The Impact of Financial Inclusion on Financial Stability in Indonesia

Wulan Pudji Lestari and Doni Putra Utama

Department of Business Management, Politeknik Negeri Batam, Jl. Ahmad Yani, Batam, Indonesia

Keywords: Financial Stability, Financial Inclusion

Abstract: The financial system has a strategic role in an economy. In the last 22 years, Indonesia has experienced two

economic crises. This event reminds of the importance of maintaining financial system stability. The data

used in this study is quarterly data for the period 2008-2019 from Indonesia Financial System Statistics and

Financial Stability Review of Bank Indonesia as well as the Annual Report of the Deposit Insurance

Corporation. Data analysis method used a t-test and f-test. The result of this investigation showed that

financial inclusion that was proxied using the number of savings accounts and the number of bank service

offices had no influence on financial stability. Meanwhile, financial inclusion that is proxied using the

number of ATMs, third-party funds-to-GDP ratio and SMEs credit account ratio to bank credit accounts has

a positive and significant effect on financial stability. This research also shows that financial inclusion

jointly has a positive and significant effect on financial stability. Based on this research, the government is

expected to create a policy that attracts the public to use financial services that are fully available.

1 INTRODUCTION

Indonesia has experienced two economic crises over

a span of 22 years. In mid-1997 until its peak in

1998 Indonesia experienced an Asian Financial

Crisis. At the beginning of 1998, the rupiah

exchange rate on the US dollar reached Rp

10.700,00, - and significantly weakened during the

first half of 1998 (Harvie & Hoa, 2016). Not just the

Asian Financial crisis, during the global economic

crisis from 2008 to 2009, the rupiah depreciated

again at a point of Rp 12,100 per US dollar. This

then became a lesson for Indonesia on the

importance of maintaining the stability of the

country’s financial system. Bank Indonesia reported

in April 2020 that Indonesia experienced a

devaluation of the exchange rate with a middle value

of Rp 16,413 per US dollar caused by the influx of

the COVID-19 pandemic in Indonesia.

Several times the economic crisis proved that

financial system stability in Indonesia is still not

gppd enough to ward off all pressures both internally

and externally. Currently, increasing financial

inclusion is a priority for many countries after global

financial crisis in 2008. The high level of financial

inclusion contributes to the increasing stability of

banks as financial service providers (Ahamed &

Mallick, 2017). Financial inclusion itself is one of

the strategies used by many countries to increase the

inclusive growth of the country (Dienillah,

Anggraeni, & Sahara, 2018). Financial inclusion in

also likely to negatively affect the stability of the

country’s financial system. According to Dienilla,

Anggraeni and Sahara (2018), the possibility of

instability in a financial system is caused by a

decline in credit standards, increased risk to the

bank’s reputation, and the absence of action on

microeconomic regulations. Bank Indonesia stated

that financial inclusion itself is a factor that can

substantially boost financial system stability and

economic growth of a country (Bank Indonesia,

2014). This is based on the role and distribution of

financing sources to national economic growth that

can only occur if the financial system can survive all

kinds of vulnerabilities both internally and

externally (Bank Indonesia, 2014).

Camara and Tuesta (2014) stated that Indonesia

is ranked 61

st

out of 82 countries that serve as the

object of research on the ease of people in accessing

financial services, as well as the 71

st

rank regarding

the absence of barriers for people in access to

financial services. This is far from the vision and

mission of inclusive finance that has been

formulated, namely creating a financial system that

can be accessed by all people easily in order to

improve the economy, prevent squalor, allign

income and realize a good financial system stability

in Indonesia (Bank Indonesia, 2014).

40

Pudji Lestari, W. and Putra Utama, D.

The Impact of Financial Inclusion on Financial Stability in Indonesia.

DOI: 10.5220/0010894600003255

In Proceedings of the 3rd International Conference on Applied Economics and Social Science (ICAESS 2021), pages 40-47

ISBN: 978-989-758-605-7

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Research conducted by Dienillah, Anggraeni and

Sahara (2018) found that countries with high income

levels have inclusive financial levels and financial

stability is better than countries with middle and low

incomes. The study also mentioned that financial

inclusion has no influence on low and middle

income countries as well as in high income countries

that have a positive effect on financial system

stability, and that the country needs to increase the

availability of financial services and improve

financial development to achieve financial inclusion

and good financial stability.

Researchers previously used the ratio of the

number of savings accounts, the ratio of the number

of bank services offices, the ratio of Third Party

Funds to Gross Domestic Product (GDP), as well as

the total credit accounts of SMEs and Banks as

independents variables that become proxies of

financial inclusion. In this study, researcher added

independent variables in the form of the number of

Automated Teller Machines (ATM) ratios as a proxy

of financial inclusion. Rusdianasari (2018) in her

research mentioned that ATM as a form of financial

technology has a role to play in the creation of good

financial inclusion in terms of the availability of

financial services. Quoted from

www.worldbank.org, Indonesia is classified as a

middle income country, which then encourages

researcher to examine the impact of financial

inclusion on financial system stability in Indonesia.

