The Influence of Auditor’s Independence, Experience and Auditor’s

Competency on Audit Judgement

Meiryani

1

, Yustinus Renald Rizky

1

, Andreas Chang

2

and Dedeh Maryani

3

1

Accounting Department, Faculty of Economics and Communication, Bina Nusantara University,

Jakarta, 11480, Indonesia

2

Entrepreneurship Department, Bina Nusantara University, Jakarta, Indonesia

3

Economic Development and Empowering People, Governmental Politic,

IPDN Jl. Ir. Sukarno Km. 20 Jatinangor Sumedang, Indonesia

Keywords: Audit Judgement, Independence, Experience, Competency.

Abstract: The purposes of research were to explore the effect of auditor’s independence, experience and competency

on Audit Judgement. The methods applied were a literature study and a field study by doing surveys using

questionnaire. The questionnaire was given to auditors in Jakarta, The research results indicated that

Independence and competency have significant effect on Audit Judgement while experience have no

significant effect on Audit Judgement. In conclusion, Audit Judgement is significantly influenced by

Independence and competency, while experience has no significant effect.

1 INTRODUCTION

Financial reports according to Financial Accounting

Standards (SAK) are part of a complete financial

reporting process which usually includes balance

sheets, income statements, changes in financial

position reports which can be presented in various

ways such as: as a cash flow statement, or a statement

of fund flows, notes and other reports and explanatory

material that are an integral part of financial reports.

Financial statements in general are the final result of

a process of recording financial transactions in a

company that shows the company’s financial

condition in 1 (one) accounting period and is also an

overview of the performance of a company, financial

statements are made based on considerations

according to the information presented by

management. companies in their financial statements.

Thus, there are differences in interests, between the

company shareholders and the company

management. The difference in interest is part of the

agency relationship.

According to Ross (Ross, 1973) Agency relations

are one of the oldest and most common modes of

social interaction. Agency relationships have arisen

between two (or more) parties when one, appointed

as agent, acts for, on behalf of, or as representative for

the other, is appointed principal, in a particular

domain of decision-making. An agency relationship

is a contract in which one or more people (principal)

engage other people (agents) to perform some

services on their behalf that involve delegating some

decision making authority to the agent.

Due to the difference in interests, the public

accounting profession appears as a third party. In this

case, the auditors are able to provide assurance

services that the financial statements are relevant and

reliable, so that it can create trust for all parties who

have an interest. Auditor services as independent

parties are very much needed, because these services

are very important for users of financial statements

for decision making. Public accountants who carry

out auditing activities work not only for the benefit of

their clients but also for other parties who use the

audit report. Thus, in this case the auditor must have

sufficient independence and competence in order to

maintain the trust of clients and users of financial

statements.

Arens (2016) Auditing is the accumulation and

evaluation of evidence about information to

determine and report at the level of correspondence

between the information and the established criteria.

The audit must be carried out by a competent and

independent person. The final objective in an audit

process is to make an independent auditor opinion on

Meiryani, ., Renald Rizky, Y., Chang, A. and Maryani, D.

The Influence of Auditor’s Independence, Experience and Auditor’s Competency on Audit Judgement.

DOI: 10.5220/0011242800003376

In Proceedings of the 2nd International Conference on Recent Innovations (ICRI 2021), pages 187-192

ISBN: 978-989-758-602-6

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

187

financial statements with audit judgment that has a

basis and deep consideration to show the absence of

improperness in the preparation of financial

statements and doubts regarding the Company’s

ability to pay off its obligations and the company’s

future sustainability. The Public Accountant

Professional Standard (SPAP) states that the audit

judgment on the ability of the business entity to

maintain its operation must be based on the auditor’s

own competence against the ability of a business

entity to sustain itself within a period of one year from

the date of the financial statements.

