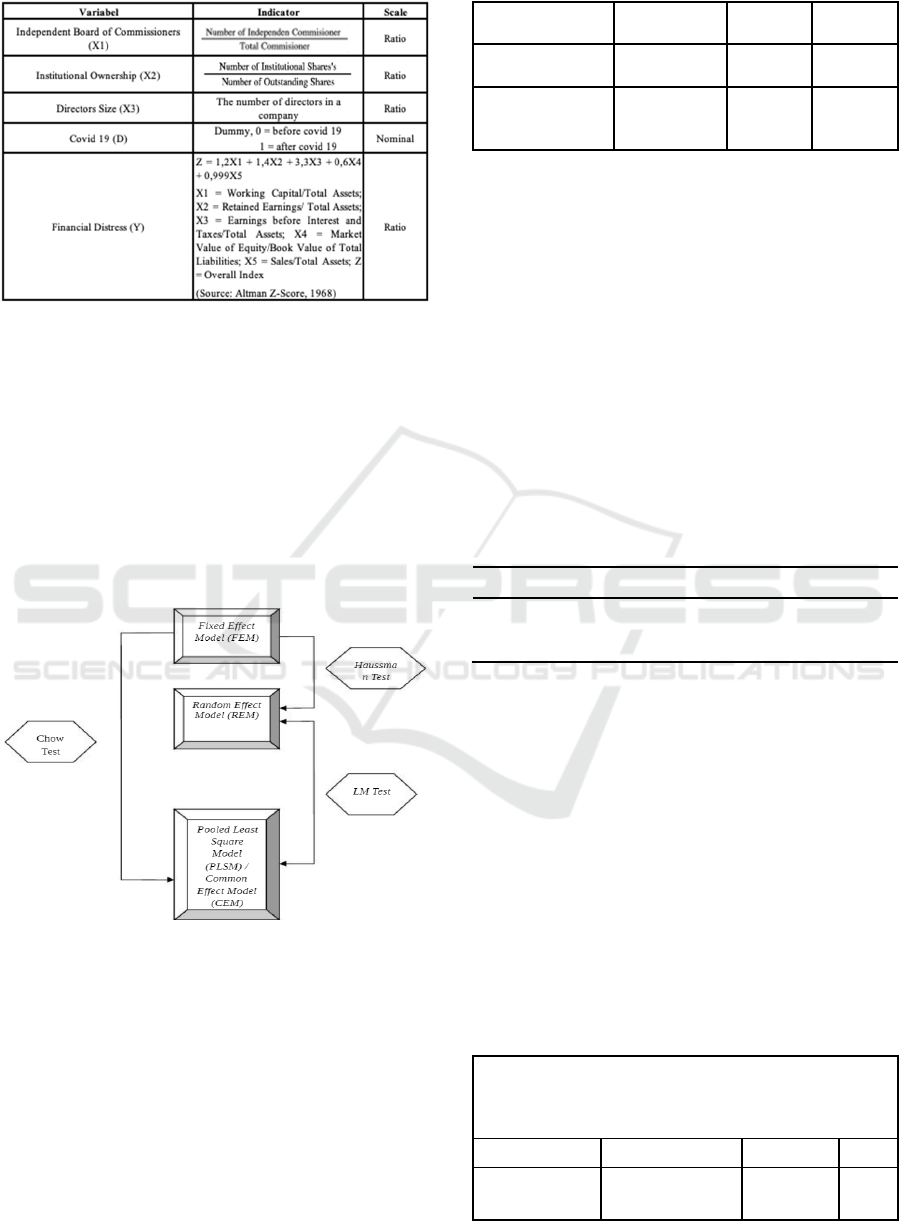

There are three model testing procedures used to

select the best panel data regression: (1) Chow Test,

it used to choose Common Effect Model (CEM) or

Fixed Effect Model (FEM); (2) Lagrange Multiplier

(LM), it used to choose CEM or Random Effect

Model (REM); (3) Haussman test, it used to choose

Fixed Effect Model (FEM) or REM (Gujarati, 2003).

Figure 2: Suitability Model Testing.

4.1 Chow Test

This test is carried out by means chi-square statistical

test with the following hypotheses: Ho: The model

follows the Common Effect Model (CEM) H1: The

model follows a Fixed Effect Model (FEM) Alpha:

5%. Condition: Reject Ho if the value of the F test or

< alpha. The following are the results obtained from

the chow-test using the EViews 8.0 software:

Table 2: Chow Test.

