Do Monetary Instruments Affect Conventional Bank Loans to

MSMEs?

Dina Yeni Martia

1

, Afriyanti Hasanah

2

, Siti Atika Liasari

1

, Endah Purwanti

1

and Kenneth Pinandhito

1

1

Accounting Department, Politeknik Negeri Semarang, Prof. Sudarto, Semarang, Indonesia

2

Business Management, Politeknik Negeri Batam, Ahmad Yanin, Batam, Indonesia

Keywords: MSME, BI 7 Days RR, SBI, Bank Indonesia Certificate

Abstract: This research aimed to analyse the effect of SBI and BI 7 Days RR on the UMKM credit of conventional

Banks in Indonesia in 2017-2019. The method used is a quantitative approach by applying multiple linear

regression models. The research used statistical data obtained from the official website of the Financial

Service Authority and Bank Indonesia's interest rate from the official website of Bank of Indonesia. This

research showed that in the 2017-2019 period, the Bank Indonesia Certificate (SBI) variable has no significant

effect on MSMEs credit of conventional banks in Indonesia. Meanwhile, the BI 7 Days RR variable had a

significant positive effect on UMKM credit of conventional banks in Indonesia in the 2017-2019 period.

Simultaneously, the results showed significant effects between SBI and BI 7 Days RR variables on the

MSMEs credit of conventional banks in Indonesia in 2017-2019. This research showed that the SBI and BI 7

Days RR variable significantly impacted conventional bank credit expansion to the MSMEs sector.

1 INTRODUCTION

Micro, small, and medium enterprises (MSMEs) are

believed to have an essential meaning in economic

development and development in both developing

and developed countries. The MSME sector in

developed countries is used as an economic driver to

trigger economic growth, innovation, and

technological progress. The developed countries in

question are the United States, Japan, France, and the

Netherlands (Tulus, 2009).

As one of the most prominent players in

Indonesia's economy, MSMEs have proven to be

economic drivers after the economic crisis. In

addition, MSMEs have saved the Indonesian

economy from the economic crisis (Singgih, 2007).

MSMEs have a role to be able to encourage

Indonesia's economic growth. MSMEs have proven

not to be affected by the crisis. In fact, every year, the

number of MSMEs continues to increase. The large

number of workers entering Indonesia is the impact

of the increase in the number of MSMEs. According

to data from the Central Statistics Agency, MSMEs

absorbed 114 million workers in 2013 (Statistik,

2021).

The significant role of MSMEs in the Indonesian

economy does not make this industry out of trouble.

One of the obstacles faced by MSMEs is limited

funds. The fund's majority of MSMEs come from

personal savings or informal sources such as

households. On the other hand, the government also

helps by financing the MSME sector. According to

the Central Statistics Agency data, the number of

loans issued continued to increase during 2016-2019.

In 2019, the MSME loan ratio was IDR 1,098.14

trillion. Compared to the previous year Statistik

(2021), this figure has increased by 6.34%.

The government's efforts to improve the

performance of MSMEs are carried out by providing

ease of use of funds for the MSME sector. Two Bank

Indonesia credit programs initiated this allocation,

namely small investment loans (KIK) and fixed

working capital loans (KMKP). In addition, Bank

Indonesia has issued Bank Indonesia Regulation

(PBI) No. 3/2 / PBI / 2001, which requires banks to

extend credit to small businesses for 20% of their total

loans. The regulation was issued as a trigger for banks

to increase their allocation of funds to the MSME

sector (Ramadhan and Beik, 2013).

As a supporter of the dual currency system, Bank

Indonesia issues Bank Indonesia Certificates (SBI) as

a conventional medium of exchange. As a monetary

instrument, SBI has its transmission line to the

physical sector, which will affect the amount of the

loan. In order to increase the role of the National Bank

58

Martia, D., Hasanah, A., Liasari, S., Purwanti, E. and Pinandhito, K.

Do Monetary Instruments Affect Conventional Bank Loans to MSMEs?.

DOI: 10.5220/0010921500003255

In Proceedings of the 3rd International Conference on Applied Economics and Social Science (ICAESS 2021), pages 58-63

ISBN: 978-989-758-605-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

as an intermediary institution, it is necessary to

increase the opportunities for lending to business

actors, especially in the small, medium and micro

business sector (Meydianawathi, 2007).