According to Arens (2016) Audit Judgment is a

personal consideration or the auditor’s point of view

in responding to information related to audit

responsibilities and risks that will be faced by the

auditor, which will affect the auditor’s independent

opinion on the financial statements of an entity. Audit

judgment is needed by the auditor in carrying out his

duties, especially in auditing the financial statements

of a company. Judgment depends on obtaining

evidence and developing that evidence so as to

produce confidence that arises from the auditor’s

ability to explain the evidence described. The more

reliable the judgment taken by the auditor, the more

reliable the audit opinion issued by the auditor. Audit

judgment is influenced by many factors, but in this

study the factors studied were the independence,

experience and competence of the auditor.

Independence is an attitude that is free from the

influence of other parties (not controlled and not

dependent on other parties), intellectually honest, and

objective (not taking sides) in considering facts and

expressing opinions. According to Arens (2016), the

auditor tries hard to maintain the level of

independence. high level of trust in users who rely on

their reports. The next factor that can influence the

auditor’s judgment is experience, the experience of an

auditor is the experience an auditor has in conducting

an examination of the number of different

assignments that have been carried out and the length

of time the auditor has carried out his profession and

can increase his knowledge of error detection,

according to Mulyadi (2002) in Pektra and Kurnia

(2015) if a person enters a career as a public

accountant, he must first seek professional experience

under the supervision of a more experienced senior

accountant.

Apart from independence and experience,

competence is another factor that can influence audit

judgment, according to Tandiontong (2016).

Competence relates to expertise, knowledge and

experience so that a competent auditor is an auditor

who has sufficient knowledge, training, skills and

experience to be able to successfully complete his

audit task, Competence concerns both knowledge of

standards, professional techniques and technical

issues involved, and the ability to make wise

judgments about applying that knowledge to each

assignment. An auditor who gives judgment on the

audit must be someone who has high competence and

is good in their field.

There are many cases of Audit Judgment in

several companies in Indonesia. These cases show the

urgency and recency of the research carried out.

These cases describe the Audit Opinion that is not in

accordance with what actually happened. This

opinion is certainly influenced by the Audit

Judgment, so the author takes the Judgment audit as

the variable under study. In 2018 there were problems

with the Garuda Company’s financial statements, due

to irregularities in the recognition of income in the

financial statements. This irregularity led to a

decrease in the audit opinion on the financial

statements, the auditor concerned was also

sanctioned, Then in addition in 2018 there were

problems in the financial statements of PT Sun Prima

Nusantara Financing (SNP) Finance. Previously, PT

SNP’s Financial Statements received an unqualified

opinion, but PT SNP experienced nonperforming

loans which caused losses to the bank. and the public

accountant concerned is sanctioned. In addition, in

2019 there was a Jiwasraya Insurance Case involving

KAP big 4 PricewaterhouseCoopers (PwC), the KAP

which audited Jiwasraya’s financial statements was

suspected of negligence. PwC provides an

unqualified opinion on the consolidated financial

statements of PT Asuransi Jiwasraya in the audited

financial report signed by the PwC auditor which

shows net income but Jiwasraya actually loses so that

there is a discrepancy in the opinion given by the

auditor. Based on the example of this case, it can be

concluded that cheating can be done by anyone if

there is an opportunity. Even if it is done by a well-

known and trusted KAP, as an auditor it should have

followed the applicable financial reporting standards.

Although management is responsible for the financial

reports they issue. The auditor remains responsible

for the opinions given by the public accounting firm.

The auditor’s opinion is made based on the auditor’s

judgment. because the auditor’s job is as an assurance

service, namely to ensure that the financial reports

have been made fair and in accordance with

applicable standards. even if it is if when the auditor

audits the company, he finds no irregularities. If the

case arises in a company that has been audited, the

auditor will be blamed and if the auditor finds

indications of fraudulent financial statements being

ICRI 2021 - International Conference on Recent Innovations

188

manipulated by management, the auditor should

make judgments in issuing an opinion. This

consideration is an Audit Judgment. Based on this

background, the problem discussed in this study is

whether Independence, Experience and Competence

affect the Audit Judgment.