Effects Test Statistic d.f. Prob.

Cross-section F 54.252059 (11,209) 0.0000

Cross-section

Chi-s

q

uare

307.678562 11 0.0000

Based on the results of the chow-test above, the F

test and the chi-square test is 0.0000 < 0.05. Thus, Ho

is rejected and H1 is accepted. The model estimation

approach follows the fixed effect model.

4.2 Lagrange Multiplier Test

The hypothesis of the LM test is as follows:

Ho: Common Effect Model (CEM)

H1: Random Effect Model (REM)

Alpha: 5%.

Condition: Reject Ho if Probability Chi-Square <

alpha 0.05. The following is the results obtained from

the Langrage Multiplier test using the EViews 8.0

software:

Table 3: Lagrange Multiplier Test.

Breusch-Godfrey Serial Correlation LM Test:

F-statistic 373.3532 Prob. F(2,218)

Obs*R-squared 176.4776 Prob. Chi-Square(2)

Based on the Lagrange Multiplier test, the Chi-

Square of 0.0000 < alpha 0.05. Thus, Ho is rejected

and H1 is accepted. Thus, the model estimation

follow REM.

4.3 Hausman Test

The hypothesis in the Hausman test is as follows:

Ho: The model follows the Random Effect Model

H1: The model follows the Fixed Effect Model

Alpha = 5% Condition: Reject Ho if the p-value <

alpha. The following are the results obtained from the

Hausman test which was carried out using the

EViews 8.0 software:

Table 4: Hausman Test.

Correlated Random Effects - Hausman Test

Equation: Untitled

Test cross-section random effects

Test Summary Chi-Sq. Statistic Chi-Sq. d.f. Prob.

Cross-section

random

0.000000 7 1.0000

Role of Good Corporate Governance in Minimizing Bankruptcy by Moderating Pandemic Covid-19

259

Based on the results of the Hausman test, the

probability value test is 1.0000, which means it has a

significance greater than the 95% (α = 5%) level of

confidence (significance level). So that the decisions

taken in this Hausman test are Ho accepted and H1

rejected. The model follows the random effect model

method.