In the MSME sector, transferring funds from

banks is influenced by internal and external factors.

Profitability is an internal factor for banks to guide

credit. At the same time, monetary instruments have

become an external factor for bank lending. It is the

reason for doing this research; the role of monetary

instruments will affect credit distribution in

conventional banking businesses in the MSME

sector.

Based on previous research examined by

Ramadhan and Beik (2013), it shows that

simultaneously the distribution of MSME loans, both

Islamic and conventional banking, is significantly

influenced by the SBIS Islamic monetary instrument

and the conventional SBI interest rate instrument.

However, the relationship between SBI and SBIS on

MSME lending or financing is negative. Meanwhile,

Devi and Cahyono (2020) research shows that are

simultaneously lending to

the MSME sector in conventional banking in

Indonesia is influenced by SBI, inflation, and the BI

Rate. Meanwhile, lending to the MSME sector in

Islamic banking in Indonesia is also influenced

simultaneously by SBIS, inflation and the BI Rate.

Based on the conventional model, the BI Rate only

partially affects MSME credit in conventional

banking in Indonesia. While in the sharia model, the

provision of MSMEs in Islamic banking in Indonesia

is only partially influenced by inflation.

Another study conducted by Ichwani and Dewi

(2021) showed that partially the BI 7 Day RR and BI

Rate had an influence on lending to MSMEs in the

short term. At the same time, the research examined

by Wirathi and Putra (2014) shows that partially the

distribution of MSME loans at Commercial Banks in

Bali Province is significantly affected by the BI Rate.

Based on previous research, we are interested in

examining the allocation of MSME funds by

Indonesian conventional banks from January 2017 to

December 2019. This research quantitatively

analyses the effect of BI 7 Days RR and SBI on

MSME loans in Indonesia. The purpose of this study

was to determine the impact of Bank Indonesia's

policies on the determination of reference interest

rates (BI exchange rates) and conventional currency

instruments (Bank Indonesia Certificates) on

Indonesian conventional bank loans to the MSME

sector.

2 LITERATURE REVIEW

2.1 Micro, Small and Medium

Enterprises (MSMEs)

Micro, Small and Medium Enterprises (MSMEs)

refers to a business activity established by the

community in individuals or business entities. In-Law

Number 20 of 2008 concerning Micro, Small and

Medium Enterprises (MSMEs), it is stated that

MSMEs have different criteria. The criteria for

MSMEs are regulated in article 6 paragraphs 1-3,

which state that the classification of micro, small and

medium enterprises is based on the value of net worth

and sales for one year. In addition, another aspect that

forms the basis for differences in the number of

employees in each business. The number of

employees absorbed in the MSME sector indicates

that this sector can contribute to the national

economy.

According to Hastuti et.al., (2020), small and

medium enterprises (MSMEs) are business activities

that can provide various kinds of benefits to the

community. The positive impacts of small and

medium enterprises (MSMEs) are expanding

employment opportunities, high community income

and the realization of equity in Indonesia. In addition,

the existence of MSMEs can strengthen the economy

and play a role in achieving national stability.

2.2 Credit

Credit or a loan is commonly called an activity carried

out by the bank with other parties based on an

agreement or agreement. Credit can be implemented

because of the trust of each party. Based on trust in a

party in need, money, goods, or services are given

with the condition that they must be paid back under

the agreement of both parties.

According to Astiko (1996), credit can make

purchases or loans with an agreement. In terms of

payment, both loan principal and loan interest can be

paid according to the predetermined credit maturity

date. Credit is something that society needs. It is

because credit can encourage and facilitate trade

activities and can meet the needs of the community.

2.3 Bank Indonesia Certificate

Bank Indonesia Certificates (SBI) are instruments

with competitive returns and are free from the risk of

default. The guarantor of the SBI (Bank Indonesia

Certificate) is the government, so the risk of bad loans

is more negligible (Ferdian, 2008).

Do Monetary Instruments Affect Conventional Bank Loans to MSMEs?

59

Bank Indonesia Certificates (SBI) are securities in

the form of short-term debt. Bank Indonesia issues

SBIs (Bank of Indonesia Certificate) in IDR currency.

In the context of currency control, Bank Indonesia

Certificates are used as an open market operation tool

for Bank Indonesia to carry out transactions on the

money market both with banks and other parties.

