Development of Accounting Application for MSMEs based

on Cloud Computing

Supardianto, Nelmiawati, Maidel Fani and Hamdani Arif

a

Informatics Engineering Department, Batam State Polytechnic, Jl. Ahmad Yani No 1 Batam Centre, Batam, Indonesia

Keywords: information technology, accounting application, cloud computing, rapid application development

Abstract: A good accounting or financial governance is the most important factor in development of Micro, Small and

Medium Enterprises (MSMEs). Ability to create a good transaction record produces a strong financial report

which is one way of good governance examples done by MSMEs. A good quality financial report contains

information that is trustworthy, straightforward, appropriate, reliable, relational, and understandable. They

are essential since they will be utilized in making a decision to determine direction of MSMEs development.

An efficient accounting application is necessary to assist MSMEs in creating essential financial reports such

as accounting journal, general ledger report, balanced list, income statement, and statement of capital changes.

Rapid Application Development (RAD) is an application design approach used to build the application.

System analysis began with a literature review, followed by creation of designs, prototypes, and collected

user input requirements. The application was tested using a Black-Box testing approach and have been

developed with Cloud Computing technology. There is a Software-as-a-Service in Cloud Computing

technology that has the benefit of being able to be run by multiple customers and without requiring them to

purchase extra infrastructure. This is due to features of start-up in the early stage, thus there is no need to

invest in an extra infrastructure. Therefore, cloud application development by utilizing Software-as-a-Service

technology is the right solution.

1 INTRODUCTION

A good accounting or financial governance is the

most important factor in development of Micro,

Small and Medium Enterprises (MSMEs). A strong

financial governance produces a good quality of

financial report based on good transaction records.

A good quality of financial report offers

information that is trustworthy, straightforward,

appropriate, reliable, relational, and understandable.

It is important since it will be used as a basis for

decision-making of MSMEs development (Fiesgrald

Wungow et al., 2016).

Many MSMEs lack of strong accounting and

financial literacy (Supardianto et al., 2019), creating

a financial report preparation was challenging. A

numerous forms of financial reports that must be

produced impede the development of MSMEs.

The use of technology in all MSMEs financial

management activities also play a role in their success

and growth. Accounting software is one of example

a

https://orcid.org/0000-0002-4925-9465

on how technology can be used to accomplish many

activities. The usage of this software may be a

solution towards freshly created MSMEs that do not

have an accountant or could not afford for engaging

one (Vanessa Dawson, 2016).

Financial statements are data records of an

industry in an accounting period that describe the

industry's performance. Bankers, creditors, owners,

and other interested parties can utilize financial

reports to analyze and evaluate financial performance

and industry circumstances.

Financial statements are the result of an

accounting process that provides financial data of an

industry that is useful for interested parties in making

economic decisions. The financial statement consists

of five various, namely accounting journal, general

ledger report, balanced list, income statement, and

statement of capital changes.

Supardianto, ., Nelmiawati, ., Fani, M. and Arif, H.

Development of Accounting Application for MSMEs based on Cloud Computing.

DOI: 10.5220/0010935600003255

In Proceedings of the 3rd International Conference on Applied Economics and Social Science (ICAESS 2021), pages 435-443

ISBN: 978-989-758-605-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

435

2 LITERATURE REVIEW

2.1 Financial Statement

Financial statements are a report of transaction

records that occur in a business, such as purchase

transactions or sales transactions. Financial reports

are records of information about a company's

performance during accounting period. Financial

statements allow banks, creditors, business owners,

and other interested parties to analyse and interpret

company's financial performance and condition

(Anggraini & Putri, 2021). Financial reports depict

company's current economic state over a specific time

period. The goal of financial statements is to show

current conditions of company's financial situation at

a specific date (on the balance sheet) and time period

(on the income statement). Balance sheets, income

statements, changes in equity, and cash flow reports

are examples of financial statements (Ismail &

Suhami, 2021)

