Company Size, Institutional Ownership on Tax Avoidance with Audit

Quality as Moderate and Independent Variables

Silviana Wagiu, Armanto Witjaksono and Meiryani

Accounting Department, Faculty of Economics and Communication, Bina Nusantara University, Jakarta, Indonesia

Keywords: Company Size, Institutional Ownership, Tax Avoidance, Audit Quality.

Abstract: This study aims to prove the relationship between profitability, firm size, institutional ownership, and audit

quality on tax avoidance, as well as whether audit quality can moderate the above variables. The research

methods and object used is quantitative research with secondary data in the mining and service sectors listed

on the Indonesia Stock Exchange for the 2015-2020 period. The empirical results prove that the factors that

have a significant positive effect on tax avoidance are firm size and institutional ownership, while profitability

and audit quality have a positive but not significant effect on tax avoidance. Audit quality proved insignificant

in moderating the effects of the above variables.

1 INTRODUCTION

Tax revenue plays a very important role in financing

state expenditures. The majority of state spending is

financed by tax revenue. Based on data taken from the

2017-2019 APBN, it was found that the average

contribution from tax revenues to state revenues was

84%, and the contribution from non-tax revenues was

16%. The facts found during the 2017-2019 period

provide information that tax revenue plays an

important role in contributing to state expenditure

financing.

It was also found that the level of realization of

tax revenues never fully reached each period.

Attributed to a high level of tax avoidance by

taxpayers. Tax revenues that are not maximized will

hamper the realization of the budget needed for

development of the nation. Quoted from the cash

website, the Director-General of Taxes of the

Ministry of Finance (Kemenkeu) Suryo Utomo spoke

about the findings of tax avoidance or tax avoidance

which is estimated to cost the state up to Rp 68.7

trillion per year. The findings announced by the Tax

Justice Network reported that due to tax evasion,

Indonesia is estimated to lose up to US$ 4.86 billion

per year. This figure is equivalent to that of the Rp.

68.7 trillion when using the rupiah exchange rate at

the close to the spot market on Monday (23/11) of Rp.

14,149 per the United States (US) dollar (Santoso,

2020). Taxpayer’s tax non-compliance is tax

avoidance, which is an effort to legally reduce the tax

burden that does not violate tax regulations by

taxpayers by trying to reduce the amount of tax owed

by looking for regulatory weaknesses (loopholes).

Quoted from DDTCNews, the KPK sees the mining

sector as a sector that is prone to corrupt practices,

one of which is tax evasion. The Corruption

Eradication Commission (KPK) recorded a shortage

of mining tax payments in forest areas of Rp. 15.9

trillion per year (Hutagaol, 2017). Tax avoidance

cannot be said to conflict with the tax laws because

this practice is dominant in exploiting loopholes in

the tax law which will affect state revenues from the

tax sector (Mangoting, 1999).

The company's profit level also has a significant

influence on the amount of tax that must be paid.

Companies incur debt to avoid taxes, this is the tax

rate charged is calculated after deducting interest

costs from the debt incurred. The company still

benefits from the debt for operations or even business

development, and the amount of taxes that must be

paid will be reduced. Direct contact with the size of

the company, it also has an influence on tax

avoidance. To prevent tax avoidance practices,

internal and external supervision of the company is

needed. An institution that invests in a company will

certainly prevent fraud that has the potential to occur.

The fraud reduces the profits to be received by the

owner company. In addition to internal supervision,

external supervision is also needed to provide a sense

of trust in the wider community in the credibility of

Wagiu, S., Witjaksono, A. and Meiryani, .

Company Size, Institutional Ownership on Tax Avoidance with Audit Quality as Moderate and Independent Var iables.

DOI: 10.5220/0011242000003376

In Proceedings of the 2nd International Conference on Recent Innovations (ICRI 2021), pages 151-157

ISBN: 978-989-758-602-6

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

151

the company. It is better to leave it to an auditor who

has a good reputation as seen from extensive

experience so that he knows the loopholes where

there is fraud, including tax evasion.