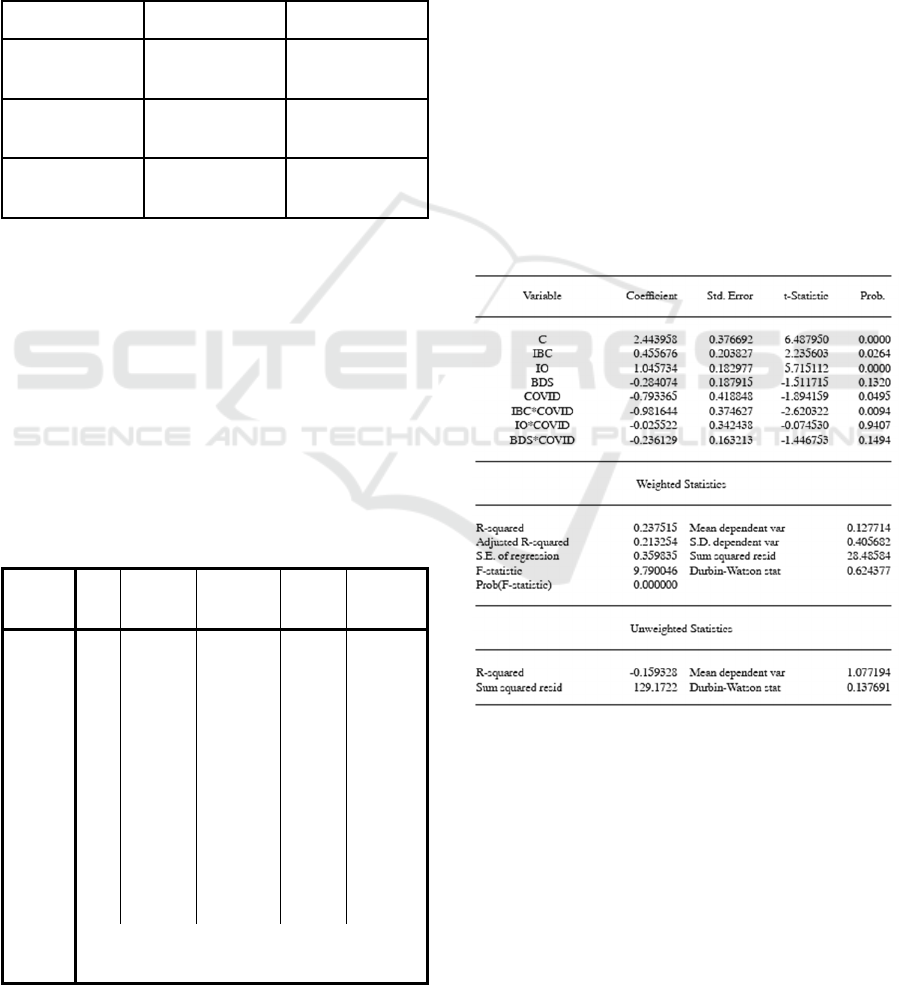

4.4 Regression Result

Table 5: Regression Model Result.

Test Name Information Result

Chow test CEM Vs FEM

Fixed Effect

Model

Hausman Test REM Vs FEM

Random Effect

Model

Lagrange

Multiplier test

PLS Vs REM

Random Effect

Model

The results of selecting the panel data regression

model in the table above show different results. The

chow-test result showed the best model is the fixed

effect model compared to the common effect model.

Based on the Langrage multiplier test, it shows that

the random effect model is better than the common

effect model. The results of the Hausman Test

showed that the best model is the random effect

model better than the fixed effect model.

Furthermore, result from the Hausman-test and

Langrage multiplier testing, it can be decided that the

test model for the regression equation is REM.

Table 6: Statistic Descriptive Result.

N Minimum Maximum Mean

Std.

Deviation

Y 228 -,82 114,64 24,3303 28,02406

M 228 ,00 1,00 ,1579 ,36544

X1 228 ,20 ,67 ,3721 ,07095

X2 228 ,32 1,00 ,6916 ,17067

X3 228 2,00 12,00 5,6491 2,56195

M1 228 ,00 ,50 ,0593 ,14053

M2 228 ,00 1,00 ,1148 ,27350

M3 228 ,00 11,00 ,8421 2,17142

Valid N

(listwise)

228

Financial Distress (Y) variable has a minimum

value of -0.82, a maximum value of 114.64, and an

average value of 24.3303. These results show that on

average the automotive industry is in a safe zone.

Furthermore, the Independent Commissioner variable

(X1) obtained a minimum value of 0.2 with a

maximum value of 0.67, and an average value of

0.3721. These results indicate that on average the

percentage of independent commissioners in the

automotive industry is still relatively low compared to

the number of commissioners. The Institutional

Ownership variable (X2) obtains a minimum value of

0.32 and a maximum value of 1, with the average value

obtained 0.6916, these results explain that on average

institutional ownership in the automotive industry is

quite high. Finally, the size Board of Directors variable

(X3) has a minimum value of 2 and a maximum value

of 12, the average value obtained is 5.649, these results

explain that on average board director size in the

automotive industry is very high. The results of REM

testing model can be seen in the following table:

Table 7: Panel Data Regression Test.

The regression model used in the study based on the

above tests is as follows: FD = 2.443958 + 0.455676

IBC + 1.045734 IO - 0.284074 BDS - 0.793365

COVID - 0.981644 IBC*COVID - 0.025522

IO*COVID - 0.236129 BDS*COVID.

From the equation model above, it can be

explained that based on the results of the regression

test using REM method, it shows the IBC and IO have

a positive relationship with financial distress, while

BDS has no effect on financial distress, and COVID-

19 pandemic has been shown to moderate the effect

of GCG on financial distress.

