Analysis of the Effect of the Use of Electronic Money, Debit Card and

Hedonic Lifestyle on College Student Consumption Behavior: Case

Study: College Student of the Batam State Polytechnic Applied

Business Administration Study Program

Ru’yati Prihastuti and Bambang Hendrawan

Applied Business Administration, Politeknik Negeri Batam, Batam, Indonesia

1

Politeknik Negeri Batam, Batam, Indonesia

Keywords: Electronic Money, Debit Cards, Hedonic Lifestyle, Consumptive Behavior.

Abstract: This study discusses the effect of electronic money, debit cards, and hedonic lifestyles on student

consumptive behavior. Retrieval of research data using questionnaires or questionnaires and documentation.

Using multiple linear regression analysis and descriptive analysis to explain the results of the study. The

research sample was 137 respondents, the respondents were students of the 2017 Applied Business

Administration study program and the 2018 batch of Batam State Polytechnic. The results of this study are

that there is a negative effect of the use of electronic money on the consumptive behavior of students, there

is a significant positive effect of a partially hedonic lifestyle on the consumptive behavior of students. The

debit card variable partially has no effect on the consumptive behavior of students. The variables of

electronic money, debit cards, and hedonic lifestyles together affect the consumptive behavior of students.

1 INTRODUCTION

Money is a legal medium of exchange. Along with

the development of increasingly rapid technological

advances, money is now not only in the form of cash

or cash. Financial Technology (Fintech) is always

developing and innovating. One of the innovations

in the world of financial technology is the

emergence of an electronic payment system, to

maximize the use of indirect payment transactions

(Dwi, et al., 2020). Payment transactions are divided

into electronic money in the form of balances on an

application or server, and chip-based electronic

money found on cards such as debit and credit cards.

Server-based electronic money is money that is

not in the form of cash but the form of balances in

application programs such as shopeepay, go-pay, i-

saku, and other forms of electronic money. The

process of filling out electronic money, using it, as

well as the security provided or facilitated by the

issuer of electronic money really, helps users to be

more efficient for financial transactions.

People also often use cards as a means of

payment, for example, using debit cards. A card

payment instrument (APMK) is a transaction

medium containing a balance (money) that is useful

for paying off obligations arising from economic

activity.

Concerning the ease of payment transactions, it

creates the habit of making shopping easier for

teenagers, especially students. Students tend to

spend time entertaining themselves by having fun

and getting the center of attention. One of the habits

that exist among students, in general, is shopping,

traveling, spending time with social media, and

others. With these habits, it is not surprising that

they spend time shopping for things that are less

needed and less useful, such habits can be called a

hedonic lifestyle (Anggraini and Santhoso, 2017).

With the non-cash payment system and the

easier, it is to use the payment, the community,

especially students, make purchases more often or

make transactions more often. More and more online

shops and marketplaces and easy transactions make

students, in particular, to be able to choose their

lifestyle to be wiser in shopping or choose to be

consumptive. Consumptive behavior is the attitude

or behavior of someone who has excessive and

Prihastuti, R. and Hendrawan, B.

Analysis of the Effect of the Use of Electronic Money, Debit Card and Hedonic Lifestyle on College Student Consumption Behavior: Case Study: College Student of the Batam State

Polytechnic Applied Business Administration Study Program.

DOI: 10.5220/0010894700003255

In Proceedings of the 3rd International Conference on Applied Economics and Social Science (ICAESS 2021), pages 307-315

ISBN: 978-989-758-605-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

307

unreasonable consumption behavior of goods

(Lestarina, et al., 2017).

Based on this description, it can be seen that

there is a change in behavior due to technological

developments, especially in the field of payment

from using cash to non-cash so that it affects the

consumptive behavior of students. For this reason,

this study examines the effect of using electronic

money, debit cards, and style. hedonic life towards

consumptive behavior of students of the Applied

Business Administration study program class of

2017 and class of 2018 Batam State Polytechnic.

2 LITERATURE REVIEW

The study of the literature discusses contains the

foundation of the theory that is relevant to the

research.

2.1 Payment System

The payment system is a system that involves a set

of rules, institutions, and mechanisms used to carry

out the transfer of funds, to fulfill an obligation that

arises from economic activity.

Meanwhile, according to previous researchers,

they defined a payment system in the form of rules

or regulations, instruments, standards, used in the

process of exchanging financial values carried out

by two or more parties (Fatmasari, et al., 2019).

Thus, it can be concluded that the payment system is

a system that involves rules, institutions, and

mechanisms used for the process of exchanging

money values or transferring funds carried out by

two or more parties to fulfill an obligation arising

from economic activity.

Indonesia has two payment systems, namely cash

payment systems, and non-cash payment systems.

Electronic money is divided based on technology,

there are two types. First, chip-based electronic

money, using a card number as an identity, for

example, an ATM card. Second, server-based

electronic money, this type of electronic money uses

an email address, phone number, or other as an

identity, for example, Dana, i-Saku, Go-pay, and

others (Dwi, et al., 2020).

2.2 Electronic Money

Electronic money is a product that has a stored value

or prepaid where there is a certain amount of money

stored in an electronic media owned by someone

called a balance that can be used for various types of

payments (multi-purposed) (Dwi, et al., 2020).

