The Effects of Perceived Usefulness and Perceived Ease of Use on the

Use of “ShopeePay” E-Wallet Application

Ade Wulan Suri and Muhammad Ramadhan Slamet

Department of Business Management, Politeknik Negeri Batam, Jl.Ahmad Yani, Batam, Indonesia

Keywords: Perceived usefulness, perceived ease of use, use of ShopeePay, TAM.

Abstract: Many factors influence a person in using the ShopeePay e-wallet. Therefore, this study aims to identify the

factors that influence the use of the ShopeePay e-wallet. Factors that influence include perceived usefulness

and ease of use based on the TAM (Technology Acceptance Model) theory. This research is a quantitative

study using primary data from questionnaires. The questionnaire was distributed to 100 respondents,

ShopeePay e-wallet users in Batam City who have used ShopeePay at least once. After testing the hypothesis

using multiple regression analysis on 100 respondents, it is known that there is a significant influence between

perceived usefulness and perceived ease of use toward the use of the ShopeePay e-wallet. This discovery is

expected to be used as reference material regarding the ShopeePay e-wallet application by the people of Batam

City.

1 INTRODUCTION

The increase in internet and mobile phone penetration

has encouraged financial technology companies to

develop payment systems, such as the use of e-wallet

(Syifa & Tohang, 2020). E-wallet is used by the public

as a non-cash payment instrument and is carried out

using smartphone, thus facilitating the transaction

process (Saputra, Rosiyadi, Gata, & Husain, 2019). In

using an e-wallet, users simply register themselves

through the e-wallet application they want to use

(Safarudin, Kusdibyo, & Senalasari, 2020). E-wallet

application provides services such as a virtual place to

store money, payments, withdrawals, transfers, and

promotional offers such as store coupons. In addition,

e-wallet application can also be used for transactions

in online and offline stores (Syifa & Tohang, 2020).

The various benefits provided by the e-wallet service

ultimately encourage consumers to use e-wallet

services (Sanawiri & Adroni, 2019).

In 2020, the number of e-wallet users in Indonesia

is increasing. Based on data analysis conducted by

iPrice and App Annie, there was an increase in e-

wallet transactions from 1.67 billion to 2.83 billion or

1

Accessible:

https://iprice.co.id/trend/insights/top-e-wallet-di-

indonesia-2020/

2

Accessible:

an increase of 70% from June 2019 to June 2020

1

.

One of the reasons is due to the COVID-19 pandemic

phenomenon which encourages people to use e-

wallet. The COVID-19 pandemic has directed people

to avoid activities that involve direct contact in

accordance with World Health Organization (WHO)

policies, such as payment processing (Aji, Berakon,

& Husin, 2020). E-wallet as a digital payment tool is

a platform that complies with the social distancing

protocol set by the government to avoid the spread of

COVID-19. This is because when transacting using e-

wallet we will avoid physical contact and long queues

(Revathy & Balaji, 2020).

One of the e-wallets with the highest transaction

volume during the pandemic is ShopeePay. Based on

research conducted by Snapcart in the June-August

2020 period, ShopeePay ranked first in terms of

transaction value which was 34%, beating OVO,

DANA, GoPay, and LinkAja. ShopeePay is also

recorded as having the highest number of users with

a percentage of 68%

2

. ShopeePay itself is an e-wallet

created to facilitate Shopee e-commerce transactions

(Junadi & Sfenrianto, 2015). Based on research

conducted by iPrice and App Annie, Shopee is the e-

https://databoks.katadata.co.id/datapublish/2020/09/09/sho

peepay-kalahkan-ovo-gopay-saat-pandemi-corona

388

Wulan Suri, A. and Ramadhan Slamet, M.

The Effects of Perceived Usefulness and Perceived Ease of Use on the Use of “ShopeePay” E-Wallet Application.

DOI: 10.5220/0010934800003255

In Proceedings of the 3rd International Conference on Applied Economics and Social Science (ICAESS 2021), pages 388-398

ISBN: 978-989-758-605-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

commerce with the highest number of visitors in the

fourth quarter of 2019 to the second quarter of 2020

3

.

Results of a survey conducted by YouGov

BrandIndex for January 1, 2019 until December 31,

2019, also showed Shopee is positioned on both the

brand most recommended among the 717 brand.

Shopee earned a percentage of 87.6% alongside

Garuda Indonesia at 90.2% in the first position, and

Samsung at 86.8% in the third position. That said,

Shopee is the highest ranked e-commerce on the list

4

.

The popularity of Shopee's e-commerce ultimately

contributed to the use of ShopeePay, which is the

payment instrument for that e-commerce.

Based on the Technology Acceptance Model

(TAM) theory, there are two fundamental factors that

influence users in using a system such as e-wallet,

namely perceived usefulness and perceived ease of

use (Davis, 1989). Perceived usefulness can be said

as the benefits that consumers will get when using an

e-wallet. These benefits consist of easy to transacting,

increasing productivity, increasing effectiveness, and

providing benefits when transacting. Meanwhile,

perceived ease of use is formed from the easiness that

consumers felt when using e-wallet, such as easy to

learn, easy to obtain, easy to understand, easy to use

when transacting, and easy to access anywhere

(Isrososiawan, Hurriyati, & Dirgantari, 2019). So it is

known that the use of e-wallet is influenced by factors

such as perceived usefulness and perceived ease of

use (Kusuma & Syahputra, 2020; Pertiwi, Suprapto,

& Pratama, 2020; Saraswati & Purnamawati, 2020;

Munoz-Leiva, Climent-Climent, & Liebana-

Cabanillas, 2016; and Deb & David, 2014).

Previous research related to the effect of

perceived usefulness on the use of e-wallet has been

done before. Isrososiawan, Hurriyati, & Dirgantari

(2019) in their research show that perceived

usefulness has a significant influence on the use of e-

wallet applications. This is because users will get

many benefits when using the e-wallet application for

transactions, so the higher the benefits, the higher the

e-wallet application users. Similar results were found

in previous research, that perceived usefulness has a

significant effect on the use of e-wallet (Kusuma &

Syahputra, 2020; Pertiwi, Suprapto, & Pratama,

2020; Saraswati & Purnamawati, 2020; Chawla &

Joshi, 2019; Munoz-Leiva, Climent-Climent, &

Liebana-Cabanillas, 2016; and Deb & David, 2014).

