Operational Audits of Inventories and Fixed Assets

Meiryani

1

, Chelsea Joscelind

1

, Andreas Chang

2

and Dedeh Maryani

3

1

Accounting Department, Faculty of Economics and Communication, Bina Nusantara University,

Jakarta, 11480, Indonesia

2

Economic Development and Empowering People, Governmental Politic,

IPDN Jl. Ir. Sukarno Km. 20 Jatinangor Sumedang, Indonesia

3

Entrepreneurship Department, Bina Nusantara University, Jakarta, Indonesia

Keywords: Efficiency, Effectiveness, Fixed Assets, Inventory, Operational Audit.

Abstract: Operational audit has an important role in identifying areas of potential and occurring problems within the

company. The purpose of these studies is to find out whether the policies and procedures related to inventory

and fixed assets management have been running effectively and efficiently, identify weaknesses that occur in

inventory and fixed assets management and provide recommendations on the results of the examinations. The

method used in this research is a descriptive method. Data collection techniques conducted by researchers is

in the form of literature and field studies through interviews, observations, questionnaires and collecting

documents from relevant data. The researchers found that PT. MND does not have a detailed written SOP in

managing its assets and lacks policies and procedures on purchasing. The researchers also obtained several

findings. Therefore, researchers provide several recommendations to anticipate the problem such as creation

of fixed assets management procedures, improvement of inventory management procedures and improvement

of inventory and fixed assets control carried out by PT. MND.

1 INTRODUCTION

1.1 Insurance Market

Operational Audit is a method used by companies to

prevent and reduce all errors that can harm the

company. The importance of operational audits for

companies is to assess whether the company’s

operational performance has been running effectively

and efficiently (Regawa, 2019). The purpose of the

operational audit itself is to assess the adequacy of the

company’s internal controls or activities to identify

areas of operation that need improvement by

providing recommendations for the weaknesses

found (Reider, 2002). One aspect that can be assessed

and which can be of particular concern in a company

is inventory management. Inventory is the main key

in this type of trading business, and pharmaceutical

companies are no exception. One example of an

inventory problem is a delay in the delivery of goods

which can result in a void of goods, causing the

company’s operational activities to also stop. In 2019

Indonesia Corruption Watch (ICW) found as many as

85 cases of drug vacancies in 4 areas experienced by

JKN patients; the findings were in Banda Aceh,

Medan, Serang, and Blitar in the period of semester

II/2018.

The vacancy occurred due to delays in distribution

by large pharmaceutical companies (Petriella, 2019).

According to Satibi et al. (2019) the problem of

public drug vacancies is caused by the slow process

of drug delivery and long waiting times from drug

providers and distributors (PBF). Another aspect that

can be assessed and which can be of particular

concern is asset management. In carrying out its

activities and business, the company also requires

fixed assets to support the company’s operations.

Assets usually have a useful life of more than one

accounting cycle, because of the length of the useful

life of assets, assets are expected to provide benefits

to the entity in carrying out operational activities

(Fauziyyah and Sondakh, 2018). Large but

unproductive assets will become a burden for the

company both from depreciation expense, as well as

financial ratio expenses and company health

(Sugiharto and Elisabeth, 2019). Lansiluto et al.

(2016) stated in their research that if the company

does not have effective internal controls, it is possible

178

Meiryani, ., Joscelind, C., Chang, A. and Maryani, D.

Operational Audits of Inventories and Fixed Assets.

DOI: 10.5220/0011242600003376

In Proceedings of the 2nd International Conference on Recent Innovations (ICRI 2021), pages 178-186

ISBN: 978-989-758-602-6

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

that the company’s financial statements contain

material weaknesses. Therefore it is important for

management to have and establish appropriate

policies and procedures and control fixed assets in the

company. With the right policies and procedures, the

company is expected to have reliable financial reports

without material misstatement on fixed assets

(Ginting and Harahap, 2018).

An operational audit of the management of

inventories and fixed assets is a method that can be

used to reduce the risk of fraud and fraud that can

harm the company and ensure that company

procedures are carried out properly. With an

operational audit, the adequacy of internal controls

needed to monitor inventories and fixed assets can be

further reviewed. This research will examine PT.