This study aims to find out whether financial

inclusion affects financial system stability in

Indonesia during the period 2008 to 2019

quarteredly, as well as to find the empirical evidence

related to the impact of financial inclusion on

financial system stability in Indonesia during the

period 2008-2019.

2 LITERATURE REVIEW

2.1 Classical Theory

According to Adam Smith (1776), all economic

resources can be used with maximum (full

employment) if there is a prefect competitive

economy, this is believed by classical economists.

They also argue that full employment can only be

achieved if the country’s economy is not mixed by

the government but rather the market mechanism has

full control over the state economy (Smith, 1776).

The accumulation of capital is also seen as the key

to progressed by the classical. This resulted in the

storage of large amounts of money tends to be done

by the classics.

2.2 Banking

The definition of banking has been first regulated by

Law Number 10 of 1998 about Banking. Banking is

an institution, business activity, and process in a

business activity related to the bank. The law also

explains that the entire community fund covered by

a business entity intended to improve the standard of

living of the community is referred to as a bank.

Banking is an activity carried out with the intention

to raise funds (funding) and channel them back

(lending), as well as a financial institution that

receives deposits from the public in the form of

savings, current accounts, and deposits and provide

credit to the community as its main (Kasmir, 2013).

Bank is also a place for exchange, transfer of money

and receipt of all forms of payments and deposits.

The bank itself is defined as a financial business

entity that serves as a storage of money from the

community that will be channelled again to the

community in the form of credit intended to improve

people’s living standard (Darmawi, 2012).

2.3 Bank Penetration

Inclusive finance must have a large number of

financial service users, so an inclusive financial

system requires bank penetration to reach all levels

of society (Sarma, 2012). Bank penetration is one of

the driving factors in the creation of financial

inclusion is what a state needs to do to encourage the

creation of a good inclusive financial system, as

evidenced by the increasing number of users of

financial services (Sarma, 2012). The number of

savings accounts owned by the public as an indicator

of bank penetration measurement has a positive and

significant effect on financial system stability

(Dienillah, Anggraeni, & Sahara, 2018). Based on

research conducted by Ahamed and Mallick (2017)

found that the number of savings accounts held per

100,000 adult population has no significant effect on

financial system stability. Therefore, the penetration

of banks as a proxy of financial inclusion measured

using the number of savings accounts is estimated to

affect the stability of the financial system in

Indonesia, so the hypothesis that will be tested in

this study as follows:

H1: Financial inclusion proxied by the ratio of

the number of savings accounts affects financial

system stability in Indonesia in the period 2008-

2019.

The Impact of Financial Inclusion on Financial Stability in Indonesia

41

2.4 Availability of Access to Financial

Services

The availability of financial services and the ease of

access to financial services by all levels of society

must exist in an inclusive financial (Sarma, 2012).

The availability of access to financial services is

indicated by the number of ATM and financial

services offices available in a region. The

availability of financial services in an area both in

urban and rural areas will result in easy public

access to these financial services, so that the

involvement of the community supports the creation

of a stable financial system.

According to Camara and Tuesta (2014) in their

research, the availability of access and the absence

of barriers in access to financial services are the

main factors in the growth of good financial

inclusion in a country, which can then also

positively affect the stability of the financial system.

Rusdianasari (2018) found that the number of bank

services offices that are indicators of financial

inclusion measurement in terms of availability of

access to financial services has a significant effect

on financial system stability in Indonesia, but this

does not apply to the number of ATM available that

do not have a significant effect on financial system

stability in Indonesia. Dienillah, Anggraeni, and

Sahara (2018) in their research, showed that the

availability of financial access proxied using the

ratio of the number of bank service offices has a

significant positive effect on financial system

stability in countries with high income levels.

Contrary, Irmayasari and Adry (2020) found that the

number of bank branch offices had no effect on

financial system stability. The of the number of bank

service offices and ATM in circulation is expected

to affect the stability of the financial system in

Indonesia, so the next hypothesis to be tested as

follows:

H2: Financial inclusion proxied by the ratio of

the number of Automatd Teller Machines (ATM)

affects the stability of the financial system in

Indonesia in the period 2008-2019.

H3: Financial inclusion proxied by the ratio of

the number of bank service offices has an effect

on financial system stability in Indonesia in the

perio 2008-2019.

2.5 the Usefulness of Financial Services

According to Sarma (2012), bank account owners

should make adequate use of these financial

services, because ownership of bank accounts alone

is not enough to encourage financial inclusion of a

country. Therefore, the deposit-to-GDP ratio as well

as the ratio of SMEs credit accounts to the number

of banking credit accounts are measuring the extent

to which people use financial services to promote

financial system stability.