Meanwhile, the value of electronic money is the

value of money stored electronically in a media

server or chip that can be transferred for the purpose

of payment transactions and or for transfer of funds,

and in electronic money there are several

instruments. payments that must meet the following

elements:

a. Issued on the basis of the value of money

that was deposited in advance to the issuer.

b. Value of money stored electronically in a

media server or chip; and

c. The value of electronic money managed by

the issuer is not a deposite as referred to in

the Law government banking.

Electronic money has some variable operational

that is ‘ease of use’, benefits of e-money, promotion,

and security. Ease of use is defined as an action

where someone believes that a computer or

electronic device can be easily understood, from this

definition it can be concluded that ease of use will

reduce a person's effort (energy and time) in learning

electronic device (Rahman and Dewantara, 2017).

The benefits of electronic money in the form of

subjective possibilities from users of applications or

electronic devices that have the potential to help in

work, so that they are more useful and more

efficient, thus the results obtained will be even better

in terms of non-physical or physical (Aksami and

Jember, 2019).

The more widespread trade in Indonesia, the

more agents or digital money issuers. As a form of

marketing, digital money publishers have recently

carried out many promotions aimed at making their

digital products used by potential users. The

definition of promotion is a means of external

communication from service/goods providers to

motivate potential buyers to make transactions

(Latief and Dirwan, 2020).

Security is a very important thing in a payment

instrument, low security in electronic money or e-

money is an aspect that really needs to be considered

by publishers for the development of these electronic

products (Aksami and Jember, 2019).

2.3 Debit Card

The payment system uses a debit card in the form of

a facility provided by the bank to customers or

holders of savings or current accounts in their

banking which can be used to perform various kinds

of transactions, including payment transactions

where if the card is used to make transactions, the

nominal amount of the funds in the savings will be

ICAESS 2021 - The International Conference on Applied Economics and Social Science

308

reduced. (Fatmasari, et al., 2019).

In terms of the function of a debit card, it

functions as a tool to withdraw money from an

ATM, it can be used for account transfers, used for

cash deposits, and paying bills. In terms of the

benefits of a debit card, it has benefits such as easy

and efficient use due to fast transaction processes,

being able to make payments without cash. For risks

and drawbacks, namely, the use of a debit card is

only limited to the balance on the card, the risk of

theft of customer data, as well as negligence by the

cardholder in storage.

The use of debit cards also has strong legal

protection as regulated concerning customer

protection as consumers. In the law, it is written

about the rights of customers as consumers and

responsibilities to the bank as the issuer. There are

two kinds of legal protection owned by the

cardholder or cardholder (Savira, 2019). First,

repressively carried out by resolving disputes.

Second, preventively carried out by the customer

making a complaint against the bank if the customer

feels or finds an inappropriate situation.

2.4 Hedonic Lifestyle

The lifestyle or lifestyle of individuals who in doing

activities to seek the pleasures of life by spending

their time having fun outside the home with their

friends just shopping or buying things that are not

needed and always want to be the center of attention

around them is called a hedonic lifestyle (Anggraini

and Santhoso, 2017).

Aspects of the hedonic lifestyle consist of:

a. Activity is a person's way of using his time with

tangible and observable actions such as talking,

traveling, shopping, entertainment, and other

activities.

b. Interest is the level of satisfaction or pleasure

that arises specifically and makes the person pay

attention to certain objects or events.

c. Opinion is a written or oral response to a

stimulus that arises in the form of social, sport,

or community issues or entertainment.

2.5 Consumptive Behavior

Individual actions that are directly or carried out by

oneself make frequent and excessive purchases of

goods to fulfill their desires, not just for needs, this

activity results in a lot of expenditure or waste so

that the costs used are inefficient (Lestarina, et al.,

2017).

Many goods or services are purchased by

consumers without thinking about their use so that

the nature of the goods or services becomes

excessive, this means that a person becomes more

controlled by worldly desires and material pleasures

(Patricia and Handayani, 2014).

The aspects of consumptive behavior according

to Khairat, et al., (2018) are as follows:

a. Impulsive buying

b. Irrational buying

c. Overbuying

After knowing what aspects of consumptive

behavior are, then there are two factors (internal and

external) that can influence consumptive behavior.

Internal factors, including motivation, observation

and learning process, personality, self-concept, also

belief. Second, external factors include culture, role

models, social class, and family (Lestarina, et al.,

2017).

2.6 Relationship between Variables

The use of money as a means of payment

transactions generally does not use cash but uses

services provided by banks such as transfers

between accounts or with existing balances in

electronic money. This allows students to have the

behavior of spending money to just fulfill their

desires or consumptive behavior. The use of debit

cards and electronic money has an effect on student

spending because the higher the use of debit cards

and electronic money, the more expenses will be

made (Ramadani, 2016).

The rapid development of technology and

industry has made people's supplies of goods more

abundant. This causes people to easily consume

goods that are not only primary goods or necessities,

but other consumption is also carried out such as

excessive shopping, visiting several tourist

attractions such as karaoke, and others. This habit is

referred to as an excessive lifestyle or having a

hedonic lifestyle. Such a lifestyle that tends to be

excessive and leads to a luxurious life leads to

consumptive behavior (Patricia and Handayani,

2014).

3 METHOD

3.1 Population and Sample

Students of Applied Business Administration Study

Program Class of 2017 and Class of 2018 Batam

State Polytechnic became the research population.

