An Online-work Motivation Analysis of Generation Y during

Covid-19 Pandemic: A Case Study in Prime Agency Insurance

Valerie Tania Juan and Parulian Hutapea

Bina Nusantara University, Indonesia

Keywords: Online-work, Motivation Analysis, Covid-19, Herzberg Two-factors.

Abstract: Generation Y or Millennials are slowly replacing Generation X within the insurance company. Even though

they are ICT user friendly, insurance companies are having difficulties finding the factors that are able to

motivate Generation Y insurance agents to stay and perform well in the company, especially during pandemic

era. This research is intended to find factors that motivate and satisfy agents during the pandemic and analyse

them by using Herzberg’s two-factor theory for the comparison. This qualitative research is conducted by

interviewing Generation Y agents and agency directors at Prime Agency, an insurance broker company. The

research identified the existence of four motivators and two hygiene factors which drive the performance of

the agents during pandemic. The motivators are work itself, advancement, reward and self-development.

During pandemic, all factors are present in the motivator section in Herzberg’s two-factor theory with the

exception of income, which is a factor classified under reward. It is the equivalent of salary, which is supposed

to be a hygiene factor, and is found to be the most significant motivating factor. Additionally, a new motivator

called holiday trips is found.

1 INTRODUCTION

1.1 Insurance Market

According to (Din et al., 2017) state that the growth

in insurance sales in developed countries is caused by

high gross domestic product (GDP) while the growth

in developing countries is caused by the low level of

income that has increased the risk aversion of the

people living in those countries. In the year of 2019,

the gross premiums in the life and non-life insurance

categories have grown on an average of 4.7 percent

and 3.6 percent, respectively (Din et al., 2017). The

(Din et al., 2017) stated that this may be due to the

enhancement of consumer awareness to start saving

money to prepare for old age and eventually,

retirement.

As the COVID-19 virus began to spread at the end

of 2019, it created a volatile environment that is filled

with uncertainties as it affects all industries including

the insurance sector. Governments took various

precautionary actions such as lockdowns, social

distancing, converting to online schools and working

from home, and many more to fight the continuous

waves of the pandemic. With the virus spreading at a

very fast rate, it came by no surprise that the gross

premiums and claim payments for health insurance

have increased (Din et al., 2017).

In Indonesia, the compound annual growth rate

of the life insurance industry (CAGR) from 2014 to

2018 was 14.9 percent while the forecasted CAGR

from 2018 to 2023 is 8.8 percent (MarketLine, ). This

shows that the market is increasing at a slowing rate

over the years.

Figure 1: Life Insurance Segment in Asia-Pacific in 2018.

Figure 1 indicates that in the life insurance

component in Asia-Pacific, Indonesia only accounts

for 1.4 percent, meanwhile Japan taking the number

one spot at 30.5 percent. Preliminary interviews with

some agents of Prime Agency claimed that the low

market share of life insurance is caused by the

Juan, V. and Hutapea, P.

An Online-work Motivation Analysis of Generation Y during Covid-19 Pandemic: A Case Study in Prime Agency Insurance.

DOI: 10.5220/0011242300003376

In Proceedings of the 2nd International Conference on Recent Innovations (ICRI 2021), pages 169-177

ISBN: 978-989-758-602-6

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

169

difficulty of insurance companies to reach its

customers (Deloitte, 2019).

There are some big players in the insurance com-

pany in Indonesia: PT Prudential Life Assurance, PT

Asuransi Allianz Life Indonesia, PT Axa Mandiri

Financial Services, PT Asuransi Jiwa Manulife

Indonesia and many more. Most of them were

established through joint ventures with foreign

companies. A report by (Deloitte, 2019) claimed that

Prudential Indonesia dominated the life insurance

industry. On the other hand, most companies are

domestically-owned in the non-life industry with no

leading competitor since all players seem to be

specialising in different insurance classes.

Furthermore, in the broker insurance industry, most

companies are also domestically-owned and they all

included property damage on their product offering.

1.2 Prime Agency

Prudential plc was first established in the year of 1848

in London, England and it has now become a

household name for many people around the world.

The company has branched out into multiple countries

including India, the United States, Singapore, Hong

Kong, Thailand, Malaysia, Indonesia and many more.

Prudential first entered the Indonesian market in 1995

through a merger with Bank Bali Indonesia that

resulted in the establishment of PT Prudential

BancBali Life Assurance. Currently, the company is

headquartered in Jakarta and has marketing offices all

around the country including Denpasar, Medan,

Bandung and Surabaya. An insurance broker agency

acts as an intermediary for insurance companies and

their final customers. Therefore, in order to execute the

necessary services in relation to insurance policies, it is

crucial to foster strong relationships with its customers

(Tseng and Kang, 2014).