Different results are shown in Fong's (2016) that

perceived usefulness does not have a significant

effect on the use of e-wallet. This is because the

3

Accessible:

https://iprice.co.id/insights/mapofecommerce/

4

Accessible:

various benefits offered by the e-wallet application

are considered to have no significant added value for

consumers. The difference results of previous studies

and Fong's (2016) study shows that there are

inconsistent results regarding the effect of perceived

usefulness with the use of e-wallet. In addition, this

finding contradicts the TAM theory which reveals

that perceived usefulness is a fundamental factor that

influences the use of the system (Davis, 1989).

Research related to the effect of perceived ease of

use on the use of e-wallet has also been carried out.

Isrososiawan, Hurriyati, & Dirgantari (2019) showed

a significant influence between perceived ease of use

on the use of e-wallet. Perceived ease of use is defined

as the ease of using the e-wallet application, which if

it is easier to use, the customer interest in using the e-

wallet application will be higher (Saraswati &

Purnamawati, 2020). Other research by Kusuma &

Syahputra (2020); Pertiwi, Suprapto, & Pratama

(2020); Munoz-Leiva, Climent-Climent, & Liebana-

Cabanillas (2016); and Deb & David (2014) also

show similar results, that perceived ease of use has a

significant influence on the use of e-wallet.

Differences in results were found in the studies of

Chawla & Joshi (2019) and Fong (2016), related to

factors that influence the use of e-wallet. This study

shows that there is no significant relationship between

perceived ease of use and the use of e-wallet.

Perceived ease of use is known to have an indirect

relationship with the intention to use e-wallet, which

is mediated by perceived usefulness. This is because

the ease of using an e-wallet will not be useful if

customers perceive it as a valueless benefit (Aji,

Berakon, & Riza, 2020). The difference in results

found by Chawla & Joshi (2019) and Fong (2016),

contradict the TAM theory, it also illustrates the

inconsistency of results related to testing the effect of

perceived ease of use on the use of e-wallet.

Referring to the research of Isrososiawan,

Hurriyati, & Dirgantari (2019) which tested the effect

of perceived usefulness and perceived ease of use on

the DANA e-wallet application for postgraduate

students at the Universitas Pendidikan Indonesia, this

research is a form of replication of that research.

Similar to this study, this study uses Davis (1989)

Technology Acceptance Model (TAM) to determine

the use of the ShopeePay e-wallet. This study also

uses perceived usefulness and perceived ease of use

as independent variables. However, unlike the

research of Isrososiawan, Hurriyati, & Dirgantari

(2019), this study uses the dependent variable of

http://www.brandindex.com/ranking/indonesia/recommen

d

The Effects of Perceived Usefulness and Perceived Ease of Use on the Use of “ShopeePay” E-Wallet Application

389

ShopeePay e-wallet usage, namely the e-wallet with

the highest number of users and transaction values in

Indonesia. This research is aimed at the people of

Batam City who use ShopeePay. This was due to an

increase in transactions (244%) and users (1.12%) of

electronic money both server or card-based in the first

quarter - second quarter of 2020 in the Riau Islands.

In addition, there was an increase in the number of

traders using the Quick Response Indonesian

Standard (QRIS) that reach 35,983 in June 2020, with

28,476 in Batam

5

. This was triggered by the people of

Batam City, which 80% already used the internet in

2017

6

.

Based on the explanation above, this study aims

to identify the effect of perceived usefulness and

perceived ease of use on the use of the ShopeePay e-

wallet application. This is because there are many

factors that influence the use of e-wallet, and the main

factors of this use are actually difficult to study

(Susilo, Prabowo, Pustikaningsih, & Samlawi, 2019).

This was proven by several previous studies which

showed an insignificant effect of perceived

usefulness and perceived ease of use on the use of e-

wallet, contrary to the TAM theory. This study was

conducted to re-examine that perceived usefulness

and perceived ease of use have a significant effect on

the use of e-wallet. Researchers formulate several

problems. First, perceived usefulness has a significant

effect on the use of ShopeePay e-wallet. Second,

whether perceived ease of use has a significant effect

on the use of ShopeePay e-wallet. This research is

expected to provide benefits, both in the development

of knowledge related to TAM theory and as a

reference regarding the use of ShopeePay e-wallet

application by the people of Batam City.

2 LITERATURE REVIEW AND

HYPOTHESIS

2.1 Literature Review

2.1.1 Technology Acceptance Model (TAM)

TAM was first proposed by Davis (1986) as an

adaptation of Theory of Reasoned Action (TRA)

(Fishbein, Ajzen, & Flanders, 1975). Davis (1986)

explains the concept of TAM aims to develop and test

5

Accessible:

https://www.bi.go.id/id/publikasi/kajian-ekonomi-

regional/kepri/Pages/Laporan-Perekonomian-Provinsi-

Kepulauan-Riau-Agustus-2020.aspx

6

Accessible:

a theoretical model related to the effect of system

characteristics on the acceptance of technology-based

information systems. TAM believes that perceived

usefulness and perceived ease of use are two

fundamental factors that stimulate consumers in using

technology systems (Davis, 1989 and Venkatesh &

Davis, 2000). In addition, the model illustrates that

external factors (system characteristics), internal

beliefs (perceived usefulness and perceived ease of

use), attitudes, behavioural intentions, and usage,

influence each other (Davis, Bagozzi, & Warshaw,

1989).

Davis (1986) explains that external factors in

TAM directly affect perceived usefulness and

perceived ease of use, but have an indirect effect on

attitudes or behaviour. Perceived usefulness and

perceived ease of use are the two main factors that

influence customer attitudes in using a system. In

addition to influencing customer attitudes, perceived

ease of use also affects perceived usefulness. This is

because an easy-to-use system will improve

performance, resulting in an increase in the benefits

or usability of the system. Therefore, external factors

will affect perceived usefulness indirectly through

perceived ease of use. Perceived usefulness and usage

attitudes will then influence behavioural intentions to

use the system, which in turn will determine whether

consumers actually use the system or not.

2.1.2 Perceived Usefulness

Perceived usefulness is defined as the extent to which

a person believes that using a particular system will

improve their work performance or productivity level

(Davis, 1989). Perceived usefulness consists of easy

to transaction, increased productivity in transactions,

increased effectiveness in transactions, useful in

conducting transactions, and providing more benefits

in transactions (Isrososiawan, Hurriyati, &

Dirgantari, 2019).