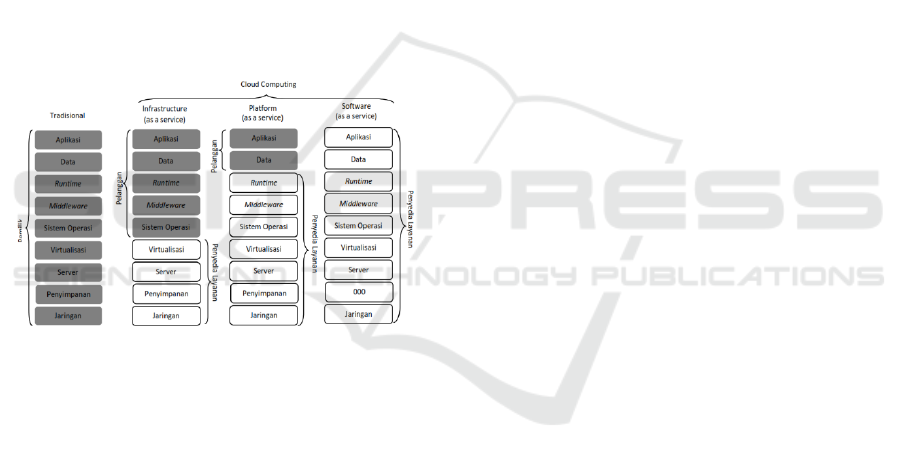

Figure 1: Service on Cloud Computing (T. Chou, 2010)

2.2 Cloud Computing

An application of technology in accounting

administration aims to increase number of tax payers

and tax income. The usage of this technology allows

for improved on automation and data collection

(Cotton & Dark, 2017). Cloud Computing technology

may be the greatest choice for developing systems that

may solve these challenges.

In terms of computer technology, Cloud

Computing has a potential to alter the view on

infrastructure investment. Previously, investment in

computer technology was seen as an asset; now, Cloud

Computing may be regarded as an investment in

computing as a service provider (De Paula & De

Figueiredo Carneiro, 2016). Cloud Computing

technology is a synthesis of technology and business,

and it has emerged as a potential commercial

computing paradigm. The goal is to make

infrastructure administration less complicated for

users.

Cloud Computing is a computer technique that uses

dynamic and scalable resources that can be shared

electronically and accessed over the internet (Wu et

al., 2010). Cloud Computing is a computer approach

in which the Internet plays primary role. The cloud

may be seen as a shared resource in which programs

and information are made available to users on

demand. In general, Cloud Computing technology is

used to run on Internet application. Since the program

is already available on the Internet, common user does

not require to install it. Services in Cloud Computing

can be seen at Figure 1.

Cloud Computing has three services offered, i.e

Software as a Service (SaaS), Platform as a Service

(PaaS), and Infrastructure as a Service (IaaS) (Zhang

et al., 2010). SaaS is a service that delivers

applications so that customers do not need to install

and access them over the Internet; consumers also do

not need to consider how data is kept or how

applications are managed. PaaS is a platform-as-a-

service that allows developers to build applications on

a customizable platform. IaaS seeks to offer virtual

hardware technology to customers, so that they do not

need to physically install their gear at workplace, but

may be accessed or remotely over the Internet.

SaaS is a service in which software and

applications are developed on a platform supplied by

the PaaS layer. It is concerned with end-users since

end-users may access and employ cloud provider-

created applications (E & R, 2013; Katyal & Mishra,

2013). It also enables customer to access applications

through cloud infrastructure using thin/thick client

interfaces such as Mozilla Firefox and Internet

Explorer.

Users do not actively manage or control cloud

infrastructure, such as networks, servers, operating

systems, and storage media, with the potential of

exceptions from restricted circuits of users with

particular application settings. This paradigm has a

potential to deliver significant benefits to both

consumers and providers of Cloud Computing

services (Youseff et al., 2008). SaaS services have

several advantages, among others (Kulkarni et al.,

2012; Mather et al., 2009; Thakral & Singh, 2014):

Reducing the cost of application software

licenses.

Enables several customers to use the same

program at the same time.

The application provider is in charge of

controlling and restricting the application's use.

SaaS consumers do not need to purchase

infrastructure since it provides by the cloud

service provider.

ICAESS 2021 - The International Conference on Applied Economics and Social Science

436

3 RESEARCH METHOD

3.1 Research Tools and Materials

The tools used to support this research are as follows:

Microsoft Visio 2016 is a program for creating

UML system models.

PHP and HTML are computer languages that

are used to create web-based applications.

MySQL is a database management system

(DBMS) that is used to manage databases.

3.2 Research Approach

The research was conducted by created an application

system with a goal of designed and developed of

cloud-based accounting application that has been

utilized by MSMEs to easily create financial

statements reports.

