Factors Affecting the Financial Statement Fraud in the Perspective of

the Pentagon Fraud

Meiryani

1

, Aurelia Devina

1

, Jajat Sudrajat

2

and Zaidi Mat Daud

3

1

Accounting Department, Faculty of Economics and Communication, Bina Nusantara University,

Jakarta, 11480, Indonesia

2

BINUS Entrepreneurship Center, Management Department, BINUS Business School Undergraduate Program,

Bina Nusantara University, Jakarta, 11480, Indonesia

3

Accounting Department, Faculty of Economics and Business, Universiti Putra Malaysia, Malaysia

Keywords: Financial Statement Fraud, Fraud Pentagon, Financial Target, Financial Stability, Change in Auditor.

Abstract: This study aims to analyse the factors that affect financial statement fraud in fraud pentagon perspective in

the consumer goods industry sector companies registered in Indonesian Stock Exchange period 2017-2018.

The sampling technique used is the purposive sample method. The analysis of data used is linear regression.

This study showed financial target, financial stability, and change in auditors have an effect on financial

statement fraud. While external pressure, ineffective monitoring, change in directors, and frequent number of

CEO pictures have not affected on financial statement fraud.

1 INTRODUCTION

According to ACFE (2018b: 25), manufacturing

companies are ranked 2nd in terms of reporting fraud.

The results of a survey by the Association of Certified

Fraud Examiners Indonesia Chapter 2017, in 2016

showed that the most costly fraud in Indonesia was

corruption (77%), misappropriation (19%), and

financial statement fraud (4%). Research conducted

by ACFE 2018 also said that private companies have

the highest position as the biggest perpetrators of

fraud, with a percentage of 29%. The first example

related to fraud that was exposed to the public was the

case of PT. Tiga Pilar Sejahtera Food (AISA), a

multinational company in the field of food, and based

in Jakarta, Indonesia. AISA committed fraud by

duplicating books and doing window dressing in

2017 based on evidence by KAP Ernst and Young. In

the report, there was an overstatement of Rp 4 trillion

in accounts receivables, fixed set of fund inventories,

and Rp 662 billion in the food entity’s EBITDA.

Then, there was a flow of funds amounting to Rp 1.78

trillion for various TPSF schemes to all parties

suspected of having a profit management affiliation,

and there was no clear disclosure to relevant

stakeholders (Simamora, 2019). The next example

comes from the case of manipulation of financial

statements by PT Kimia Farma, which in 2001 was

reported to have a net income of IDR 132 billion.

BUMN and Bapepam consider that reported profits

are too large and contain manipulations or

manipulations in it. This happens because there is

overstated sales and inventory. Errors were

discovered after the financial statements were re-

audited in 2002. The audit found an increase in

earnings of 24.7% from what should have been

reported. This was due to overstated sales of Rp 2.7

billion, overstated inventory of the central logistics

unit of Rp 23.9 billion, overstated inventory of large

pharmaceutical wholesaler units of Rp 8.1 billion, and

overstated sales of Rp 10.7 billion. This occurs as a

result of misstatements in the financial statements

resulting from a significant increase in the value of

the inventory price list. Fraud is also committed to

sales by double recording sales transactions that are

not sampled, so that fraud is not detected.

Agency theory is a relationship or cooperation

that occurs between shareholders and management.

According to Vidyantie and Handayani (2006), the

interests of each party cause an agency conflict which

assumes that each individual, namely the agent and

principal, is only motivated by their respective

desires, causing conflict between the principal and the

agent. This misinterpreted situation is supported by

the misinterpretation of high agent motivation which

198

Meiryani, ., Devina, A., Sudrajat, J. and Mat Daud, Z.

Factors Affecting the Financial Statement Fraud in the Perspective of the Pentagon Fraud.

DOI: 10.5220/0011243400003376

In Proceedings of the 2nd International Conference on Recent Innovations (ICRI 2021), pages 198-205

ISBN: 978-989-758-602-6

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

is opportunistic. The existing information will be

made as good as possible so that the principal will

assess the company as ”good” and ”healthy”.