MND where PT. MND is a company engaged in the

distribution of pharmaceuticals and is a

pharmaceutical wholesaler (PBF). And in 2019, PT

MND had a problem with delays in distribution or

delivery to the pharmaceutical industry, this shows

that the policies and procedures related to inventory

management contained at PT. MND is not sufficient.

In addition, PT. MND also does not yet have standard

operational procedures (SOPs) related to asset

management. Looking at the explanation above, it can

be seen that PT. MND requires further study in order

to maintain business continuity, especially in terms of

managing inventories and fixed assets. It can be seen

that inventory and fixed assets have quite an

important meaning for effectiveness at PT.MND. It is

known that PT. MND does not yet have good

inventory and fixed asset management. This could be

a problem that could hinder the operational activities

of PT. MND. Therefore an operational audit is needed

to solve the problem of managing inventory and fixed

assets at PT. MND. Based on the explanation above,

the purpose of this study is to determine the policies

and procedures that take place at PT. MND related to

inventory management and fixed assets, knowing

whether policies and procedures related to inventory

management and fixed assets at PT.MND have been

running effectively and efficiently, and knowing the

weaknesses that occur in inventory management

activities and fixed assets which will then be given

recommendations and suggestions as improvements

in inventory management activities and fixed assets

at PT.MND.

2 RESEARCH METHODOLOGY

The research method used in this research is a

descriptive method with a case study approach. This

study uses primary and secondary data obtained from

interviews, questionnaires, observations,

documentation and references from books and

journals. The way to process data is to use qualitative

analysis, namely analyzing the results of answers to

interviews, questionnaires, observations, and

documentation which consists of reviewing standard

operating procedures (SOPs) related to purchasing,

receiving, storing and releasing goods and identifying

risks that exist in internal control available at PT.

MND. The sampling method used is non probability

sampling, which is a sampling technique that does not

provide equal opportunities or opportunities for each

element or member of the population to be selected as

samples (Now and Bougie, 2016). The type of

nonprobability sampling used is purposive sampling,

which is a sampling technique for data sources with

certain considerations or criteria that must be met by

the samples used for this study. Where in this study

the authors use sampling data collection techniques

based on the value of the transaction which is

considered material which represents the value

boundary criteria. Sampling is taken from purchasing

data per year 2019 to analyze documentation of

purchases and receipt of goods. Meanwhile, sales data

per 2019 are used to analyze documentation of

expenditures on goods. To recalculate depreciation

calculations use the criteria for purchasing assets with

the highest cost for each asset category. Meanwhile,

for purchases and verification, the criteria are used,

namely purchases that occurred in 2019. Based on the

results of this screening, 11 samples were obtained for

inspection of purchase and receipt of goods, 16

samples for inspection of documentation of goods

expenditures, 5 samples for inspection of asset

purchase documentation and for verification of

company assets, and 12 samples for recalculating

depreciation calculations company assets.

3 RESULT AND DISCUSSION

PT. MND is a company engaged in the distribution of

pharmaceuticals or known as pharmaceutical

wholesalers in Jakarta and is engaged in the

distribution of drugs or raw materials for drugs and

food and medical devices. The main focus of PT.

MND is a provider of raw materials for the

pharmaceutical industry, food supplements, and

traditional medicines and can provide added value to

these industries in Indonesia by implementing good

drug distribution methods (CDOB). In line with the

objectives contained in the background, this study

will focus on managing inventory and fixed assets at

Operational Audits of Inventories and Fixed Assets

179

PT. MND to assess the effectiveness and efficiency

of the company by conducting an operational audit.

According to Reider (2002) an operational audit is an

activity carried out to identify areas within the

company that need improvement and assess the

effectiveness and efficiency of the company, which

then results from these activities as recommendations

given to the company. The operational audit stages

are carried out starting from the planning phase, the

work program phase, the field work phase, the

development of findings and recommendation phase.

The planning stage is the initial stage of an

operational audit at PT. MND which aims to find

information about operational activities that are

taking place at PT. MND and identify problems that

are happening or have and also have the opportunity

to occur.

