Customer Loyalty Business Model during the Covid-19 Pandemic:

A Case Study on Bank Syariah Indonesia Post-Merger

Mustika Widowati

1

, Winarto

2

, Atif Windawati

1

and Mella Katrina Sari

1

1

Sharia Banking Study Program, Department of Accounting, Politeknik Negeri Semarang,

Jln. Prof. Soedarto, Semarang, Indonesia

2

Marketing Study Program, Department of Business Administration, Politeknik Negeri Semarang,

Jln. Prof. Soedarto, Semarang, Indonesia

Keywords: Customer knowledge, customer engagement, customer trust, loyalty, merger, sharia banking.

Abstract: Islamic banks are business entities that are growing and developing rapidly in the world. Indonesia is a country

with the largest Muslim population in the world, but the market share achieved is still small. It shows that the

Indonesian people prefer conventional banks to Islamic banks. Indonesian government took the initiative to

merge three state Islamic banks into one Islamic bank. As a bank with a new entity, the adjustment process

will create various complex uncertainties and have the potential to affect customer loyalty. The condition was

exacerbated by the fact that the merger was carried out when the COVID-19 pandemic was sweeping the

world. This study aims to build a loyalty development business model in the context of a recently merged

Islamic bank in Indonesia. Data collection was conducted through a survey that involved 138 Bank Syariah

Indonesia’s customers. Customer knowledge, trust, and engagement variables are used to predict customer

loyalty. The research model was tested using path analysis. The result shows that customer trust affects

customer loyalty is a better model than customer knowledge affects loyalty with customer engagement as a

mediating role.

1 INTRODUCTION

Islamic banks are business entities that are growing

and developing rapidly in the world. Indonesia is the

largest Muslim population in the world. This is a

source of inspiration that the study of the behavior of

Islamic bank customers. The number of Islamic banks

also makes competition between Islamic banks

increasing and inefficient. Therefore, the government

took the initiative to merge three state-owned Islamic

banks into one Islamic bank. The merger was

officially carried out on February 1, 2021, which

merged Bank Rakyat Indonesia Syariah, Bank Negara

Indonesia Syariah, and Bank Syariah Mandiri into

Bank Syariah Indonesia.

As a bank with a new entity, the adjustment

process will inevitably lead to various complex

uncertainties and have the potential to affect customer

loyalty. A critical period occurs at the beginning of

the merger process because the uncertainty and

changes that occur will potentially become a problem

if it is not handled correctly, especially from the

customer aspect. Unfortunately, the case of mergers

of state-owned commercial Islamic banks has never

occurred in Indonesia, so that the empirical studies

and information on best practices are not yet

available.

Consumers have different reactions depending on

the valence of the joining brand; if the valence of the

previous brand is positive but joins a negative brand,

the consumer will react negatively and vice versa

(McLelland et al., 2014). Consumers tend to react

negatively to mergers and acquisitions by devaluing

the acquirer's brand, increasing their intention to

switch, and adjusting their attitude towards the target

brand upwards (brand up-word) (Thorbjørnsen &

Dahlén, 2011). (Sarala et al., 2019) proposes avenues

for further research on the “human side” of global

mergers and acquisitions. The merger will give hope

to customers. (Sharma, 2018) conveyed that from the

customer's point of view, the success of the merger

occurred because the customer benefited from the

economies of scale of the merged bank, the expansion

of the working area and technological sophistication,

as well as the opportunity to obtain a competitive

interest rate due to the increase in authorized capital.

Widowati, M., Winarto, ., Windawati, A. and Katr ina Sari, M.

Customer Loyalty Business Model during the Covid-19 Pandemic: A Case Study on Bank Syariah Indonesia Post-Merger.

DOI: 10.5220/0010934900003255

In Proceedings of the 3rd International Conference on Applied Economics and Social Science (ICAESS 2021), pages 399-407

ISBN: 978-989-758-605-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

399

Based on these empirical findings, the vulnerable

points of mergers and acquisitions are on the human

side and psychological resistance due to changes and

uncertainties. The vulnerable conditions at the

beginning of the merger in the case of the Indonesian

Islamic Bank became increasingly interesting to

study because the merger occurred during the Covid-

19 pandemic that was sweeping the world, including

Indonesia. The vulnerable conditions at the beginning

of the merger will be overcome with the right

business model approach. Customer loyalty is one of

a critical points in every merger process. For this

reason, the formulation of a loyalty development

business model is a very important study from both a

theoretical and practical perspective. For Bank

Syariah Indonesia, this loyalty development business

model is a crucial issue.

Retaining customers is believed to provide more

financial benefits for the company because it is

cheaper and saves resources. However, the issue of

loyalty is not a simple matter. The involvement of

customers in business processes and trust is essential

to build so that customers understand the ongoing

process and ensure that the interests and welfare of

customers are the central points (Plé et al., 2010). The

problem that arises is how much knowledge,

engagement, and trust of Bank Syariah Indonesia’s

customers can influence loyalty and how to develop

the suitable loyalty development model.

The purpose of this study is to build a business

model for developing customer loyalty with the

variables of customer knowledge, customer

engagement, customer trust, in the context of a newly

merged Islamic bank. The object of research on

Indonesian Islamic Bank customers is a new thing

because there has been no similar research in

Indonesia, considering that this is the first time the

merger of stated-owned sharia commercial banks has

occurred. The research will make a significant

contribution to the development of customer loyalty

theory with a business model approach that adopts

customer involvement as theorized in Service-

Dominant Logic and Customer Integrated Business

Model theory. This research is also beneficial on a

practical level for developing the loyalty of Bank

Syariah Indonesia to realize the goal of the merger,

which is to become the leading Islamic bank that can

compete in the global arena.

2 LITERATURE REVIEW

2.1 Business Model

Conceptually, Islamic banking operations are carried

out based on Islamic sharia principles, full of meaning

about the social relationship between humans as a

manifestation of worship to Allah. The concept of the

relationship between the interacting parties is also

based on the principle of cooperation partnership.