ICRI 2021 - International Conference on Recent Innovations

260

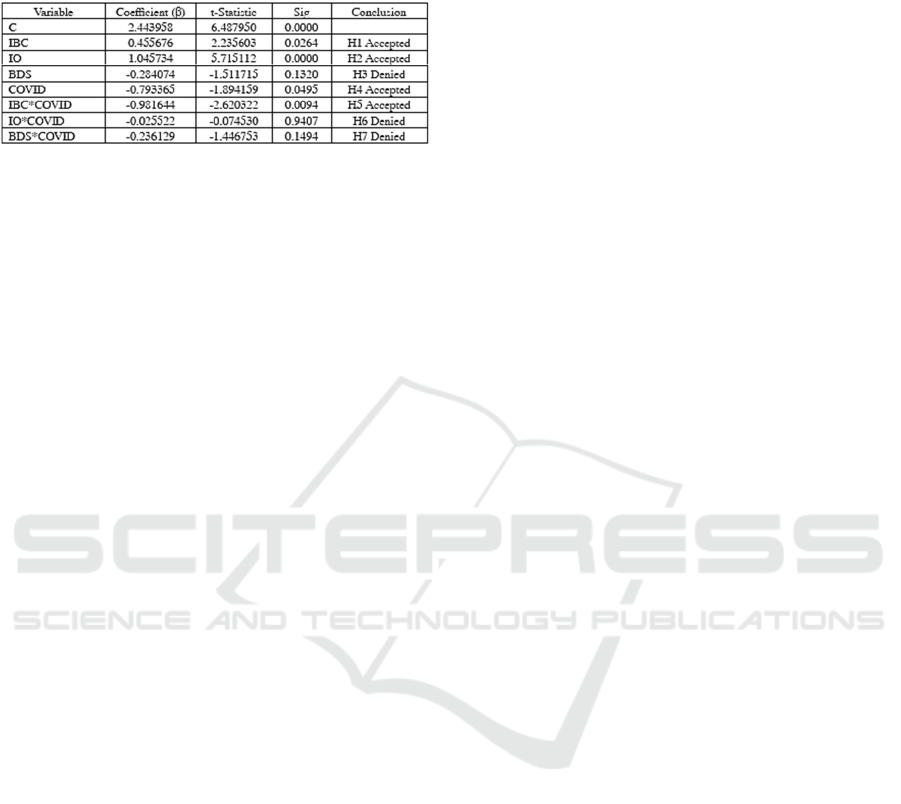

4.5 Hypothesis Result

Table 8: Partial Test (t-test).

4.5.1 The Test Results of the Independent

Board of Commissioners on Financial

Distress.

The independent board variable has value of β (beta)

with a positive direction of 0.455676, a t-statistic

value of 2.235603 and a significance value of 0.0264

< 0.05 (5% significance level). The conclusion is

independent board commissioners has a positive and

significant effect to financial distress. Interpretation

Altman Z-score results if the value is greater > 0, then

the company will be less likely to experience

financial difficulties, so it concluded that if there is a

positive coefficient relationship statistically, means

there is a negative relationship between the board of

commissioners and financial distress. Widhiadnyana

and Ratnadi (2018) stated the proportion of

independent commissioners has a positive effect on

financial distress. Means greater percentage for

independent commissioners will impact on

decreasing financial distress.

4.5.2 The Test Results of Institutional

Ownership on Financial Distress

The t test (partial) of institutional ownership variable

has β (beta) value with a positive direction of

1.045734, t-statistic value of 5.715112 and a

significance value of 0.0000 <0.05 (5% significance

level). The conclusion is institutional ownership has

positive and significant effect to financial distress.

This result supported by Tri Wahyuning Tias and

Muharam (2012); and Merkusiwati (2015) stated that

institutional ownership has an effect on financial

distress. This means the institutional ownership

structure is one of the factors can affect the condition

of the company in the future, whether the company

run into financial distress or even goes bankrupt. The

same results were also found by Helena and Saifi

(2018) which showed that institutional ownership had

a significant effect on financial distress. Means the

companies that have greater institutional ownership,

the less likely the company will experience financial

distress.

4.5.3 The Test Results of Size of the Board

of Directors on Financial Distress

The t test (partial) of variable size of the board of

directors obtained a β (beta) value in a negative

direction of -0.284074, a t-statistic value of -1.511715

and a significance value of 0.1320 > 0.05 (5%

significance level). The conclusion is size of the

board of directors a negative and insignificant effect

on financial distress. The results of this study are in

line with the research of Putri and Kristanti (2020)

and Kristian (2017) which states that the board of

directors has no effect on financial distress. This

means that the board of directors cannot influence

financial distress. Thus, directors have rights and

powers, new decisions are made, the members of the

board of directors unable affect the possibility of

financial distress.

