The Effect of Direct Foreign Investment Realization, Employment

and Regional Tax Receiving on Province Economic Growth in

Indonesia 2016-2018

Bella Febiola

a

and Adi Irawan Setiyanto

b

Managerial Accounting Department, Batam State Polytechnic, Indonesia

Keywords: Foreign Direct Investment, Labor, Local Tax Revenue, Economic Growth

Abstract: This study aims to determine the effect of the realization of foreign direct investment, labor and local tax

revenue on provinces in Indonesia in 2016-2018. This study uses secondary data with data collection

techniques using all reports on the realization of foreign direct investment, labor, local tax revenue and

province economic growth in Indonesia registered with Badan Pusat Statistik (BPS) or Statistics Indonesia

and Bank Indonesia (BI) for the 2016-2018 period. The research method used is a quantitative method with

an analysis of 34 provinces in Indonesia in the 2016-2018 period with a total sample size of 86 samples.

Secondary data is processed using SPSS version 26 application. The test results in this study indicate: The

realization of foreign direct investment affects the economic growth of provinces in Indonesia; Labor affects

the economic growth of provinces in Indonesia; Regional tax revenues have an effect on provincial economic

growth in Indonesia; Foreign direct realization, labor and local tax revenue simultaneously have a positive

and significant effect on provincial economic growth in Indonesia.

1 INTRODUCTION

In a country, a developing economy becomes a

problem for a relatively short period of time.

Economic growth is one of the important roles for the

success of development from one period to the next.

Without neglecting the efforts of equity and stability

as a developing country, Indonesia continues to carry

out development in stages and in a structured manner.

According to Rahardja and Manurung (2008) the

ideal category of an economy in an area can be seen

from the continuous increase in the economy and

shows trends and increases every year for a period of

one quarter.

Regional economic development shows the

efforts made by regional authorities and other

stakeholders, including local residents who are able

to stimulate the economic development of an area by

creating a network of cooperation to create job

opportunities, using existing resources to be managed

(Kuncoro, 2004).

An increase in the economy will contribute

greatly to welfare which has an impact on the quality

of community life. Based on this, economic growth

becomes important for every level of society that

concerns the overall welfare. Without economic

growth, it will cause the economy to stay in place or

stagnate which causes the absence of proper welfare

for the people of the area.

According to data on economic growth in

Indonesia published on the official website of Bank

Indonesia, namely www.bi.go.id, Indonesia

experienced an increase in economic growth in 2016-

2018. It was recorded that in 2016, the Indonesian

economy grew by 5.02%, in 2017 by 5.07%, and in

2018 by 5.17%. The economic growth that exists

in each country is certainly supported by the

economic growth achieved by each region. The

regional economy can be observed for its growth by

analyzing the value of Gross Regional Domestic

a

https://orcid.org/0000-0003-2791-3523

b

https://orcid.org/0000-0001-6270-0158

Product (GDP), as well as the value of Gross

Domestic Product (GDP) as a criterion for the value

of GRDP, which is the service and goods sector in an

area using production elements owned by the region.

48

Febiola, B. and Irawan Setiyanto, A.

The Effect of Direct Foreign Investment Realization, Employment and Regional Tax Receiving on Province Economic Growth in Indonesia 2016-2018.

DOI: 10.5220/0010894800003255

In Proceedings of the 3rd International Conference on Applied Economics and Social Science (ICAESS 2021), pages 48-57

ISBN: 978-989-758-605-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

in a certain year. The level of development progress

of an area can be described by the value of GRDP.

The average economic growth of all provinces in

Indonesia in 2016 was 5.33%, experienced a decline

in 2017 of 0.08% and an increase in 2018 of 3.59%,

so that economic growth in 2018 was 5.64%. This

shows that there is a phenomenon of fluctuations in

the average economic progress of all provinces in

Indonesia.

The economic growth is influenced by regional

economic development in Indonesia. The

development carried out must be able to explore the

potential that exists in each region to be managed and

developed in order to provide real benefits for the

future. The determining factors include human

resources, natural resources, culture, and other factors

that must be developed optimally. National and

regional economic development aims to provide

employment opportunities and achieve national and

regional economic stability.

The economic growth has a relationship with

investment and labor. In implementing the level of

economic growth of a region, it will definitely depend

on investment activities which are crucial factors in

the regional development sector. It aims to provide

long-term benefits, if the investment activity

increases, it will be aligned with the economic sector

of a region in a linear manner.

Investment growth from foreign investment in

Indonesia in 2016-2018 published by BPS through

the www.bps.go.id page experienced an ups and

downs phenomenon. The total realization of foreign

direct investment in 2016 was 28,964.1 million US$,

in 2017 it was 32,239.8 million US$ and in 2018 it

was 29,307.9 million US$.