Each party involved in a balanced, fair, pure,

transparent, and accountable pattern to achieve

benefit and eliminate harm.

The business model was developed very

intensively in theoretical and practical studies to find

the best solution regarding the strategy and its impact

on the company's sustainability. The sservice-

Dominant Logic theory explains that the company's

achieving its goals is a service process to customers

(Vargo & Lusch, 2017). The linkage of the added

value creation process increasingly leads to the

involvement of consumers in the creation of added

value for the resulting product or service. This is

driven well educated and have access to good

information consumers, brave and can convey what

they want. Especially service companies involved

consumer on use of technology in operation

processes. They are determining factor success of the

services will be produced. The concept of consumer

involvement in this business model is very

appropriate be applied in sharia-based businesses.

Applying an appropriate business model is an

essential consideration for companies to deal with

dynamic environmental situations and achieve

superior sustainable performance. In recent years

more and more companies have been involved even

mobilizing customers in their business processes to

increase revenue, reducing costs, and increasing

profits (Plé et al., 2010). Customer participation in the

business process model has been widely studied of

service management and marketing.

The framework of the Customer-Integrated

Business Model, customers are considered as a

resource (Plé et al., 2010). Thus, customers can be

empowered and managed to support the creation of a

sustainable competitive advantage. This is by the

opinion of (Sarala et al., 2019) that the business

model is the embodiment of logic and strategic

choices to capture and create value in the value

network. (Vargo & Lusch, 2017) directs that the value

creation process is one of the embodiments of the

business model in accommodating these two interests

proportionally as a way to create shared value and all

those involved in value creation as service-dominant

ICAESS 2021 - The International Conference on Applied Economics and Social Science

400

logic. The existence of the organization is to integrate

and transform micro-competencies into complex

services demanded by the market. The nature and

characteristics of the business model must be relevant

to market-oriented customers. This implies that the

business model must pay serious attention to the

customers’ interests and not just to realize the

interests of the company to achieve high loyalty.

2.2 Loyalty and Its Antecedents

(Kandampully et al., 2015) stated that loyalty is a

long-term company asset. Customer loyalty is a

severe concern in studies in the field of marketing

because loyalty is seen as the primary source that can

bring long-term profits, so it is expected to be able to

create a competitive advantage for the company.

Loyalty is also seen as the key to marketing success,

so companies must always keep customers loyal.

Loyalty is also seen as a way to create word of mouth

and can create economic benefits such as customer

willingness to pay more, reduced costs due to

increased sales volume.

Loyalty is a process of thinking, behaving, and

behaving a consumer that cannot be separated from

the factors influencing the behavior. Loyalty is

importance aspect for the long-term survival of the

company. Loyalty studies have been carried out from

various perspectives and the factors that influence it.

Loyalty models are widely studied with various

factors that influence it and the context of its

application. (Abu-alhaija et al., 2018) said that there

are three determinants of customer loyalty, namely

the primary determinant, which includes customer

satisfaction, trust, perceived value, and perceived

service quality; secondary determinant, which

includes other factors used by the nature and context

of the research; the last one is loyalty's moral

determinant, which includes spirit.

Several studies use primary determinant loyalty,

such as (Keisidou et al., 2013) found that customer

satisfaction and loyalty had no effect on financial

performance, but satisfaction and image had a

significant effect on loyalty. (Abdullaeva, 2020)

found a positive relationship between customer

satisfaction and loyalty. (Rather et al., 2018) said that

customer–brand identification strengthens affective

commitment, engagement, and brand loyalty. It is

further revealed that trust in service providers, trust in

regulators, economic-based trust, and information-

based trust significantly affect customer engagement,

with trust in service providers and trust in regulators

driving higher levels of customer engagement. The

results also reveal that customer engagement

significantly enriches customer loyalty and mediates

the relationship between the dimensions of trust and

customer loyalty. Customer engagement is a very

relevant variable used as an antecedent of loyalty. In

banking industry, customer engagement is the long-

term nature of customer-bank relationships.

(Monferrer et al., 2019) revealed a strong relationship

between customer engagement and customer loyalty.

(Agyei et al., 2020) highlights the importance of

building compelling customer trust to advance

customer engagement and customer loyalty. The use

of customer engagement variables is based on the

findings of (Ganiyu et al., 2012), which explain that

customer satisfaction cannot achieve the goal of

creating a loyal customer. Customer satisfaction and

loyalty are not directly correlated, especially in a

competitive business environment because there is a

big difference between satisfaction and loyalty.

Satisfaction refers to a passive customer condition,

while loyalty describes an active or proactive

relationship with the organization. These findings

indicate that the selection of loyalty antecedents must

consider the characteristics of the variables and

customer engagement as appropriate as the

antecedent of loyalty because these variables

represent active and proactive customer conditions.

Furthermore, (Hidayat et al., 2015) show that the

quality of service and customer trust of Islamic banks

together have a significant effect on customer

satisfaction and have an indirect effect on customer

loyalty is mediated by customer satisfaction. (Yeh et

al., 2020) shows that the relationship between

physical attractiveness, intellectual competence, and

trust plays a vital role in determining satisfaction, and

loyalty. (Darmawan, 2018) finds evidence that trust

has a positive and significant effect on customer

loyalty, with the indicator of trust being that Islamic

banks are very concerned with Islamic principles,

security, and the products and services offered are

based on Islamic principles. (Ali et al., 2018) find that

understanding, relative advantage, compatibility,

observable uncertainty, complexity, and service

quality have a positive effect on the adoption of

Islamic bank services. Customer knowledge is

important because individuals will go through stages

of mental processing before adopting and receiving

products or services. This variable is important to

shape customer behavior to the stage of loyalty.

