The Impact of Limited Carbon Emission on Supply Chain and

Emission Cost

Thina Ardliana

1,2

a

, I Nyoman Pujawan

2

b

and Nurhadi Siswanto

2

c

1

Design and Manufacture Engineering, Shipbuilding Institute of Polytechnic Surabaya, Surabaya, Indonesia

2

Department of System and Industrial Engineering, Sepuluh Nopember Institute of Technology, Surabaya, Indonesia

Keywords: Carbon Emission Policies, Supply Chain, Inventory.

Abstract: Nowadays, the effects of global warming are at a critical point and have threatened the destruction of the

earth's ecosystems. The most dangerous cause of global warming is carbon. This problem seriously forces the

countries of the world to focus on reducing carbon emissions. The commitments are binding for all countries,

so they have limited CO2. Transportation is one of the largest sources of emissions from activities in the

supply chain. The transportation issue should be investigated at the same time inventory decisions are made

to minimize supply chain costs. The modes of transport considered in this study are trucks that are distributed

from the multi-supplier to the warehouse. The purpose of this model is to observe the impact of the application

of carbon emission policies, such as carbon cap (limited) and carbon tax on the decision variables. The

changes in the parameters of emissions affect the quantity of emissions, the total cost of the system, and the

total cost of emissions.

1 INTRODUCTION

Carbon emission is defined as the number of carbon

dioxide gas (CO2) emitted to the air. The carbon

emission is also categorized as greenhouse gases

(GHGs). The ideal composition of CO2 in the clean

air should be at the level of 314 ppm. If the amount of

carbon emissions in the atmosphere is too high, it will

increase air pollution and cause a greenhouse gas

effect (Ardliana, 2020a). The IPCC (2006) stated that

GHG emissions increased by 70% between 1970 and

2004 and that the majority of GHG elements are CO2.

The increase in GHGs is due to three main sectors:

energy, transport, and industry (Ardliana, 2020b). In

2009, the Low Carbon Society (LCS) set a goal of

reducing CO2 emissions from 2.9 tons per capita to

0.5 tons per capita by 2050. Therefore, the developed

countries and the industrialized countries should

reduce their emissions to 0.5 tons per capita by 2050

to offset the increase in CO2 emissions in the last 70

years, which has caused the greenhouse effect.

Not only are the developed countries and the

industrialized countries demanded to reduce their

a

https://orcid.org/0000-0002-8349-9462

b

https://orcid.org/0000-0002-9587-8152

c

https://orcid.org/0000-0003-1148-9166

emissions, but also to stimulate or support the

developing countries that still have tropical forests.

Indonesia is one of the countries that could receive

this support with compensation for the preservation

of its tropical forests on the islands of Sumatra,

Kalimantan, Sulawesi, and Papua. Furthermore,

tropical and developing countries also could receive

additional support or incentives if they can reduce

CO2 emissions to 0.5 tons per capita by 2050. In this

case, the developed countries committed to utilizing

their resources to reduce global CO2 emissions. In

previous studies, the relationship between costs and

emissions is inversely proportional.

For example, with respect to the carbon cap, the

more lenient the carbon limit is given, the lower the

cost, but the higher the carbon emissions produced

(Ardliana, 2018). Therefore, an optimization between

these two variables is necessary to find a compromise

or a trade-off. The higher the emissions produced; the

more costs are spent reducing them to achieve the

theoretical goal: zero-emission. Several regulatory

mechanisms have been issued related to carbon

emissions policies such as carbon cap (the regulation

304

Ardliana, T., Pujawan, I. and Siswanto, N.

The Impact of Limited Carbon Emission on Supply Chain and Emission Cost.

DOI: 10.5220/0010944500003260

In Proceedings of the 4th International Conference on Applied Science and Technology on Engineering Science (iCAST-ES 2021), pages 304-308

ISBN: 978-989-758-615-6; ISSN: 2975-8246

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

of carbon emission capacity permitted by a

company). Benjaafar et al. (2010), Hua et al. (2011),

and Hammami et al. (2015) carried out an

investigation in the inventory area taking into account

carbon emission. Furthermore, Hoen et al. (2011),

Pan et al. (2013), Jin et al. (2014), and Mohammed et

al. (2017) conducted studies on the selection of

transportation modes that consider carbon emissions.