4.5.4 The Test Results of Covid-19

Pandemic on Financial Distress

The t test (partial) in the regression model, the Covid-

19 pandemic variable obtained a β (beta) value in a

negative direction of -0.793365, a t-statistic value of -

1.894159 and a significance value of 0.0495 < 0.05

(5% significance level). The conclusion is Covid-19

pandemic has a negative and significant effect on

financial distress. Economic recession potentially

cause possibility of company bankruptcy, due to the

company's inability to make sales, resulting in negative

company profits and discontinuation of company

operations (Svobodová 2013; Achim et al. 2012;

Smrcka et al. 2013). Besides impact macro economy,

Covid-19 pandemic also directly affected to declining

the company's performance. Supported by Shen et al's

(2020) founded that Covid 19 had a significantly

impact on China’s financial performance.

4.5.5 The Test Results Independent Board

of Commissioners Moderated by the

Covid-19 on Financial Distress

The results of the t test (partial) in the regression

model, the variable of the independent board of

commissioners moderated the Covid-19 pandemic

obtained a β (beta) value in a negative direction of -

0.981644, a t-statistic value of -2.620322 and a

significance value of 0.0094 < 0.05 (significance

level 5%). The conclusion is the independent board of

commissioners has a negative and significant effect

on financial distress which moderated by the Covid-

19 pandemic.

Role of Good Corporate Governance in Minimizing Bankruptcy by Moderating Pandemic Covid-19

261

4.5.6 The Test Results Institutional

Ownership Moderated by the Covid-19

on Financial Distress

The t test (partial) in the regression model,

institutional ownership variable with the Covid-19

pandemic moderated, the β (beta) value is obtained in

a negative direction of -0.025522, the t-statistic value

is -0.074530 and a significance value of 0.9407 > 0.05

(significance level of 5%). The conclusion is

institutional ownership has a negative and

insignificant effect on financial distress moderated by

the Covid-19 pandemic.

4.5.7 The Test Results Board Directors Size

Moderated by the Covid-19 on

Financial Distress

The t test (partial) in the regression model, the

variable size of the board of directors moderated by

the Covid-19 pandemic obtained a β (beta) value in a

negative direction of -0.236129, a t-statistic value of

-1.446753 and a significance value of 0.1494> 0.05

(significance level 5%). The conclusion is size of the

board of directors has a negative and insignificant

effect on financial distress which is moderated by the

Covid-19 pandemic. Supported by Ainun (2019);

Cinantya and Merkusiwati (2015) showed size of the

board of directors doesn’t effect on financial distress.

It indicated that managers are not motivated by

individual goals, but managers are motivated to fully

realize the goals of shareholders. Managers consider

that the responsibility given as company management

is a mandate that must be properly maintained, so that

no matter the structure of the board in a company,

managers will still try their best to improve company

performance and avoid financial distress.

5 CONLUSIONS AND

RECOMMENDATION

Based on testing, hypothesis analysis and discussion

show that independent commissioners, institutional

ownership and Covid 19 have impact on financial

distress. Board directors size doesn’t impact on

financial distress. Independent board commissioners

which moderated by the Covid-19 impact on financial

distress but institutional ownership and size board of

directors which are moderated by the Covid-19 don’t

impact on financial distress. Results for this study

cannot generalized for all companies listed on

Indonesia Stock Exchange. Recommendation for next

research to use for another sectors. This research only

using three types of corporate governance

components, that are independent board

commissioners, institutional ownership and size

board directors because those variables are related to

the problem of conflicts of interest that occur between

shareholders and managers.

REFERENCES

Moore, R., Lopes, J. (1999). Paper templates. In

TEMPLATE’06, 1st International Conference on

Template Production. SCITEPRESS.

Smith, J. (1998). The book, The publishing company.

London, 2

nd

edition.

Achim, V. M., and Borlea, N. S. (2012). Consideration on

Business Risk of Bankruptcy. Faculty of Economics

and Business Administration & Faculty of Science

Economics.

Adnan Aziz, M. and Dar, H. A. (2006). Predicting corporate

bankruptcy: Where We Stand?. Corporate Governance,

Vol. 6 No. 1, pp. 18-33.

Ainun Jariyah, Anindhyta. (2019). Pengaruh Rasio

Likuiditas, Profitabilitas, dan Aktivitas Terhadap

Prediksi Financial Distress Perusahaan Tekstil dan

Garmen. E-ISSN: 2461-0593. Jurnal Ilmu Riset

Manajemen, Vol. 08, No 1.

Aleksanyan, L. and Huiban, J. Pierre. (2016). Economic

and financial determinants of firm bankruptcy:

evidence from the French food industry. Review of

Agricultural, Food and Environmental Studies, Vol.

97, pp. 89–108.