Based on the data above, the realization of

investment can help economic growth in creating

jobs. As for how to find out how much economic

growth provinces in Indonesia are able to

accommodate the number of workers in order to

minimize the number of workers who do not have

jobs. Thus, a data-based analysis of workers in each

province in Indonesia is needed.

BPS Indonesia publishes labor data in Indonesia

through the official website www.bps.go.id. The total

working population aged over 15 years in each

province in Indonesia in 2016 was 118,411,973

people, in 2017 it was 121,022,423 people, and in

2018 it was 124,004,950 people. The data illustrates

that the working population of Indonesia from 2016-

2018 has increased. This illustrates that the province's

economic improvement in Indonesia has excelled in

increasing the number of the workforce each year.

If it is observed that the influence of investment

and labor has contributed to producing rapid

economic growth in national and regional life. The

rapid economic growth is also influenced by local tax

revenues because the tax revenues are used to support

the development and administration of Indonesia

which has the ultimate goal of realizing prosperity for

the people of Indonesia.

The country's economy is derived from tax

revenues. In Indonesia, taxes are the largest revenue

for the state which will later be used in financing

development for the welfare of the community, so

that taxes are considered an important instrument for

the state and society (Sagala & Ratmono, 2015). The

regulation on levies is stated in the 1945 Constitution

Article 23A Amendment III which reads, "tax levies

used for coercive state purposes have been regulated

in law". Local tax is a compulsory contribution based

on the enforcement of the rules, as a taxpayer.

National income originating from the central or

local government is dominated by taxes. In these

circumstances, local tax reform can be declared

successful if it achieves all of the above indices,

namely, being free of KKN, having the ability to

realize convenience and accuracy in the tax system,

so that it is easy for the public as taxpayers to pay

taxes, and the implementation of improving the

quality of public services by the government area. In

the first index, local government transparency can

guarantee maximum implementation of regional tax

revenues for the growth of an economy.

In the second and third indexes, in developing an

easy and effective local tax system, local

governments have unlimited opportunities because

they are supported by advances in Technology and

Computer Science (ICT). The success of tax reforms

from various regions can be seen from the soaring tax

revenue which leads to increased economic growth.

Based on the background that has been explained,

the researcher is finally interested in raising the title

"The Effect of Realization of Foreign Direct

Investment, Labor and Regional Tax Revenue on

Provincial Economic Growth in Indonesia in 2016-

2018".

The Effect of Direct Foreign Investment Realization, Employment and Regional Tax Receiving on Province Economic Growth in Indonesia

2016-2018

49

2 THEORETICAL AND

LITERATURE REVIEW

2.1 Harrod-Domar.'s Theory of

Economic Growth

Horrod-Domar theory states that the growth theory

explains that one of the important roles in the process

of economic growth is investment. This is because

investment can have an impact on achieving the

amount of revenue and increasing the quality scale of

the final output of economic products in the form of

capital reserves. A growing and developing economy

can be accelerated by creating investment from the

mobilization of foreign savings.

2.2 Neo-classical Economic Growth

Theory (Solow – Swan)

This research is supported by the growth theory

developed by Solow and Swan, which explains that

there are several aspects of production that affect

economic growth, namely aspects of society,

workers, and assets and modern information

technology. This interpretation is based on the

opinion that underlies the classical analysis, namely

the level of full use of labor will affect the economy

on the ability of capital equipment used over time

(Sukirno S, 2000).

2.3 Investment and Foreign Direct

Investment

Gitman and Joehnk (2005) stated investment shows a

means of funds that can be placed in generating

positive income or increasing its value. According to

Sarwedi (2002) a funding for activities abroad and

has potential compared to other funding sources, is

foreign direct investment. According to Anoraga

(1995) direct investment is a Foreign Investment

(PMA), where investors can directly invest in a

company. In addition to the nature of foreign direct

investment which focuses on the long term, foreign

direct investment also affects the absorption of new

jobs in the industrial sector.

2.4 Labor

Workers are each individual who works in producing

goods and services so that their needs are met. The

positive impact in stimulating economic growth with

the rapid growth and development of society and

several things that have a relationship with the

increase in the number of workers. Observing the

results of the neoclassical theory developed by Solow

and Swan, it was found that workers are mentioned as

one of several elements that influence fluctuations in

economic growth.

2.5 Tax

According to Sumarsan (2010) Tax is a contribution

of each individual to the state and is coercive, where

taxpayers must pay in accordance with applicable

rules (laws) without getting reciprocal results and

direct appointments can be made.