If the inventory and the transportation mode selection

decision are combined and make the carbon

emissions as a key consideration, it is expected to

minimize costs as well as carbon emissions in supply

chain activities (Konur, 2014; Palak et al., 2014;

Konur & Schaefer, 2014Tang et al., 2015 and

Schaefer & Konur, 2015).

The carbon emission factors are the constraints

and the objective function according to the applicable

regulations. Benjaafar et al. (2010) contributed to the

development of a general and simple optimization

model of emissions and total system costs. However,

the optimization model did not involve the

relationship between inventory and transportation

aspects which are important to the model.

Therefore, the purpose of this study is to optimize

the total costs associated with transportation and

inventory taking into account the carbon limitation

and carbon tax. The optimization model is based on

the mixed-integer linear programming (MILP)

approach.

2 PROBLEM DESCRIPTION

The problem studied is when multi-supplier carries

out sales and distribution activities in the form of

goods shipped to the warehouse. Transport is very

important to be considered because it is proved to

have an impact on costs optimization and its

emissions. Furthermore, the inventory storage

activity also has an impact on costs and emissions.

This research uses a single product. The suppliers

deliver solid raw materials such as fertilizer and

others. Several suppliers send their products to the

warehouse.

This condition leads to differences in the total

shipping costs and the emissions generated. Each

supplier’s production capacity is different, resulting

in a different number of shipments. It is assumed that

the transport capacity of the trucks from the suppliers

to the warehouse is the same because they use the

same truck. Transportation costs from the suppliers to

the warehouse depending on the location between the

parties.

The research problem configuration system is

illustrated in Figure 1. We address a system

consisting of a multi-supplier, (j = 1,2, …, J), and a

single-warehouse, W. The suppliers deliver the

product to the warehouse. Total demand for the

period t is notable. The warehouse also holds

inventory. There is initial inventory for each supplier

to be zero.

Figure 1: Problem configuration system.

3 MATHEMATICAL MODEL

3.1 Index and Notations

Here we describe the definition of index, parameter

and variable for research as follows:

Index

t: Set of planning time horizon [t = 1, 2,…, T]

j: Set of suppliers, [j = 1, 2, 3, …, J]

W: warehouse

Inventory variable

𝐼

: inventory at the end of period t at supplier j

𝐼

: inventory on warehouse at the end of t period

𝐼

,

: inventory at supplier j in previous period t

Delivery variable

𝑦

: quantity of product delivered to supplier j at

planning period t.

𝑥

: equal to 1 if get the order at period t

Delivery parameter

𝑑

: total demand quantity at period t

𝐾

: maximum capacity at a warehouse

𝑄 : vehicle capacity

Carbon emission Parameter

Cap : Emission carbon cap

f

j

: fixed inventory carbon emission at the

supplier j (in tons)

Y

t,

m

j

I

,

f, d

j = 1,2,…, J

Warehouse

X

j,

I

j

, f

j

Suppliers

The Impact of Limited Carbon Emission on Supply Chain and Emission Cost

305

f

w

: fixed inventory carbon emission the

inventory at a warehouse (in tons)

m

s

: fixed distribution carbon emission from

supplier j to a warehouse (in tons)

𝑜

: fixed order carbon emission (in tons)

∝: coefficient tax of emission cost

Parameters for the objective functions

𝑐

: transportation cost from supplier j to warehouse

ℎ

: holding cost at supplier j

ℎ

: holding cost at a warehouse

𝑝

: fixed cost

3.2 Model Development

The objective function of this model (1) is to optimize

the total costs which are consist of the total cost of

inventory at multiple suppliers and a single

warehouse, fixed order costs, transport costs, and

carbon emission cost. The formulation of the model

of this research is given by:

Minimize

𝑇𝐶= ℎ

𝐼

+ℎ

𝐼

+

𝑝

𝑥

+

𝑐

𝑦

+

∝𝑒

𝐼

+𝑒

𝐼

+

𝑒

𝑥

+𝑒

𝑦

(1)

Subject to

𝐼

=𝐼

,

+𝑦

∀ 𝑡∈𝑇 ,∀

𝑗

∈𝐽

(2)