The practice of tax avoidance, although it does not

violate the law, its economic value is considered

unethical. This results in a loss to the country. This

can increase the realization of state tax revenues for

the development of the Indonesian state. From the

cases that have been described above, the authors are

interested in realizing suggestions from previous

researchers to expand the research sample. The

research was conducted using issuers in the mining

and service sectors. Because the two sectors are

interrelated to each other to increase the state treasury

income. In terms of the research year, the researchers

extended the research period from 2015 to 2020 so

that the research results were more effective and

efficient.

The contribution of this research is to prove that

there is a relationship between the effect of

profitability, firm size, institutional ownership, and

audit quality on tax avoidance, as well as audit quality

as a moderating variable to determine whether to

strengthen or weaken profitability, firm size and

institutional ownership. Therefore, from the

background that the author has described above, the

authors are interested in conducting a study entitled

"The Effect of Profitability, Company Size, and

Institutional Ownership on Tax Avoidance with

Audit Quality as Moderating Variable and

Independent Variable".

2 LITERATURE REVIEW

2.1 Positive Accounting Theory

Positive accounting theory grew around the 1960s

which focuses on economic and behavioral

approaches by bringing up the efficient market

hypothesis and agency theory initiated by Watt and

Zimmerman which consists of three hypotheses, (1)

bonus planning, (2) debt covenants, and (3) the cost

of the political process. The dominant positive

accounting theory refers to empirical research that

maximizes profits (investors, managers, and the

public) in choosing the available accounting methods

(Januarti, 2004). In this study, the researcher uses the

political cost theory hypothesis, which explains why

companies choose accounting policies to minimize

the income tax burden. Income tax is considered a

political cost, therefore companies tend to reduce

taxable income. This action is per the definition of tax

avoidance according to Hanlon and Heitzman (2010),

namely an effort to reduce the amount of explicit tax

value through tax planning efforts in the legal and

illegal ranges. Political cost theory introduces a

political dimension to the choice of accounting

policy. According to positive accounting theory, the

accounting procedures used by companies do not

have to be the same as others, but companies are

given the freedom to choose one of the available

alternative procedures to minimize contract costs and

maximize firm value. With this freedom, managers

tend to take action according to the positive

accounting theory, which is called opportunistic

behavior. Thus, opportunistic action is an action taken

by the company in choosing an accounting policy that

is profitable and maximizes the company's

satisfaction.

2.2 Agency Theory

Agency theory Michael (1976) states that there is a

cooperative relationship between two parties, where

the relationship that occurs is a working relationship.

The parties involved in the relationship are between

the party giving the authority (principal) and the party

receiving the authority (agent). The agency model

designs a system with a mutual agreement between

the management as the agent, and the shareholders or

owners as the principal. Agency theory assumes that

it is based on the economics of the man model

(Ghozali, 2020). This model assumes that individuals

(both principal and agent) optimize their respective

utilities (satisfaction). In the principal-agent

relationship, the agent is contracted to maximize the

utility of the principal (Ross, 1973 in Ghozali, 2020);

however, agency theory assumes that the agent will

behave opportunistically, namely maximizing his

interests.

2.3 Hypothesis Development

2.3.1 The Effect of Profitability on Tax

Avoidance

Companies that have high profitability have the

opportunity to carry out tax planning which can

reduce the total burden of tax obligations (Chen et al,

2010). Another argument also comes in support of

(Anouar, 2017), which states that profitability has a

positive effect on tax avoidance. In agency theory, the

agent will try to manage his tax burden so as not to

reduce the agent's performance compensation as a

result of reduced company profits because it is eroded

by the tax burden. Thus, the company's resources are

ICRI 2021 - International Conference on Recent Innovations

152

used by agents to maximize the agent's performance

compensation, namely by suppressing the company's

tax burden to maximize company performance.

Another study conducted by Oktamawati (2017)

found that profitability affects tax avoidance. H1:

Profitability has a positive effect on tax avoidance.

2.3.2 The Effect of Firm Size on Tax

Avoidance

Research on the relationship between aggressive tax

avoidance and firm size has been carried out by Lanis

and Richardson (2015) with political cost theory

showing a positive relationship between firm size and

aggressive tax avoidance. Another study conducted

by Rego (2003) found that firm size has a positive

effect on tax avoidance. In contrast to previous

research, the results of Fitri (2015) research-based on

political power theory show a negative relationship

between firm size and aggressive tax avoidance. H2:

Firm size has a negative effect on tax avoidance.

