Compensation Impact on the Firm Performance of Indonesian

Insurance Companies Listed on the IDX

Cynthia Bella Soeryono and Winanda Wahana Warga Dalam

Managerial Accounting Study Program, Batam Polytechnics, Jl. Ahmad Yani, Batam Centre 29461, Indonesia

Keywords: Compensation, Profitability, Revenue Growth.

Abstract: The purpose of this study is to examine the effect of increasing employee’s compensation on firm performance

of insurance companies measured by profitability and revenue growth from both short-term and long-term

perspective. This study use purposive sampling method as a sampling technique and data archived to obtain

research sample that consisting 50 observations covering from 10 insurance firm listed in Indonesian Stock

Exchange from 2015-2019. The hypothesis testing is using panel data regression. The results show that in the

short-term increasing employee’s compensation has a negative effect on company performance measured by

company’s profitability, and in the long-term increasing employee’s compensation also has a negative effect

on company performance measured by company’s revenue growth. This study limits to using insurance

companies listed on the Indonesia Stock Exchange within 5 years as a sample.

1 INTRODUCTION

Human Resources (HR) play a role as one of the main

factors that support the company's operations.

According to Danish (2010) HR is the most important

thing among the existing resources in an organization,

therefore companies need to create an efficient and

experienced workforce, so companies can get more

competitive advantages and value-added. Company

performance is closely related to the work of

employees, thus success level that achieved by a

company is also determined by employees, therefore

company need a great human resources in order to

create a great company performance.

These conditions make HR or employees as

important asset in the company, so companies are

competing in creating competent and highly

dedicated human resources to the company. Human

Resources have needs, thoughts, feelings, and

expectations that must be considered by the company

in creating employee achievement, dedication, and

loyalty to their work and company. One of the modes

used by companies in improving the skills and

abilities of employees is to provide satisfactory

compensation (Elbadiansyah, 2019).

Compensation according to Sudaryo et al (2018)

is all rewards received by employees in return for

services they have provided, while Batjo & Shaleh

(2018) argue that wages or salaries and all forms of

awards given by the company to employees are

referred to as compensation. The purpose of

providing compensation according to Sudaryo et al

(2018) is to attract, motivate, and retain employees

and according to research by Kim & Jang (2020), the

compensation received by employees is also used to

support their daily life needs.

Rizal et al (2014) research shows that

compensation is an important role in improving

employee performance through increasing motivation

and strengthening organizational commitment. The

mismatch between business strategy and

performance-linked compensation (PLC) can harm

the company, so companies are advised to align the

compensation structure with strategy and other

contingency factors, because the match between

strategy and compensation structure will positively

affect the company's performance (Chen & Johnny,

2012). Supported by Gupta & Shaw (2014) research

which focuses on claims and statements related to

payment of wages for employee performance, it is

stated that the compensation system play an important

role for HR. Compensation is considered the most

powerful tool for designing successful HR

management, because compensation can be used to

shape employee behavior and increase company

effectiveness.

64

Bella Soer yono, C. and Wahana Warga Dalam, W.

Compensation Impact on the Firm Performance of Indonesian Insurance Companies Listed on the IDX.

DOI: 10.5220/0010934500003255

In Proceedings of the 3rd International Conference on Applied Economics and Social Science (ICAESS 2021), pages 64-71

ISBN: 978-989-758-605-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Regarding the problem of the compensation

system, Indonesia is still classified as one of the

countries that provide low salaries. Based on a survey

related to countries that provide high salaries,

obtained from Numbeo, the largest database on the

cost of living in the world, states that Indonesia

occupies the 93

rd

position out of 102 countries

recorded. Indonesia has various business sectors

including the insurance sector which is one of the

business sectors that provide the highest salary to its

employees according to the survey results from the

Statistics Indonesia.

Based on the descriptions above, researchers are

interested in examining the effect of compensation on

company performance in the short and long term. The

research sample was taken from insurance service

companies that were listed on the Indonesia Stock

Exchange from 2015 to 2019. Insurance companies

were used as research samples because the insurance

industry has an important role in supporting the

national development process and is a source of funds

for the development of the Indonesian state.