The number of users of financial services is not

enough to encourage the creation of good financial

inclusion, but it must be followed by the utilization

of financial services itself (Sarma, 2012). Han and

Melecky (2013) mentioned that increased access to

bank savings can increase the resilience of the

funding base of savings collected in the form third-

party funds, the study also found that third-party

funds negatively and significantly affect the stability

of the financial system. Dienillah and Anggraeni

(2016) in their research found that the ratio of

deposit to third-party funds is positively related to

financial stability in Asian countries. This is in line

with research conducted by Laksamana and

Suryahana (2018), showing that the increase in

third-party funds also has a positive impact directly

on financial stability in Indonesia. The increase in

the number of SMEs accounts alone has an effect on

improving financial stability related to decreasing

the credit risk of SMEs (Laksamana & Suryadhana,

2018). Similarly, Siddik and Kabiraj (2018) found

that financial inclusion measured using SME credit

amounts to banking credit had a positive and

significant contribution to financial system stability.

From this explanation, the ude of financial services

as a proxy of financial inclusion as measured using

the ratio of deposit to third-party funds as well as the

ratio of the number of SMEs credit accounts to the

number of banking credit accounts is estimated to

affect the stability of the financial system in

Indonesia, do the next hypothesis that will be texted

in this study as follows:

H4: Financial inclusion proxied by deposit-to

third-party funds ratio affects financial system

stability in Indonesia in the period 2008-2019.

H5: Financial inclusion proxied by the ratio of

SME credit accounts to banking credit accounts

has an effect on financial system stability in

Indonesia in the period 2008-2019.

2.6 Financial Inclusion

Financial inclusion is defined as an overall effort

aimed at eliminating all material and non-material

obstacles to the ease of public access in utilizing

financial services (Bank Indonesia, 2014). It is still

far in fact of the world achieved, evidenced by the

number of people who have difficulty in accessing

ICAESS 2021 - The International Conference on Applied Economics and Social Science

42

financial services that result in financial inclusion in

Indonesia is no better that financial inclusion from

other countries (Camara & Tuesta, 2014). This is far

from the criteria for creating a good economic

system, based on community involvement in the

economic system is an important factor in the

creation of a good economic system, marked by the

ease of access to financial services by all levels of

society as a form of community involvement in the

country’s economic system (Bank Indonesia, 2014).

It is also based on research conducted by Dienillah

and Anggraeni (2016), mentioning that financial

system stability in Asia is significantly affected by

financial inclusion. Financial inclusion has several

factors that affected whether or not financial

inclusion, namely bank penetration, availability of

access to financial services, as well as the usefulness

of financial services (Sarma, 2012).

The three driving factors of financial inclusion,

especially the availability of financial services, are

believed to encourage the growth of financial

inclusion that has positive impact on financial

system stability (Camara & Tuesta, 2014). Financial

inclusion is explained to have both positive and

negative effects on financial system stability (Khan,

2011). Research conducted by Dienillah, Anggaraeni

and Sahara (2018), shows that financial inclusion

only has a significant effect on countries with high

income levels and has no effect on middle-income

countries. Based on this, financial inclusion is

expected to simultaneously affect the stability of the

financial system in Indonesia so, the next hypothesis

to be tested as follows:

H6: Financial inclusion significantly affects

financial system stability in Indonesia in the

period 2008-2019.