𝐼

≥0 ∀ 𝑡∈𝑇

(3)

𝐼

=𝐼

,

+𝑦

− 𝑑

∀ 𝑡∈𝑇 ,∀

𝑗

∈𝐽

(4)

𝐼

≥0 ∀ 𝑡∈𝑇 ,∀

𝑗

∈𝐽

(5)

𝑓

𝐼

+𝑓

𝐼

+

𝑜

𝑥

+

𝑚

𝑦

≤𝐶𝑎𝑝

(6)

𝑦

≤𝑄

∈

∀ 𝑡∈𝑇 ,∀

𝑗

∈𝐽

(7)

𝑦

≥0 ∀ 𝑡∈𝑇 ,∀

𝑗

∈𝐽

(8)

𝑥

∈

0,1

∀ 𝑡∈𝑇

(9)

Constrain are explain with:

(2) the inventory balance at the each supplier.

(3) no shortage at the each supplier.

(4) the inventory balance on warehouse.

(5) to ensure that there is no stock-out at the

warehouse.

(6) the limit of carbon emission.

(7) limitation that guarantee the quantity

delivered does not exceed the capacity of

truck.

(8)-(9) are integrality and non-negativity constraints.

4 DATA EXPERIMENT

In this section, the numerical test was carried out for

five suppliers with three time periods to analyze the

impact of the carbon policy on the quantity of carbon

emission and the total emission cost. Two carbon

policies are addressed, namely the carbon cap and the

carbon tax. The delivery activity is assumed by the

supplier to the warehouse which is far away. The data

are given: 1). capacities of each supplier (5000 tons),

2) warehouse capacity (10,000 tons), 3) vehicle

capacity (1000 tons). Each supplier produces 1000

tons per period.

The demand for each period is given 900 tons, 900

tons, and 800 tons. The warehouse holding cost is

$0.9 and the holding costs for each supplier are $0.7;

$0.6; $0.5; S0.4; and $0.3. The shipping costs from

each supplier to the warehouse are $1; $2; $3; $4; and

$5. Then we use the carbon emission data such as the

carbon tax is $0.25, while the coefficients of each

supplier inventory are $0.9; $0.7; $0.6; $0.2; and

$0.1. The emission coefficient of warehouse

inventory is 0.4 and the truck emission coefficient

from each supplier is 0.4; 0.3; 0.2; 0.3; and 0.2.

Meanwhile, the fixed order cost emission is $0.5;

$0.1; $0.3; $0.1; and $0.2.