2.6 Regional Taxes and the Legal Basis

of Regional Taxes

Prakosa (2005) stated that, mandatory contributions

carried out by individuals or entities to the region, do

not receive a direct reply, can be coercive based on

rules and laws, are intended for financing the

implementation of government activities and regional

development, are local taxes. Local taxes are the role

of taxpayers in areas listed on individuals and

business entities that must be carried out in

accordance with legislation, without retaliation and

are intended for regional needs for the welfare of the

community. According to Prakosa (2005), local taxes

are divided into two segments, namely 1) Provincial

taxes include taxes on motorized vehicles and

vehicles on water, motor vehicle fuel taxes, transfer

fees for motorized vehicles and vehicles on water,

taxes for taking and utilizing underground water. land

and surface water and 2) local taxes, including

restaurant taxes, hotel taxes, entertainment taxes,

advertisement taxes, street lighting taxes, class c

excavation and processing taxes and parking taxes.

2.7 Literature Review

Analysis of The Effect of Household Consumption

Expenditure, Investment and Labor to Economic

Growth: A Case in Province of North Sumatra. The

results of his research explain that household

consumption, investment and labor have a positive

and partially significant effect on economic growth in

North Sumatra Province.

The results of the research by Purnamasari, Rostin

and Ernawati (2017) which examine the Effect of

Investment and Labor on Economic Growth in

Southeast Sulawesi Province. The results show that

investment and labor as a whole have a significant

and positive effect on economic growth in Southeast

Sulawesi Province, while partially investment has a

ICAESS 2021 - The International Conference on Applied Economics and Social Science

50

positive and significant effect on economic growth.

Bawuno, Kalangi, and Sumual (2015) examined the

Effect of Government Investment and Manpower on

Economic Growth in Manado City in 2003-2012. The

research shows a positive and significant effect of

capital expenditure on economic growth. Other

results show that labor has a positive and insignificant

effect on economic growth.

Mahriza and Amar (2019) in his research on the

Effect of Domestic Investment, Foreign Investment,

Manpower, and Infrastructure on the Economy in

West Sumatra Province. The test results explain that

partially there is a significant positive relationship

between foreign investment on the economic growth

of West Sumatra.

2.8 Hypothesis Development

2.8.1 Effect of Realized Foreign Direct

Investment on Economic Growth

Investment activities are strongly related to economic

growth. This is because investment is said to be one

of several crucial elements in determining economic

growth in a province. Harrod-Domar said that the

supporting factor in economic growth is investment.

In an area in order to increase the rate of economic

growth each year, it requires additional investment

which becomes a capital reserve. In the following

study, the investment variable is indicated by

information on the realization value of foreign direct

investment from regional foreign investment.

H1: Realization of Foreign Direct Investment

Affects Economic Growth

2.8.2 Effect of Labor on Economic Growth

One of the potential sources in the formation of

regional economic growth as a driver and

implementer of regional development is the presence

of labor. The increase in population in an area is in

line with the number of workers. So that the increase

in this number is also in line with the increase in

production activities. Periodic increase in population

is also able to trigger, as well as hinder economic

development. According to Todaro (2006), the

number of workers will increase if the population also

increases. The number of workers when utilized

optimally will affect economic growth from one year

to the next.

H2: Labor Affects Economic Growth

2.8.3 Effect of Regional Tax Revenue on

Economic Growth

In the past twenty years, local tax reform has taken

place in Indonesia. This reform occurred over a

period of three periods (Abuyamin, 2015). In the first

period, it begins with the enactment of Law of the

Republic of Indonesia Number 18 of 1997 concerning

Regional Taxes and Regional Levies. The next

period, marked by the amendment to the Law of the

Republic of Indonesia Number 34 of 2000 and the

third period, with the enactment of the Law of the

Republic of Indonesia Number 28 of 2009 concerning

Regional Taxes and Levies. The purpose of the

implementation of the tax reform is to generate

regional income in the tax sector which is ultimately

utilized for the welfare of the community by

increasing economic growth and regional

development.

The great potential of tax revenues can encourage

economic growth if used appropriately to finance

productive and potential development programs

which in turn can improve the welfare of the people

in Indonesia.

H3: Local Tax Revenue has an effect on Economic

Growth.

2.8.4 Effect of Realized Foreign Direct

Investment, Labor and Local Tax

Revenue on Economic Growth

The main source of economic growth is foreign

investment. Foreign investment activities will result

in a growing capital stock. The increase in production

power has an effect on increasing the capital stock

which is able to increase economic growth and

development and encourage the absorption of the

labor force. Broadly speaking, economic growth will

grow if a lot of investment enters the area (Sarwedi,

2002).

According to Lewis in Todaro (2006) investment

activities in the industrial sector as well as the total

capital in the modern sector have the effect of

economic growth on the absorption of labor, which

has a widespread impact on output in the modern

sector. These are related to each other.

