Financial Strategy Analysis for Development of Liquid Natural Gas

LNG Power Plant to Replace Diesel Fuel Power Plant:

Case Study LNG based PLTMG Tanjung Balai Karimun 3x4 MW

Rosa Darman

1

and M. Dermawan Wibisono

2

1

PT XYZ, VP BD & ENTERPRISE, Batam, Indonesia

2

School of Business and Management, Institut Teknologi Bandung, Indonesia

Keywords: Business Feasibility Analysis, Electricity Tariff, PLTMG.

Abstract: Many of the islands around Batam use diesel power plants (PLTD) to generate electricity.

The cost of operating these plants is very expensive since they use expensive diesel fuel and tend to experience

significant increases, so that it burdens the government and users if they subsidize the electricity tariff. PT

XYZ intends to expand its business by becoming a supplier of electricity to the islands around Batam by using

a Gas Engine Power Plant (PLTMG) to replace the existing PLTD on the islands. To determine whether the

PLTMG construction has business feasibility, and the electricity tariff is cheaper than the PLTD tariff, re-

search is carried out that focuses on the Business Feasibility for the PLTMG construction and the selection of

gas transportation modes will be best to supply gas to the generating site. By using the economic feasibility

parameters NPV, IRR, PBP and BCR and by conducting sensitivity analysis and risk management, it is ex-

pected that the results of this study will provide clear, safe, and comprehensive guidance for management in

order to grow and develop their electricity business. After conducting a Technical Study and Business Feasi-

bility Analysis, it was found that the PLTMG construction was feasible to be implemented on Karimun Island

with a capacity of 3 x 4 MW using ISO Tanks and LCT ships to transport natural gas in the form of LNG. PT

XYZ will benefit from the construction of a PLTMG of IDR17,327,179,295, - in the first year with an elec-

tricity tariff of IDR1.805/kWh. And when compared to the current PLTD electricity tariff of IDR 3,000/kWh,

the PLTMG electricity tariff are much cheaper. In addition, this will also provide significant savings in the

cost of providing electricity for PT PLN (Persero) WRKR of IDR106,775,640,000/year.

1 INTRODUCTION

1.1 Background

PT XYZ is a subsidiary of PT PLN (Persero) and

experiencing a saturation phase in developing its

business in its working area which is only on 3

islands: Rempang Island, Galang Island and Batam

Island. With this limited working area and the impact

of the covid 19 pandemic which has made electricity

sales growth decline, further complicating the

business conditions faced by PT XYZ.

There are 2 factors that need to be considered in

finding solutions for business development, they are

Internal factors and External factors. The following

internal factors encourage the development of an off-

grid electricity sales business i.e.:

a) The electricity business area and IUPTL of PT

XYZ are limited to Batam, Rempang and Galang.

This area of business is quite narrow.

b) The growth of electricity sales in Batam has

started to decline due to economic growth in

Batam which is not in good condition.

c) Batam has started to enter a saturated condition as

development for business, industry and housing is

getting narrower.

Meanwhile external factors are the driving factors for

finding new business development solutions, i.e.:

a) Apart from Batam, Rempang and Galang, there

are still many islands around the island of Batam

that require electricity supply at a more

economical rate.

360

Darman, R. and Wibisono, M.

Financial Strategy Analysis for Development of Liquid Natural Gas LNG Power Plant to Replace Diesel Fuel Power Plant: Case Study LNG based PLTMG Tanjung Balai Karimun 3x4 MW.

DOI: 10.5220/0010923100003255

In Proceedings of the 3rd International Conference on Applied Economics and Social Science (ICAESS 2021), pages 360-365

ISBN: 978-989-758-605-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

b) Currently the power plants in these islands

operate PLTD that uses Solar Oil and MFO which

are expensive and tend to increase.

c) Currently, the availability of Fuel Gas in

Indonesia and abroad is still quite abundant.

The existence of these 2 factors made the authors

conduct research to determine whether

the construction of PLTMG is feasible or not and

produces electricity rates that are cheaper than PLTD

electricity rates and how much potential profit can be

obtained by the company.

