Prediction of Mining Corporation Stock Index based on Gold Price

Index and Exchange Rate of Currency

Prajna Deshanta Ibnugraha

a

and Moch Fahru Rizal

School of Applied Science, Telkom University, Bandung, Indonesia

Keywords: Stock Prediction, Naïve Bayes, Mining Corporation, Gold Price, Currency Exchange.

Abstract: The stock prediction is essential part for stock trader. It is able to reduce potential risk of financial loss. The

stock prediction model can be built using time series algorithm in machine learning such as Naïve Bayes. This

algorithm is utilized by this study for forecasting stock price of mining corporation PT Antam. Two features

involved in forecasting are gold price and currency exchange of Indonesian Rupiah (IDR) to US Dollar (USD).

The dataset is obtained from Stock Exchange of Indonesia in 2018-2019 period. Splitting of dataset and cross-

validation are used to compute the accuracy of the model. The model produces 51%-52% of accuracy. It

means that features are not reliable to predict the stock price of mining corporation in Indonesia.

1 INTRODUCTION

Part of ownership in corporation can be represented

in form of stocks capital. The stock owners have right

to corporation earning. In order to achieve profit from

corporation stocks, investors must consider stocks

price when they want to invest their money in

corporation stocks. In stock trading, investors do not

only take profit from corporation earning, but they

also make profit from selling margin. The investors

must create strategy to make decision related to buy,

hold, or sell the stocks. However, the movement of

stocks price is a problem because stocks price change

dynamically where it can be affected by many factors.

The mistakes in choosing strategy cause impact to

investor such as financial loss. Therefore, investors

must understand the movement pattern of stocks price

so they can predict stock price.

In stocks market analysis, there are two types of

analysis, namely fundamental analysis and technical

analysis (Peachavanish, 2016). Fundamental analysis

uses corporation condition to determine stocks price.

Generally, it uses variables such as financial report,

income balance, etc. Meanwhile, technical analysis is

more likely to analyse stocks price based on historical

prices and trends. In order to use fundamental

analysis, investors can refer to stock exchange

recommendation related to corporations having good

a

https://orcid.org/0000-0002-8362-370X

fundamental. The problem arises when investors want

to implement technical analysis where they must

involve a lot of information related to historical prices

and trends to make decision. The Proper prediction

model is needed by investors to determine stocks

price from that information.

In this study, we propose prediction model for

stocks price in Indonesian stock exchange. However,

we do not predict all of stocks price because the

difference types of corporation stocks have different

factors affecting stock price. We decide to use PT.

Antam Tbk as a case study. PT Antam Tbk is

corporation that produces mining commodities such

as gold, nickel, coal, and silver. However, gold is the

main commodities from these corporation.

2 RELATED WORKS

In order to predict stocks price, there are many factors

and methods that must be considered. PT Antam Tbk

as mining corporation, has stock price where it has

relationship with external factors such as gold price

and the exchange rates of currency from the

Indonesian Rupiah (IDR) against the US Dollar

(USD) (Sinay, Tihurua, & Rahakbauw, 2018). Both

factors affect Antam stock price in short and long

term. Those relationship has been evaluated using

1276

Ibnugraha, P. and Rizal, M.

Prediction of Mining Corporation Stock Index based on Gold Price Index and Exchange Rate of Currency.

DOI: 10.5220/0010963700003260

In Proceedings of the 4th Inter national Conference on Applied Science and Technology on Engineering Science (iCAST-ES 2021), pages 1276-1280

ISBN: 978-989-758-615-6; ISSN: 2975-8246

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

Autoregressive Distributed Lag (ARDL) method by

placing PT Antam stock price as dependent variable

and gold price and the exchange rate of the IDR

against the Dollar as independent variables. Those

forms of relationship are also reinforced by previous

study. Those previous study stated that stocks market

prices were affected by gold price and exchange rate

of currency (Arfaoui & Ben Rejeb, 2017). Stocks

price is linked with gold price and both factors have

significant influence to each other in short and long

term. Exchange rate of currency is also able to

influence stocks price and movement of exchange

rate of currency can be used to predict stocks price.