Analysis of the Effect of the Use of Electronic Money, Debit Card and Hedonic Lifestyle on College Student Consumption Behavior: Case

Study: College Student of the Batam State Polytechnic Applied Business Administration Study Program

309

The research sample was 137 respondents.

Determination of the number of respondents using

the Solvin formula with a 95% confidence level.

Sampling using the method of distributing

questionnaires to respondents using google form.

3.2 Operational Variables

Conducting a study, of course, requires complete

instructions on what must be there and observed and

what variables must be measured and tested, so

operational variables are needed.

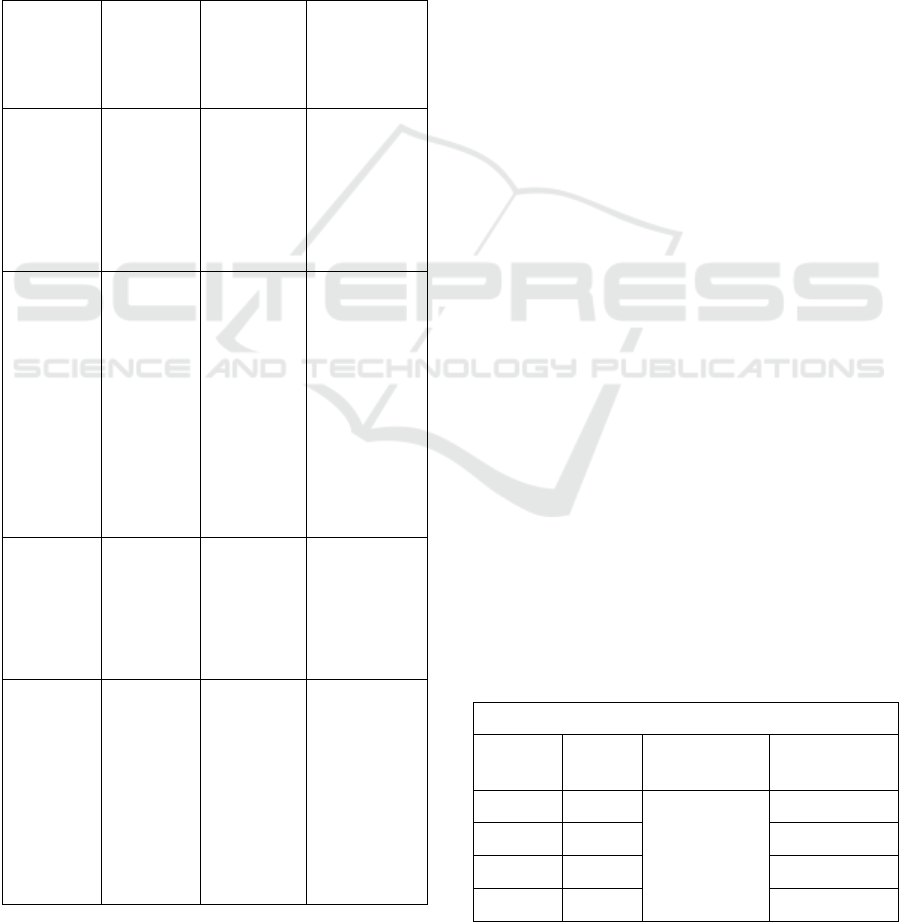

Table 1: Operational Variables.

Variable

Definition

Variable

Dimensi

Variabel

Indikator

Electronic

Money

(X

1

)

Electronic

money is

money

stored in

electronic

media.

Advantage

s of using

electronic

money.

1. (Easy to

use)

2. Benefits of

electronic

money

3. Promiotion

4. Securit

y

Debit

Card

(X

2

)

Debit

Card (X2)

Payment

instrument

using the

card

provided

by the

bank as a

facility for

its

customers.

Facilities

obtained

using a

debit card.

1. Debit card

function

2. Debit card

benefits

3.Security

using a debit

card

Hedonic

Lifestyle

(X

3

)

A lifestyle

that is

carried out

by

someone

for fun.

Aspects of

a hedonic

lifestyle 1.

Activities

1. Activit

y

2. Interest

3. O

p

inion

Consumpt

ive

Behavior

(Y)

An

individual

action or

behavior

in buying

goods

based on

desires,

not based

on needs.

Aspects of

Consumpti

ve

behavior.

1. Impulsive

Purchase

2. Irrational

Purchase

3. Excessive

Purchase

3.3 Analysis Method

In completing exploratory interactions, the

techniques used are descriptive elaboration and

inferential measurement. The descriptive translation

method is used to explain and describe the data

contained in the study in the form of diagrams,

tables, and others (Hanafiah, et al., 2020). Inferential

statistics is a technique for analyzing data in a study

(Susilawati, et al., 2019).

The research data was obtained by using a

questionnaire or questionnaire and documentation

method. After getting the data, then the data is

processed using the SPSS version 25 application

program. To measure the validity and reliability of

the items that become indicators in data collection

by conducting reliability tests and validity tests.

After the validity and reliability tests have been

carried out, different tests are carried out, namely

normality tests, heteroscedasticity tests, and

multicollinearity tests which are generally referred

to as presumption tests or classical assumption tests.

To test the analysis using multiple linear regression,

and to test speculation using the F test, and t-test.

4 RESULTS

After obtaining data from the distribution of

questionnaires and documentation, the following are

the results and explanations of the analysis used.