Customer Loyalty Business Model during the Covid-19 Pandemic: A Case Study on Bank Syariah Indonesia Post-Merger

401

3 RESEARCH MODEL AND

HYPOTHESES

DEVELOPMENT

3.1 Model I: The Influence of

Customer Knowledge on Customer

Loyalty through Customer

Engagement

The knowledge of customers has a significant

positive relationship with loyalty, it has also a

moderating effect between both satisfaction and

loyalty (Wang, et al., 2016). (Ali et al., 2018),

understanding, relative advantage, compatibility,

observable uncertainty, complexity, and service

quality have a positive effect on the adoption of

Islamic banking services. Furthermore, there is the

influence of customer engagement on loyalty (Fianto

et al., 2020). The strong relationship between

customer engagement and customer loyalty.

Customer engagement has a positive effect on

Customer Loyalty (Harimurti & Suryani, 2019).

Based on the findings of the previous research, the

model I is formulated with the following hypothesis:

H1: Customer Knowledge has a direct effect on

Customer Loyalty. H2: Customer Engagement has a

direct effect on Customer Loyalty. H3: Customer

Knowledge has a direct effect on Customer

Engagement. H4: Customer Knowledge has an

indirect effect on Customer Loyalty through

Customer Engagement.

3.2 Model II: The Influence of

Customer Trust on Customer

Loyalty through Customer

Engagement

Referring to (Ganiyu et al., 2012), the use of customer

engagement as an antecedent of loyalty is more

appropriate because it represents the active and

proactive nature of the customer's condition. Service

quality and the trust of Islamic bank customers

together have a significant effect on customer

satisfaction and an indirect effect on customer loyalty

which is mediated by customer satisfaction (Hidayat

et al., 2015). Trust has a positive and significant effect

on customer loyalty (Darmawan, 2018). The

relationship between physical attractiveness,

intellectual competence, and trust plays an important

role in determining satisfaction and loyalty (Yeh et

al., 2020). Then, (Agyei et al., 2020) highlight the

importance of building compelling trust to advance

customer engagement and loyalty. Based on these

findings, the following hypothesis is formulated: H5:

Customer Trust has a direct effect on Customer

Loyalty. H6: Customer Trust has a direct effect on

Customer Engagement. H7: Customer Engagement

has a direct effect on Customer Loyalty. H8:

Customer Trust has an indirect effect on Customer

Loyalty through Customer Engagement. Figure 1

below is the relationship between the hypothesized

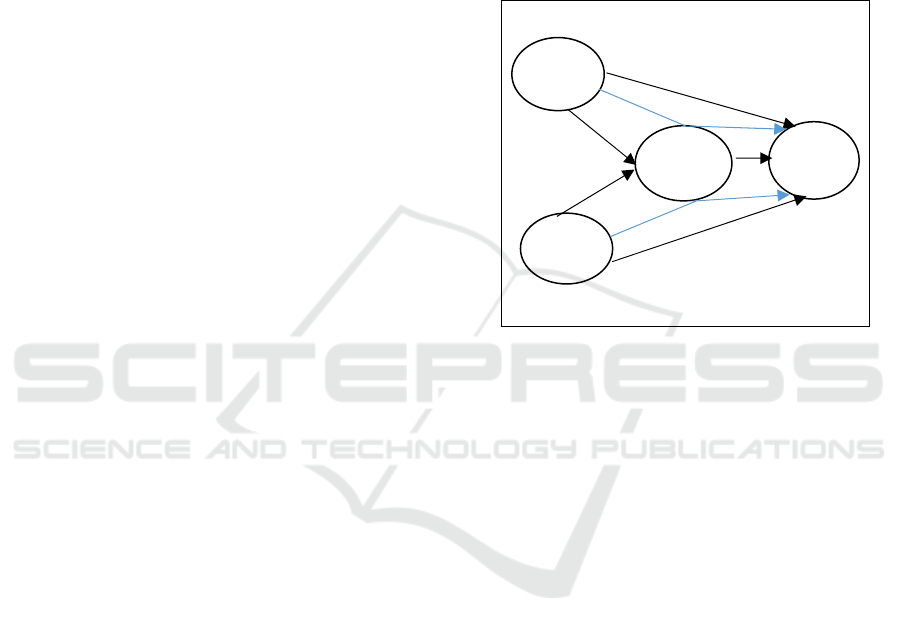

variables.

H1

H3 H4

H2

H6

H8

H7

Figure 1: Research Model.

4 SAMPLE AND DATA

COLLECTION

The research was conducted using a survey technique

with a questionnaire as data collection tool.

Questionnaire were given to the target respondents

using a google form that was sent on personal social

network. This method was carried out considering the

time of research during the COVID 19 pandemic so

that data collection online was the safest way

according to health protocols. Sampling technique

using judgment sampling. The characteristics of the

target respondents are customers who have an account

at Bank Syariah Indonesia, are adults, and have

sources of income. Respondents who responded to

requests for filling out the questionnaire via google-

form were 167 out of 305 given a questionnaire link

via private WhatsApp messages or through WhatsApp

groups. Requests for link forwarding to colleagues

receiving the first link are also made via questionnaire

cover messages. This means that the response rate is

54.75%. Finally, respont from 138 respondents used

in this resarch. The google-form submission period is

July 14 to July 23, 2021. This period is the peak period

of the second wave of the pandemic, and the

CE

C

T

CK

C

L

ICAESS 2021 - The International Conference on Applied Economics and Social Science

402

Indonesian government is implementing the

imposition of restrictions on community activities as

an effort to prevent the spread of COVID 19. The

following table 1 presents data on the characteristics

of respondents in detail.