Currently, Prime Agency has a total of more than

1200 employees, with only 20 people working in

administration. There are 40 agent leaders and a

minimum of 30 agents are working under their

leadership. Amongst those working in and with Prime

Agency, there are approximately 80 percent of

Millennials. The agents are considered to be ultimately

working for Prudential since Prime Agency only serves

as a home for its agents by providing an office and

utilities such as computers. Therefore, Prudential is

responsible for most of the compensation schemes,

which includes bonus, commission, free trips to

foreign countries, etc. However, it is worth to know

that these compensations are awarded according to the

quality of performance of the agent. Furthermore,

Prime Agency does have its own compensations that it

offers to agents as an additional tool to promote

motivation.

The broker agency does not have any available

website however, they are very much active on their

Instagram page and Facebook posts. This reaffirms the

earlier statement that technology is now perceived as

very important and the shift to social media platforms

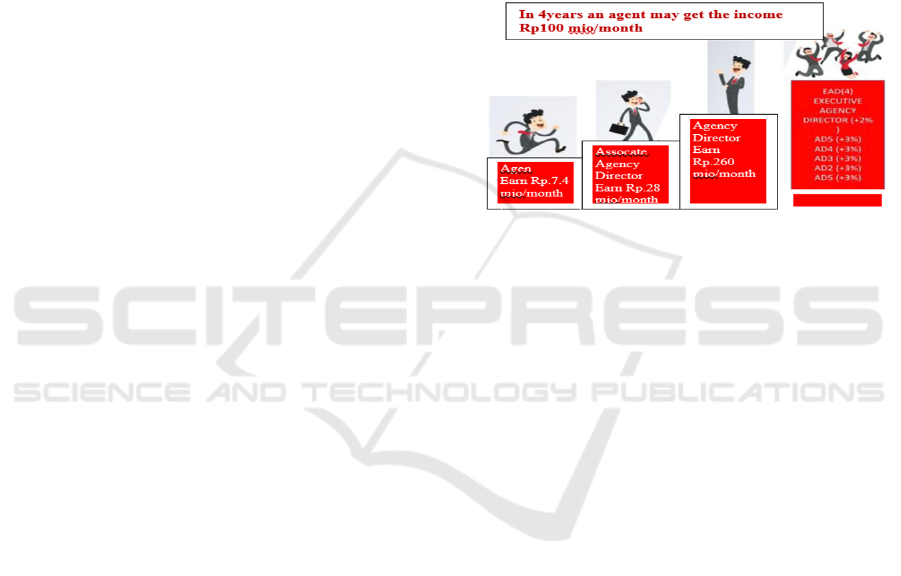

as a way of communicating. Figure 2 demonstrates the

hierarchy within the broker agency. Every person who

joins Prime Agency will always start from the bottom

as an agent. It has an internal system which is given by

the head company, Prudential, that all partnering

agencies must adhere to.

Figure 2: Career and Income Path System.

Figure 2 shows this career path and income

system. It demonstrates that it is possible for an agent

to be in the executive agency director position in just

four years. Therefore, this system may encourage

agents to always dream big. Agents can work

themselves up the hierarchy by obtaining more and

more per month. However, they should be able to

maintain their income as there is a chance to be

demoted. For instance, if an agency director has failed

to achieve its 60 million Rupiah target, he or she

would be demoted to associate agency director. The

hierarchy in the insurance industry is not similar to a

normal company’s career path system as this

particular system permits numerous people to fill in a

position. Hence, there can be more than one agency

director at a certain time period.

1.3 Research Problem

Based on the preliminary interviews conducted in the

Prime Agency, currently the Agency is developing its

human resource systems that provide a room for its

employees to have their careers in the Agency. So far,

the Agency has not had a clear knowledge about what

motivation factors that make it employees performed,

willing to stay and building their career in the agency.

The knowledge is very important to build career

development system in the company, which 80% of

its agents are millennials.

ICRI 2021 - International Conference on Recent Innovations

170

1.4 Research Objectives

There are two research objectives for this research:

• To identify motivational factors that make

Generation Y employees willing to perform

and stay longer in the company during the

Covid-19 pandemic.

• To analyse how those factors work by

comparing them to those that have been

described in Herzberg’s motivational theory.

2 LITERATURE REVIEW.

2.1 Characteristics of Generation Y

In the world today, the workforce comprises the

Silent Generation, Baby Boomers, Generation X and

Generation Y (Twenge et al., 2010). According to

(Center, 2019), Generation Y or most commonly

called as Millennials, are people who are born

between 1981 and 1996. As Millennials slowly

replaced Generation X in the workforce, they should

be able to promote and sell their insurance policies as

good as the earlier generations.

Millennials are more exposed to technology than

Boomers or even Generation X did, which has shaped

and influenced the way Millennials act or think.

(Mehra and Nickerson, 2019) concluded that

Millennials in the workforce are more likely to

exploit those moderate media tools to communicate

with the stakeholders of the company that they are

working in.

Many people would say that Millennials are

selfassured, driven and positive-minded (Perry,

2015), qualities which seem perfect for any job type.