2 LITERATURE REVIEW

2.1 Equity Theory

Equity theory was first introduced by John Stacy

Adam in 1963. Equity theory is a theory about work

motivation cantered on a person's perception of

equality and fairness in their work. This theory states

that individuals tend to make comparisons of the

outcomes received with the inputs contributed to their

work, then the input-outcome comparisons will be

compared back to the input-outcome comparisons of

reference or other people, and the results of these

comparisons will affect individual motivation at

work. Inequality can occur when individuals feel that

their input-outcome comparison is not compatible

with the input-outcome of other people or other

people.

2.2 Compensation

According to Batjo & Shaleh (2018) wages or salaries

and all forms of awards given by the company to

employees referred as compensation, and according

to Sudaryo et al (2018) compensation is stated as all

the rewards received by employees in return for

services that have been provided. Compensation is

given in order to attracting, motivating, and retaining

employees, and based on the type of compensation is

divided into three, namely direct financial

compensation, indirect financial compensation, and

non-financial compensation. While Elbadiansyah

(2019) argues that compensation or income is income

received by a worker as remuneration provided by the

company, with the hope that the compensation can

motivate and encourage workers to improve their

work performance efficiently and effectively.

2.3 Human Resources

Human resources is one of the important assets in the

company because HR is a determinant of the success

of a company. Companies need to pay attention to

things such as thoughts, feelings, needs, and certain

expectations that employees have to build employee

achievement, dedication, and loyalty to their work

and company (Elbadiansyah, 2019). According to

Danish (2010) HR is the most important thing among

the resources owned by a company, it is important for

companies to create an efficient and experienced

workforce so that companies can add competitive

value and other benefits.

2.4 Company Performance

Hani (2005) defines performance as the output

produced from various processes, products, and

services that are evaluated and compared with goals,

standards, previous achievements, as well as other

companies. Civelek et al (2015) state that company

performance is the level of achievement of the vision

and goals of a business. According to Bititcia et al

(2012) company performance can be measured by 9

key indicators (KPI) including revenue growth and

company profitability, supported by the arguments

stated by Marr (2014), Widyarini et al (2002), and

Civelek et al ( 2015).

The company's performance can be determined

from a financial perspective, a successful company

will have a good financial condition as well, in

accordance with the opinion of Hani (2005) which

states that financial results are the final indicator of

the success of a company. Supported by the opinion

of Agustiranda et al (2019) which states that company

profits can be used as a benchmark in assessing the

success of company performance. Bititcia et al (2012)

stated that the profitability variable is the most

important performance indicator in explaining the

level of company performance.

According to Marr (2015) revenue growth is a

dynamic metric that needs to be compared to

something else such as different time periods,

different companies or products in order to be truly

meaningful. The company's revenue growth ratio can

Compensation Impact on the Firm Performance of Indonesian Insurance Companies Listed on the IDX

65

be used to better understand the company's financial

performance, especially in terms of business

development, namely by applying a comparative

analysis of revenue growth this year with last year or

known as year-to-year comparison. The results of this

comparison will show the development of both an

increase and a decrease in revenue so that the

company can find out how well the performance is

produced (Marr, 2014).

Hypothesis

Human resources are considered the most important

thing among the resources owned by a company

(Danish, 2010). The performance produced by HR is

also very influential on the company's performance,

therefore a successful company requires HR to have

high competence and dedication to the company.

According to research by Gupta & Shaw (2014) and

Kim & Jang (2020) compensation can be used as a

powerful tool for managing company HR, because

with compensation employees can meet their daily

needs.