According to Sihombing and Rahardjo (2014),

financial statement fraud is intentional that occurs in

financial statements or reports that are presented

without following generally accepted accounting

principles. Pentagon fraud is a theoretical

development that has previously been found, namely

the fraud triangle theory by Cressey (1953) and also

the fraud diamond expressed by Wolfe and

Hermanson (2004). According to Marks (2012),

refining the fraud triangle theory into a fraud

pentagon occurs due to changes in the environment

and business practices in the 1950s compared to

conditions in the 2000s. The company has grown

from having only a local scale operational scope,

having few suppliers, simple organizational structure,

and self-managed ownership, has grown to a

company with the characteristics of a global

operational scale, global network vendor, complex

organizational structure, and no owner. In business

management. 89% of cases of fraud are committed by

individuals at the top management level, namely the

Chief Executive Director (CEO) and Chief Financial

Director (CFO). 70% of the profiles of perpetrators of

fraud are caused by arrogance or greed and individual

pressure (Marks, 2012).

In this study, the pressure factor is measured using

financial targets (ROA), financial stability

(ACHANGE), and external pressure (Leverage). The

second factor, opportunity is measured by Ineffective

Monitoring (BDOUT). The third factor

rationalization is measured by Change in Auditor

(CPA), the fourth factor is competence as measured

by Change in Director (DCHANGE), and the fifth

factor is arrogance which is measured by the frequent

number of CEO’s picture (CEOPIC). Research

conducted by Aulia Haqq and Budiwitjaksono (Aulia

Haqq and Budiwitjaksono, 2021), entitled ”Pentagon

fraud theory analysis as fraud detection in financial

statements” produces research results that financial

stability and CEO’s photo frequency have a

significant effect on fraudulent financial reporting in

LQ45 companies listed on the IDX in 2015-2017.

And also previous research conducted by Daughter

(Daughter, 2019), entitled ”Pentagon Fraud in

Earnings Management in Metal and Chemical

Manufacturing Companies” found that pressure,

rationalization, and competence had a significant

effect on financial statement fraud. Based on the

problems described, and on previous studies, this

research provides novelty related to research on

pentagon fraud in consumer goods industry

manufacturing companies listed on the Indonesia

Stock Exchange in 2017-2018, using RStudio as a

data processing application, with the aim of to

determine the effect of factors on the fraud pentagon

on financial statement fraud.

2 RESEARCH METHODOLOGY

The type of data used in this research is quantitative.

This study uses secondary data sources, according to

Ghazali (2018). Secondary data is data whose sources

are obtained indirectly or through intermediaries. The

data sources used are obtained from the Indonesia

Stock Exchange website, namely www.idx.co.id. The

data used in this study is a type of panel data, namely

data that combines time series and cross section data

The population in this study were all

manufacturing companies in the consumer goods

industry listed on the Indonesia Stock Exchange in

2017-2018, totaling 61 companies. The sampling

technique used in this study was purposive sampling

technique. The following are the criteria established

in the sample selection in this study, namely as

follows:

• Manufacturing companies in the consumer

goods industry sector which are listed on the

Indonesia Stock Exchange (IDX) in 2017-

2018.

• Manufacturing companies in the consumer

goods industry that publish audited annual

financial reports that can be accessed on the

Indonesia Stock Exchange (IDX) website

during 2017-2018 which are stated in rupiah

(IDR).

• The company provides complete information

according to research needs, relating to the

independent variable and the dependent

variable.

This study collected samples using the

documentation method of audited financial reports

and annual reports of manufacturing companies in the

consumer goods industry which were listed on the

Indonesia Stock Exchange in 2017-2018. Data

collection is done by gathering information and then

studying existing documents. This research also uses

literature study method which obtains data and theory

from journals, internet, books, articles, and previous

research related to this research. The data analysis

method in this study uses quantitative methods, by

quantifying research data, so that it can provide

results in the form of information needed in the

analysis. This study uses multiple linear regression

Factors Affecting the Financial Statement Fraud in the Perspective of the Pentagon Fraud

199

analysis methods, and uses the F-Score Model to

measure financial statement fraud, which according

to (Adherian Kurnia and Anis, 2017; Septriani and

Handayani, 2018), is formulated as follows:

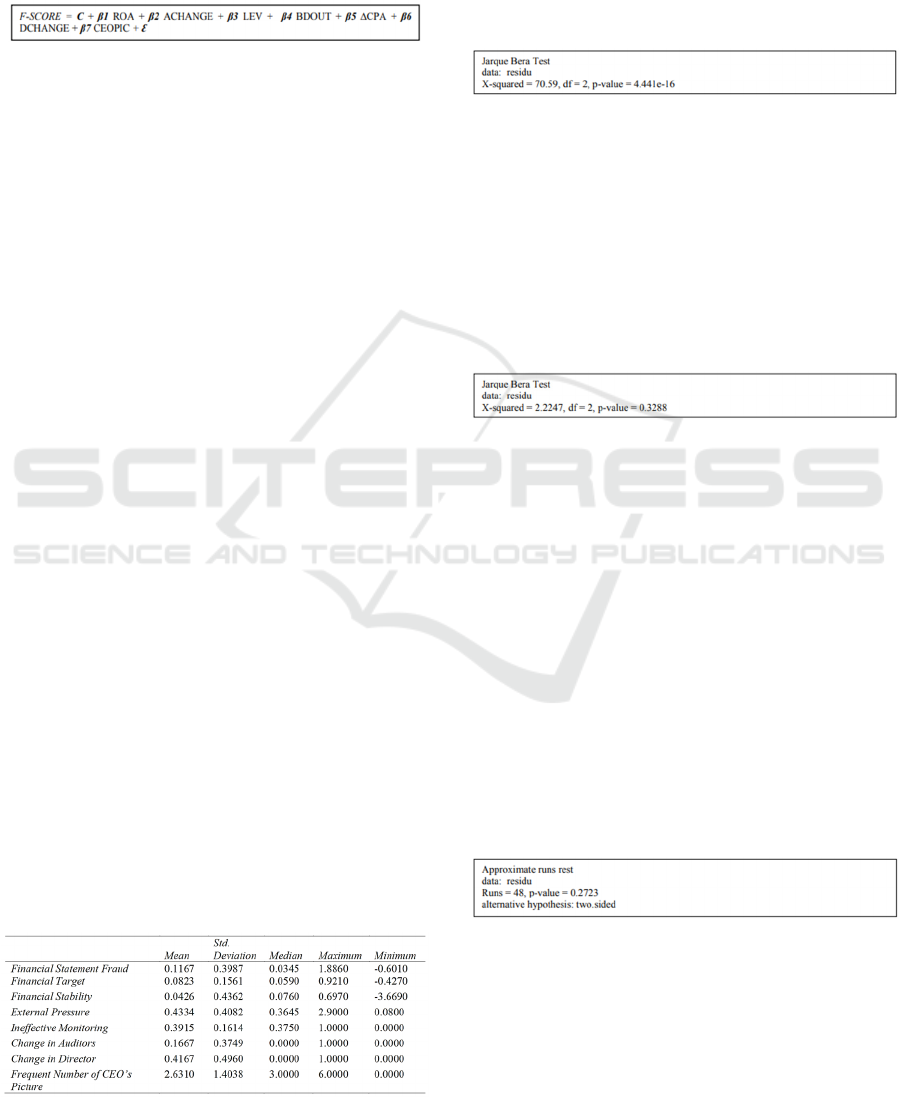

Table 1: F SCORE Model.

Information :

F-Score = Fraudulent financial statements

c = Constant

1-8 = Regression coefficient

ROA = Return on Assets

ACHANGE = the ratio of changes in total assets

LEV = the ratio of total liabilities to total assets

BDOUT = Independent board of commissioners ratio

CPA = Change of independent auditors

DCHANGE = Change of the board of directors in the

company

CEOPIC = Number of CEO photos included in an

annual report = Error

This study presented data using a table containing

the test results of the research object with software

such as RStudio which is used to test data statistically

or Microsoft Excel, which is used to collect and

summarize data. The results of the analysis of the

research will be presented in a narrative form to

explain the results of the research.

3 RESULT AND DISCUSSION

3.1 Descriptive Statistical Analysis

The first step in conducting this research is to analyze

existing data, through descriptive analysis methods.

Descriptive analysis is an analytical method used to

explain the problem being analyzed in the form of a

summary of research data. The following are the

results of descriptive statistics on the variables of this

study using Rstudio software version 3.6.1 which are

presented in the following table:

Table 2: Descriptive Statistics Test Results.

3.2 Normality Test

The normality test is used to see the distribution of

data that will be used in the study. This study uses the

Jarque-Berra test (JB-test), where the data will be

declared normal if the p-value 0.05.

Table 3: Normality Test Results.

Through the results above, it can be seen that the

p-value 0.05, and it means that the data is not

normally distributed. According to Ghazali (2018)

data that does not have a normal distribution can be

transformed to become normal. In this study, the

FSCORE variable data was transformed into natural

logarithms so that the data could be used. Following

are the results of the normality assumption test from

this study after the data were transformed:

Table 4: Normality Test Results After Transformation.