They are considered as great team players in which

they would demonstrate full active participation and

provide their finest attempts at the work bestowed

upon them when they are assigned to work in groups

(Perry, 2015). Myers and Sadaghiani (2010)

discovered that Millennials are hard-working in

achieving their targets in their place of work, although

they are said to be self-centred. He said that this is due

to the presence of technology, hence although

technology is able to maintain a link within the

community, it can also cause Millennials to feel

detached from other people. Millennials are used to

transparency that technology enabled around them

(Myers and Sadaghiani, 2010) and so, they expect it

to be practiced at their workplace too.

According to (Weber, 2017) found that Millennial

workers display a strong eagerness towards learning

new things and that they often search for

organisational training programs to join, which are

assumed to be due to the need to quickly advance

their work position. Additionally, they also

discovered that millennial workers crave only

positive feedback, which they take very personally,

and acknowledgement of their success.

Agreeing with Baker Rosa and Hastings, (Baker

Rosa and Hastings, 2018) stated that Millennials will

stay in a company longer if the given

acknowledgement and compensation, job content and

work-life balance are satisfactory. They said that

although Millennials need high salaries due to the rise

in living expenses, they would rather prioritise the

quality of life more than financial compensation.

2.2 Generation Y in the Insurance

Industry

According to a survey by (Tirta and Enrika, 2020) 84

percent of Generation Y in the insurance industry are

employed at an insurance agency. Furthermore, 33

percent works in the customer service division and 30

percent works in the sales division. In this current

digital era, Millennials are constantly surrounded by

technology and are connected to each other through

the internet. This shows that they are more techsavvy

than the generations before them. There are 59

percent of Millennials in the insurance industry that

utilize social media platforms such as Facebook and

Instagram, and reported that those platforms are most

beneficial to retain customers and provide support

(Tirta and Enrika, 2020).

The continuous advancement of technology over

the years led to the creation of diverse tools that have

the potential to give a competitive advantage to

businesses. Therefore, it comes by no surprise that on

line technology is being adopted by all industries

including the insurance sector. Additionally, 81

percent of Millennials in the insurance industry have

faith that technology will boost efficiency and 56

percent believe that it can improve relationships.

These percentages are higher than the results for

Generation X and Boomers. This shows that

Millennials have the utmost trust in regards to

technology. This could be because they do not need

to adapt to the presence of technology since they are

born directly into it, as compared to the generations

before them who require some time to fully integrate

technology into their lives. Companies would want to

recruit salespeople who are confident in their ability

to use social media as it is proven to improve sales

performance (Vertafore, 2020).

An Online-work Motivation Analysis of Generation Y during Covid-19 Pandemic: A Case Study in Prime Agency Insurance

171

2.3 Work Motivation

The word ‘motivation’ stemmed from ‘movere’, a

Latin term which translates to movement (Schultz et

al., 2012) described work motivation as “a set of

energetic forces that originate both within as well as

beyond an individual’s being, to initiate work-related

behaviour, and to determine its form, direction,

intensity, and duration”. Therefore, based on these

explanations, it can be concluded that work

motivation can be defined as forces that contain the

power to stimulate desired actions, which are tailored

to a work setting, to improve work performance and

achieve organisational goals.

Every individual has their own separate personal

goals, hence employees would only be motivated to

work in a company if that specific company can aid

them in reaching their goals (Steers et al., 2004).

Employees possess different needs, which can affect

how they act in their workplace; thus, the continuous

effort to fulfil their needs will improve their

motivation towards work (Jost, 2014). Therefore, if

those needs could not be accomplished, employees

would not feel satisfied and motivated enough to stay

with the company since staying would not benefit

them at all.

2.4 Herzberg’s Two-factor Theory

According to (Herzberg et al., 2017), hygiene factors

relate to the “job context” while motivators concern

the “job content”. He explained that when an

employee feels unsatisfied, it involves the general

circumstances surrounding their job. Meanwhile,

when an employee feels satisfied, it involves the

overall nature of their job. In the occasion in which

hygiene factors are implemented inadequately, it

possesses the power to demotivate employees

(Mackay, 2007). On the other hand, if motivators are

implemented appropriately, it can create the feeling

of satisfaction towards work. Figure 3 shows the

overall picture of the twofactor theory and all the

variables included within each type of factor.

Figure 3: Herzberg’s Two-Factor Theory.

3 RESEARCH METHODOLOGY

3.1 Sampling Method

Since the research questions of this thesis are

qualitative in nature, a non-probability type of

sampling should be applied (Zhang et al., 2020). The

researcher determined which participants are suitable

to be studied based on their attributes (Berndt, 2020).

This particular sampling method is very beneficial

since it allows the researcher to obtain elaborate

explanations. By using this sampling method, the

researcher could pick potential interviewees that are

able to contribute directly to the research topic and

assist in answering the research questions.

3.2 Number of Sample

According to (Elfil and Negida, 2017), interviewing

a large quantity of participants does not automatically

translate to good research. (Brinkmann, 2013) stated

that research that is qualitative in nature should

remain gathering data until saturation is reached,

which is referred to when no new knowledge is

gained from the interviews conducted. Prior to the

interviews, the researcher decided on the eligibility of

the candidates by ensuring that they fulfil all the

requirements in order to facilitate the accurateness of

the result. The researcher ended up interviewing 11

people from Prime Agency, consist of: 4 Agency

Directors and 7 agents.