In stocks market prediction, stocks price has time

series trend (Wen, Li, Zhang, & Chen, 2019). There

are several approaches to predict stocks price in time

series trend, such as statistical approach and machine

learning (Shah, Isah, & Zulkernine, 2019). Methods

using statistical approach are Smooth Transition

Autoregressive (STAR), Auto-Regressive Moving

Average (ARMA), Generalized Autoregressive

Conditional Heteroskedastic (GARCH), and Auto-

Regressive Integrated Moving Average (ARIMA).

Anaghi built stock prediction model using ARMA

and involving filtering, interpolation, and smoothing

(Anaghi & Norouzi, 2012). The model had best

performance when it used 2 poles and zeros. In

previous study, ARIMA was also used in predicting

stock price. Adebiyi utilized ARIMA for forecasting

stock price in Nigeria Stock Exchange (NSE) and

New York Stock Exchange (NYSE) (Adebiyi,

Adewumi, & Ayo, 2014). According to the output of

Adebiyi research, ARIMA has good performance in

short-term prediction.

Meanwhile, techniques in machine learning can

be classified in supervised learning and unsupervised

learning. In unsupervised learning, dataset is trained

using specific algorithm to result pattern of data such

as clusters, so it does not require label. Otherwise,

supervised learning requires label to determine

expected output. Therefore, supervised learning is

suitable in prediction involving several factors.

Algorithms used in supervised learning are Naïve

Bayes, Neural Network, Random Forest, and etc. In

previous study, Loke built prediction stock model

with Random Forest based on financial ratio and

technical analysis (Loke, 2017). Loke used dataset

from Hong Kong Stock Exchange in 2011-2014 and

divided each annual data becoming quarters. The

testing result of Loke research stated that financial

ratio was not reliable to predict the stock price.

Ravikumar also compared several algorithms in

classification using Apple stock dataset where it was

obtained from Yahoo Finance dataset. The compared

algorithms were Support Vector Machine (SVM),

Naïve Bayes, K-Nearest Neighbours (KNN),

Decision Tree Classification, Logistic Regression,

and Random Forest Classification. The result stated

that Logistic Regression had better accuracy among

the others. However, the accuracy is 68,622% so it

has not been adequate as prediction model. In other

case, Chaigusin also utilized Neural Network

algorithm to forecasting stock price in Stock

Exchange of Thailand (SET) (Chaigusin,

Chirathamjaree, & Clayden, 2008). Dataset was

obtained from SET in 2003-2004 period. Chaigusin

research produced conclusion that stock market in

SET was affected by Nikkei index, Dow Jones index,

Hang Seng index, exchange rates of Thai Baht to US

dollar, Minimum Loan Rate (MLR), and the price of

gold.

In previous explanation, there are two focuses, i.e.

variables affected stock market price and prediction

algorithms of stock price. We utilize these two

focuses to result new analysis related to prediction

algorithm in stock market price scope using gold

price index and exchange rate of currency as

variables.