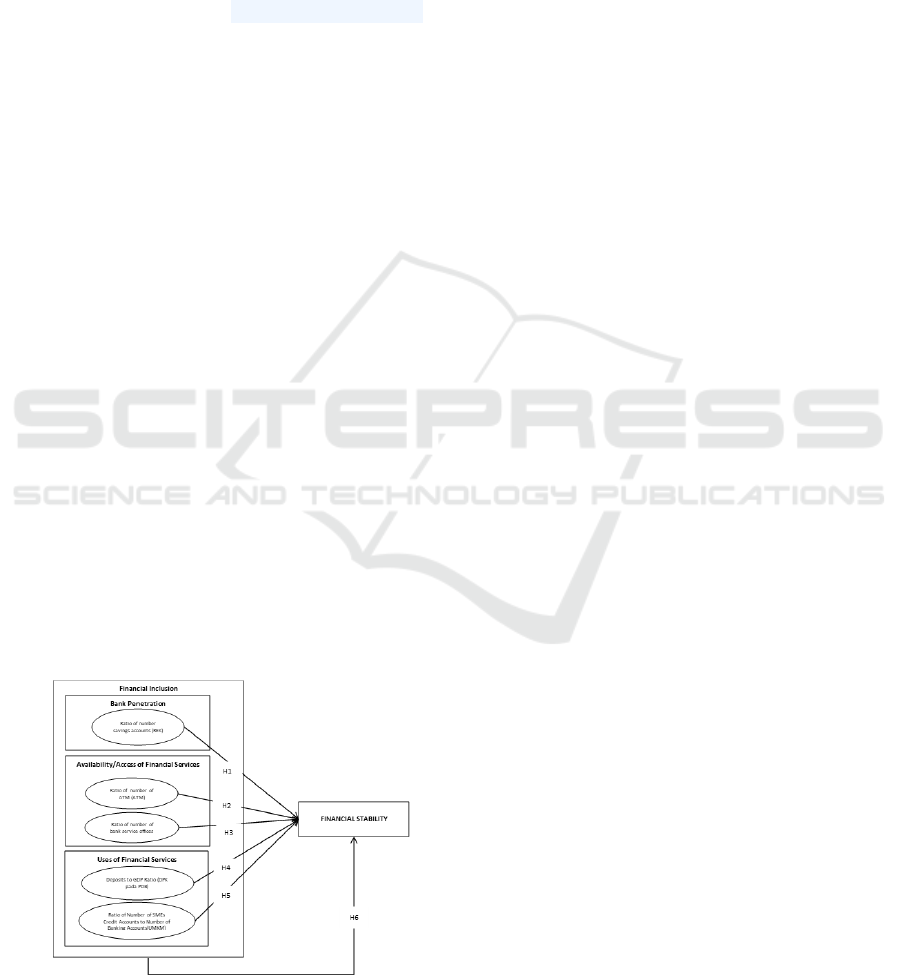

Based on the hypotheses that have been

presented, the research model is obtained as follows:

Figure 1: Research Model.

3 RESEARCH METHOD

The method approach used in this study is the

hypothesis test, where there are data analysed in the

form of numbers and this study there is an influence

test that requires quantitative approach in processing

the data.

This type of research is descriptive using

quantitative data. The object of this research is banks

in Indonesia. The sampling technique in this study is

to use census sampling.

4 RESEARCH RESULT AND

DISCUSSION

4.1 Characteristic of Sample

The characteristics of the sample on this study

divided in two characteristics, based on the amount

of core capital of bank, and based on operational

bank. This study has 110 banks in Indonesia which

is become the sample of this study. Based on the

amount of core capital of banks in Indonesia, banks

in Indonesia are classified in four category which is

called General Banks Business Activity (GBBA).

Bank which classified in GBBA I have a core capital

of less than 1 trillion, GBBA II with a core capital

above 1 trillion to 5 trillion, GBBA III with a core

capital above 5 trillion to 30 trillion, while for the

category of GBBA IV is a bank that has a core

capital above 30 trillion. Based on 110 banks in

Indonesia, most of the sample classified in the

category of GBBA II with total 61 banks (55%).

GBBA, I have 14 banks (13%), GBBA III has 28

banks (25%), and GBBA IV only has 7 banks (6%).

It can be explained that the amount of core capital of

banks Indonesia is above 1 trillion to 5 trillion.

Based on the operational bank, banks in

Indonesia classified in two, conventional banks and

sharia banks. Conventional bank itself is a bank that

in providing services and financial traffic as a

business activity is carried out in accordance with

the provisions previously stipulated. On the other

hand, sharia banks are banking whose business

activities are in accordance with Islamic law and

Law Number 21 of 2008 about Sharia banking.

From 110 banks in Indonesia, most of them is

classified into conventional banks with has 96 banks

on total (87%) and sharia banks has 14 banks (13%).

It can be explained that the operational banks

Indonesia is conventional bank.

The Impact of Financial Inclusion on Financial Stability in Indonesia

43

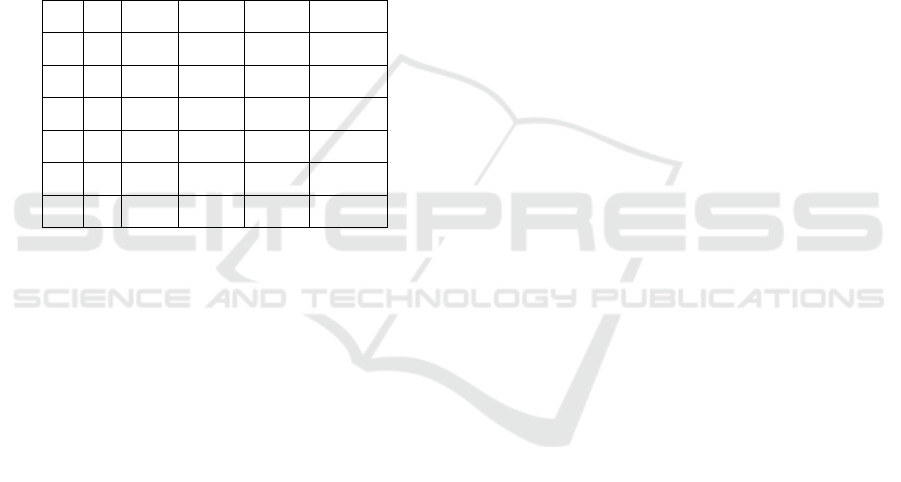

4.2 Descriptive Statistics

Descriptive statistics are statistics that describe the

characteristics of the data to be examined.

Descriptive statistics also have frequency,

dispersion, measurement of central tendencies, and

measurement of shapes. A frequency that indicates

the number of times a phenomenon occurs.

Measurement of central tendency is used to measure

the central value of data distribution in the form of

average, median, mode (Ghozali, 2011). The

purpose of this analysis is to determine the state of

the variables used during the study period. The result

of the descriptive statistical analysis can be seen as

follows:

Table 1: Descriptive Statistics.