3.3 Application System Development

A MSMEs accounting application system takes the

advantage of Cloud Computing and Software-as-a-

Service. The program has been hosted on the cloud

for users to access on the Internet through a browser.

The program was used to create financial

statements such as an accounting journal, general

ledger report, balanced list, income statement, and

statement of capital changes. Software Development

Life Cycle (SDLC) was used in system development,

such as Rapid Application Development (RAD)

paradigm. The process includes analysis and rapid

design, prototype cycles, testing, and

implementation. There were three processes in the

prototype cycle stage: construct, showcase, and

refine. Flow diagram of the application system

development can be seen in Figure 2.

Figure 2: The Flow Diagram of the Application System

Development

3.3.1 Analysis and Quick Design Phase

RAD was started through project requirement

identification process. At this point, the team must

identify which requirements to be satisfied by a

project. This preliminary stage is excellent for

presenting a high-level overview of the project.

The process continues to design a cloud-based

taxation application, among others. Making UML

diagrams that consist of use case diagrams, activity

diagrams, making database schemes, and designing

the interface design of the application that will

developed.

3.3.2 Prototyping Cycles Phase

At this stage, developer designs an application

prototype with various features and functions. The

goal is to evaluate whether the prototype that is

produced is consistent with the original concept. This

procedure allows for an investigation of any mistakes

that may arise later. It is important for error reduction

and debugging.

The development of application program has been

done by using IDE Visual Studio Code software with

PHP programming language, Zilla, Putty File

software to put the application in the Cloud.

3.3.5 Testing Phase

The application that was developed in the prototype

stage has been tested at this step-in order to obtain

feedback from users. The procedure has been

repeated until the final step, which is the product's

implementation and finalization.

Application system testing were done by

functional testing of each module section of the

program, whether it was running following the

functions of system design. Testing using Black-Box

testing focuses on logic, functionality, and minimize

errors as well as ensure the resulting output is as

expected.

3.3.6 Implementation Phase

At this step, developer was verified any flaws

discovered throughout program development process

who have been resolved. This work includes

enhancing the application's steadiness, refining the

interface, doing maintenance, and produced

documentation.