Insurance agents are human resources owned by

insurance companies, they work to find new

policyholders and serve existing policyholders. The

amount of commission received by the agent is

determined based on the sales generated (Widodo,

2016), the higher the level of sales, the more

commissions received. The many demands and needs

of daily life require workers like insurance agents to

generate more income. In overcoming this problem,

one way that agents can do is to increase sales so that

the compensation received is even higher. Based on

the previous statement, compensation is considered to

be able to motivate and encourage employees to

improve their performance in a short time (short

term), so that the company's performance will also

increase immediately, this study construct the first

hypothesis as follows:

H1: Increasing employee compensation has a

positive effect on company performance in the

short run

According to the equity theory by Adams (1965)

stated that the outcome or results received by the

individual will be equal with input or effort given at

work. Kim & Jang's (2020) research stated that the

effect of increasing compensation will not last long

because of the possibility of inequality received by

employees regarding inputs and outcomes in their

work. The possibility of an unfair distribution of

compensation that makes employees tend to reduce

their efforts at work, and when employees always

receive high compensation they will become

accustomed to creating a mindset that overestimates

the effort given in their work, then the impact of

increasing compensation employees will turn out to

be bad in the long run, so this study construct the

second hypothesis as follows:

H2: Increasing employee compensation has a

negative effect on company performance in the

long run

3 RESEARCH METHOD

3.1 Data Sample

The research model used quantitative approach and

sample as secondary data from the annual financial

statements for the period 2014 – 2019 of insurance

companies listed on the IDX. The research data were

obtained through the official website of the IDX and

the websites of the sample companies.

3.2 Dependent Variable

3.2.1 Revenue Growth

The company's performance used as dependent

variable which measured by the company's revenue

growth and profitability. Revenue growth is

calculated using the Year-over-Year (YoY) method,

which compares the company's revenue growth in the

one year period with the previous year, which is

formulated as follows:

𝐺𝑟𝑜𝑤𝑡ℎ =

(

,

)

(1)

3.2.2 Profitability

The measurement used to calculate the company's

profitability is the Underwriting Ratio. According to

Satria (1994) the underwriting ratio used for measure

the insurance company's ability to generate profits

from its main business. The ratio is calculated by

comparing the underwriting revenue with premium

earned, which is formulated as follows:

Profitabilty =

(2)

3.3 Independent Variable

3.3.1 Employee Compensation

Compensation per employee and the long-term effect

of employee compensation act as independent

ICAESS 2021 - The International Conference on Applied Economics and Social Science

66

variables of the study. Employee compensation is

obtained by adding up the total labor expense

consisting of salaries, employee benefits, and pension

then divided by the number of employees working in

the company, which is formulated as follows:

Emp_Comp = (Total Labor Expense

i,t

) (3)

Total Number of Employees

i,t

The long-term effect of employee compensation

is calculated by adding up the company's total

workforce starting from the period a year before the

research year (t-1) divided by the number of

employees working in the company, which is

formulated as follows:

Emp_Comp

t-1

= (Total Labor Expense

i,t-1

) (4)

Total Number of Employees

i,t-1

The regression equation in this study is described as

follows:

Hypothesis 1:

PROFIT

i,t

= α + β EMP_COMP

i,t

+ Ԑ

i,t

(5)

Hypothesis 2:

GROWTH

i,t

= α + β EMP_COMP

i,t-1

+ Ԑ

i,t

(6)

To simplify data management, researchers used

the Eviews software version 9 to generate data from

several tests such as the Descriptive Statistics,

Assumption Test, Panel Data Regression Test,

Hypothesis Test, and Coefficient of Determination.

4 RESULTS AND DISCUSSION

4.1 Characteristics of Respondent

This study uses the population of insurance sector

companies listed on the Indonesia Stock Exchange in

2015-2019. The company sample is determined based

on predetermined criteria, namely there are 10

insurance companies so that the research sample data

within a period of 5 years amounted to 50 data.