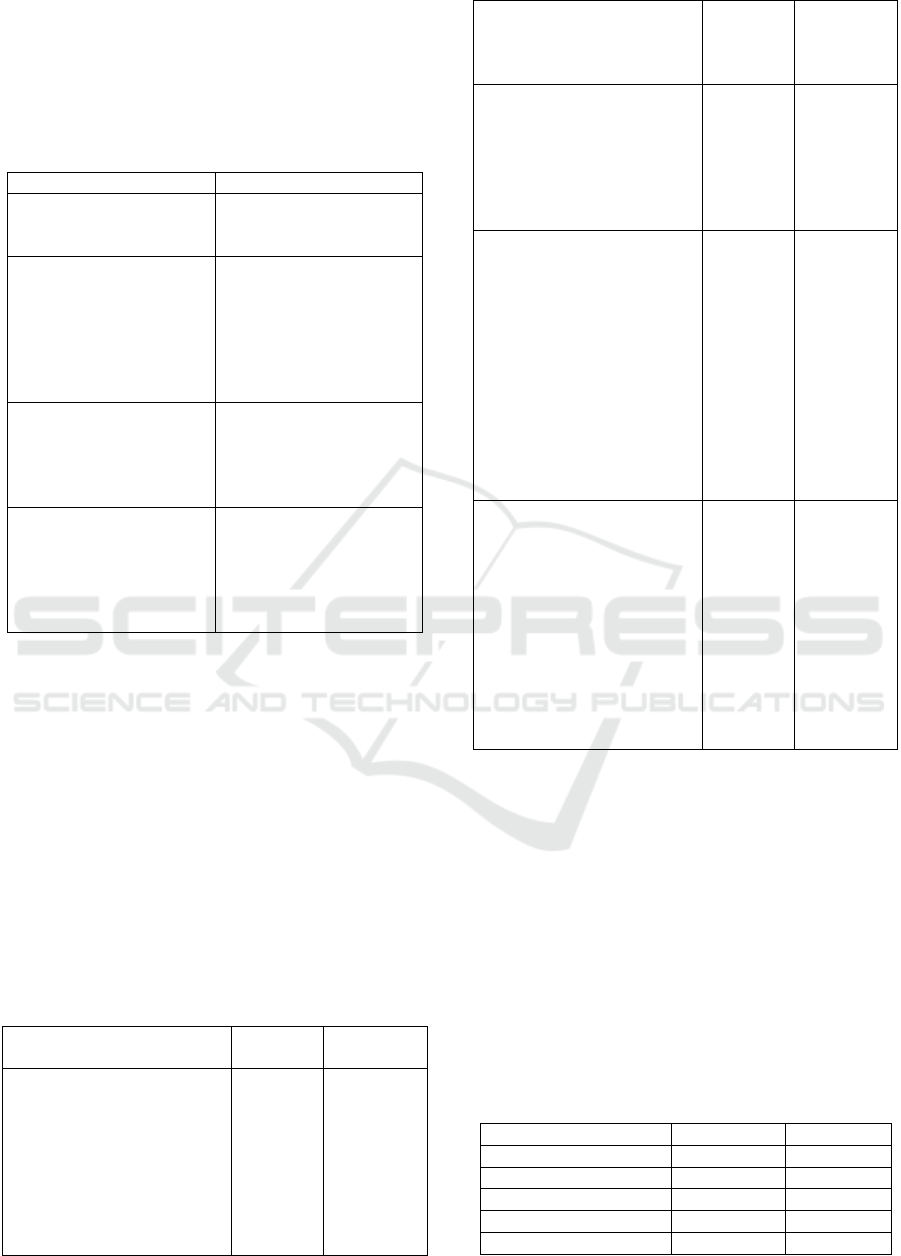

Table 1: Characteristics of Respondents.

Characteristics Percentage

Gender:

Male

Female

27.5

72.5

Age:

17 - 21

22 - 26

27 - 31

32 - 36

37 - 40

> 40

21

35.5

10

3,6

1.4

27.5

Years with the bank:

< 1

2 - 5

6 - 10

>10

14.5

57.2

18.1

10.1

Occupancy:

Teacher

Businessman

Employee

Student

Othe

r

24.6

5,8

26,8

37.7

5

Table 1 shows that 72.5% of respondents are

women and the rest are men. The highest age range is

22-36 years, respondents have been customers with

accounts for 2-5 years is 57.2% and 37.7% as a

student.

Loyalty is conceptualized based on (Kotler,

1997). Likewise, the customer knowledge construct

was adapted (Ali et al., 2018). Meanwhile, customer

engagement was adapted (MSI-Marketing Science

Institute, 2010), and customer trust (Darmawan,

2018). A five-point Likert scale was used to measure

the question items, namely 1=strongly disagree,

2=disagree, 3=neutral, 4=agree, and 5=strongly

agree. The following are the items used in this study.

Table 2: Validity and Reliability.

Detail Cronbach

Al

p

ha

Correlation

Customer Loyalty (CL):

• Not move to another bank.

• Using of other products.

• Pay more.

• Repeat purchase.

• Recommendation.

• Frequent top-up compared

to other banks.

0.875*

0.739**

0.737**

0.809**

0.779**

0.705**

0.707**

• Invite colleagues to

become customers.

• Do not tell anyone terrible

thin

g

s.

0.765**

0.624**

Customer Knowledge (CK):

• Knowing the merger

• Ownership status

• Leader qualities

• Technology ownership

• Increasing asset ownership

0,628*

Delete

Delete

0.705**

0.682**

0.636**

Customer Engagement

(CE):

• Likes to talk

• Interested in knowing

more.

• Follow more detailed news

about the brand.

• Willing to go the extra

mile to buy the product.

• Talking about the product

to other people.

• Writing reviews &

b

logging.

0,838*

0.809**

0.635**

0.787**

0.754**

0.845**

0,627**

Customer Trust (CT):

• Banks are very concerned

with Islamic principles.

• The promises made

• The contract has a suitable

explanation.

• The employee

performance is getting

better

• Trust fund management

for the benefit

• Trust safe deposits

0,866*

0.796**

0.806**

0.766**

0.748**

0.817**

0.715**

* reliable according to Nunally’s (1967) criteria, in

(Ghozali, 2005).