2.3.3 The Effect of Institutional Ownership

on Tax Avoidance

Companies whose share ownership is larger are

owned by other corporate institutions or the

government, then the performance of the company's

management to be able to obtain the desired profit

will tend to be monitored by institutional investors.

This encourages management to be able to minimize

the value of taxes owed by the company. In agency

theory, the role of investors, which in this case are

institutions, will reduce the information gap between

agents and investors. So it is hoped that it will reduce

the opportunity for agents to evade tax because agents

are supervised by investors who are also institutions

so that institutional investors also better understand

the state of the company being invested in compared

to investors in general. Research conducted by

Khurana and Moser (2013) found that institutional

ownership does not affect tax avoidance. The

argument above is against the current research

conducted by (Nuralifmida, 2008) which found that

the large or small concentration of institutional

ownership affects tax avoidance policies by

companies. Thus, the hypothesis is formulated

consisting of: H3: Institutional ownership has a

negative effect on tax avoidance.

2.3.4 Effect of Audit Quality on Tax

Avoidance

According to Vincent et al (2011), if a company is

audited by the Big Four Public Accounting Firm

(KAP), it will be difficult to carry out aggressive tax

policies. Auditor industry specialization describes

auditors who already have a lot of industry-specific

knowledge. The Public Accounting Firm (KAP)

industry specialization considers it to be able to

provide more certainty because of the many

experiences in handling clients in different industries

so that it can produce quality audit quality

information (Kusuma and Widiasmara, 2019).

According to the Qorika (2017), it clearly states that

the auditor's consideration of the company's

competitiveness in maintaining the company's

operations must be based on the assessment of a

qualified auditor. So far, the quality of auditors is

juxtaposed with the size and reputation of the Public

Accounting Firm (KAP). Based on agency theory, the

role of the auditor in this case is as a messenger from

the principal to be able to see the performance and as

a supervisory agent in carrying out his duties.

Therefore, the auditor appointed to conduct the audit

must have good knowledge of the loopholes that can

be used to commit fraud. The need for an auditor who

has a good reputation can also be a reference that the

company has been examined by a credible party so

that the company does not commit fraud, which in

this case is tax evasion. Thus, the hypothesis is

formulated consisting of: The role of the auditor in

this case is as a messenger from the principal to be

able to see the performance and as a supervisory agent

in carrying out his duties. H4: Audit quality has a

positive effect on tax avoidance.

2.3.5 The Effect of Profitability on Tax

Avoidance Moderated by Audit

Quality

Based on agency theory, the agent will try to reduce

the amount of his tax burden so that the compensation

received by the agent will be maximized. A high level

of profitability will generate high profits, from high

profits will result in a high tax burden, so that the

company's income will be eroded by the tax burden.

Therefore, the agent will carry out earnings

management to avoid the company's profits from

being eroded by the tax burden. This allows the

company's resources to be managed by agents to

maximize compensation for their performance. The

findings from Dina et al., (2018) state that

profitability has a significant effect on tax avoidance.

The results of this study are not in line with Dina et

al., (2018) which states that profitability does not

affect tax avoidance. H5: Audit quality moderates

profitability on tax avoidance.

Company Size, Institutional Ownership on Tax Avoidance with Audit Quality as Moderate and Independent Variables

153

2.3.6 The Effect of Firm Size on Tax

Avoidance Moderated by Audit

Quality

Based on political cost theory, firm size has a

negative effect on tax avoidance. This happens

because the larger the company, the more the

company will attract the attention of the regulator so

that the company will reduce actions that can harm

the regulator. This will be able to influence the

company to do tax avoidance. Audit quality in this

case is expected to moderate the effect of firm size on

tax avoidance so that the level of influence of firm

size on tax avoidance can be influenced by audit

quality. Because audit quality in agency theory acts

as a messenger from the principal to check the agent

in carrying out his obligations so that frauds that

occur can be reduced. Research conducted by Qorika

(2017) states that audit quality can affect tax

avoidance. Based on the explanations mentioned

above, the following hypotheses can be made: H6:

Audit quality moderates firm size on tax avoidance.