2.1.3 Perceived Ease of Use

Perceived ease of use is defined as the extent to which

a person believes that using a particular system will

reduce the effort expended when carrying out an

activity (Davis, 1989). Perceived ease of use consists

of ease of learning applications, ease of getting

applications, ease of understanding applications, ease

https://mediacenter.batam.go.id/arsip/berita-pengguna-

internet-indonesia-umumnya-untuk-media-sosial.html

ICAESS 2021 - The International Conference on Applied Economics and Social Science

390

of use when transacting, and ease of access

(Isrososiawan, Hurriyati, & Dirgantari, 2019).

2.1.4 Use of E-Wallet

The use of e-wallet can be interpreted as a customer's

actions in owning, maintaining, and using an e-wallet

application in transactions (Singh, Srivastava, &

Sinha, 2017). There are factors that influence

customers to have financial technology applications

such as e-wallet, including perceived ease of use and

perceived usefulness (Amin, Azhar, Amin, & Akter,

2015). Perceived usefulness and perceived ease of use

are theoretically believed to be fundamental

determinants in the use of e-wallet applications

(Davis, 1989). In addition to these two factors, there

are also characteristics in the use of e-wallet

applications consisting of mobility, reachability,

compatibility, and convenience (Isrososiawan,

Hurriyati, & Dirgantari, 2019; and Kim,

Mirusmonov, & Lee, 2010).

2.2 Hypothesis

2.2.1 Perceived Usefulness and ShopeePay

E-Wallet Usage

Consumers believe that using an e-wallet application

will increase their productivity in carrying out daily

activities, assist in increasing performance

effectiveness, and greatly assist in transactions.

Consumers who believe that by using an e-wallet they

will get these benefits, they will intend to use an e-

wallet application (Kustono, Nanggala, & Mas'ud,

2020). Therefore, it can be said that the higher the

perceived usefulness, the higher the use of e-wallet

applications (Saraswati & Purnamawati, 2020 and

Pertiwi, Suprapto, & Pratama, 2020). This is in line

with the research of Isrososiawan, Hurriyati, &

Dirgantari (2019) which found that perceived

usefulness has a significant influence on the use of e-

wallet. Similar results were found in other studies

related to factors that influence the use of e-wallet,

that there is a significant influence between perceived

usefulness on the use of e-wallet (Kusuma &

Syahputra, 2020; Pertiwi, Suprapto, & Pratama,

2020; Saraswati & Purnamawati, 2020; Chawla &

Joshi, 2019; Munoz-Leiva, Climent-Climent, &

Liebana-Cabanillas, 2016; and Deb & David, 2014).

Based on Technology Acceptance Model (TAM)

which examines the acceptance model of computer-

based information systems, that external factors

(system characteristics), internal beliefs (perceived

usefulness and perceived ease of use), attitudes,

behavioural intentions, and usage, influence each

other (Davis, Bagozzi, & Warshaw, 1989). Davis

(1989) explained that perceived usefulness or benefits

of a system such as an e-wallet in helping work is a

driving force for consumers to use the application.

This is because in deciding to use or not to use a

system, consumers believe that the capabilities or

benefits provided by the system in helping work are

important. Based on this statement, the following

hypotheses can be drawn:

H1: Perceived usefulness has a significant effect on

the use of ShopeePay e-wallet.

2.2.2 Perceived Ease of Use and ShopeePay

E-Wallet Usage

In the context of using technology such as e-wallet,

perceived ease of use is an important factor, because

the purpose of using technology is as a solution to

make it easier for us to do activities (Syifa & Tohang,

2020). This convenience then creates a good

perception, thus encouraging users to increasingly use

e-wallet applications as a means of payment

(Sanawiri & Adroni, 2019). This is because the higher

the perceived ease of use, the higher the use of e-

wallet applications (Saraswati & Purnamawati, 2020

and Pertiwi, Suprapto, & Pratama, 2020). This

statement is in line with the research of Isrososiawan,

Hurriyati, & Dirgantari (2019) which found that

perceived ease of use has a significant influence on

the use of e-wallet. Similar results were found in other

studies related to factors that influence the use of e-

wallet, that there is a significant influence between

perceived ease of use on the use of e-wallet (Kusuma

& Syahputra, 2020; Pertiwi, Suprapto, & Pratama,

2020; Saraswati & Purnamawati, 2020; Munoz-

Leiva, Climent-Climent, & Liebana-Cabanillas,

2016; and Deb & David, 2014).

Based on the Technology Acceptance Model

(TAM) which examines the acceptance model of

computer-based information systems, external factors

(system characteristics), internal beliefs (perceived

usefulness and perceived ease of use), attitudes,

behavioural intentions, and use, influence each other

(Davis, Bagozzi, & Warshaw, 1989). Davis (1989)

explained that perceived ease of use or ease in using

systems such as e-wallet to carry out the functions

provided is a driving force for consumers to use the

system. This is because although consumers believe

the system has many benefit, consumers must also

believe that the system is easy to use so that the effort

they spend on using the system is in accordance with

The Effects of Perceived Usefulness and Perceived Ease of Use on the Use of “ShopeePay” E-Wallet Application

391

the benefits that will be obtained. Based on this

statement, the following hypotheses can be drawn:

H2: Perceived ease of use has a significant effect on

the use of ShopeePay e-wallet.