1.2 Problem Statement

a) What is the best transportation mode that can be

used by PT. XYZ to transport gas in the form of

LNG from Tg? Jabung to Balai Karimun?

b) How is investment performance for PLTMG

evaluated by Capital Budgeting?

c) How competitive are the electricity tariff for

LNG-based compared to diesel-fueled?

1.3 Objective

The main objectives of this paper are as follow:

a) Determine and analyze the mode of gas

transportation to be used.

b) Analyze project investment and determine the

best investment scenario.

c) Determine how profitable the electricity tariff of

LNG-based compared to diesel fuel-based.

2 THEORETICAL BASES

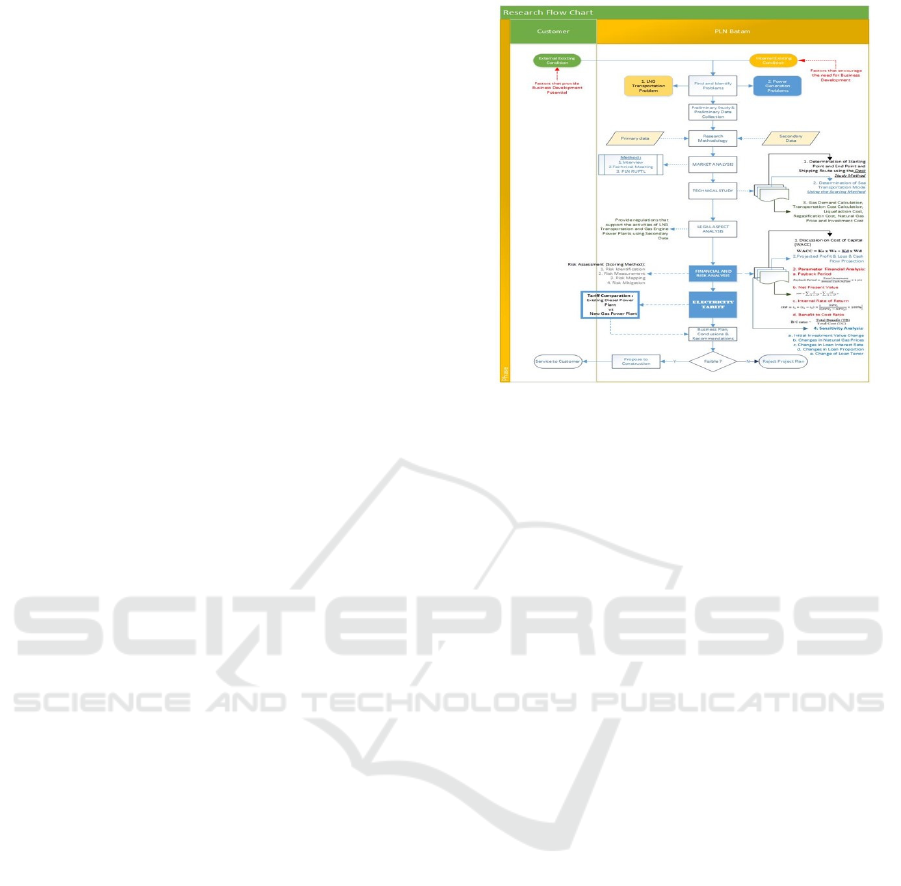

2.1 Conceptual Framework

To perform Financial Analysis in order to achieve the

expected goals, a systematic financial analysis

method is used and is commonly used by business

people. The method used to perform financial

analysis can be seen in Figure as below:

Figure 1.

2.2 Calculation of CAPEX, OPEX and

ABCD Component Costs to Get

Electricity Rates

To obtain data that will be used in financial analysis,

what must be done first is to calculate data on CAPEX

and OPEX costs for the construction and operation of

PLTMG and then define them into ABCD

components to facilitate analysis and get the value of

electricity tariff in accordance with IRR is set at 11%.