2.3.7 The Effect of Institutional Ownership

on Tax Avoidance Moderated by Audit

Quality

In agency theory, the role of investors, which in this

case are institutions, will reduce the information gap

between agents and investors. So it is hoped that it

will reduce the opportunity for agents to evade tax

because agents are supervised by investors who are

also institutions, so that institutional investors also

better understand the state of the company being

invested in compared to investors in general.

Research conducted by Krisna (2019) found that high

institutional ownership in a company can affect tax

avoidance by management with the support of

empirical evidence, while research on audit quality

variables does not affect tax avoidance in a company.

In contrast to the research conducted by Ghozali

(2016) which states that audit quality can affect tax

avoidance. Research conducted by Tarekegn and

Ayele (2020) states that audit quality can moderate

the effect of institutional ownership on tax avoidance.

Audit quality in this case is expected to moderate the

effect of institutional ownership on tax avoidance so

that the level of influence of institutional ownership

on tax avoidance can be influenced by audit quality.

Because audit quality in agency theory acts as a

messenger from the principal to check the agent in

carrying out his obligations, so that frauds that occur

can be reduced. Based on the explanations mentioned

above, the following hypotheses can be made:

Research conducted by Adisti Maharani (2019) states

that audit quality can moderate the effect of

institutional ownership on tax avoidance. Audit

quality in this case is expected to moderate the effect

of institutional ownership on tax avoidance so that the

level of influence of institutional ownership on tax

avoidance can be influenced by audit quality.

Because audit quality in agency theory acts as a

messenger from the principal to check the agent in

carrying out his obligations, so that frauds that occur

can be reduced. Based on the explanations mentioned

above, the following hypotheses can be made:

Research conducted by Adisti Maharani (2019) states

that audit quality can moderate the effect of

institutional ownership on tax avoidance. Audit

quality in this case is expected to moderate the effect

of institutional ownership on tax avoidance so that the

level of influence of institutional ownership on tax

avoidance can be influenced by audit quality.

Because audit quality in agency theory acts as a

messenger from the principal to check the agent in

carrying out his obligations, so that frauds that occur

can be reduced. Based on the explanations mentioned

above, the following hypotheses can be made: so that

fraud can be reduced. Based on the explanations

mentioned above, the following hypotheses can be

made: so that fraud can be reduced. Based on the

explanations mentioned above, the following

hypotheses can be made: H7: Audit quality moderates

institutional ownership of tax avoidance.

3 RESEARCH METHODOLOGY

The data collection method in this study used panel

data regression. Panel data is a combination of cross-

sectional (individual) and time series (time series)

approaches. The population in this study is the

industry that produces raw materials and services,

totaling 283 companies, in addition to finance. The

sample obtained was 177 issuers from 2015-

2020.The following is a summary of the company's

sectors and sub-sectors that the researcher uses. The

researcher uses this sample because it represents the

population of two industries listed on the Indonesia

Stock Exchange (IDX), namely producers of raw

materials and services, in addition to finance. From

the total of the two industries above, there are 283

companies, then each sector has taken its sub-sector.

The data was obtained manually from the Indonesia

Stock Exchange web page on the website

www.idx.co.id and research.or.id in 2015-2020. The

sampling technique in this study was conducted using

ICRI 2021 - International Conference on Recent Innovations

154

a purposive sampling method with the following

criteria: (i) mining sector companies listed on the

Indonesia Stock Exchange (IDX) for the 2015-2020

period; (ii) service sector companies listed on the

Indonesia Stock Exchange (IDX) for the 2015-2020

period; (iii) companies that publish annual reports and

financial statements that have been audited by

independent auditors in the 2015-2020 period; (iv)

companies that publish their financial statements in

Indonesian Rupiah; (v) Companies that publish their

financial statements in United States Dollars (USD)

and have been converted to Indonesian Rupiah at the

middle rate for December 30, 2020.

4 RESULT AND DISCUSSION

The use of sections to divide the text of the paper is

optional and left as a decision for the author. Where

the author wishes to divide the paper into sections the

formatting shown in Table 2 should be used.