3.3 Data Analysis Method

Thematic analysis was applied in this research. It is a

very common approach usually used in qualitative

studies. This type of analysis required the researcher

to codify the qualitative information obtained from

the interviews to recognise themes or repetitions

transpiring throughout the data collection process to

enable further investigation (Morse, 1995). All of the

interviews were recorded and codified manually by

the researcher. Thematic analysis is a well-organised

method, which proves to be favourable as it can result

in an abundance of valuable interpretations.

3.4 Reliability and Validity

This thesis paper incorporated triangulation to

validate the research findings. To verify the data

collected, triangulation requires the researcher to

utilise two or more sources of data or methods of data

accumulation (Morse, 1995). The main purpose of

triangulation is to be a supporting method to cross-

ICRI 2021 - International Conference on Recent Innovations

172

check findings. For this particular paper, the

researcher used two sources of data, which were

extracted from agents and agency directors.

Additionally, the researcher interviewed the founder

of the Prime Agency.

4 FINDING

4.1 Thematic Data Analysis

The data analysis method utilised in this research

paper is thematic analysis, which is beneficial to

identify codes and assemble themes derived from the

qualitative data.

This particular chapter mainly focuses on the

results of the interviews which were conducted by the

researcher with the aim to explore the factors that are

able to motivate Generation Y individuals working in

the insurance industry and how it compares to the

well-known two-factor theory.

4.2 Data Display

The data is displayed based on the sound recordings

of online interviews which were then manually made

into a transcript. Through this transcript, the

researcher was able to locate multiple codes which

were repeatedly brought up by interviewees or which

the researcher deemed to hold a significant value.

Therefore, the coding process results in the data

display containing numerous codes and sub-codes,

two subcategories, and one category. In the

discussion, the researcher compares the coding

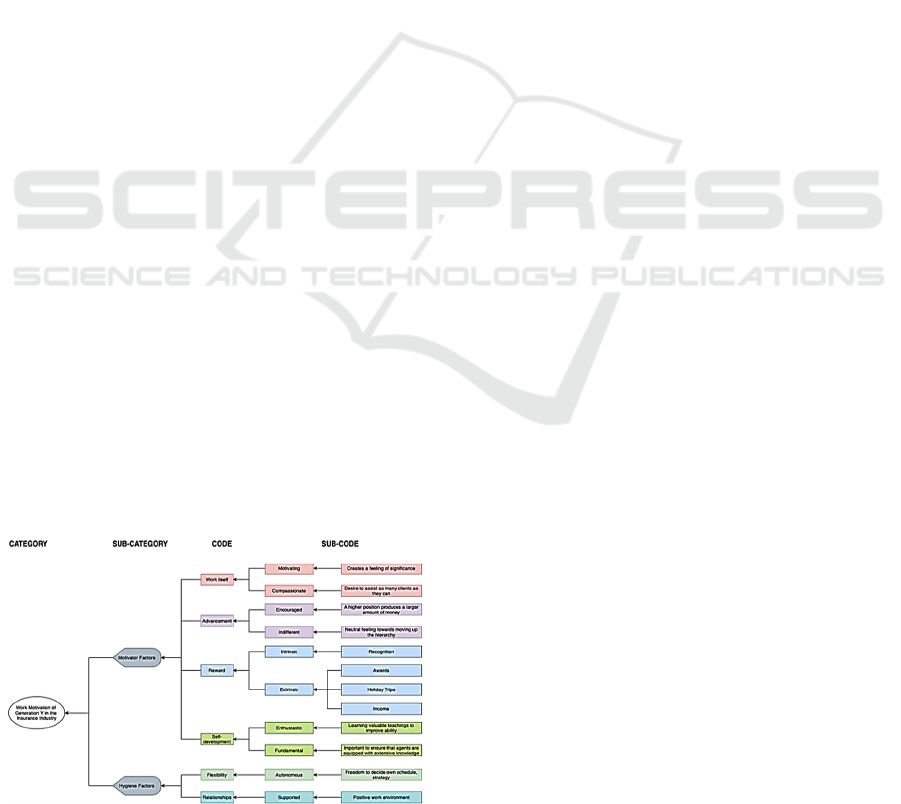

mapping described in Figure 4 with Herzberg’s Two-

Factor Theory described in Figure 3.

4.3 Coding Description

The following figure provides a coding mapping of

the interview results as can be seen in Figure 4.

Figure 4: Coding Mapping of the Interview Result.

4.3.1 Motivator Factors

Based on the responses derived from the interviews,

the researcher found four motivator factors that play

a part in motivating the agents at Prime Agency. As

can be seen in the coding mapping of the interview

results, the motivators are work itself, advancement,

reward and self-development.

• To identify motivational factors that make

Generation Y employees willing to perform

and stay longer in the company during the

Covid-19 pandemic.