** Correlation is significant at the 0.01 level (2-tailed).

Based on table 2, it can be concluded that the

reliability of all variables is above 0.60, and all

indicators are valid except for indicators of customer

knowledge: knowing the merger incident and

ownership status which are not significant so they are

deleted and not used in further analysis.

The normality of the data was tested by looking at

the Z Skewness and Z Kurtosis values. The following

table 3 summarizes the results of the two Z scores as

follows:

Table 3: Z Skewness and Z Kurtosis.

Variable ZSkewnes Conclusion

Customer Knowledge -2.869 Moderat

Customer En

g

a

g

ement -2.329 Normal

Customer Trust -0.407 Normal

Customer Lo

y

alt

y

-1.423 Normal

Variable Zkurtosis Conclusion

Customer Loyalty Business Model during the Covid-19 Pandemic: A Case Study on Bank Syariah Indonesia Post-Merger

403

Customer Knowled

g

e -0.094 Normal

Customer Engagement 1.098 Normal

Customer Trust -2.122 Normal

Customer Lo

y

alt

y

0.609 Normal

Based on table 3, at the 0.01 significance level, all

Z Skewness and Z Kurtosis values are smaller than

2.58 (significance level 0.01) so it can be concluded

that the data is normally distributed except for CK has

Z Skewness -2.869 smaller than three, which means

the data is moderately non-normally distributed at the

significance level of 0.001 Curran et al., 1996 in

(Ghozali, et al., 2005).

5 TESTS OF HYPOTHESIS

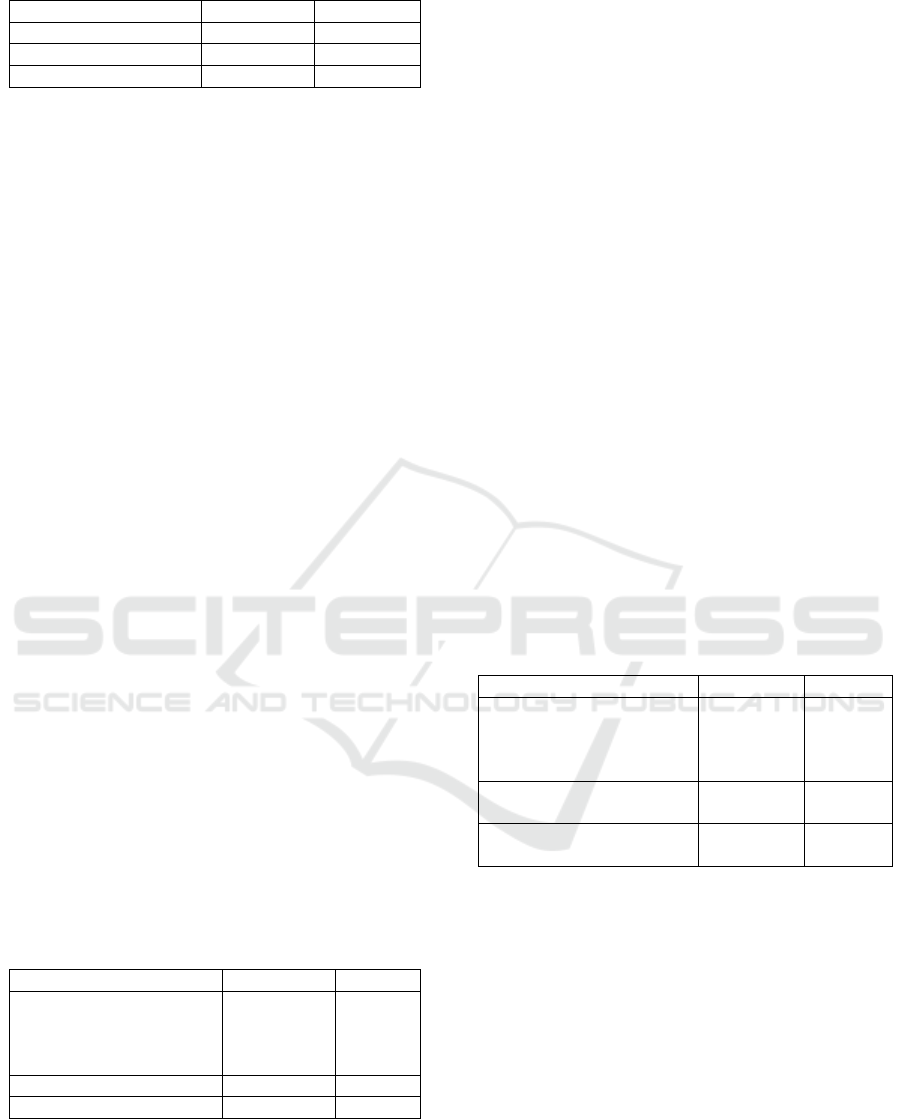

Testing the model used the R2 test against model I,

namely customer loyalty, which was predicted by

customer knowledge with customer engagement as a

mediating variable. The R2 value in a model I is

0.3622 (36.22%); this value exceeds 25%, which is

stated as satisfaction and accepted prediction level

Gaur and Gaur, 2006 in (Nawaf Al-Nsour, 2020).

Meanwhile, model II is customer loyalty which is

predicted by customer trust by mediating customer

engagement. The R2 value in model II is 0.5297

(52.97%); this value exceeds 25%, so it can be

considered as a model that is satisfied and accepted.

When viewed R2 in the model I is 0.3622 and the

model II R2 is 0.5297. This means that customer

engagement increases the percentage of R2 by 0.1675

(16.75%) when applied as a mediating variable in this

study with customer trust as a predictor.

Hypothesis testing is done using SPSS software.

Model I is a test of the direct and indirect effect

customer knowledge on customer loyalty by

customer engagement as a mediating variable. Table

4 shows the test results of the model I.

Table 4: Direct effect and indirect effect customer

knowledge on customer loyalty.