Altman, Edward I. (1968): Financial Ratios, Discriminant

Analysis and the Prediction of Corporate Bankruptcy.

The Journal of Finance, 22(4), pp. 589-609

Arianandini P. Winning and Ramantha, I. Wayan. (2018).

Pengaruh Profitabilitas, Leverage, dan Kepemilikan

Institusional Pada Tax Avoidance. E-Jurnal Akuntansi,

Vol. 22, No. 3, pp. 2088-2116.

Bellovary, Jodi L., Giacomino, Don and Akers, M. (2007).

A Review of Bankruptcy Prediction Studies: 1930 to

Present. Journal of Financial Education, Vol. 33.

Ben, D. A., AR, M. D., and Topowijono. (2015). Analisis

Metode Springate (Score) Sebagai Alat Untuk

Memprediksi Kebangkrutan Perusahaan (Studi Pada

Perusahaan Property dan Real Estate Yang Listing di

Bursa Efek Indonesia pada Tahun 2011-2013). Jurnal

Administrasi Bisnis S1 Universitas Brawijaya, Vol. 21

(1).

Cinantya, I. G. A. Ayu Pritha and Merkusiwati, N. K. L.

Aryani. (2015). Pengaruh Corporate Governance,

Financial Indicators, dan Ukuran Perusahaan Pada

Financial Distress. E-Jurnal Akuntansi, Vol. 10, No, 3,

pp. 897-915.

Edi and May Tania. (2018). Ketepatan Model Altman,

Springate, Smijewski dan Grover Dalam Memprediksi

Financial Distress. Jurnal Review Akuntansi dan

Keuangan, Vol. 8, No.1.

ICRI 2021 - International Conference on Recent Innovations

262

Gujarati, Damodar. (2003). Ekonometrika Dasar.

Terjemahan: Sumarno Zain. Jakarta: Erlangga.

Hanafi, Mamduh. (2013). Analisis Laporan Keuangan.

Yogyakarta: Penerbit UPP AMK.

Hanifah, and Purwanto, A. (2013). Pengaruh Struktur

Corporate Governance Dan Financial Indicators

Terhadap Kondisi Financial Distress. Diponegoro

Journal of Accounting, Vol. 0, pp. 648-662.

Helena, S. and Saifi, M. (2018). Pengaruh Corporate

Governance Terhadap Financial Distress (Studi Pada

Perusahaan Transportasi Yang Terdaftar di Bursa Efek

Indonesia Periode 2013-2016). Semantic Scholar.

Koemary, N. P. C. Oety., gama, A. S., and Astiti, N. P.

Yeni. (2019). Pengaruh Struktur Corporate Governance

Dan Financial Indicators Terhadap Kondisi Financial

Distress (Studi Pada Sektor Industri Otomotif Dan

Komponennya Yang Terdaftar Di Bursa Efek Indonesia

Periode 2015 - 2017). Repository UNMAS Denpasar.

Koh, S., Durand, R. B., Dai, L. and Chang, M. (2015).

Financial distress: Lifecycle and corporate

restructuring. Journal of Corporate Finance, 33 19-33.

Kristian, M. (2017). Pengaruh Jumlah Dewan Direksi dan

Shareholder Equity to Total Asset Ratio Terhadap

Financial Distress (Studi Pada Perusahaan Manufaktur

Yang Terdaftar Di BEI Tahun 2012-2015).

Researchgate, Vol. 22, No. 3.

Li, H., Meng, L., Wang, Q. and Zhou, L.A. (2008). Political

connections, financing and firm performance: evidence

from Chinese private firms. Journal of Development

Economics, Vol. 87, No. 2, pp. 283-299

Mackevicius, Jonas., Sneidere, Ruta., and Tamuleviciene,

Daiva. (2019). The waves of enterprises bankruptcy and

the factors that determine them: The case of Latvia and

Lithuania. Researchgate, Vol. 6, No. 8, pp. 100-114.

Manzaneque, M., Cruz, Alba M. P., and Madrid, Elena M.

(2015). Corporate governance effect on financial

distress likelihood: Evidence from Spain. Researchgate,

Vol. 23, No. 1.

Marlinda, D. Eva., Titisari, K. H., and Masitoh, E. (2020).

Pengaruh GCG, Profitabilitas, Capital Intensity, dan

Ukuran Perusahaan terhadap Tax Avoidance.