This problem can be divided into two, namely

areas that can be a potential problem (critical area) or

a problem that has already occurred (critical

problem). After identifying these problems the writer

will further examine the problems that have occurred

which will then be used as the basis for developing a

work program. Based on the information the author

has collected, it is known that PT. MND has

experienced delays in the distribution of goods and

there are no standard operational procedures (SOPs)

on asset management. Therefore, the authors

determine the management of inventory and fixed

assets at PT. MND is classified as a critical problem

that will be used as corrective action that can fix these

problems. Critical problems identified by the author

are inventory management and fixed assets at PT.

MND has not been running effectively and

efficiently. It is expected that by conducting an

operational audit at PT. MND, the author can find

what are the obstacles and causes in the management

of inventory and fixed assets at PT. MND which can

then be generated as an effort to overcome the

problem. At this stage of the work program, the

author will describe and explain what programs or

things the author will do in conducting this

operational audit. It is hoped that after carrying out all

the work programs that have been described, it can

produce useful findings in this study. The following

is a work program that the author will do in

conducting operational audits related to inventory

management and fixed assets at PT. MND.

The employment stage is the stage where the

author will conduct an inspection of the inventory

management process, starting from the process of

purchasing, receiving, storing and releasing goods.

As well as asset management starting from the

process of purchasing assets, verifying assets and

depreciating assets. Based on the results of audit

testing on the purchase of medicinal raw materials,

the results show that almost all of the purchasing

processes of medicinal raw materials are in

accordance with existing policies and procedures.

Namely, with an application for an import certificate

(SKI) at the BPOM. Which was then approved by the

BPOM as well as a statement letter for drug use.

Purchase orders sento suppliers have been approved

by the pharmacist in charge and the purchase of

medicinal raw materials is purchased at suppliers who

have met the assessment requirements at PT. MND

and in accordance with BPOM regulations. In

submitting an application for an import certificate

(SKI), there are complete documents (invoice, air

waybills, packing list, certificate of analysis, material

safety sheet data), invoice number and name of drug

raw materials on the pur- chase order, all in

accordance with the information in the certificate.

import (SKI). But in PO number 020 / SU / 2019,

there was a purchase of medicinal raw materials that

were not listed in the supplier product list, while the

purchase of medicinal raw materials with PO number

001 / EN / 2019 was made to suppliers who were not

listed in the supplier data list.

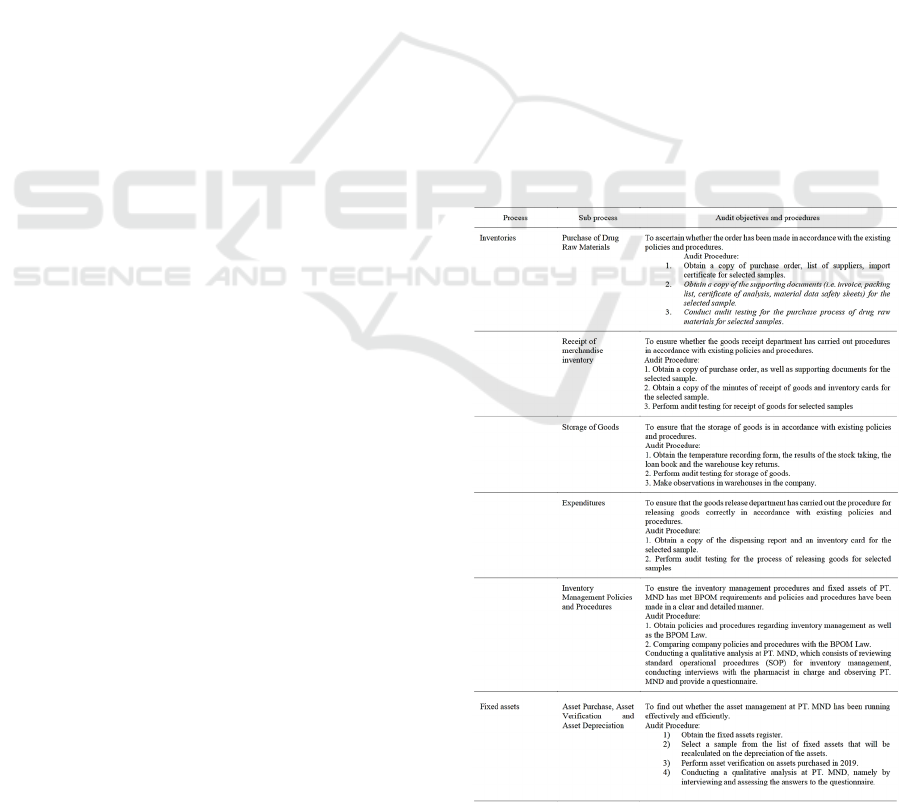

Table 1: Work Program.

