Evaluation of the Influence of Customer Loyalty and Customer Trust

through Customer Retention on Social CRM on PT. Mega Finance

R. A. Aryanti Wardaya Puspokusumo

1

, Nadiah Kusuma Ariastuti

1

and Meiryani

2

1

Faculty of Economics and Communication, Bina Nusantara University, Jakarta, 11480, Indonesia

2

Accounting Department, Faculty of Economics and Communication, Bina Nusantara University,

Jakarta, 11480, Indonesia

Keywords: Credit Instalment, Customer Trust, Customer Loyalty, Customer Retention, Media Social, Social Customer

Relationship Management.

Abstract: The research goal were to evaluate the influence of customer loyalty and customer trust through customer

retention to social CRM at PT. Mega Finance. The research method used in this study was Structural Equation

Modelling. The result of this study is derived from 350 respondents who had used MegaZip program

beforehand, known media social account that company had. This study analyzes the effect of customer loyalty

and customer trust factors to customer retention and social customer relationship management that company

already had. The outcome of this study were each of customer loyalty and customer trust had a significant

effect on customer retention. While customer loyalty and customer retention had a significant effect on social

customer relationship management, customer trust had no significant effect on social customer relationship

management.

1 METHOD

Research design is a blueprint or plan for the

collection, measurement, and analysis of data made to

obtain information to answer research problems.

Research design not only anticipates and determines

seemingly countless decisions connected by

conducting data collection, processing, and analysis,

but provides a logical basis for the decisions made.

According to Sekaran and Bougie (2016), the

research design is also a master plan that establishes

methods and procedures for collecting and analyzing

the necessary information. The design of research

planning makes it easier for researchers to conduct

research (Buttle, 2005).

This study uses quantitative research model with

descriptive analysis, where according to (Sekaran and

Bougie, 2016), descriptive analysis is used to collect

data that will describe the characteristics of objects

that may see quantitative data collection. In this

research focuses on customer trust as dependent

variable and customer loyalty, customer retention and

social customer relationship management as

dependent variables (Cuiqing Jiang, 2019). This

descriptive research describes the evaluation of the

influence of customer loyalty variables and customer

trust variables through customer retention variables

on social customer relationship management in PT.

Mega Finance.

This quantitative data collection comes from the

dissemination of questionnaires based on statements

that correspond to the topics taken by researchers.

Questionnaires that are distributed online using

google form format, where the analysis unit and

objects in this study are individuals, namely

respondents who are or have used the MegaZip

program offered by PT. Mega Finance and active and

know the social media accounts and official websites

owned by the company.

Hypotheses in the scope of customer loyalty

influence and customer trust through user retention to

the use of social media as a form of social customer

relationship management at PT. Mega Finance is as

follows.

2 RESULT AND DISCUSSION

Questionnaire is one of the data collection methods

that researchers use to retrieve active customer data

of MegaZip program offered by PT. Mega Finance

about loyalty and trust that customers feel through

236

Wardaya Puspokusumo, R., Kusuma Ariastuti, N. and Meiryani, .

Evaluation of the Influence of Customer Loyalty and Customer Trust through Customer Retention on Social CRM on PT. Mega Finance.

DOI: 10.5220/0011244500003376

In Proceedings of the 2nd International Conference on Recent Innovations (ICRI 2021), pages 236-241

ISBN: 978-989-758-602-6

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

official social media owned by the company (Dewi,

2018). The dissemination of this questionnaire is

done online using google form format, where the

distribution of this questionnaire is done to all

customers who have been or are using megazip

program which is a product owned by PT. Mega

Finance. The link from this online questionnaire is

distributed through the customer retention division

that works to provide the link to customers or active

customers owned by the company (Griffin et al.,

2002).

Figure 1: Litian pene thought framework.

The total questionnaires that can be 350, but the

total questionnaire used for data processing is 282

respondents. This is done because the data used in this

study is the data of respondents who have been or are

using the MegaZip program and know the official

social media owned by PT. Mega Finance. Data from

each respondent’s answer will then be moved into

microsoft excel so that it can be cleaned first before

analysis using SmartPLS version 3.0.