Various previous studies have been conducted

which prove the existence of a relationship between

independence, experience and competence in audit

judgment. Vincent and Osesonga (2019) conducted a

study where they found that independence has an effect

on audit judgment. Besides, Yendrawati and Mukti

(2015) in their research suggest that the experience of

the auditor has a significant effect on audit judgment.

And Rani and Putra (2016) research states that the

competence of auditors is proven to have a significant

effect on audit judgment. The three studies show that

Independensi Experience and Competence influence

audit judgment. So the researchers conducted this

research to prove the truth of the model to public

accountants at KAP in Jakarta. Based on the above

formulation, the purpose of this study is to analyze the

influence of the independence, experience and

competence variables on the audit judgment.

2 RESEARCH METHODOLOGY

The research method used in this research is a

quantitative method. According to Sekaran (2016)

quantitative data is data in the form of numbers which

is generally collected through structured questions.

And the data is collected using a questionnaire that

will be given to the public accounting firm to be filled

in and given back to the author, so that the author can

get data in the form of answers from the questionnaire

created by the author and in each of the questionnaire

questions there are answers that are weighted using a

Likert scale. Likert scale. According to Sekaran

(2016) the Likert scale is a scale designed to test how

strongly respondents agree with the statement.

For a best viewing experience the used font must

be Times New Roman, on a Macintosh use the font

named times, except on special occasions, such as

program code. The data studied is primary data,

which refers to information obtained from the results

of direct research empirically to direct actors or those

directly involved with data collection techniques

resulting from filling out questionnaires commonly

carried out by researchers. Primary data comes from

the results of data collection in the form of

questionnaires to respondents to auditors at the Public

Accounting Firm in Jakarta. According to Sekaran

(2016), the sample is part of the population,

consisting of several selected members. In other

words, some but not all of the elements of the

population make up the sample. A sample is thus a

subgroup or subset of the population. By studying a

sample, the researcher should be able to draw

generalizable conclusions for the population of

interest. There are two main types of sampling

techniques, namely: probability sampling and

nonprobability sampling. The sampling technique

used is non probability sampling. With a sampling

technique, namely purposive sampling.

According to Sekaran (2016), purposive sampling

is sampling that is limited to certain types of people

who can provide the desired information, either

because they are the only ones who have it or they

conform to several criteria set by the researcher. In

this study the authors used respondents, namely

auditors who work at the public accounting firm in

the Jakarta area. Determination of the sample using

the Rule of Thumb. Roscoe (1975) proposes a Rule

of thumb for determining sample size: (1) sample sizes

greater than 30 and less than 500 are appropriate for

most studies. (2) where the sample is to be divided into

subsamples, a sample size of at least 30 for each

category is required. (3) in a multivariate study, the

sample size should be several times larger than the

number of variables in the study. (4) for simple

experimental research with strict experimental control,

successful research is possible with a sample size as

small as 10 to 20. To obtain objective data on the

independence, experience and competence of auditors

and their effect on audit judgment, a questionnaire will

be given to auditors who work at KAP in Jakarta. From

these calculations it can be determined that this study

will take a sample of 49 respondents. To obtain data

and information in this study, the authors collected data

using a questionnaire technique.

For the purposes of this analysis and research, the

author requires a number of data, both from within

and outside the organization. To obtain data and

information in this study, the authors collected data

using a questionnaire technique. Sekaran (2016), a

questionnaire is a set of pre-formulated written

questions where respondents record their answers,

usually in a more closely defined alternative. In this

study, the researcher used the data analysis method,

namely multiple linear regression. Multiple linear

regression analysis is a technique used to calculate the

estimated relationship of one or more independent

variables with the dependent variable.

In this study, the researcher used the data analysis

method, namely multiple linear regression. Multiple

linear regression analysis is a technique used to

calculate the estimated relationship of one or more

The Influence of Auditor’s Independence, Experience and Auditor’s Competency on Audit Judgement

189

independent variables with the dependent variable.