• To analyse how those factors work by

comparing them to those that have been

described in Herzberg’s motivational theory

Based on the coding mapping in Figure 4, there

are two sub-codes that are found to support the

development of work itself, which are Motivating and

Compassionate. Below are the samples of interview

responses about these two sub-codes:

// We are here to help people as well. There are

people who have a mission to help clients have their

own insurance. So, of course we are helping a lot of

people. //

// Of course what makes me the most motivated is

that I want to give the best for my clients because as

a result of that, my clients are satisfied . . . .and my

business also grows. //

// I do not really know, but I just want to give the

best for my potential clients. //

// I feel that in this COVID situation, there are a

lot of difficulties. Therefore, I feel proud when I can

make my customers have their own insurances. This

can make me feel motivated. //

The results of the interviews conducted by the

researcher above have a general theme of agents

desiring to help their customers. Overall, they have a

humanitarian attitude, which aims to ensure that

customers are protected by insurance.

Based on Figure 4, there are two sub-codes that

build reward, which are Intrinsic and Extrinsic.

Intrinsic rewards comprise Recognition while

Extrinsic rewards consists of Awards, Holiday Trips

and Income. The responses that aid in the development

of these sub-codes are as follows: Recognition.

// Recognition through the media, where it is

published in Kompas newspaper. Then, the award

nights are also shown on YouTube, which displays

the achievers’ photos. //

// Well, what kind of recognition is it? Maybe

selfactualisation. So it is like if we get a reward or

something, we can be in the Kompas newspaper. So

it is like self-actualisation. //

An Online-work Motivation Analysis of Generation Y during Covid-19 Pandemic: A Case Study in Prime Agency Insurance

173

// In the insurance sector, there are usually many

people who are good at being sales agents and they

usually get a lot of rewards. So there may be an

intrinsic compensation in the form of recognition

from others. //

Holiday trips awarded by Prudential are always of

high quality with one interviewee mentioning that the

hotel is always five stars. These exclusive trips

therefore make them feel appreciated for their hard

work. Hence, the agents feel thankful and motivated

when they are given the free trips.

// At that time, I was able to immediately get a trip

to Europe. Every achieved target can earn us a trip to

somewhere. At that time, I was immediately able to

travel to Europe with Prudential in Budapest. //

// For instance, we can get a trip to Europe. The

scope is not only in Asia but also Europe and America

too. Last year, I was supposed to go to London and

Edinburgh. However due to COVID, we were given

compensation in the form of cash. So we are given a

return in the form of a cash back; thus, we are

appreciated for the results of our hard work that year.

//

// When we travel, we are given top five stars

hotels. For the duration of the stay, sometimes I feel

like it is a shame that the hotel is only used for us to

sleep in because we always go out from the morning

till night. The hotel is never a four star, it is always a

five star. //

As specified by the researcher in the coding

mapping, there are two sub-codes that build

selfdevelopment. These sub-codes include

Enthusiastic and Fundamental. Stated below are

examples from the interview responses:

// We are often given training, which can be from

well-known speakers so we can just attend the

seminars. This also gives value as we are able to learn

from it. //

// Because I have only worked as an agent for one

year, I like to participate in training in order to

understand more because there is still much I need to

learn. //

// I would say that for me, mentoring and seminars

can make me motivated. Because as I have said

before, I am also eager to learn. //

The responses derived from the interview

transcripts stated above shows that the agents are

dedicated to learn and enhance their skills and

capabilities. Overall, self-development enables

agents to feel motivated as it is crucial for their

operations and life outside of their work.

4.3.2 Hygiene Factors

According to the results of the interviews conducted

by the researcher, there are two factors identified to

have the potential to demotivate agents if it is

unsatisfied. As specified in the coding mapping of the

interview results, these hygiene factors are flexibility

and relationships.

// Another thing besides that is the flexible time,

where you can manage your own time so you can

follow your child’s golden moments while working.

//

// Maybe in Prudential, it is the time freedom or

time flexibility because we are able to set our own

time when we are working. . . . //

// Flexible working hours can also motivate me

because I have children at home. Therefore, there can

be good time management. //

// Besides that, the flexible working hours are also

really good. //

In this first hygiene factor, there are repeated

mentions of time flexibility in all of the responses

above. By being able to schedule their own working

hours, the interviewees are able to divide their times

wisely.