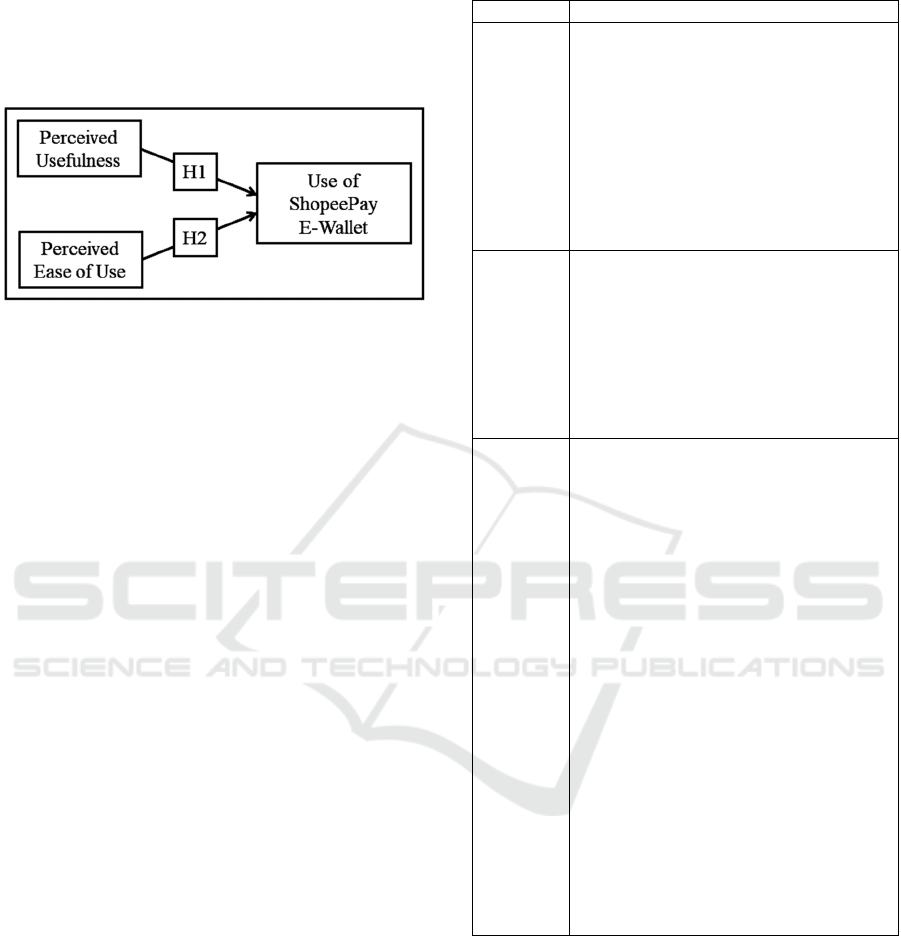

Figure 1: Research Model.

3 RESEARCH METHODS

This study uses a quantitative method approach that

is proven to be able to use to examine factors in the

use of e-wallet, and has been widely used in similar

studies (Kusuma & Syahputra, 2020).

3.1 Data Types and Source

This research data is primary data obtained from

survey through a web-based questionnaire which is a

form of adoption from the research of Isrososiawan,

Hurriyati, & Dirgantari (2019). The using of

questionnaire as a research instrument is because the

questionnaire is able to provide data regarding the

reasons why customers use e-wallet in detail, at once

in large quantities, and can be designed according to

what the researcher wants (Sinha, Majra, Hutchins, &

Saxena, 2018). The questionnaire in this study used a

likert scale measurement, or interval data (Lind,

Marchal, & Wathen, 2012). The following are the

indicator variables used in the preparation of the

questionnaire.

Table 1: Indicator Variable.

Variable Indicators

Perceived

usefulness

(1) ShopeePay makes transactions easy.

(2) ShopeePay increases the productivity

in transactions.

(3) ShopeePay increases effectiveness in

transactions.

(4) ShopeePay is useful in conducting

transactions.

(5) ShopeePay providing more benefits

in transactions.

(Isrososiawan, Hurriyati, & Dirgantari,

2019

)

Perceived

ease of use

(1) ShopeePay is easy to learn.

(2) ShopeePay is easy to obtain.

(3) ShopeePay is clear an easy to

understand.

(4) ShopeePay is easy to use in

transactions.

(5) ShopeePay is easy to acces anywhere.

(Isrososiawan, Hurriyati, & Dirgantari,

2019

)

Use of

ShopeePay

e-wallet

Mobility

(1) ShopeePay usable anytime.

(2) ShopeePay usable anywhere.

(3) ShopeePay usable when travelling.

Reachability

(1) ShopeePay can be accessed with

smartphone.

(2) ShopeePay payment can be done

outside of ShopeePay’s partner.

Compatibility

(1) ShopeePay adaptable to existing

technology.

(2) ShopeePay adaptable to daily

activities.

Convenience

(1) ShopeePay is convenient to use

because users often use smartphone.

(2) ShopeePay is convenient to use

because it can be used in various

conditions.

(3) ShopeePay is convenient to use

because it is not difficult to use.

(Isrososiawan, Hurriyati, & Dirgantari,

2019

)

3.2 Location and Objects

The location and the object of this study is user of e-

wallet ShopeePay in Batam. The reason for choosing

the location is due to the phenomenon of an increase

in transaction value and electronic money users, both

server-based and card-based, as well as an increase in

merchants using QRIS in Batam City. Furthermore,

the reason for choosing ShopeePay users is because

the number of users and the transaction value of e-

wallet ShopeePay is the largest in Indonesia.

ICAESS 2021 - The International Conference on Applied Economics and Social Science

392

3.3 Sample

Sample collected is 100 samples, which is determined

using the Lemeshow technique (Lemeshow, Hosmer

Jr., Klar, and Lwanga, 1990). The sampling technique

is convenience sampling, with ShopeePay e-wallet

users in Batam City who have transacted using

ShopeePay at least once as criteria.

3.4 Data Analysis Technique

The data obtained from the questionnaire was then

processed using MS. Excel and SPSS version 22 for

further analysis. This study uses descriptive and

statistical data analysis techniques. The descriptive

analysis carried out includes an explanation of the

results of the processed data so that it is easier to

understand. The statistical analysis carried out

includes a test of the effect with multiple linear

regressions. However, before that, the instrument was

tested for validity and reliability. In addition, the

classic assumption test was also carried out, such as

normality, multicollinearity, and heteroscedasticity

tests. The multiple linear regression equation formed

is as follows:

Y = a +

b

1X1 +

b

2X 2 + e (1)

Information:

Y = ShopeePay e-wallet usage

A = Constant

b1 = Estimated coefficient of perceived usefulness

b2 = Estimated coefficient of perceived ease of use

X1 = Perceived usefulness

X2 = Perceived ease of use

Multiple linear regressions have a provision that

if the value of X (perceived usefulness and perceived

ease of use) is equal to zero, then the value of Y (use

of ShopeePay e-wallet) will increase or decrease by a

(constant). In addition, if the value of X1 (perceived

usefulness) increases by one unit while the value of

the other variable (perceived ease of use) remains,

then the value of Y (use of ShopeePay e-wallet) will

increase or decrease by b1 (estimated coefficient of

perceived usefulness). The same provisions occur in

X2 (perceived ease of use).