3 METHODOLOGY

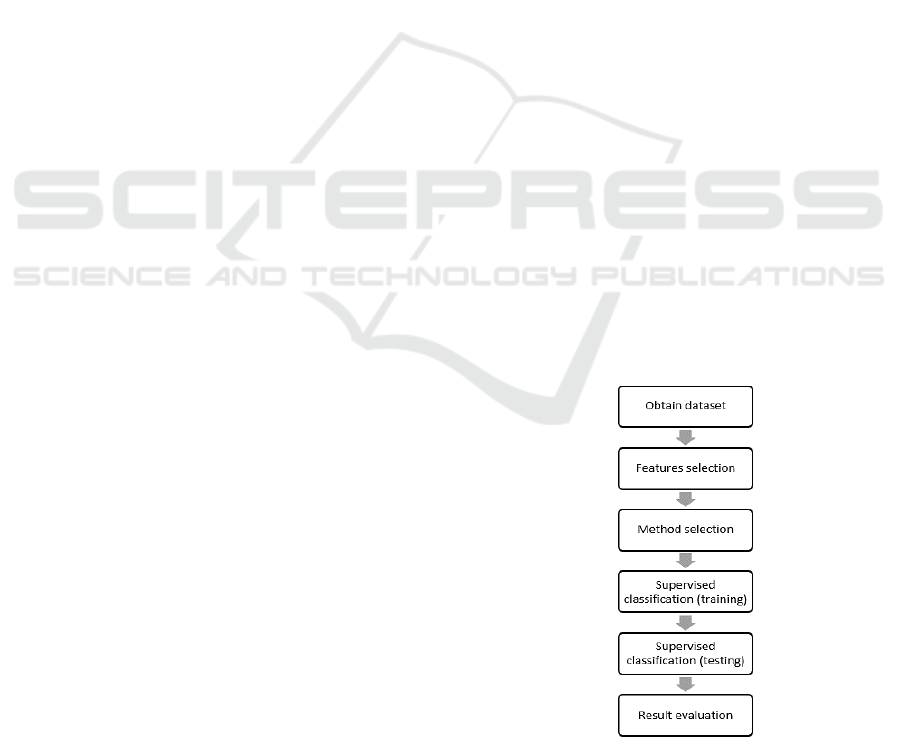

In this study, we propose six steps of work to solve

the problem. The steps is defined from previous

research (Kumar, Dogra, Utreja, & Yadav, 2018) and

it is adjusted with the problems in this study. The

sequence from steps of work can be shown in figure

1.

Figure 1: The six steps of work to build and evaluate the

stock prediction model.

Prediction of Mining Corporation Stock Index based on Gold Price Index and Exchange Rate of Currency