2.3 Funding Scheme Calculation using

WACC (Weighted Average Cost of

Capital)

Related to business feasibility, capital composition is

an important element. This project is planned to be

funded through 30% equity and 70% loan from

finasncial institutions with a period of 7 years. The

weighted average cost of capital (WACC) is used by

analysts and investors to assess an investor's return on

investment in a company. Since most businesses run

on borrowed funds, the cost of capital is an important

parameter in assessing a company's potential net

profitability. WACC measures a company's cost of

borrowing money, where the WACC formula uses the

company's debt and equity in its calculations. WACC

is used by investors to determine whether an

investment is profitable, while company management

tends to use WACC in determining whether a project

is feasible to run. WACC calculations can be done

using a formula (Gittman, 2012):

Financial Strategy Analysis for Development of Liquid Natural Gas LNG Power Plant to Replace Diesel Fuel Power Plant: Case Study LNG

based PLTMG Tanjung Balai Karimun 3x4 MW

361

2.4 Economic Feasibility Parameters

The biggest benefit and objective of this research is

to find out whether the construction of PLTMG can

be a solution for the company's business

development. For this reason, a Business Feasibility

Study is carried out using business feasibility

parameters as the analysis method.

The business feasibility parameters used in this

study are:

a) PBP (Payback Period)

The payback period is the investment cost divided by

the annual cash flow. The shorter the return, the more

desirable the investment. On the other hand, the

longer the payback, the less desirable it is. The

formula used is:

b) NPV (Net Present Value)

NPV is the difference between the present value of

the cash inflows and the present value of the cash

outflows over a certain period of time. NPV is used

in capital budgeting and investment planning to

analyze the profitability of a projected investment or

project. The formula used is

c) IRR (Internal Rate of Return)

IRR is a method used in financial analysis to estimate

the profitability of a potential investment. IRR is the

discount rate that makes the net present value (NPV)

of all cash flows equal to zero in the discounted cash

flow analysis. The formula used is:

d) BCR (Benefit To Cost Ratio)

BCR is a ratio used in cost-benefit analysis to

summarize the overall relationship between the

relative costs and benefits of a proposed project.

BCR can be expressed in monetary or qualitative

terms. The formula used is:

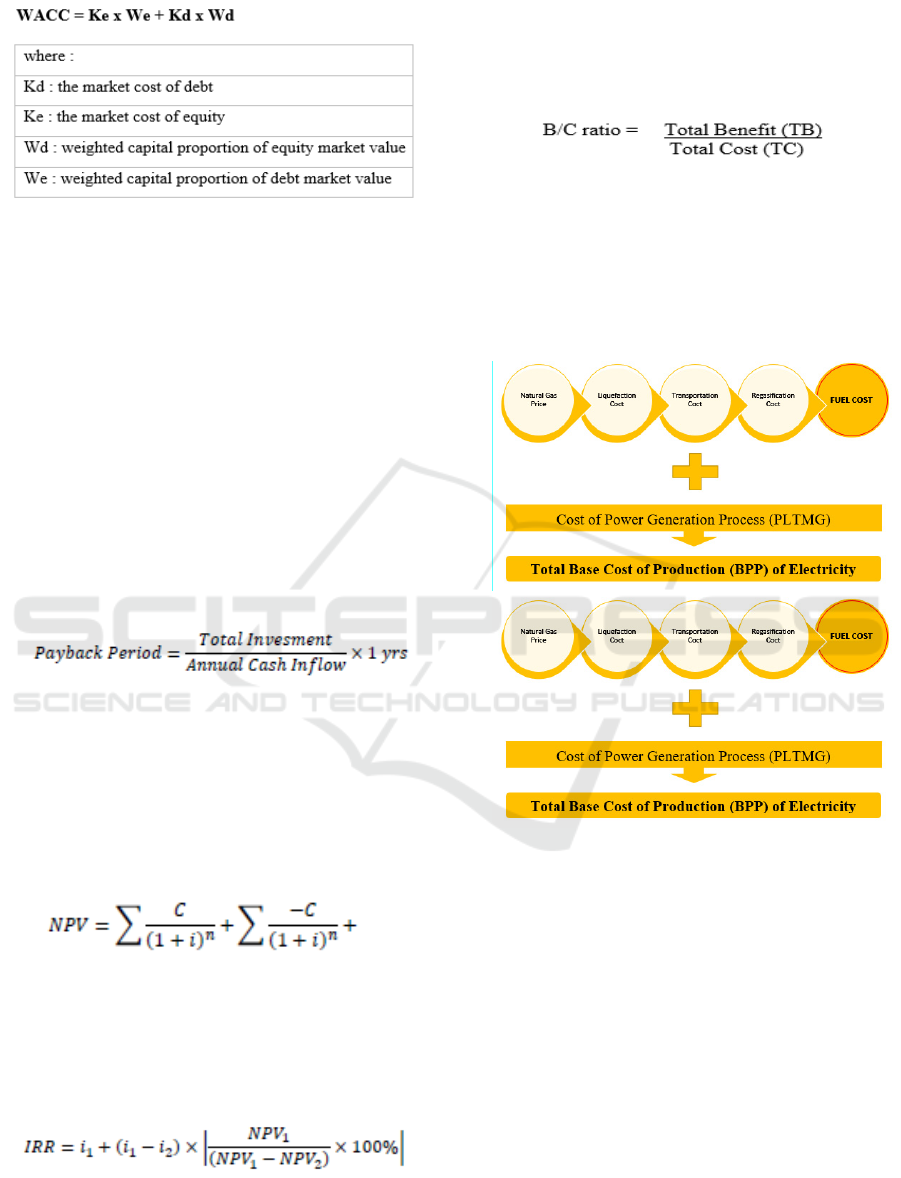

3 RESEARCH METHOD

To get electricity tariffs that meet business feasibility

parameters, it must first be understood about the

PLTMG Production Cost structure as shown in the

image below.

Figure 2.

The outline of the methodology for implementing

the Feasibility Study for the Development of

Liquefied Natural Gas PLTMG from Tanjung Jabung

Jambi for Power Plants on Karimun Island and its

surroundings includes :

a) Collecting data and information related to the

location and capacity of natural gas sources in

Tanjung Jabung Jambi and the location of power

plants and power plant capacity on Karimun

Island.

b) Collecting data and information related to

transportation modes and ports around the

location of gas sources and power plant locations.

c) Determining sea shipping lanes with the desk

study method.

ICAESS 2021 - The International Conference on Applied Economics and Social Science

362

d) Techno-economic analysis and calculations for

aspects:

Technical Study on Selection of LNG

Transportation Mode. Technical Study on the

Selection of Gas Power Plants.

Calculation of Construction and O&M Costs of

Power Plant.

Definition of ABCD components.

Determination of Electricity Tariffs with an

IRR of 11%.

Business Feasibility Analysis based on 4

parameters, i.e.: Internal Rate of Return (IRR),

Benefit to Cost Ratio (BCR), Payback Period

(PBP) and Net Present Value (NPV).

Sensitivity Analysis with several sensitivity

parameters.

e) Make a comparison of electricity prices/kwh

between PLTD and PLTMG using LNG.

f) Obtain a statement of benefit and potential profit

for the company.

4 DATA ANALYSIS AND

DISCUSSION

The first thing to do is to determine the initial

assumptions from the data used as the basis for

analyzing the feasibility of gas transportation modes

of business and the construction of PLTMG. After

conducting a Technical Study and Business

Feasibility Analysis, the following results were

obtained:

4.1 Initial Investment Cost (CAPEX)

a) LNG Transportation: Rp 59,508,365,760

b) PLTMG : Rp 135,481,769,640

4.2 O&M Cost

a) B1. LNG Transportation

Description Amount (Rp/Year)

Salaries for

em

p

lo

y

ees in

834,000,000

Employee

Salar

y

in

132,000,000

spare parts

904,800,000

Loading &

ldi

1,440,000,000

Rent &

li ibili

3,420,000,000

Variable cost

2,702,665,306

Indirect Cost

744,000,000

Sub-Total

10,177,465,306

b) PLTMG

Description

Amount

(

R

p

/Year

)

General Affair

and Management

Cost

1,925,000,000

Operation &

Maintenance Cost

5,359,200,000

Labor Cost 3,060,000,000

Property

Insurance

334,950,000

Fuel Cost

107,918,566,184

Variable Cost 2,396,867,400

Sub Total Annual

Cos

t

120,994,583,584

4.3 The Agency of Change

Components Value

Component A (Capital

Recover

y

)

450

Component B (O&M

Fix)

120

Component C (Bahan

Bakar)

1,208

Component D (O&M

Variable)