Respondents who received the questionnaire were

PT customers. Mega Finance is or has used megazip

service program offered by the company either

through electronic installment program or

twowheeled bicycle installment program

(motorcycle). The total number of respondents who

filled out this questionnaire was 350 respondents in a

period of approximately 3 weeks in June 2020.

Table 1: Quantity of MegaZip Program Usage.

Question Answer Presented Number of

Respondents

Have you

ever used

MegaZip

program

already 80,6% 283

do not 19,4% 67

So it can be concluded that the selection of

respondents who have used the MegaZip program is

appropriate in this study because 80.6% of

respondents have used the MegaZip program which

is a product offered by PT. Mega Finance.

Based on Table 2, The number of respondents

who are undergoing one of the MegaZip programs

offered by PT. Mega Finance amounted to 65.7% or

186 respondents while the number of respondents

who had undergone one of the previous MegaZip

programs amounted to 34.3% or 97 respondents.

Table 2: Status of MegaZip Programs That Respondents

Live.

Question Answer Presented Number of

Respondents

Have you

ever used

MegaZip

program

already 80,6% 283

do not 19,4% 67

Table 3: The Form of MegaZip Instalments That Are or

Have Been Lived.

Question Answer Presented Number of

Respondents

The status

of your

MegaZip

program

I'm

undergoing

one of the

MegaZip

programs

65,7% 186

I've been

through

one of the

MegaZip

programs

34,3% 97

Based on Table 3, the number of respondents who

have been or are undergoing the MegaZip program in

the category of electronic installments is 84.8% or

240 respondents and the number of respondents who

have been or are undergoing the MegaZip program in

the category of two-wheeled vehicle installments

(motorcycles) is 15.2% or 43 respondents.

Evaluation of the Influence of Customer Loyalty and Customer Trust through Customer Retention on Social CRM on PT. Mega Finance

237

Table 4: Price Range of MegaZip Programs That Are or

Have Been Run.

Price range of

ongoing programs

Presented Number of

Respondents

Rp. 1.000.000 –

Rp. 2.499.000

8,1% 23

Rp. 2.500.000 –

Rp. 9.999.000

58% 164

Rp. 10.000.000 –

Rp. 14.499.000

15,5% 44

Rp. 15.500.000 -

Rp. 19.999.000

9,2% 26

Rp. 20.000.000 –

Rp. 24,499,000

6,7% 19

> Rp. 25.500.000 2 2,5% 7

Based on Table 4 shown above, it can be seen that

62.1% or 218 respondents are male while the rest are

37.9% or 133 respondents are female. So it can be

concluded after the researchers conducted the

dissemination of questionnaire respondents in

jabodetabek area is more dominated by male

respondents than female respondents. This indicates

that respondents are using the MegaZip program

offered by PT. Mega Finance is mostly male.

Based on Table 5, it can be seen that the most

results came from the number of respondents aged 26

– 35 years of age of 52.4% or 184 respondents

followed in the second position by the number of

respondents aged 36-45 years of age of 26.2% or 92

respondents, followed in the third position by

respondents aged 20- 25 years of age of 13.7% or 48

years and in the fourth position or the last position by

respondents over the age of 45 years of 7.7% or 27

respondents. Based on the above results, it can be

concluded that most of the respondents who are or

have undergone the MegaZip program offered by PT.

Mega Finance is the majority of 26-35 year olds with

a total of 52.4% or 184 respondents.

Table 5: Respondents by Age.

Age Presented Number of

Respondents

20 - 25 Years Ol

d

13.7% 48

26 - 35 Years Ol

d

52.4% 184

36 - 45 Years Ol

d

26.2% 92

> 45 Years 7.7% 27

Table 6: Respondents by Residence Domicile.

residence Presented Number of

Respondents

Jakarta 32.8% 115

Bo

g

or 18.8% 66

Depok 11.7% 41

Tan

g

eran

g

6.8% 24

10/ 7.1% 25

Othe

r

22.8% 80

Based on Table 6, the most results from the

division of respondents based on their residence

domicile fell on the city of Jakarta where 32.8% or

115 respondents domiciled in Jakarta, followed by the

second position of respondents domiciled outside

jabodetabek city of 22.8% or 80 respondents,

followed by the next position in respondents

domiciled in the city of Bogor by 18.8% or 66

respondents , continued in the fifth position in

respondents domiciled in the city of Depok by 11.7%

or 41 respondents, and the last second position fell to

respondents located in the city of Bekasi by 7.1% or

25 respondents and respondents located in Tangerang

by 6.8% or 24 respondents. Because this study only

focuses on jabodetabek area, the respondents used for

data processing is 271 respondents.