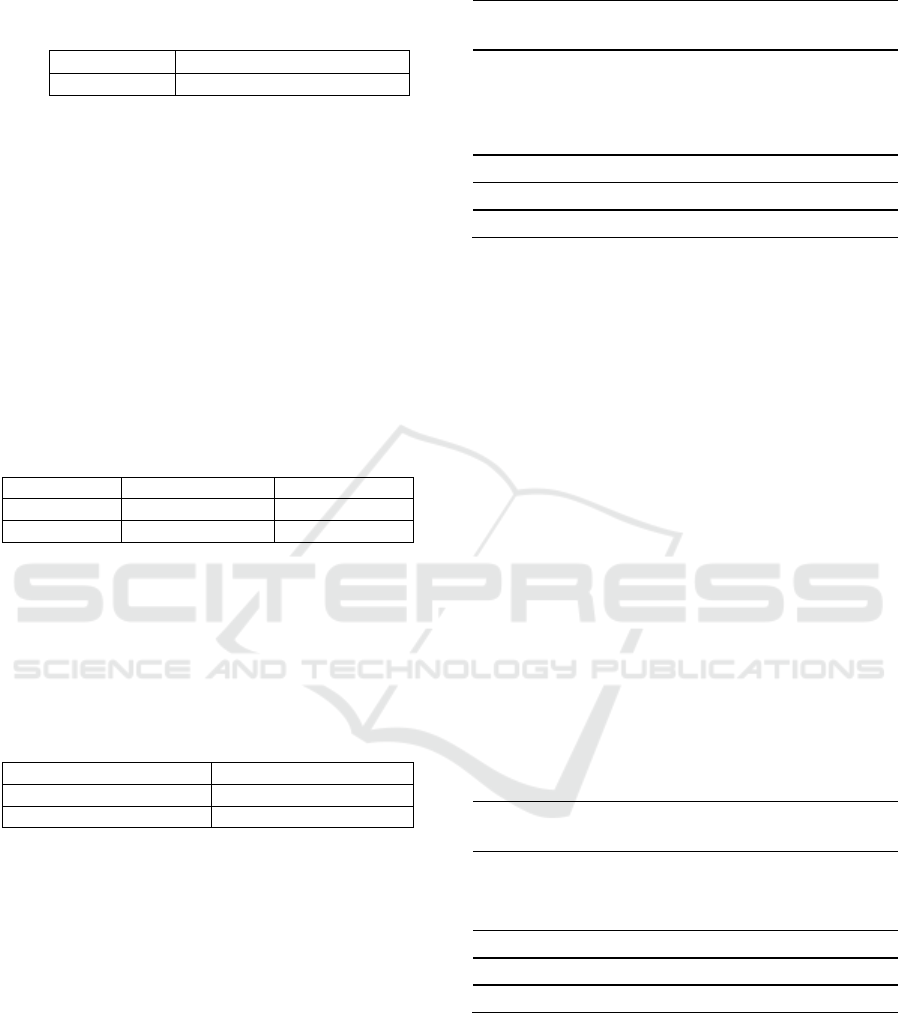

4.2 Descriptive Statistics

Statistical testing using Eviews 9 and resulted in an

overview of the independent variables and the

dependent variable of the study in the form of mean,

maximum, minimum and standard deviation values.

The test results are presented in table 1 below.

Table 1: Descriptive Statistics.

Variable

Mean Median Maximu

m

Minimu

m

Std.De

v

Growth

0,0328 0,0300 0,3900 -0,2300 0,1277

Profit

0,1940 0,1850 0,3300 0,0100 0,0842

Emp_comp

i,t

28121

0

26186

3

580100 126944 11217

1

Emp_comp

i,t

-1

26622

6

25296

0

580100 110808 106527

Panel data analysis is done through three

approaches, which is common effect, fixed effect, and

random effect. In choosing the most appropriate

regression model, it is necessary to do several tests

first, that is Chow test, Hausman test, and Lagrage

Multiplier test.

4.3 Chow Test

Table 2: Chow Test Result.

Hypothesis

Probabilit

y

Value

Cross-section F Cross-section

Chi-square

H1 0.0001 0.0000

H2 0.0000 0.0000

Based on the test results from table 2, it is known that

hypothesis 1 and hypothesis 2 have a cross-section

value of F < 0.05, so both hypotheses used fixed

effect model.