4.1 Descriptive Statistical Analysis

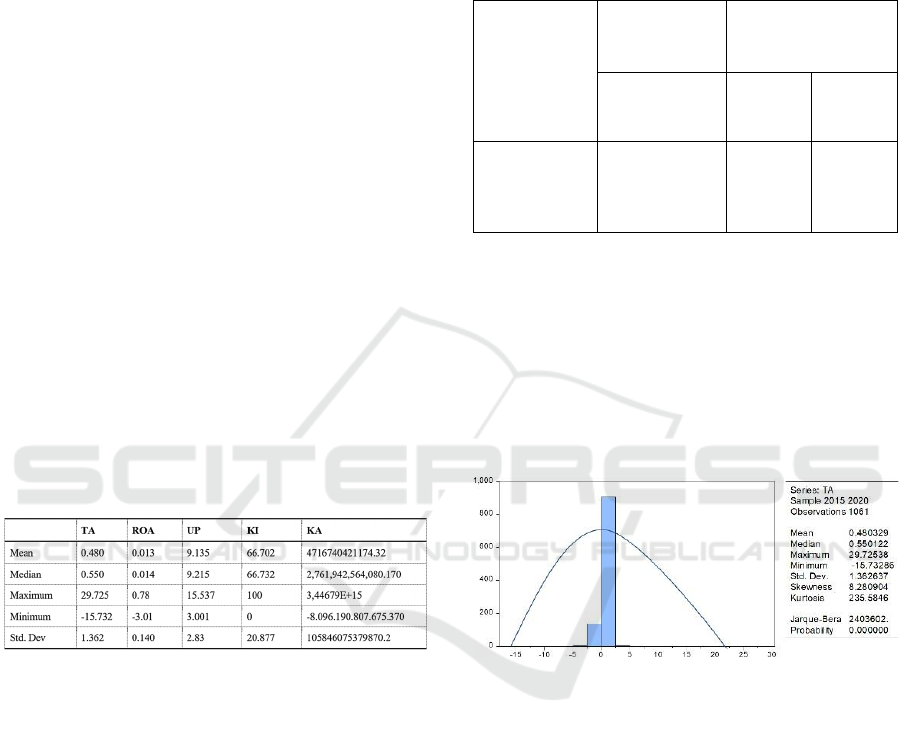

Results descriptive analysis of the variables of this

study can be seen in the folloing table:

Table 1: Results of Descriptive Aalysis.

Standard deviation value is 0.140, the maximum

value is 0.78, while the minimum value is -3.01. The

mean value of firm size is 9.135, the standard

deviation is 2.832, the maximum value is 15.53, while

the minimum value is 3.001. The mean value of

institutional ownership is 66,702, the standard

deviation value is 20.877, the maximum value is 100,

while the minimum value is 0. The mean value of

audit quality is 4716740421174.32, the standard

deviation value is 105846075379870.2, the

maximum value is 3446794474294695, while the

maximum value is 3446794474294695. The

minimum is 8096190807675,376. The mean value of

tax avoidance is 0.480, the standard deviation is

1.362, the maximum value is 29.725, while the

minimum value is 15.732.

4.2 Panel Data Analysis

The selected panel data model is the Random Effect

Model (REM)

Table 2: Results of Random Effect Model (REM).

Hypothesis Test

Cross-section

Time

Both

Breusch-Pagan 15.85419

(0.0001)

0.324395

(0.5690)

16,17858

(0.0001)

Based on the test results above, it is known that

the value of both in the Breusch-Pagan section is

0.0001 < 0.05, so it can be concluded that the results

of the Lagrange Multiplier (LM) test that were

selected were the Random Effect Model (BRAKE).

4.3 Classic Assumption Test

4.3.1 Normality Test

Figure 1: Normality test.

Based on Figure 1, it can be seen that the value of the

probability is 0.000000. This means that it rejects H0,

the prob value is 0.000000 <0.05 the data is not

normally distributed. Because some data contains

outliers. There are some data in 2020 that are empty

(not found in the company's annual report nor on the

Indonesia Stock Exchange (IDX) web page. After

testing the data and finding outlier data, the

anticipation that can be done consists of removing

outlier data and working on outlier data. However,

philosophically the outlier data should still be used on

the condition that the data includes observations in

the population.