ICRI 2021 - International Conference on Recent Innovations

180

Based on the results of the audit test on the receipt

of goods, the results show that almost all processes of

receiving goods are in accordance with existing

policies and procedures, receipt of goods has been

recorded and documented on the minutes of receipt of

goods, minutes of receipt of goods have also been

checked and approved by the pharmacist. the person

in charge, receipt of goods is also equipped with

complete supporting documents. As well as the

receipt of goods has also been recorded on the

inventory card. The recording in the receipt book is in

accordance with the goods receipt document. But

there was a receipt of goods with PO number 029 /

SU / 2019 it was found that there was an official

report on the receipt of the goods which was not

signed by the delivery officer and the pharmacist in

charge.

Based on the results of audit testing on the goods

storage process, the results show that all storage

processes are in accordance with existing policies and

procedures, logistics or company operational staff

have taken temperature measurements every three

times a day and the results of these checks have been

reviewed by the pharmacist in charge. Inventory of

goods has also been placed and stored according to

the type of product each. For warehouse four, the

warehouse is always locked and requires permission

from the pharmacist in charge if you want to enter the

warehouse which is documented in the loan book and

the return of the warehouse keys. The damaged or

rejected or counterfeit or expired goods have been

stored in the reject warehouse. Stock taking has been

carried out once a month by the warehouse admin.

Based on the results of audit testing on the process of

releasing goods, the results show that all processes for

releasing goods are in accordance with the existing

policies and procedures, namely the release of goods

has been documented on the official report of

releasing the goods, the minutes of releasing the

goods have been checked and approved by the

pharmacist in charge. answer. The sales form is in

accordance with the official report of the new

expenditure and there is a cover letter and supporting

documents in the process of releasing goods

(certificate of analysis and material data safety sheet).

Goods dispensed are recorded on the inventory card.

Based on the results of a comparison between the

company’s standard operating procedures (SOPs) and

the BPOM Law No. 7 of 2016 it can be concluded

that all standard operational procedures (SOPs) at

PT.MND related to inventory management starting

from the process of purchasing goods, receiving

goods, storing and releasing goods have met the

requirements and are in accordance with the BPOM

Law in effect in Indonesia. Based on the results of a

qualitative analysis at PT. MND, namely conducting

observations and assessing answers to questionnaires,

interviews and reviewing company standard

operating procedures (SOPs), the authors found

several strengths and weaknesses related to inventory

management at PT. MND, namely:

Advantages:

• There is a special goods receiving area;

• There is a special area for releasing goods;

• All warehouses are locked and can only be

accessed by employees who have obtained

permission from the pharmacist in charge of

Java;

• Inventories that are found in the warehouse are

all neatly arranged;

• There is CCTV in the warehouse area;

• There is a supply card and temperature

recording form;

• There are standard operational procedures

(SOPs) for the process of purchasing,

receiving, storing and releasing goods;

• There are standard operational procedures

(SOPs) for the supplier assessment process;

• Storage of medicinal raw materials is stored in

accordance with the drug category in the

warehouse;

• The warehouse area is clean and free of

insects;

•

Stock taking is done once a month. Weakness:

• There is no formal policy and procedure for

regulating purchase orders;

• The absence of a formal policy regarding job

descriptions at PT. So far, MND has conveyed

job descriptions orally;

• Not making a budget analysis with the actual

expenditure;

• There are no formal policies and procedures

governing the purchase planning process such

as determining safety stock to support

purchase planning;

• Delays in delivery of goods to customers are

caused by delays in delivery from suppliers

and the company does not have sufficient

safety stock;

• There is no separation of duties between the

goods receiving staff and the storage staff;

• Never did a sudden stock-taking.