Effect Coefficient

p

-value

Direct effect:

CK on CL

CE on CL

CK on CE

0.2917

0.8406

0.8501

0.0000

0.0000

0.0000

Indirect effect: CK on CL 0.7146 0.0000

Total effect: CK on CL 1.0064 0.0000

Note: p value < .05

Based on table 4, it can be seen that the coefficient

of the direct influence of customer knowledge on

customer loyalty is 0.2917, the direct influence of

customer engagement on customer loyalty is 0.8406,

and the direct influence of customer knowledge on

customer engagement is

0.8501. All coefficients are

significant at the 0.05 level. The result support H1,

there is a direct effect of customer knowledge on

customer loyalty. Likewise, H2, which states that

customer engagement, has a direct effect on loyalty,

is also supported. H3, which states that customer

knowledge has a direct effect on customer

engagement is also supported. H4, customer

knowledge has an indirect effect on customer loyalty

through customer engagement is also supported by a

coefficient value of 0.7146 (p <0.05). To ensure the

mediation effect of customer engagement in a model

I is seen from the confidence interval (CI), namely the

Boot LLCI value of 0.3755 and the Boot ULCI value

of 1.0761. These two values are not in the range that

exceeds 0. These result indicates that there is an

influence of customer engagement in mediating effect

of customer knowledge on customer loyalty. The total

effect of customer knowledge on customer loyalty is

1.0064 (p<0.05).

Model II testing is a test of the direct and indirect

effect of customer loyalty which is predicted by

customer trust with customer engagement as a

mediating variable. Table 5 shows the results of

model II testing.

Table 5: Direct and Indirect effect of customer trust on

customer loyalty.

Effect Coefficient

p

-value

Direct effect:

CT on CL

CE on CL

CT on CE

0.3383

0.8406

0.7629

0.0000

0.0000

0.0000

Indirect effet:

CT on CL

0.5807

0.0000

Total effect:

CT on CL

0,9191

0.0000

Note: p value < .05

Based on table 5, it can be seen that the coefficient

of the direct effect of customer trust on customer

loyalty is 0.3383, the direct effect of customer

engagement on customer loyalty is 0.8406, and the

direct effect of customer trust on customer

engagement is 0.7629. All coefficients are significant

at the 0.05 level. These results support H5, there is a

direct effect of customer trust on customer loyalty.

Likewise, H6, which states a direct effect of customer

engagement on loyalty, is also supported. H7, which

states that customer trust has a direct effect on

customer engagement, is also supported. H8, which

states that customer trust has an indirect effect on

customer loyalty mediated by customer engagement,

is also supported by a coefficient value of 0.5807

ICAESS 2021 - The International Conference on Applied Economics and Social Science

404

(p<0.05). The mediation effect of customer

engagement in model II, is seen from the confidence

interval (CI), namely the Boot LLCI value of 0.3843

and the Boot ULCI value of 0.7869. These two values

are not in the range that exceeds 0, so this indicates

that there is an influence of customer engagement in

mediating the effect of customer trust on customer

loyalty. The total effect of customer knowledge on

customer loyalty is

0.9191 (p<0.05).

6 DISCUSSION AND

IMPLICATIONS

6.1 Discussions of Findings

The results of the study show that all hypotheses are

accepted significantly. The result can be concluded

that customer knowledge and customer trust have

direct and indirect effects on customer loyalty by

mediating role of customer engagement. The results

showed that model I gave a more significant total

effect than model II. This means that customer

knowledge affects customer loyalty by mediating

customer engagement, which provides a more

significant total effect than customer trust, which

affects customer loyalty by mediating customer

engagement. This finding indicates that knowledge

plays a more sigificant role in forming loyalty than

trust with mediating engagement. This is in line with

the opinion (Wang et al., 2016) which states that

knowledge has a significant effect on loyalty.

(Suchánek & Králová, 2019) showed the direct

influence of the product-knowledge on customer

expectation and product competitiveness, as well as

the influence on customer loyalty. However,

customer product knowledge negatively moderates

service quality and online customer loyalty and

positively moderates the relationship between

sacrifice and customer loyalty (Xu et al., 2011).

(Nora, 2019) stated that customer knowledge was not

directly able to increase the intention of repeat

purchase but, indirectly effect high customer

knowledge, supported by the high customer intimacy,

it can indirectly increase the high repurchasing

intention.

In the dynamics of a competitive and increasingly

complex business environment, companies are

always required to build and maintain a competitive

advantage. Customers can more accessible and faster

access and disseminate information. It leads to the

formation of a knowledge-based society. This means

that the company's ability to implement and manage

knowledge to improve company performance in

dynamic decision-making is essential. Companies

need to manage customer knowledge through an

integrated system and involve the existence of

customers as an integral part of the system. The flow

of information is a significant part of maintaining

customer knowledge. The customers need to get

reliable news and understanding from trusted sources

before they obtain information from other sources.

Smooth and quality-maintained communication with

customers can be done if the customer has a

comfortable involvement with the company so that

the customer integrated business model is a wise

choice to build loyalty. Reliable customer knowledge

indicators used in this study are: leadership qualities,

technology ownership, increasing asset ownership.

These indicators can be used as a basis for managing

customer knowledge. Companies need to provide

clear and transparent information regarding these

indicators to get a true and accurate understanding.

This study also found a significant direct and

indirect effect between customer trusts toward

customer loyalty. This indicates that trust also plays

an essential role in the formation of customer loyalty.

Especially in the Islamic banking industry, trust is a

fundamental problem. This finding is in line with the

findings, which state that trust affects customer

loyalty in hotels (Haryanto & T.J, 2009), customer

member of the credit unions (Nguyen et al., 2013),

commercial banks (Leninkumar, 2017). (Daud et al.,

2018) stated that there are direct and indirect effects

of trust toward loyalty in ICT customers. The direct

and indirect effect of trust on loyalty in several

industries provides evidence that trust has good

generalization as an antecedent of loyalty.