1277

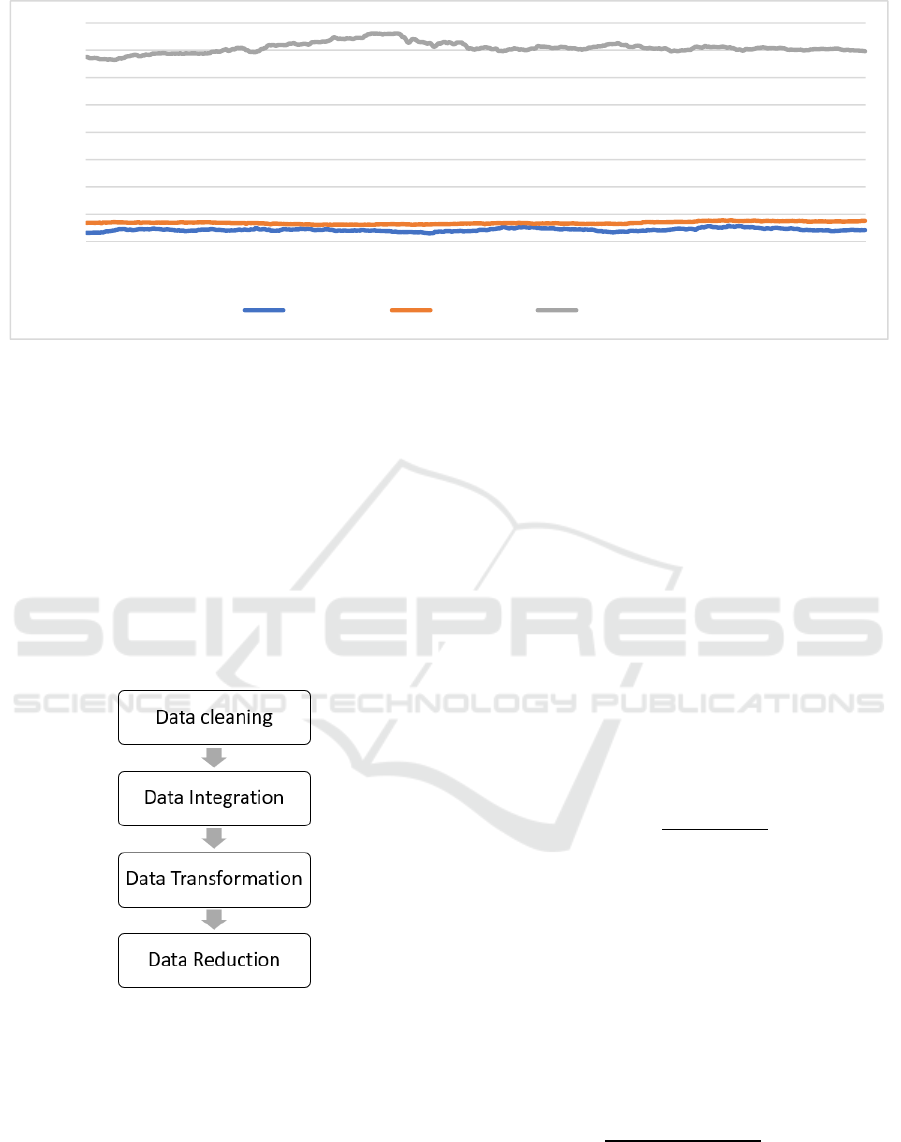

Figure 2: The data of Antam stock index, gold price index, and currency exchange rate from US Dollar (USD) to Indonesian

Rupiah (IDR).

In order to obtain dataset, we use the daily data in

2018-2019 with amount of data about 474 data from

Indonesian stock exchange institution. The data

distribution of Antam stock price, gold price index,

and exchange rates of currency from US Dollar (USD)

to Indonesian Rupiah (IDR) in early 2018 until last

2019 can be shown in figure 2.