Based on the results of the recalculation of the

depreciation calculation, the results show that the

depreciation calculation has been carried out by the

tax consultant at PT. MND is in accordance with the

Operational Audits of Inventories and Fixed Assets

181

existing procedure, namely the calculation of

depreciation for the category of electronics, furniture

and laptops has been calculated using the straight-line

method with a useful life of 4 years. Meanwhile, the

calculation of asset depreciation for the vehicle

category has been calculated using the straight-line

method with a useful life of 8 years. All depreciation

calculations at PT. MND has also matched the results

of the recalculation carried out by the author. Based

on the results of asset verification, all assets

purchased in 2019 have been labeled and are in

accordance with the existing asset list. However,

when performing the audit test method by matching

the asset labeled with the asset list, it was found that

there was a difference between the label printed on

the asset and the label on the asset list. Based on the

results of the analysis of observations, answers to

interviews and questionnaires related to asset

management, there are several strengths and

weaknesses, namely:

Advantages:

• Assets at PT. MND has been labeled or clearly

marked;

• Asset verification is performed by operational

or administrative staff twice a year;

• At the time of disposal of assets there is a letter

of approval by the board of directors.

Weakness:

• PT. MND does not have written standard

operational procedures (SOPs) related to the

management of fixed assets (purchase, asset

location, depreciation method, useful life and

disposal of assets).

• The documentation related to the purchase of

assets is still inadequate because there are no

purchase orders and there is no written

document regarding the selection of suppliers.

• The list of fixed assets does not include the

location of the asset, which makes it difficult

to detect the existence of the asset.

• Asset verification is not monitored by

personnel who have responsibility for asset

supervision. This could potentially lead to

manipulation in the verification process of

fixed assets.

• Never do a validation or review again on the

calculation of asset depreciation by a tax

consultant.

• List of fixed assets (fixed asset register) that is

not updated.

The findings and recommendations development

stage is the stage where the authors develop the

findings at the fieldwork stage. Development findings

will be made using conditions, criteria, cause, and

effect. After the findings, the author will provide

recommendations regarding any findings and

weaknesses that occur in inventory management

activities and fixed assets at PT. MND. The following

are the weaknesses found at the fieldwork stage:

• Purchases of medicinal raw materials are

purchased from suppliers who are not

registered in the supplier assessment.

• The official report on the receipt of the goods

is not signed by the delivery officer and the

pharmacist in charge.

• There are no formal policies and procedures

governing who has the authority to create and

approve purchase orders.

• There are no formal policies and procedures

governing the purchase planning process such

as determining safety stock to support

purchase planning. •

• Not making a budget analysis with the actual

expenditure.

• There is no separation of duties between the

goods receiving staff and the storage staff.

• The absence of a formal policy regarding job

descriptions at PT. So far, MND has conveyed

h. job descriptions orally.

• PT. MND does not have written standard

operational procedures (SOPs) related to the

management of fixed assets (purchase, asset

location, depreciation method, useful life and

disposal of assets).

• Documentation related to asset purchases is

still inadequate because there is no purchase

order and there is no written document on the

supplier selection.

• The list of fixed assets does not include the

location of the asset, which makes it difficult

to j. detect the existence of the asset.

• There is a discrepancy between the physical

asset label and the label on the fixed assets

register.

• List of fixed assets (fixed asset register) that is

not updated.

• Never conducted a validation or review again

on the calculation of asset depreciation by a

tax consultant.

• Never conducted a sudden stock taking

(surprise audit).

After the authors identify the weaknesses that

exist in PT. MND, the authors classify these

weaknesses into several findings, which consist of:

ICRI 2021 - International Conference on Recent Innovations

182

• The inventory management process is not yet

effective. Findings: 1, 2.

• Policies and procedures related to inventory

management have not been effective and

efficient. Findings: 3, 4, 5.

• There is no separation of functions between

receiving goods and storing goods. Findings:

6, 7.

• Policies and procedures related to asset

management are not yet effective and

efficient. Findings: 8, 9, 10, 11, 12, 13.

• PT. MND has never done sudden stock-taking.

Findings: 14.