In addition, multiple linear regressions can show

the effect of the independent variable on the

dependent variable whether it is significant or not. If

the t

count

> t

table

(1.66) or the significance value < α, it

can be said that the influence of the independent

variables perceived usefulness and perceived ease of

use is significant toward the dependent variable the

ShopeePay e-wallet usage, and vice versa. Analysis

of coefficient of determination is also done by

looking at that result, especially the value of Adjusted

R Square. Because it is known that the use of e-wallet

can be explained by perceived usefulness and

perceived ease of use by the percentage value of

Adjusted R Square, while the remaining percentage

value represents by other factors (Isrososiawan,

Hurriyati, & Dirgantari, 2019; Ariawaty & Evita,

2018 and Lind, Marchal, & Wathen, 2012) .

4 RESULT

4.1 Respondent Characteristic

Based on the results of 100 questionnaires which have

been collected, the respondents had the following

characteristics as seen in the table below.

Table 2: Respondent Characteristic.

Characteristic Frequenc

y

Percentage

Age :

11-20

21-30

31-40

41-50

23

76

1

2

23%

76%

1%

2%

Gander :

Woman

Man

89

11

89%

11%

Income :

< 2 million

2 million -5 million

5 million - 10 million

> 10 million

67

18

12

3

67%

18%

12%

3%

Profession :

Private employee

Civil servant

College students

Others

25

3

59

13

25%

3%

59%

13%

First use :

2018

2019

2020

17

39

44

17%

39%

44%

Information

acquisition:

Brochure

Advertising

Exhibition

Others

3

40

8

49

3%

40%

8%

49%

Purchasing

determinants :

Self

Friends

Parents

Others

70

24

1

5

70%

24%

1%

5%

The Effects of Perceived Usefulness and Perceived Ease of Use on the Use of “ShopeePay” E-Wallet Application

393

Based on Table 2 above, it is known that most

respondents who filled out the questionnaire were in

the age range of 21-30 years with a percentage of

76%. Meanwhile, in terms of gender, female

respondents dominated with 89%. Meanwhile, in

terms of income, respondents with an average

monthly income of less than Rp2 million got the

highest percentage gain, which was 67% compared to

others. Based on profession, respondents were

dominated by college students with a percentage of

59%. In addition, in terms of when the respondent

first used the ShopeePay e-wallet, most respondent

first use it in 2020, which was represented by 44%.

Furthermore, it is also known that respondents obtain

ShopeePay information from other factors apart from

brochures, advertisements, or exhibitions. This proofs

by 49% result. Finally, the determinant of purchasing

with ShopeePay e-wallet dominates by their own will

with a percentage of 70%.

4.2 Instrumentation Test

4.2.1 Validity Test

Validity test can be done to test the measurement

accuracy of an instrument. Validity test is done by

looking at the r

counts

value and r

table.

If r

counts

> r

table

(0,1654) then the instrument is said to be valid

(Sanawiri & Adroni, 2019) .

Table 3: Validity Test Result.

Variable Ite

m

r

counts

r

table

Result

Perceived

usefulness

(PU)

PU1 0,821 0,1654 Vali

d

PU2 0,688 0,1654 Vali

d

PU3 0,842 0,1654 Vali

d

PU4 0,798 0,1654 Vali

d

PU5 0,742 0,1654 Vali

d

Perceived

ease of

use

(PEOU)

PEOU1 0,831 0,1654 Vali

d

PEOU2 0,746 0,1654 Vali

d

PEOU3 0,889 0,1654 Vali

d

PEOU4 0,702 0,1654 Vali

d

PEOU5 0,748 0,1654 Vali

d

Usage

(KP)

KP1 0,808 0,1654 Vali

d

KP2 0,752 0,1654 Vali

d

KP3 0,787 0,1654 Vali

d

KP4 0,573 0,1654 Vali

d

KP5 0,764 0,1654 Vali

d

KP6 0,654 0,1654 Vali

d

KP7 0,781 0,1654 Vali

d

KP8 0,699 0,1654 Vali

d

KP9 0,750 0,1654 Vali

d

KP10 0,789 0,1654 Vali

d

Based on Table 3, it is known that the questions

on the perceived usefulness variable are said to be

valid. This is proven by the value of r

counts

from the

results of data processing using SPSS, that the five

questions related to the perceived usefulness variable

have an r

counts

value that is greater than r

table.

The same

thing was obtained for the questions related to the

perceived ease of use variable. The five questions

about the perceived ease of use variable obtained a

r

counts

value that is greater than the r

table.

Therefore, the

five questions on the perceived ease of use variable

are said to be valid. Likewise with the questions on

the ShopeePay e-wallet usage variable, the results

show that the ten questions were tested valid. Because

the r

counts

results obtained for the ten questions are

greater than the r

table

. Because based on the previous

explanation, if r

counts

> r

table

(0,1654) then the question

used from the instrument is said to be valid.

4.2.2 Reliability Test

Reliability testing is used to determine whether the

measuring instrument's ability is consistent, can be

trusted, and reliable. This study used Cronbach's

Alpha technique to test it. If Cronbach's Alpha > 0.60

then the data generated from the research instrument

is said to be reliable (Sanawiri & Adroni, 2019).

Table 4: Reliability Test Result.

Variable

Cronbach’s

Alpha

Alpha

Result

PU 0,832

0,60

Reliable

PEOU 0,845 Reliable

KP 0,903 Reliable

Based on Table 4, it is known that Cronbach's

Alpha of perceived usefulness variable is 0.832,

perceived ease of use is 0.845, and the use of

ShopeePay e-wallet is 0.903. The three Cronbach's

Alpha values were proven to be greater than 0.6, so it

can be concluded that the questions from the

questionnaires posed to respondents as instruments in

this study were tested to be reliable.

4.3 Classic Assumption Test

4.3.1 Normality Test

To find out if the data is normally distributed or not,

it is necessary to do a normality test. The classical

assumption will be fulfilled if the data is normally

distributed. A data is said to be normally distributed

if it meets the terms of a significance value > α (0.1)

(Duli, 2019).

ICAESS 2021 - The International Conference on Applied Economics and Social Science

394

Table 5: Normality Test Result.