After the data were transformed, a p-value of

0.3288 was obtained. This value is 0.05 or 5%, so the

research data is stated to be normally distributed.

3.3 Autocorrelation Test

The autocorrelation test uses the run-test statistical

test, where if the probability is more than 0.05, then

the regression model is considered not to have

autocorrelation. The results of the run-test can be seen

in Table 5 below:

Based on the results of the above processing, the

p-value is 0.2723. This value is greater than the

residual significance value, namely 0.05 or 5%. This

means that there is no autocorrelation problem in the

regression model.

Table 5: Autocorrelation Test Results.

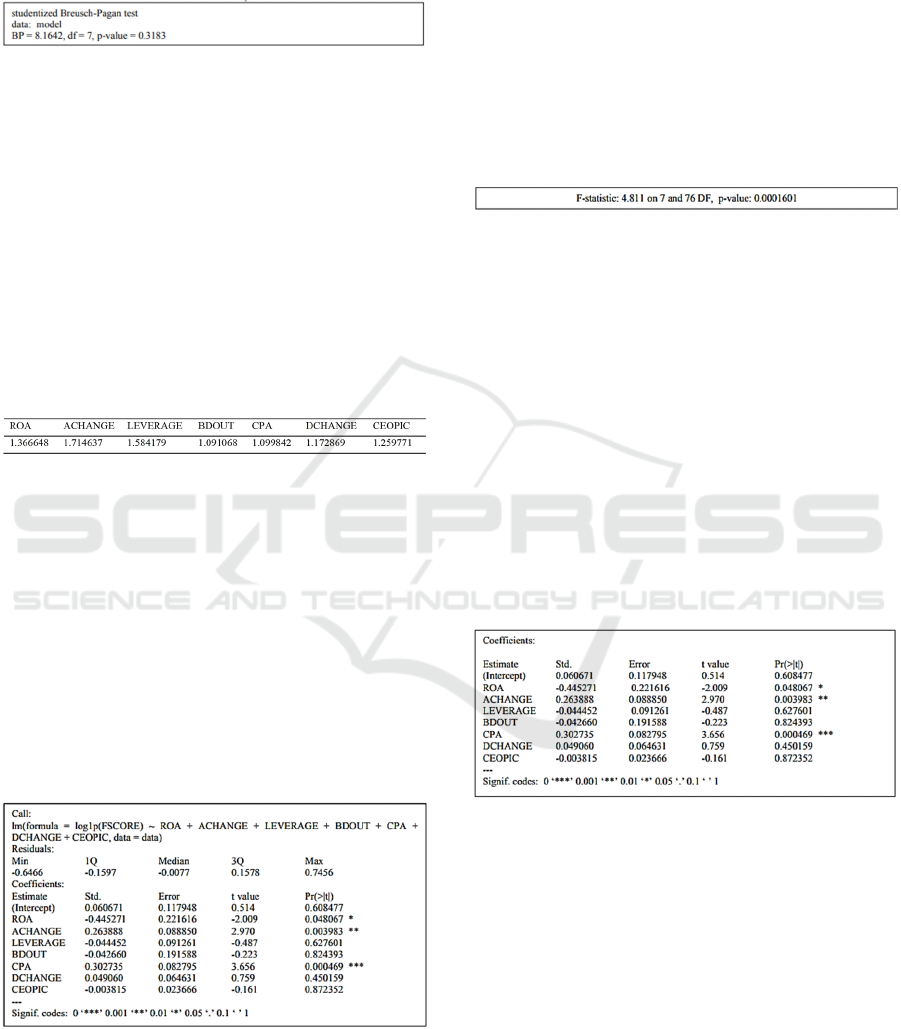

3.4 Heteroscedasticity Test

The heteroscedasticity test in this study used the

Breusch Pagan Godfrey (BPG) test. The criterion in

the Pagan Godfrey (BPG) Breusch test is that if the

probability value is 0.05, then there is no indication

ICRI 2021 - International Conference on Recent Innovations

200

of a heteroscedasticity problem. The following are the

results of the heteroscedasticity test:

Table 6: Heteroscedasticity Test Results.

Based on the results of the above processing, the

p-value is 0.3183. This value is greater than the

residual significance value, namely 0.05 or 5%. This

means that there is no heteroscedasticity problem in

this study.

3.5 Multicollinearity Test

The multicollinearity test in this study uses the

centered Variance Inflation Factor (VIF) value. If the

VIF value is 10, it means that there is no

multicollinearity. The following are the results of the

multicollinearity test:

Table 7: Multicollinearity Test Results.