Then, after the author has classified the findings

into 5 findings, the author will develop these findings

using 5 attributes, namely conditions, criteria, cause,

effect and recommendation. nventory management

process has not been effective. Inventory

management at PT. MND has not been effective

because of the following weaknesses:

• There is a purchase of goods purchased from a

supplier that is not listed in the supplier

assessment list. Purchases should be made to

suppliers who have been registered in the

supplier assessment list carried out by the

company. The occurrence of purchases of

goods from suppliers who are not listed on the

PT. MND is caused by not updating the

supplier assessment list and the list of goods at

PT. MND. Purchases from suppliers that are

not registered in the company’s assessment

can risk poor quality goods and overpriced

purchases of goods. The recommendation

given is that PT. MND updates the supplier list

every time there is a change to ensure that the

goods received are of the best quality. As well

as trying to start making a list of supplier data

that can be used as a company database.

• There is an official report on the receipt of

goods that were not signed by the delivery

officer and the pharmacist in charge. The

minutes of goods receipt should be signed and

approved by the pharmacist in charge. The

official report on receipt of goods is not

checked and approved by the pharmacist in

charge of it due to inaccuracy in the process of

checking the item receipt which causes the

item receipt of the item not signed by the

pharmacist in charge. The impact of not

signing the minutes of receipt of goods can

lead to not achieving company goals

(effectiveness). The recommendation given is

that PT. MND increases control over the

management of its supplies, namely providing

outreach to employees who do not comply

with the policies and regulations that exist in

the company, this is so that employees at PT.

MND understands the importance of doing

their job properly.

Policies and Procedures related to Inventory

Management are not yet effective and efficient.

Policies and procedures related to inventory

management have not been effective because of the

following weaknesses:

• There are no formal policies and procedures

governing who has the authority to create and

sign purchase orders. To achieve effective

inventory management, there should be

policies and procedures related to who has the

authority to create and approve purchase

orders and must be clear and detailed. This is

caused by the ignorance of company owners

about the importance of making clear and

detailed policies and procedures in this regard.

This can lead to purchase orders that are not

recognized by the authorized party. The

recommendation given is that PT. MND

creates and develops policies and procedures

related to who has the authority to create and

sign purchase orders.

• There is no formal policy and procedure

governing inventory purchase planning,

namely the determination of safety stock to

support purchase planning, in order to achieve

efficient inventory management, there should

be policies and procedures for determining

purchase planning, namely inventory safety

stock. This is caused by the ignorance of

company owners about the importance of

making policies and procedures related to

safety stock inventory so that it can cause the

risk of inventory shortages that can disrupt

operations at PT. MND. The recommendation

given is that PT MND should make and

develop formal policies and procedures

related to safety stock in the company by

conducting stock analysis to determine safety

stock based on the use of stock turnover and

sales forecasts.

• The company does not make a budget analysis

with the actual expenditure, it should be in

order to achieve efficient inventory

management, the company makes a budget

analysis with the actual expenditure. This is

caused by the ignorance of the company owner

about the importance of mak- ing a budget

Operational Audits of Inventories and Fixed Assets

183

analysis with the actual expenditure. This can

make it difficult to identify and mitigate any

expenses that are not in accordance with the

budget.

There is no separation of functions between

receiving goods and storing goods. At PT. MND

goods receipt is carried out by general operational

staff who are personnel who have the authority to

store and manage inventory in the storage warehouse.

The company should separate the duties of each

personnel regarding the function of receiving and

storing goods. Companies can use different people to

carry out activities in the company starting from the

activities of receiving goods and storing goods. This

occurs because the lack of resources owned by the

company causes multiple positions to be carried out

by these employees and this is due to the absence of

a job description at PT. MND thus causing multiple

positions. This can lead to the risk of fraud being

committed against the warehouse inventory card. The

general operational staff who recorded the calculations

knew the actual amount actually received by PT.

MND, if there is an excess amount of goods received

at PT. MND, the general operational staff could record

according to the receipt of goods, but the excess

amount was not included in the recording and was

instead taken or stolen. The recommendation given is

that PT. MND increases supervision of personnel who

carry out multiple positions and creates and formalizes

a complete and clear job description in order to manage

employee assignments.