Company Size, Institutional Ownership on Tax Avoidance with Audit Quality as Moderate and Independent Variables

155

5 CONCLUSION

5.1 Conclusion

Based on the results of the research and discussion

above, the conclusions of this study are as follows: (i)

Profitability has been shown to have a positive effect

on tax avoidance, but it is not significant. This is

because of the level of public sensitivity to the

obligation to pay taxes by with the tax payable

without having to take tax avoidance actions, (ii)

Company size has been shown to have a positive and

significant effect on tax avoidance. This is due to the

maturity level of the company running operations that

produce clear and complex transactions while still

practicing tax avoidance. (iii) Institutional ownership

is proven to have a positive and significant effect on

tax avoidance. This is because to minimize financial

manipulation by managers, it is controlled by the size

of institutional ownership to control the company's

performance. (iv) Audit quality has been shown to

have a positive effect on tax avoidance, but it is not

significant. This is because the big four and non-big

four Public Accounting Firms (KAPs) both have good

reputations. In carrying out his audit duties at a client

company that is guided by quality control standards

on audit quality and the existence of ethical rules that

have been set in carrying out audits. (v) Audit quality

proved insignificant in strengthening the effect of

profitability and institutional ownership and proved

insignificant in weakening the effect of firm size on tax

avoidance. This is because auditors are often

unsuccessful in detecting management behavior that

intentionally practices tax avoidance. (vi) Profitability,

firm size, institutional ownership, and audit quality are

proven to have an effect of 1.4% on tax avoidance,

while the remaining 98.6% are influenced by other

variables not discussed in this study.

5.2 Suggestion

Based on the conclusions, the following suggestions

can be taken: (i) It is suggested to use a predictive

model other than tax avoidance to be used as a proxy

in future research, to be a measure and comparison in

estimating the possibility of companies doing tax

avoidance. (ii) Future researchers are expected to use

other moderating variables, namely outside audit

quality, for example using intervening variables or

control variables. (iii) Future researchers are expected

to be able to combine different samples of companies,

namely outside the mining and service sectors. Thus,

further research will determine the effect on

companies in other sectors.

5.3 Limitation

The limitations of the results of this study are as

follows: (i) This research is limited to two

company sectors, namely the mining sector and

the service sector listed on the Indonesia Stock

Exchange (IDX) with a research period of 2015-

2020.

(ii) In this study the independent variables

consisting of profitability, company size,

institutional ownership, and quality of income

can affect tax

avoidance only by 1.4%, while the

remaining 98.6% is influenced by other variables

not discussed in

this study. (iii) This study only

uses one dependent variable, namely tax

avoidance.

REFERENCES

D. J. A. Penyusunan Direktorat APBN, “INFORMASI

APBN 2017, APBN yang lebih kredibel dan berkualitas

di tengah ketidakpastian global,” 2017. [Online].

Available: https://www.kemenkeu.go.id/media/6557/

budget-in-brief-2017.pdf.

D. J. A. Penyusunan Direktorat APBN, “INFORMASI

APBN 2018, Pemantapan pengelolaan fiscaluntuk

mengakselerasi pertumbuhan ekonomi yang

berkeadilan,” 2018. [Online]. Available: https://www.

kemenkeu.go.id/media/6552/informasi-apbn-2018.pdf.

D. J. A. Penyusunan Direktorat APBN, “INFORMASI

APBN 2019, APBN untuk mendorong Investasi dan

daya saing melalui pembangunan sumber daya

manusia,” 2019. [Online]. Available: https://www.

kemenkeu.go.id/media/11213/buku-informasi-apbn-

2019.pdf.

Santoso, “Dirjen Pajak angkat bicara soal kerugian Rp 68,7

triliun dari penghindaran pajak,” Jakarta Indonesia,

2020.

J. Hutagaol, Perpajakan: Isu-isu Kontemporer. Yogyakarta:

Graha Ilmu, 2017.