4.1 Validity Test

The validity of an indicator item in the questionnaire

is of course very important, for that, a validity test is

carried out which is useful to see whether the

questionnaire items in each variable are valid or

invalid. Indicator items are said to be substantial or

valid if R count > R table (Ghozali, 2018). R table is

obtained by looking at the R-table with df = (N-2)

and = 0.05. The R-table is 0.1678.

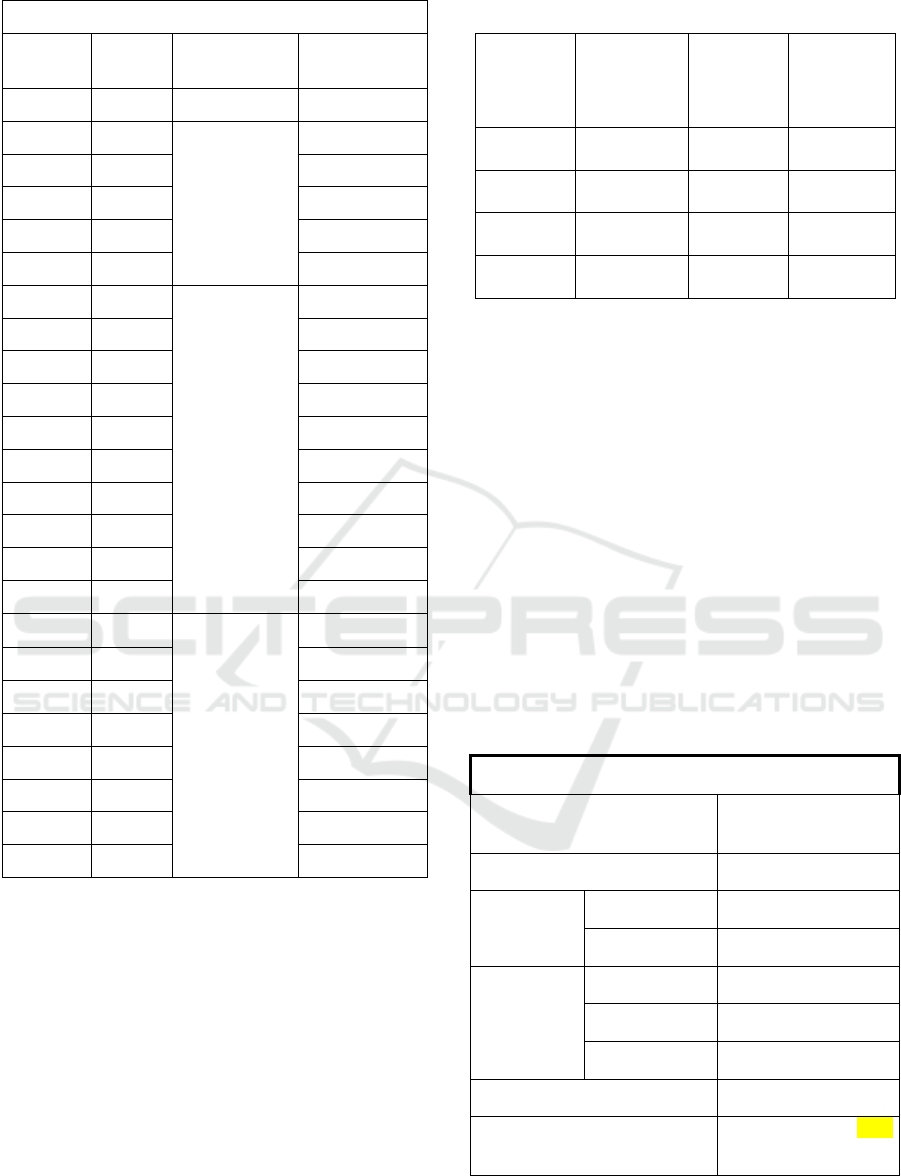

Table 2: Result of Validity Test.

Validity

Item

R-

Count

R-table Decison

X1.1 0.811

0,1678

Valid

X1.2 0.775 Valid

X1.3 0.844 Valid

X1.4 0.825 Valid

ICAESS 2021 - The International Conference on Applied Economics and Social Science

310

Validity

Item

R-

Count

R-table Decison

X1.5 0.686 Valid

X2.1 0.827

0,1678

Valid

X2.2 0.906 Valid

X2.3 0.862 Valid

X2.4 0.831 Valid

X2.5 0.780 Valid

X3.1 0.572

0,1678

Valid

X3.2 0.599 Valid

X3.3 0.626 Valid

X3.4 0.662 Valid

X3.5 0.527 Valid

X3.6 0.465 Valid

X3.7 0.416 Valid

X3.8 0.632 Valid

X3.9 0.675 Valid

X3.10 0.661 Valid

Y1 0.614

0,1678

Valid

Y2 0.221 Valid

Y3 0.700 Valid

Y4 0.754 Valid

Y5 0.390 Valid

Y6 0.354 Valid

Y7 0.744 Valid

Y8 0.573 Valid

Based on the results of calculations using a data

processing application, all statement items in the

questionnaire have a significance value of more than

0.1678, which means that all statement items for

each variable are valid.

4.2 Reliability Test

Reliability testing was carried out aimed at seeing

the reliability of the statement items contained in the

electronic money variable, debit card variable,

hedonic lifestyle variable, and consumptive behavior

variable. It is said reliable if the value Cronbach

Alpha > 0.06 (Nanincova, 2019).