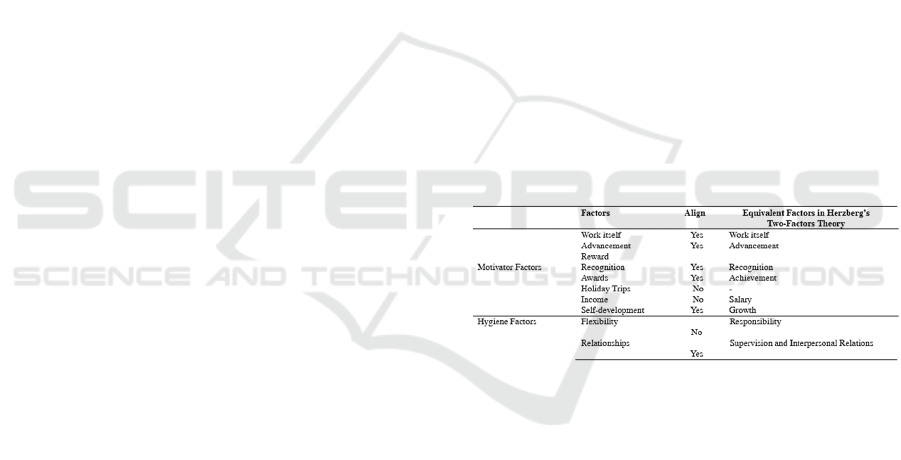

Table 1: Research Findings Summary.

The second factor that is inconsistent with

Herzberg’s theory is income, which can be called

salary based on Herzberg’s definition. A research by

(Berndt, 2020) on the motivation of employees in the

Egyptian hotel industry found that money has a

positive relationship with job satisfaction due to

inadequate access to fundamental life necessities in

underdeveloped nations. It can be said that the

insurance agents interviewed are quite privileged as

compared to low-paid workers in Indonesia.

However, since Indonesia is still considered as a

developing country, it can be concluded that the

quality of life in this country is poorer than in

developed countries where Herzberg conducted his

research. Therefore, this finding supports the research

in which income is considered as a motivator instead

of a hygiene factor, although it is of different

industries.

ICRI 2021 - International Conference on Recent Innovations

174

On the other hand, in the hygiene section, there is

only flexibility and relationships. In this research,

most of the hygiene factors from Herzberg’s

twofactor theory are not identified in this research.

This includes company policy and administration,

work condition, personal life, status and security.

Relationships is a combination of Herzberg’s

supervision and interpersonal relations, which means

that it supports the theory. However, the research

found evidence that flexibility, which is parallel to

responsibility according to Herzberg’s definition, is

included in this category. This important finding is

found due to the unique nature of the insurance

industry that allows and encourages freedom.

On the other hand, in the hygiene section, there is

only flexibility and relationships. In this research,

most of the hygiene factors from Herzberg’s

twofactor theory are not identified in this research.

This includes company policy and administration,

work condition, personal life, status and security.

Relationships is a combination of Herzberg’s

supervision and interpersonal relations, which means

that it supports the theory. However, the research

found evidence that flexibility, which is parallel to

responsibility according to Herzberg’s definition, is

included in this category. This important finding is

found due to the unique nature of the insurance

industry that allows and encourages freedom.

5 DATA ANALYSIS AND

DISCUSSION

5.1 Motivator Factors

When compared side-by-side between the research

finding and Herzberg’s two-factor theory, a motivator

that is missing from Herzberg’s theory is

responsibility, and holiday trips are a new factor, and

thus could not be found in the theory. All of the factors

that are under reward are aligned with Herzberg’s two-

factor theory except for holiday trips and income.

Hence, it can be concluded that the reward factor as a

whole does not fully align with Herzberg’s theory.

The second extrinsic reward is holiday trips,

which is a newfound motivator identified in this

research as it does not relate to Herzberg’s theory.

Holiday trips are included in the compensation

system of Prime Agency and Prudential, and

therefore are perceived as quite important.

The last extrinsic reward to be discussed in this

section is income. This factor is parallel to the

definition of salary in Herzberg’s two-factor theory.

The difference is that Herzberg classified salary as a

hygiene factor instead of a motivator factor.

According to the results of the interviews, the

researcher gathered that the agents are in fact satisfied

by monetary rewards, which proves that they don’t

support Herzberg theory. Therefore, income is not

completely aligned with Herzberg’s theory as it is a

motivator.

5.2 Hygiene Factors

In Herzberg’s two-factor theory, there are eight

hygiene factors. These include company policy and

administration, supervision, interpersonal relations,

work condition, salary, personal life, status and

security. However, the researcher has only found two

factors, which are flexibility and relationships. The

reason that they joined the insurance business is

mostly because they are not required to work every

day. Therefore, they can use their free time from their

other job to do insurance work. If this autonomy is

decreased or removed, the agents would be

demotivated and would potentially end up quitting

their insurance roles. Thus, flexibility is considered as

a hygiene factor. Another hygiene factor is

relationships, which is a combination of interpersonal

relations and supervision from Herzberg’s two-factor

theory. This signifies that this factor is aligned with

the theory as relationships along with interpersonal

relations and supervision are all considered as

hygiene factors. The interview responses regarding

relationships involve comments about a supportive

environment where peers are helpful towards each

other and the willingness of agency directors to lend

their help towards those in need. This creates a

wonderful synergy within Prime Agency. Hence, the

researcher classified this factor as hygiene, which is

fully aligned to Herzberg’s theory.