Table 7: Respondent Profiles by Occupation.

Work Presented Number of

Respondents

Private Emplo

y

ees 68.9% 242

State Office

r

4.6% 16

ICRI 2021 - International Conference on Recent Innovations

238

Based on Table 7, 68.9% or 242 respondents had

jobs as private employees, followed by 17.4% or 61

respondents had jobs as entrepreneurs, 9.1% or 32

respondents had jobs other than private employees,

public servants and entrepreneurs and 4.6% or 16

respondents had jobs as civil servants. It can be

concluded that most of the respondents are private

employees with 68.9% of the total or 242

respondents.

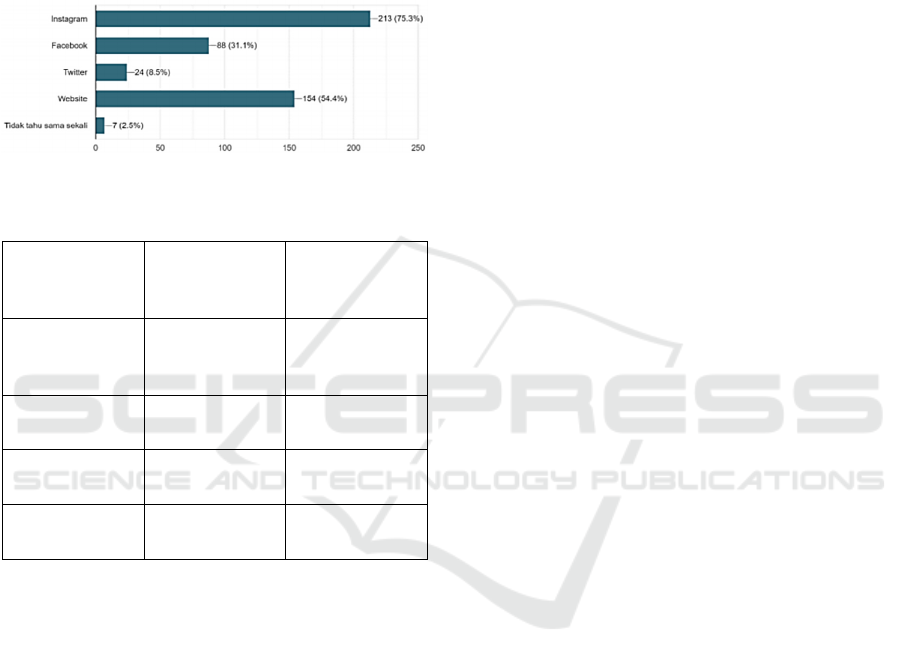

Figure 2: Respondents by Company’s Social Media.

Table 8: Respondents by Occupation.

work Presented Number of

Respondents

Private

Employees

68.9% 242

State Officer 4.6% 16

Entrepreneurial 17.4% 61

Other 9.1% 32

Based on Table 8, 75.3% or 213 respondents

know the official Instagram account owned by PT.

Mega Finance, followed by 54.4% or 154 respondents

know the official website of PT. Mega Finance,

furthermore, 31.1% or 88 respondents know the

official Facebook account owned by PT. Mega

Finance, and continued with 8.5% or 24 respondents

know the official Twitter account owned by PT. Mega

Finance and lastly 2.5% or 7 respondents do not know

social media accounts and official websites owned by

PT. Mega Finance. Because this study only focuses

on respondents who know social media accounts and

official websites owned by companies, respondents

who do not know social media accounts and official

websites belonging to companies will not be included

in this study. Therefore, based on the above results, it

can be concluded that most respondents know the

official instagram account owned by PT. Mega

Finance with a percentage of 75.3% of the total or 213

respondents.

Simultan is a test conducted against all escogen

variables against endogenous variables

simultaneously. In this simultaneous study,

researchers used two factors or variables customer

loyalty and customer trust that if running together can

affect the social customer relationship management

that the company has or not. Based on the results of

research that has been done, customers who have a

sense of loyalty are proven to have their own level of

trust both in the products offered by the company and

to the company that offers the product. Loyalty itself

comes when customers have experienced or positive

impressions during their use of the products they buy,

it also applies to customers who are or have used the

MegaZip program offered by PT. Mega Finance.