Based on the results of the data processing above,

it can be seen that each variable has a VIF value

below 10. This means that there are no symptoms of

multicollinearity.

3.6 Multiple Regression Analysis

After conducting descriptive statistical tests and

classical assumption tests, multiple linear regression

analysis was carried out. The following is the result

of multiple linear regression using the Rstudio

version 3.6.1 program:

Table 8: Results of Multiple Linear Regression Analysis.

Based on the results of the data processing above,

the following equation can be formulated: FSCORE

= 0.060671 - 0.445271 * ROA + 0.263888

*ACHANGE - 0.044452 * LEVERAGE - 0.042660

* BDOUT + 0.302735 * CPA + 0.049060 *

DCHANGE - 0.003815 * CEOPIC.

3.7 F-value Test Results

The F value test is carried out so that it can be seen

whether there is a joint influence between the

independent variable and the dependent variable. The

following are the results of the F value test using the

Rstudio 3.6.1 program:

Table 9: F-Value Test Results.

Based on Table 9 of the F-Value Test Results

above, it can be seen that the results of the F-statistical

profitability above have a p-value of ¬ 0.0001601.

This means that at the 5% significance level, H0 is

rejected. This means that the independent variables

have a joint influence on the dependent variable (H1

is accepted).

3.8 T-value Test Results

The t statistical test is used to determine whether the

independent variable partially has a significant effect

on the dependent variable. The following are the

results of the t-value test using the Rstudio 3.6.1

program:

Table 10: Test Results Value t.

Based on Table 10 the results of the t-value test

above, at the 5% significance level, the results can be

obtained:

● Financial target (ROA). Testing of return on

assets in this study results in the results that

financial targets have an influence on financial

statement fraud in consumer goods industry

sector companies listed on the IDX in 2017-

2018. Based on the results in Table 10, ROA

has a significance value of 0.048067, this

indicates that the value is less than 0.05.

Through these results it can be concluded that

H1 is accepted.

Factors Affecting the Financial Statement Fraud in the Perspective of the Pentagon Fraud

201

● Financial stability (ACHANGE). Testing on

the ratio of changes in total assets, resulted in

the result that financial stability had an

influence on financial statement fraud in

consumer goods industry sector companies

listed on the IDX in 2017-2018. Based on the

results in Table 10, ACHANGE has a

significance value of 0.003983, this indicates

that the value is less than 0.05. Through these

results it can be concluded that H1 is accepted.

● External pressure (Leverage). Testing on the

leverage ratio resulted in the result that

external pressure had no effect on financial

statement fraud in consumer goods industry

sector companies listed on the IDX in 2017-

2018. Based on the results in Table 10,

leverage has a significance value of 0.627601,

this indicates that this value is greater than

0.05. Through these results it can be concluded

that H0 is accepted and H1 is rejected.

● Ineffective Monitoring (BDOUT). Testing on

the ratio of the independent board of

commissioners, results in the result that

ineffective monitoring has no effect on

financial statement fraud in consumer goods

industry sector companies listed on the IDX in

2017-2018. Based on the results in Table 10,

BDOUT has a significance value of 0.824393,

this indicates that the value is greater than

0.05. Through these results it can be concluded

that H0 is accepted and H1 is rejected.

● Change in Auditor (CPA). Testing on change

in auditors resulted in the result that

rationalization had an influence on financial

statement fraud in consumer goods industry

sector companies listed on the IDX in 2017-

2018. Based on the results in Table 10, CPA

has a significance value of 0.000469, this

indicates that the value is less than 0.05.

Through these results it can be concluded that

H1 is accepted.

● Change in Auditor (CPA). Testing on change in

auditors resulted in the result that

rationalization had an influence on financial

statement fraud in consumer goods industry

sector companies listed on the IDX in 2017-

2018. Based on the results in Table 10, CPA has

a significance value of 0.000469, this indicates

that the value is less than 0.05. Through these

results it can be concluded that H1 is accepted.

● Frequent Number of CEO’s Picture

(CEOPIC). Testing the number of photos of

the CEO in the company’s annual report

results that arrogance has no effect on

financial statement fraud in consumer goods

industry sector companies listed on the IDX in

2017-2018. Based on the results in Table 10,

CEOPIC has a significance value of 0.872352,

this indicates that the value is greater than

0.05. Through these results it can be concluded

that H0 is accepted and H1 is rejected.