5.3 Final Comparison

By comparing the results of this research with

Herzberg’s two-factor theory, some significant

findings are discovered to be very different from the

original factors stated by Herzberg. Table 1 presents

the summary of all research findings. All motivator

factors are identified in the insurance industry,

although not all of them are classified as what is

supposed to be based on the theory. The motivators

which similar to Herzberg’s motivators are: work

itself, advancement, recognition and reward, as well

as self-development. Two factors are found to not

support this theory. The first factor is holiday trips,

which are identified to possess a motivating power for

An Online-work Motivation Analysis of Generation Y during Covid-19 Pandemic: A Case Study in Prime Agency Insurance

175

Millennial agents. This is not written in the theory and

hence, it provides a new finding.

Table 1: Research Findings Summary.

Factors Align Align

Equivalent Factors in

Herzberg’s Two-

Factors Theor

y

Motivator

Factors

Work itself Yes Work itself

Advancement Yes Advancement

Reward Yes Reward

Recognition Yes Recognition

Awards No Achievement

Holiday Trips No Salary

Self-

develo

p

ment

Yes Growth

Hygiene

Factors

Flexibility No Responsibility

Relationships Yes

Supervision and

Interpersonal Relations

The second factor that is inconsistent with

Herzberg’s theory is income, which can be called

salary based on Herzberg’s definition. A research by

(Berndt, 2020) on the motivation of employees in the

Egyptian hotel industry found that money has a

positive relationship with job satisfaction due to

inadequate access to fundamental life necessities in

underdeveloped nations. It can be said that the

insurance agents interviewed are quite privileged as

compared to low-paid workers in Indonesia. However,

since Indonesia is still considered as a developing

country, it can be concluded that the quality of life in

this country is poorer than in developed countries

where Herzberg conducted his research. Therefore,

this finding supports the research in which income is

considered as a motivator instead of a hygiene factor,

although it is of different industries.

On the other hand, in the hygiene section, there is

only flexibility and relationships. In this research,

most of the hygiene factors from Herzberg’s

twofactor theory are not identified in this research.

This includes company policy and administration,

work condition, personal life, status and security.

Relationships is a combination of Herzberg’s

supervision and interpersonal relations, which means

that it supports the theory. However, the research

found evidence that flexibility, which is parallel to

responsibility according to Herzberg’s definition, is

included in this category. This important finding is

found due to the unique nature of the insurance

industry that allows and encourages freedom.

As stated in the literature review of this thesis,

according to Herzberg’s two-factor theory,

motivators are intrinsic while hygiene factors have an

extrinsic nature. However, the findings derived from

this research claimed otherwise. The motivator

factors are all intrinsic except for income, which is

supposedly a hygiene factor. On the other hand,

flexibility is a hygiene factor as opposed to a

motivator in Herzberg’s theory. This proves that

motivator factors and hygiene factors are not always

intrinsic and extrinsic, respectively. Instead, there can

be a mixture of both natures.

6 CONCLUSION AND

RECOMMENDATIONS

6.1 Conclusion

During the pandemic era, there are four motivators

identified in the Prime Agency Insurance Broker:

work itself, advancement, reward and self-

development. Meanwhile, for hygiene factors, there

are only two: flexibility and relationship. Compared

to Herzberg’s two-factor theory, all of the original

motivator factors are present while only two hygiene

factors are identified at Prime Agency. In addition,

the research founds that the salary is more suitable to

be put as motivator factor rather than hygiene factor

and this is considered as novelty of this research. It

concludes that Herzberg’s two-factor theory is not

fully applicable in insurance industry. The different

sample sources that are used by Herzberg

(accountants and engineers) and this research may

become the cause of the difference. The location of

the research also matters as Herzberg conducted his

study in a Western country while this research is

conducted in Jakarta, Indonesia. .

6.2 Recommendations

For future research, it is recommended that, a similar

study is conducted by replication on other insurance

broker agencies or by utilising other motivational

theories such as Ryan and Deci’s self-determination

theory.

REFERENCES

UI Din, S. M., Abu-Bakar, A. & Regupathi, A. (2017).

Does insurance promote economic growth: A

comparative study of developed and emerging/

ICRI 2021 - International Conference on Recent Innovations

176

developing economies. Cogent Economics & Finance,

5(1), 1-12.

Organisation for Economic Co-operation and

Development. (2021). Global Insurance Market Trends

2020 [Report]. Retrieved from http://www.oecd.org/

daf/fin/insurance/Global-Insurance-Market-Trends-20

20.pdf

MarketLine. (2020). Life Insurance in Indonesia [Report].

Retrieved from http://web.b.ebscohost.com/ehost/pdf

viewer/pdfviewer?vid=3&sid=329d2ba8-aee3-4365-

8d96-83e4a3dc3e4b%40sessionmgr102

Deloitte. (2019). Deloitte Indonesia Perspectives [Report].