In a dynamic, transparent, and increasingly digital

business environment, trust is an essential component

in a relationship. Trust is indispensable as a guarantor

of business sustainability in the long term. Therefore,

the company needs to pay attention to building trust

to achieve superior performance. In this study, the

indicators used in the trust are: believing that banks

are very concerned with Islamic principles, believe

in the promises made, believe that the contract has a

suitable explanation, believing in employee

performance is getting better, trust fund management

for the benefit, trust safe deposits. These indicators

are relevant to be used as a basis for increasing

loyalty.

6.2 Theoretical Implications

The research was conducted on a unique case that

happened for the first time in Indonesia, namely the

Customer Loyalty Business Model during the Covid-19 Pandemic: A Case Study on Bank Syariah Indonesia Post-Merger

405

merger of the stated-owned Islamic commercial

banks, which made customer confused. The research

was also carried out at a time when COVID 19

pandemic hit the world and Indonesia, which made

socio-economic conditions worse. The two

conditions of the object of this research provide a very

significant contribution to the development of the

theory of customer behavior, especially the

development of antecedent customer loyalty. The

research findings show the role of customer

engagement in mediating customer knowledge and

customer trust on customer loyalty.

6.3 Managerial Implications

The results of this study provide managerial

implications as follows, first the use of customer

knowledge and trust as the basis for building loyalty.

The study provides an understanding of how

customer knowledge and trust affect customer

engagement and loyalty in the context of Islamic

banks in the early stages of the merger. The research

was conducted during the COVID 19 pandemic, so

the results also provide an understanding of how to

manage customer knowledge and customer trust to

build loyalty by mediating customer engagement.

Second, the important thing in managing customer

loyalty is the ability of Islamic banks to maintain

customer knowledge with relevant and proportional

information so that customers are well-informed and

avoid misleading information. Third, growing

customer trust is an essential part of realizing

engagement and building loyalty. In building trust,

the critical thing that Islamic banks need to do is keep

the promises made and concentrate on the benefit.

Fourth, customer engagement is an important part

plays a role in mediating customer knowledge and

trust toward loyalty.

6.4 Limitation and Future Direction

This study has several limitations as a pathway for

further research. This study examines two models to

build loyalty. Although this research is a case study

in a newly merged Islamic bank, the research model

can be used in other contexts and objects. This

research was conducted during the COVID 19

pandemic, an unstable market condition, so it is

necessary to carry out further research in the future

under normal market conditions. However, this

research can also be used as a reference for similar

research if the market is in a crisis. The use of

customer engagement variables to mediate customer

knowledge and customer trust in customer loyalty can

be developed for further research to be able to

produce consistent findings. The indicators of each

variable need to be further developed by adopting

other findings under the dynamics of customer

behavior development. The data collection

techniques using google forms also need to be

reviewed because although this technique is not

something new, for the case in Indonesia it has not

been widely used, especially for academic research.

The use of other social media besides WhatsApp is

highly recommended to expand the reach of relevant

respondents and generalization of the research result.

REFERENCES

Abdullaeva, M. (2020). Impact of Customer Satisfaction on

Customer Loyalty in Upscale Ethnic Restaurants.

Theoretical & Applied Science, 86(06), 372–375.

https://doi.org/10.15863/tas.2020.06.86.71

Abu-alhaija, A. S., Nerina, R., Yusof, R., Hashim, H., &

Jaharuddin, N. S. (2018). Determinants of Customer

Loyalty: A Review and Future Directions. Australian

Journal of Basic and Applied Sciences, July.

https://doi.org/10.22587/ajbas.2018.12.7.17

Agyei, J., Sun, S., Abrokwah, E., Penney, E. K., & Ofori-

Boafo, R. (2020). Influence of Trust on Customer

Engagement: Empirical Evidence From the Insurance

Industry in Ghana. SAGE Open, 10(1).

https://doi.org/10.1177/2158244019899104

Ali, Q., Yaacob, H. B., & Haji Mahal, D. H. N. B. D.

(2018). Empirical Investigation of Islamic Banking

Adoption in Brunei. International Journal of Islamic

Banking and Finance Research, 2(2), 24–38.

https://doi.org/10.46281/ijibfr.v2i2.202

Darmawan, D. (2018). The Effect of Service Quality,

Customer Satisfaction and Corporate Image on

Customer Loyalty in the banking sector in Indonesia.

19(11), 46–51. https://doi.org/10.31219/osf.io/uxsfr

Daud, A., Farida, N., Andriyansah, & Razak, M. (2018).

Impact of customer trust toward loyalty: The mediating

role of perceived usefulness and satisfaction. Journal of

Business and Retail Management Research, 13(2),

235–242. https://doi.org/10.24052/jbrmr/v13is02/art-

21

Fianto, B. A., Gan, C., Widiastuti, T., & Sukmana, R.

(2020). Customer loyalty to Islamic banks: Evidence

from Indonesia. Cogent Business and Management,

7(1). https://doi.org/10.1080/23311975.2020.1859849

Ganiyu, R., Uche, I., & Adeoti, O. (2012). Is customer

satisfaction an indicator of customer loyalty?

Australian Journal of Business and Management

Research, 2(7), 14.

Ghozali, I. dan Fuad. (2005). Structural Equation

Modeling. Semarang, BP. Universitas Diponegoro.