N Min Max Mean Std. Dev

Y 48 0.74 2.43 1.2844 0.48687

X1 48 46.57 148.34 81.692 30.6966

X2 48 20.00 56.00 37.646 11.75

X3 48 10.00 20.00 14.563 3.10734

X4 48 31.64 39.17 37.354 1.71376

X5 48 18.93 28.37 20.035 1.80764

Source: The data is processed using SPSS software

Based on the descriptive statistical test result in

table 1, N shows the amount of data that is 48 data

obtained secondary and the processed. Minimum

shows the lowest value of each variable data. On the

Y variable, namely financial system stability index,

the minimum value of 0,74, this figure is the

financial system stability index of Indonesia in third

quarter of 2017. On variable X1, ratio of the number

of savings accounts per 100,000 adults shows a

value of 46,57 which is the value of ratio of the

number of saving accounts in Indonesia in first

quarter on 2008, while in the variable X2 shows the

minimum value of 20,00 is the value of ratio of

ATM number per 1,000 km

2

in Indonesia in fourth

quarter of 2008. In X3 variable the ratio of the

number of bank service offices per 1,000 km

2

shows

the minimum value of 10,00 is the value of

Indonesia’s ratio of the number of bank service

offices per 1,000 km

2

. Variable X4 shows the

minimum value of 31,64 is the value of ratio of

third-party funds to GDP in Indonesia in fourth

quarter of 2008, and variable X5, namely the ratio

SMEs credit accounts to banking credit accounts

showed a value of 18,93 in first quarter of 2008 in

Indonesia.

Maximum shows the highest value of each

variable data. In variable Y, the maximum financial

system stability index value is 2,43, which is the

financial system stability index of Indonesia in

fourth quarter of 2008. In variable X1, the ratio of

the number of saving accounts per 100,000 adults

shows a maximum value of 148,34, which is the

value of ratio of the number of saving accounts per

100,000 adults in Indonesia in fourth quarter of

2019, while on the ratio of number of ATM per

1,000 km

2

, X2 shows the maximum value of 56,00

is the value of Indonesia’s ratio of the number of

ATM per 1,000 km

2

in fourth quarter of 2017. On

the value of the ratio of the number of bank service

offices per 1,000 km

2

, X3 shows the maximum

value of 20,00 in fourth quarter of 2018. Variable

X4 shows the maximum value of 39,17 is the value

of ratio of third-party funds to GDP in Indonesia in

third quarter of 2017, and variable X5, namely the

ratio SMEs credit accounts to banking credit

accounts showed a value of 28,37 in fourth quarter

of 2015 in Indonesia.

Means showing the average value of each data

variable. In variable Y, the financial system stability

index average value is 1,2844. In variable X1, the

ratio of the number of saving accounts per 100,000

adults shows an average value of 81,692, while on

the ratio of number of ATM per 1,000 km

2

, X2

shows the average value of 37,646. On the value of

the ratio of the number of bank service offices per

1,000 km

2

, X3 shows the average value of 14,563.

Variable X4 shows the average value of 37,354, and

variable X5, namely the ratio SMEs credit accounts

to banking credit accounts showed an average value

of 20,035.

Standard deviations indicate the heterogenicity

contained in the tested data or the average amount of

variability of the data examined. In variable Y, the

financial system stability index, the standard

deviation is 0,48687. In variable X1, the ratio of the

number of saving accounts per 100,000 adults shows

a standard deviation of 30,6966, while on the ratio of

number of ATM per 1,000 km

2

, X2 shows the

standard deviation of 11,75. On the ratio of the

number of bank service offices per 1,000 km

2

, X3

shows the standard deviation of 3,10734. Variable

X4 shows the standard deviation of 1,71376, and

variable X5, namely the ratio SMEs credit accounts

to banking credit accounts showed a standard

deviation of 1,80764.

ICAESS 2021 - The International Conference on Applied Economics and Social Science

44

4.3 Classical Asumption Testing

Results

The result of testing the classic assumptions of the

regression model is usually referred to as good

models if they meet the test requirements, the results

of the test that have been carried out consist of

normality test, heteroscedasticity test and

multicollinearity test.

4.3.1 Normality Test

Normality tests are performed to determine the value

of group deployments and data variables whether

they are distributed normally or not. A data variable

is said to be distributed normally if the significant

value is greater than 0.05 or 5% (Santoso, 2012).

The normality test results are follows:

Table 2: Normality Test.

Variable

Kolmogorov-Smirnov

a

Shapiro-Wilk

Sig. Sig.