5 RESULT AND DISCUSSION

5.1 Carbon Cap

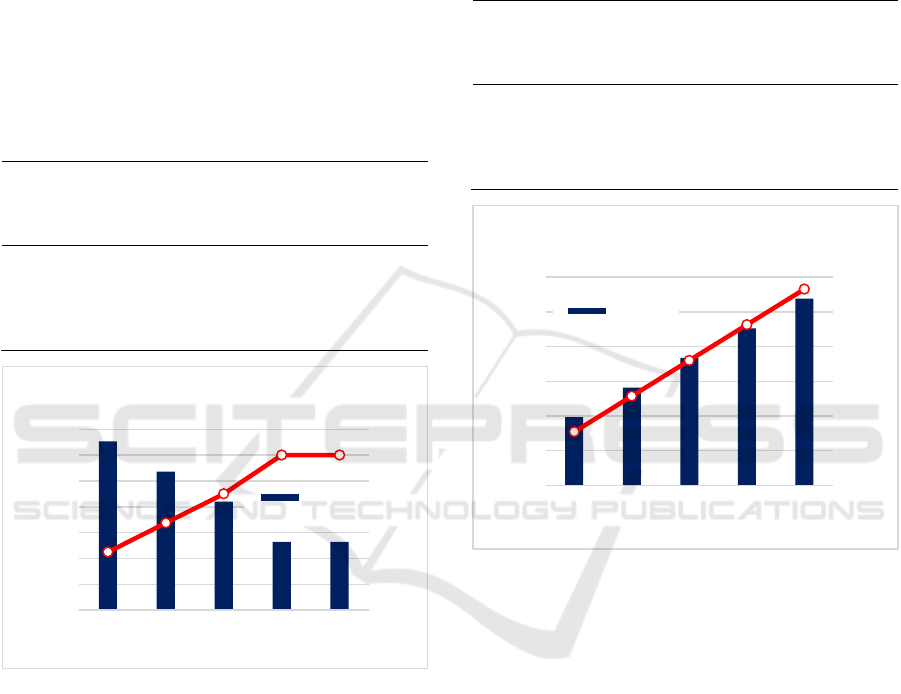

In this section, we examined the effect of changing

the carbon cap parameter on the total system costs,

total emission costs, and the quantity of carbon

emission in five scenarios. The impact of this change

in carbon cap is seen as its impact on the total supply

chain costs (in $), total emission costs (in $), and the

total amount of emissions generated (in tons). The

results of the comparison obtained are shown in Table

1 and Figure 2.

Table 1 and Figure 2 show that five scenarios of

carbon cap parameters in the range of 570 to 610 tons

are used to analyze the effects on three variables,

iCAST-ES 2021 - International Conference on Applied Science and Technology on Engineering Science

306

namely the total cost of the system, the total emission

cost, and the quantity of carbon emission. The results

show that the more relaxed the allowable carbon

emission cap, the lower the total system costs, but will

increase the total emission costs and the quantity of

emission. As for the carbon cap in the 600 tons

scenario, it will produce an optimal solution, as stable

as total cost, total quantity, and total emission. This

can be seen in the value effect, or the effect is the

same if the carbon cap value increases above 600

tons. This shows that there is an optimal solution in

the carbon cap number.

Table 1: The effect of the change in carbon cap on total cost,

total emission cost, and quantity of carbon emission.

Carbon

cap

Total cost

of system

($)

Total

emission

cost ($)

Qty. of

carbon

emission

(tons)

570 52,765.70 142.50 570

580 52,182.05 144.75 579

590 51,598.40 147.00 588

600 50,820.20 150.00 600

610 50,820.20 150.00 600

Figure 2: Sensitivity analysis of carbon cap.

5.2 Carbon Tax

Next, the carbon tax parameter is addressed in this

study in five scenarios. The value of the carbon cap is

set to the optimal solution (600 tons), while the value

of the carbon emission tax is changed in the range of

$0.15 to $0.55. The impact of this change in the

carbon tax is seen as its effect on changes in total

supply chain costs (in $), total emission costs (in $),

and the total amount of emissions produced (in tons).

The following is the result of the comparison is shown

in Table 2 and Figure 3.

Table 2 and Figure 3 indicate that increasing the

emission tax therefore the total cost and the emission

cost increase. However, the impact of the changes in

the carbon tax on the total quantity of carbon emission

seems to be insignificant (the optimal value remains

600 tons). This is because the carbon tax has an

impact on the objective function of this modeling.

Table 2: The effect of the change in carbon tax on total cost,

total emission cost, and quantity of carbon emission.

Carbon

tax

Total cost

of system

($)

Total

emission

cost ($)

Qty. of

carbon

emission

(tons)

0.15 4,9968.20 90.00 600

0.25 50,820.20 150.00 600

0.35 51,672.20 210.00 600

0.45 52,524.20 270.00 600

0.55 53,376.20 330.00 600

Figure 3: Sensitivity analysis of carbon tax.

6 CONCLUSIONS

This paper investigates the carbon cap and carbon tax

for multi-supplier with a single warehouse and

multiple periods. This paper develops a MILP model

to optimize the carbon emissions and minimize the

overall costs of the system. The results obtained from

the numerical test show that the more leeway the

allowable carbon emission capacity is allowed, the

higher the cost of emissions, and carbon generated,

but the overall cost of the system decreases.