4 RESULTS AND DISCUSSION

4.1 System Overview

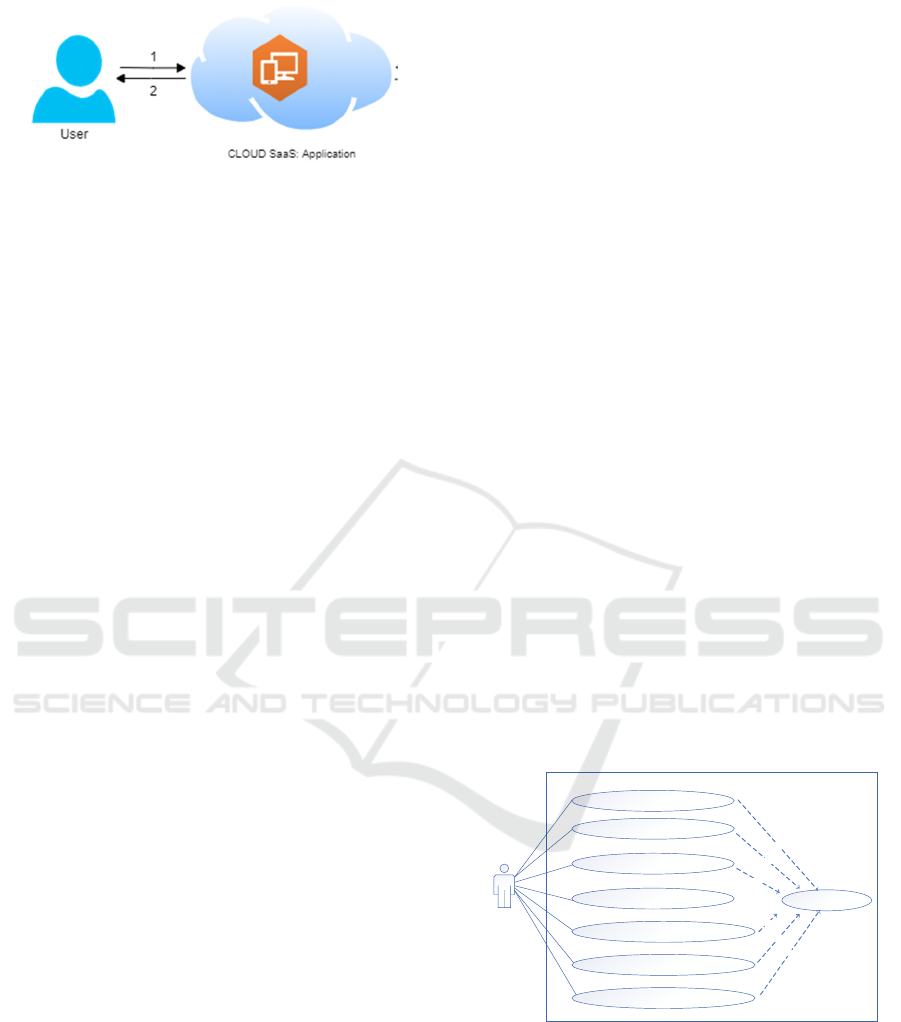

System overview design is shown in Figure 3.

Development of Accounting Application for MSMEs based on Cloud Computing

437

Figure 3: System Overview

Note:

1. A user will enter data transaction process. Data

transaction process consists of debit and credit

transactions. The data will be sent to the

application and stored in the database.

2. The application will provide an output report

according to data transaction that has been input

by user. The application will automatically

generate and display a report.

There are two main processes contained in the

accounting application i.e.:

The process of recording transactions.

The first step taken by the application user is to

record the transactions that occur in the business

activities. This transaction recording process

requires user to provide a number for each

transaction that occurs. This number intends to

make each transaction have an identity.

The process of creating a report.

After calculation has been done and the

application calculates per transaction, the

application displays financial report such as an

accounting journal, general ledger report,

balanced list, income statement, and statement

of capital changes.

4.2 System Requirements Analysis

4.2.1 Functional Requirements Analysis

Functional requirements analysis identifies the

processes that will be carried out by the system. The

functional requirements of accounting applications

for MSMEs based on cloud-based i.e.:

1. Add transactions.

2. View accounting journal.

3. View ledger report.

4. View balanced list.

5. View income statement.

6. View statement of capital changes.

4.2.1 Non-functional Requirements Analysis

Analysis of non-functional requirements identify

behaviour property owned by the system. The needs

of non-functional accounting applications for

MSMEs were as follows:

Availability

System availability is a capacity to offer

services to users. Except for system

maintenance or system upgrades, the system can

function continuously for 24 hours.

Availability guarantees that users may obtain

information and utilize the program at any time.

Ergonomic

Ergonomic refers to the interaction of system or

application users. The program that is created

must be efficient or user friendly. This is due to

the fact that application users are ordinary users

who are not all familiar with computers.

Portability

The applications can be accessed on any

platform or operating system capable of running

web-based applications. It is designed for

consumers to be able to access apps from any

devices.

Security

To maintain data security, the user's browser

must be able to obtain an SSL certificate from

the system. It is restricted to the Internet, and

trials for offline access are not available.

4.3 Design System

4.3.1 Use Case Diagram

The accounting application use-case diagram for

cloud-based start-ups can be seen in Figure 4:

User

Add Transactions

View accounting journal

View ledger report

View balanced list

View income s tatement

Registration

Login

<<in clude>>

<<in clud e>>

<<i nclud e>>

<<i nclud e>>

<<i nclud e>>

View statement o f capital changes

<<in clud e>>

Figure 4: Use Case Diagram

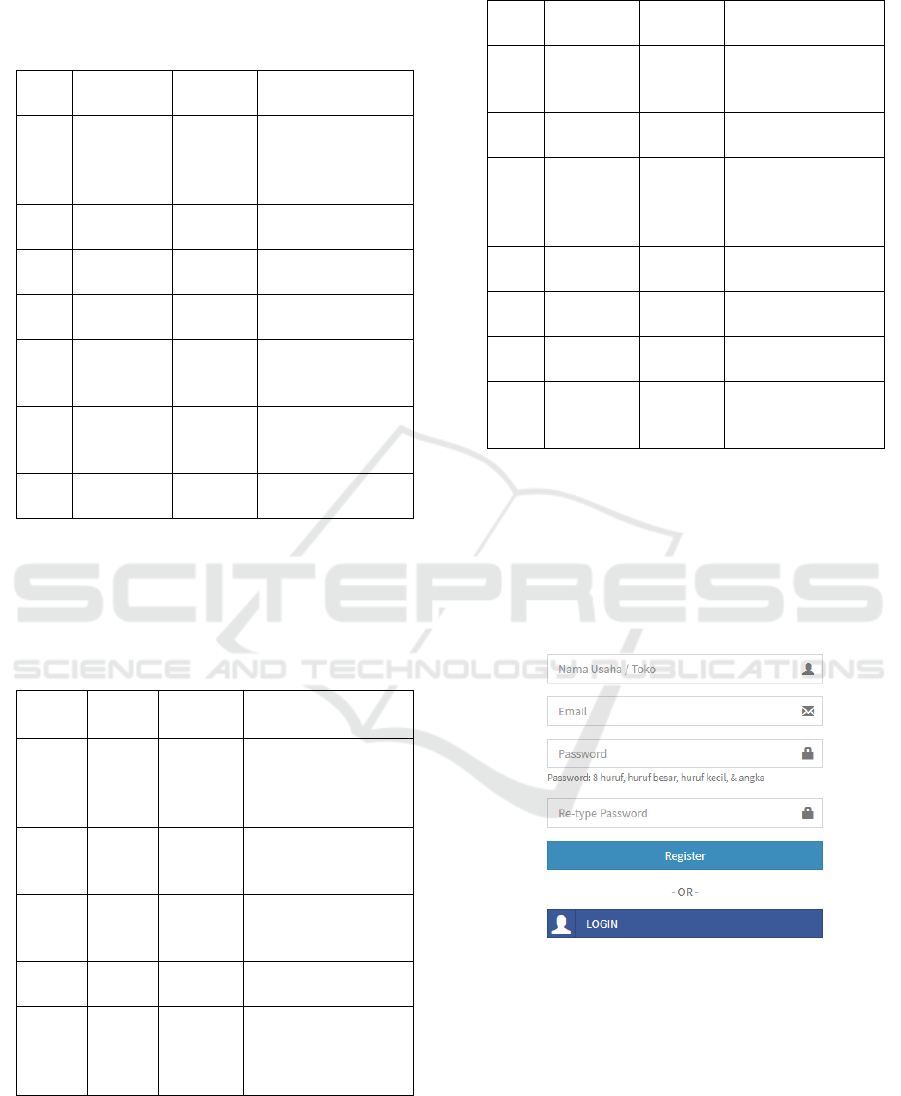

4.3.2 Design Table

Database used in development of accounting

applications for cloud-based is a MySQL database

that consists of several tables as follow:

TB_User

ICAESS 2021 - The International Conference on Applied Economics and Social Science

438

Table 1 contains user data (MSMEs) that

register to be able to use the application.

Table 1: TB_Business_Identity

No. Field

Data

Type

Note

1 id_user int(11)

An auto-

increment that use

as the id of the

user

2

nama_usa

ha

Varchar

(50)

The name of the

user’s business

3 email

Varchar

(50)

Full email from

user

4 password

Varchar

(50)

The password

used by the user

5

tahun_ber

diri

Int (4)

Years of the

user’s business

stood

6

status_usa

ha

Varchar

(20)

The legal status of

the business of the

user

7

deskripsi_

usaha

text

Description of the

user’s business

TB_Faktur

Table 2 contains invoice data recorded by user

in the form of transaction activities of the

ongoing business.

Table 2: TB_Transaction

No. Field

Data

Type

Note

1

id_fak

tur

int(11)

An auto-increment

that use as the id of

a transaction

invoice

2

id_use

r

int(11)

Foreign key from

table TB_business_

identity

3

descri

ption

Varchar

(50)

Invoice number

used on each

invoice

4

tgl_fa

ktur

Date

The date the invoice

transaction occurred

5 file

Varchar

(50)

The name of the

buyer of the

transaction that

occurred

TB_Detail_Transaction

Table 3 contains detail data from transaction

which have been made by users be recorded into

the application.