27

Total 1,805

4.4 Economic Feasibility Parameters

Components Transportastion PLTMG

WACC 9.67% 9.67%

Net Preset

Value

3,473,673,773 8,964,082,475

IRR 11.02% 11.03%

Payback

Perio

d

6 Year 1 Month

6 Year 1

Month

Benefit Cost

Ratio

1.73 1.73

Financial Strategy Analysis for Development of Liquid Natural Gas LNG Power Plant to Replace Diesel Fuel Power Plant: Case Study LNG

based PLTMG Tanjung Balai Karimun 3x4 MW

363

Tarif

31,245

IDR/MMBTU

1,805

IDR/kWh

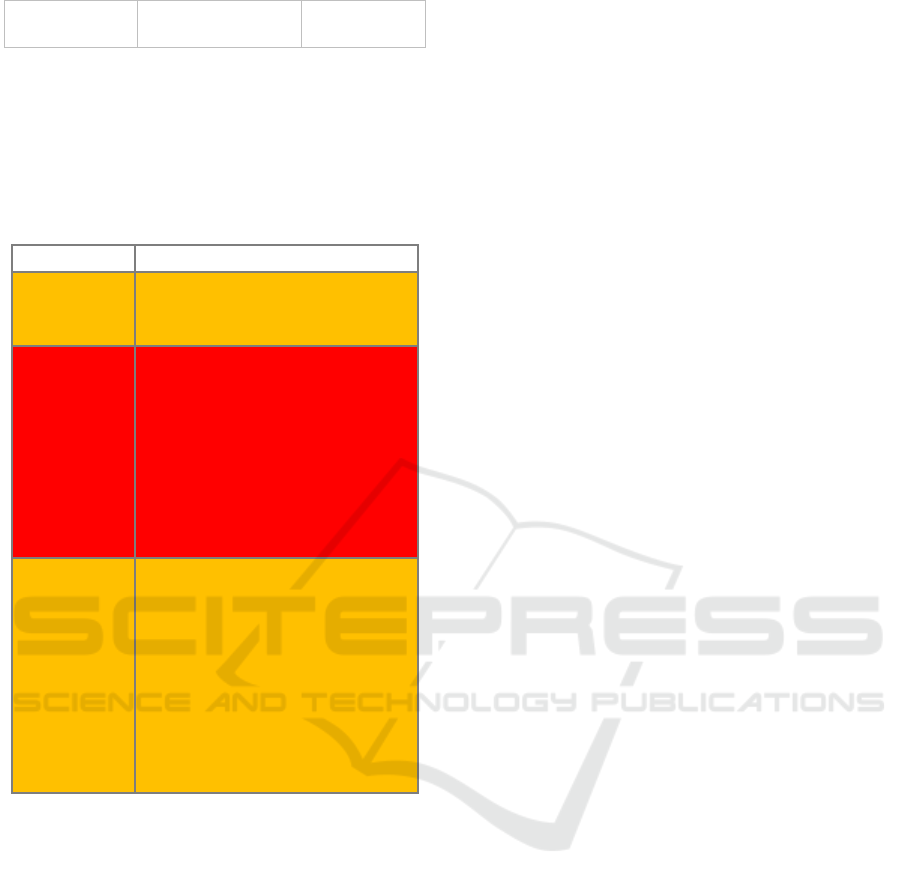

4.5 Risk Mitigation Plan

There are 3 Risk Mitigation Plans that need more

attention because they have a fairly high level of risk,

as shown in the table below:

Table 1.

Ris

k

Miti

g

asi Plan

Suitability of

purchasing

electricity

Preparation of long-term

contracts with a minimum

p

urchase of electricit

y

.

Decrease in

the amount of

electricity

demand

1. Preparation of long-term

contracts with a minimum

purchase of electricity.

2

. If the purchase of electric

power is equal to the minimum

power calculation, then the

tariff charged is the same as

the PLTD tariff, which is IDR

3,000/kWh.

PJTBL risk

ends

prematurely

Preparation of long-term

contracts according to the age of

the project with a statement of

commitment from PLN WRKR

regarding the minimum purchase

of electricity with the amount

and length of the period in

accordance with the age of the

project that was agreed at the

b

e

g

innin

g

PT XYZ must concentrate on the risk mitigation plan

as mentioned above, to reduce the impact or ensure

that the risk does not occur.