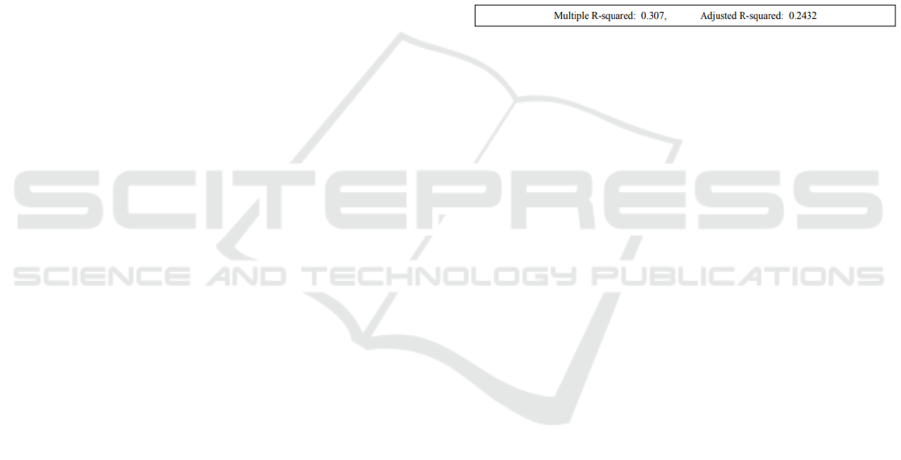

3.9 Coefficient of Determination

(Adjusted R2)

The coefficient of determination is carried out to

determine the size of a model’s ability to explain its

dependent sample variations. The following is the test

result of the coefficient of determination using the

Rstudio 3.6.1 program:

Table 11: Adjusted R2 Test-Result.

From Table 11 Adjusted R2 Test Results, it can

be seen that the coefficient of determination is

0.2432. This means that FSCORE is influenced by all

independent research variables by 24.32%. While the

remaining 75.68% is influenced by other factors that

are not included in this research model.

3.10 The Influence of Financial Targets

on Fraud Financial Statement

The first hypothesis proposed states that financial

targets have an influence on financial statement fraud

in consumer goods industry sector companies listed on

the IDX in 2017-2018. In this study, the financial target

was used as a proxy for the pressure factor on the fraud

pentagon. The management of the company generally

expects a high level of income in the company, this is

certainly in accordance with agency theory, which

explains the relationship between shareholders and

management. According to Tiffani and Marfuah

(2015), the pressure on achieving targets or the high

level of ROA that must be met to get a bonus, of

course, causes a high possibility for company

management to manipulate earnings. These results are

in line with the results of research by Agusputri and

Sofie (2019), which state that financial targets have a

significant effect on financial statement fraud.

3.11 The Effect of Financial Stability on

Fraud Financial Statement

The second hypothesis that is put forward states that

financial stability has an influence on financial

ICRI 2021 - International Conference on Recent Innovations

202

statement fraud in consumer goods industry sector

companies listed on the IDX in 2017-2018. Financial

stability in this study is also used as a proxy for the

pressure factor on the fraud pentagon. The ratio of

changes in total assets is used to measure financial

stability, because this ratio can provide a reflection of

the company’s financial condition. The higher the

asset growth rate of a company, the higher the

company’s ability to operate properly. An increase in

company assets, usually can be due to management’s

motivation to increase these assets, because the assets

of the previous year tend to be small, and this is

related to company pressure that triggers

management. This result is in line with the research

results of Siddiq et al. (2017), which state that

financial stability has a significant effect on financial

statement fraud.

3.12 Effect of Ineffective Monitoring on

Fraud Financial Statement

The fourth hypothesis proposed states that ineffective

monitoring has no effect on financial statement fraud

in consumer goods industry sector companies listed

on the IDX in 2017-2018. In this study, the ratio of

the independent board of commissioners is a proxy

for the opportunity factor in the fraud pentagon.

Financial statement fraud can occur if there is an

opportunity or opportunity to do so. The low level of

internal control will create opportunities for certain

parties to manipulate financial reports. This study

resulted in the result that the number of independent

commissioners had no effect on the occurrence of

financial statement fraud. This proves that the

independent board of commissioners in the consumer

goods industry sector company in 2017-2018 has a

good function in carrying out its internal supervision.

These results are in line with the results of research

by Yulianti et al. (2019), which states that ineffective

monitoring has no significant effect on financial

statement fraud.