Table 3: Result of Reliability Test.

Variable

Alpha

Cronbach

Cut off

Alpha

Cronbach

Decision

X1 0.846 0.60 Reliabel

X2 0.896 0.60 Reliabel

X3 0.785 0.60 Reliabel

Y 0.730 0.60 Reliabel

Referring to the results of the reliability test,

which has been summarized in the form of a table, it

can be seen that the Cronbach Alpha value in the

three research variables is more than 0.60 it means

that all research items are reliable.

4.3 Classic Assumption Test

Test carried out in order to obtain ideal results from

the regression model used. There are three konds of

test:

4.3.1 Normality Test

Used to see the normality or fairness in the

distribution of the data has been generated. It is

considered normal if the sig. > 0.05 (Ghozali, 2018).

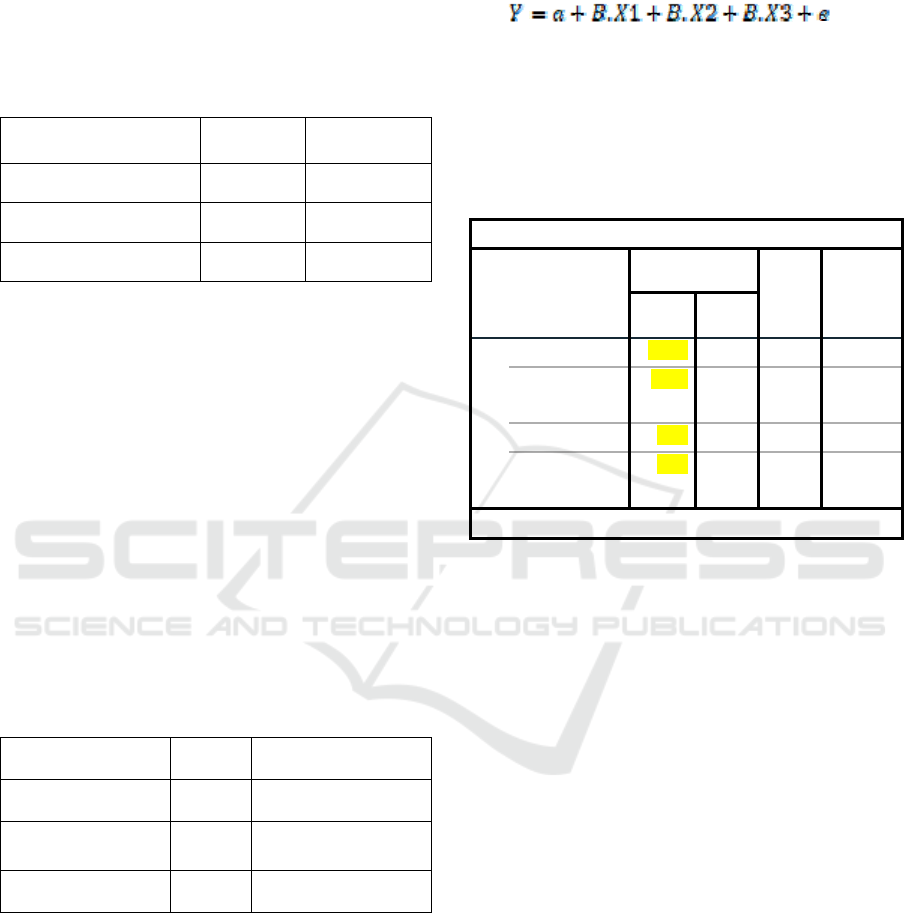

Table 4: Result of Normality Test.

One-Sample Kolmogorov-Smirnov Test

Unstandardized

Residual

N 137

Normal

Parameters

a, b

Mean .0000000

Std. Deviation 2.01603426

Most

Extreme

Differences

Absolute .071

Positive .041

Negative -.071

Test Statistic .071

Asymptotic Significance (2-

tailed)

.086

c

The significance value of this research article is

0.086, which means that the distribution of the data

is reasonalble or normal.

Analysis of the Effect of the Use of Electronic Money, Debit Card and Hedonic Lifestyle on College Student Consumption Behavior: Case

Study: College Student of the Batam State Polytechnic Applied Business Administration Study Program

311

4.3.2 Multicollinearity Test

It is necessary to determine the correlation or

relationship between the independent variables of

the study, for that a multicollinearity test is carried

out.

Table 5: Result of Multicollinearity Test.

Variable Tolerance VIF

Electronic Money 0.665 1.504

Debit Card 0.649 1.540

Hedonic Lifestyle 0.969 1.033

As seen from table 5 the three independent

variables are said to be good and meet the

requirements because they have met the

requirements in the multicollinearity test, namely the

tolerance value more than 0.1 and VIF value is less

than 10.

4.3.3 Heteroscedasticity Test

In this study, it is necessary to see the residual value

of between variables, so a heteroscedasticity test is

carried out with the aim that the regression model

used is free from heteroscedasticity. The certainty of

the test is determined if the significance value is

more than 0.05 (Gumilang, 2020).

Calculation of test statistics heteroscedasticity is

presented in table 5. following:

Table 6: Hasil Uji Heteroskedastisitas.

Variabel Sig. Keputusan

Electronic Money 0.482

Free

Heteroscedasticit

y

Debit Card 0.287

Free

Heteroscedasticity

Hedonic Lifestyle 0.565

Free

Heteroscedasticity

Referring to table 6. it can be seen that the

significance value of the independent variables,

namely 0.482, 0.287, 0.565 is more than 0.5 which

means that it is free from heteroscedasticity.