Y 0.117 0.197

X1 0.119 0.158

X2 0.2 0.096

X3 0.188 0.051

X4 0.2 0.516

X5 0.2 0.708

Source: The data is processed using SPSS software

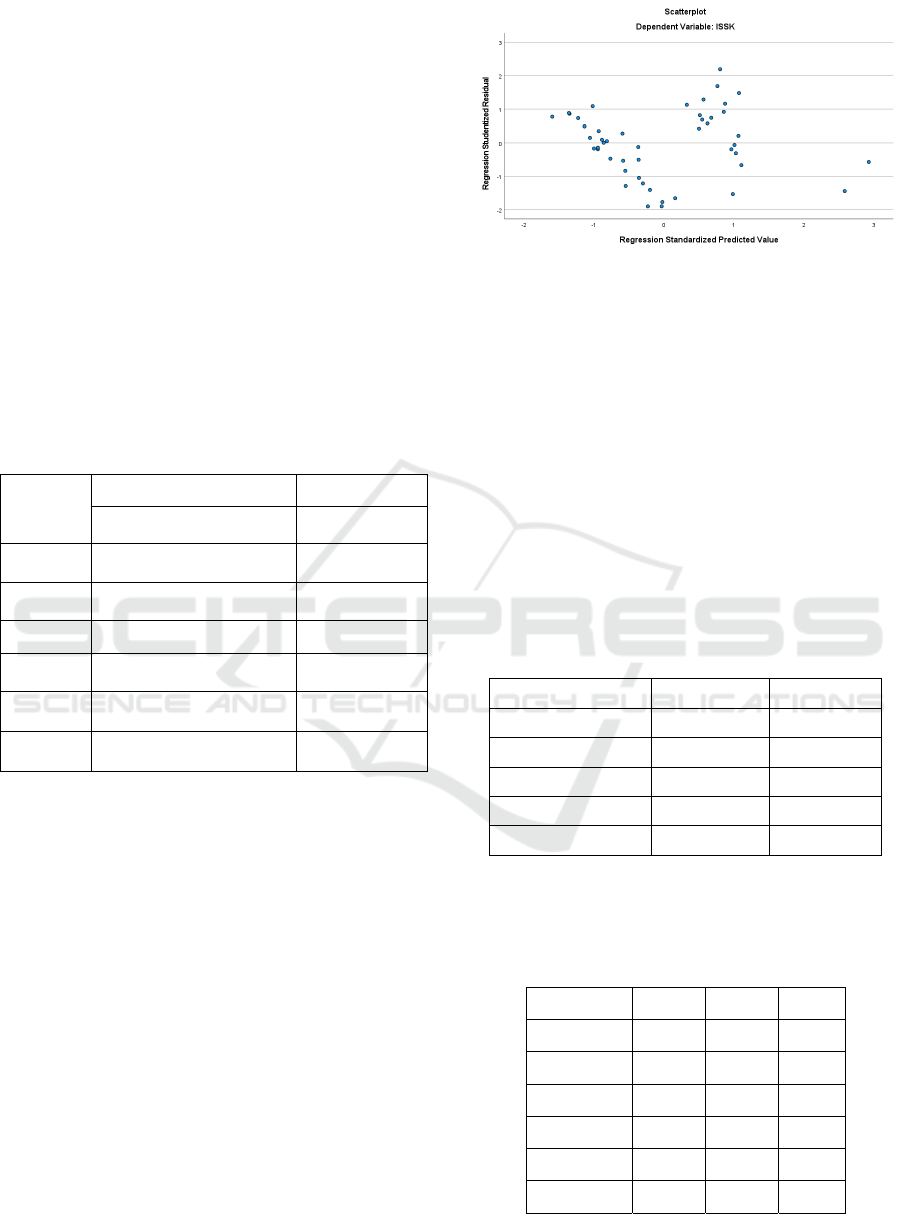

4.3.2 Heterocedasticity Test

Heteroscedasticity testing is conducted to determine

whether there are similarities of a research

regression model used, which if the research

variable does not experience heteroscedasticity, then

indicates the research regression model used well

(Sunyoto, 2016). Scatterplot charts are used as

heteroscedasticity testing, taking into account

scatterplot points at standardized value (ZPRED)

and stundentized residual (SRESID). A regression

model is said not to experience heteroscedasticity

when the points in ZPRED and SRESID do not form

a particular pattern. The heteroscedasticity test

results are follows:

Source: The data is processed using SPSS software

Figure 2: Heterocedasticity Test.

4.3.3 Multicolinenieritas Test

Multicolieniertas test is the existence of a definite

liner relationship between the free changes. To find

out if there is a problem with data related to

multicollinearity test can be seen from the value of

Tolerance and VIF (Value Infaltion Factor). If the

value of tolerance is more than 0,10 and the value of

VIF is less than 10 then the variable has no problem

related to the multicollinearity test with other

independent variables (Ghozali, 2011). The

multicollinearity test results are follows:

Table 3: Multicolieniertas Test.