Y. Mangoting, “Tax Planning : Sebuah Pengantar Sebagai,”

J. Akunt. dan Keuang., vol. 1, no. 1, pp. 43–53, 1999,

[Online]. Available: http://puslit.petra.ac.id/journals/

accounting/.

I. Januarti, “Pendekatan Dan Kritik Teori Akuntansi

Positif,” J. Akunt. dan Audit., vol. Volume 1, no.

Nomor 1, pp. 83–94, 2004.

M. Hanlon and S. Heitzman, “A review of tax research,” J.

Account. Econ., vol. 50, no. 2–3, pp. 127–178, 2010,

doi: 10.1016/j.jacceco.2010.09.002.

M. W. H. Jensen Michael C, “Theory Of The Firm :

Managerial Behavior , Agency Costs And Ownership

Structure I . Introduction and summary In this paper

WC draw on recent progress in the theory of ( 1 )

property rights , firm . In addition to tying together

ICRI 2021 - International Conference on Recent Innovations

156

elements of the theory of e,” J. Financ. Econ. 3 305-

360, vol. 3, pp. 305–360, 1976.

I. Ghozali, “25 Grand Theory Teori Besar Ilmu

Manajemen, Akuntansi Dan Bisnis. Semarang: Yoga

Pratama”, 2020.

C. A. Pohan, Manajemen Perpajakan Strategi Perpajakan

dan Bisnis Edisi Revisi. Jakarta: PT Gramedia Pustaka

Utama, 2016.

T. O. Viandita, Suhadak, and A. Husaini, “Pengaruh Debt

Ratio ( Dr ), Price To Earning Ratio ( Per ), Earning Per

Share ( Eps ), Dan Size Terhadap Harga Saham (Studi

pada Perusahaan Industri yang Terdaftar Di Bursa Efek

Indonesia) Tamara,” J. Adm. Bisnis, vol. 1, no. 2, pp.

113–121, 2013, [Online]. Available: http://administrasi

bisnis.studentjournal.ub.ac.id/index.php/jab/article/vie

w/47.

A. Prasetyantoko, Corporate Governance; Pendekatan

Institusional. Jakarta: PT Gramedia Pustaka Utama,

2008.

L. E. DeAngelo, “Auditor size and audit fees,” J. Account.

Econ., vol. 3, no. 3, pp. 183–199, 1981.

V. Ilat and W. Kusumadewi, “Analisis Kinerja Keuangan

Pada Pemerintah Kabupaten Minahasa Utara Tahun

2012-2014,” J. Ris. Ekon. Manajemen, Bisnis dan

Akunt., vol. 4, no. 1, pp. 634–644, 2016, doi:

10.35794/emba.v4i1.11766.

S. Chen, X. Chen, Q. Cheng, and T. Shevlin, “Are family

firms more tax aggressive than non-family firms?,” J.

financ. econ., vol. 95, no. 1, pp. 41–61, 2010, doi:

10.1016/j.jfineco.2009.02.003.

D. Anouar, “The Determinants of Tax Avoidance within

Corporate Groups: Evidence from Moroccan Groups,”

Int. J. Econ. Financ. Manag. Sci., vol. 5, no. 1, p. 57,

2017, doi: 10.11648/j.ijefm.20170501.15.

M. Oktamawati, “Pengaruh Karakter Eksekutif, Komite

Audit, Ukuran Perusahaan, Leverage, Pertumbuhan

Penjualan, Dan Profitabilitas Terhadap Tax

Avoidance,” J. Akunt. Bisnis, Vol. 15, No. 1, Maret

2017, vol. 15, no. 1, pp. 23–40, 2017.

R. Lanis and G. Richardson, “Is Corporate Social

Responsibility Performance Associated with Tax

Avoidance?,” J. Bus. Ethics, vol. 127, no. 2, pp. 439–

457, 2015, doi: 10.1007/s10551-014-2052-8. “Jurnal

Sulhendri 2020-hlm1_Pengaruh Corporate

Governance, Leverage dan Ukuran Perusahaan

Terhadap Tax Avoidance (Studi Kasus pada

perusahaan Manufaktur Sektor Automotive yang

Terdaftar di BEI tahun 2015-2019).pdf.”.