Table 3: TB_Detail_Transaction

No Field

Data

Type

Note

1 id_detail int(11)

An auto-increment

that use as the id

of a tax deposit

2 Id_faktur int(11)

Foreign key the id

of a transaction

3 id_user int(11)

Foreign key from

table

TB_business_

identity

3

account_

name

Varchar

(50)

Account name

4 amount

Varchar

(20)

Amount

5

descriptio

n

Int (11)

Description

transaction

6

State_acc

ount

Enum

(debit,

kredit)

State transaction

account

4.4 Implementation System

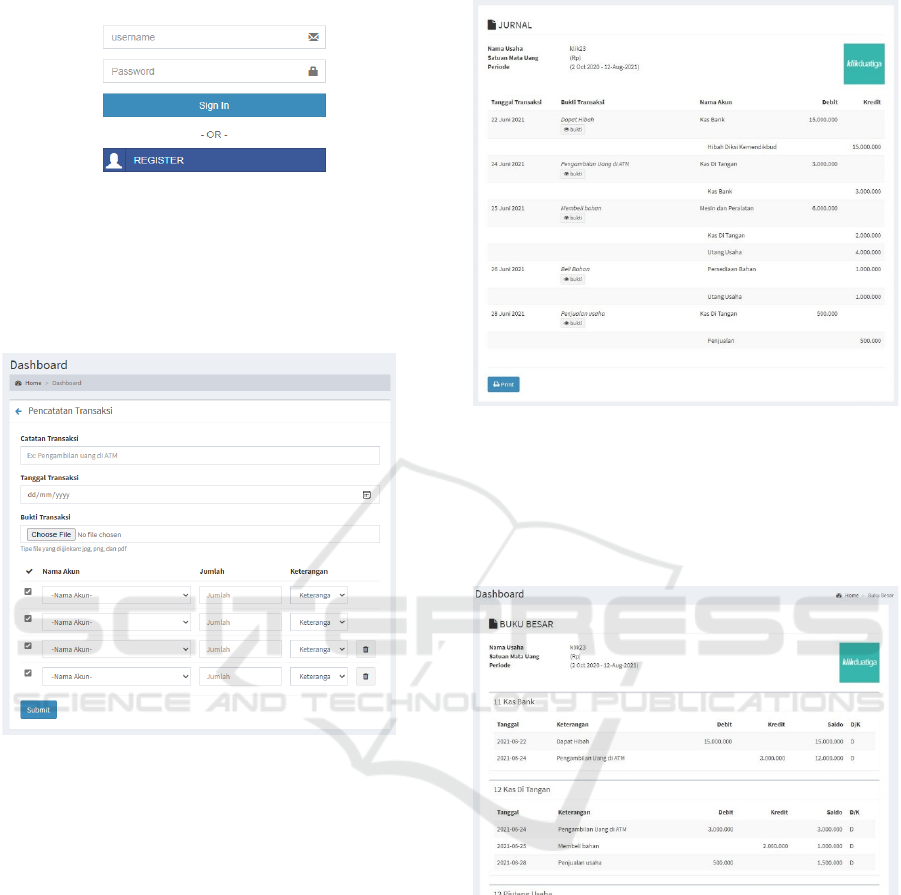

4.4.1 Register

Figure 5 displays a registration form that allows users

to register to be able to use the application.

Figure 5: Register

4.4.2 Login

Figure 6 displays a login form that users can use to

enter the application. On the login page, the user will

be validated whether the user is registered or not.

Development of Accounting Application for MSMEs based on Cloud Computing

439

Figure 6: Login

4.4.3 Add Transactions

Figure 7 displays an added transaction form. It was

used for those who want to record transactions and

will be stored in database.

Figure 7: Add Transactions

4.4.6 Accounting Journal Report

Figure 8 displays an accounting journal report. This

page display data transaction per date when user add

transactions.

Figure 8: Accounting Journal

4.4.7 Ledger Report

Figure 9 contains information about ledger report.

This page display data per account name and status

account where is debit or credit.