As

y

m

p

.Si

g

.

(

2-tailed

)

Al

p

ha

0,200 0,1

Based on Table 5, the results of the normality test

using Kolmogrof-Smirnov on SPSS obtained

Asymp.Sig. of 0.200. So it is known that the

significance value > α, or 0.200 > 0.1. Therefore, it

can be concluded that the tested data were normally

distributed.

4.3.2 Multicollinearity Test

This test is conducted to determine whether there is a

linear relationship between the independent variables

and the regression model. The classical assumption

will be fulfilled if it is free from multicollinearity or

there is no relationship between the independent

variables and the regression model. This will be

achieved if VIF < 10 or the tolerance > 0.1 (Ariawaty

& Evita, 2018 and Lind, Marchal, & Wathen, 2012).

Table 6: Multicollinearity Test Result.

Variable Tolerance VIF

PU 0,675 1,482

PEOU 0,675 1,482

Based on Table 6, it is known that the tolerance

value of the perceived usefulness and perceived ease

of use variables is 0.675, respectively. This shows

that perceived usefulness and perceived ease of use

have a tolerance value > 0.1 or 0.675 > 0.1. In

addition, it is also known that the VIF value of the

perceived usefulness and perceived ease of use

variables is 1.482, respectively. This shows that

perceived usefulness and perceived ease of use have

a VIF value (1.482) < 10. So it can be concluded that

the independent variables perceived usefulness and

perceived ease of use do not have a linear relationship

with the regression model or can be said free from

multicollinearity.

4.3.3 Heteroscedasticity Test

This test is carried out to determine whether there is a

variance inequality from the residuals on all tests or

to determine the presence of heteroscedasticity

deviations. The classical assumption is fulfilled if the

linear regression is free from heteroscedasticity with

conditions that the significance value is > α (0.1)

(Isrososiawan, Hurriyati, & Dirgantari, 2019).

Table 7: Heteroscedasticity Test Result.

Variable Si

g

Al

p

ha

PU 0,320

0,1

PEOU 0,425

Based on Table 7, it is known that the significance

value of the perceived usefulness and perceived ease

of use variables from the results of data processing

using SPSS is 0.320 and 0.425, respectively. This

shows that perceived usefulness has a significance

value > α, or 0.320 > 0.1. The same thing happened

to the perceived ease of use which also had a

significance value > α, or 0.425 > 0.1. So it can be

concluded that in the regression model there is no

heteroscedasticity deviation.

4.4 Hypothesis Test

Table 8: Multiple Linear Regression Test Result.

Variable

Unst

d. B

Std.

Coeff.

Beta

t Sig.

Adj. R

square

Constant 9,55

7

2,82

9

0,006

0,508

PU 0,50

3

0,246 2,86

1

0,005

PEOU 1,03

1

0,551 6,41

4

0,000

Based on Table 8, it is known that the multiple linear

regression equation formed is as follows:

Y = 9,557 + 0,246X1 + 0,551X1 + e (2)

The equation above shows that the constant value

is 9.557. This can be interpreted if the value of the

perceived usefulness and perceived ease of use

variables is equal to zero, then the value of the

ShopeePay e-wallet usage variable will increase by

9.557. The equation above also shows that if the value

of X1 (perceived usefulness) increases by one unit,

while the value of the other variable (perceived ease

of use) remain, then the value of Y (use of ShopeePay

e-wallet) will increase by 0.246. Likewise, if there is

an increase of one unit in X2 (perceived ease of use),

while the value of the other variable (perceived

usefulness) remains, thus the value of Y (use of

ShopeePay e-wallet) will increase by 0.551. Table 8

also shows the Adjusted R Square value of 0.508 or

50.8%. This shows that the use of ShopeePay e-wallet

is influenced by the perceived usefulness and

perceived ease of use by 50.8%. Meanwhile, the rest

49.2% is influenced by other factors.

The Effects of Perceived Usefulness and Perceived Ease of Use on the Use of “ShopeePay” E-Wallet Application

395

4.4.1 Perceived Usefulnes on the Use of

ShopeePay E-Wallet

Table 8 shows how much influence perceived

usefulness has on the use of ShopeePay e-wallet. It

can be seen from the t value of 2.861 and the

significance value of 0.005. This value can be

interpreted that perceived usefulness has a t

counts

> t

table

or 2.861 > 1.66, and a significance value < α, or 0.005

< 0.1. So it can be concluded that perceived

usefulness has a significant effect on the use of

ShopeePay e-wallet, which means that H1 is

supported.

4.4.2 Perceived Ease of Use on the Use of

ShopeePay E-Wallet

Table 8 shows how much influence the perceived

ease of use has on the use of the ShopeePay e-wallet.

It can be seen from the t value of 6.414 and the

significance value of 0.000. This value can be

interpreted that the perceived ease of use has a value

of t

counts

> t

table

or 6.414 > 1.66, and a significance

value < α, or 0.000 < 0.1. So it can be concluded that

perceived ease of use has a significant influence on

the use of ShopeePay e-wallet, which means H2 is

supported.

4.5 Data Analysis

4.5.1 Perceived Usefulness on ShopeePay’s

E-Wallet Usage

Perceived usefulness has a significant influence on

the use of ShopeePay e-wallet, as proven by the t

counts

value of 2.861 > 1.66, and a significance value of

0.005 < 0.1. These results are in accordance with the

TAM (Technology Acceptance Model) theory which

explained that perceived usefulness is one of the

fundamental factors that drive the use of a system. In

TAM theory, Davis (1989) explains that the

perceived usefulness or benefits of a system in

helping work, as well as the benefits contained in e-

wallet, is a driving force for consumers to use the

application. That's because in deciding to use or not

to use a system, consumers believe that the

capabilities or benefits provided by the system in

helping work are important.

This also indicates that factors such as easy to

transactions, increased productivity in transactions,

increased effectiveness in transactions, useful in

conducting transactions, and provide more benefits in

transactions, are able to increase or encourage

consumers to use the ShopeePay e-wallet. Thus, it is

evident that perceived usefulness has a significant

influence on the use of the ShopeePay e-wallet. This

statement indicates that the purpose of this research

related to the identification of factors that influence

the use of ShopeePay e-wallet and the effect of

perceived usefulness on the use of ShopeePay e-

wallet is fulfilled.