Retrieved from https://www2.deloitte.com/content/

dam/Deloitte/id/Documents/about-deloitte/id-about-

dip-edition-1-full-en-sep2019.pdf

KPMG Siddharta Advisory. (2016). Insurance in Indonesia:

Opportunities in a Dynamic Market [Report]. Retrieved

from https://assets.kpmg/content/dam/kpmg/id/pdf/id-

ksa-insurance-in-indonesia.pdf

Tseng, L.-M., and Kang, Y.-M. (2014). The influences of

sales compensations, management stringency and

ethical evaluations on product recommendations made

by insurance brokers. Journal of Financial Regulation

and Compliance, 22(1), 26-42.

Twenge, J. M., Campbell, S. M., Hoffman, B. J., & Lance,

C. E. (2010). Generational Differences in Work Values:

Leisure and Extrinsic Values Increasing, Social and

Intrinsic Values Decreasing. Journal of Management,

36(5), 1117-1142.

Pew Research Center. (2019). Defining generations: Where

Millennials end and Generation Z begins [Report].

Retrieved from: https://www.pewresearch.org/fact-

tank/2019/01/17/where-millennials-end-and-

generation-z-

begins/#:~:text=Anyone%20born%20between%20198

1%20and,part%20of%20a%20new%20 generation

Mehra, P., & Nickerson, C. (2019). Does technology divide

or unite generations?

International Journal of Organizational Analysis, 27(5),

1578-1604.

Perry, M. (2015). Finding Middle Ground: Expectations of

and Enrollment Strategies for Millennial

Students. College and University, 90(3), 39-42.

Myers, K. K., & Sadaghiani, K. (2010). Millennials in the

Workplace: A Communication Perspective on

Millennials’ Organizational Relationships and

Performance. Journal of Business and Psychology,

25(2), 225-238.

Weber, J. (2017). Discovering the Millennials’ Personal

Values Orientation: A Comparison to Two

Managerial Populations. Journal of Business Ethics,

143(3), 517-529.

Baker Rosa, N. M., & Hastings, S. O. (2018). Managing

Millennials: looking beyond generational stereotypes.

Journal of Organizational Change Management, 31(4),

920-930.

Tirta, A. H., & Enrika, A. (2020). Understanding the impact

of reward and recognition, work life balance, on

employee retention with job satisfaction as mediating

variable on millennials in Indonesia. Journal of

Business and Retail Management Research, 14(3), 88-

99.

Vertafore. (2018). Millennials in Insurance [White Paper].

Retrieved from https://www.vertafore.com/sites/

default/files/files/2018-10/Millennials%20in%20Insu

rance%202018%20White%20Paper.pdf

Vertafore. (2020). The Insurance Industry Workforce

[White Paper]. Retrieved from https://www.vertafore.

com/sites/default/files/files/2020-02/Insurance-Indus

try-Workforce-White-Paper-2020-FIN.pdf

Schultz, R. J., Schwepker, C. H., & Good, D. J. (2012).

Social media usage: an investigation of B2B

salespeople. American Journal of Business, 27(2), 174-

194.

Steers, R. M., Mowday, R. T., & Shapiro, D. L. (2004).

Introduction to Special Topic Forum: The Future Work

Motivation Theory. Academy of Management Review,

29(3), 379-387.

Jost, P.-J. (2014). The Economics of Motivation and

Organization: An Introduction. Cheltenham, United

Kingdom: Edward Elgar Publishing Limited.

Green Jr., P. I., Finkel, E. J., Fitzsimons, G. M., & Gino, F.

(2017). The energizing nature of work engagement:

Toward a new need-based theory of work motivation.

Research in Organizational Behavior, 37, 1-18.

Sanjeev, M. A., & Surya, A. V. (2016). Two Factor Theory

of Motivation and Satisfaction: An Empirical

Verification. Annals of Data Science, 3(2), 155-173.

Herzberg, F., Mausner, B., & Snyderman, B. B. (2017). The

Motivation to work. London: Routledge.

Mackay, A. (2007). Motivation, Ability and Confidence

Building in People. Burlington: Routledge.

Zhang, X. J., Jinpeng, X., & Khan, F. (2020). The Influence

of Social Media on Employee’s Knowledge Sharing

Motivation: A Two-Factor Theory Perspective. SAGE

Open, 10(3), 1-17.

Berndt, A. E. (2020). Sampling Methods. Journal of Human

Lactation, 36(2), 224-226.

Elfil, M., & Negida, A. (2017). Sampling methods in

clinical research; An educational review. Emergency,

5(1), 1-3.

Brinkmann, S. (2013). Qualitative Interviewing. New

York: Oxford University Press.

Morse, J. M. (1995). The Significance of Saturation.

Qualitative Health Research, 5(2), 147-149.

Saunders, M., Lewis, P., & Thornhill, A. (2015). Research

Methods for Business Students (7th edition). New

York: Pearson Education.

Sobaih, A. E. E., & Hasanein, A. M. (2020). Herzberg’s

Theory of Motivation and Job Satisfaction: Does it

Work for Hotel Industry in Developing Countries?

Journal of Human Resources in Hospitality & Tourism,

19(3), 319-343.

An Online-work Motivation Analysis of Generation Y during Covid-19 Pandemic: A Case Study in Prime Agency Insurance

177