Harimurti, R., & Suryani, T. (2019). the Impact of Total

Quality Management on Service Quality, Customer

Engagement, and Customer Loyalty in Banking. Jurnal

ICAESS 2021 - The International Conference on Applied Economics and Social Science

406

Manajemen Dan Kewirausahaan, 21(2), 95–103.

https://doi.org/10.9744/jmk.21.2.95-103

Haryanto, B., & T.J, S. (2009). Pengaruh Relationship

Marketing, Trust, Commitment, Citra, Dan Fasilitas

Pada Customer Loyalty. Jurnal Manajemen Teori Dan

Terapan| Journal of Theory and Applied Management,

2(3), 199–209. https://doi.org/10.20473/jmtt.v2i3.2385

Hidayat, R., Akhmad, S., & Machmud, M. (2015). Effects

of Service Quality, Customer Trust, and Customer

Religious Commitment on Customers Satisfaction and

Loyalty of Islamic Banks in East Java. Al-Iqtishad:

Journal of Islamic Economics, 7(2), 151–164.

https://doi.org/10.15408/ijies.v7i2.1681

Kandampully, J., Zhang, T. (Christina), & Bilgihan, A.

(2015). Customer loyalty: A review and future

directions with a special focus on the hospitality

industry. International Journal of Contemporary

Hospitality Management, 27(3), 379–414.

https://doi.org/10.1108/IJCHM-03-2014-0151

Keisidou, E., Sarigiannidis, L., Maditinos, D. I., &

Thalassinos, E. I. (2013). Customer satisfaction, loyalty

and financial performance: A holistic approach of the

Greek banking sector. International Journal of Bank

Marketing, 31(4), 259–288.

https://doi.org/10.1108/IJBM-11-2012-0114

Kotler, P. (1997). Mareketing Management. New York:

Prentichall, Inc.

Leninkumar, V. (2017). The Relationship between

Customer Satisfaction and Customer Trust on

Customer Loyalty. International Journal of Academic

Research in Business and Social Sciences, 7(4), 450–

465. https://doi.org/10.6007/ijarbss/v7-i4/2821

McLelland, M. A., Goldsmith, R., & McMahon, D. (2014).

Consumer reactions to the merger: Understanding the

role of pre-merger brands. Journal of Brand

Management, 21(7), 615–634.

https://doi.org/10.1057/bm.2014.28

Monferrer, D., Moliner, M. A., & Estrada, M. (2019).

Increasing customer loyalty through customer

engagement in the retail banking industry. Spanish

Journal of Marketing - ESIC, 23(3), 461–484.

https://doi.org/10.1108/SJME-07-2019-0042

MSI-Marketing Science Institute. (2010). Understanding

customer experience and behavior: Research priorities

2010-2012, Cambridge, MA, USA, Accessed on March

29, 2021, http://image.sciencenet.cn/olddata/

Nawaf Al-Nsour, S. (2020). The Role of Customer

Engagement and Relationship Quality toward E-

Customer Loyalty in the Jordanian Online

Environment. International Journal of Business and

Management, 15(2), 149.

https://doi.org/10.5539/ijbm.v15n2p149

Nguyen, N., Leclerc, A., & LeBlanc, G. (2013). The

Mediating Role of Customer Trust on Customer

Loyalty. Journal of Service Science and Management,

06(01), 96–109.

https://doi.org/10.4236/jssm.2013.61010

Nora, L. (2019). Trust, commitment, and customer

knowledge : Clarifying relational commitments and

linking them to repurchasing intentions Article

information : June. https://doi.org/10.1108/MD-10-

2017-0923

Plé, L., Lecocq, X., & Angot, J. (2010). Customer-

integrated business models: A theoretical framework.

Management, 13(4), 226–265.

https://doi.org/10.3917/mana.134.0226

Rather, R. A., Tehseen, S., & Parrey, S. H. (2018).

Promoting customer brand engagement and brand

loyalty through customer brand identification and value

congruity. Spanish Journal of Marketing - ESIC, 22(3),

321–341. https://doi.org/10.1108/SJME-06-2018-0030

Sarala, R. M., Vaara, E., & Junni, P. (2019). Beyond merger

syndrome and cultural differences: New avenues for

research on the “human side” of global mergers and

acquisitions (M&As). Journal of World Business,

54(4), 307–321.

https://doi.org/10.1016/j.jwb.2017.10.001

Sharma, K. P. (2018). The Impact of Merger and

Acquisition on Customer Satisfaction in Post- Merger

Phase in Banking Sector of Nepal. Journal of Nepalese

Business Studies, 11(1), 57–69.

https://doi.org/10.3126/jnbs.v11i1.24202

Suchánek, P., & Králová, M. (2019). Customer satisfaction,

loyalty, knowledge, and competitiveness in the food

industry. Economic Research-Ekonomska Istrazivanja ,

32(1), 1237–1255.

https://doi.org/10.1080/1331677X.2019.1627893

Thorbjørnsen, H., & Dahlén, M. (2011). Customer

reactions to acquirer-dominant mergers and

acquisitions. International Journal of Research in

Marketing, 28(4), 332–341.

https://doi.org/10.1016/j.ijresmar.2011.05.005

Vargo, S. L., & Lusch, R. F. (2017). Service-dominant logic

2025. International Journal of Research in Marketing,

34(1), 46–67.

https://doi.org/10.1016/j.ijresmar.2016.11.001

Wang, C.-C., Wang, Y.-M., & Chieh, W.-H. (2016). The

Moderating Role of Customer Knowledge on the

Relationship between Customer Satisfaction and

Loyalty. Journal of Economics, Business and

Management

, 4(4), 292–295.

https://doi.org/10.18178/joebm.2016.4.4.406

Xu, J. D., Benbasat, I., & Cenfetelli, R. (2011). The effects

of service and consumer product knowledge on online

customer loyalty. Journal of the Association for

Information Systems, 12(11), 741–766.

https://doi.org/10.17705/1jais.00279

Yeh, W. C., Lee, C. C., Yu, C., Wu, P. S., Chang, J. Y., &

Huang, J. H. (2020). The impact of the physical

attractiveness and intellectual competence on loyalty.

Sustainability (Switzerland), 12(10).

https://doi.org/10.3390/SU12103970

Smith, J., 1998. The book, The publishing company.

London, 2

nd

edition.

Customer Loyalty Business Model during the Covid-19 Pandemic: A Case Study on Bank Syariah Indonesia Post-Merger

407