4.4 Hausman Test

Table 3: Hausman Test Result.

H

yp

othesis

Probabilit

y

Value

Chi-Sq. Statistic Probability

H1 3.867823 0.0492

H2 2.606378 0.1064

Based on the test results from table 3, it is known that

hypothesis 1 has a probability value less than 0.05

which is 0.0492, so the model chosen for hypothesis

1 is fixed effect model. The test results above

conclude that the most appropriate model to be used

in testing the impact of increasing employee

compensation on company performance in the short

term is the fixed effect model. In hypothesis 2, it is

known that the probability value is > 0.05, which is

0.1064, so the model used for the second hypothesis

is a random effect model.

Compensation Impact on the Firm Performance of Indonesian Insurance Companies Listed on the IDX

67

4.5 Lagrage Multiplier Test

Table 4: Lagrage Multiplier Test Result.

Hypothesis Prob. Breusch-Pagan

H2 0.0000

Based on the test results from table 4, it is known that

hypothesis 2 has a Prob Breusch-Pagan <0.05, which

is 0.0000, so the model chosen for hypothesis 2 is a

random effect model. The test results above conclude

that the most appropriate model to be used in testing

the impact of increasing employee compensation on

company performance in the long term is the random

effect model. According to the previous Hausman

test, the best model for hypothesis 1 is the fixed effect

model, so that hypothesis 1 doesn’t need to be

retested with the lagrage multiplier test.

4.6 Normality Test

Table 5: Normality Test Result.

H

yp

othesis Jar

q

ue Bera Probabilit

y

H1 2.217232 0.330015

H2 0.430864 0.806193

Based on results in table 4.6, it is known that

hypothesis 1 and hypothesis 2 have a probability

value greater than (0.05) so the data is declared to

have a normal distribution.

4.7 Heteroscedasticity Test

Table 6: Heteroscedasticity Test Result.

Hypothesis Prob. Chi-Square

H1 0.6354

H2 0.8478

Based on the test results in table 6, it is known that

both hypothesis 1 and hypothesis 2 have a p-value

greater than 0.05 so that it can be concluded that there

are no symptoms of heteroscedasticity.

4.8 Data Panel Regression Analysis

This study conducted panel data regression analysis

to determine the effect of increasing employee’s

compensation on company’s performance which

measured by profitability and revenue growth.

Table 7: Hypothesis Testing Results of First Model.

Variable Coefficien

t

Std. error t-Statistic Prob.

Constant

0.205291

0.063282 3.244088 0.0024

Emp_Comp

i

,t

-4.02E-08 2.24E-07 -0.179367 0.8586

N 50

Adjusted R

2

0.704694

F-statistic 12.69297

Based on the test results in table 7, it can be

concluded as follows:

1. From the test results, the variable EMP_COMP

i,t

has a probability value of 0.8586 with a regression

coefficient of -4.02E-08. The probability value is

0.8586, where the value is greater than the

significance level (0.05) which mean that the

increase in employee compensation

(EMP_COMP

i,t

) has no effect on the company's

performance in the short term, and the coefficient

value has a negative direction so that it is not in in

line with statement of hypothesis 1, making the

First Hypothesis rejected.

2. The constant value of 0.205291 explains that if the

value of EMP_COMP

i,t

is constant so the value of

the PROFIT variable is 0.205291, and the

regression coefficient of the EMP_COMP

i,t

variable has value of -4.02E-08, explaining that

every time there is an increase of one unit

EMP_COMP

i,t

it will reduce the PROFIT value by

-4.02E-08.

Table 8: Hypothesis Testing Results of Second Model.

Variable Coefficien

t

Std. error t-Statistic Prob.