Variable Tolerance

VIF

X1 0.247 4.048

ATM 0.252 3.973

X3 0.804 1.244

X4 0.693 1.444

X5 0.764 1.309

Source: The data is processed using SPSS software

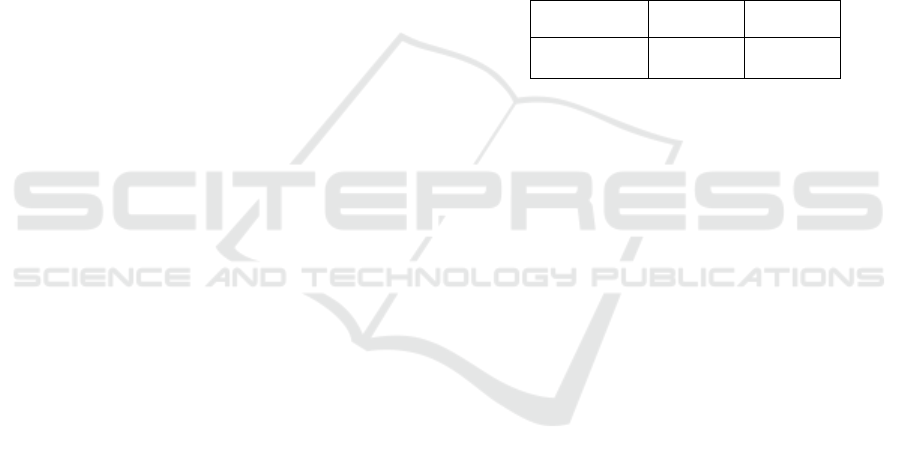

4.4 Hypothesis Testing Results

Table 4: Multiple Linear Regression Analysis Results.

Variables B T Sig

(Constant) -2.871 -3.21 0.003

X1 -0.001 -0.571 0.571

X2 -0.017 -3.302 0.002

X3 -0.016 -1.475 0.148

X4 0.101 4.704 0.000

X5 0.067 3.451 0.001

Source: The data is processed using SPSS software

The Impact of Financial Inclusion on Financial Stability in Indonesia

45

From table 4, obtained the multiple linear regression

equation is as follows:

Y = α + β

1

X1+ β

2

X2 + β

3

X3 + β

4

X4 + β

5

X5

(1)

The multiple regression explained that a constant

value of -2,871 which means that if ratio of the

number of saving accounts per 100,000 adults (X1),

ratio of number of ATM per 1,000 km

2

(X2), ratio of

number of bank service offices per 1,000 km

2

(X3),

ratio of third-party funds to GDP (X4), and ratio of

SMEs credit accounts to banking credit accounts

(X5) have a zero value, then the level of financial

system stability index (Y) is the value -2,871. The

regression coefficient for the ratio of the number of

saving accounts per 100,000 adults (X1) is -0,001,

the ratio of number of ATM per 1,000 km

2

(X2) is -

0,017, the ratio of number of bank service offices

per 1,000 km

2

(X3) is -0,016, the ratio of third-party

funds to GDP (X4) is 0,101, and ratio of SMEs

credit accounts to banking credit accounts (X5) is

0,067.

Based on the equation model above, it can be

explained that if ratio of the number of saving

accounts per 100,000 adults increase by 1 value,

then the financial system stability index will be

decreased by 0,001. Based on the table above, it can

be explained that the significance of the ratio of the

number of saving accounts per 100,000 adults

variable is 0,571, which means that there is no

significant effect because the value is greater than

0,05, it can be conclude that H1 not supported.

Based on table 4, it can be explained that if ratio

of number of ATM per 1,000 km

2

increase by 1

value, then the financial system stability index will

be decreased by 0,017. Based on the table above, it

can be explained that the significance of the ratio of

number of ATM per 1,000 km

2

variable is 0,002,

which means that there is has significant effect

because the value is lesser than 0,05, it can be

conclude that H2 is supported.

Based on table 4, it can be explained that if ratio

of number of bank service offices per 1,000 km

2

increase by 1 value, then the financial system

stability index will be decreased by 0,016. Based on

the table above, it can be explained that the

significance of the ratio of number of ATM per

1,000 km

2

variable is 0,148, which means that there

is no significant effect because the value is greater

than 0,05, it can be conclude that H3 not supported.

Based on table 4, it can be explained that if ratio

of third-party funds to GDP increase by 1 value,

then the financial system stability index will be

increased by 0,101. Based on the table above, it can

be explained that the significance of the ratio of

third-party funds to GDP variable is 0,000, which

means that there is has significant effect because the

value is lesser than 0,05, it can be conclude that H4

is supported.

Based on table 4, it can be explained that if ratio

of SMEs credit accounts to banking credit accounts

increase by 1 value, then the financial system

stability index will be increased by 0,067. Based on

the table above, it can be explained that the

significance of the ratio of SMEs credit accounts to

banking credit accounts variable is 0,001, which

means that there is has significant effect because the

value is lesser than 0,05, it can be conclude that H5

is supported.

Table 5: Simultan Test Result (F-Test)

F Si

g

.

Regression 41.718 .000

b

Source: The data is processed using SPSS software

Based on table 4, it can be explained that all

independent variables are ratio of the number of

saving accounts per 100,000 adults, ratio of number

of ATM per 1,000 km

2

, ratio of number of bank

service offices per 1,000 km

2

, ratio of third-party

funds to GDP, and ratio of SMEs credit accounts to

banking credit accounts significantly affect

simultaneously to financial system stability index in

Indonesia. Therefore, it can be concluded that H6 is

supported.