Figure 9: Ledger Report

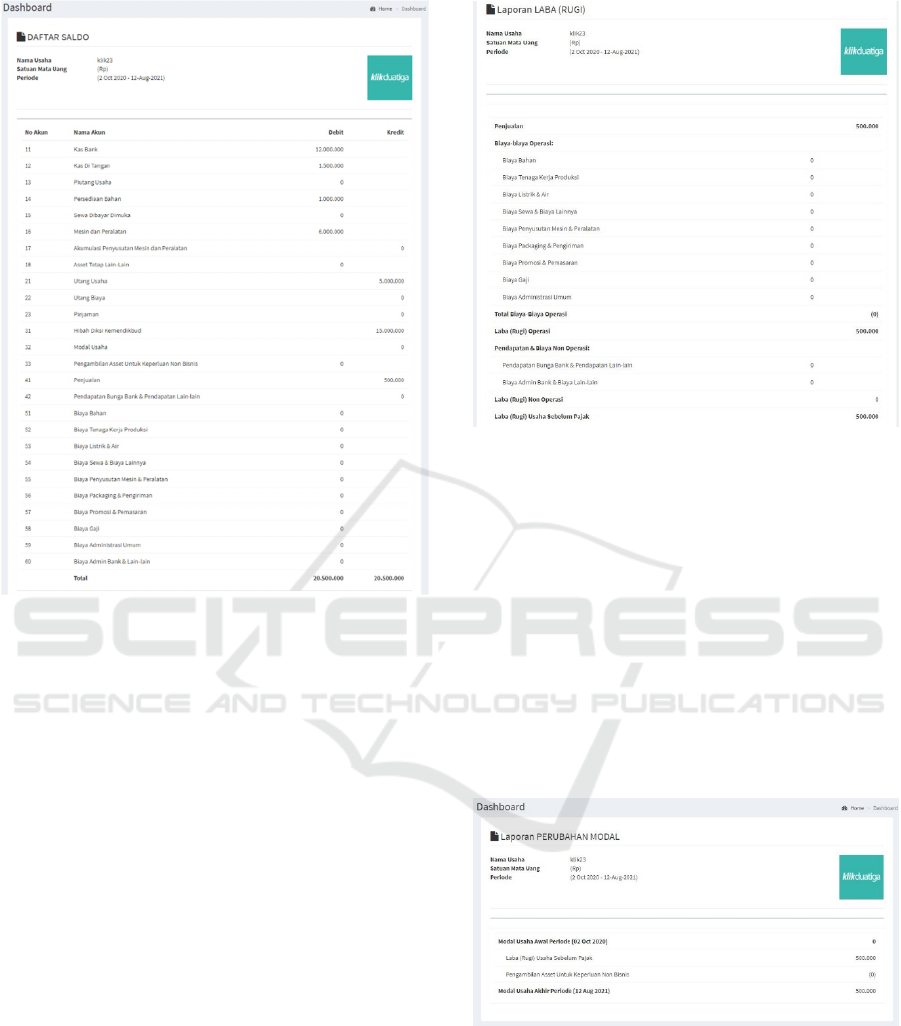

4.4.8 Balance Book Report

Figure 10 is a page for view balance book. Balance

book is a list containing the balances (difference

between total debits and total credits) of each account

in the general ledger on a certain date. The purpose of

making a balance list is to find out the balance of each

account and check that the balance of the accounting

equation is maintained.

ICAESS 2021 - The International Conference on Applied Economics and Social Science

440

Figure 10: Balance List

4.4.9 Income Statement

Figure 11 displays income statement. Income

statements that a company must have after the

balance sheet and cash flow. From the report, we can

see how much income and expenses are borne by the

company in a certain period of time.

Figure 11: Income Statement

4.4.10 Statement of Changes in Capital

Figure 12 displays statement of changes in capital.

Statement of Changes in Capital is a financial report

of a service company that shows the causes of

changes in capital, from initial capital to end of period

capital.

In the report on changes in capital, it shows that

by calculating the owner's capital at the beginning of

the period, adding to the net profit as stated in the

profit/loss statement, then subtracting it from the

owner's personal take (private), so that the owner's

capital at the end of the period is obtained.

Figure 12: Statement of Changes in Capital

Development of Accounting Application for MSMEs based on Cloud Computing

441

4.4.11 Balance Sheet

Figure 13 displays a balance sheet. Balance sheet is a

financial statement that presents the total assets,

liabilities (debt), and equity (capital) of the company

at a certain time period.

Figure 13: Balance Sheet

4.5 System Testing

Functional testing for Accounting Application Cloud

Computing-based were performed by using Black-

Box testing methods, which involves outcome

execution by using data test and evaluated the

functionality of the application. Findings on

functionality testing demonstrated that the

application provides relevant functionality.

4.6 Discussions

Development of accounting application helps

MSMEs to record sales transactions. This application

also helps MSMEs to generate financial report such

as accounting journal, ledger report, balanced list,

income statement, and statement of capital changes.

The program was used to create financial statements

such as an accounting journal, ledger report, balanced

list, income statement, and statement of capital

changes. This application produces a simple financial

report for those MSMEs who do not have an

accounting.

5 CONCLUSIONS

Based on the results of development and evaluation

of applications that have been carried out,

conclusions are as follows:

1. Application can record and stored data

transactions to database.