4.4 Multiple Linear Regression

Analysis

In conducting the research, an analytical tool is

needed to prove the research hypothesis about the

effect of the independent variable on the dependent

variable, so multiple linear regression is used. The

regression equation used is:

(1)

Y = variable bound

α

= constant

B

= regression coefficients

X = independent variable

e = eror

Table 7: Result of Multiple Regression Analysis.

Coefficients

a

Model

Unstandardized

Coefficients

t Sig.B

Std.

Erro

r

1 (Constant) 9.466 1.749 5.412 .000

Uang

Elektronik

-.208 .101 -2.071 .040

Kartu Debit .109 .101 1.084 .280

Gaya Hidup

Hedonis

.470 .044 10.70

4

.000

a. Dependent Variable: Perilaku Konsumtif

The form of the regression equation model based

on the resulting table of regression analysis is

presented in the form of the following equation:

Y= 9.466 - 0.208X

1

+ 0.109X

2

+ 0.470X

3

+ e (2)

Referring to the existing regression equation

model, then:

The constant value of 9.466 is the absolute value

of the dependent variable. This means that the value

will remain if each independent variable (electronic

money, debit card, hedonic lifestyle) does not

increase or is 0.

The effect of the electronic money variable (X1)

on electronic money (Y) can be seen by referring to

the equation model, namely by looking at the

regression coefficient value on the electronic money

variable, which is -0.208, thus having a meaning for

each change per unit of the electronic money

variable, it will be reduced by 0.208 on the variable

consumptive behavior with a note that the value of

the other independent variables remains.

The effect of the debit card variable (X2) on the

consumptive behavior variable (Y) can be seen by

referring to the equation model, namely by looking

at the regression coefficient value on the debit card

variable, which is 0.109. This indicates that for each

ICAESS 2021 - The International Conference on Applied Economics and Social Science

312

change per unit value in the debit card variable, it

will increase by 0.109 in the consumptive behavior

variable with a note that the value of other variables

does not change or remains.

Referring to the equation model, the coefficient

value on the hedonic lifestyle variable (X3) is 0.470.

This shows that for every one-unit increase in the

hedonic lifestyle variable, it will increase by 0.470

in the dependent variable of consumptive behavior

(Y) with a note that the other independent variables

have a fixed value.

4.5 Hypothesys Test

The proof of the hypothesis in the research article

uses the simultaneous test of the F test and the

partial test of the t-test and RandR square analysis.

4.5.1 Simultaneous Tes (F-test)

The F test is used to see whether there is an

influence between the independent factors on the

dependent variable simultaneously or together.

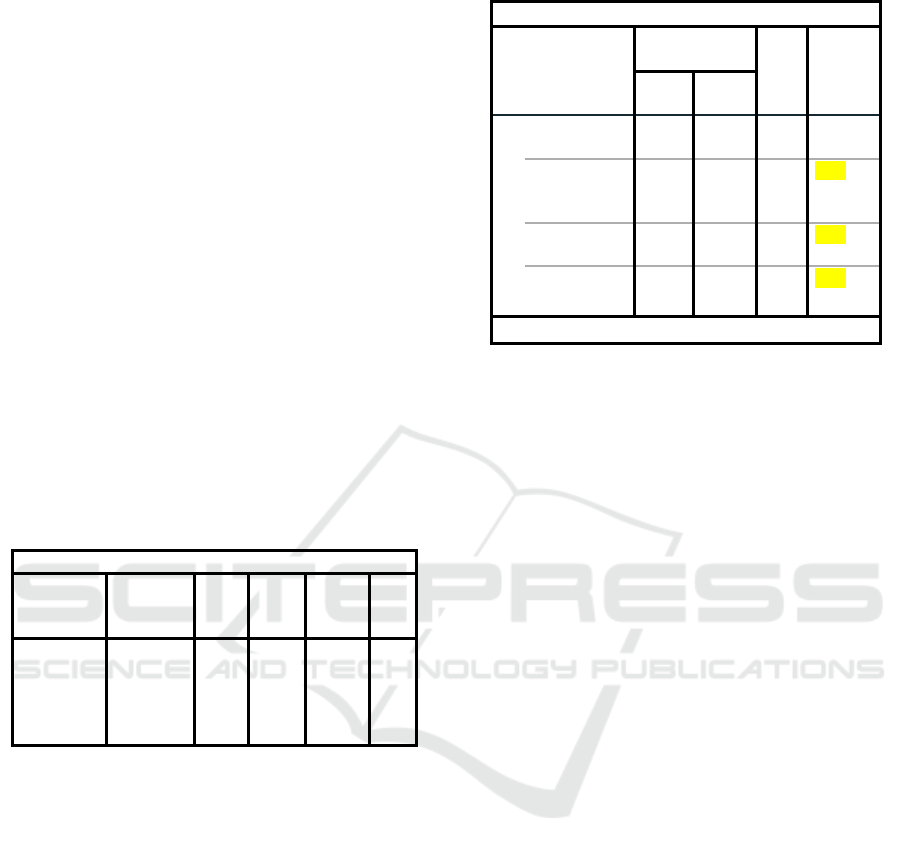

Table 8: Result of F-test.