Constant 0.068093 0.075986 0.896122 0.3747

Emp_Comp

i

,t-1

-1.33E-07 2.56E-07 -0.517482 0.6072

N 50

Adjusted R

2

-0.015352

F-statistic 0.259116

Based on the test results in table 8, it can be

concluded as follows:

1. From the test results, the variable EMP_COMP

i,t-

1

has a probability value of 0.6072 with a

regression coefficient of -1.33E-07. The

coefficient value has a negative direction which is

in line with H2 but has a probability value of

0.6072, where the value is greater than the

ICAESS 2021 - The International Conference on Applied Economics and Social Science

68

significance level (0.05) which means that

although the negative direction is in line with the

H2 statement, the increase in employee

compensation (EMP_COMP

i,t-1

) remains

considered not to have a significant influence on

the company's performance in the long term, this

is because the prob.value (0.6072) > the level of

significance (0.05) so that Second Hyphothesis is

rejected.

2. The constant value of 0.068093 explains that if the

value of the employee compensation variable is

constant then the value of the GROWTH variable

is 0.068093, and the regression coefficient of the

long-term effect of employee compensation

variable (EMP_COMP

i, t-1

) has a value of -1.33E-

07 explaining that every increase of one-unit

EMP_COMPi, t-1 will reduce the GROWTH

value by -1.33E-07.

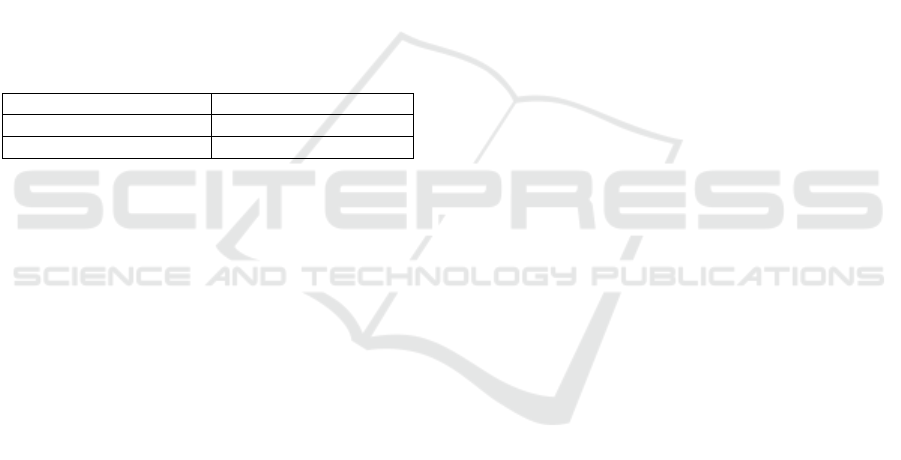

4.9 Coefficient Determination

Table 9: Coefficient Determination Result.

H

yp

othesis Ad

j

usted R-s

q

uared

H1 0.704694

H2 - 0.015352

Based on table 9, it is known that the coefficient of

determination from hypothesis 1 is 0.704694 or 70%

which explains that the independent variable of

employee compensation can affect the dependent

variable of company profitability (PROFIT) by 70%

while the remaining 30% is explained by other

variables not included in this study. The coefficient of

determination of hypothesis 2 is -0.015352 or 0%

which explains that the independent variable long-

term effect of compensation does not affect the

dependent variable of income growth (GROWTH)

because it has a value of 0%.

4.10 Analysis

4.10.1 The Effect of Increasing Employee

Compensation on Company

Performance in the Short-term

Based on the results of testing hypothesis 1, it shows

that increasing employee compensation does not have

a significant effect on the profitability of insurance

companies in the short term. This makes Hypothesis

1 which states that an increase in employee

compensation has a positive effect on the

performance of insurance companies in the short term

is rejected. This makes Hypothesis 1 which states that

an increase in employee compensation has a positive

effect on the performance of insurance companies in

the short term is rejected. The negative effect that

arises is caused by an increase in employee

compensation which makes more expenses incurred,

resulting in the company's profitability will

immediately decrease. Babiak et al (2019) also argue

that an increase in employee wages can lead to a

decrease in company profits. The results of this study

are in line with the research of Draca et al (2011)

which examines the relationship between employee

wages and company profitability, with research

results showing that when employee wages increase

significantly, company profitability will decrease. It

is also supported by the research of Pujiati & Arfan

(2013) which states that bonus compensation has a

negative effect on earnings management in

manufacturing companies on the IDX.