According to Sekaran (2016) Multiple linear

regression analysis is used in situations where one or

more independent variables are hypothesized to

influence the dependent variable. Multiple linear

regression analysis will be carried out if the number

of independent variables is at least two or more and

translate into several sub hypotheses which state the

influence of the most dominant independent sub

variable on the dependent variable. Methods of

presenting data using a variety of software, such as

Microsoft Excel and SPSS. Microsoft Excel is used

to summarize and collect quantitative data for later

processing. Meanwhile, SPSS is used to perform

statistical tests on data collected using a questionnaire

that has been previously distributed. After that, the

results of the analysis of each test carried out will be

presented descriptively in narrative form to explain

the research results in more detail. The research data

is processed using SPSS 22 software by performing

descriptive statistical testing, testing data quality by

testing validity and reliability, testing classical

assumptions. with the normality test,

multicollinearity test and heteroscedasticity test, and

hypothesis testing with the coefficient of

determination test, the F-value test (Simultaneous)

and the Tvalue test (Pasial). By doing this research, it

is hoped that it can become a consideration or

evaluation for public accountants regarding the

influence of the independence, experience and

competence variables on audit judgment.

3 RESULT AND DISCUSSION

In this study, the factors studied were independence

(X1), experience (X2) and competence (X3) on audit

judgment (Y). After doing data quality testing, in the

form of validity test, reliability test. The classic

assumption test is in the form of normality test,

multicollinearity test, heteroscedasticity test and

hypothesis test in the form of the coefficient of

determination test, F test and T test using spss 22,

then the hypothesis testing is known as follows:

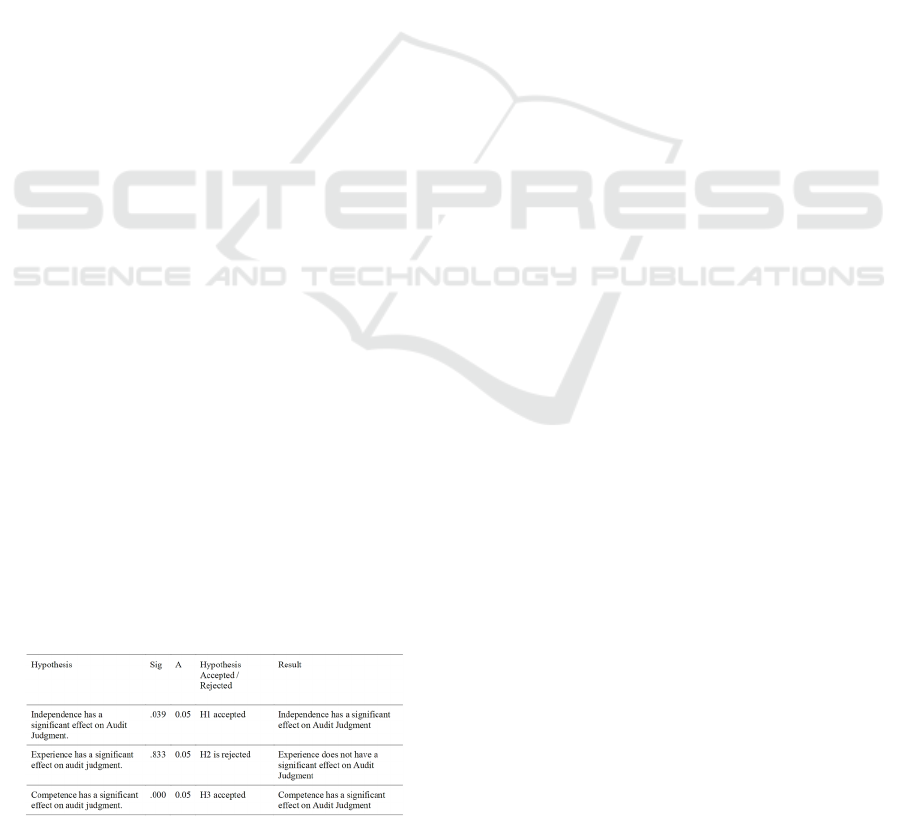

Table 1: Summary of Hypothesis Test Results.