S. O. Rego, “Tax-Avoidance Activities of U.S.

Multinational Corporations,” Contemp. Account. Res.,

vol. 20, no. 4, pp. 805–833, 2003, doi: 10.1506/VANN-

B7UB-GMFA-9E6W.

S. T. Damayanti Fitri, “Pengaruh Komite Audit, Kualitas

Audit, Kepemilikan Institusional, Risiko Perusahaan

Dan Return On Assets Terhadap Tax Avoidance,” J.

Bisnis dan Manaj. Vol. 5, No. 2, Oktober 2015, vol. 5,

no. 2, pp. 187–206, 2015.

I. K. Khurana and W. J. Moser, “Institutional shareholders’

investment horizons and tax avoidance,” J. Am. Tax.

Assoc., vol. 35, no. 1, pp. 111–134, 2013, doi:

10.2308/atax-50315.

K. L. Annisa, Ayu Nuralifmida, “Pengaruh Corporate

Governance Terhadap Tax Avoidance,” J. Akunt.

Audit. Vol. 8/No. 2/Mei 2012 95-189, vol. 8, pp. 95–

189, 2008.

J. G. L. J. Owhoso Vincent E, William F, Messire, JR,

“Error Detection by Industry-Specialized

Teams during Sequential Audit Review,” J. Account. Res.

Vol. 40 No. 3 June 2002 Print. U.S.A, vol. 40, no. 3,

2002. I. A. P. I. Indonesia, Standar Profesional Akuntan

Publik. Jakarta: Salemba Empat, 2011.

N. A. Dewi Lia Kusuma, Anny Widiasmara, “Pengaruh

Profitabilitas Dan Manajemen Laba Terhadap Tax

Avoidance Dengan Corporate Social Responsibility

Sebagai Variabel Moderating Pada Perusahaan

Manufaktur Yang Terdaftar Di Bursa Efek Indonesia

Tahun 2015-2017,” Semin. Inov. Manajemen, Bisnis

Dan Akunt. I 14 AGUSTUS 2019, pp. 321–333, 2019

D. Qorika, “Pengaruh Good Corporate Governance Dan

Kualitas Laporan Keuangan Terhadap Tax Avoidance”

(Studi Pada Perusahaan Manufaktur Yang Terdaftar

Pada Bursa Efek Indonesia Periode 2013-2015).

Malang, 2017.

M. Dina, K. H. Titisari, and E. Masitoh, “The Effect of

Corporate Governance on Tax Avoidance (Empirical

Study of the Consumer Goods Industry Companies

Listed On Indonesia Stock Exchange Period 2013-

2016),” 2nd Int. Conf. Technol. Educ. Soc. Sci. 2018

(The 2nd ICTESS 2018), vol. 2018, pp. 123–132, 2018.

N. Kurniasih, F. Ekonomi, U. E. Unggul, J. Arjuna, K.

Jeruk, and J. Barat, “Pengaruh Sales Growth, Leverage,

Kualitas Audit Dan Ukuran Perusahaan Terhadap

Penghindaran Pajak,” JCA Ekon. Vol. 1 Nomor 1

Januari - Juni 2020, vol. 1, 2020.

A. M. Krisna, “Pengaruh Kepemilikan Institusional dan

Kepemilikan Manajerial pada Tax Avoidance dengan

Kualitas Audit sebagai Variabel Pemoderasi,” Wacana

Ekon. (Jurnal Ekon. Bisnis dan Akuntansi) Vol. 18,

Nomor 2, 2019; pp. 82–91, vol. 18, no. September, pp.

82–91, 2019.

I. Ghozali, Aplikasi Analisis Multivariate Dengan Program

IBM SPSS 19 (edisi kelima). Semarang: Universitas

Diponegoro, 2016.

K. Tarekegn and A. Ayele, “Impact of improved beehives

technology adoption on honey production efficiency:

empirical evidence from Southern Ethiopia,” Agric.

Food Secur., vol. 9, no. 1, pp. 1–13, 2020, doi:

10.1186/s40066-020-00258-6.

Company Size, Institutional Ownership on Tax Avoidance with Audit Quality as Moderate and Independent Variables

157