Local tax revenues are very real in contributing to

economic growth, where economic stability can

encourage the economic performance of

entrepreneurs and increase people's purchasing

power. On the one hand, according to Keynes's

economic opinion regarding the number of taxpayers,

he views taxpayers as a form of market expansion.

The Effect of Direct Foreign Investment Realization, Employment and Regional Tax Receiving on Province Economic Growth in Indonesia

2016-2018

51

Thus, taxpayers make a good contribution to

economic growth.

H4: Realization of Foreign Direct Investment,

Labor and Local Tax Revenue Influence on

Economic Growth.

Based on the description of the theoretical study,

literature review, and hypothesis development that

have been described previously, the research model

can be seen in Figure 1:

Figure 1: Research Model.

3 RESEARCH METHODS

Researchers apply quantitative methods in this study.

Researchers use secondary data realization, namely

by collecting and analyzing direct report data, labor,

regional tax revenues and provincial economic

growth in Indonesia in 2016 - 2018 which are

available on the www.bps.go.id and www.bi.go

pages.

3.1 Variable Operational Definition

Dependent Variable

Researchers use economic growth as a dependent

variable influenced by independent variables. He said

the rupiah was expected to strengthen to Rp 9,100 per

dollar in the Jakarta interbank spot market on

Tuesday. As for measuring on a dependent variable

that is proscribed by economic growth.

Independent Variable

In the study the independent variables used were

influential and triggering the dependent variable

changes. Independent variables in this case include

direct foreign investment, labor and tax revenues. As

for operating definition per variable on independent

variables as follows:

1) Foreign direct investment is the total value of

foreign investment realization of provinces in

Indonesia calculated in units of million US$. The

data source is taken from BPS Indonesia with

units of million US$.

2) Labor is the total employment of each province

in Indonesia which is calculated in units. The

data source is taken from BPS Indonesia in units.

3) Tax revenue is the amount of regional tax

revenue for each province in Indonesia which is

calculated in million rupiah (Rp). The data

source is taken from BPS Indonesia.

3.2 Data Processing Techniques

Archival basic data used by researchers to collect

secondary data obtained through the www.bps.go.id

page, to obtain data on the realization of foreign direct

investment, labor and local tax revenues and the

www.bi.go.id website to obtain data on economic

growth province. The researcher uses the SPSS

statistical version 26 application because this

application provides the features needed in research

and has a significant level of accuracy when

processing data.

4 RESULTS

The research data processed in this study is data from

all provinces in Indonesia published by the BPS

website, namely www.bps.go.id and BI, namely

www.bi.go.id, which publishes reports on the

realization of foreign direct investment, labor, tax

revenues. regions as well as economic growth reports

from 2016-2018. The total population from 2016-

2018 was 86 data. Details of the number of samples

can be seen in table 1 below:

Table 1: Samples.

Sample Criteria Amount

Indonesia’s provinces from 2016-2018

102

Sample period 2016-2018

102

Outlier data

(16)

Total sample data processed in research

86

4.1 Descriptive Statistical Analysis

The description of statistical analysis data in this

study is presented in tabular form. The presentation

of the data displays the minimum, maximum, mean,

and standard deviation of the research data. Below is

a descriptive statistical analysis table:

ICAESS 2021 - The International Conference on Applied Economics and Social Science

52

Table 2: Descriptive statistical table.

N Min Max Mean

Std.

Deviatio

n

PE 102 0.36 10.11 5.4138 1.49315

IAL 102 8.00 5573.50 887.451

0

1229.923

52

TK 102 273423.

00

2077988

8.00

356313

0.8431

5058090.

44003

PD 102 2063254

70.00

3753891

2327.00

367246

5492.79

41

6712957

803.7842

0

Valid 102

The table above shows that there is no big enough

gap between the minimum and maximum values of

all ratios, because the average value of each ratio is

greater than the inequality value or standard

deviation.

4.2 Classic Assumption Test

The classical assumption test stage in this study

consisted of four types of tests, namely normality test,

multicollinearity test, and heteroscedasticity test, and

autocorrelation test with the following explanation:

4.2.1 Normality Test

Table 3: Normality test table.

Test Summary Sig K-S Conclusion

Asymp.

Sig (2-tailed)

0,200

Data is normally

distributed

The results of the normality test with one sample

Kolmogorov-Smirnov show that the significance

value is 0.200. The results obtained have a

significance value > 0.05 so that the variables used

are PE, IAL, TK, and PD in this study are normally

distributed.

4.2.2 Multicollinearity Test

Table 4: Multicollinearity test.