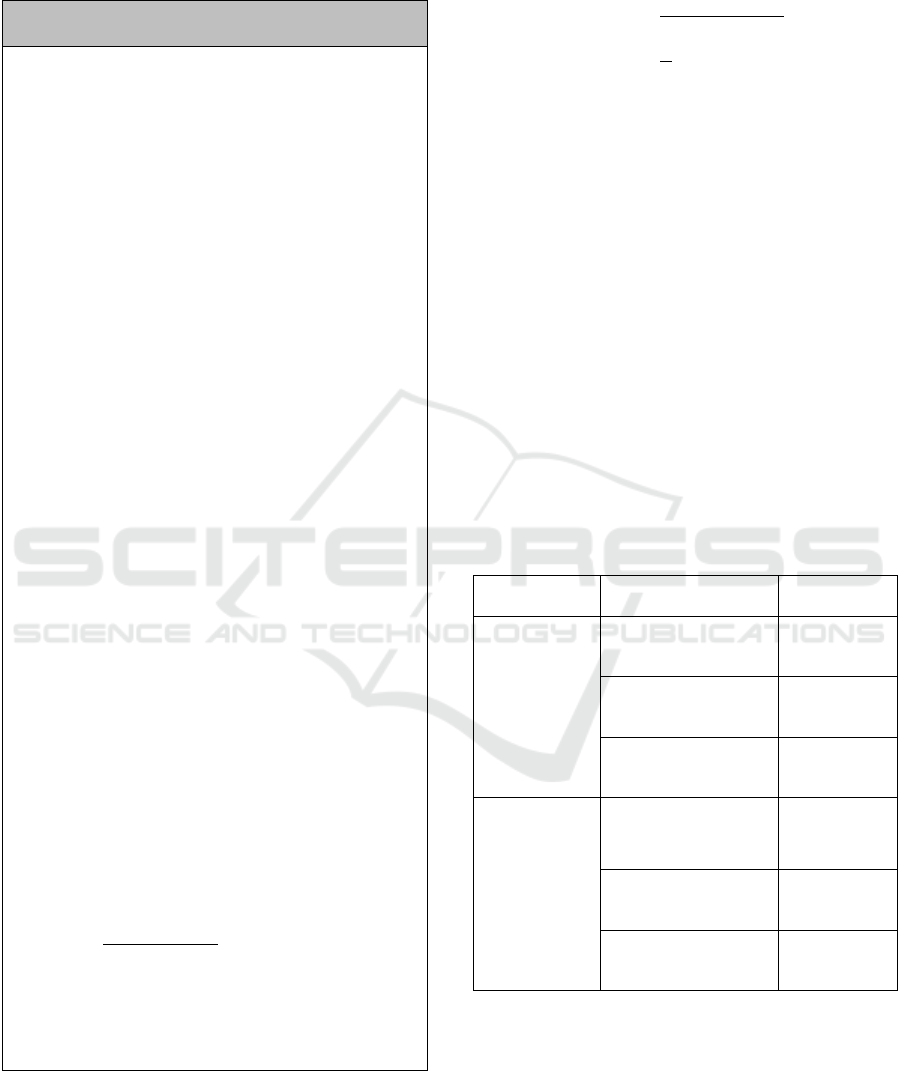

The dataset is through pre-processing steps before

it is inputted in the predictor algorithm. The pre-

processing of dataset consists of four steps shown in

figure 3 (Nti, Adekoya, & Weyori, 2020).

Figure 3: The pre-processing steps for converting data

source to dataset.

The dataset in this study is structured data, so data

cleaning step is not necessary in this case. Data

cleaning usually is needed by unstructured data to

reduce inconsistent form of data. In data integration

step, we integrate three types of data, namely stock

movement data, gold price movement data, and

exchange rates of currency from IDR to USD. In data

transformation, we equalize the movement of stock

price, gold price, and exchange rate of currency to be

three levels, i.e., up, down, and fixed. Furthermore,

the suitable information from dataset is selected in

data reduction step. It aims to decrease the volume of

dataset.

In method selection, we involve Naïve Bayes

algorithm to predict stock market price of mining

corporation. This algorithm is selected based on

characteristics of stock market movement where it is

time series trend. We also have several reasons to

select this algorithm such as having good accuracy,

able to work in less of data, able to handle quantitative

and discrete data. The Naïve Bayes uses probabilistic

approach to result output. This classifier involves

Bayes Theorem in its algorithm where it can be

shown in equation (1).

(

|

)

=

(

|

)

.

(

y

)

(

)

(1)

y represents class variable, while x is features. If

the features consist of several factors, then it can be

represented by equation (2).

=

(

,

,

,…

)

(2)

Therefore, this classifier also has form like equation

(3).

(

|

,

,

,…

)

=

(

|

)

=

∏

(

|

)

.()

∏

(

)

(3)

In order to conduct supervised classification in

training and testing, we use two conditions. First

condition use splitting process of dataset and second

0

2000

4000

6000

8000

10000

12000

14000

16000

1

15

29

43

57

71

85

99

113

127

141

155

169

183

197

211

225

239

253

267

281

295

309

323

337

351

365

379

393

407

421

435

449

463

Stock Price Gold Index USD to IDR

iCAST-ES 2021 - International Conference on Applied Science and Technology on Engineering Science

1278

condition use cross validation process. Algorithm 1 is

the flow of dataset process in Naïve Bayes.

Algorithm 1.