5 CONCLUSIONS

This study aims to find out and provide empirical

evidence of the influence of financial inclusion on

financial system stability, which is financial

inclusion is projected with a ratio of the number of

savings accounts per 100,000 adults, the ratio of the

number of bank service offices per 1,000 km

2

, the

ratio of ATM numbers per 1,000 km

2

, the ratio of

third-party funds to GDP, and the ratio SMEs credit

accounts to banking credit accounts and FSSI as a

proxy of financial system stability. After conducting

research, the conclusion can be taken as follows:

1. Financial inclusion measured using the ratio of

the number of savings accounts per 100,000

adults and the ratio of the number of bank

service offices per 1,000 km

2

had no effect on

ICAESS 2021 - The International Conference on Applied Economics and Social Science

46

the stability of the financial system measured

using Y.

2. Financial inclusion measured using the ratio

number of ATM per 1,000 km

2

, third-party

funds to GDP ratio and the ratio of SMEs credit

accounts to banking credit accounts had a

positive and significant effect on financial

system stability, which was indicated by a

significant value of the variable which is

smaller than 0,05.

3. Financial inclusion measured using the ratio of

the number of savings accounts per 100,000

adults, the ratio of the number of bank service

offices per 1,000 km

2

, the ratio number of ATM

per 1,000 km

2

, third-party funds to GDP ratio

and the ratio of SMEs credit accounts to

banking credit accounts together have a positive

and significant influence on stability of the

financial system in Indonesia.

REFERENCES

Ahamed, M. M., & Mallick, S. K. (2017). Is Financial

Inclusion Good for Bank Stability? International

Evidence. Journal of Economic Behaviour &

Organization, 1-53.

Bank Indonesia. (2014). Buku Saku Keuangan Inklusif.

Jakarta: Departemen Pengembangan Akses Keuangan

dan X5.

Camara, N., & Tuesta, D. (2014). Measuring Financial

Inclusion: a Multidimensional Index. Working Paper,

1-40.

Darmawi, H. (2012). Manajemen Perbankan. Jakarta:

Bumi Aksara.

Dienillah, A. A., & Anggareni, L. (2016). Dampak Inklusi

Keuangan terhadap Stabilitas Sistem Keuanga di Asia.

Buletin Ekonomi Moneter dan Perbankan, 409-430.

Dienillah, A. A., Anggraeni, L., & Sahara. (2018). Impact

of Financial Inclusion on Financial Stability Based on

Income Group Countries. Bulletin of Monetary

Economics and Banking, 1-14.

Ghozali, I. (2011). Aplikasi Analisis Multivariate dengan

Progran SPSS 19. Semarang: BP Universitas

Diponegoro.

Han, R., & Melecky, M. (2013). Financial Inclusion for

Financial Stability : Access to Bank Deposits and the

Growth of Deposits in the Global Financial Crisis.

Policy Research Working Paper Series 6577, 1-24.

Harvie, C., & Hoa, T. V. (2016). The Causes and Impact

of The Asian Financial Crisis. Berlin: Springer.

Irmayasari, & Adry, M. R. (2020). Pengaruh Inklusi

Keuangan Terhadap Stabilitas Sistem Keuangan dan

Pertumbuhan Ekonomi di ASEAN. Jurnal Kajian

Ekonomi dan Pembangunan, 161-176.

Kasmir. (2013). Bank dan Lembaga Keuangan Lainnya.

Jakarta: Raja Grafindoi Persada.

Khan, H. R. (2011). Financial Inclusion and Financial

Stability: are they two sides of the same coin?

Chennai: Indian Bankers Association and Indian

Overseas Bank.

Laksamana, K. R., & Suryadhana, N. A. (2018). Dampak

Pertumbuhan Inklusi Keuangan terhadap Stabilitas

Sistem Keuangan di Indonesia. Prosiding Warmadewa

National Conference of Economic (WNCE), 20-36.

Le, T. H., & Chuc, A. T. (2019). Financial Inclusion and

its Impact on Financial Efficiancy and Sustainability:

Empirical Evidence from

Republik Indonesia. (Lembaran Negara Republik

Indonesia Tahun 1988 Nomor 182). Undang-Undang

Republik Indonesia Nomor 10 Tahun 1982 Tentang

Perbankan. Jakarta: Sekretariat Negara.

Rusdianasari, F. (2018). Peran Inklusi Keuangan melalui

Integrasi Fintech dalam Stabilitas Sistem Keuangan di

Indonesia. Jurnal Ekonomi Kuantitatif Terapan, 244-

253.

Santoso, S. (2012). Statistik Parametrik. Jakarta: PT

Gramedia Pustaka Umum.

Sarma, M. (2012). Index of Financial Inclusion - A

Measure of Financial Sector Inclusiveness. Working

Paper, 472-476.

Siddik, M. A., & Kabiraj, S. (2018). Does Financial

Inclusion Induce Financial Stability? Evidence from

Cross-country Analysis. Australian Accounting,

Business and Finance Journal, 34-46.

Smith, A. (1776). An Inquiry into the Nature and Causes

of the Wealth of Nations. London: Methuen & Co.

Ltd.

Sunyoto, D. (2016). Metodologi Penelitian Akuntansi.

Bandung: PT Refika Aditama.

World Bank. (2019, July 1). New Country Classification

by Income Level: 2019-2020. Retrieved from World

Bank Web site: www.worldbank.org

The Impact of Financial Inclusion on Financial Stability in Indonesia

47