This indicates that carbon constraints have an

impact on the total cost of the supply chain, total

emission costs, and the total amount of emissions

generated. Meanwhile, the higher the value of the

carbon tax imposed, it will burden the total system

costs and supply chain emission costs. This research

is still limited to a small scale and can then be further

138

140

142

144

146

148

150

152

49500

50000

50500

51000

51500

52000

52500

53000

570 580 590 600 610

Total emission cost

Total cost of system

Carbon cap (tons)

Effect of the change in carbon cap on total

cost of system and total emission cost

Total cost of

system

0

50

100

150

200

250

300

350

48000

49000

50000

51000

52000

53000

54000

0,15 0,25 0,35 0,45 0,55

Total emission cost

Total cost of system

Carbon tax ($)

Effect of the change in carbon tax on total

cost of system and total emission cost

Total cost of

system

The Impact of Limited Carbon Emission on Supply Chain and Emission Cost

307

developed by comparing it to metaheuristic methods

such as the genetic algorithm (GA) and particle

swarm optimization (PSO). Further studies may

consider multiple distribution centers as well as more

complex models with multiple customers.

REFERENCES

Ardliana, T., Pujawan, I., Siswanto, N., (2020a). The

Effects of Carbon Tax on Inventory and Land

Multimodal Integration. IOP Conf. Ser.: Mater. Sci.

Eng. 830 042008

Ardliana, T., Pujawan, I., Siswanto, N., (2020b). The

Effects of Carbon Cap Limitations on Inventory and

Multimodal Transportation AIP Conf. Proceedings

2217 030019

Ardliana, T., Pujawan, I., Siswanto, N. (2018). Inventory-

Transportation Model Considering Carbon Cap

International Conference on Industrial Engineering

and Operations Management, pp. 1319-1325.

Benjaafar, S., Li, Y., Daskin, M. (2010) Carbon Footprint

and the Management of Supply Chains: Insights from

Simple Models IEEE Trans. Autom. Sci. Eng, 10 (1)

99–116.

Hua, G., Cheng, Wang, S. (2011). Managing Carbon

Footprints in Inventori Management International

Journal of Production Economics 132(2) 178–185.

Hammami, R., Nouira, I., Frein, Y. (2015) Carbon

Emissions in a Multi-Echelon Production-Inventori

Model with Lead Time Constraints. International

Journal of Production Economics 164 292–307.

Hoen, K. M. R., Tan, T., Fransco, J., C, Houtumn, G. J.

(2010). Effect of Carbon Emission Regulations on

Transport Mode Selection in Supply Chains

http://cms.ieis.tue.nl/Beta/Files/WorkingPapers/Beta_

wp308.pdf.

Pan, S., Ballot, E., Fontane, F., (2013). The Reduction of

Greenhouse Gas Emissions from Freight Transport by

Pooling Supply Chains. International Journal of

Production Economics 143(1) 86–94.

Jin, M,. Granda-Marulanda, N. A., Down, I. (2014). The

Impact of Carbon Policies on Supply Chain Design and

Logistics of a Major Retailer. J. Cleaner Prod. 85 453–

461.

Mohammed, F., Selim, S., Hassan, A., Syed M. N. (2017)

Multi-Period Planning of Closed-Loop Supply chain

with Carbon Policies under Uncertainty Transportation

Research Part D: Transport and Environment . 51 146–

172.

Konur, D. (2014a). Carbon Constrained Integrated

Inventory Control and Truckload Transportation with

Heterogonous Freight Trucks. Int. J. Prod. Econ. 153

268-279.

Konur, D., Schaefer, B. (2014b). Integrated Inventory

Control and Transportation Decisions under Carbon

Emissions Regulations: LTL vs. TL Carriers.

Transportation Research Part E: Logistics and

Transportation Review. 68. 14–38.

Palak, G., Eksioglu S. D., Geunes, J. (2014). Analyzing the

Impacts of Carbon Regulatory Mechanisms on Supplier

and Mode Selection Decisions: an Application to to a

Biofuel Supply Chain. Int. J. Prod. Econ. 154. 198–

216.

Tang, S., Wang, W., Yan, H., Hao, G. (2015). Low Carbon

Logistics: Reducing Shipment Frequency to Cut

Carbon Emissions. International Journal of

Production Economic. 164 339–350.

Schaefer, B., Konur, B. (2015) Economic and Enviromental

Considerations in a Continuous Review Inventory

Control System with Integrated Transportation

Decisions. Transportation Research Part E 80. 142-

165.

iCAST-ES 2021 - International Conference on Applied Science and Technology on Engineering Science

308