Table 4 shows the results of testing the dependent

variable PE, IAL has a VIF value of 1.007 and a

tolerance value of 0.993. TK has a VIF value of 1.345

and a tolerance value of 0.743. PD has a VIF value of

1.351 and a tolerance value of 0.740. Based on the

test results, all variables do not have multicollinearity,

because they have a tolerance value of > 0.10 and a

VIF value of < 10.00. It can be concluded that the

regression model does not occur multicollinearity

4.2.3 Heteroscedasticity Test

Table 5: Heteroscedasticity Test.

Variable Si

g

Conclusion

IAL

0,730 There is no heteroscedasticity

TK

0,505 There is no heteroscedasticity

PD

0,704 There is no heteroscedasticity

Table 5 shows that the probability value of IAL is

greater than the significance value of 0.730 > 0.05.

The probability value in TK is greater than the

significance value 0.505 > 0.05 and in PD the

significance value is 0.704 > 0.05. So, from the test

results above, it can be concluded that the regression

model does not occur heteroscedasticity.

4.2.4 Autocorrelation Test

The results of the autocorrelation test explain that the

DW value is 1.067 which indicates that there is a

positive autocorrelation. The results of the

autocorrelation test can be seen in table 4.6:

Table 6: Autocorrelation Test Results Prior to the

application of the Cochrane Orcutt autocorrelation method.

Model R

R

Square

Adjusted

R Square

Std.

Error of

the

Estimate

Durbin-

Watson

1

0,367

a

0,134 0,103 0,29859 1,067

a. Predictors: (Constant), PD, IAL, TK.

b. Dependent Variable: PE

Based on the test results above that the test results

have an autocorrelation problem. These problems can

be solved by using the data transformation method.

Data transformation is a method to meet the classical

assumption test criteria by changing the data

measurement scale to another form that still has the

same value (Ghozali, 2016). In this study using the

Model

Collinearity Statistics

Conclusion

Tolerance VIF

IAL

0,993 1,007 There is no

multicollinearity

TK

0,743 1,345 There is no

multicollinearity

PD

0,740 1,351 There is no

multicollinearity

The Effect of Direct Foreign Investment Realization, Employment and Regional Tax Receiving on Province Economic Growth in Indonesia

2016-2018

53

data transformation of Cocharane Orcutt. Cocharane

orcutt is a method to solve the autocorrelation

problem by including the lag of the dependent

variable as one of the independent variables.

Table 7: Autocorrelation Test Results After the Application

of the Cochrane Orcutt Autocorrelation Method

Model R

R

Square

Adjusted

R Square

Std. Error

of the

Estimate

Durbin-

Watson

1

0,446a 0,199 0,169 0,26151 1,779

a. Predictors: (Constant), PD, IAL, TK.

b. Dependent Variable: PE

The results of the test using the Cocharane Orcutt

after repairing the autocorrelation show in table 7 the

dependent variable of economic growth has a DW of

1.779. These results indicate that the dependent

variable of economic growth does not have a negative

or positive autocorrelation, because the value of

Durbin Watson is between 1.5 to 2.5.

4.3 Panel Data Regression Analysis

4.3.1 Multiple Linear Regression Analysis

Test Results

This study uses two independent variables and one

dependent variable, namely economic growth as the

dependent variable and the realization of foreign

direct investment, labor and local tax revenues are

independent variables. This processing uses the SPSS

version 26 application with the results of multiple

linear regression analysis obtained as follows:

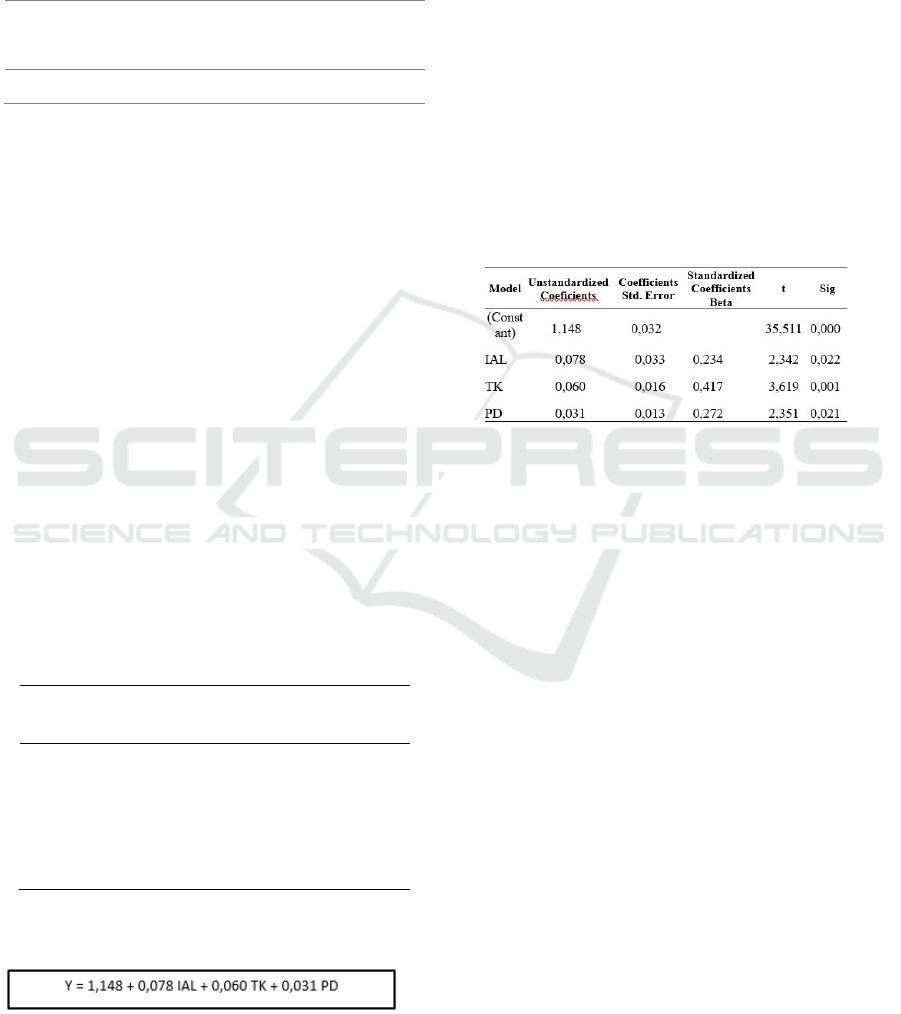

Table 8: Multiple Linear Regression Analysis Test Results.

Model

Unstandardi

zed

Coefficients

Coefficients

Std. Error

Standardized

Coefficients

Beta

t Sig

(Const

ant)

1,148 0,032

35,511 0,000

IAL

0,078 0,033 0,234 2,342 0,022

T

K

0,060 0,016 0,417 3,619 0,001

PD 0,031 0,013 0,272 2,351 0,021

From table 8, it can be seen that the coefficients

for the multiple regression equation are as follows:

In the above equation, a constant coefficient of

1.148 shows that if the independent variable is

considered non-existent, there will be no increase in

economic growth of 1.148. The regression coefficient

for the foreign direct investment variable is 0.078,

indicating that everyone level increase of the foreign

direct investment variable with other assumptions

remains, it will increase economic growth by 0.078.

The regression coefficient for the labor variable is

0.060, indicating that everyone level increase in the

labor variable with other assumptions remains, it will

increase economic growth by 0.060. The regression

coefficient for the local tax revenue variable is 0.031,

indicating that everyone level increase from the local

tax revenue variable with other assumptions remains,

it will increase economic growth by 0.031.

4.3.2 Partial Test Results (t Test)

Table 9: Partial Test Results.

Dependent Variabel: PE

The results of the t-statistical test in table 9 on the

foreign direct investment realization variable have a

positive and significant effect on economic growth.

This can be seen from the significance value of the

variable (IAL) of 0.022 and the probability value of

2.342 where the value is smaller than its significance

(0.022 < 0.05), then the IAL variable is accepted. The

significance value of the labor variable (TK) is 0.001

and the probability value is 3.619, where the value is

smaller than the significance (0.001 < 0.05). This

shows that kindergarten has an effect on economic

growth and has a positive and significant direction.

The local tax revenue (PD) variable has a probability

value of 2.351 and a significance value of 0.021,

which is smaller than its significance (0.021 < 0.05),

it can be concluded that PD has a positive and

significant effect on economic growth.

4.3.3 Simultaneous Significance Test Results

(Test F)

The following are the results of the simultaneous

significance test of the dependent variable which can

be seen in table 4.10, as follows:

ICAESS 2021 - The International Conference on Applied Economics and Social Science

54

Table 10: Simultaneous Test Results.

ANOVA

a

Model

Sum of

Square

s

df

Mean

Squar

e

F

Si

g

Regres

s

ion 1,378 3 ,459

6,71

4 ,000

b

Residu

a

l

5,540 81 ,068

Total

6,917 84

a. Dependent Variable: PE

b. Predictors: (Constant), PD, IAL, TK

Table 10 shows the F statistical test has a

probability value of 0.000b < 0.05, so it can be

concluded that all independent variables together

have a positive and significant effect on the

dependent variable.

4.3.4 Coefficient of Determination Test

Results (R2)

The coefficient of determination (R

2

) describes the

change in the dependent variable and is explained by

the independent variable.