4.10.2 The Effect of Increasing Employee

Compensation on Company

Performance in the Long-term

Based on the results of testing hypothesis 2, it shows

that the impact of increasing compensation in the long

term does not have a significant effect on the growth

of insurance company income. This makes

Hypothesis 2 which states that increasing employee

compensation has a negative effect on the

performance of insurance companies in the long term

is rejected. The results showed that in the long term

or within one year an increase in employee

compensation still has a negative impact on company

performance, this indicates that although

compensation can be used as a tool to increase

employee motivation, compensation cannot be used

to increase the income of insurance companies in

Indonesia. An increase in compensation can also lead

to competition between employees which will

hamper their performance, this is supported by the

research of Grund & Sliwka (2007) which states that

an increase in employee compensation can trigger a

reference point to compare the compensation

received. The results of this study are in line with the

results of Kim & Jang's (2020) research which states

that an increase in compensation can have a negative

effect on restaurant revenue growth in the long term

or within a year.

5 CONCLUSION

This study aims to examine the impact of increasing

employee compensation on company performance in

the short term and long term. The sample in this study

Compensation Impact on the Firm Performance of Indonesian Insurance Companies Listed on the IDX

69

are insurance companies listed on the Indonesia Stock

Exchange in the 2015-2019 period. This study uses

secondary data from 10 insurance companies studied

for 5 years so that the research sample is 50 data. This

study uses panel data regression analysis and the

EViews 9 program for processing the data.

The results showed that increasing employee

compensation in the short term did not have a

significant impact on company performance as

measured by company profitability, and in the long-

term increasing employee compensation also did not

have a significant impact on company performance as

measured by company revenue growth. The results of

the study show that the negative impact is caused by

the employee compensation that is too high or

unbalanced so it can reduce profitability and company

revenue growth in both the short and long term.

This study has several limitations, including the

use of samples, especially for only using samples

from insurance sector companies. This study also

only uses two independent variables, which is

employee compensation and the long-term effect of

employee compensation, although there are other

variables which can be better at explaining the impact

of increasing employee compensation on company

performance.

Based on the limitations that described above,

there are few suggestions for further research. In the

future, researcher should increase the number of

company samples and not be limited to only one

sector on the Indonesia Stock Exchange and

researcher can also added other variables or use

different variables to get more accurate research

results.

REFERENCES

Adams, J. S. 1965. Inequity in Social Exchange . New York.

Ansofino, Jolianis, Yolamalinda, & Arfilindo, H. 2016.

Buku Ajar Ekonometrika. Yogyakarta: Deepublish.

Babiak, M., Chorna, O., & Gebicka, B. P. 2019. Minimum

Wage Increase and Firm Profitability: Evidence from

Poland . Czechia: IES.

Batjo, N., & Shaleh, M. 2018. MANAJEMEN SUMBER

DAYA MANUSIA. Makasar: Aksara Timur.

Bititcia, U., Firat, S., & Garengo, P. 2012. How to compare

performances of firms operating in different sectors?

Production Planning and Control , 24(12):1-18.

Chen, Y., & Johnny , J. 2012. Business strategy, executive

compensation and firm performance. Accounting and

Finance.

Civelek, M. E., Çemberci, M., & Artar, O. K. 2015. Key

Factors of Sustainable Firm Performance. Zea Books.

Danish, R. Q. 2010. Impact of Reward and Recognition on

Job Satisfaction and Motivation: An Empirical Study

from Pakistan. International Journal of Business and

Management Vol. 5, No. 2 .

Draca, M., Machin, S., & Reenen, J. V. 2011. Minimum

Wages and Firm Profitability. American Economic

Journal: Applied Economics 3, 129–151.

Duli, N. 2019. Metodologi Penelitian Kuantitatif:

Beberapa Konsep Dasar Untuk Penulisan Skripsi &

Analisis Data dengan SPSS. Yogyakarta: CV BUDI

UTAMA.