Interest rate determination is carried out based on an

auction system. If the determination of the SBI

interest rate is high enough, it will impact

conventional bank investment where conventional

banks will prioritize investment in SBI instruments

compared to lending (Sugema, 2010).

2.4 BI 7 Days RR

According to Setianingsih (2018) the BI interest rate

is the interest rate set by Bank Indonesia, which

reflects the attitude of monetary policy. BI interest

rates are announced to the public every month by the

Board of Directors of Bank Indonesia.

Bank Indonesia has conducted monetary

operations through managing liquidity in the money

market. By conducting monetary operations, Bank

Indonesia's monetary policy targets can be achieved.

Since August 19th, 2016, a new benchmark interest

rate has been introduced by Bank Indonesia, with the

name BI 7 Days Repo Rate. The new interest rate

serves to strengthen Bank Indonesia's monetary

operating framework. However, the implemented

monetary policy will not change even though Bank

Indonesia has introduced a new benchmark interest

rate policy (Haryanto and Widyarti, 2017).

3 RESEARCH METHODS

3.1 Population and Sample

In this study, the population in the form of MSME

loans from Indonesian conventional banks. In

addition, the saturated sampling technique is a

sampling technique in this study. In determining the

sample from a population, it is necessary to pay

attention to relatively few population elements. The

research sample was all Indonesian conventional

bank MSME loans in 2017-2019.

3.2 Method of Collecting Data

In this study, the data was obtained in the form of

additional data from other available sources. The data

used in this study came from several sources, namely

banking statistics issued by the Financial Services

Authority by Keuangan (2021) and BI 7 Days RR

issued by Bank Indonesia.

3.3 Analysis Methods and Variable

Measurement Data

The research method is quantitative. This research

uses multiple linear regression analysis methods

using SPSS version 25.0 application. The

independent variables used are Bank Indonesia

Certificates (SBI) and BI 7 Days RR. While the

dependent variable used is MSME credit.

The author will summarize the variables

discussed so that the empirical model used by the

author in this study can be expressed as follows (Devi

and Cahyono, 2020):

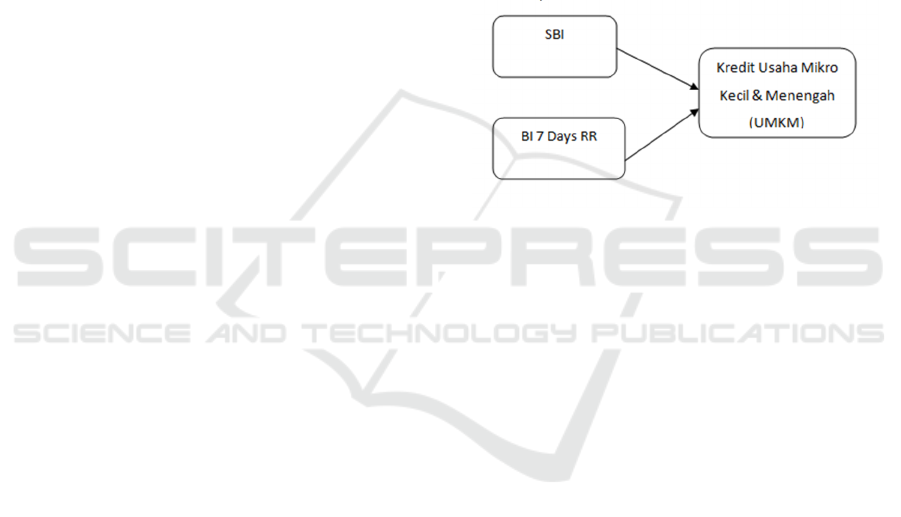

Figure 1: Research framework.

With the model equation as follows:

Y = α+β_ (1) X_1+β_2 〖 X〗_2+ et

Information:

Y = MSMEs Loan

α = Constant

β_1 β_2 = Regression Coefficient

X_1 = Bank Indonesia Certificate

X_2 = BI 7 Days RR

e = Error

The multiple linear regression method is an analytical

technique used in research. The hypothesis can be

stated in this study as follows:

H1: BI 7 Days RR and Bank Indonesia Certificates

(SBI) have a partial effect on MSME loans of

Indonesian conventional banks.

H0: BI 7 Days RR and Bank Indonesia Certificates

partially have no significant effect on MSME loans of

Indonesian conventional banks.