Policies and Procedures Regarding Asset

Management Are Not Running Effectively and

Efficiently. Asset management has not been running

effectively and efficiently because of the following

weaknesses:

• There are no policies and procedures related to

asset management. In order to achieve

effective and efficient asset management, it is

necessary to implement asset management

procedures in the daily operations of the

company for employees to carry out their

duties. This is due to the owner’s ignorance of

the importance of establishing policies and

procedures related to asset management. The

impact of the absence of these policies and

procedures can lead to ineffective and efficient

asset management and can lead to

inappropriate and inconsistent practices. And

it will be difficult for PT. MND to ensure the

completeness of assets and the existence of

assets. The recommendation given is that PT.

MND develops policies and procedures

related to asset management in writing for

asset labeling, asset location, asset insurance,

asset verification, depreciation method, asset

useful life, asset purchase and disposal. Then,

the procedures related to asset management

must be checked periodically and approved by

the authorized party and distributed to the

authorized personnel.

• Purchases of assets are made without being

based on specific document records. To

achieve effective and efficient asset

management, sufficient documentation in

asset management is required. This is due to

the company’s owner’s ignorance of the

importance of making documentation related

to asset purchases. The effect of inadequate

paperwork on asset purchases will result in

receipt of incorrect or ordered assets. The

recommendation given is that the company

must make the required recording documents,

namely the purchase reacquisition so that each

asset purchase is approved by the authorized

personnel and avoids the risk of receiving

unsubscribed assets.

• Asset management has not been running

efficiently because the fixed assets register

does not include the location of the assets and

differences are found between the labels on the

assets and the labels on the fixed assets

register. In creating good practice for the

company, everything related to changes in

fixed assets should be updated immediately on

the fixed assets register. This is due to the

company’s owner’s lack of understanding of

the importance of carrying out maintenance on

assets which results in suboptimal and

efficient asset management. The impact of not

listing the location of assets and the difference

between the physical label of the asset and the

label on the fixed asset register can cause

difficulties when verifying assets, as well as

assets that are lost or damaged will not be

detected quickly. Recommendations given in

the form of control over asset management

must be improved by always updating the list

of fixed assets if there are changes.

• PT. MND has never performed a validation or

review again on the calculation of tax

depreciation by a tax consultant. To achieve

optimal asset management, PT. MND must

monitor the depreciation calculation made by

the tax consultant. This is due to the

company’s owner’s lack of understanding of

the importance of monitoring the depreciation

ICRI 2021 - International Conference on Recent Innovations

184

calculation. The impact of not validating or

reviewing the depreciation calculation will

lead to the ignorance of PT. MND if there is

an error in the depreciation calculation such as

an incorrect input of the cost of assets. The

recommendation given is that PT. MND

conducts a review or validation on the asset

calculation carried out by a tax consultant at

least once a year.

PT. MND has never done sudden stock-taking.

PT. MND conducts stock-taking on inventory of

goods in the warehouse on a regular basis, i.e. once a

month, the company never does a surprise audit. PT.

MND only conducts stock taking according to the

schedule and procedures that have been determined

and with prior notification by the responsible

pharmacist. In creating healthy practices, PT. MND

needs to carry out a surprise stock-taking of the

inventory in the warehouse without notification. This

happened because PT. MND feels that it is enough

just to take stock according to the set schedule and

policies. The impact of never carrying out a sudden

stock-taking (surprise audit) on the inventory of

goods that allows fraud - fraud committed by

employees because they already know the schedule of

stock taking. This can cause the company to suffer

losses. The recommendation given was that the

company should conduct a surprise audit, that is, take

stock taking outside the specified schedule. This is

done to avoid cheating - cheating that can occur. With

a surprise audit of inventories, the company can find

out whether fraud has occurred or not and can

encourage employees to carry out their duties

appropriately.

4 CONCLUSION AND

SUGGESTION

4.1 Conclusion

Based on the results of operational audit research

conducted at PT. MND, the following conclusions are

obtained:

• Inventory management policies and

procedures have been defined in a written

procedure. Policies and procedures for

managing purchases, receiving, storing and

releasing inventory of goods at PT. MND is in

accordance with the Food and Drug

Administration Act No. 7 of 2016 in existence.

Inventory management policies and

procedures are not yet effective and efficient

because the purchasing policies and

procedures do not clearly state who has the

authority to make the purchase order. There is

no inventory planning process such as

determining safety stock to support purchase

planning. Asset management is not defined in

a written procedure. Purchase of assets is

carried out directly by the responsible

pharmacist without adequate supporting

documents. Asset verification is carried out

twice a year by operational or administrative

staff and the calculation of asset depreciation

is carried out by a tax consultant.