ANOVA

a

Model

Sum of

S

q

uares df

Mean

Squar

e F Si

g

.

1 Regress

ion

510.425 3 170.1

42

40.93

8

.000

b

Residua

l

552.758 133 4.156

Total 1063.182 136

Referring to the results of the statistical test in

table 8. The significance value is 0.000 which means

it is below 0.05. Therefore, based on a significance

level of 5% or 0.05, namely H0 is rejected and H1 is

recognized or there is an influence from the

independent variables of electronic money, debit

cards, and hedonic lifestyles on the dependent

variable, namely consumptive behavior.

4.5.2 Partial Test (T-test)

This test is used to see whether there is an influence

of independent factors or independent variables on

the dependent factors individually or individually.

Table 9: Result of T-test.

Coefficients

a

Model

Unstandardize

d Coefficients

t Sig.B

Std.

Erro

r

1 (Constant) 9.466 1.749 5.41

2

.000

Uang

Elektronik

-.208 .101 -

2.07

1

.040

Kartu Debit .109 .101 1.08

4

.280

Gaya Hidup

Hedonis

.470 .044 10.7

04

.000

a. Dependent Variable: Perilaku Konsumtif

Decision making on t-test:

a. The significance value is less than 0.05, then:

H0 is rejected and H1 is accepted.

b. The significance value is more than 0.05, then:

H0 is acccepted and H1 is rejected.

The Effect of Electronic Money Variables on

Consumptive Behavior

Referring to the results of the analyst test that has

been carried out and seen in the t-test table, it can be

seen that the significance value of electronic money

is 0.040, which means less than 0.05. It can be

concluded that at the 5% significance level, H0 is

rejected and H1 is accepted or there is an influence

of the electronic money variable itself on the

consumptive behavior variable.

The Effect of Debit Card Variables on

Consumptive Behavior

Referring to the analysis test that has been

carried out and seen in the t-test table, it can be seen

in the debit card's significance value, which is 0.280,

which means it is greater than 0.05. It can be

concluded that at the 5% significance level, H0 is

accepted and H1 is rejected or in other words, the

independent variable of the debit card has no

independent influence on the dependent variable of

consumptive behavior.

The Effect of Hedonic Lifestyle Variables on

Consumptive Behavior

Referring to the analysis test that has been

carried out and seen in the t-test table, it can be seen

that the significance value of the hedonic lifestyle is

0.000, which means it is less than 0.05. It can be

concluded that at the 5% significance level, H1 is

accepted and H0 is rejected or in other words, the

Analysis of the Effect of the Use of Electronic Money, Debit Card and Hedonic Lifestyle on College Student Consumption Behavior: Case

Study: College Student of the Batam State Polytechnic Applied Business Administration Study Program

313

independent variable of the hedonic lifestyle itself

has an influence on the dependent variable of

consumptive behavior.

4.5.3 Correlation (R) and Determination

Analysis (R square)

The following table shows the results of the

calculation of the correlation coefficient and the

coefficient of determination:

Table 10: Result of R and R square.

Model Summar

y

Model R

R

S

q

uare

Adjusted

R S

q

uare

Std. Error of the

Estimate

1 .693

a

.480 .468 2.039

Referring to table 10. which the results can be

seen as a correlation value of 0.693. Thus, giving

meaning to the independent variable correlation of

electronic money, debit card, hedonic lifestyle on the

dependent variable of consumer behavior is quite

strong and positive. This means that the higher the

respondent's answer value on the electronic money,

debit card, and hedonic lifestyle variables, the higher

the value of the consumptive behavior variable. On

the other hand, the lower the value of the

independent variable, the lower the value of the

dependent variable will be.

The value of the coefficient of determination (r

square) is 0.480 or 48%. this means that the

variables of electronic money, debit cards, and

hedonic lifestyles affect the consumptive behavior

variable by 48%, while the remaining 52% is

influenced by other variables outside the study.

Based on table 9. the three independent

variables, namely electronic money, debit cards, and

hedonic lifestyle variables, have been t-tested. The

results of the test indicate that two independent

variables from three independent variables have a

significant influence on consumptive behavior,

namely the electronic money variable and the

hedonic lifestyle variable. Between the two, it can be

seen that the hedonic lifestyle variable is the most

powerful variable in influencing consumptive

behavior with a t value of 10,704 and a variable

mean value of 2.53.

Although the electronic money variable has a

variable mean value of 3.31 which means it is

greater than the hedonic lifestyle variable. This does

not make the electronic money variable a fairly

strong variable in influencing consumptive behavior

because the t value in the electronic money variable

is -2.071 which means it is smaller than the t value

in the hedonic lifestyle variable. Thus, the hedonic

lifestyle variable is the variable that has the most

significant value in influencing the Consumptive

Behavior of students of the Batam State Polytechnic

Business Administration study program in the 2017

and 2018 batches.

5 CONCLUSIONS

Based on the results of research that have been

conducted regarding the influence of the use of

Electronic Money, Debit Cards, and Hedonic

Lifestyles on Consumptive Behavior of students of

the 2017 Applied Business Administration study

program and the 2018 Batam State Polytechnic, it

can be concluded that:

1.

Electronic money itself has a negative effect on

the consumptive behavior of students of the

2017 Applied Business Administration study

program and the 2018 batch of Batam State

Polytechnic.

2.