From the chart above, it can be explained that

there is a significant influence between Independence

(X1) and Competence (X3) on Audit Judgment (Y).

but the variable experience (X2) does not have a

significant effect on audit judgment.

Independence is very important in conducting an

audit, an independent auditor must have better

opinion quality and in accordance with reality than an

auditor who is not independent, independence is the

attitude of an auditor who is free from the influence

of other parties, is honest, objective and impartial.

The auditor is obliged to be honest not only with

management and shareholders, but also to creditors

and other users of financial statements who give

confidence in the work of a public accountant. This

means that the auditor must show honesty in

formulating and expressing his opinion, must

consider the facts as a basis for providing an opinion,

the auditor must be objective and impartial. By testing

the hypothesis it can be concluded that H1 is

accepted. This indicates that the effect of auditor

independence on the audit judgment that will be taken

is significant. This means that an auditor who has a

high level of independence will have better

performance and can produce more precise opinions.

This is in accordance with the research of (Drupadi

and Sudana, 2015) which states that Independence

has a significant effect on Audit Judgment. This is not

in accordance with the research of (Azizah and

Pratono, 2019; Primasari and Azzahra, 2015) which

state that independence does not have a significant

effect on Audit Judgment.

Experience is a combination of all that is obtained

from the results of interaction or all that has been

experienced, lived, tasted and borne through repeated

interactions with fellow objects, nature,

circumstances, ideas and senses. A person’s work

experience shows the types of work a person has done

and provides a great opportunity for a person to do a

better job with a more detailed way of thinking.

Experience for auditors is important because

professional auditors are auditors who have a lot of

experience. The experience that the auditors have will

make auditors who are proficient and think critically

of audit evidence. By testing the hypothesis it can be

concluded that H2 is rejected. This states that the

effect of the auditor’s experience on the Audit

Judgment that he will take is not significant on the

auditor’s assessment. Therapy because the number of

public accountants who answered the questionnaire

were mostly Junior Auditors so they did not track

them and there was a possibility that the auditor’s

experience would not have a significant effect. This

is not in accordance with the research of (Yendrawati

ICRI 2021 - International Conference on Recent Innovations

190

and Mukti, 2015) which states that the audit

experience has no influence on the Audit Judgment.

But this is in accordance with the research of (Rani

and Putra, 2016; Vincent and Osesonga, 2019;

William, 2019) which state that audit experience has

a significant influence on Audit Judgment. Auditor

competence is the auditor’s professional expertise

and knowledge of his/her field of auditing, in the form

of personal quality, general knowledge and special

expertise. Auditor competence can be measured

through the number of certificates, training, seminars

or symposia. The more certificates you have and the

more often you attend training,

seminars/symposiums, the more competent the

auditor will be in carrying out their duties.

By testing the hypothesis it can be concluded that

H3 is accepted. This states that the influence of the

auditor’s competence on the audit judgment that will

be taken is significant. This shows that the more

competent the auditor is, the better his audit judgment

will be. This is in accordance with the research of

(Azizah and Pratono, 2019; Vincent and Osesonga,

2019; Muslim et al., 2018) which states that

competence has a significant effect on Audit

Judgment. But it is not in accordance with the

research of Primasari and Azzahra, (2015) which

state that competence does not have a significant

effect on audit judgment.

4 CONCLUSION AND

SUGGESTION

4.1 Conclusion

This study was made by the author and aims to prove

empirically whether the independent variables owned

by the author have an influence on the dependent

variable. The independent variables owned by the

author are independence, experience and

competence. While the dependent variable is Audit

Judgment. The research made by this author uses a

sample of 49 questionnaires filled out by auditors

who work at the public accounting firm located in

Jakarta. 49 of these data is data that can be used in

data processing systems. Testing in research used by

this writer uses SPSS 22 software. Based on the

results of the tests the author uses the SPSS 22

software and which has been described in the

previous chapter. So the authors can conclude about

penusi research as follows:

• Independence has a significant effect on Audit

Judgment, this means that auditors who have a

high level of independence will have better

performance and the assessors can produce

more accurate opinions.