• Inventory and asset management procedures

at PT. MND still cannot be said to be effective

and efficient, it is indicated by the existence of

weaknesses in the management of inventories

and assets as follows:

Purchases of medicinal raw materials are

purchased from suppliers who are not listed in

the supplier assessment list.The official report

for the receipt of the goods is not signed by the

delivery officer and the pharmacist in charge.

Do not do budget analysis with actual

expenses. Lack of a separation function,

namely the function of receiving and storing

goods. There is no written job description.

Documentation related to asset purchases is

still inadequate because there are no purchase

requests and purchase orders as well as written

documents regarding supplier selection. The

list of fixed assets does not include the

location of the asset which makes it difficult

to detect the existence of the asset. Asset

verification is not monitored by responsible

personnel which could potentially lead to

manipulation in the fixed asset verification

process. PT. MND has never done sudden

stock-taking. There is a difference between the

label on the physical asset and the label on the

fixed asset register.

4.2 Suggestion

Suggestions or recommendations given based on

research and all stages of the operational audit are as

follows:

• Regarding policies and procedures for

purchasing plans and inventory management

that are not detailed, the suggestions put

forward by the authors are some of the

corrective actions as follows:

Develop purchasing policies and

procedures to be more detailed and approved

Operational Audits of Inventories and Fixed Assets

185

by authorized personnel and disseminated to

relevant personnel.

The development of policies and

procedures must be monitored by authorized

personnel to ensure the timeliness of

completing these policies and procedures.

Stock analysis to determine safety stock

must be carried out based on estimated sales

and stock turnover.

Making budget analysis and actual

expenditure must be documented and checked

every month.

REFERENCES

Fauziyyah, W., & Sondakh, J. J. (2018). Ipteks of

Effectiveness of Internal Control of Fixed Assets at

Bank Indonesia Representative Office of North

Sulawesi. Journal of Accounting Science and

Technology for Society, Vol. 2, No. 2, 16-24.

Ginting, T. A., & Harahap, S. N. (2018). Internal Control

Analysis in Order to Design Standard Operational

Procedure (SOP) For Fixed Assets Procurement and

Maintenance Activities: Case Study on PT ABC.

Journal of Accounting and Economic Symposium, 364-

370.

Lansiluota, Aapo, Jokippi, Anukka, Eklund, & Thomas.

(2016). Internal control effectiveness - a clustering

apporach. Mangerial Auditing Journal, Vol. 31 (1), 5 - 34

Regulation of the Head of the Drug and Food Control

Agency of the Republic of Indonesia. (No. 7 2016).

Regarding Guidelines for the Management of Certain

Drugs That Are Often Misused.

Petriella, Y. (2019). ICW found 85 drug vacancies in 4

regions, this is the reason. Retrieved March 2020, from

Ekonomi.bisnis.com: https://Ekonomi.business.com/

read/20190226/12/893771/icw-discover-85-cases-kek

osongan-ob at-in-4-regions-why

Reider, R. (2002). Operational Review Maximum Results

at Efficient Costs Third Edition. Hokoben, New Jersey:

John, Wiley & Sons, Inc.

Regawa, J. G. (2019). Operational Examination of Sales

Activities at Alqueby Hotels to Assess Sales

Effectiveness. Marantha Journal of Accounting, Vol.

11, 332 - 357.

Satibi, Fudholi, A., Tuko, E. C., & Swastiandari, G. L.

(2019). Inventory Control, Storage and Distribution

Facilities in the Pharmaceutical Industry to Support the

Availability of JKN Era Medicines. Journal of

Pharmaceutical Management and Services, 27-37.

Now, U., & Bougie, R. (2016). Research Methods for

Business. West Sussex: John Wiley & Sons Ltd.

Sugiharto, N. A., & Elisabeth, C. R. (2019). Analysis of

Fixed Asset Control Testing to Prevent Loss of Fixed

Assets at the Bhakti Pos Indonesia Education

Foundation. Journal of Accounting Year XII No. 02,

94-102.

ICRI 2021 - International Conference on Recent Innovations

186