Researchgate, Vol. 4, No. 1.

Miglani, Seema., Ahmed, Kamran., and Henry, D. (2014).

Voluntary corporate governance structure and financial

distress: Evidence from Australia. Researchgate, Vol.

11, No. 1.

Nicoleta Bărbuță-Mișu and Mara Madaleno. (2020).

Assessment of Bankruptcy Risk of Large Companies:

European Countries Evolution Analysis. Journal of

Risk and Financial Management, MDPI, Open Access

Journal, Vol. 13 (3), pp. 1-28.

Platt, H.D., and M.B. Platt. (2002). Predicting Corporate

Financial Distress: Reflections on Choice-Based

Sample Bias. Journal of Economics and finance, Vol.

26, No. 2. Pp. 60-72.

Platt, Harlan., and Platt, M. B. (2006). Understanding

Differences Between Financial Distress and

Bankruptcy. International Review of Applied

Economics, Vol. 2, No. 2.

Prihatini, Ni Made Evi Dwi and Maria M. Ratna Sari.

(2013). Analisis Prediksi Kebangkrutan dengan Model

Grover, Altman Z-score, Springate dan Zmijewski pada

perusahaan Food and Beverages di BEI. Jurnal

Akuntansi, Universitas Udayana, Vol. 5, No. (3), 544-

560.

Putri, A. K. and Kristanti, F. T. (2020). Faktor-Faktor Yang

Mempengaruhi Financial Distress Menggunakan

Survival Analysis. JIMFE (Jurnal Ilmiah Manajemen

Fakultas Ekonomi), Vol. 6, No. 1, pp. 31-42.

Radifan, R., and Yuyetta, E. N. A. (2015). Analisis

Pengaruh Mekanisme Good Corporate Governance

Terhadap Kemungkinan Financial Distress.

Diponegoro Journal of Accounting, Vol. 4, No. 3, pp.

453-463.

Sajjan, Rohini. (2016). Predicting Bankruptcy of Selected

Firms by Applying Altman’s Z-Score Model.

International Journal of Research – Granthaalayah, Vol.

4 (4).

Schonfeld, J., Kudej, M. and Smrcka, L. (2013). Financial

health of enterprises introducing safeguard procedure

based on bankruptcy models. Journal of Business

Economics and Management, Vol. 19 (5), pp. 692-705.

Shahwan, Tamer M. (2015). The effects of corporate

governance on financial performance and financial

distress: evidence from Egypt. Corporate Governance,

Vol. 15 No. 5, pp. 641-662.

Shen, H., Fu, M., Pan, H., Yu, Z., and Chen, Y. (2020). The

impact of the COVID-19 pandemic on firm

performance. Emerging Markets Finance and Trade,

Vol. 56 (10), 2213–2230.

Suntaruk, P. (2009). Predicting financial distress: Evidence

from Thailand. Proc. Of The European Financial

Management Association 2009 Annual Meeting, Milan,

pp. 24-27.

Svobodová, Libuše. (2013). Trends in the number of

bankruptcies in the Czech Republic. Paper presented at

Hradecké ekonomické dny (Hradec Economic Days),

Hradec Králové, 19–20; pp. 393–99.

Triwahyuningtias, M. and Muharam, H. (2012). Analisis

Pengaruh Struktur Kepemilikan, Ukuran Dewan,

Komisaris Independen, Likuiditas Dan Leverage

Terhadap Terjadinya Kondisi Financial Distress (Studi

Pada Perusahaan Manufaktur Yang Terdaftar di Bursa

Efek Indonesia Periode Tahun 2008-2010). Eprints

UNDIP.

Widhiadnyana, I. K. and Ratnadi, M. D. (2018). The impact

of managerial ownership, institutional ownership,

proportion of independent commissioner, intellectual

capital on financial distress. Journal of Economics

Business and Accountancy Ventura, Vol. 21 (3).

Widyasaputri, Erlinda. (2012). Analisis Mekanisme

Corporate Governance pada Perusahaan yang

Mengalami Kondisi Financial Distress. Accounting

Analysis Journal.Vol. 1, No. 2, pp. 1–8.

Zmijewski, M. E. (1984). Methodological Issues Related to

the Estimation of Financial Distress Prediction Models.

Journal of Accounting Research, Vol. 22, pp. 59-82.

Role of Good Corporate Governance in Minimizing Bankruptcy by Moderating Pandemic Covid-19

263