The Debit Card itself does not have a significant

influence on the consumptive behavior of

students of the 2017 Applied Business

Administration study program and the 2018

batch of Batam State Polytechnic.

3.

The Hedonic Lifestyle itself has a positive

effect on the consumptive behavior of students

of the 2017 Applied Business Administration

study program and the 2018 batch of Batam

State Polytechnic.

4.

Based on the results of the analysis that the

three variables (electronic money, debit cards,

and a hedonic lifestyle) simultaneously have a

significant influence on the consumptive

behavior of students of the 2017 and 2018

Applied Business Administration study

program, Batam State Polytechnic.

ACKNOWLEDGMENTS

Acknowledgments are addressed to Mr. Uuf

Brajawidagda, ST., MT., Ph.D., Director of Batam

State Polytechnic, Mr. Bambang Hendrawan, ST.,

MSM., CIPM., CISPM, as Assistant Director II for

General Administration and Finance, Mrs. Arniati,

SE., MSi., Ph.D. AK., CPA, as Head of the Business

Management Department, Mr. Rahmat Hidayat.,

S.AB., M.AB as Head of the Applied Business

Administration Study Program, Ms. Dwi

ICAESS 2021 - The International Conference on Applied Economics and Social Science

314

Kartikasari, ST., MBA as Lecturer Guardian, and a

Lecturer in the Polytechnic Business Management

Department Batam country.

REFERENCES

Aksami, N. D., and Jember, I. (2019). Analisis Minat

Penggunaan Layanan E-Money pada Masyarakat Kota

Denpasar. Jurnal Ekonomi Pembangunan, 8(9), 2439-

2470.

Anggraini, R. T., and Santhoso, F. H. (2017). Hubungan

antara Gaya Hidup Hedonis dengan Perilaku

Konsumtif pada Remaja. Gadjah Mada Journal of

Psychology, 3(3), 131-140.

Dwi, S. A. N., Malik, Z. A., and Hidayat, Y. R. (2020).

Pengaruh Penggunaan Uang Elektronik (E-Money)

terhadap Perilaku Konsumen. Prosiding Hukum

Ekonomi Syariah, 1-4.

Fatmasari, D., Waridin, Kurnia, A. S., and Amin, R.

(2019). Use of E-Money and Debit Cards in Student

Consumption Behavior. E3S Web of Converences

125, 03013, ICENIS, 1-4.

Ghozali, I. (2018). APLIKASI ANALISIS

MULTIVARIATE Dengan Program IBM SPSS 25.

SEMARANG: UNDIP.

Gumilang, R. R. (2020). Eksistensi Dampak Yang

Mempengaruhi Faktor Keinginan Mahasiswa

Menggunakan E-Money. Coopetition: Jurnal Ilmiah

Manajemen, 19-24.

Hanafiah, Sutedja, A., and Ahmaddien, I. (2020).

PENGANTAR STATISTIKA. Bandung, Jawa Barat:

Widina Bhakti Persada Bandung.

Khairat, M., Yusri, N., and Yuliana, S. (2018). Hubungan

Gaya Hidup Hedonis dengan Perilaku Konsumtif pada

Mahasiswi. Jurnal Psikologi Islam, 10(2), 130-139.

Latief, F., and Dirwan. (2020). Pengaruh Kemudahan,

Promosi dan Kemanfaatan terhadap Keputusan

Penggunaan Uang Digital. Jurnal Ilmiah Akuntansi

Manajemen, 3(1), 16-30.

Lestarina, E., Hasnah, K., Febrianti, N., Ranny, and

Harlina, D. (2017). Perilaku Konsumtif Dikalangan

Remaja. JRTI (JURNAL RISET TINDAKAN

INDONESIA), 2(2), 1-6.

Nanincova, N. (2019). Pengaruh Kualitas Layanan

terhadap Kepuasan Pelanggan Noach Cafe and Bister

CAFE AND BISTER. AGORA, 7(2), 1-5.

Patricia, N. L., and Handayani, S. (2014). Pengaruh Gaya

Hidup Hedonis terhadap Perilaku Konsumtif pada

Pramugari Maskapai Penerbangan 'X'. Jurnal

Psikologi, 12(1), 10-17.

Rahman, A., and Dewantara, R. Y. (2017). Pengaruh

Kemudahan Penggunaan dan Kemanfaatan Teknologi

Informasi terhadap Minat Menggunakan Situ Jual Beli

Online". Jurnal Administrasi Bisnis (JAB), 52(1), 1-7.

Ramadani, L. (2016). Pengaruh Penggunaan Kartu Debit

dan Uang Elektronik (E-Money) Terhadap

Pengeluaran Konsumsi Mahasiswa. Jurnal Ekonomi

dan Pembangunan (JESP), 8(1), 1-8.

Savira, N. (2019). Gerbang Pembayaran Nasional (GPN)

sebagai Salah Satu Sistem Pembayaran di Indonesia.

Jurist - Diction, 2(3), 1067-1082.

Susilawati, T., Dharmawansyah, D., and Sumaedi. (2019).

Metode Penerapan Keselamatan dan Kesehatan Kerja

terhadap Kinerja Proyek Konstruksi. JURNAL

TAMBORA, 3(3), 107-114.

Analysis of the Effect of the Use of Electronic Money, Debit Card and Hedonic Lifestyle on College Student Consumption Behavior: Case

Study: College Student of the Batam State Polytechnic Applied Business Administration Study Program

315