Var:

x

k

:= data of feature, (x

1

, x

2

, x

3

,….x

n

)

v

k

:= data of feature, (v

1

, v

2

, v

3

,….v

n

)

y

k

:= data of class variable, (y

1

, y

2

, y

3

,….y

n

)

k := label (up, fixed, down)

x

t

:= x transform of k condition

v

t

:= v transform of k condition

y

t

:= y transform of k condition

Pred := model output

Begin

x

t

←φ , v

t

←φ , y

t

←φ , Pred ←φ

count := 1

while count ≤ n do

if (x

k

– x

k-1

)>0 then

x

t

← “up”

else if (x

k

– x

k-1

)=0 then

x

t

← “fixed”

else if (x

k

– x

k-1

)<0 then

x

t

← “down”

end if

if (v

k

– v

k-1

)>0 then

v

t

← “up”

else if (v

k

– v

k-1

)=0 then

x

t

← “fixed”

else if (v

k

– v

k-1

)<0 then

v

t

← “down”

end if

if (y

k

– y

k-1

)>0 then

y

t

← “up”

else if (y

k

– y

k-1

)=0 then

y

t

← “fixed”

else if (y

k

– y

k-1

)<0 then

y

t

← “down”

end if

count +=1

end while

(

|

)

=

(

|

)

.

(

)

(

)

Pred ←

(

,

|

)

End

Meanwhile, result evaluation is conducted by

involving two variables, namely Correctly Classified

Instances (CCI) and Root Mean Square Error

(RMSE). RMSE is index of error from the prediction

output where the predictor has good performance if

the value of index is low. RMSE can be computed by

equation (4).

=

1

(

−

)

(4)

n is the total number of data, x

i

is actual value of stock

level, and y

i

is predicted value of stock level.

4 RESULT AND DISCUSSION

In order to predict stock price based on the data, we

use two conditions. First, we use splitting process of

dataset to be 80% of data as training set and 20% of

data testing set. Previous research used proportion 7:3

for training set and testing set (Long, Lu, & Cui,

2019). Second, we use cross validation with k-folds

for generating model. These condition changes

dataset becoming random subset, namely fold. This

study uses 10-folds where it uses 10 folds as testing

set and rest of folds as training set. Results of these

condition with Naïve Bayes are shown in table 1.

Table 1: Result of Naïve Bayes algorithm on dataset.

Condition Variables Value

Splitting

process

Correctly Classified

Instances

51.5789 %

Incorrectly Classified

Instances

48.4211 %

Root mean squared

error

0.4424

Cross-

validation

Correctly Classified

Instances

52.1097 %

Incorrectly Classified

Instances

47.8903 %

Root mean squared

error

0.4385

Both conditions result almost similar value of

Correctly Classified Instances (CCI). These variables

is used to state number of data classified correctly

with Naïve Bayes algorithm. Condition with splitting

dataset 8:2 results CCI=51.5789 % and

RMSE=0.4424, whereas condition with cross-

validation 10-folds results CCI=52.1097 % and

RMSE=0.4385. Even though cross-validation 10-

Prediction of Mining Corporation Stock Index based on Gold Price Index and Exchange Rate of Currency

1279

folds produces better result than 8:2 portion, both

results have not filled as adequate output in prediction

model. The prediction output is feasible if it has

accuracy 80% or higher (Lin et al., 2019).

5 CONCLUSION

In previous research, the stock price of mining

corporation has relation with gold price and exchange

rates of currency. Therefore, this study wants to build

prediction model using those variables. In order to

handle time series characteristic of stock prices,

Naïve Bayes algorithm is involved to build prediction

model. Dataset was obtained from Indonesian stock

exchange institution in period 2018-2019. In order to

build prediction model, this study uses two

conditions, i.e., splitting dataset and cross-validation

10-folds. However, the result of both conditions has

not been feasible because it has accuracy less than

80%. The splitting dataset only produces

CCI=51.5789% with RMSE=0.4424 whereas cross-

validation results CCI=52.1097% with

RMSE=0.4385.

REFERENCES

Adebiyi, A. A., Adewumi, A. O., & Ayo, C. K. (2014).

Stock price prediction using the ARIMA model.