3.13 The Effect of Change in Auditors

on Financial Statement Fraud

The fifth hypothesis proposed states that

rationalization has an influence on financial statement

fraud in consumer goods industry sector companies

listed on the IDX in 2017-2018. According to

Agusputri and Sofie (2019), auditor changes that are

done too often by a company can make it difficult for

auditors to detect financial statement fraud, this is

because these changes require new auditors to take

longer than usual in studying the company’s financial

statements. By changing auditors, a new auditor who

takes a long time will find it more difficult to detect

indications of financial statement fraud, because new

auditors must first study the company’s financial

condition from year to year. From the above results,

it can be interpreted that a financial statement fraud

may occur due to a change in auditors due to the

company’s dissatisfaction with the auditor’s

performance. The influence on the occurrence of

financial statement fraud can also indicate that the

company can change auditors in an effort to eliminate

traces of fraud detected by the previous auditor. This

result is in line with the research results of Agusputri

and Sofie (2019), which state that rationalization has

a significant effect on financial statement fraud.

3.14 The Influence of Change in

Director on Fraud Financial

Statement

The sixth hypothesis proposed states that competence

has no influence on financial statement fraud in

consumer goods industry sector companies listed on

the IDX in 2017-2018. In this study, the change of

directors was carried out to measure the proxy of

competence which is a factor of pentagon fraud.

Changing the board of directors to become more

competent is considered to be more effective in

improving company performance. Changes of

directors can also occur because the directors who

served previously have retired or have passed away.

Apart from these reasons, changes to the directors can

be made for efforts to get rid of the previous directors,

who have indications of fraudulent practices.

Through the results of the above research, the results

show that change in director has no effect on the

occurrence of financial statement fraud. These results

are consistent with research conducted, who state that

change in director does not have a significant effect

on financial statement fraud.

3.15 The Effect of Frequent Number of

CEOs on Financial Statement

Fraud

The seventh hypothesis proposed states that

arrogance has no effect on financial statement fraud

in consumer goods industry sector companies listed

on the IDX in 2017-2018. In this study, the number

of photos of the CEO on the financial statements is

used to measure the arrogance factor of the fraud

pentagon. Measurements are made by calculating the

number of CEO photos contained in each sample of

the annual report of companies in the consumer goods

Factors Affecting the Financial Statement Fraud in the Perspective of the Pentagon Fraud

203

industry sector for 2017-2018. The photo of the CEO

on the company’s annual report is intended to

introduce the CEO’s profile, and the large number of

figures in the annual report is a photo resulting from

the activities held by the company. In addition, there

are still some sample companies that do not show

photos of their CEOs in their annual reports. This

means that the large number of CEO photos in the

company’s annual report has no relationship with

financial statement fraud. This result is in line with

the research results of Daughter [9], which state that

arrogance does not have a significant effect on

financial statement fraud, and Prima and Siska

(2019), who state that frequent number of CEO’s

pictures do not have a significant effect on financial

statement fraud.

4 CONCLUSION AND

SUGGESTION

4.1 Conclusion

Based on the phenomena, problem formulation,

hypothesis development, results and discussion,

conclusions as follow:

● Financial targets have a significant effect in

detecting the existence of financial statement

fraud in consumer goods industry sector

companies listed on the Indonesian Stock

Exchange 2017- 2018.

● Financial stability has a significant influence

in detecting financial statement fraud in

consumer goods industry companies listed on

the Indonesia Stock Exchange in 2017-2018.

● External pressure has no effect in detecting

financial statement fraud in consumer goods

industry companies listed on the Indonesia

Stock Exchange in 2017-2018.

● Ineffective Monitoring has no effect in

detecting financial statement fraud in

consumer goods industry companies listed on

the Indonesia Stock Exchange in 2017-2018.

● Change in auditors have a significant effect in

detecting financial statement fraud in

consumer goods industry companies listed on

the Indonesia Stock Exchange in 2017-2018.

● Change in director has no effect in detecting

financial statement fraud in consumer goods

industry companies listed on the Indonesia

Stock Exchange in 2017-2018.

● Frequent number of ceo’s pictures have no

effect in detecting the existence of financial

statement fraud in consumer goods industry

sector companies listed on the Indonesia Stock

Exchange in 2017-2018.

4.2 Suggestion

Based on the above conclusions, the following

suggestions can be given by the author:

● For further researchers. Future research is

expected to increase the number of samples in

the study, and increase the period of the study

year, and use other data regression techniques,

so that the research results are better, more

relevant, and updated.