Model Summary

Model R

R

Square

Adjusted

R Square

Std. Error of

the Estimate

1

0,446

a

0,199 0,169 0,26151

Predictors: (Constant), PD, IAL, TK

The results of the coefficient of determination R

square value of 0.199 indicate that the realization of

IAL, TK and PD is only influenced by 19.9%, the rest

of 80.1% is influenced by other variables outside the

variables listed in the study. The factors that influence

economic growth are Y = C + I + G + (X – M). The

explanation of these factors is that Y is national

income, C is consumption, I is investment, G is

government expenditure, X is exports and M is

imports.

4.4 Data Analysis

The following is a summary table of test results from

this study:

Table 11: Summary of test result

Hypothesis

Result

H1: Foreign direct investment

Realization has significant effect on

economic

g

rowth

Supported

H2: Labor has significant effect on

economic

g

rowth

Supported

H3: Local tax revenue has

significant effect on economic

g

rowth

Supported

H4: Realization of foreign direct

investment, labor and local tax

revenue

has silmutaneously effect on

economic

g

rowth

Supported

4.4.1 Effect of Realized Foreign Direct

Investment on Economic Growth

Based on the results of the researcher's test in table

4.12, it can be concluded that the realization of

foreign direct investment has proven to have a

positive and significant effect on economic growth.

Investment is the formation of capital that has the

opportunity to increase the economy in an area. With

the high value of organized investment, it will have

an impact on increasing the regional economy. This

is linear with the statement of Mankiw, et al (2012)

which states that investment can support sustainable

economic growth.

This research is in line with the opinion of

economists in general stating that investment has a

positive relationship with economic growth. The

investment factor is the dominant supporting factor

for economic growth in a country, especially in

Indonesia. Demand and supply are two contributing

factors of investment to economic growth. In this

regard, the government should take a policy that is

intended to increase investment, especially foreign

investment. The results of this study are relevant to

Purnamasari, et al (2017) which prove the effect of

investment on economic growth.

4.4.2 Effect of Labor on Economic Growth

Based on the description of the statistical test

described in table 4.12, it shows that there is a positive

and significant influence between labor on economic

growth. So, it can be concluded that the workforce has

a partial positive influence on aspects of economic

growth. In a sense, the higher the number of workers,

the higher the rate of economic growth.

Research conducted by Todaro (2000) the

increase in society and labor is considered to be one

of the positive factors that spur economic growth. The

high number of workers will increase production.

This is also linear with the theory put forward by

Solow, where economic growth is influenced by an

increase in the number of workers seen from the total

population. Population growth becomes a more

The Effect of Direct Foreign Investment Realization, Employment and Regional Tax Receiving on Province Economic Growth in Indonesia

2016-2018

55

dominant aspect in explaining continuous economic

growth. The results of this study are supported by

Bawuno, et al (2015); Helen, et al (2017); Sari, et al

(2016); Heidy (2012); Mahriza and Amar (2019) in

general the workforce has a positive and significant

influence on economic growth.

4.4.3 Effect of Regional Tax Revenue on

Economic Growth

Based on the results of statistical tests, in table 4.12

which have been explained show a significant and

positive influence between local tax revenues on

economic growth. Viewed from several positive

perspectives on the effect of tax revenues on

economic growth, it can be analyzed those

regulations covering several activities such as the

formulation, decision making, assessment and

implementation of policies, as well as procedures.

From the previous research Saragih (2018);

Gebreegziabher (2018); Stoilova (2017); Adkisson

and Mohammed (2014) who globally detect that there

is a positive effect of local tax revenues on economic

growth. This illustrates that if local tax revenues

increase or are above the average value, it will have a

positive impact on provincial economic growth in

Indonesia.

4.4.4 Effect of Realized Foreign Direct

Investment, Labor and Local Tax

Revenue on Economic Growth

Based on the results of statistical tests, it shows that

IAL, TK, PWD have a significant influence on

economic growth. This shows that these three

variables significantly affect economic growth.

Supported by the results of previous research, namely

Purnamasari, Rostin and Ernawati (2017). The impact

of high investment will affect the opening of job

opportunities which will indirectly absorb labor, so

that more and more workers can increase the income

generated. The high income will have an impact on

the higher taxpayers who make tax payments and will

affect local tax revenues in an area. This illustrates,

the high level of local tax revenue will affect regional

economic growth. Thus, foreign direct investment,

labor and local tax revenues have an effect on

economic growth.

5 CONCLUSIONS

Based on the limitations of the problems that have

been described, there are suggestions for further

research, namely as follows: (1) Further research is

expected to be able to increase the number of time

periods used, so that they can represent the years

before and after; (2) Further research, it is better to

add other variables that are thought to affect

economic growth, such as exchange rates, domestic

investment, inflation, and capital accumulation.