The results of hypothesis testing in this study are

in line with the research of Isrososiawan, Hurriyati, &

Dirgantari (2019) which found that perceived

usefulness has a significant influence on the use of e-

wallet. Similar results were found in other studies

related to factors that influence the use of e-wallet,

that there is a significant influence between perceived

usefulness on the use of e-wallet (Kusuma &

Syahputra, 2020; Pertiwi, Suprapto, & Pratama,

2020; Saraswati & Purnamawati, 2020; Chawla &

Joshi, 2019; Munoz-Leiva, Climent-Climent, &

Liebana-Cabanillas, 2016; and Deb & David, 2014).

4.5.2 Perceived Ease of Use on ShopeePay’s

E-Wallet Usage

Perceived ease of use has a significant influence on

the use of ShopeePay e-wallet, as proven by the t

counts

value of 6.414 > 1.66, and a significance value of

0.000 < 0.1. These results are in accordance with the

TAM (Technology Acceptance Model) theory which

explained that perceived ease of use is one of the

fundamental factors that encourage the use of a

system. In TAM theory, Davis (1989) explains that

ease of use in carrying out the functions of a system,

such as e-wallet, is a factor that encourages

consumers to use the system. This is because,

although consumers believe that the system is useful

in helping their work, consumers must also believe

that the system is easy to use so that the effort they

spend on using the system is in accordance with the

benefits that will be obtained.

In addition, the results also show that there are

several convenience factors that affect the use. These

convenience factors include ease of learning the

application, ease of getting applications, ease of

understanding the application, ease of use when

transacting, and ease of access, have an influence on

increasing or encouraging consumers to use the

ShopeePay e-wallet. So it is proven that perceived

ease of use has a significant influence on the use of

ShopeePay e-wallet. These results are in accordance

with the purpose of this study, which is to identify

factors that influence the use of ShopeePay e-wallet

and the effect of perceived ease of use on the use of

ShopeePay e-wallet.

ICAESS 2021 - The International Conference on Applied Economics and Social Science

396

The results of the hypothesis test in this study are

in line with the research of Isrososiawan, Hurriyati, &

Dirgantari (2019) which found that perceived ease of

use had a significant effect on the use of e-wallet.

Similar results were also found in other studies

related to factors that influence the use of e-wallet,

that there is a significant influence between perceived

ease of use on the use of e-wallet (Kusuma &

Syahputra, 2020; Pertiwi, Suprapto, & Pratama,

2020; Saraswati & Purnamawati, 2020; Munoz-

Leiva, Climent-Climent, & Liebana-Cabanillas,

2016; and Deb & David, 2014).

5 DISCUSSION AND

CONCLUSION

5.1 Conclusion

This study aims to examine the effect of perceived

usefulness and perceived ease of use on the use of

ShopeePay e-wallet in Batam City. Based on the

results of the analysis, there are several conclusions

that can be drawn such as:

(1) Perceived usefulness has a significant influence

on the use of e-wallet ShooeePay. Because

perceived usefulness is one of the fundamental

factors that encourage the use of systems such as

e-wallet, as stated in the TAM theory proposed by

Davis (1986). It is mean, the amount of benefits

or experienced which consumers felt later will

affect or encourage the use of ShopeePay e-wallet.

Some of the factors that encourage this are easy to

transactions, increased productivity in

transactions, increased effectiveness in

transactions, useful in conducting transactions,

and providing more benefits in transactions.

(2) Perceived ease of use has a significant influence

on the use of ShopeePay e-wallet, as stated by

Davis (1986) on TAM theory. It stated that

perceived ease of use is one of the fundamental

factors that encourage people to use systems such

as e-wallet. This is because the various

conveniences or experienced which consumers

felt will influence or encourage the use of

ShopeePay e-wallet. The primary factors include

the ease of learning the application, the ease of

getting the application, the ease of understanding

the application, the ease of use when transacting,

and the ease of access.

5.2 Implication

This study was conducted to identify the effect of

perceived usefulness and perceived ease of use on the

use of ShopeePay e-wallet. After doing research, it is

known that perceived usefulness and perceived ease

of use have a significant influence on the use of

ShopeePay e-wallet. These results are a form of using

the TAM theory in order to add insight for researchers

and readers, and are expected to be a reference

regarding the ShopeePay e-wallet usage of the people

in Batam City.

5.3 Limitation

The researcher realizes that in conducting this

research, there are still some limitations. First, there

are still many people in Batam City who have not

used the ShopeePay e-wallet, especially the people

closest to the researcher, so it takes quite a while to

collect questionnaire data. Second, the sample used is

limited to ShopeePay e-wallet users in Batam City,

thus allowing for differences in results if done using

samples outside Batam City. Third, the results of the

analysis using adjusted R square show that perceived

usefulness and perceived ease of use only represent

50.2% of the factors that influence the use of

ShopeePay e-wallet. While 49.8% is influenced by

other factors that the researchers did not examine in

this study.

5.4 Suggestion

Based on the limitations described, the researcher

suggests several things that can be used as a reference

in further research. First, using a sample that is not

only limited to ShopeePay e-wallet users in Batam

City. Second, develop or add the variables using the

latest theories to represent 49.8% of other factors that

might influence the use of ShopeePay e-wallet in

Batam City. Third, examine more deeply factors that

are the reasons consumers using ShopeePay e-wallet

by conducting direct interviews with consumers.

REFERENCES

Aji, H. M., Berakon, I., & Husin, M. M. (2020). COVID-

19 and e-wallet usage intention: A multigroup analysis

between Indonesia and Malaysia. Cogent Business &

Management.

Aji, H. M., Berakon, I., & Riza, A. F. (2020). The effect of

subjective norm and knowledge about riba on intention

The Effects of Perceived Usefulness and Perceived Ease of Use on the Use of “ShopeePay” E-Wallet Application

397

to use e-money in Indonesia. Journal of Islamic

Marketing.

Amin, M. K., Azhar, A., Amin, A., & Akter, A. (2015).

Applying the Technology Acceptance Model in

examining Bangladeshi consumers’ behavioral

intention to use Mobile Wallet: PLS-SEM Approach.

18th International Conference on Computer

Information Technology (ICCIT) (pp. 93-98). Dhaka:

IEEE Explore.