Proceedings - UKSim-AMSS 16th International

Conference on Computer Modelling and Simulation,

UKSim 2014, 106–112. https://doi.org/10.1109/

UKSim.2014.67

Anaghi, M. F., & Norouzi, Y. (2012). A model for stock

price forecasting based on ARMA systems. 2012 2nd

International Conference on Advances in

Computational Tools for Engineering Applications,

ACTEA 2012, 265–268. https://doi.org/10.1109/

ICTEA.2012.6462880

Arfaoui, M., & Ben Rejeb, A. (2017). Oil, gold, US dollar

and stock market interdependencies: a global analytical

insight. European Journal of Management and

Business Economics, 26(3), 278–293.

https://doi.org/10.1108/EJMBE-10-2017-016

Chaigusin, S., Chirathamjaree, C., & Clayden, J. (2008).

The use of neural networks in the prediction of the stock

exchange of Thailand (SET) index. 2008 International

Conference on Computational Intelligence for

Modelling Control and Automation, CIMCA 2008,

670–673. https://doi.org/10.1109/CIMCA.2008.83

Kumar, I., Dogra, K., Utreja, C., & Yadav, P. (2018). A

Comparative Study of Supervised Machine Learning

Algorithms for Stock Market Trend Prediction.

Proceedings of the International Conference on

Inventive Communication and Computational

Technologies, ICICCT 2018, (Icicct), 1003–1007.

https://doi.org/10.1109/ICICCT.2018.8473214

Lin, Y. T., Lee, M. T. S., Huang, Y. C., Liu, C. K., Li, Y.

T., & Chen, M. (2019). Prediction of recurrence-

associated death from localized prostate cancer with a

charlson comorbidity index-reinforced machine

learning model. Open Medicine (Poland), 14(1), 593–

606. https://doi.org/10.1515/med-2019-0067

Loke, K. S. (2017). Impact of financial ratios and technical

analysis on stock price prediction using random forests.

1st International Conference on Computer and Drone

Applications: Ethical Integration of Computer and

Drone Technology for Humanity Sustainability,

IConDA 2017, 2018-Janua, 38–42.

https://doi.org/10.1109/ICONDA.2017.8270396

Long, W., Lu, Z., & Cui, L. (2019). Deep learning-based

feature engineering for stock price movement

prediction. Knowledge-Based Systems, 164, 163–173.

https://doi.org/10.1016/j.knosys.2018.10.034

Nti, I. K., Adekoya, A. F., & Weyori, B. A. (2020). A

systematic review of fundamental and technical

analysis of stock market predictions. Artificial

Intelligence Review (Vol. 53). Springer Netherlands.

https://doi.org/10.1007/s10462-019-09754-z

Peachavanish, R. (2016). Stock selection and trading based

on cluster analysis of trend and momentum indicators.

In International MultiConference of Engineers and

Computer Scientists (Vol. 1, pp. 317–326).

Shah, D., Isah, H., & Zulkernine, F. (2019). Stock market

analysis: A review and taxonomy of prediction

techniques. International Journal of Financial Studies,

7(2). https://doi.org/10.3390/ijfs7020026

Sinay, L. J., Tihurua, F. R. N., & Rahakbauw, D. L. (2018).

Analisis Harga Saham Pt. Antam Tbk Berdasarkan

Harga Emas Dan Nilai Tukar Rupiah Terhadap Dolar

Menggunakan Model Autoregressive Distributed Lag.

Barekeng: Jurnal Ilmu Matematika Dan Terapan,

12(1), 53. https://doi.org/10.30598/vol12iss1pp53-

62ar364

Wen, M., Li, P., Zhang, L., & Chen, Y. (2019). Stock

market trend prediction using high-order information of

time series. IEEE Access, 7, 28299–28308.

https://doi.org/10.1109/ACCESS.2019.2901842

iCAST-ES 2021 - International Conference on Applied Science and Technology on Engineering Science

1280