REFERENCES

Abuyamin, O. (2015). Perpajakan: Dasar-dasar Perpajakan,

KUP.PPh, PPN & PPnBM, PBB, Pajak Daerah dan

Retribusi Daerah. Bandung: Mega Rancage Press.

Anoraga, P. (1995). Perilaku Keorganisasian. Jakarta:

Pustaka Jaya.

Badan Pusat Statistik. (2019). Statistik Keuangan

Pemerintah Provinsi 2016-2019. Jakarta, Indonesia:

BPS RI.

Bawuno, E. E., Kalangi, B. J., & Sumual, I. J. (2015).

Pengaruh Investasi Pemerintah dan Tenaga Kerja

Terhadap Pertumbuhan Ekonomi di Kota Manado. Sam

Ratulangi Fakultas Ekonomi dan Bisnis, Jurusan Ilmu

Ekonomi Pembangunan Universitas.

Gebreegziabher, S. (2018). Effects of Tax and Government

Expenditure on Economic Growth in Ethiopia.

Ghozali. (2016). Aplikasi Analisis Multivariate dengan

Program IBM SPSS. Semarang: Badan Penerbit

Universitas Diponegoro.

Gitman, L. J., & Joehnk, M. D. (2005). Fundamentals of

Investing. Jakarta: Pearson.

Heidy, M. (2012). Pengaruh Investasi dan Tenaga Kerja

Terhadap Pertumbuhan Ekonomi Kota Manado.

Fakultas Ekonomi Universitas Sam Ratulangi.

Kuncoro, M. (2004). Otonomi dan Pembangunan Daerah,

Reformasi, Perencanaan Strategis dan Peluang2004.

Jakarta: Erlangga.

Mahriza, T., & Amar, S. B. (2019, Agustus). Pengaruh

Investasi Dalam Negeri, Investasi Asing, Tenaga Kerja

dan Infrastuktur Terhadap Perekonomian di Provinsi

Sumatera Barat. Jurnal Kajian Ekonomi dan

Pembangunan Fakultas Ekonomi Universitas Negeri

Padang, 1(3), 691-704.

Mankiw, N. G., Quah, E., & Wilson, P. (2012). Pengantar

Ekonomi Makro: Principles of Economics an Asian

Edition (Volume 2). Jakarta: Salemba Empat.

Prakosa, K. B. (2005). Pajak dan Retribusi Daerah.

Yogyakarta: UII Press.

Purnamasari, S. A., Rostin, & Ernawati. (2017). Pengaruh

investasi dan tenaga kerja terhadap pertumbuhan

ekonomi di provinsi Sulawesi Tenggara. Jurnal Progres

Ekonomi Pembangunan (JPEP), 2, 1-14.

Republik Indonesia (2000). Undang-Undang Nomor 34

Tahun 2000 tentang Pajak Retribusi Daerah

Rahardja, P., & Manurung, M. (2008). Pengantar Ilmu

Ekonomi (Mikroekonomi dan Makroekonomi).

Jakarta: Salemba Empat.

Sagala, & Ratmono. (2015). Analisis Pengaruh

Pengungkapan Corporate Social Responsibility

ICAESS 2021 - The International Conference on Applied Economics and Social Science

56

terhadap Agresivitas Pajak. Diponegoro Journal of

Accounting, 1-9.

Saragih, A. H. (2018). Pengaruh Penerimaan Pajak

Terhadap Pertumbuhan Ekonomi di Indonesia. Jurnal

Sistem Informasi, Keuangan, Auditing dan Perpajakan,

3, 17-27.

Sari, M., Syechalad, M. N., & Majid, S. A. (2016,

November). Pengaruh Investasi, Tenaga Kerja dan

Pengeluaran Pemerintah terhadap Pertumbuhan

Ekonomi di Indonesia. Jurnal Ekonomi dan Kebijakan

Publik, 3(2), 109-115.

Sarwedi. (2002). Investasi Asing Langsung di Indonesia

dan Faktor yang Mempengaruhinya. Jurnal Akuntansi

dan Keuangan.

Stoilova, D. (2017). An Empirical Evidence for the Impact

of Taxation on Economy Growth in the European.

Contaduria y Administracion, 62(3), 1041-2057.

Sukirno, S. (2000). Makroekonomi Teori Makroekonomi.

Jakarta: PT. Raja Grafindo.

Sumarsan, T. (2010). Perpajakan Indonesia. Jakarta:

Indeks.

Todaro, M. p. (2000). Pembangunan Ekonomi di Dunia

Kelima, Edisi ketujuh. Jakarta: Bumi Aksara.

Todaro, P. M., & Stephen, C. S. (2006). Pembangunan

Ekonomi. Jakarta: Erlangga.

The Effect of Direct Foreign Investment Realization, Employment and Regional Tax Receiving on Province Economic Growth in Indonesia

2016-2018

57