● For the Company. With this research, it is

hoped that the company management will be

more vigilant regarding fraud that may occur

in the company. The management may also be

able to take preventive measures by increasing

internal controls in the company.

● For Investors. It is hoped that investors will be

able to be careful and pay attention to various

aspects in making their investment decisions,

especially in terms of the company’s financial

statements. This is so that investors will later

be able to avoid losses in investing resulting

from fraudulent financial statements.

REFERENCES

Adherian Kurnia, A., & Anis, I. (2017). Pentagon Fraud

Analysis in Detecting Fraudulent Financial Statements.

XX Jember National Accounting Symposium.

Agusputri, H., & Sofie. (2019.). Factors Affecting

Fraudulent Financial Reporting Using Pentagon Fraud

Analysis. Journal of Taxation Information, Accounting

and Public Finance, 14 (2), 105-124.

Aulia Haqq, A., & Budiwitjaksono, G. (2021). Pentagon

fraud theory analysis as fraud detection in financial

statements. Journal of Economics, Business, and

Accountancy Ventura Vol. 22, No. 3, 319-332.

Cressey, D. (1953). Other people's money, in: The Internal

Auditor as Fraud buster, Hillison, William. Et. Al.

1999. Managerial Auditing Journal, MCB University

Press, 14 (7): 351-362.

Fakhruddin, Hendy M. 2008. The term Capital Market A-

Z.Gramedia. Jakarta

Ghazali, Imam. (2018). Multivariate Analysis Application

with SPSS Program. Semarang: Diponegoro University

Publishing Agency.

Marks, J. (2012). The mind behind the fraudsters crime:

Key behavioral and environmental elements. In ACFE

Global Fraud Conference. Association of Certified

Fraud Examiners.

ICRI 2021 - International Conference on Recent Innovations

204

Prima & Siska. (2019). The Effect of Pentagon Fraud on

Financial Statement Fraud (Study on the Consumer

Goods Industry Sector Listed on the IDX 2015-2017

Period). Journal of Accounting, Auditing, and

Accounting Information Systems, 3 (3).

Daughter, T. (2019). Pentagon fraud in profit management

in metal and chemical manufacturing companies.

Wahana Accounting Journal, 14 (2), 143-155.

Septriani, Y., and Handayani, D. (2018). Detecting Fraud

Financial Statements with Pentagon Fraud Analysis.

Journal of Financial and Business Accounting, 11 (1),

11–23.

Siddiq, Faiz Rahman, Fatchan Achyani, and Zulfikar.

(2017). Pentagon Fraud in Detecting Fraud Financial

Statement. National Seminar and the 4th Call for Sharia

Paper, 1–14.

Sihombing, K. S., and Rahardjo, S. N. (2014). Diamond

Fraud Analysis in Detecting Fraud Financial Statement.

Journal of Accounting, 3 (2), 1-12.

Simamora, N. S. (2019). AISA Confusion, Alleged

Double Bookkeeping and Ernst & Young's Window

Dressing. Retrieved August, 23 2020 from

https://market.bisnis.com/read/20190327/192/905016/

kisruh-aisadugaan-pembukuan-gandahingga-window-

dressing-t Discoveryernst-young

Tiffani, L., & Marfuah. (2015). Detection of Fraud

Financial Statement Using Fraud Triangle Analysis in

Manufacturing Companies Listed on the Indonesia

Stock Exchange. Indonesian Journal of Accounting and

Auditing, 19 (2), 112-125.

Vidyantie, D. N. and R. Handayani. (2006). The Analysis

of The Effect of Debt Policy, Dividend Policy,

Institutional Investor, Business Risk, Firm Size and

Earning Volatility to Managerial Ownership Based on

Agency Theory Perspective. Journal of Business and

Accounting, Vol. 8, No.2, April, p. 19-33.

Wolfe, D., & Hermanson, D. (2004). The Fraud Diamond:

Considering the Four Elements of Fraud Considering

the four elements of fraud. The CPA Journal, pp. 1-5.

Yulianti, Pratami, S. R., Widowati, Y. S., & Prapti, L.

(2019). Influence of Fraud Pentagon Toward

Fraudulent Financial Reporting in Indonesia an

Empirical Study on Financial Sector Listed in

Indonesian Stock Exchange. International Journal of

Scientific & Technology Research, 808, 238-242.

Factors Affecting the Financial Statement Fraud in the Perspective of the Pentagon Fraud

205