Elbadiansyah. 2019. MANAJEMEN SUMBER DAYA

MANUSIA. Malang: CV IRDH.

Grund, C., & Sliwka, D. 2007. Reference-Dependent

Preferences and the Impact of Wage Increases on Job

Satisfaction: Theory and Evidence. Journal of

Institutional and Theoretical Economics, 313-335 (23).

Gupta, N., & Shaw , J. D. 2014. Employee compensation:

The neglected area of HRM research. Human Resource

Management Review, 4(1), 1–4.

Hani, A. 2005. Tujuh Pilar Perusahaan Unggul :

Implementasi Kriteria Baldrige untuk Meningkatkan

Kinerja Perusahaan. Jakarta: PT Gramedia Pustaka

Utama.

Kim, H. S., & Jang, S. 2020. The effect of increasing

employee compensation on firm performance:

Evidence from the restaurant industry. International

Journal of Hospitality Management, 88, 102513.,

102513.

Marnisah, L. 2019. Hubungan Industrial dan Kompensasi

(Teori dan Praktik). Yogyakarta: Deepublish.

Marr, B. 2014. 25 Need-To-Know Key Performance

Indicators. United Kingdom: Financial Times.

Marr, B. 2015. Key Performance Indicators For Dummies.

Chichester: John Wiley & Sons.

Pambuko, Z. B., & Nuryanto. 2018. Eviews untuk Analisis

Ekonometrika Dasar: Aplikasi dan Interpretasi.

Magelang: UNIMMA PRESS.

Pujiati, E. J., & Arfan, M. 2013. STRUKTUR

KEPEMILIKAN DAN KOMPENSASI BONUS

SERTA PENGARUHNYA TERHADAP

MANAJEMEN LABA PADA PERUSAHAAN

MANUFAKTUR YANG TERDAFTAR DI BURSA

EFEK INDONESIA TAHUN 2006-2010 VOL.6 NO.2.

JURNAL TELAAH & RISET AKUNTANSI, 122-139.

Rizal, M., Idrus, M. S., Djumahir, & Mintarti, R. 2014.

Effect of Compensation on Motivation, Organizational

Commitment and Employee Performance (Studies at

Local Revenue Management in Kendari CIty).

International Journal of Business and Management

Invention Vol.3 Issue 2, 64-79.

Saidi. 2004. Faktor-Faktor yang Mempengaruhi Struktur

Modal pada Perusahaan Manufaktur Go Public di BEJ

Tahun 1997-2002. Jurnal Bisnis dan Ekonomi , Vol. XI

(1).

Santoso, S. 2017. Statistik Multivariat dengan SPSS.

Jakarta: Elex Media Komputindo.

Satria, S. 1994. Pengukuran kinerja keuangan perusahaan

asuransi kerugian di Indonesia: dengan analisis rasio

keuangan "Early Warning System". Jakarta: Lembaga

Penerbit FE-UI.

ICAESS 2021 - The International Conference on Applied Economics and Social Science

70

Shaleh, M. 2018. Komitmen Organisasi Terhadap Kinerja

Pegawai. Makasar: Aksara TImur.

Sudaryo, Y., Aribowo, A., & Sofiati, N. A. 2018.

Manajemen Sumber Daya Manusia, Kompensasi Tidak

Langsung dan Lingkungan Fisik. Yogyakarta : ANDI.

Widodo, S. 2016. Mindset Kaya Agen Asuransi : Jurus Anti

Gagal Agen Asuransi . PT. Gramedia Widiasarana

Indonesia.

Widyarini, L. A., Kaaro, H., & Anastasia. 2002. Short-

Term and Long-Term Company Performance

Prediction in Different Economic Conditions: Internal

and External Managerial Perspectives. Kajian Bisnis

(Business Investigation), (2) 1.

Compensation Impact on the Firm Performance of Indonesian Insurance Companies Listed on the IDX

71