Annur, C. M. (2020, September 09). ShopeePay Kalahkan

OVO & GoPay saat Pandemi Corona. Retrieved from

Databoks Web Site:

https://databoks.katadata.co.id/datapublish/2020/09/09

/shopeepay-kalahkan-ovo-gopay-saat-pandemi-corona

Ariawaty, R. N., & Evita, S. N. (2018). Metode Kuantitatif

Praktis. Bandung: PT Bima Pratama Sejahtera.

Bank Indonesia. (2020, 08 31). Laporan Perekonomian

Provinsi Kepulauan Riau Agustus 2020. Retrieved from

Bank Indonesia Web site:

https://www.bi.go.id/id/publikasi/kajian-ekonomi-

regional/kepri/Pages/Laporan-Perekonomian-Provinsi-

Kepulauan-Riau-Agustus-2020.aspx

Chawla, D., & Joshi, H. (2019). Consumer attitude and

intention to adopt mobile walet in India - An empirical

study. International Journal of Bank Marketing.

Davis, F. D. (1986). A Technology Acceptance Model for

Empirically Testing New End-User Information

Systems: Theory and Results. Cambridge:

Massachusetts Institute of Technology.

Davis, F. D. (1989). Perceived usefulness, Perceived ease

of use, and User Acceptance of Information

Technology. MIS Quarterly, 319-340.

Davis, F. D., Bagozzi, R. P., & Warshaw, P. R. (1989). User

Acceptance of Computer Technology: A Comparison

of Two Theoritical Models. Management Science, 982-

1003.

Deb, M., & David, E. L. (2014). An empirical examination

of customers’ adoption of m-banking in India.

Marketing Intelligence & Planning, 475-494.

Devita, V. D. (2020, August 12). E-wallet Lokal Masih

Mendominasi Q2 2019-2020. Retrieved from iPrice

Group Web Site: https://iprice.co.id/trend/insights/top-

e-wallet-di-indonesia-2020/

Duli, N. (2019). Metodelogi Penelitian Kuantitatif:

Beberapa Konsep Dasar untuk Penulisan Skripsi &

Analisis Data dengan SPSS. Yogyakarta: Deepublish.

Fishbein, M., Ajzen, I., & Flanders, N. A. (1975). Belief,

Attitude, Intention, and Behavior: An Introduction to

Theory and Research. Addison-Wesley Publishing

Company.

Fong, C. P. (2016). An investigation of mobile payment (m-

payment) services in Thailand. Asia-Pacific Journal of

Business Administration.

iPrice. (2020, July 21). Peta E-Commerce Indonesia.

Retrieved from iPrice Group Web Site:

https://iprice.co.id/insights/mapofecommerce/

Isrososiawan, S., Hurriyati, R., & Dirgantari, P. D. (2019).

Technology Acceptance Model (TAM) Toward

"DANA" E-wallet

Customer. Jurnal Minds:

Manajemen, Ide, Inspirasi, 181-192.

Junadi, & Sfenrianto. (2015). A Model of Factors

Influencing Consumer’s Intention To Use E-Payment

System in Indonesia. Procedia Computer Science, 214-

220.

Kim, C., Mirusmonov, M., & Lee, I. (2010). An empirical

examination of factors influencing the intention to use

mobile payment. Computers in Human Behavior, 310-

322.

Kustono, A. S., Nanggala, A. Y., & Mas’ud, I. (2020).

Determinants of the Use of E-wallet for Transaction

Payment among College Students. Journal of

Economics, Business, and Accountancy Ventura, 85-95.

Kusuma, A. P., & Syahputra. (2020). Pengaruh Persepsi

Kemudahan dan Persepsi Manfaat Terhadap Sikap

Penggunaan E-wallet di Kota Bandung 2020. Journal

of Applied Business Administration (JABA), 108-114.

Lemeshow, S., Hosmer Jr, D. W., Klar, J., & Lwanga, S. K.

(1990). Adequacy of Sample Size in Health Studies.

New York: John Wiley & Sons.

Lind, D. A., Marchal, W. G., & Wathen, A. S. (2012).

Statistical Techniques in Business and Economics. New

York: McGraw-Hill/Irwin.

Munoz-Leiva, F., Climent-Climent, S., & Liebana-

Cabanillas, F. (2016). Determinants of intention to use

the mobile banking apps: An extension of the classic

TAM model. Spanish Journal of Marketing - ESIC.

Pertiwi, D., Suprapto, W., & Pratama, E. (2020). Perceived

Usage of E-wallet among the Y Generation in Surabaya

Based on Technology Acceptance Model. Jurnal

Teknik Industri, 17-24.

Revathy, C., & Balaji, P. (2020). Determinants of

Behavioural Intention On E-wallet Usage: An

Empirical Examination In Amid of COVID-19

Lockdown Period. International Journal of

Management, 92-104.

Safarudin, A., Kusdibyo, L., & Senalasari, W. (2020).

Faktor-Faktor Pembentuk Loyalitas Generasi Z dalam

Menggunakan Financial Technology E-wallet.

Prosiding The 11th Industrial Research Workshop and

National Seminar (pp. 1073-1078). Bandung:

Politeknik Negeri Bandung.

Sanawiri, B., & Adroni, M. (2019). Pengaruh Persepsi

Konsumen dan Kepuasan Pengguna Terhadap

Pemakaian M-Wallet. JSMBI (Jurnal Sains Manajemen

Dan Bisnis Indonesia), 160-173.

Saputra, S. A., Rosiyadi, D., Gata, W., & Husain, S. M.

(2019). Analisis Sentimen E-wallet Pada Google Play

Menggunakan Algoritma Naive Bayes Berbasis

Particle Swarm Optimization. Jurnal RESTI (Rekayasa

Sistem dan Teknologi Informasi), 377-382.

Saraswati, P. D., & Purnamawati, I. A. (2020). Determinan

Minat Penggunaan E-wallet

Singh, N., Srivastava, S., & Sinha, N. (2017). Consumer

preference and satisfaction of M-wallets: a study on

North Indian consumers. International Journal of Bank

Marketing, 944-965.

Sinha, M., Majra, H., Hutchins, J., & Saxena, R. (2018).

Mobile payments in India: the privacy factor.

International Journal of Bank Marketing.

ICAESS 2021 - The International Conference on Applied Economics and Social Science

398