Ha: BI 7 Days RR and Bank Indonesia Certificates

(SBI) partially have a significant effect on MSME

loans of Indonesian conventional banks.

H2: BI 7 Days RR and Bank Indonesia Certificates

(SBI) simultaneously have a significant effect on

MSME loans of Indonesian conventional banks.

H0: BI 7 Days RR and Bank Indonesia Certificates

simultaneously do not affect MSME loans of

Indonesian conventional banks.

ICAESS 2021 - The International Conference on Applied Economics and Social Science

60

Ha: BI 7 Days RR and Bank Indonesia Certificates

(SBI) simultaneously affect MSME loans of

Indonesian conventional banks.

4 RESULTS AND DISCUSSION

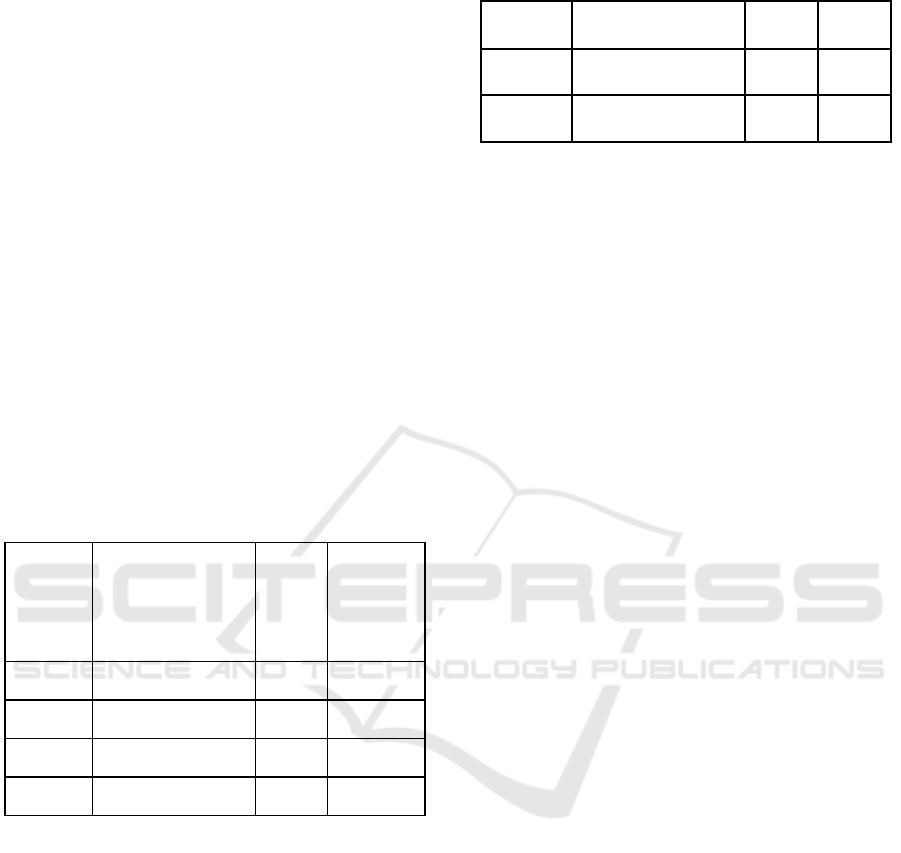

4.1 Statistic Descriptive

The following are SBI Indonesia Bank Certificate

data from BI 7 Days Repo Rate and MSMEs lending

from January 2017 to December 2019. The minimum

Indonesian Bank Certificate during 2017-2019 is IDR

1,109 billion in December 2017, with the maximum

amount issued is IDR 40,805 in May 2019. While the

lowest 4.25% BI-7 Days Repo Rate was regulated in

the 3rd quarter of 2017, and the highest is 6.00% from

November 2018 until June 2019. The smallest loan

disbursed was IDR 780,179 in January 2017, while

the largest disbursement was IDR 1,044,764 billion in

November 2019. It is increasing significantly during

the observation years.

Table 1: Statistic Descriptive.