2. Accounting applications that have been built for

MSMEs can create financial statement such as

accounting journal, ledger report, balanced list,

income statement, and statement of capital

changes automatically.

ACKNOWLEDGEMENTS

This work is fully funded and supported by Politeknik

Negeri Batam under “Penelitian Internal P2M”.

REFERENCES

Anggraini, L. D., & Putri, A. U. (2021). Implementation of

SAK-EMKM Towards Controlling Financial

Statements on Msmes in Palembang City. Ijisrt.Com,

6(2), 437–441.

https://ijisrt.com/assets/upload/files/IJISRT21FEB372.

pdf

Cotton, M., & Dark, G. (2017). Use of Technology in Tax

Administrations 2 : Core Information Technology

Systems In Tax Administrations. IMF Technical Notes

and Manuals.

De Paula, A. C. M., & De Figueiredo Carneiro, G. (2016).

Cloud Computing adoption, cost-benefit relationship

and strategies for selecting providers: A systematic

review. ENASE 2016 - Proceedings of the 11th

International Conference on Evaluation of Novel

Software Approaches to Software Engineering, Enase,

27–39. https://doi.org/10.5220/0005872700270039

E, E., & R, G. (2013). Cyber Security and Reliability in a

Digital Cloud. US Dep. Def. Sci. Board Study, January.

Fiesgrald Wungow, J., Lambey, L., & Pontoh, W. (2016).

Pengaruh tingkat pendidikan, masa kerja, pelatihan dan

jabatan terhadap kualitas laporan keuangan pemerintah

Kabupaten Minahasa Selatan. JURNAL RISET

AKUNTANSI DAN AUDITING “GOODWILL,” 7,

174–188.

Ismail, B., & Suhami, H. (2021). Making Guidance of

Financial Reports Using the Application and Improving

Company Profile for B2b Promotion on Indonesia

Leather Shoes MSMEs. 1st ICEMAC 2020:

International Conference on Economics, Management,

and Accounting, 2021, 71–80.

Katyal, M., & Mishra, A. (2013). A Comparative Study of

Load Balancing Algorithms in Cloud Computing

Environment. Int. J. Distrib. Cloud Computing, 1 no. 2.

Kulkarni, G., Chavan, P., Bankar, H., Koli, K., & Waykule,

V. (2012). A new approach to software as service cloud.

2012 7th International Conference on

Telecommunication Systems, Services, and

Applications, 196–199.

https://doi.org/10.1109/TSSA.2012.6366050

ICAESS 2021 - The International Conference on Applied Economics and Social Science

442

Mather, T., Kumaraswamy, S., & Latif, S. (2009). Cloud

Security and Privacy (First Edit). O’Reilly Media, Inc.

https://doi.org/978-0596802769

Supardianto, Ferdiana, R., & Sulistyo, S. (2019). The role

of information technology usage on startup financial

management and taxation. Procedia Computer Science,

161. https://doi.org/10.1016/j.procs.2019.11.246

T. Chou. (2010). Introduction to Cloud Computing. Cloud

Book.

Thakral, D., & Singh, M. (2014). Virtualization in Cloud

Computing. Journal of Information Technology &

Software Engineering, 04(02), 1262–1273.

https://doi.org/10.4172/2165-7866.1000136

Vanessa Dawson. (2016). How To Manage Your Startup’s

Finances From Day One.

https://www.forbes.com/sites/vinettaproject/2016/09/2

7/how-to-manage-your-startups-finances-from-day-

one/#2b6e379d271e

Wu, J., Ping, L., Ge, X., Ya, W., & Fu, J. (2010). Cloud

storage as the infrastructure of Cloud Computing.

Proceedings - 2010 International Conference on

Intelligent Computing and Cognitive Informatics,

ICICCI 2010, 380–383.

https://doi.org/10.1109/ICICCI.2010.119

Youseff, L., Butrico, M., & Da Silva, D. (2008). Toward a

Unified Ontology of Cloud Computing. 2008 Grid

Computing Environments Workshop, 1–10.

https://doi.org/10.1109/GCE.2008.4738443

Zhang, Q., Cheng, L., & Boutaba, R. (2010). Cloud

Computing State of the art and research.pdf. Journal of

Internet Services and Applications, 7–18.

Development of Accounting Application for MSMEs based on Cloud Computing

443