• Experience has no significant effect on Audit

Judgment. It means that the effect of the

auditor’s experience on the audit examination

that will be taken is not significant on the

auditor’s assessment.

• Competence has a significant effect on Audit

Judgment. Meaning that the more competent

the Auditor is, the more appropriate the audit

assessment will be in accordance with reality.

We hope you find the information in this template

useful in the preparation of your submission.

4.2 Suggestion

This research in the future is expected to provide

quality results. Some input for researchers who will

conduct in the future, namely:

• Future research can add other independent

variables to determine the effect of other

variables that can strengthen or weaken the

dependent variable as a whole.

• Researchers in collecting the questionnaire

should be made more evenly so there is no

possibility of bias.

• Future researchers must also be able to

determine the right time, when the auditor is

not busy to get a high level of respondents.

• Public accountants are expected to pay more

attention to the competence and independence

of auditors because these variables are very

influential, so that it is possible to minimize

the incidence of auditors’ assessment errors

and improve the quality of public accounting

firms in the eyes of the public.

REFERENCES

Arens, A.A., Randal J.E, Mark S.B. (2016). Auditing and

Assurance Services: An Integrated Approach. England:

Pearson Education Limited.

Azizah, N.D.J. & Pratono, R. (2019). The Influence of

Locus of Control, Independence, Task Complexity and

Gender on Audit Judgment. Journal of Liability

Accounting. 2 (1). 106-126.

Drupadi, M.J. & Sudana, I.P. (2015). The Influence of

Auditor Expertise, Pressure of Compliance and

Independence on Audit Judgment. Udayana University

Accounting E-Journal. 12 (3). 623-655.

Muslim, M. Pelu, M.F.A & Mentari, K.S. (2018). The

Effect of Auditor Competence, Obedience Pressure,

The Influence of Auditor’s Independence, Experience and Auditor’s Competency on Audit Judgement

191

and Task Complexity on Audit Judgment. Bongaya

Journal for Research in Accounting. 1 (2). 8-17

Pektra, S. & Kurnia, R. (2015). The Influence of Gender,

Task Complexity, Obedience Pressure, Auditor

Experience on Audit Judgment. Journal of Accounting

Ultima Accounting. 7 (1). 1-20

Primasari, N.H. & Azzahra, L. (2015). The Influence of

Gender, Supervision, Independence, Professional

Competence and Understanding of Audit Standards on

Audit Judgment. Journal of Accounting and Finance 4

(2). 141-160

Rani, P. & Putra, A.M.T. (2016). The Influence of Gender,

Task Complexity, Auditor Experience and Professional

Competence on Audit Judgment. Journal of Accounting

and Finance, Faculty of Economics, Budi Luhur

University, 5 (2), 200-220.

Roscoe, J. T. (1975) Fundamental Research statistics for the

behavioral sciences, 2nd ed. New York: Holt, Rinehart

and Winston.

Ross (1973) 'The Economic Theory of Agency: The

Principal's Problem' 63 (2) 134-139.

Sekaran, U & Bougie, R. (2016). Research Method For

Business (7th edition) united states: wiley.

Tandiontong, M. (2016). Audit Quality and Measurement.

Bandung: Alfabeta.

Vincent, N. & Osesonga, M.S. (2019). The Influence of

Auditor Experience, Auditor Expertise, Independence,

Obedience Pressure and Task Complexity on Audit

Judgment. ULTIMA Accounting Journal. 11 (1). 58-80.

William, A. (2019). Effect of task complexity, Auditor

Experience and Auditor Competence on Audit

Judgment. Scientific Journal of Accounting,

BILANCIA 3 (1). 99-109.

Yendrawati, R. & Mukti, D.K. (2015). The Influence of

Gender, Auditor Experience, Task Complexity,

Obedience Pressure, Work Ability and Auditor

Knowledge on Audit Judgment. Journal of Innovation

and Entrepreneurship, 4 (1). 1-8.

ICRI 2021 - International Conference on Recent Innovations

192