Bank Indonesia

Certificate (IDR

Billion)

BI 7

Day RR

MSMEs

Loan

(IDR

Billion)

N statistic 36 36 36

Minimum 1109 4,25% 780179

Maximum 40805 6,00% 1044764

Mean 18217,36 5,10% 917487,69

Source: Processed Data, 2021

4.2 Multiple Linear Regression

Analysis

Table 1 shows that the SBI variable has a regression

coefficient of 0.618. However, it is not significant.

Whilst the regression coefficient of the BI-7 Days

variable is 7274828,079. It shows that the BI-7 Days

positively affect MSME credit, meaning that the

larger the BI-7 Days, the more credit distribution to

MSMEs will be. With the increase in BI-7 Days

everyone unit, the MSME credit variable has

increased by 7274828,079 percent and vice versa.

Table 2: Multiple Linear Regression Results.

Model Coefficient t-stat Sig.

SBI 0.618 0.634 0.531

BI Rate 7274828.079 3.709 0.001

Source: Processed Data, 2021

Based on the t-test result, it can be analysed that

the t-test value for the SBI variable is 0.634, and the

significance level is 0.531. The significance value of

the data above is more than 0.05. It shows that the SBI

variable does not have a significant positive effect on

the MSME credit variable. It can also be interpreted

that this SBI variable does not have a partial influence

on MSME credit. On the other hand, the t-test result

on the BI-7 Days variable is 3.709, and the

significance level is 0.001. The significance value is

less than 0.05, so it can be concluded that the BI

interest rate variable has a significant positive effect

on the MSME credit variable. In other words, the BI-

7 Days variable partially affects MSME loans.

4.3 The Effect of SBI on MSMEs Loan

Based on the partial regression test results, it can be

seen that Bank Indonesia Certificates (SBI) do not

have a significant positive effect on conventional

bank MSME loans in Indonesia because the

significance value of SBI> 0.05 is 0.531. In the t-test

calculation, it is known that the SBI variable is 0.634,

so it can be concluded that in the Indonesian

conventional banking industry, SBI does not have a

significant effect on MSME loans. Using the results

of the t-test that has been carried out, the analysis

results reject the new hypothesis, which means that

the SBI portion does not affect MSME loans.

4.4 The Influence of BI-7 Days on Fund

Distribution to MSMEs

Based on the partial regression test results, it can be

seen that BI-7 Days has a significant positive effect

on MSME loans of Indonesian conventional banks.

The calculation shreds of evidence that the

significance value of BI-7 Days is 0.001 or <0.05. In

the t-test calculation, it is known that the BI-7 Days

variable is 3.709. It can be concluded that BI-7 Days

has a significant positive effect so that there is a one-

way relationship between the BI-7 Days variable and

MSME Credit. By using the results of the t-test, the

results of the analysis accept the following

Do Monetary Instruments Affect Conventional Bank Loans to MSMEs?

61

hypothesis: BI-7 Days has a partial effect on MSME

loans.

The results of this study are contrary to previous

research conducted by Osei and Asenso (2015),

which showed that BI-7 Days had a negative effect on

lending. It shows that the increase in BI-7 Days will

increase bank interest rates and cause lending to

decline. Vice versa, the decline in BI-7 Days will

cause credit demand to increase.

4.5 Coefficient of Determination R2

R2 (Coefficient of Determination) in this study was

0.416 or 41.6%. It means that the magnitude of the

influence of SBI, BI-7 Days on MSME loans is

41.6%, while other variables influence the other

58.4% (error value).

Table 3: Coefficient of Determination (R

2

).

Model R R

Square

F

Change

Sig F

Change

0.645 0,416 11,765 0.000

Source: Processed Data, 2021

4.6 F-test

Based on the table of F test results, it is known that

the F value in this study is 11.765. Meanwhile, based

on the results of the significance of 0.000 <0.05, it is

concluded that all independent variables (namely

Bank Indonesia Certificates (SBI) and BI-7 Days)

have a significant positive effect on the dependent

variable (MSME credit).

Table 4: F test Result.

Model F Sig.

1 11.765 0.000b

Source: Processed Data, 2021

5 CONCLUSION

Based on research using multiple linear regression

analysis to test the hypothesis, it was concluded that

partially, Indonesian conventional bank MSME loans

during 2017-2019 were not significantly affected by

the Bank Indonesia Certificate (SBI) variable.

Meanwhile, the BI-7 Days RR variable significantly

affects traditional Indonesian bank MSME loans

during 2017-2019.