Customers who have loyalty to megazip program

or PT. Mega Finance is a group of customers who

have confidence in the information provided by the

company both through the internet and through social

media accounts. Therefore, customers who are or

have used megazip program tend to have a much

higher level of trust with all the information they see

from social media or the internet than people who

have never used megazip program before. This can be

proven through the results of research that has been

done, where customer loyalty and customer trust

simultaneously have a significant influence on the

social customer relationship management that the

company has

3 CONCLUSION

Based on the results of research and data processing

that has been done by researchers related to the

evaluation of the influence of customer loyalty and

customer trust through customer retention on social

customer relationship management in PT companies.

Mega Finance, the author of several conclusions,

including:

• The results of the research showed that the data

used and processed has passed the validity and

reliability tests based on the value of Outer

Loadings, Average Variance Extracted (AVE),

Cronbach’s Alpha, Cross Loadings, and

Composite Reliability so that it can qualify from

hair, hult, ringle and sarstedt theory (2017).

• Customer Trust factors or variables have a

significant influence on Customer Loyalty

because psychologically customers who have

used the MegaZip program will have a much

higher sense of trust than before, so as to cause

a sense of loyalty or loyalty to the MegaZip

Evaluation of the Influence of Customer Loyalty and Customer Trust through Customer Retention on Social CRM on PT. Mega Finance

239

program as well as to pt companies. Mega

Finance itself.

• Customer Loyalty factors or variables have a

significant influence on Customer Retention

where loyal customers will most likely have the

urge to reuse the MegaZip program they have

already lived.

• Customer Trust factors or variables have a

significant influence on Customer Retention

because of the trust that customers have because

they have experienced a good experience when

undergoing the MegaZip program is able to

encourage them to reuse the MegaZip program

that suits their needs.

• Customer Loyalty factors or variables have a

significant influence on Social Customer

Relationship Management where loyal

customers have the urge to know all information

about the MegaZip program so that they will

find out more deeply through the official

website or social media accounts owned by the

company.

• Customer Trust factors or variables do not have

a significant influence on Social Customer

Relationship Management due to the way

people view information in general on

information spread in social media accounts.

Therefore, although many people see

information about the MegaZip program in

social media accounts, few people decide to

contact the company for more information.

• Customer Retention factors or variables have a

significant influence on Social Customer

Relationship Management where customers

who have often used the MegaZip program must

have a desire to continue to follow all

information related to the program, thus making

customers follow all the information that has

been posted in social media accounts and

official websites owned by the company.

• Customer Loyalty and Customer Trust factors or

variables simultaneously have a significant

influence on Customer Retention because

customers who have confidence will have their

own level of loyalty to the MegaZip program,

thus encouraging them to reuse the MegaZip

program offered by PT. Mega Finance.

• Factors or variables Customer Loyalty and

Customer Trust simultaneously have a

significant influence on Social Customer

Relationship Management because customers

who have confidence will have their own level

of loyalty to the MegaZip program so that makes

them want to find out more about the program

information. It allows customers to find out the

information on the official website or official

social media accounts owned by the company.

REFERENCES

Andreas, K. M., & Haenlein, M. (2010). Users of the world,

unite! The challenges and opportunities of social media.

Business Horizons.

Arimbawa, A. d. (2018). BISMA. Journal of Business and

Management.

Buttle, L. A. (2005). Customer retention management

processes: A quantitative study. European Journal of

Marketing.

Cuiqing Jiang, R. M. (2019). Investigating the role of social

presence dimensions and information support. Journal

of Retailing and Consumer Services.

Dewi, R. K. (2018). The Influence of Social Media Against

Customer Retention (Case Study on J.Co).

Florin Sabin Foltean, S. M. (2018). Customer relationship

management capabilities and social media technology

use: Consequences on firm performance. Journal of

Business Research.

Griffin, W., Ricky, & Ebert, R. J. (2002). Management.

Jakarta: Erlangga. Hair, J. F. (2017). A Primer on

Partial Least Squares Structural Equation Modeling

(PLSSEM): 2nd edition. SAGE Publications Inc.