5 CONCLUSIONS

5.1 The Results of the Technical Study

From the results of the technical study, it was

determined that:

a) The choice of the type of LNG transportation

from the gas source in Tanjung Jabung Jambi to

the Generating site in Tanjung Balai Karimun

Karimun Island is using ISO Tanks and LCT

Ships because they have several advantages over

using FSRU or FSO.

b) The selection of the type of power plant with a

capacity of 12 MW is to use PLTMG 3 x 4 MW

because the power generation capacity is below 5

MW per unit and has a good heat rate so that the

efficiency of the gas engine is high.

5.2 The Results of the Financial Study

From the results of the Financial Study, the following

data were obtained:

a) The cost of LNG transportation that is feasible is

Rp. 31,245/MMBTU.

b) The proper electricity tariff to be applied on

Karimun Island is Rp. 1,805 /kWh.

c) The electricity tariff using PLTMG fueled by

LNG (Rp. 1,805/kWh) is cheaper than the

electricity tariff using PLTD (Rp. 3,000/Kwh).

d) The potential profit of the company is Rp.

17,327,179,295 in the first year.

e) The maximum potential saving of User electricity

production cost is Rp. 106,775,640,000 /year.

REFERENCES

Brigham, F, E.; Houston, F, J. (2011): Dasar-Dasar

Manajemen Keuangan, Terjemahan. 11e. Buku Dua,

Salemba Empat, Jakarta

Damodaran, A. (2011): Applied Corporate Finance 3rd

Edition. United State: Wiley.

Dr. Kasmir SE. MM; Jakfar SE. MM, (2013), Studi

Kelayakan Usaha, Kencana Prenada Media Group,

ISBN 978-602-9413-09-0 650, Jakarta.

Gitman, J, L. (2012): Principles of Managerial finance, 13th

Edition, Pearson Education, Inc, United States.

Gasperz, V. (1996): Ekonomi Manajerial, Gramedia

Pustaka Utama, ISBN 979-605-469-8, Jakarta.

Menteri ESDM Republik Indonesia, (2020): Keputusan

Menteri Energi dan Sumber Daya Mineral Nomor 91

K/12/MEM/2020 tentang Harga Gas Bumi di

Pembangkit Tenaga Listrik (Plant Gate)

Sianturi, N, M.; Purba, D. (2021): Analisa Laporan

Keuangan Untuk Teknik Dan Ekonomi, NEM, ISBN

9786236906880, 6236906882, Jakarta

Wibowo, A. Y. (2009): Financial Feasibility Study and

CDM Potential Opportunity in Geothermal Power Plant

Project. Bandung: MBA-ITB

XYZ, PT. (2018): Kajian Teknis dan Kelayakan Ekonomi:

Studi Kelayakan Pemilihan Lokasi Terminal LNG

Storage Untuk Pembangkit Listrik Di Pulau-Pulau

Isolated Wilayah Sumatera, Batam.

XYZ, PT. (2018): Perjanjian Jasa Kompresi Gas Bumi &

Transportasi CNG antara PT PLN Batam dan PT

Excelsior Strategy Mandiri, Batam

ICAESS 2021 - The International Conference on Applied Economics and Social Science

364

XYZ, PT. (2019): Kontrak Studi Kelayakan Penyediaan

Layanan Khusus Pertamina Ep Asset 1 Lirik Field,

Batam.

XYZ, PT. (2020): Pengadaan Sewa PLTD 4 x 1 MW di

Mukomuko Bengkulu, antara PT PLN Batam dengan

KSO PT Beringin Mas Powerindo dan PT VPower

Operation Services, Batam.

XYZ, PT. (2020): Perjanjian Pembelian Tenaga Listrik

PLTMG Baloi 30 MW antara PT PLN Batam dengan

Konsorsium PT max Power Indonesia – PT Cogindo

Daya Bersama, Batam

Financial Strategy Analysis for Development of Liquid Natural Gas LNG Power Plant to Replace Diesel Fuel Power Plant: Case Study LNG

based PLTMG Tanjung Balai Karimun 3x4 MW

365