Meanwhile, the study results show that

simultaneously the variables of Bank Indonesia

Certificates (SBI) and BI-7 Days RR significantly

influence the distribution of Indonesian conventional

bank loans to the MSME sector during 2017-2019.

It is hoped that the next researcher can further

develop this research by adding other variables and

extending the research time and data volume so that

the results obtained are more precise and

comprehensive.

ACKNOWLEDGEMENT

We gratefully thank to Politeknik Negeri Semarang

and Politeknik Negeri Batam for the support.

REFERENCES

Astiko, S. (1996). Pengantar Manajemen Perkreditan.

Yogyakarta: Andi Yogyakarta.

Devi, W. L., and Cahyono, E. F. (2020). Analisis Pengaruh

Sertifikat Bank Indonesia (SBI), Sertifikat Bank

Indonesia Syariah (Sbis), Inflasi Dan Bi Rate Terhadap

Penyaluran Dana Ke Sektor UMKM Oleh Perbankan

Syariah di Indonesia. Jurnal Ekonomi Syariah Teori

dan Terapan, 7(3), 499-512.

Ferdian, I. R. (2008). SBI, Instrumen Moneter atau

Instrumen Investasi. Republika. Senin, 21.

Haryanto, S. B., and Widyarti, E. T. (2017). Analisis

pengaruh NIM, NPL, BOPO, BI Rate dan CAR

terhadap penyaluran kredit bank umum go public

periode tahun 2012-2016. Diponegoro Journal of

Management, 6(4), 942-952.

Hastuti, P., Nurofik, A., Purnomo, A., Hasibuan, A.,

Aribowo, H., Faried, A. I.,Saputra, D. H. (2020).

Kewirausahaan dan UMKM: Yayasan Kita Menulis.

Ichwani, T., and Dewi, R. S. (2021). Pengaruh perubahan

BI rate menjadi BI 7-day reverse repo rate terhadap

jumlah kredit UMKM. Jurnal Manajemen dan Bisnis,

1(1), 67-76.

Keuangan, O. J. (2021). Statistik Perbankan Indonesia

Retrieved from www.ojk.go.id

Meydianawathi, L. G. (2007). Analisis Perilaku Penawaran

Kredit Perbankan Kepada Sektor UMKM di Indonesia

(2002-2006). Buletin Studi Ekonomi, 12(2), 134-147.

Osei, A. E., and Asenso, J. K. (2015). Regulatory capital

and its effect on credit growth, non-performing loans,

and bank efficiency: Evidence from Ghana. Journal of

Financial Economic Policy.

Ramadhan, M. M., and Beik, I. S. (2013). Analisis

pengaruh instrumen moneter syariah dan konvensional

terhadap penyaluran dana ke sektor usaha mikro kecil

ICAESS 2021 - The International Conference on Applied Economics and Social Science

62

dan menengah (umkm) di indonesia. Al-Muzara'ah,

1(2), 175-190.

Setianingsih, D. (2018). Pengaruh Inflasi, Bi Rate,

Sertifikat Bank Indonesia Syariah, Dan Financing to

Deposit Ratio Terhadap Pembiayaan Usaha Mikro

Kecil Dan Menengah Pada Bank Umum Syariah Dan

Unit Usaha Syariah di Indonesia Periode 2014–2017.

Skripsi. IAIN Surakarta.

Singgih, M. N. (2007). Strategi Penguatan Usaha Mikro

Kecil Menengah (UMKM) Sebagai Refleksi

Pembelajaran Krisis Ekonomi Indonesia. Jurnal

Ekonomi Modernisasi, 3(3), 218-227.

Statistik, B. P. (2021). Statistik Indonesia 2021. Retrieved

from https://www.bps.go.id/

Sugema, I. (2010). BI Masih Pertahankan Bunga SBI. In:

Kontan.

Tulus, T. (2009). UMKM di Indonesia. Jakarta: Ghalia

Indonesia.

Wirathi, I., and Putra, I. B. G. (2014). Pengaruh LDR, BI

Rate, CAR, NPL terhadap Penyaluran Kredit UMKM

di Bank Umum Provinsi Bali Periode 2004. I-2013. IV.

E-Jurnal Ekonomi Pembangunan Universitas Udayana,

3(12), 44499.

Do Monetary Instruments Affect Conventional Bank Loans to MSMEs?

63