Indonesia Digital 2019: Social Media. (2019). Retrieved

from Websindo: https://websindo.com/indonesia-

digital-2019-media-sosial/

Kevin J. Trainor, J. (. (2013). Social media technology

usage and customer relationship performance: A

capabilities-based examination of social CRM. Journal

of Business Research.

Khuong, M. N. (2015). Factors affecting impulse buying

toward fashion products in Ho Chi Minh City: A

mediation analysis of hedonic purchase. International

Journal of Trade, Economics and Finance, 223–229.

Lalinthorn Marakanon, V. P. (2017). Perceived quality,

perceived risk and customer trust affecting customer

loyalty of environmentally friendly electronics. Journal

of Social Sciences.

Lo Liang Kheng, O. M. (2010). The Impact of Service

Quality on Customer Loyalty: A Study of Banks in

Penang, Malaysia. International Journal of Marketing

Studies.

Miles, P. H. (2015). From e-CRM to s-CRM. Critical

factors underpinning the social CRM activities of

SMEs.

Miller, Q. S. (2019). How Social Media Communications

Combine with Customer. Journal of Interactive

Marketing.

Mohammad Rashed Hasan Polat, S. M. (2018). Impact of

Brand Loyalty on Improving Customer Retention – A

Case Study on Tesco Malaysia. Journal of Business and

Management.

Mohsin, M. (2019, March 07). 10 Social Media Statistics in

2019 [Infographic]. Retrieved from Oberlo:

ICRI 2021 - International Conference on Recent Innovations

240

https://id.oberlo.com/blog/social-media-marketing-

statistics

Narges Delafrooz, M. Z. (2017). The Effect of Social Media

on Customer Loyalty and Company Performance of

Insurance Industry. International Journal of Economics

and Financial Issues.

Nugroho, W. (1997). Credit Information for Small

Businesses or Entrepreneurial Development, Bank

Management Series no. 5. Jakarta: Binaman Presindo

Library. Smartphone users in Indonesia 2016-2019.

(2019). Retrieved from Databoks.katadata:

https://databoks.katadata.co.id/datapublish/2016/08/08

/pengguna-smartphone-di-indonesia2016-2019

Rabaa’I, A. (2018). Social Media Engagement: Content

Strategy and Metrics Research Opportunities.

Robin Nunkoo, V. T. (2018). Service quality and customer

satisfaction: The moderating effects of hotel star rating.

International Journal of Hospitality Management.

S. Murali, S. P. (2016). Modelling and Investigating the

relationship of after sales service. Journal of Retailing

and Consumer Services.

Sasatanun, P. C. (2016). Social media use for CRM and

business performance satisfaction: The moderating

roles of social skills and social media sales intensity.

Scholastica Makau, C. L. (2017). The Role of Information

Quality on the Performance of Hotel Industry in Kenya

. European Scientific Journal.

Sebastian Molinilloa, R. A.-S.-C. (2019). Analyzing the

effect of social support and community factors on

customer engagement and it's impact on loyalty

behaviour. Computers in Human Behavior.

Sekaran, U. &. (2016). Research Methods for Business. In

Encyclopedia of Quality of Life and Well-Being

Research (Seventh ed). Chichester, West Sussex,

United Kingdom: John Wiley & Sons Ltd.

Shelly, G. B., & M. F. (2011). Web 2.0: Concepts and

Applications. Boston, USA: Course Technology.

Siakas, K. P. (2019). Social Customer Relationship

Management: A Case Study. International Journal of

Entrepreneurial Knowledge.

Sugiyono. (2016). Research and Development (R&D)

method. Bandung: Alfabeta.

Sugiyono. (2017). Quantitative, Qualitative, and R&D

Research Methods. Bandung: Alfabeta.

Vohra, G. G. (2019). Social Media Usage Intensity: Impact

Assessment on Buyers’ Behavioural Traits. Journal of

International Business.

Xia Liu, H. S. (2019). Examining the impact of luxury

brand's social media marketing on customer

engagement: Using bigdata analytics and natural

language processing. Journal of Business Research.

Evaluation of the Influence of Customer Loyalty and Customer Trust through Customer Retention on Social CRM on PT. Mega Finance

241